In the volatile world of decentralized finance, where trust is as scarce as stable yields, DAO treasury transparency has become non-negotiable. The collapse of Terra’s UST in 2022 exposed the perils of opaque reserves and unchecked minting, prompting a shift toward rigorous on-chain mechanisms. Today, protocols like MakerDAO exemplify this evolution, with 14% of reserves in real-world assets such as U. S. Treasury bonds to temper volatility, alongside a steadfast 150% minimum collateralization ratio: locking $1.50 in assets for every $1 of DAI minted. Uniswap DAO complements this by capping new UNI token mints at 2% of total supply annually, blending governance with restraint. These practices underscore a broader push for DAO treasury transparency, where on-chain reserves management and DAO collateral tracking foster accountability without sacrificing decentralization.

Yet, achieving maximum trust demands more than diversification; it requires adherence to structured principles drawn from Chainlink’s proof-of-reserves framework and DeFi’s hard-won lessons. These seven core tenets, rooted in verifiable smart contracts, address reserves, collateral, and minting limits head-on, ensuring communities can audit treasuries as easily as checking a blockchain explorer.

7 Key DAO Treasury Transparency Principles

-

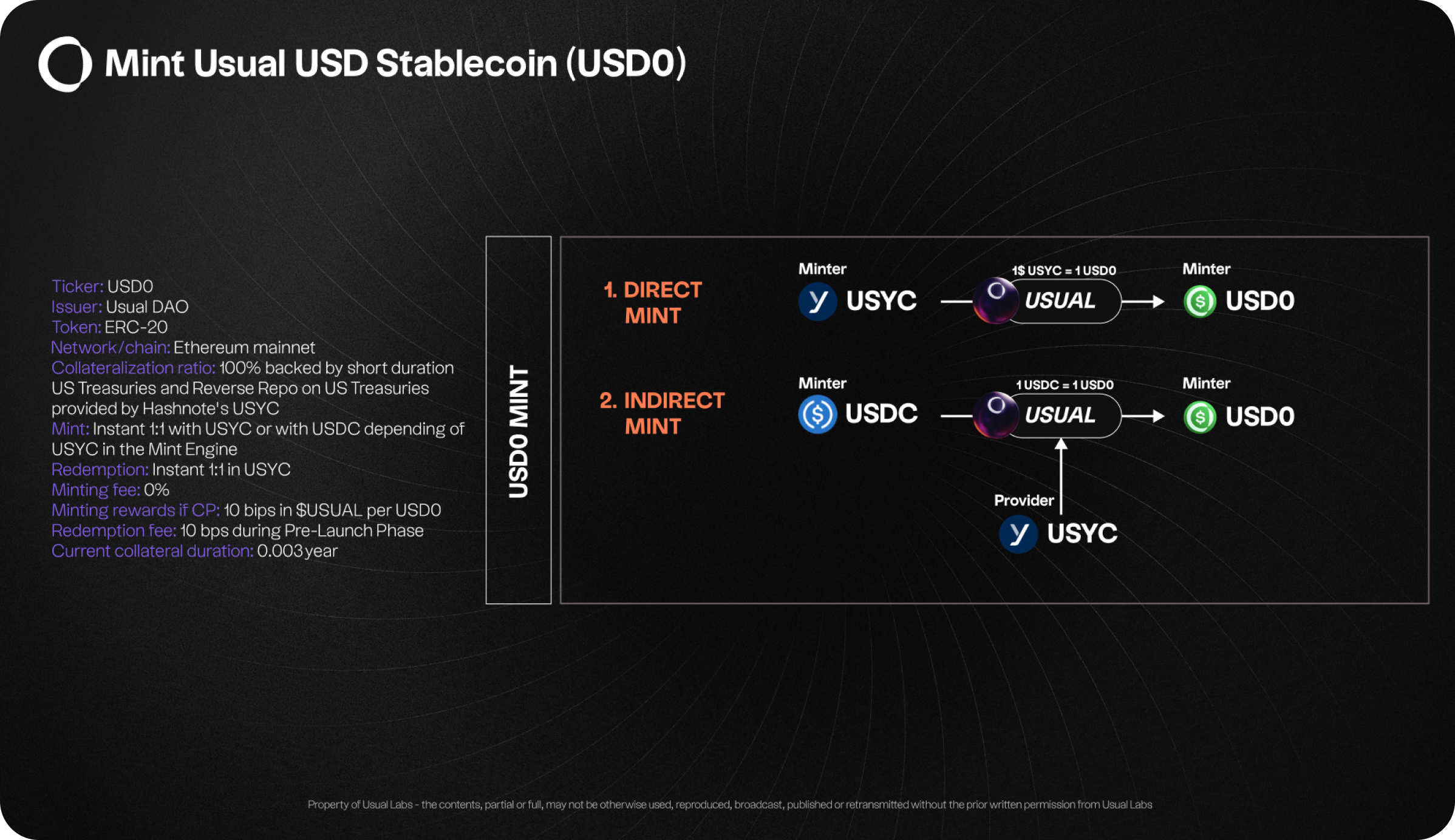

1. Full On-Chain Visibility of Reserves: All treasury assets must be held in publicly auditable smart contracts, allowing real-time verification via block explorers like Etherscan. MakerDAO exemplifies this with its reserves, including 14% in U.S. Treasury bonds as RWAs.

-

2. Real-Time Cryptographic Proof of Reserves: Use zero-knowledge proofs or Chainlink Proof of Reserves oracles for instant, tamper-proof validation without revealing sensitive wallet data, building trust post-UST collapse.

-

3. Over-Collateralization with Dynamic Monitoring: Maintain ratios like MakerDAO’s 150% minimum ($1.50 collateral per $1 DAI minted), with automated tools tracking volatility and RWAs for stability.

-

4. Strict Minting Limits Tied to Verified Collateral: Cap issuance, as in Uniswap DAO’s 2% annual UNI supply limit via governance, ensuring new tokens require verified over-collateralization.

-

5. Immutable Governance for Treasury Parameters: Encode rules in upgradeable but auditable smart contracts, like Reserve Protocol’s 100% collateral backing, preventing unauthorized changes.

-

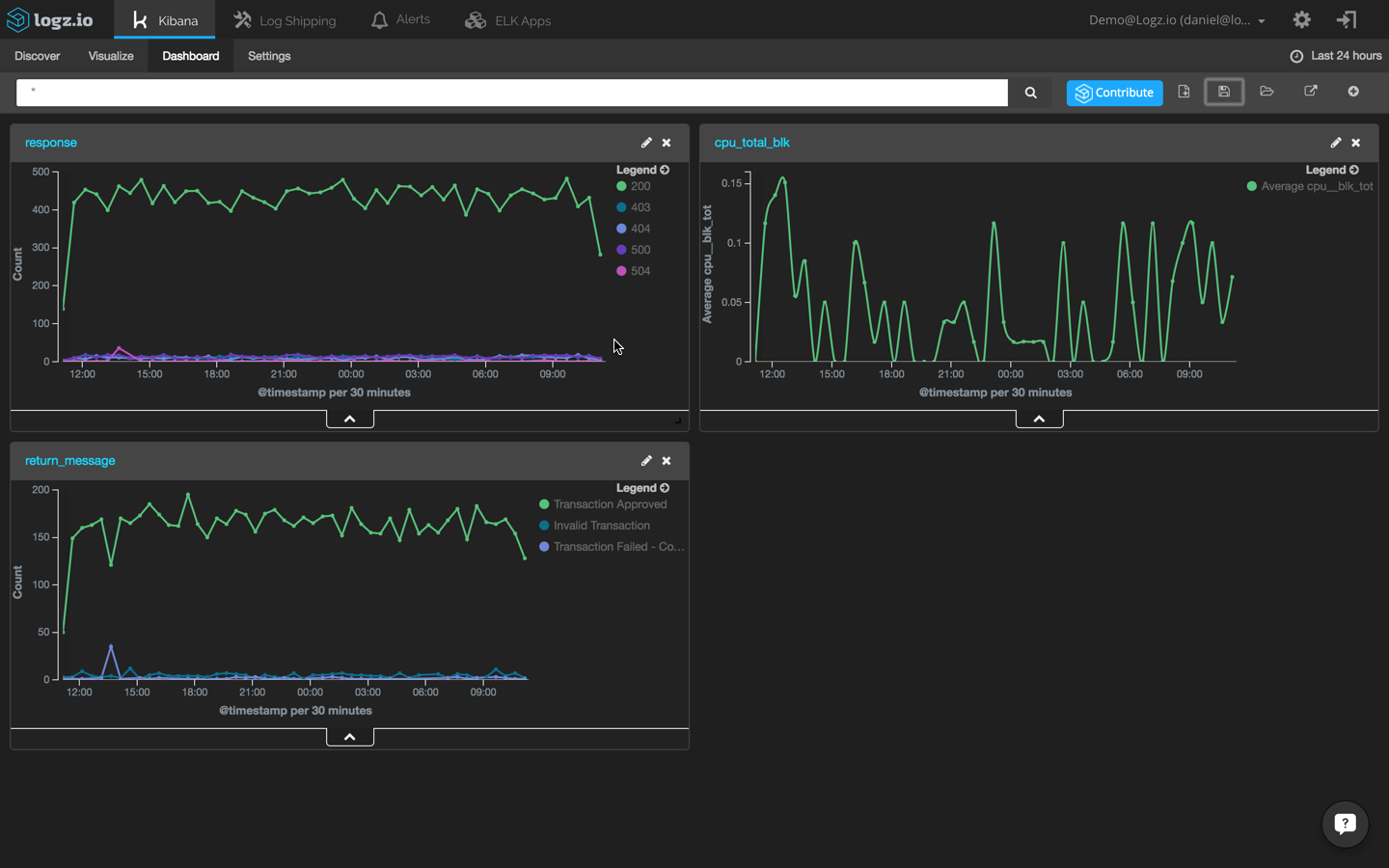

6. Automated Anomaly Detection and Alerts: Deploy oracles and monitoring from Chainlink or Enzyme for real-time alerts on deviations, enhancing proactive treasury security.

-

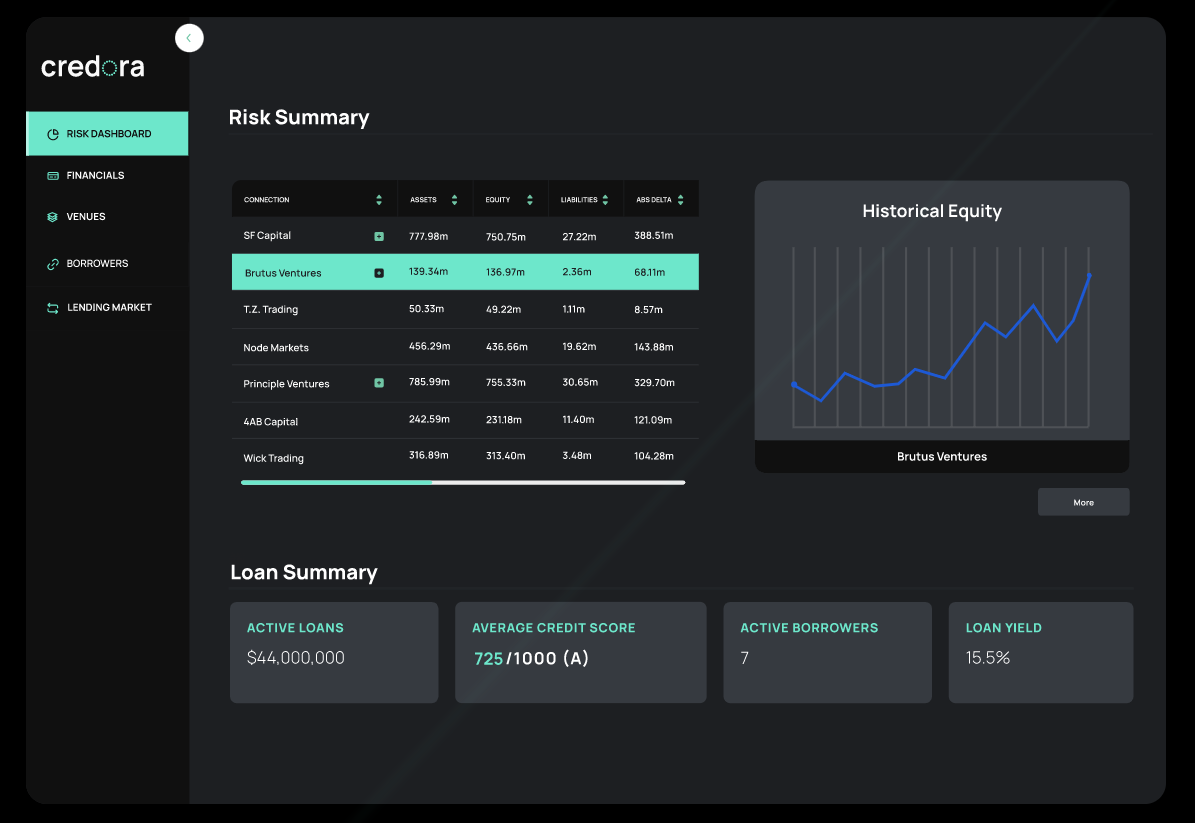

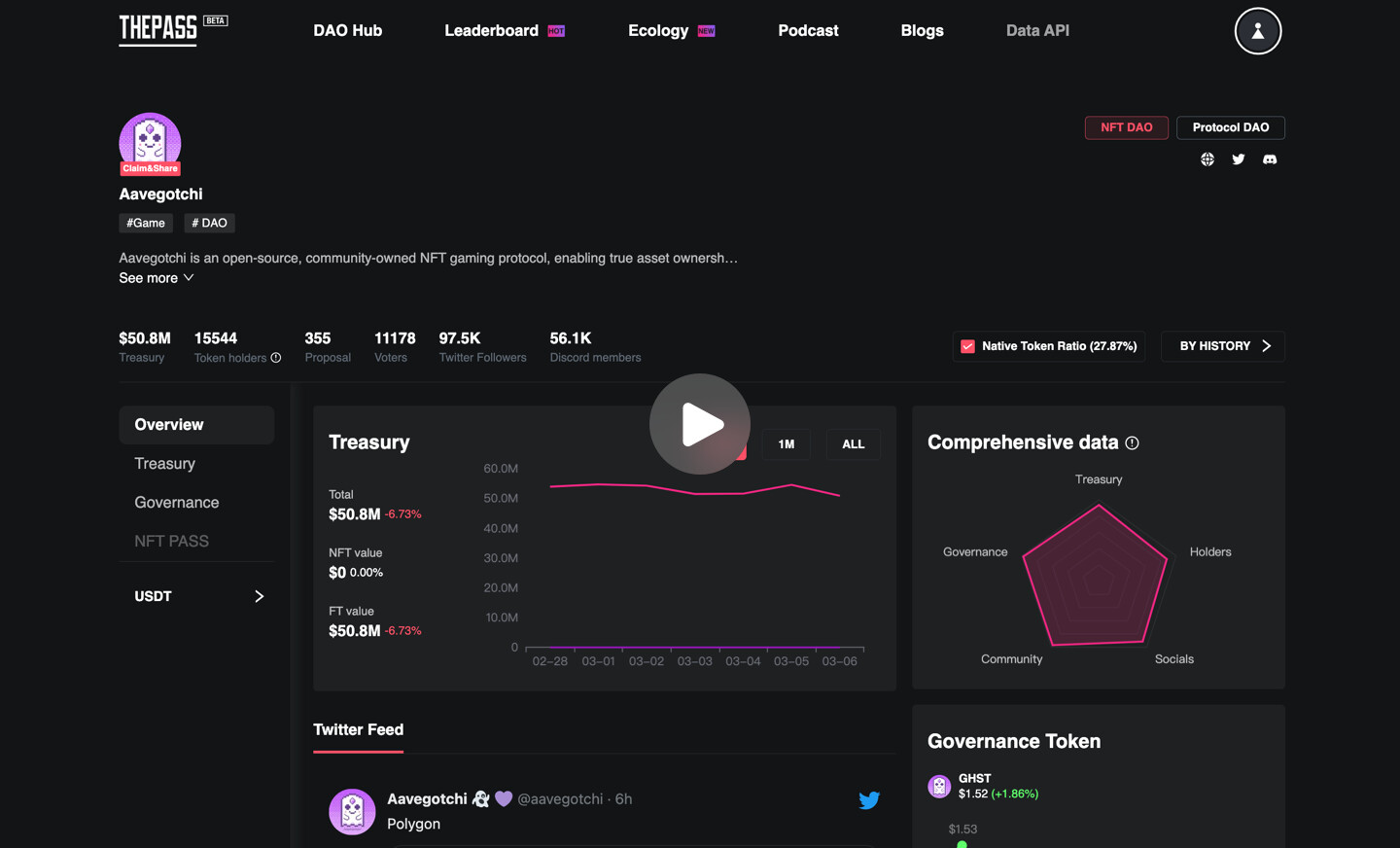

7. Community-Verifiable Dashboards and Reports: Provide tools like Dune Analytics dashboards for token holders to audit reserves, fostering accountability as in CoW DAO practices.

Full On-Chain Visibility of Reserves: The Transparency Imperative

At the heart of on-chain reserves management lies full visibility, every asset in a DAO’s treasury must be traceable on public ledgers. No black boxes, no off-chain custodians promising the moon. MakerDAO’s integration of RWAs, now at 14% of reserves, shines here: bonds and tokenized treasuries appear immutably on Ethereum, letting token holders verify holdings instantly. This principle eliminates the “trust me, bro” era, replacing it with empirical proof. In my view, it’s the ultimate risk reducer; diversity across assets, from ETH to stablecoins and now RWAs, means little if obscured. Protocols like Reserve Protocol reinforce this by targeting at least 100% collateral backing, with all movements logged transparently to prevent demand-driven depegs.

Transparency of on-chain transaction data reduces the need for statutory disclosures, as noted in academic analyses of DeFi versus CeFi.

Real-Time Cryptographic Proof of Reserves: Verifiability at Light Speed

Visibility alone falls short without proof. Real-time cryptographic attestations, powered by oracles like Chainlink, confirm reserves match claims instantaneously. Imagine a ZK-proof attesting to MakerDAO’s 150% ratio without exposing wallet specifics, privacy preserved, trust amplified. This principle, central to Chainlink’s PoR, uses zero-knowledge tech to broadcast solvency proofs across chains. For DAOs, it’s a game-changer: community members query proofs via dashboards, spotting discrepancies before they fester. Uniswap’s governance-tied minting benefits too; proofs ensure circulating supply aligns with on-chain reality, capping inflation risks at that 2% threshold.

Balancing this, we must acknowledge trade-offs: computational overhead from frequent proofs can hike gas fees. Still, as networks scale, the cost of doubt far exceeds it. CoW DAO echoes this, emphasizing publicly accessible transactions as the cornerstone of accountability.

Over-Collateralization with Dynamic Monitoring: Buffering Against Volatility

Over-collateralization isn’t just prudent, it’s protocol armor. Requiring excess backing, like MakerDAO’s 150%, creates a volatility buffer, dynamically monitored via oracles tracking asset prices and ratios. If collateral dips, liquidation kicks in automatically, protecting minted assets. This principle ties directly to DAO collateral tracking, where smart contracts adjust in real-time: RWAs at 14% provide yield stability, while crypto collateral offers liquidity. Enzyme Myso and similar platforms extend this with on-chain transparency for governance-aligned strategies.

Dynamic monitoring elevates it further. Automated feeds flag under-collateralization early, preventing cascades akin to UST. In practice, DAOs set liquidation penalties at 13%, incentivizing prudence. Opinionated take: while 150% suits DAI’s conservatism, nimbler DAOs might tune to 120% for yield chasing, but never below 100%: lest history repeat.

Strict Minting Limits Tied to Verified Collateral: Controlled Expansion

Minting limits prevent runaway issuance, anchoring supply growth to verified collateral. Uniswap’s 2% annual cap exemplifies this, requiring governance votes backed by on-chain proofs. Here, minting limits DAOs intersect with reserves: no new tokens without excess collateral, audited cryptographically. Reserve Protocol’s buyback mechanics during low demand ensure backing stays robust, minting only when over-collateralized.

Linking minting to collateral verification creates a self-regulating loop, where expansion mirrors treasury health. This principle shines in asset-backed DAO treasuries, blending stability with growth potential. Without it, even diversified reserves crumble under unchecked supply.

Immutable Governance for Treasury Parameters: Parameters Carved in Stone

Governance must be ironclad, with treasury parameters like collateral ratios and mint caps encoded immutably via time-locks or multi-sig upgrades. MakerDAO’s 150% threshold, for instance, demands supermajority votes and delay periods before tweaks, thwarting hasty decisions amid market frenzy. This DAO treasury transparency pillar ensures parameters evolve deliberately, not reactively. Uniswap’s 2% mint limit follows suit, proposal-hardened against whims. In my experience across FX and crypto, mutable rules breed doubt; immutability, even if rigid, builds conviction. Platforms like Enzyme Myso embed this in their DeFi vaults, where governance snapshots tie changes to verifiable on-chain states.

Yet balance matters: pure immutability stifles adaptation. Hybrid models, with emergency pauses, offer flexibility without fragility, as seen in CoW DAO’s transparent processes.

Key DAO Treasury Parameters: Alignment and Transparency

| DAO | Key Parameters | Principle Alignment | Transparency Score (/10) |

|---|---|---|---|

| MakerDAO | 150% collateral ratio, 14% RWAs | 1,3,5 (Full On-Chain Visibility, Over-Collateralization, Immutable Governance) | 9 |

| Uniswap | 2% annual UNI mint cap | 4,5 (Strict Minting Limits, Immutable Governance) | 8 |

| Reserve Protocol | 100% collateral backing | 1,3,4 (Full On-Chain Visibility, Over-Collateralization, Strict Minting Limits) | 8 |

Automated Anomaly Detection and Alerts: Vigilance Without the Watchmen

Human oversight falters in 24/7 markets; automation steps in. Smart contracts with oracle-fed anomaly detection scan for deviations, like collateral drops below 150% or suspicious mint spikes, triggering alerts to governance channels. Chainlink’s real-time feeds power this, flagging RWAs underperformance before it erodes trust. For DAO collateral tracking, it’s proactive defense: if volatility pushes ETH collateral ratios perilously close to liquidation, bots notify holders instantly. Post-UST, this principle has proliferated, with DAOs integrating it into core protocols.

Opinion: Relying solely on community vigilance invites complacency. Automated systems, tuned conservatively, act as the DAO’s immune response, preserving on-chain reserves management integrity. TRES Finance highlights similar tools for financial stability, underscoring alerts’ role in preempting crises.

Community-Verifiable Dashboards and Reports: Empowering the Auditors

Transparency culminates in accessible interfaces. Dashboards aggregating PoR proofs, collateral stats, and mint histories let any holder verify claims independently. MakerDAO’s Oasis portal, with its RWA breakdowns at 14%, sets the standard; Uniswap’s explorers extend to supply caps. ZK-attestations enhance this, proving constraints met sans privacy leaks. These tools democratize auditing, turning passive holders into active sentinels.

Integrating all seven principles crafts unbreakable trust. DAOs embracing them, from full visibility to verifiable reports, navigate volatility with poise. As treasury audits evolve, expect standardized dashboards across chains, blending Chainlink oracles with user-friendly UIs. For protocols serious about longevity, this framework isn’t optional, it’s foundational. Diversity in reserves, rigorously tracked and governed, remains the ultimate hedge in DeFi’s wilds.