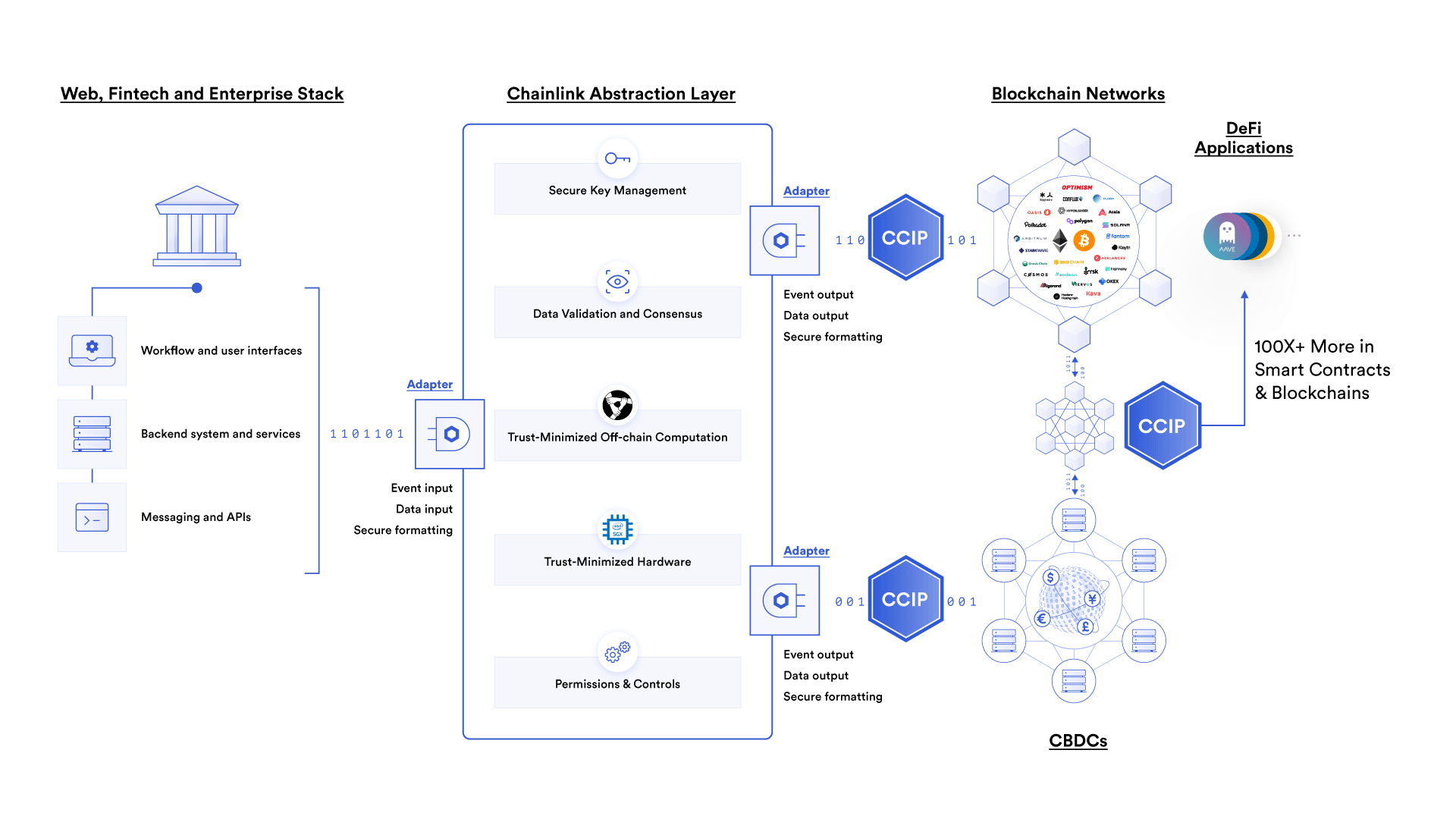

Decentralized Autonomous Organizations (DAOs) and stablecoin issuers face a persistent challenge: how to verify, in real time, that their on-chain assets are fully backed by off-chain or cross-chain reserves. In the wake of recent market volatility and regulatory scrutiny, the demand for robust, automated, and transparent asset verification has never been higher. Chainlink Proof of Reserve (PoR) has emerged as a leading solution, providing DAOs and stablecoin projects with a decentralized oracle system that delivers real-time, automated reserve checks, directly on-chain.

Chainlink PoR: Real-Time Reserve Verification at $22.59

As of now, Chainlink (LINK) trades at $22.59, reflecting its growing relevance in the DeFi security stack. Chainlink PoR is not just a technical upgrade, it is a paradigm shift for on-chain treasury security. By enabling automated, trust-minimized audits of tokenized assets, PoR empowers DAOs and stablecoin issuers to prove, at any moment, that their tokens are properly collateralized. This is not a theoretical promise but a live, production-grade system that has been adopted by leading platforms, including TrueUSD (TUSD) and Matrixdock.

Automated Safeguards for DAO Treasury Security

DAOs often manage treasuries worth millions, sometimes billions, of dollars, with diverse holdings spanning stablecoins, wrapped assets, and tokenized securities. Manual audits are slow, opaque, and error-prone. Chainlink PoR integrates directly with DAO smart contracts, enabling real-time, automated reserve verification. This means that every token representing an off-chain asset can be continuously audited by decentralized oracles, eliminating the need for trust in a single custodian or opaque attestation process.

The security implications are significant. PoR allows DAOs to implement circuit breakers and automated controls that halt treasury operations if reserves dip below predefined thresholds, preventing systemic failures and safeguarding community funds. As highlighted by Chainlink’s documentation, this level of automation and transparency is crucial for maintaining stakeholder confidence in volatile markets (source).

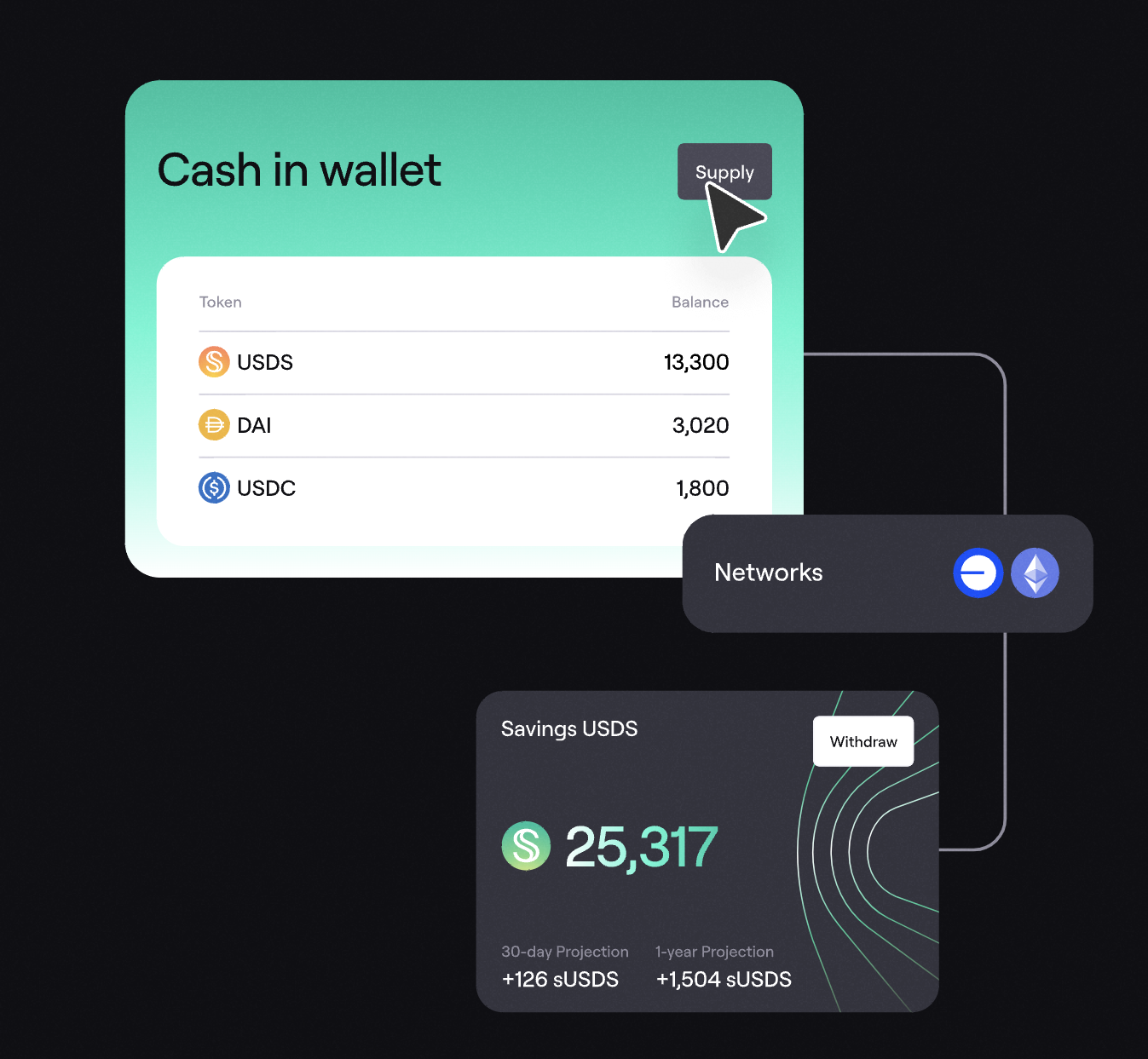

Stablecoin Issuers: Transparent Collateralization and Secure Minting

Stablecoins underpin much of DeFi’s liquidity, yet their stability depends entirely on robust collateralization. The collapse of undercollateralized projects has made users wary of opaque reserve practices. Chainlink PoR addresses this head-on by providing public, tamper-proof evidence of reserves. For example, TUSD has integrated PoR to ensure that new tokens can only be minted when there is a corresponding increase in verified USD reserves. This “Secure Mint” feature is programmable and resistant to human error or manipulation (source).

This level of transparency is not just about compliance, it is about building trust at scale. Users and institutional investors can independently verify stablecoin reserves at any time, reducing reliance on quarterly attestations or delayed audits. The result is a more resilient, accountable stablecoin ecosystem where risks such as infinite mint attacks are programmatically mitigated.

Preventing Infinite Mint Attacks with Programmatic Controls

One of the most critical attack vectors in DeFi is the so-called “infinite mint” attack, where vulnerabilities allow malicious actors to mint unbacked tokens, destabilizing markets and eroding trust. Chainlink PoR directly addresses this risk by linking minting permissions to real-time reserve data, a mechanism detailed as “Secure Mint” in Chainlink’s technical documentation (source). If reserves fall short, minting is automatically halted, providing a robust last line of defense against catastrophic exploits.

This approach not only fortifies the technical perimeter of DAO and stablecoin protocols but also aligns with emerging regulatory expectations for continuous, verifiable collateral checks. As more institutional capital flows into DeFi, the demand for such automated risk controls will only intensify. Chainlink PoR’s ability to deliver tamper-resistant, on-chain proof of reserves positions it as an essential tool for any treasury seeking to meet the dual mandate of security and transparency.

Real-World Adoption: Matrixdock and Tokenized Treasuries

Matrixdock’s integration of Chainlink PoR for its tokenized Treasury Bill (T-Bill) offerings provides a clear demonstration of how this technology translates theory into practice. By leveraging PoR, Matrixdock enables stakeholders to independently monitor U. S. Treasury securities backing its tokens in real time. This not only enhances confidence among investors but also sets a new standard for transparency in tokenized real-world asset markets. For DAOs considering tokenized securities or off-chain yield products, such integrations are rapidly becoming table stakes for responsible treasury management (source).

Top Use Cases for Chainlink Proof of Reserve in DAO and Stablecoin Security

-

Automated, Real-Time Auditing of DAO Treasuries: Chainlink Proof of Reserve enables DAOs to conduct continuous, automated audits of their on-chain treasuries, ensuring that tokenized assets are always backed by verified off-chain or cross-chain reserves. This transparency helps DAOs implement automated safeguards, such as circuit breakers, to prevent systemic failures if reserves fall below critical thresholds.

-

Strengthening Stablecoin Collateralization: Stablecoin issuers like TrueUSD (TUSD) use Chainlink Proof of Reserve to publicly verify and disclose reserve holdings in real-time. This ensures that every stablecoin is fully backed, enhancing user trust and regulatory compliance.

-

Mitigating Infinite Mint Attacks with Secure Mint: By integrating Proof of Reserve directly into the token minting process, Chainlink’s Secure Mint feature ensures that new tokens can only be created when sufficient reserves are verified. This programmatic enforcement significantly reduces the risk of infinite mint attacks and undercollateralization.

-

On-Chain Transparency for Tokenized Real-World Assets: Platforms like Matrixdock leverage Chainlink Proof of Reserve to provide real-time, on-chain transparency for tokenized U.S. Treasury Bills (T-Bills). Investors and DAOs can independently verify that each tokenized T-Bill is adequately backed by actual Treasury securities.

-

Building Community Trust and Regulatory Readiness: By offering verifiable, decentralized reserve data, Chainlink Proof of Reserve helps DAOs and stablecoin issuers build trust with their communities and meet evolving regulatory expectations for transparency and asset backing.

Compliance, Community Trust, and the Future of DAO Treasury Security

Beyond technical risk mitigation, Chainlink PoR is fast becoming a cornerstone for crypto compliance tools and best practices. Regulators are increasingly scrutinizing stablecoin issuers and DAOs for proof of solvency and real-time reserve verification. By adopting PoR, organizations can demonstrate proactive compliance, reducing legal exposure and fostering greater acceptance by traditional finance partners.

Equally important is the community impact. DAOs thrive on stakeholder trust and transparent governance. When reserve data is available on-chain and updated in real time, it empowers token holders to make informed decisions and participate confidently in governance. This transparency can also drive broader ecosystem adoption as new users seek out protocols that prioritize security and accountability.

Security-first treasuries are no longer optional. As DAOs and stablecoins scale, Chainlink Proof of Reserve offers the most robust, automated defense against undercollateralization, infinite mint exploits, and opaque asset management. For organizations committed to long-term resilience, integrating PoR is quickly becoming the industry standard.

Key Takeaways for DAO and Stablecoin Leaders

- Automated, real-time reserve checks are critical for preventing systemic risk.

- Programmatic controls like Secure Mint are essential for stopping infinite mint attacks before they start.

- On-chain transparency fosters trust, drives adoption, and meets evolving compliance standards.

- Chainlink (LINK) price at $22.59 reflects growing institutional interest in decentralized security solutions.

As the DeFi ecosystem matures, expect Proof of Reserve to become a baseline requirement for any protocol entrusted with significant capital. For DAOs and stablecoin issuers committed to security-first treasury management, Chainlink PoR is the most reliable path forward.