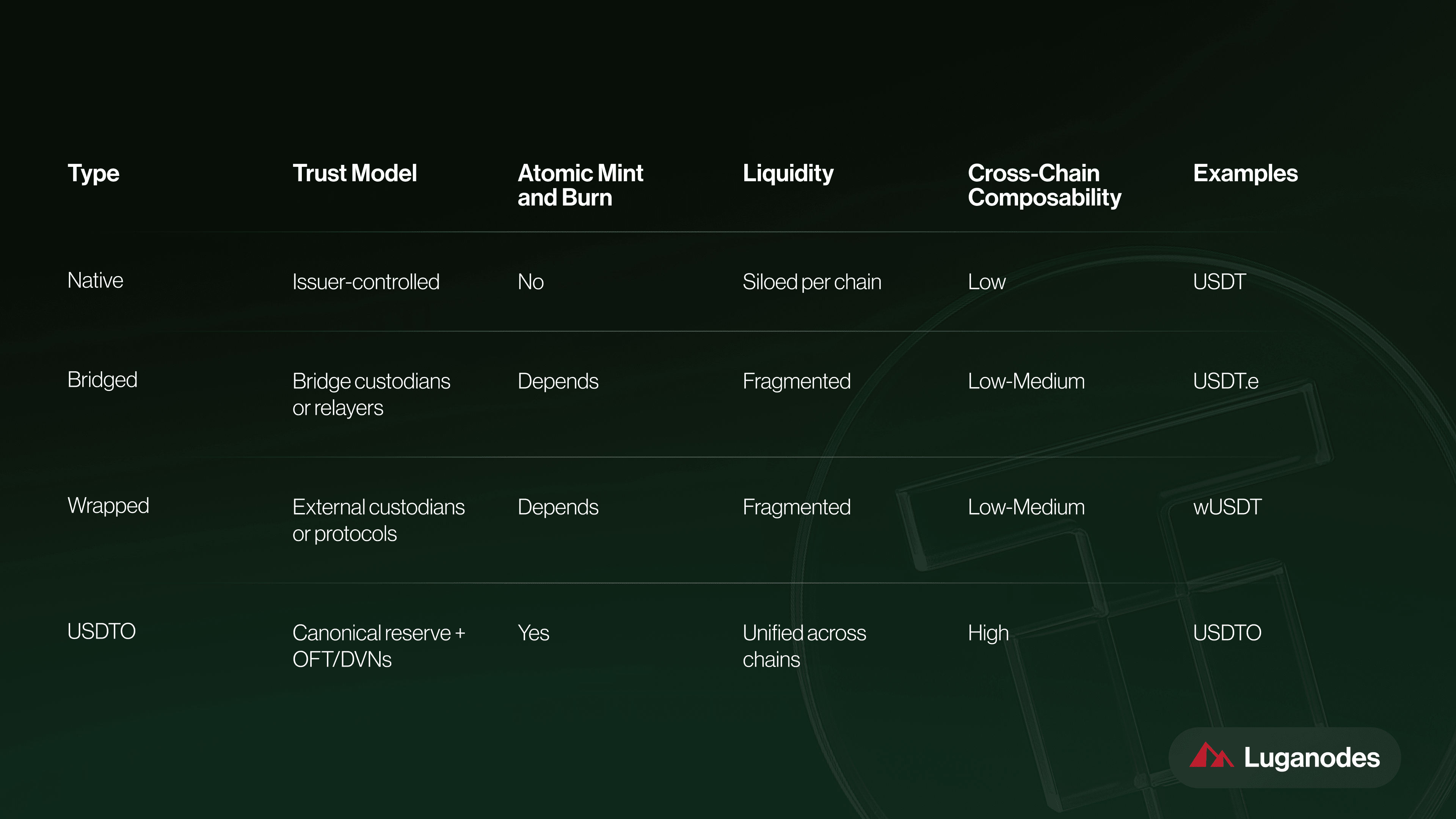

Stablecoin liquidity has long been fragmented across the decentralized finance (DeFi) landscape, with each blockchain ecosystem siloed behind its own wrapped tokens, bridges, and liquidity pools. This fragmentation introduces inefficiencies for users and DAOs alike, from increased slippage and security risks to operational headaches in multi-chain treasury management. Enter USDT0: Tether’s omnichain stablecoin solution that is rapidly redefining how digital dollars move across blockchains.

USDT0: The Canonical Cross-Chain Stablecoin

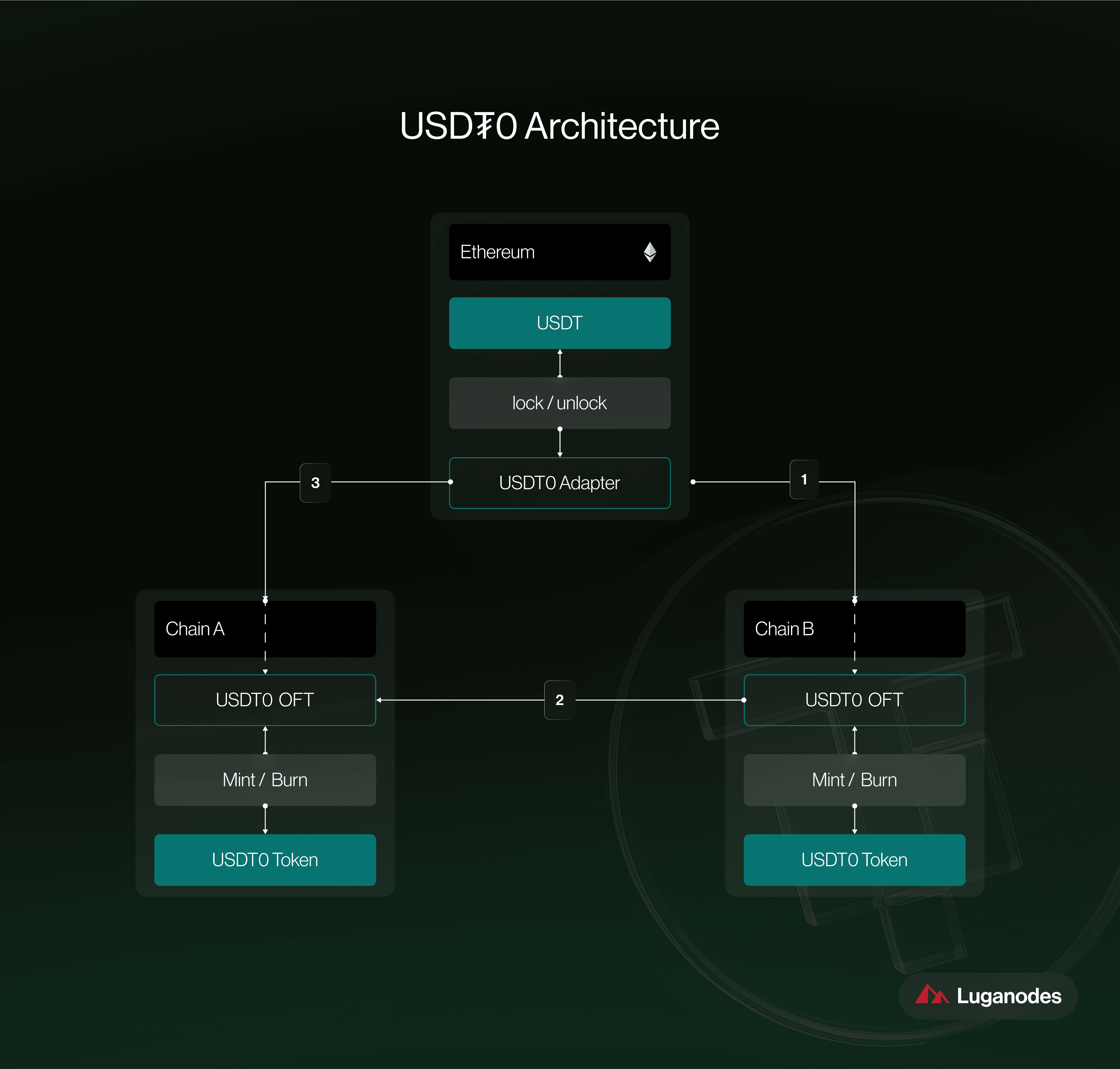

Launched in January 2025, USDT0 is Tether’s answer to the persistent challenges of cross-chain stablecoin interoperability. Built on LayerZero’s Omnichain Fungible Token (OFT) standard, USDT0 enables direct, native transfers of stablecoins across more than 12 major blockchains, without the need for wrapped assets or risky third-party bridges. This design not only eliminates redundant liquidity pools but also unifies capital efficiency under a single, canonical asset.

Unlike traditional models where each chain hosts its own version of USDT (often as a wrapped or synthetic variant), USDT0 maintains a strict 1: 1 backing with original USDT reserves. Every transfer is native and atomic, secured by LayerZero’s messaging protocol, which has become the backbone for modern cross-chain DeFi infrastructure (source).

The End of Liquidity Fragmentation

The impact of USDT0 on DeFi liquidity protocols cannot be overstated. By consolidating what were once isolated liquidity pools into a unified network, USDT0 unlocks several critical advantages:

Key Benefits of Unified Stablecoin Liquidity for DAOs and DeFi

-

Seamless Cross-Chain Transfers: USDT0 enables direct, native stablecoin movement across 12+ blockchains—including Ethereum, Tron, TON, and Celo—without relying on wrapped tokens or third-party bridges, reducing operational friction for DAOs and DeFi protocols.

-

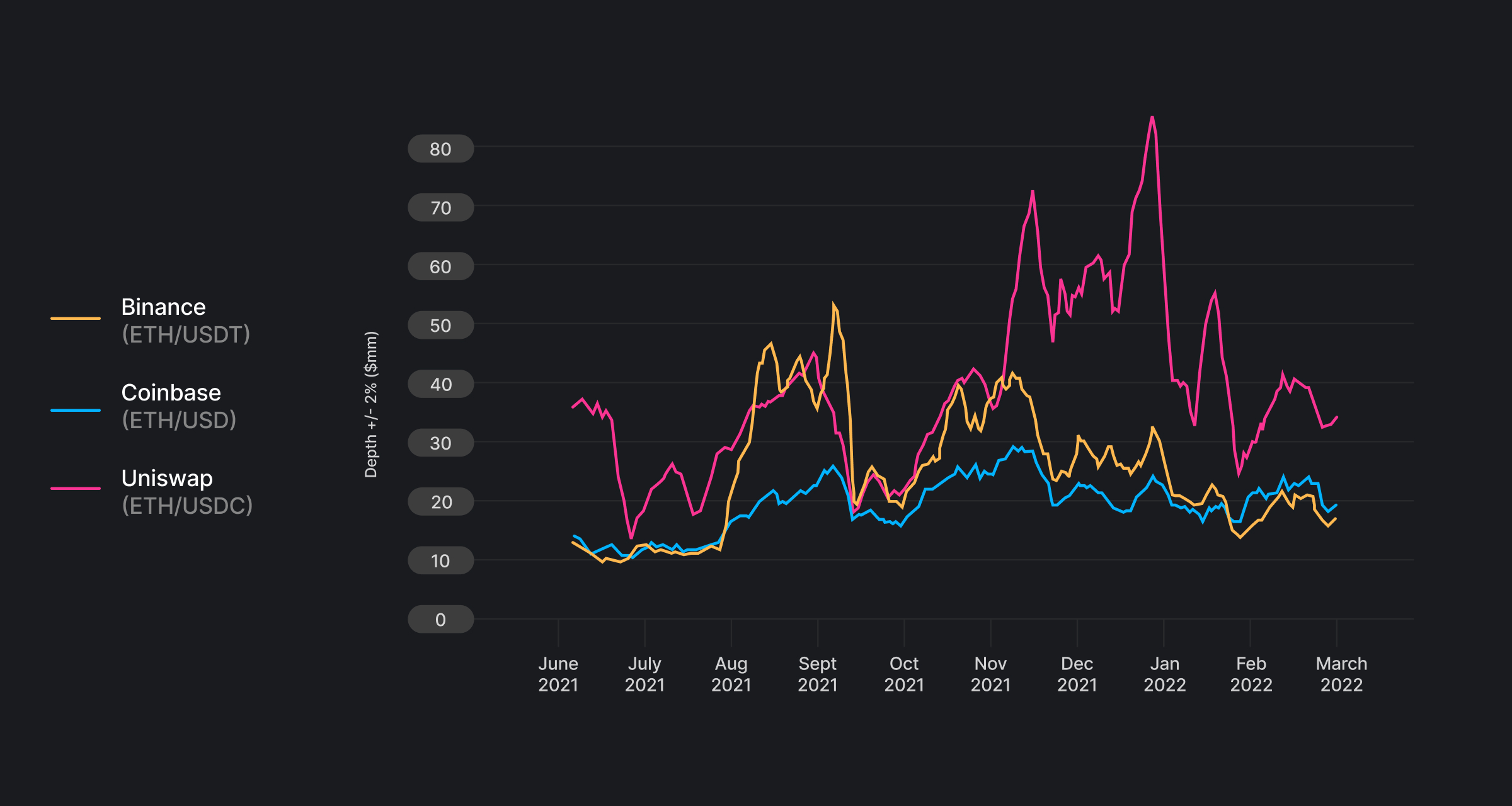

Elimination of Liquidity Fragmentation: By consolidating stablecoin liquidity into a single pool, USDT0 prevents the splitting of assets across multiple wrapped versions, ensuring deeper liquidity and tighter spreads for DeFi markets.

-

Enhanced Capital Efficiency: Unified liquidity allows DAOs and protocols to deploy assets more effectively, minimizing idle funds and maximizing yield opportunities across interconnected DeFi ecosystems.

-

Improved Security and Reduced Risk: USDT0’s use of LayerZero’s OFT standard eliminates the need for traditional bridges, which are frequent targets for exploits, thereby lowering the risk of cross-chain vulnerabilities.

-

Consistent User Experience: Users and developers benefit from a standardized process for stablecoin transfers, simplifying asset management and reducing complexity when interacting with multiple chains.

-

Lower Transaction Costs: Native USDT0 deployments, such as on Polygon, offer reduced fees for stablecoin transfers compared to legacy bridging or wrapping solutions, making DeFi participation more accessible.

-

Scalability for Protocol Growth: The integration of USDT0 with major infrastructure partners like Arbitrum and OKX enables DAOs and DeFi protocols to scale operations and reach broader user bases across supported blockchains.

This model allows DAOs to manage treasuries across multiple chains without juggling fragmented assets or incurring costly bridge fees. For developers and traders, it means lower slippage and deeper liquidity, key ingredients for any robust DeFi market.

Platforms like Polygon have already upgraded to native USDT0, resulting in lower fees and seamless transfers between supported chains (source). Similarly, integrations with networks such as Sei and Bitcoin Layer 2 Rootstock are expanding the reach of unified stablecoin liquidity even further.

Infrastructure Partnerships Powering Multi-Chain Expansion

The rapid adoption of USDT0 is no accident, it’s driven by strategic partnerships with leading infrastructure providers. Arbitrum’s collaboration with Tether has been instrumental in powering scalable deployments across Ethereum-compatible ecosystems (source). Meanwhile, exchanges like OKX have enabled millions of users to access omnichain stablecoin transfers at scale.

This momentum is catalyzing new standards in multi-chain treasury management, as DAOs can now deploy capital flexibly wherever opportunity arises, without sacrificing security or transparency. The result is an interconnected DeFi ecosystem where stable value flows frictionlessly between chains, setting a new benchmark for capital efficiency and risk mitigation.

Security, composability, and operational simplicity are at the heart of USDT0’s appeal. By eliminating the patchwork of wrapped tokens and legacy bridges, USDT0 minimizes attack surfaces and reduces the risk of exploits that have historically plagued cross-chain DeFi. Each movement of value is tracked natively on-chain, ensuring complete transparency, an essential feature for DAOs with strict audit requirements or regulatory oversight.

For treasury managers, this translates into smoother rebalancing and capital deployment. Instead of navigating multiple bridges or liquidity providers (each with their own risks and fees), DAOs can now consolidate their stablecoin holdings in a single, unified pool. This not only cuts operational overhead but also allows for more agile yield farming, hedging, and liquidity provisioning strategies across all supported blockchains.

Practical Implications for DeFi Builders and Users

USDT0’s omnichain design is already driving innovation at both the protocol and user levels. DeFi builders can integrate a standardized stablecoin experience without worrying about fragmented liquidity or inconsistent UX across chains. For users, moving stable value between ecosystems like Ethereum, Tron, Polygon, Sei, TON, Celo, and others becomes as simple as a single transaction, no manual bridging or swapping required.

The result? Faster arbitrage opportunities for traders, more reliable collateral for lending protocols, and seamless on/off-ramps for exchanges and wallets. This unified approach to stablecoin liquidity is poised to become the backbone of next-generation DeFi applications.

Real-World Use Cases Powered by USDT0 Cross-Chain Interoperability

-

Unified DeFi Liquidity Pools: USDT0 enables seamless aggregation of stablecoin liquidity across major blockchains like Ethereum, Tron, and Polygon, allowing protocols such as Uniswap and Curve Finance to offer deeper, cross-chain pools without fragmented wrapped tokens.

-

Instant Cross-Chain Payments: With USDT0, users and businesses can send stablecoin payments instantly between networks like TON, Celo, and Sei, reducing settlement times and costs for remittances and merchant transactions.

-

Omnichain NFT Marketplaces: Platforms such as OpenSea can accept USDT0 from buyers on any supported chain, streamlining NFT purchases and sales without manual bridging or conversion.

-

Cross-Chain Yield Farming: DeFi users can deploy USDT0 across protocols on networks like Arbitrum and Kraken’s Ink Layer 2 to access yield opportunities, maximizing returns without liquidity fragmentation.

-

Simplified Treasury Management for DAOs: DAOs and Web3 projects can manage their stablecoin treasuries more efficiently by holding USDT0, enabling unified accounting and rapid fund allocation across multiple blockchains.

-

Secure Cross-Chain Arbitrage: Traders can capitalize on price differences between exchanges on different chains using USDT0, executing arbitrage strategies without the risks and delays of traditional bridges.

What Comes Next: Evolving Standards in Stablecoin Interoperability

As USDT0 continues its expansion, now live on over 12 blockchains, the standard it sets will likely influence future stablecoin designs. The LayerZero OFT protocol has proven that secure cross-chain messaging is not just possible but scalable at production volumes. We can expect other major issuers to follow suit with omnichain-native assets that prioritize unified liquidity pools over fragmented wrappers.

This evolution will further empower DAOs to pursue sophisticated multi-chain treasury management strategies without being hamstrung by technical limitations or liquidity silos. As composability increases between protocols spanning different chains, we’ll see entirely new classes of DeFi products emerge, ranging from global automated market makers to cross-chain lending vaults, all powered by canonical assets like USDT0.

The bottom line: USDT0 unified liquidity is quickly becoming the gold standard for cross-chain stablecoins. Its impact on capital efficiency, security posture, and user experience signals a new era for decentralized finance, one where value moves as freely as information across an ever-growing web of interconnected blockchains.