For DAOs and DeFi asset managers, the pursuit of omnichain stablecoin liquidity is far more than a technical upgrade – it’s a strategic imperative in today’s fragmented blockchain landscape. As TVL surges past $90 billion and stablecoins like Tether and Circle command a combined market cap exceeding $120 billion, the pressure to optimize capital efficiency, reduce float risk, and streamline cross-chain operations has never been higher. But with innovation comes complexity: liquidity is now distributed across dozens of blockchains, each with its own quirks, risks, and opportunities. The result? Treasury managers face both unprecedented flexibility and heightened operational risk.

Why Omnichain Liquidity Is Now Essential

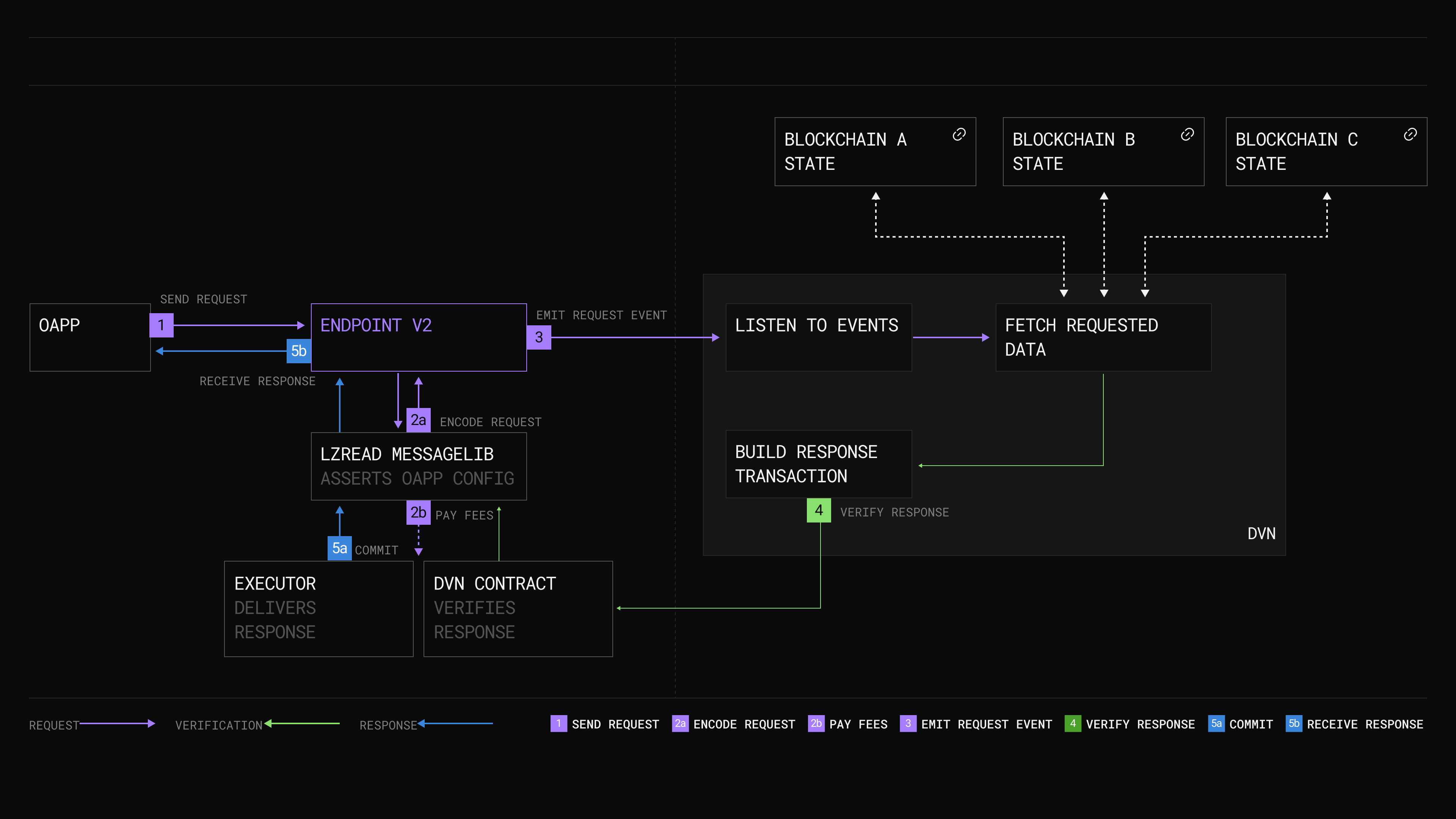

The emergence of protocols like LayerZero and intent-driven models from platforms such as Owlto Finance is rapidly dissolving old barriers between chains. This means that DAOs can finally treat their treasury as a unified pool – rather than a patchwork of siloed assets – unlocking new levels of agility for yield generation, payments, and risk mitigation. But success in this environment demands more than just technical integration; it requires deliberate strategy.

Below are the top 5 actionable strategies for DAO and DeFi asset managers to harness omnichain stablecoin liquidity for efficient, secure, and yield-optimized treasury management:

Top 5 Strategies for Omnichain Stablecoin Liquidity

-

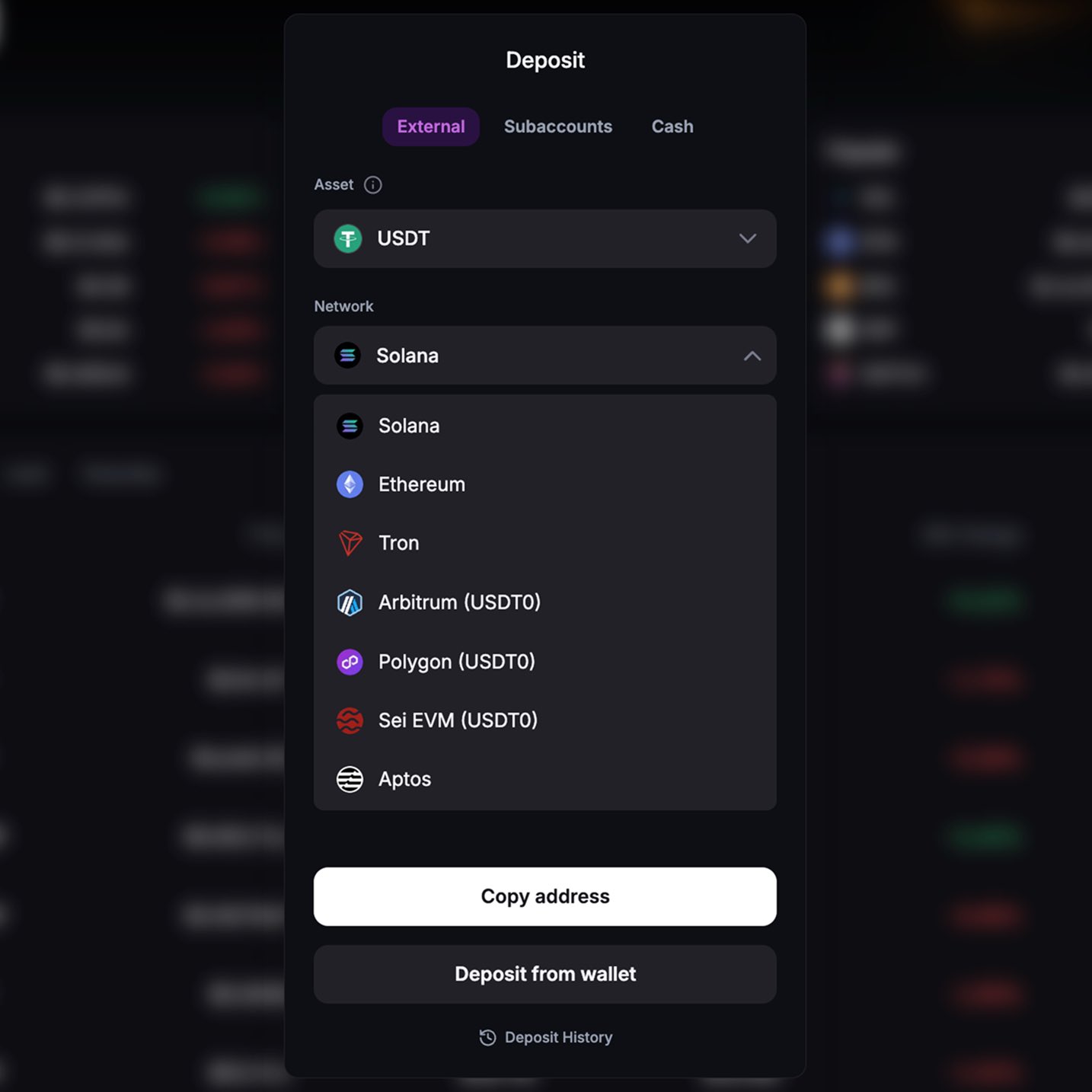

Adopt Omnichain Stablecoins (e.g., USDT0 on Backpack) for Unified Liquidity Pools: Leverage omnichain stablecoins like USDT0 on Backpack to consolidate liquidity across multiple blockchains. This approach streamlines treasury operations and reduces fragmentation, ensuring capital can be deployed efficiently wherever opportunities arise.

-

Implement Automated Cross-Chain Rebalancing to Optimize Treasury Allocation: Utilize tools like LayerZero or Owlto Finance to automate the rebalancing of assets across chains. Automated rebalancing ensures optimal allocation, reduces manual intervention, and helps maintain targeted risk and yield profiles.

-

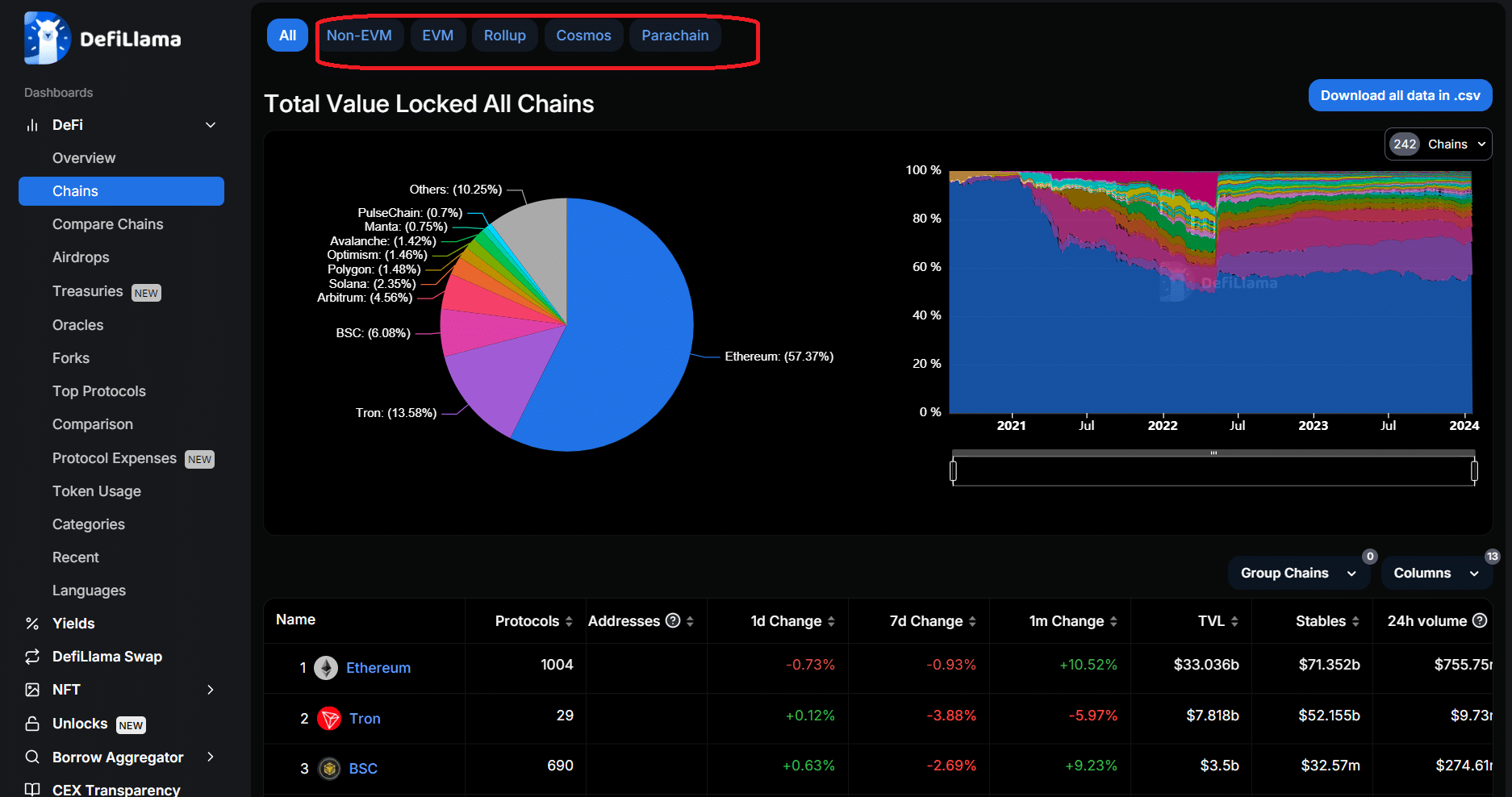

Utilize Multi-Chain Analytics Dashboards for Real-Time Treasury Monitoring: Deploy analytics platforms such as DeFiLlama or Dune Analytics to monitor treasury positions, liquidity, and yields across all supported blockchains. Real-time data empowers asset managers to make informed decisions and quickly respond to market changes.

-

Integrate Composable DeFi Protocols to Maximize Yield Across Chains: Engage with composable DeFi protocols like Aave or Curve, which enable seamless asset deployment and yield optimization across multiple networks. This strategy allows treasuries to access diverse yield opportunities while maintaining flexibility.

-

Establish DAO Governance Policies for Secure Cross-Chain Asset Transfers: Develop and enforce governance frameworks using platforms such as Aragon or Snapshot to oversee and secure cross-chain transactions. Robust governance minimizes operational risks and ensures that all transfers align with the DAO’s risk management and compliance standards.

1. Adopt Omnichain Stablecoins (e. g. , USDT0 on Backpack) for Unified Liquidity Pools

The first step toward frictionless multi-chain asset management is adopting truly omnichain stablecoins. Assets like USDT0 on Backpack, or d2O from DAM Finance’s Moonwalkers v1 testnet (source), are designed to operate natively across multiple blockchains without requiring bridging or wrapping. This unified approach eliminates fragmentation and enables DAOs to deploy capital wherever the best opportunities arise – instantly.

Unlike legacy models that lock assets into single-chain silos or expose treasuries to bridge risk, omnichain stablecoins allow managers to maintain one liquidity pool that can be tapped for payments, investments, or yield strategies across any supported network. The result is lower operational overhead and dramatically improved capital efficiency.

2. Implement Automated Cross-Chain Rebalancing to Optimize Treasury Allocation

No matter how diversified a DAO’s holdings may be, static allocations quickly become suboptimal as market conditions shift across networks. Automated cross-chain rebalancing tools allow treasuries to dynamically move assets between chains based on real-time factors like yield rates, protocol incentives, or evolving risk profiles.

This automation not only improves returns but also reduces manual intervention (and human error). For example, if Arbitrum suddenly offers superior liquidity mining yields compared to Optimism or Ethereum mainnet, an automated system can shift stablecoin allocations accordingly – maximizing performance while preserving overall treasury health.

3. Utilize Multi-Chain Analytics Dashboards for Real-Time Treasury Monitoring

The complexity of omnichain operations demands robust oversight. Multi-chain analytics dashboards are now indispensable tools for real-time monitoring of balances, flows, exposures, and protocol-specific risks across all supported networks. With these dashboards in place, DAO treasurers gain instant visibility into their entire portfolio, no matter how many chains or DeFi protocols they interact with.

This transparency not only supports better decision-making but also strengthens internal controls and accountability, key pillars for sustainable DAO governance in an era where regulatory scrutiny is increasing alongside TVL growth.

4. Integrate Composable DeFi Protocols to Maximize Yield Across Chains

To fully capitalize on omnichain stablecoin liquidity, DAOs and DeFi asset managers must look beyond passive holding and embrace the power of composable DeFi protocols. By integrating with platforms that support composability across chains, treasuries can automate yield optimization strategies such as lending, staking, and liquidity provisioning, no matter where the best rates emerge.

For example, a DAO using USDT0 on Backpack can seamlessly allocate capital to lending pools on one chain while simultaneously deploying assets into liquidity mining programs on another. This cross-chain composability amplifies returns and allows for rapid adaptation as yield opportunities shift between ecosystems. The key is to leverage protocols designed with interoperability at their core, reducing friction and unlocking true capital efficiency.

5. Establish DAO Governance Policies for Secure Cross-Chain Asset Transfers

The technical ability to move stablecoins across chains is only as valuable as the security and governance framework that underpins it. DAOs must formalize cross-chain asset transfer policies that address risk management, multi-sig requirements, emergency halts, and audit trails. These policies should be codified in smart contracts wherever possible to minimize human error and ensure consistent enforcement.

Effective governance not only protects against internal threats but also builds trust with token holders and external partners. For instance, requiring multi-signature approvals or time-locked transfers for large cross-chain movements can mitigate risks associated with malicious actors or protocol exploits. As omnichain infrastructure evolves, so too must the governance mechanisms that safeguard treasury assets.

Putting It All Together: The Future of Multi-Chain Treasury Management

The convergence of omnichain stablecoins, automated rebalancing tools, analytics dashboards, composable DeFi protocols, and robust governance marks a new era in multi-chain asset management. DAOs that adopt these strategies are positioned to thrive amid growing competition, and regulatory scrutiny, by maintaining liquidity, optimizing yield, and minimizing operational risk across the full spectrum of blockchain networks.

Recent innovations from projects like LayerZero (source) and DAM Finance are already reshaping how treasuries approach cross-chain flows. But technology alone is not enough: success depends on disciplined execution of best practices tailored to each DAO’s unique mission and risk appetite.

Which omnichain strategy do you consider most critical for your DAO’s treasury in 2024?

As omnichain stablecoin liquidity becomes essential for efficient DAO treasury management, which of these top strategies do you believe will have the biggest impact this year?

Key Takeaways for DAO and DeFi Asset Managers

- Diversification is non-negotiable: Spread assets across chains to reduce exposure to single-network failures or congestion.

- Automation unlocks efficiency: Let smart systems rebalance allocations based on live data, not gut feelings.

- Transparency builds trust: Use analytics dashboards so every stakeholder understands treasury health at a glance.

- Governance is your last line of defense: Codify cross-chain transfer rules before an incident tests your system’s resilience.

The bottom line? The playbook for effective DAO treasury management in 2024 isn’t about chasing the latest yield farm, it’s about orchestrating a resilient system where omnichain stablecoin liquidity works in concert with automation, analytics, composability, and governance. As always in decentralized finance: adapt early or risk being left behind by those who do.