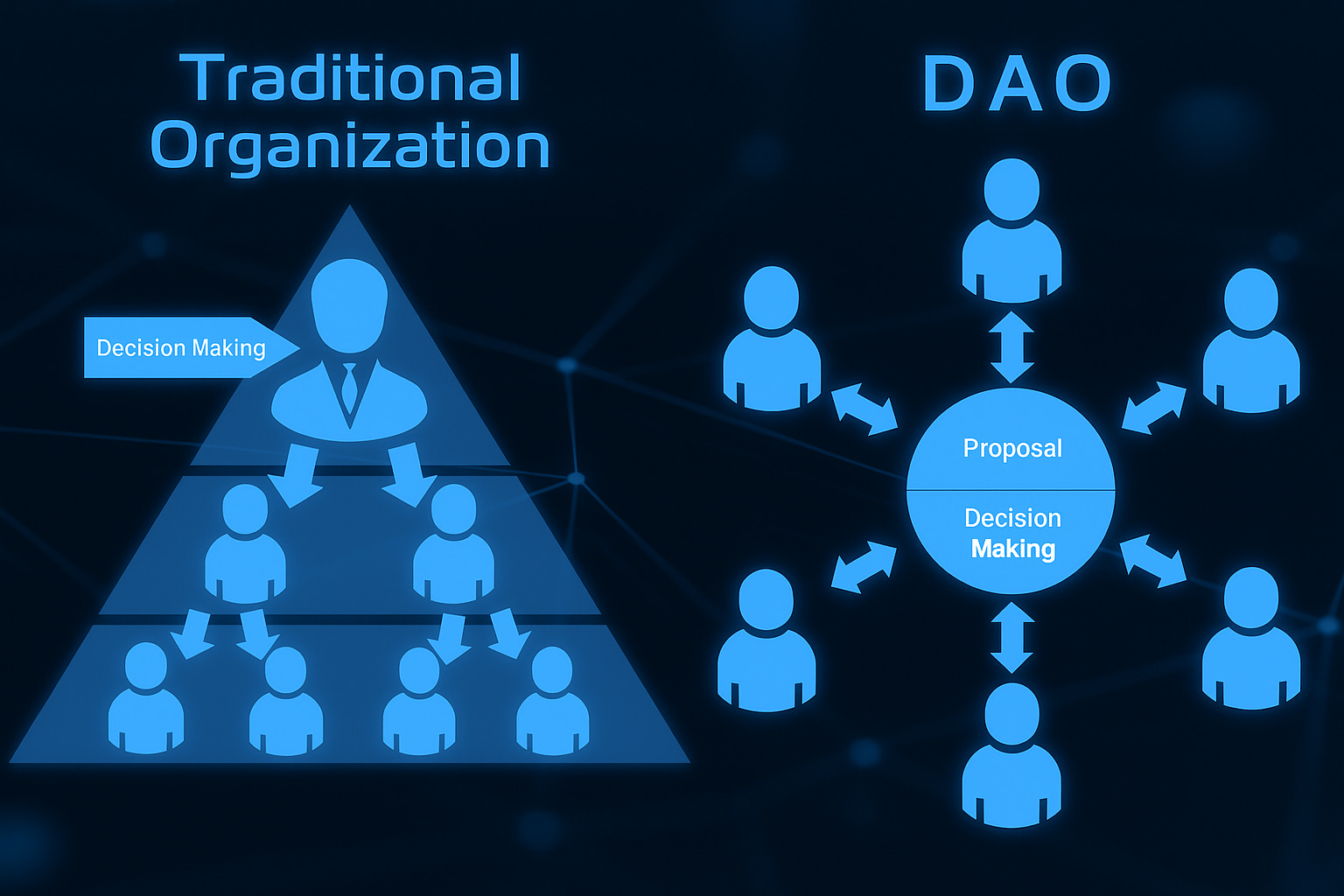

DAO treasury management is hitting a tactical inflection point, and stablecoin-native blockchains are the accelerant. For years, DAOs wrestled with the wild volatility of holding governance tokens and blue chips like ETH or BTC, making budgeting and runway projections a game of whack-a-mole. But now, stablechain for DAOs is not just a buzzword – it’s the backbone of modern on-chain treasury strategy.

Stablecoin-Native Blockchains: The New Financial Backbone

Let’s get tactical. By leveraging stablecoins as native assets, blockchains like Plasma and USDT gas blockchain have redefined what it means to manage digital assets at scale. Instead of sweating over token price swings, DAOs can lock in predictable budgets and execute payroll or grant programs without fear that next week’s crash will gut their reserves.

This isn’t theoretical. MakerDAO recently shifted $2.2 billion of its $5 billion AUM into U. S. Treasurys via stablecoins – a move that signals just how critical stability has become in DAO treasury management (axios.com). The result? DAOs can sidestep crypto’s notorious volatility while still earning yield, all thanks to the composability of on-chain treasury stablecoins.

Pushing Past Volatility: Predictable Budgets and Cross-Border Efficiency

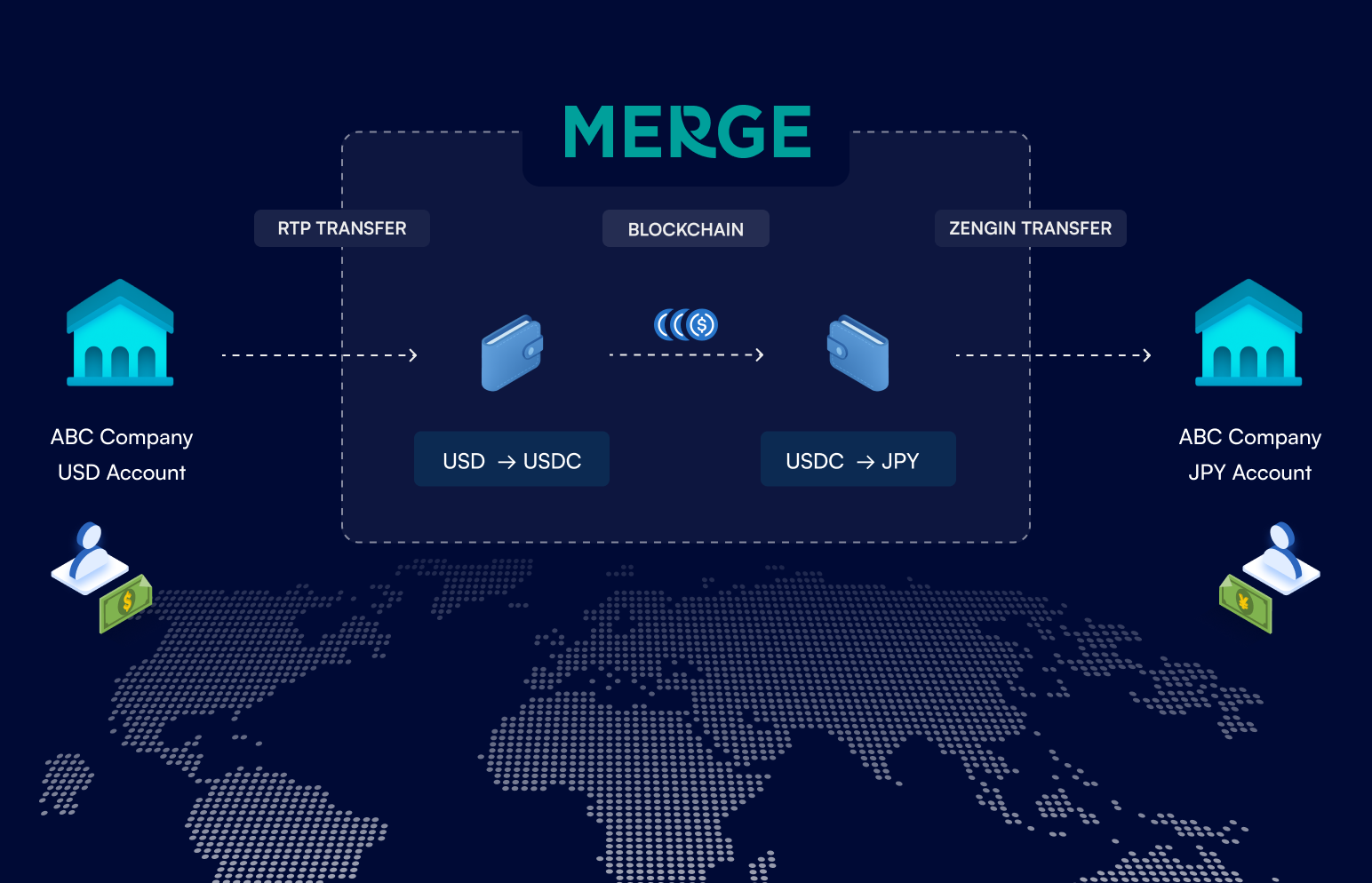

The power move here is not just about holding stablecoins – it’s about using blockchains purpose-built for them. Stablecoin-native chains streamline cross-border payments, cut settlement times from days to minutes, and slash fees to near zero compared to legacy banking rails.

Top Advantages of Stablecoin-Native Blockchains for DAO Treasuries

-

Enhanced Stability & Predictable Budgeting: Stablecoin-native blockchains let DAOs avoid wild price swings by using stablecoins as their main treasury asset. This means more reliable budgeting and less risk of sudden treasury drops. For example, MakerDAO now allocates $2.2 billion of its $5 billion assets into U.S. Treasurys, leveraging stablecoins for steady value.

-

Seamless Integration with Traditional Finance: These blockchains make it easy for DAOs to tap into real-world assets like tokenized U.S. Treasurys. Platforms like Hyperliquid and experts like Sébastien Derivaux help DAOs bridge DeFi with traditional finance, unlocking new yield opportunities.

-

Operational Efficiency & Lower Costs: Stablecoins power faster, cheaper cross-border payments for DAOs. Tools like Modern Treasury now support stablecoin payouts, letting DAOs pay global contributors 24/7 and manage funds with fewer fees and delays.

-

Diversification & Risk Management: By holding a basket of stablecoins (like USDC, DAI, USDT), DAOs can reduce risk from any single stablecoin’s issues—whether that’s de-pegging or regulatory trouble. This approach boosts treasury resilience and aligns with the stablecoin trilemma.

-

Automated Treasury Operations: Stablecoin-native blockchains support smart contracts and DeFi tools for automating treasury strategies. DAOs can lend stablecoins on Aave or Compound, or provide liquidity in pools to earn yield—all with minimal manual work.

For globally distributed DAOs paying contributors everywhere from Seoul to São Paulo, this is game-changing. Platforms like Modern Treasury are already enabling 24/7 global payouts in stables – no more waiting for wire transfers or eating up capital with float risk (moderntreasury.com).

Diversification and Risk Management: The Stablecoin Trilemma

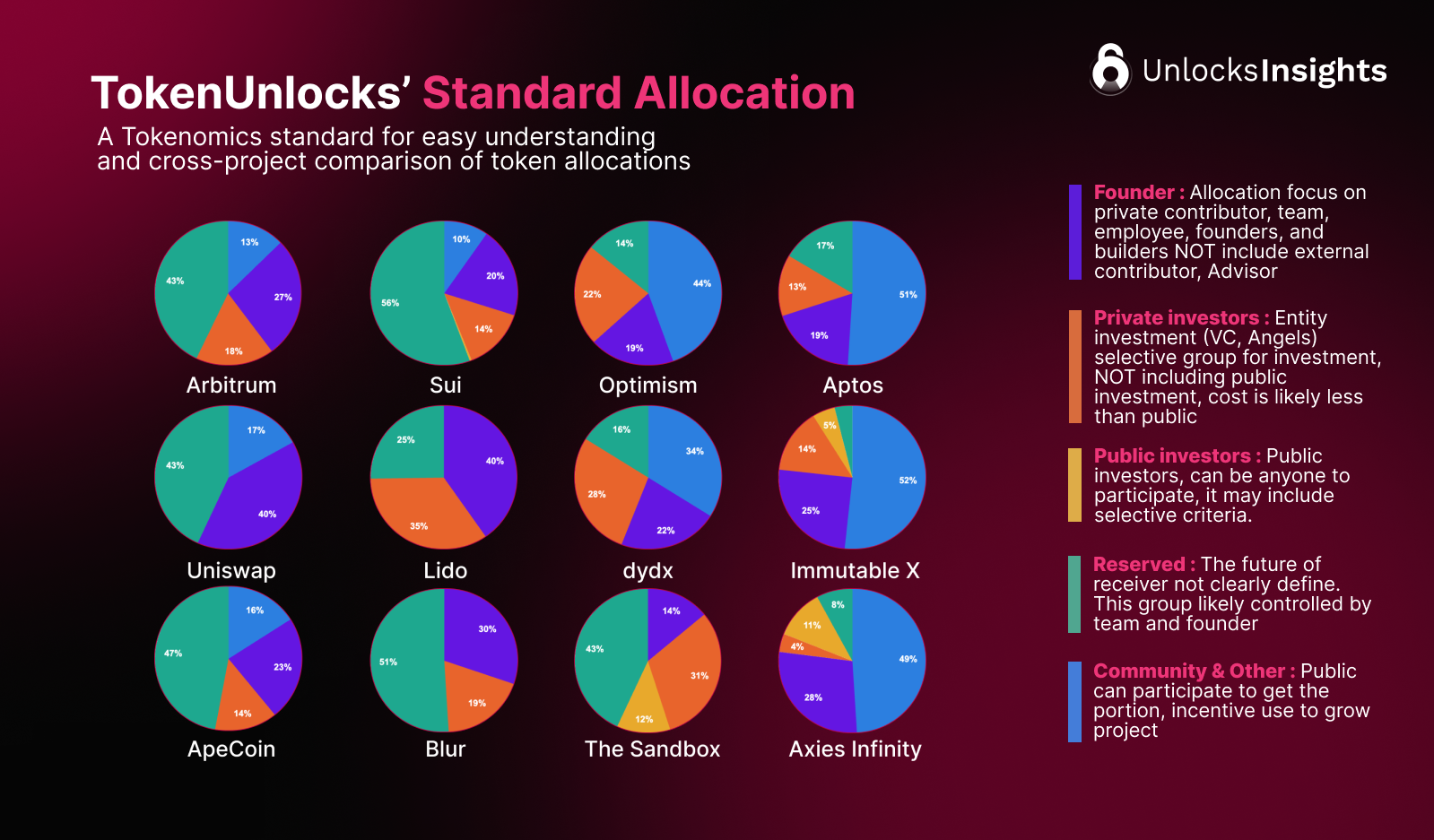

If you’re only holding one flavor of stables, you’re missing the plot. The real edge comes from diversification – splitting your stack across multiple stablecoins (think USDC, DAI, USDH) so you’re not exposed if one depegs or faces regulatory drama (medium.com). This aligns with the “stablecoin trilemma”: balancing decentralization, capital efficiency, and peg stability.

The most sophisticated DAO treasuries are already deploying automated strategies: lending stables on Aave or Compound for yield, providing liquidity in pools for trading fees – all managed by smart contracts that reduce human error and maximize uptime.

Automation is the secret sauce. With stablecoin-native blockchains, DAOs can deploy smart contracts that rebalance portfolios, auto-distribute grants, and trigger risk controls in real time. No more manual spreadsheet jockeying or governance gridlock. Instead, you get programmatic execution and a treasury that’s always on, always earning.

Let’s not gloss over compliance and transparency, either. Stablecoin-native chains are engineered for auditability. Every movement of funds is on-chain, traceable, and verifiable by the DAO community or external auditors. This is a huge leap from the opaque off-chain bank accounts that still haunt some legacy treasuries.

Next-Level Analytics: Real-Time Treasury Intelligence

What sets the best on-chain treasury stablecoins apart? Real-time analytics dashboards. These tools let DAOs track yields, exposures, and liquidity positions across multiple chains and protocols at a glance, empowering treasury managers to make high-frequency decisions with confidence.

Imagine seeing your DAO’s entire stablecoin stack, USDT gas blockchain allocations, Plasma ecosystem yields, cross-chain flows, in one unified dashboard. You’re not just managing risk; you’re actively optimizing for growth every single block.

The data advantage here is massive: instant alerts for depegs or protocol exploits, automated rebalancing when thresholds are breached, and deep visibility into where every dollar is working hardest. That’s how DAOs move from defensive to offensive treasury strategies.

The Road Ahead: Dynamic Vaults and Composable Finance

The future belongs to composable finance, where DAOs can plug their stablecoin vaults directly into new DeFi primitives as they emerge. Think dynamic allocation between lending protocols based on real-time APY shifts or auto-migrating funds to new regulatory-compliant stablecoins as jurisdictions evolve.

This agility lets DAOs stay ahead of both market risk and regulatory changes without missing a beat. As the Plasma stablecoin ecosystem matures and more chains embrace native stables as their core asset layer, expect even tighter integration between DAO governance, yield optimization, and compliance automation.

Tactical takeaway: Stablecoin-native blockchains aren’t just reducing volatility, they’re unlocking an entirely new operating system for decentralized capital management.

Ready to Upgrade Your DAO’s Treasury?

If you’re still running your treasury like it’s 2021, heavy in volatile tokens or stuck in slow-moving multisigs, it’s time to level up. The playbook now centers on stability, automation, and real-time analytics powered by the latest generation of stablechain infrastructure.

The DAOs that win in this new cycle will be those who treat their treasuries like high-frequency trading desks: diversified across multiple on-chain stablecoins, automated for yield capture and risk control, relentlessly transparent, and always ready to pivot as DeFi evolves.

Tactical Steps for Future-Proofing DAO Treasuries

-

Diversify into Major Stablecoins for Predictable Budgets: Allocate a significant portion of your treasury to established stablecoins like USDC, DAI, and USDT to minimize volatility and ensure reliable funding for operations. For example, MakerDAO has moved $2.2 billion of its $5 billion assets into U.S. Treasurys using stablecoins as a bridge.

-

Integrate with Tokenized Real-World Assets: Use platforms such as Ondo Finance and Maple Finance to access tokenized U.S. Treasurys and other real-world assets. This provides stable yield and deeper diversification, as seen in MakerDAO’s adoption of U.S. Treasurys.

-

Automate Treasury Operations with DeFi Protocols: Deploy smart contracts on protocols like Aave, Compound, and Balancer to automate lending, liquidity provision, and yield generation, reducing manual overhead and boosting treasury growth.

-

Adopt Multi-Stablecoin Strategies for Risk Management: Hold a basket of stablecoins (e.g., USDC, DAI, FRAX, LUSD) to hedge against de-pegging or regulatory risks affecting any single stablecoin, enhancing overall treasury resilience.

-

Leverage Stablecoin-Native Payment Platforms: Use services like Modern Treasury and Circle to enable 24/7 global payouts, streamline contributor payments, and manage cross-border transactions with lower fees and faster settlement.

-

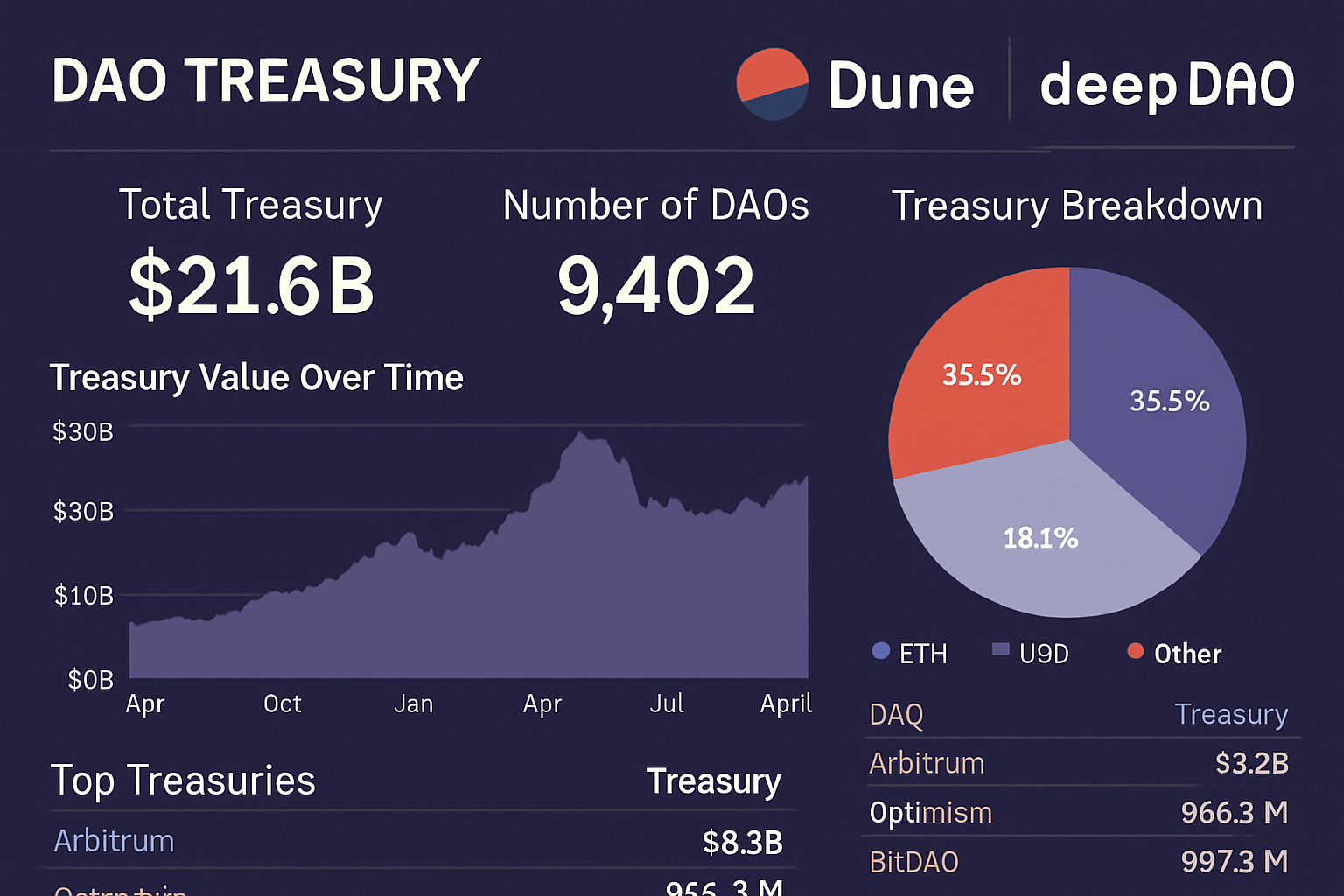

Continuously Monitor and Rebalance Treasury Allocations: Utilize analytics tools such as Dune Analytics and DeepDAO to track treasury performance, identify risks, and rebalance holdings in response to market shifts and governance decisions.