Decentralized Autonomous Organizations (DAOs) are rapidly evolving into sophisticated financial entities, managing treasuries that rival traditional institutions in both scale and complexity. As DAOs mature, optimizing treasury fees and deploying reinvestment strategies have become mission-critical for sustainable growth. Effective on-chain treasury management not only preserves capital but also enables DAOs to fund innovation and weather market volatility with resilience.

Reducing Costs Through Strategic DAO Treasury Optimization

Fee management remains a persistent challenge for DAOs, especially as transaction volumes and asset diversity increase. Every basis point saved on transaction and protocol fees directly enhances long-term runway. The most forward-thinking DAOs are taking several steps:

- Batching Transactions: Consolidating multiple payments or transfers into single transactions to minimize gas fees.

- Utilizing Layer-2 Solutions: Migrating routine operations to Layer-2 networks where transaction fees are significantly lower than Ethereum mainnet.

- Selecting Cost-Efficient Protocols: Leveraging platforms with transparent fee structures and proven security records.

- Automating Routine Payments: Using smart contracts to schedule recurring disbursements, reducing manual intervention and error rates.

This disciplined approach to fee optimization ensures that capital is preserved for high-impact initiatives rather than lost to inefficiencies. For a deeper dive into the practicalities of DAO treasury management, see the analysis from Coinmetro on effective practices for managing DAO treasuries.

Diversification: The Cornerstone of Sustainable On-Chain Treasury Management

A robust diversification strategy is fundamental for risk mitigation and yield generation. The most resilient DAOs allocate across multiple asset classes, balancing growth potential with capital preservation:

Top DAO Treasury Diversification Strategies

-

Stablecoin Allocations: Allocating treasury funds to well-established stablecoins such as USDC and DAI helps maintain liquidity and minimize exposure to crypto market volatility. Stablecoins are widely used for operational expenses and as a hedge against price swings.

-

Major Cryptocurrencies: Diversifying into leading cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) offers growth potential and liquidity. These assets are foundational to most DAO treasuries due to their market dominance and robust security.

-

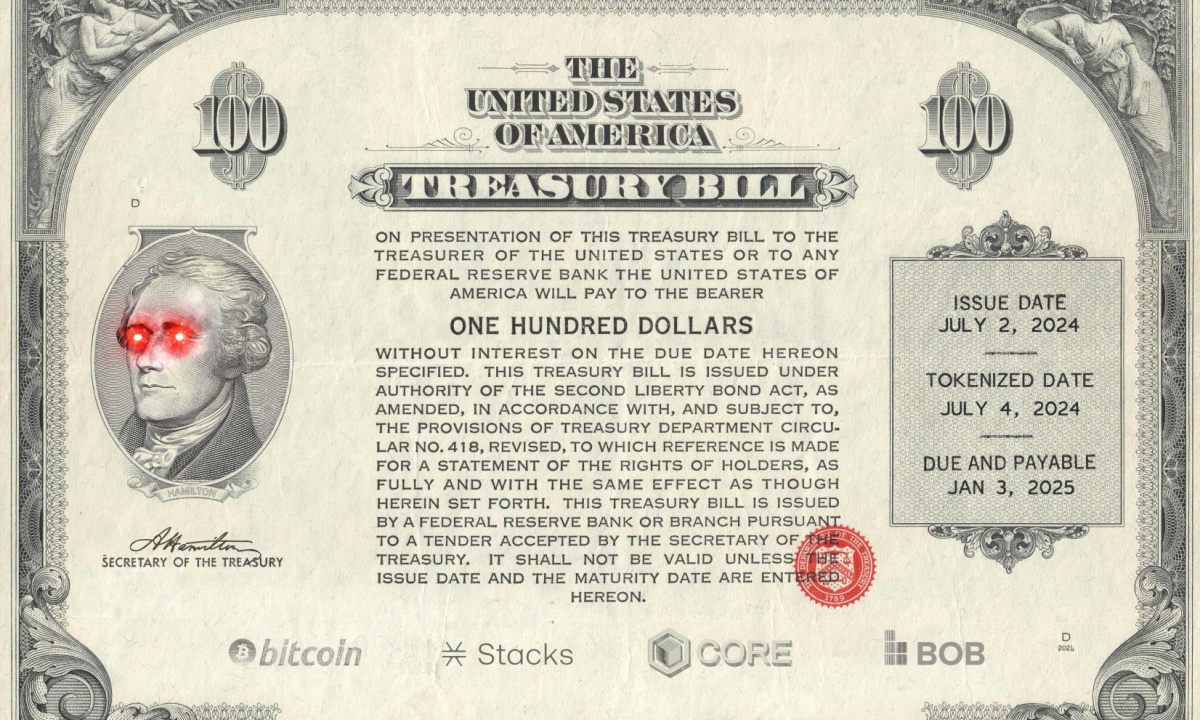

Tokenized Real-World Assets: Investing in tokenized assets such as U.S. Treasury bonds (e.g., via MakerDAO) or real estate tokens enables DAOs to access stable, yield-generating instruments outside the crypto market. For example, MakerDAO’s allocation to U.S. Treasury bonds generated over $100 million in annual revenue.

-

DeFi Yield Strategies: Earning returns by lending stablecoins on platforms like Compound and Aave, or by staking assets in protocols such as Lido and Rocket Pool. These strategies can generate steady income while maintaining liquidity for the DAO.

-

Fixed-Rate Instruments: Utilizing fixed-income DeFi products, such as those offered by Notional Finance, allows DAOs to secure predictable returns and manage interest rate risk in their portfolios.

-

Asset Management Protocols: Leveraging platforms like Set Protocol for automated, diversified portfolio management, or Aera Finance for dynamic yield optimization, helps DAOs efficiently rebalance and optimize their asset allocations.

The MakerDAO case study exemplifies this approach. By allocating $500 million into U. S. Treasury bonds, MakerDAO generated over $100 million in annual revenue – a clear demonstration of how integrating traditional assets can stabilize returns while lowering risk exposure (source). This blend of crypto-native assets (like ETH) with stablecoins and real-world instruments is now considered best practice among leading DAOs.

Yield Generation Without Compromising Security

The next frontier in DAO treasury optimization is deploying idle assets into yield-generating protocols – but only within strict security parameters. Conservative strategies include:

- Lending Stablecoins: Platforms such as Compound or Aave allow DAOs to earn interest without exposing principal to excessive volatility.

- Staking Major Tokens: Participating in network validation can generate rewards while supporting ecosystem health; for example, Aave DAO’s Safety Module has delivered approximately $3.2 million annually from staking ETH (source).

- Liquidity Provisioning: Supplying assets to decentralized exchanges can earn trading fees, though this requires careful monitoring due to impermanent loss risks.

A methodical approach demands regular rebalancing and ongoing due diligence on protocol security – especially as the DeFi landscape evolves rapidly. Automated tools like Set Protocol or dynamic rebalancing platforms such as Aera Finance are gaining traction among DAOs seeking operational efficiency without sacrificing oversight (read more here).

Beyond yield, DAOs must weigh the trade-offs between maximizing returns and maintaining sufficient liquidity for operational needs. Fixed-rate instruments, such as those offered by Notional Finance, allow DAOs to lock in predictable income streams while insulating themselves from rate volatility. This is particularly valuable for organizations with ongoing grant programs or recurring expenditures that require budget certainty.

Governance and Compliance: Building Trust Through Transparency

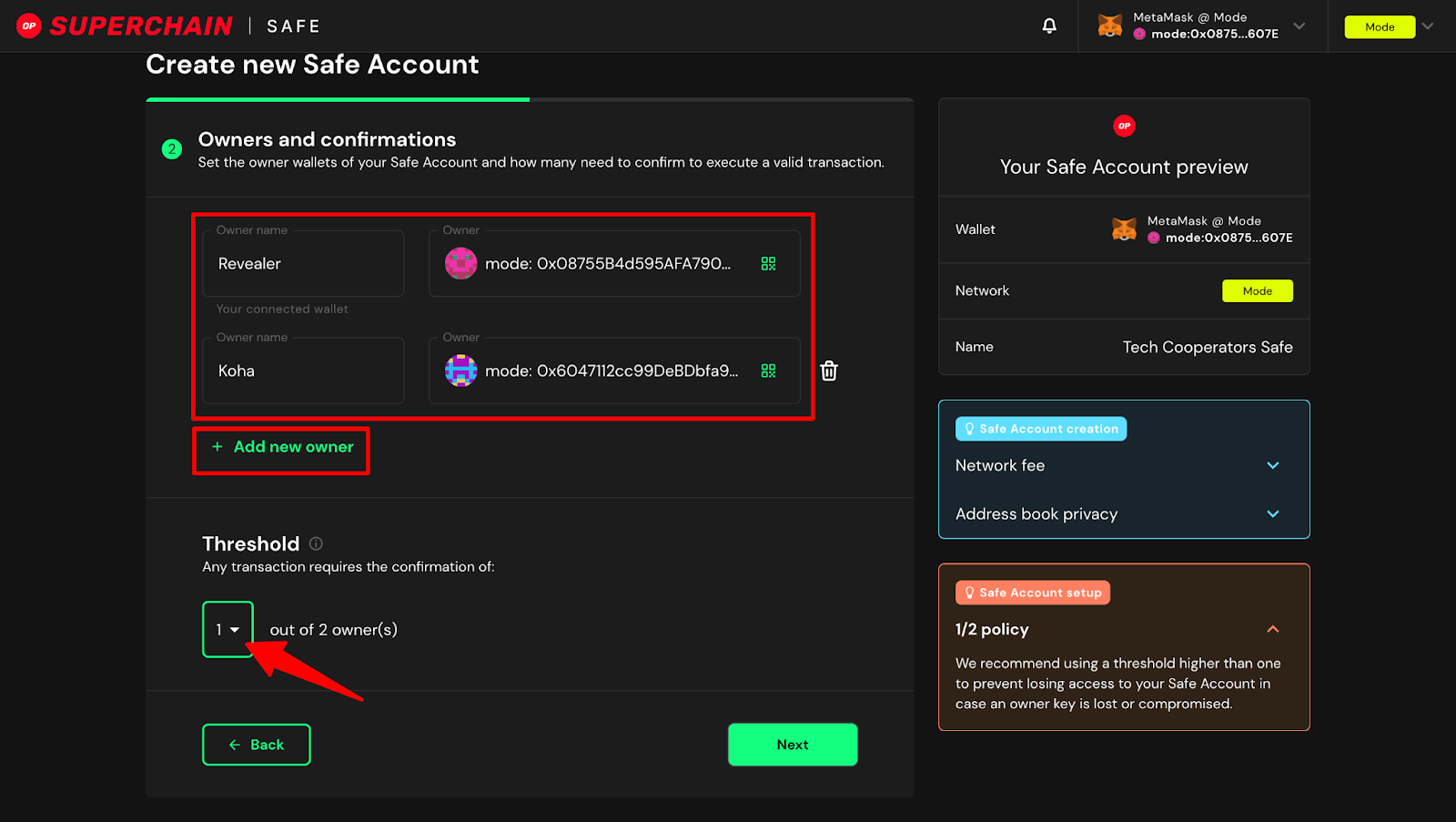

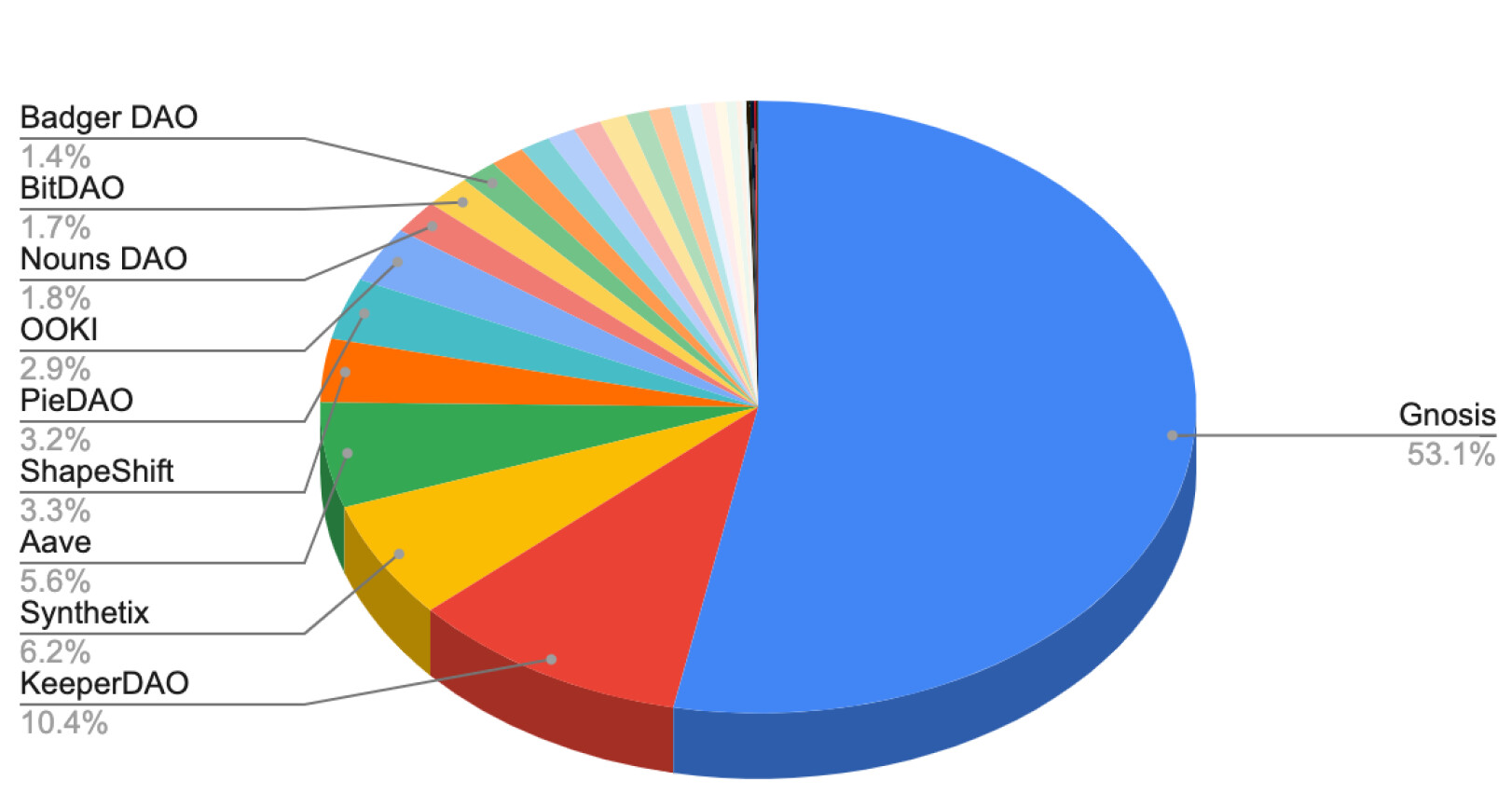

Effective on-chain treasury management depends as much on robust governance as on financial acumen. DAOs must establish transparent frameworks for budgeting, oversight, and risk controls. Multi-signature wallets are now the industry standard for securing treasury assets, requiring multiple approvals before funds are moved. This not only reduces the risk of unilateral action or compromise but also reinforces community trust.

Regular audits, both internal and external, are essential to verify compliance with established policies and identify potential vulnerabilities early. Publishing audit results to the community further enhances accountability and aligns all stakeholders around shared goals.

Essential DAO Treasury Governance Practices

-

Implement Multi-Signature Wallets: Require multiple authorized signers for treasury transactions using platforms like Gnosis Safe, significantly reducing the risk of unauthorized fund transfers and enhancing overall security.

-

Conduct Regular Smart Contract and Financial Audits: Schedule periodic audits with reputable firms such as OpenZeppelin or CertiK to ensure code integrity and financial transparency, helping to proactively identify vulnerabilities or inefficiencies.

-

Define Clear Budget Categories and Spending Policies: Establish explicit budget allocations for operations, development, reserves, and grants, and formalize these in governance proposals to ensure transparent and accountable fund usage.

-

Provide Transparent Community Reporting: Publish regular, detailed treasury reports using platforms like Dune Analytics or Messari, keeping all stakeholders informed about asset allocations, expenditures, and financial health.

-

Centralize Treasury Management on Secure Platforms: Use established platforms such as Request Finance or Set Protocol to centralize financial flows, automate payments, and manage diversified portfolios with robust access controls.

Smart Reinvestment: Aligning Capital With DAO Mission

Reinvestment decisions should always be mission-driven. Leading DAOs earmark a portion of their yield or fee savings to fund ecosystem growth initiatives, such as developer grants, research bounties, or liquidity mining programs that directly enhance protocol utility. Aligning financial strategy with organizational objectives ensures that treasury optimization is not just about numbers but about advancing the DAO’s long-term vision.

For example, several major DAOs have adopted frameworks where a fixed percentage of annual yield is reinvested into ecosystem development while maintaining a conservative reserve ratio for downside protection (see tokenomics research). This approach balances growth with prudence, a hallmark of sustainable decentralized treasury growth.

The Future of On-Chain Treasury Optimization

The landscape of DAO treasury optimization will continue to evolve alongside DeFi innovation. As regulatory clarity improves and new asset classes emerge, including tokenized real-world assets, DAOs will have even more tools to diversify risk and generate resilient returns. However, security must remain paramount; automation should never come at the expense of oversight or sound governance.

The most successful DAOs will be those that combine rigorous cost control with adaptive reinvestment strategies, always guided by transparent processes and a commitment to their core mission. By embedding these principles into their operational DNA, DAOs can build treasuries that not only survive market turbulence but thrive in any cycle.