In 2024, Decentralized Autonomous Organizations (DAOs) are managing over $30 billion in collective treasury value, a figure that underscores the growing sophistication of on-chain treasury management. With the top five DAOs holding 60% of these assets and governance activity at record highs, the pressure to maximize yield while maintaining robust risk controls has never been greater. Stablecoin vaults have emerged as a cornerstone in this evolution, offering DAOs a way to earn steady returns and manage volatility across diverse DeFi landscapes.

How Stablecoin Vaults Drive DAO Yield Optimization

Stablecoin vaults are purpose-built smart contract systems that automate yield generation on stablecoin holdings. These vaults allow DAOs to allocate assets into a range of DeFi strategies, such as lending, liquidity provision, and cross-protocol aggregation, without requiring constant manual intervention. The result is an optimized blend of yield generation, risk mitigation, and operational efficiency.

Three primary strategies have become standard among leading DAOs seeking to maximize their treasury yields via stablecoin vaults:

Top DAO Stablecoin Vault Strategies in 2024

-

Dynamic Stablecoin Allocation: DAOs leverage automated vaults like Aera to dynamically rebalance between leading stablecoins (USDT, USDC, DAI, FDUSD) and lending protocols. This strategy aims to optimize yield while minimizing exposure to any single asset or protocol, using real-time analytics and autonomous management.

-

Leveraged Stablecoin Lending: By deploying treasury assets into DeFi protocols such as Aave and Compound, DAOs can participate in over-collateralized stablecoin lending. This approach earns interest and additional incentive tokens, enhancing returns but requiring careful risk management of leverage and protocol health.

-

Multi-Protocol Diversification: DAOs allocate funds across multiple stablecoin yield platforms like Yearn Finance and Morpho Blue. Diversification reduces systemic risk and allows treasuries to capture the most competitive rates available in real time, balancing risk and reward across protocols.

1. Dynamic Stablecoin Allocation with Automated Vaults

The first strategy centers on dynamic allocation, where DAOs leverage platforms like Aera to rebalance assets between top stablecoins, USDT, USDC, DAI, FDUSD, and high-yield lending protocols in real time. Aera’s autonomous vault management system uses algorithmic models to assess yield opportunities and risk exposures across multiple protocols. By continuously shifting allocations based on market conditions and protocol health metrics, Aera helps DAOs avoid overexposure to any single asset or platform while capturing optimal yields.

This approach is particularly effective for treasuries seeking hands-off optimization without sacrificing transparency or control. The automated nature of these vaults aligns well with DAO governance frameworks by reducing human error and streamlining proposal cycles for routine rebalancing tasks.

2. Leveraged Stablecoin Lending via DeFi Protocols

The second strategy involves deploying treasury assets into over-collateralized lending protocols such as Aave and Compound. Here, DAOs supply stablecoins, often USDC or DAI, to lending pools where borrowers post excess collateral to secure loans. In return, the DAO earns interest payments plus additional incentive tokens native to the protocol.

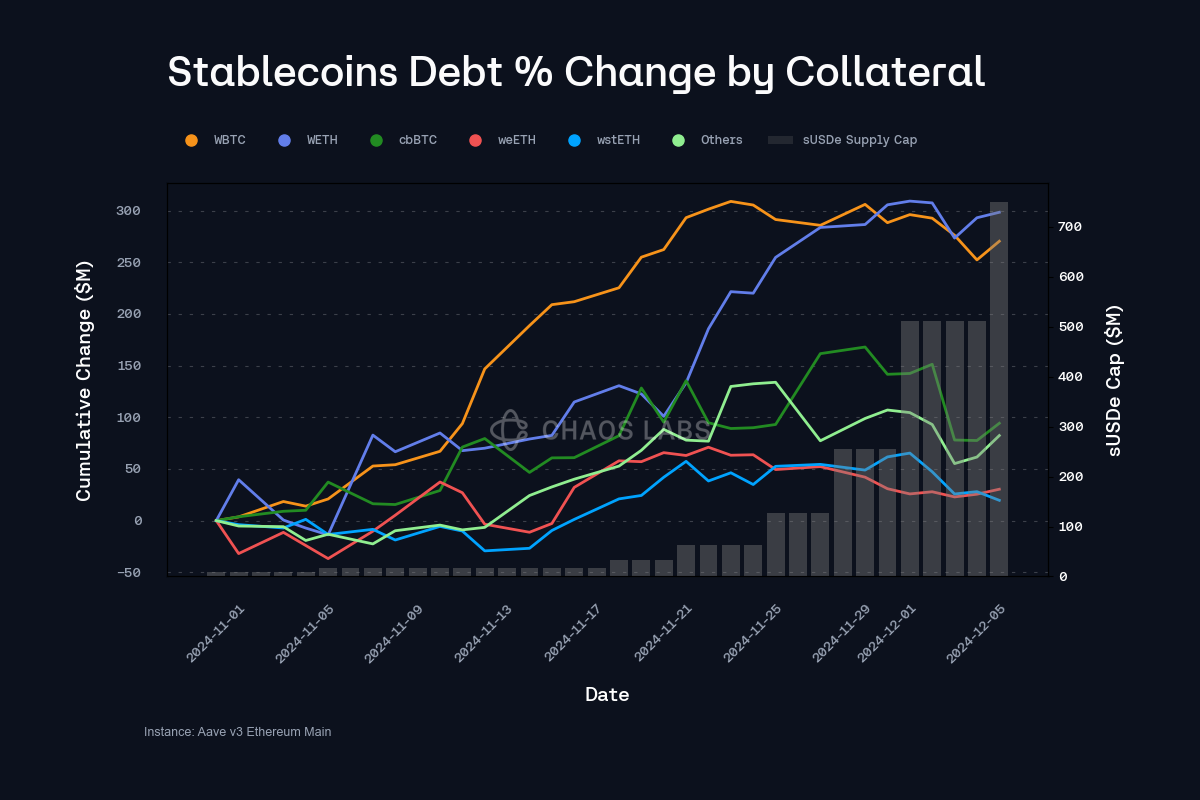

This technique allows for leveraged exposure: by borrowing against deposited assets or participating in recursive lending loops (within governance-approved risk limits), treasuries can amplify returns during periods of high demand for stablecoins. However, it requires careful monitoring due to liquidation risks if collateral values fluctuate sharply, a scenario that played out during several market events in 2024 when certain stablecoins briefly depegged from their fiat anchors.

The Importance of Multi-Protocol Diversification

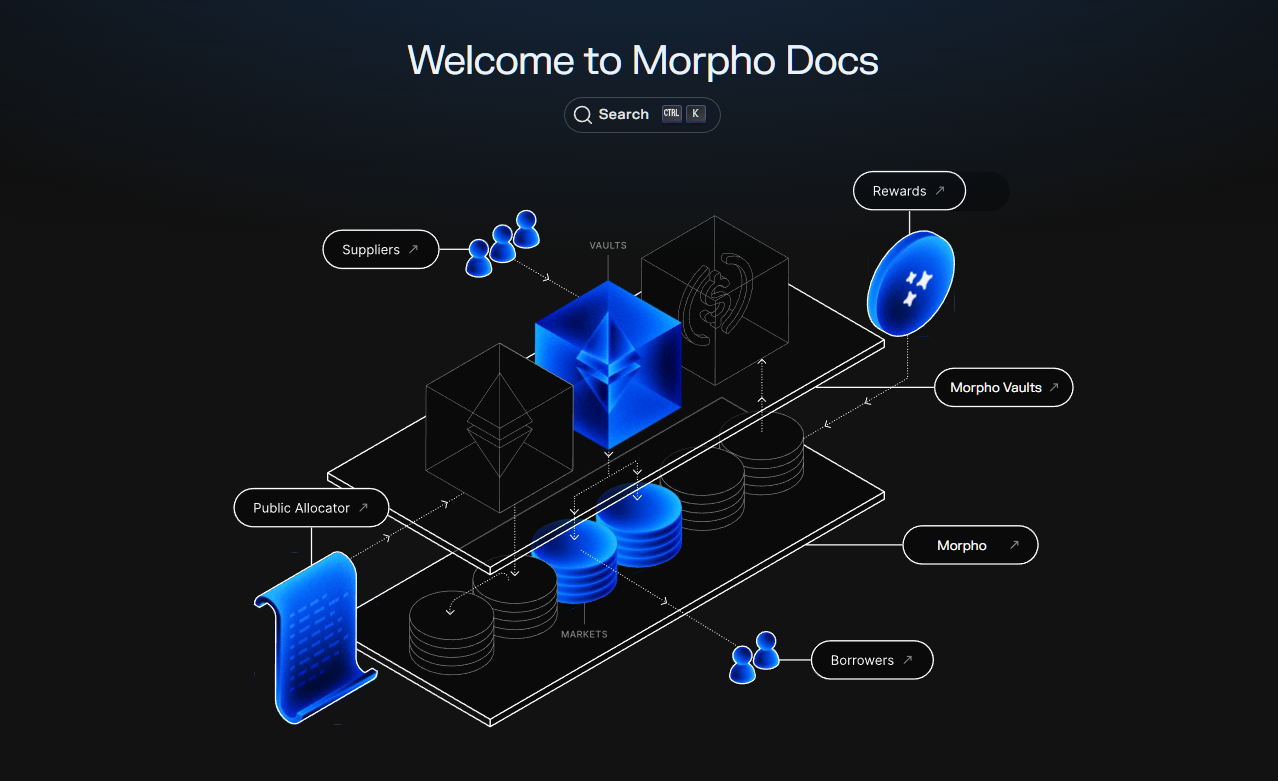

The third pillar of effective DAO treasury management is diversification across multiple protocols, a response to both market volatility and idiosyncratic protocol risks. Platforms like Yearn Finance and Morpho Blue enable DAOs to allocate funds across a curated set of yield-generating strategies simultaneously.

Learn more about how DAOs use multi-protocol diversification for risk management here.

Morpho Blue’s peer-to-peer matching engine offers efficient capital deployment with granular risk controls, while Yearn automates strategy selection based on real-time analytics, ensuring that treasuries can capture rates from emerging opportunities without being tied down by manual rebalancing or single-platform dependencies.

Navigating Risks in DAO Stablecoin Vault Strategies

No yield strategy is without its pitfalls. Even as automation reduces operational burdens, DAOs must remain vigilant against three primary categories of risk:

- Smart Contract Vulnerabilities: Even the most reputable vaults and protocols are not immune to code exploits. The Radiant Capital incident in late 2024, where a sophisticated malware attack compromised hardware wallet signatures, underscored how a single vulnerability can result in losses exceeding $50 million. DAOs must implement rigorous due diligence, continuous audits, and insurance mechanisms to mitigate such risks.

- Stablecoin Depegging: The stability of DAO treasuries is only as strong as the pegs of their underlying stablecoins. In 2024, several algorithmic and undercollateralized stablecoins experienced brief but severe depegs, causing unexpected markdowns on treasury balances. Dynamic allocation strategies like those used by Aera help limit exposure to any single stablecoin, but robust monitoring and contingency plans remain essential.

- Protocol Insolvency or Governance Attacks: The decentralized nature of DeFi introduces governance risk, malicious actors accumulating governance tokens can push through proposals that redirect funds or freeze assets. Compound’s narrowly-averted attack in early 2024 is a reminder that multi-protocol diversification (via platforms like Yearn Finance and Morpho Blue) is not just about yield optimization but also about spreading risk across governance structures.

Spotlight on Top Stablecoin Vault Protocols for DAOs

The competitive landscape for DAO-focused stablecoin vaults has matured rapidly, with three protocols standing out for their innovation and risk management capabilities:

Top Protocols for DAO Stablecoin Vault Yields in 2024

-

Aera: Autonomous vault management platform specializing in dynamic rebalancing of DAO treasuries across top stablecoins (USDT, USDC, DAI, FDUSD) and DeFi strategies. Aera’s dynamic vaults continuously optimize risk-adjusted returns by reallocating assets in real time, minimizing exposure to any single asset or protocol. Ideal for DAOs seeking automated, adaptive treasury management.

-

Yearn Finance: Leading yield aggregator that automates strategy selection for stablecoin deposits. Yearn aggregates yields from various lending markets and protocols, deploying DAO treasury assets to the highest-yielding opportunities while minimizing manual intervention. Widely adopted for DAO treasury optimization due to its robust automation and diversified strategies.

-

Morpho Blue: Next-generation peer-to-peer lending protocol offering efficient matching for stablecoin lending. Morpho Blue enhances yield potential with risk controls and competitive returns, allowing DAOs to lend stablecoins directly to borrowers with improved capital efficiency and transparency. Favored by DAOs prioritizing control and risk mitigation.

Aera sets the standard for autonomous vault management, enabling DAOs to dynamically rebalance between top stablecoins (USDT, USDC, DAI, FDUSD) and high-yield strategies with minimal manual input. Its algorithmic models factor in real-time risk metrics, making it an ideal solution for treasuries seeking both efficiency and resilience.

Yearn Finance remains the premier yield aggregator for DAOs looking to automate strategy selection across multiple lending markets. By pooling assets into optimized strategies and leveraging AI-driven analytics, Yearn reduces the complexity of chasing yield while ensuring broad protocol coverage.

Morpho Blue, meanwhile, has emerged as a next-generation lending platform focused on peer-to-peer matching and enhanced risk controls. Its integration with self-custody solutions like Ledger Live appeals to security-conscious treasuries that value granular control over capital deployment.

Best Practices for DAO Treasury Yield Optimization

For DAOs aiming to maximize returns while safeguarding principal capital, a methodical approach is required:

- Diversify across both assets and protocols: Use automated platforms like Aera to avoid overexposure.

- Monitor smart contract risks continuously: Subscribe to audit feeds and consider insurance products where available.

- Set clear governance parameters: Establish limits on leverage usage within lending protocols such as Aave or Compound.

- Maintain liquidity buffers: Ensure sufficient reserves are kept outside high-yield vaults for operational needs or emergency withdrawals.

The trend toward automated stablecoin vaults will likely accelerate as DAO treasuries continue to scale. By combining dynamic allocation (Aera), leveraged lending (Aave/Compound), and multi-protocol diversification (Yearn/Morpho Blue), organizations can construct resilient portfolios that balance yield generation with prudent risk management.

If you’re interested in deeper dives into these strategies, including technical guides on implementation, visit our comprehensive resource at How Stablecoin Vaults Are Reshaping DAO Treasury Management in 2025.