Decentralized Autonomous Organizations (DAOs) have transformed the landscape of digital governance, but with this evolution comes a new set of security and strategy challenges. As treasuries grow and DAOs handle increasingly complex portfolios, the demand for confidential DAO treasury management has never been higher. This shift is not merely about hiding balances; it’s about enabling strategic flexibility, safeguarding sensitive information, and ensuring robust governance in a transparent yet secure on-chain environment.

Why Confidential Treasury Management Matters for DAOs

The earliest DAOs championed radical transparency: every transaction was public, every wallet visible. While this model fosters trust and community oversight, it also exposes organizations to unique risks. Malicious actors can analyze on-chain data to front-run DAO trades or target specific contributors for social engineering attacks. As treasury sizes swell into the millions, the stakes are simply too high for naïve operational models.

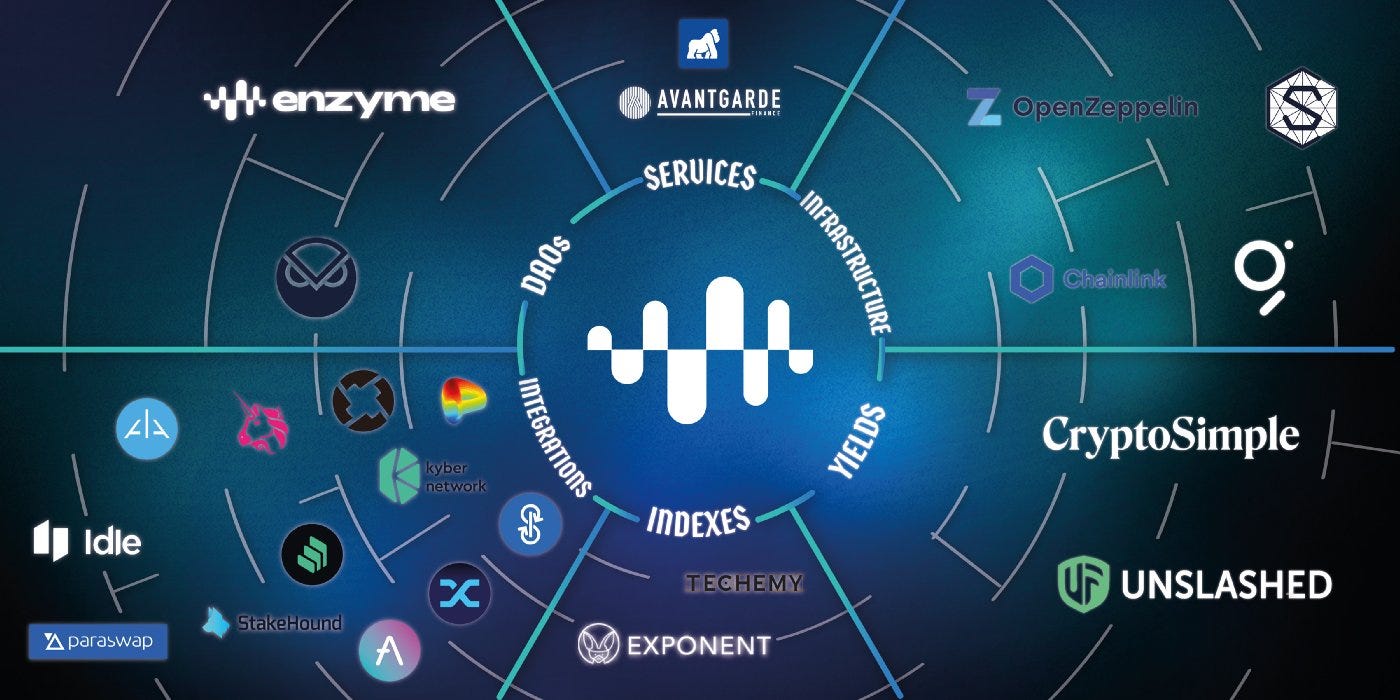

This is where private on-chain treasury solutions come into play. Platforms like Set Protocol and Enzyme have pushed the boundaries of verifiable DAO transactions by blending transparency with modular privacy settings. For example, Set Protocol allows DAOs to assign asset managers while maintaining auditable activity logs for governance review. Enzyme’s Myso protocol provides similar controls, supporting real-time reporting with customizable access permissions.

The Mechanics of Secure DAO Asset Management

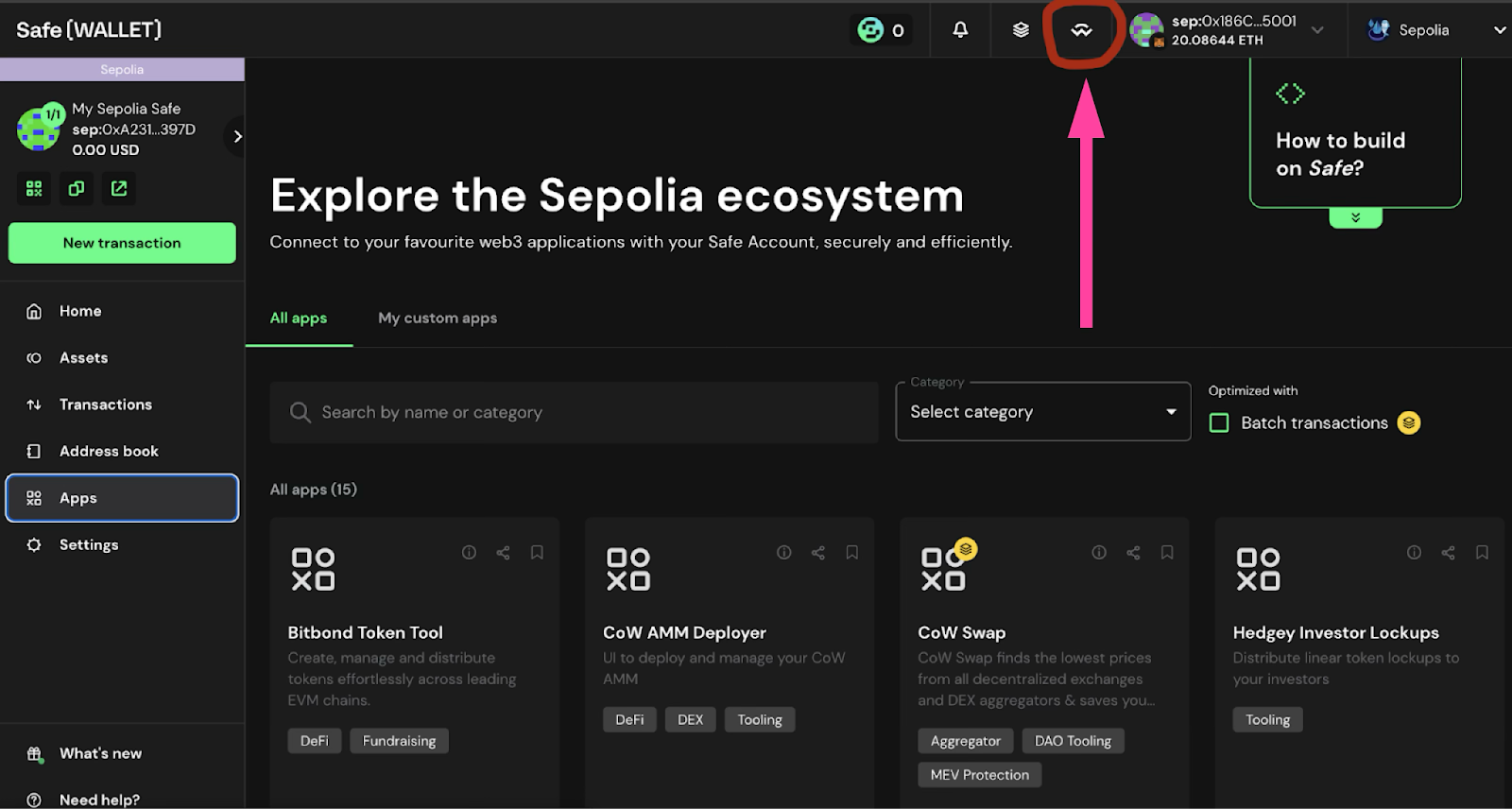

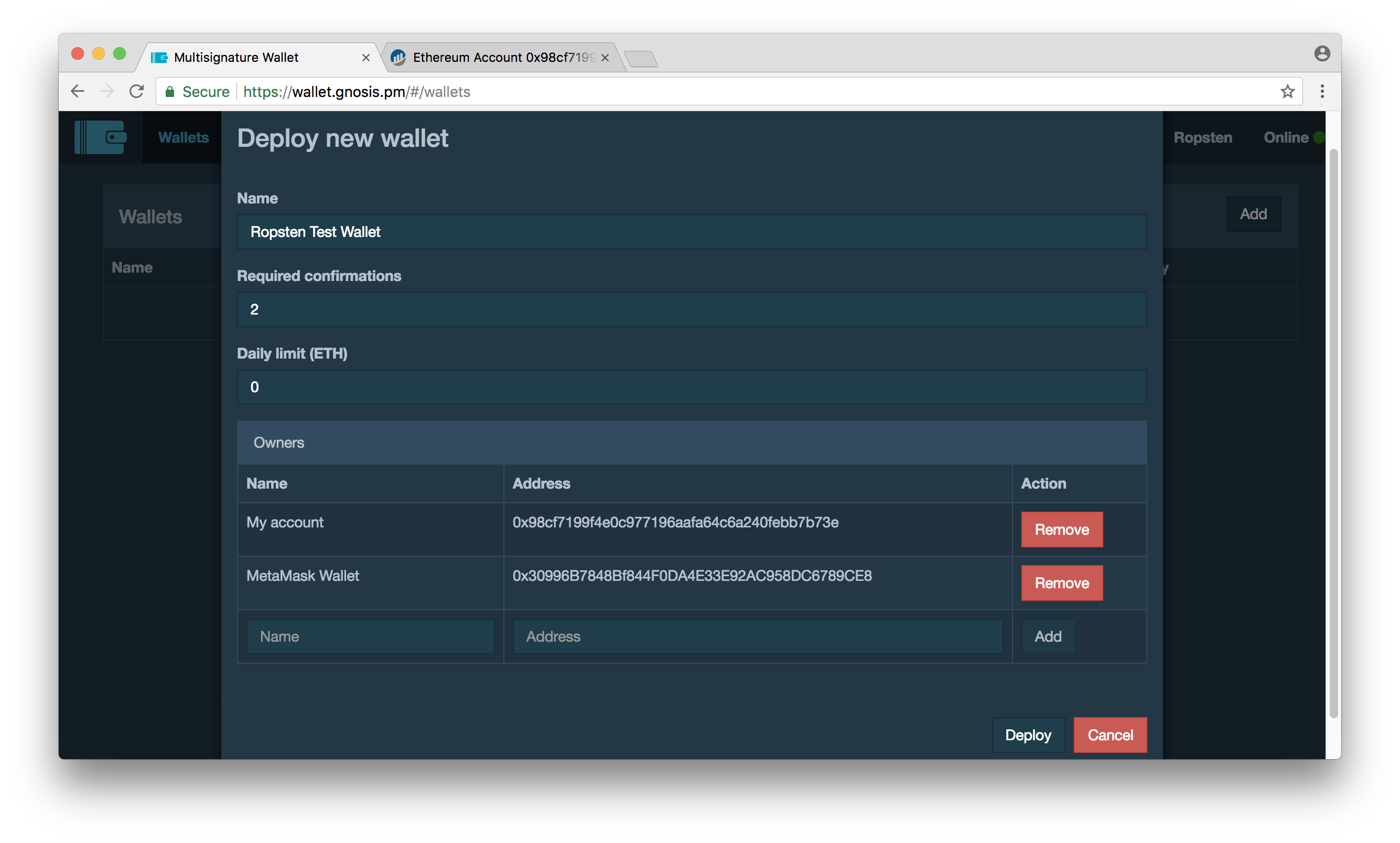

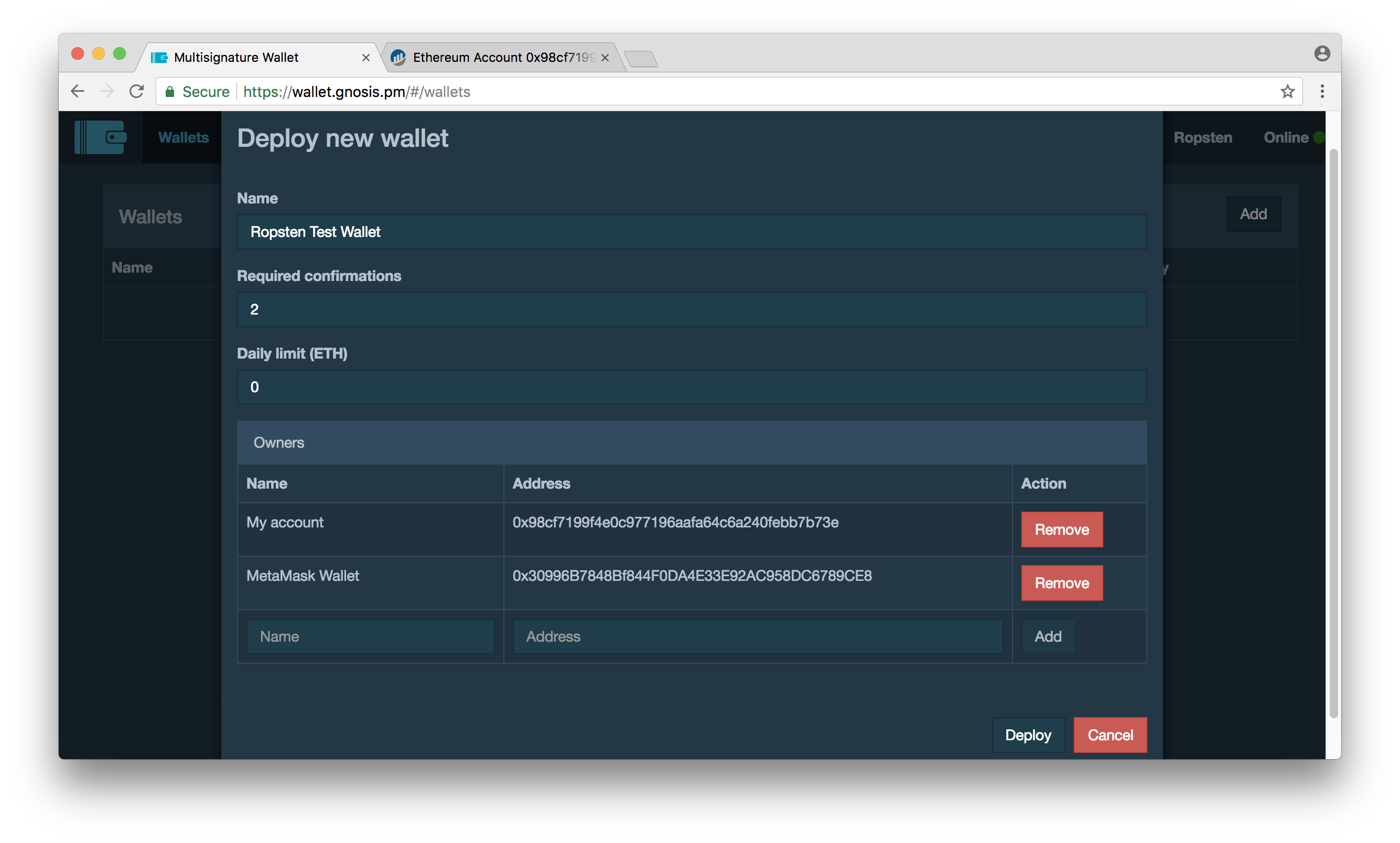

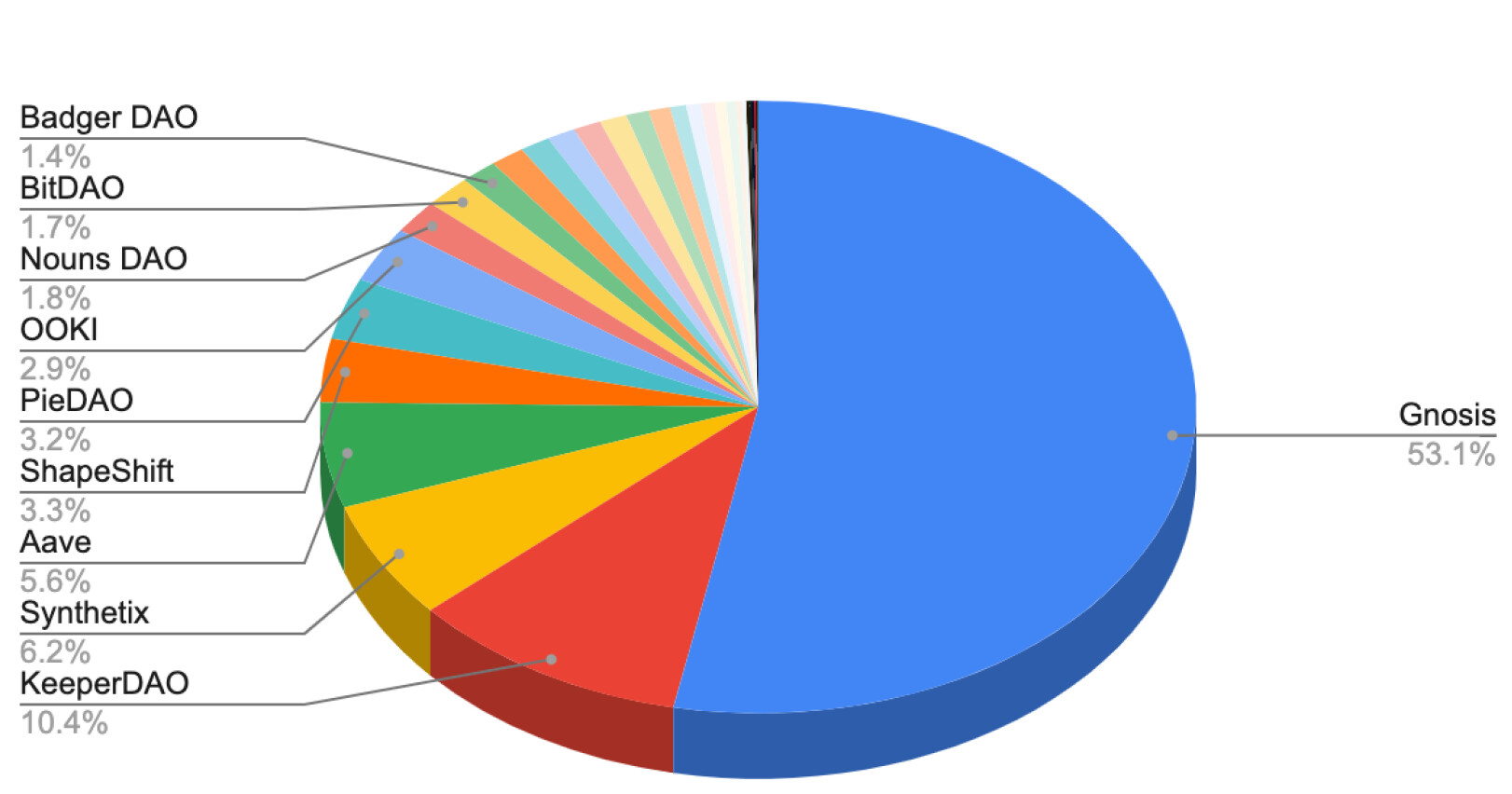

Modern DAOs are moving beyond simple multisig wallets like Gnosis Safe to adopt layered security architectures. These often include:

Key Features of Confidential Treasury Management Platforms for DAOs

-

Multi-signature Wallets (e.g., Gnosis Safe): Require multiple approvals for transactions, significantly reducing unauthorized access risks and enhancing collective control over DAO funds.

-

On-chain Transparency with Permission Controls (e.g., Set Protocol, Enzyme): Offer verifiable transaction histories and customizable manager permissions, supporting both transparency and selective confidentiality for sensitive operations.

-

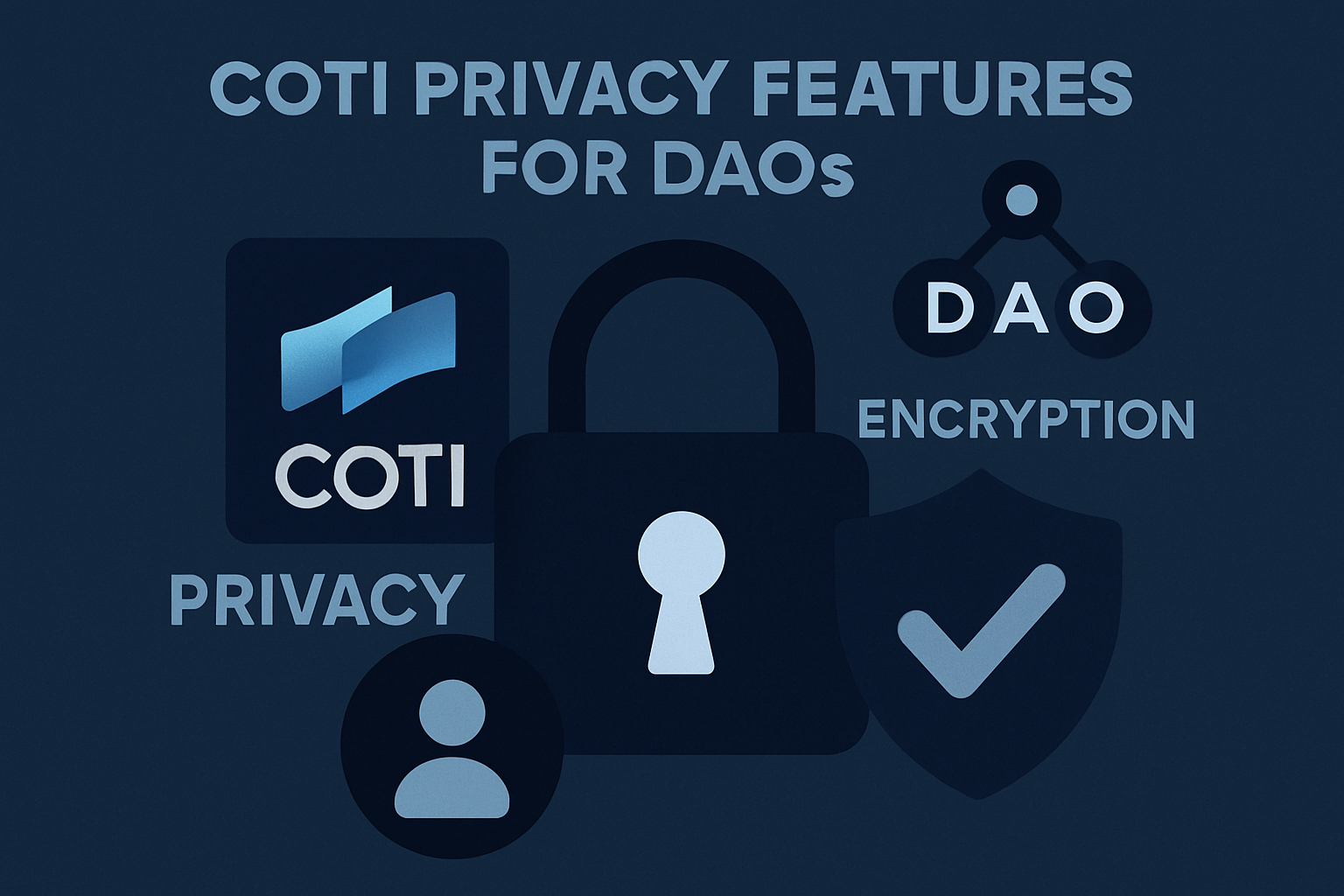

Privacy-Preserving Solutions (e.g., COTI): Enable encrypted treasury management, private voting, and confidential interactions across multiple blockchains, ensuring sensitive financial data remains secure.

-

Non-custodial Asset Management (e.g., dHEDGE): Allow DAOs to retain full control of assets while setting guardrails, pool privacy settings, and manager roles for secure, trustless treasury operations.

-

Encrypted Participant Authentication (e.g., NFT-based Access): Utilize NFT authentication to enable encrypted, role-based access to treasury functions, further safeguarding internal DAO processes.

-

Real-time Financial Reporting (e.g., Dune Analytics): Provide transparent, up-to-date financial data and analytics, supporting informed governance and decision-making within the DAO community.

By requiring multiple approvals for each transaction and integrating permissioned access layers, DAOs can deter internal fraud while retaining operational agility. Solutions such as dHEDGE introduce asset guardrails and privacy pools that restrict who can view or interact with sensitive funds.

For example, COTI’s privacy solution leverages encrypted treasury management across 71 and blockchain networks, enabling both private voting and compliant confidentiality without sacrificing auditability at the protocol level. This dual mandate – transparency for stakeholders but privacy from adversaries – is at the heart of next-generation DAO security strategy.

DAO Treasury Privacy vs Transparency: Striking the Right Balance

The debate over DAO treasury privacy vs transparency is far from academic; it has real-world implications for governance quality and risk mitigation. While full disclosure ensures accountability, selective confidentiality protects against exploitation and preserves competitive advantage.

Diversified treasury management strategies now incorporate NFT-based authentication systems that encrypt interactions among approved participants only. This means contributor payrolls or strategic investment decisions can remain shielded from public view while still being provably compliant via cryptographic proofs.

- Avantgarde Finance: Empowers DAOs with bespoke solutions combining real-time reporting and capital-efficient strategies without compromising on security.

- COTI: Offers encrypted operations across dozens of chains for truly private governance workflows.

- dHEDGE and Set Protocol: Enable custom permissions and asset guardrails tailored to each organization’s risk profile.

This nuanced approach is rapidly becoming best practice as more organizations recognize that effective treasury management isn’t just about protecting funds – it’s about empowering smarter decisions in an adversarial environment.

Confidential treasury management is not a zero-sum game; it’s about deploying the right tools for the right context. DAOs that embrace privacy-preserving mechanisms can shield sensitive operations from adversaries while still delivering verifiable DAO transactions to their communities. For instance, payrolls and strategic allocations can be encrypted, yet aggregate financials remain accessible for audit. This duality enables DAOs to comply with regulatory expectations and community norms without exposing themselves to unnecessary risk.

Implementing Confidential Treasury Management: Practical Considerations

Adopting confidential treasury strategies requires more than just technical integration, it demands a cultural shift in how DAOs approach security and transparency. Key considerations include:

Best Practices for Confidential DAO Treasury Management

-

Utilize Multi-Signature Wallets like Gnosis Safe to require multiple approvals for treasury transactions, reducing the risk of unauthorized access and enhancing operational security.

-

Implement Privacy-Preserving Protocols such as COTI to enable encrypted treasury management and private voting, supporting confidentiality across multiple blockchain networks.

-

Adopt Transparent Asset Management Platforms like Set Protocol and dHEDGE for on-chain visibility, verifiable transaction data, and customizable manager permissions, balancing transparency with privacy controls.

-

Leverage NFT Authentication for Encrypted Interactions within blockchain frameworks, ensuring that only authorized participants can access sensitive treasury operations and communications.

-

Maintain Real-Time Financial Reporting with Tools like Dune Analytics to provide transparent, up-to-date financials for the community while safeguarding sensitive details through selective data disclosure.

DAOs must define clear policies around who can access sensitive information, under what circumstances, and how disclosures are logged. Multi-signature wallets remain foundational, but advanced protocols now enable dynamic permissions, adjusting access based on contributor roles or governance outcomes.

Platforms like Avantgarde Finance and Enzyme Myso are leading this evolution by offering customizable reporting dashboards that blend privacy with real-time analytics. These solutions help DAOs maintain a well-balanced treasury, pay contributors efficiently, and manage risk exposure with greater precision.

The Strategic Edge: Confidentiality as an Enabler

In a landscape where capital moves at algorithmic speed and adversaries are increasingly sophisticated, the ability to keep key decisions private is a strategic asset. Confidential treasury management empowers DAOs to:

- Mitigate front-running risk: By obscuring large trades or portfolio rebalancing events until execution is complete.

- Safeguard contributor privacy: Protecting individuals from targeted attacks or doxxing.

- Preserve competitive advantage: Enabling stealth investments or partnerships before public disclosure is warranted.

This new paradigm does not mean abandoning transparency altogether. Rather, it’s about calibrating disclosure in ways that protect the organization while maintaining trust with token holders and regulators alike.

Looking Ahead: The Future of Secure DAO Asset Management

The next wave of innovation will likely focus on seamless integration between privacy layers and compliance tooling, enabling DAOs to automate reporting while keeping sensitive details confidential by default. Expect further adoption of NFT authentication schemes, zero-knowledge proofs for financial attestations, and cross-chain privacy solutions as organizations scale globally.

Ultimately, the rise of confidential DAO treasury management marks a turning point where security becomes synonymous with strategic flexibility. As best-in-class platforms continue to evolve, expect more DAOs to strike this delicate balance, maximizing both resilience against threats and their capacity for bold decision-making in the decentralized economy.