Yield-bearing stablecoins are rapidly transforming the way decentralized organizations and crypto investors approach on-chain treasury yield. While traditional stablecoins like USDC and USDT have long offered price stability, they typically leave capital idle, missing out on the passive income opportunities that define DeFi. Enter yield-bearing stablecoins: a new class of digital assets that combine the reliability of fiat-pegged value with built-in yield generation, unlocking a powerful tool for DAOs, DeFi protocols, and sophisticated treasury managers.

What Are Yield-Bearing Stablecoins?

At their core, yield-bearing stablecoins are designed to maintain a 1: 1 peg with a fiat currency (usually the US dollar), while automatically accruing interest or yield for holders. This is achieved by backing these coins with income-generating assets or strategies, ranging from tokenized U. S. Treasury bills to sophisticated on-chain lending, staking rewards, or derivatives-based approaches.

The appeal is clear: users can hold a stablecoin that not only preserves value but also grows in quantity or purchasing power over time. For DAOs and crypto treasuries seeking sustainable DAO passive income, these assets represent a “next layer” of capital efficiency, eliminating the need for manual yield farming or risky protocol exposure.

The Current Market Landscape: $11 Billion and Growing

The market for yield-bearing stablecoins has exploded in 2025. According to recent data, their circulation reached $11 billion by mid-2025, capturing 4.5% of the total stablecoin market, a staggering leap from $1.5 billion (1% share) at the start of 2024 (source). This surge is being driven by both institutional and DAO treasuries seeking secure, scalable ways to earn on idle reserves while maintaining operational liquidity.

Much of this growth can be attributed to regulatory clarity. In February 2025, the U. S. SEC approved yield-bearing stablecoins as “certificates” under securities law, providing legitimacy and opening doors for larger players (source). The impact isn’t just limited to crypto: research shows large inflows into these coins are already affecting traditional markets by reducing short-term Treasury yields (source).

Top 5 Yield-Bearing Stablecoins in 2025

-

Ethena’s USDe: Launched in February 2024, USDe is a synthetic stablecoin that uses derivatives and delta-neutral strategies to maintain its peg and generate yield. Its innovative approach has attracted significant investor interest, helping it become one of the fastest-growing yield-bearing stablecoins in 2025.

-

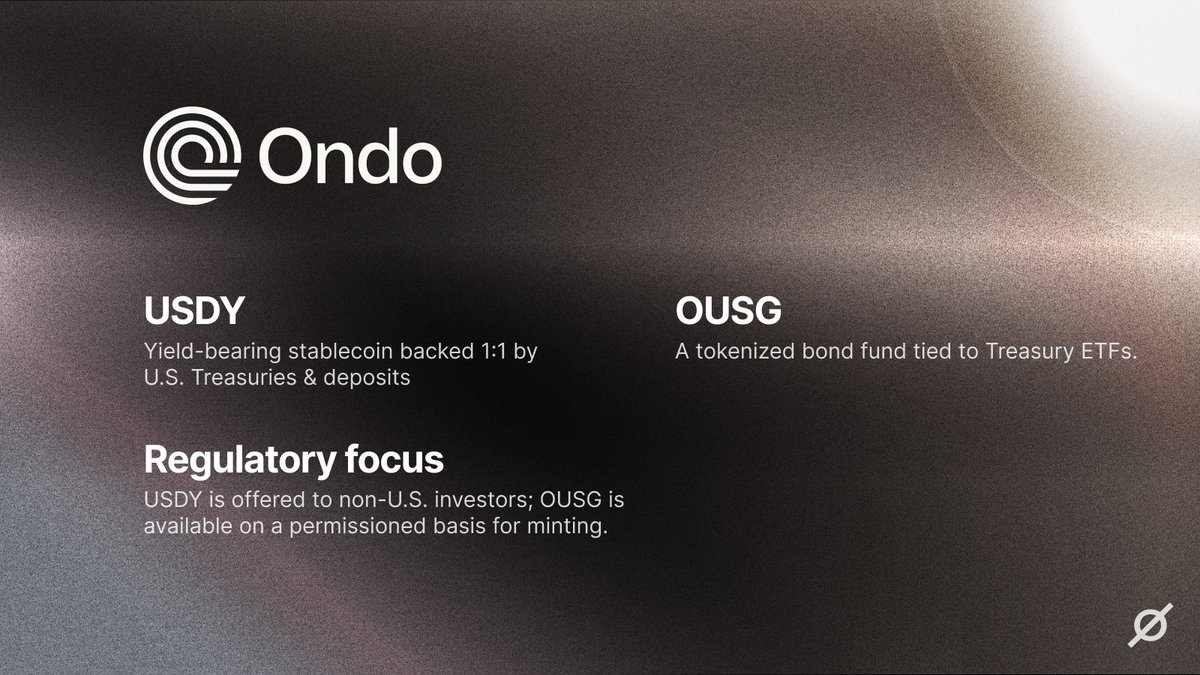

Ondo Finance’s USDY: USDY is backed by short-term U.S. Treasury securities and bank deposits. It offers automatic yield accrual to holders, meaning users earn passive income without needing to stake or take extra actions. USDY has gained prominence for bridging real-world assets with DeFi.

-

Mountain Protocol’s USDM: Regulated in Bermuda and launched in 2023, USDM is fully collateralized by tokenized U.S. Treasury bills. It provides holders with an annualized return of approximately 4% to 5%, making it a popular choice for on-chain treasury management.

-

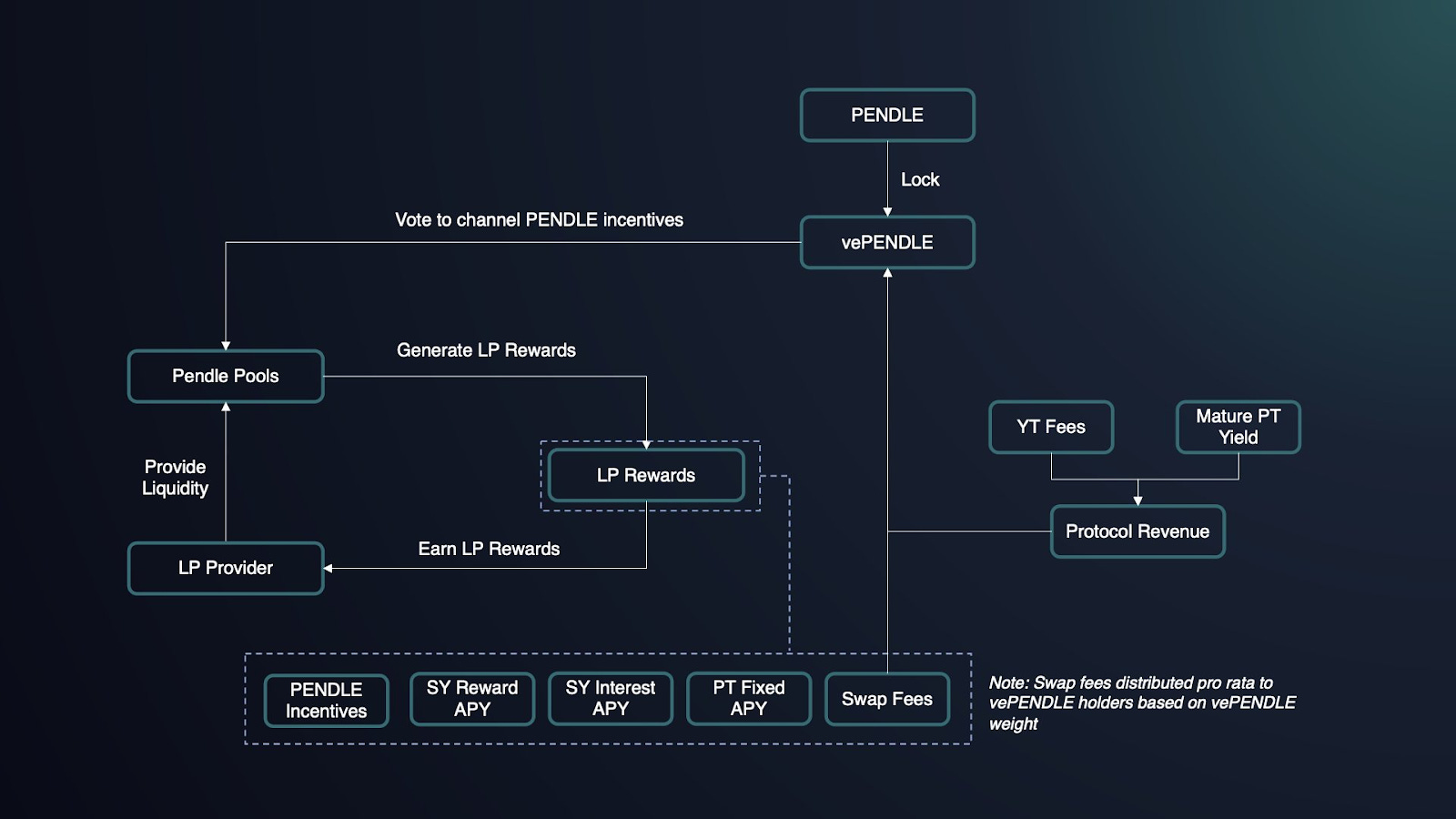

Pendle’s PT-yield Stablecoins: Pendle enables users to tokenize and trade future yield from various DeFi assets, including stablecoins. Its platform has seen rapid growth in 2025, with PT-yield stablecoins allowing holders to lock in and trade yield streams directly on-chain.

-

csUSDL by Clearpool: csUSDL is designed for on-chain treasuries and DAOs, optimizing yield by aggregating returns from multiple DeFi protocols and real-world assets. Its treasury-focused strategy has made it a notable player in the yield-bearing stablecoin sector.

Pillars of Yield Generation: How These Stablecoins Work

Yield-bearing stablecoins typically rely on one (or a mix) of three main strategies:

- Tokenized Real-World Assets (RWAs): Coins like Ondo Finance’s USDY and Mountain Protocol’s USDM are backed by tokenized U. S. Treasury bills or bank deposits, passing through government bond yields directly to holders.

- Synthetic and Derivatives-Based Approaches: Ethena’s USDe uses delta-neutral derivatives strategies to generate returns while maintaining its peg, appealing to users who want exposure to DeFi-native yields without volatility risk.

- Lending and On-Chain Protocols: Some projects tap into established DeFi lending markets or staking pools, distributing interest earned from borrowers to coin holders automatically.

This diversity allows DAOs and treasuries to select protocols that match their risk tolerance and compliance requirements, whether prioritizing regulatory oversight (e. g. , Bermuda-regulated USDM) or maximizing returns via innovative DeFi mechanisms.

Key Examples Leading the Charge in On-Chain Treasury Yield

The rapid evolution of this sector is best illustrated through its standout projects:

- Ethena’s USDe: Launched in February 2024, USDe leverages derivatives markets for delta-neutral returns, attracting significant capital due to its high yields and synthetic design (source).

- Ondo Finance’s USDY: Backed by short-term U. S. Treasuries and bank deposits; offers seamless auto-accrual of yields without user intervention (source).

- Mountain Protocol’s USDM: Fully collateralized by tokenized Treasuries; delivers an annualized return around 4%–5%, making it attractive for compliant treasuries (source).

This innovation is not just about boosting APY, it’s about building resilient financial primitives for DAOs and DeFi organizations seeking robust on-chain treasury management.

As these protocols mature, more treasury managers are recognizing the strategic advantages of yield-bearing stablecoins. Instead of complex manual yield farming or constantly rotating between DeFi pools, DAOs can now hold a single asset that delivers both stability and passive income, streamlining operations and reducing risk exposure. The automated nature of most stablecoin yield protocols also means less overhead for compliance and reporting, a crucial benefit as regulatory scrutiny intensifies worldwide.

Risk Management, Transparency, and Compliance

Of course, no innovation comes without tradeoffs. Yield-bearing stablecoins introduce new risk factors that treasury leaders must consider:

- Counterparty and Custodial Risk: Many RWA-backed coins depend on off-chain custodians or intermediaries to manage underlying assets. Assessing their transparency and legal structure is essential.

- Smart Contract and Protocol Risk: As with all DeFi products, code vulnerabilities or governance failures could impact peg stability or yield distribution.

- Regulatory Uncertainty: While the SEC’s February 2025 ruling (source) offers clarity in the U. S. , global frameworks remain fragmented. Treasuries operating internationally must monitor evolving requirements closely.

The best-in-class projects address these concerns through regular audits, real-time asset attestations, transparent on-chain reporting, and robust legal structures. For DAOs prioritizing sustainability over raw yield, these factors are just as important as APY figures.

Essential Steps for DAOs Before Allocating to Yield-Bearing Stablecoins

-

Conduct Thorough Due Diligence on Stablecoin ProjectsDAOs should rigorously research yield-bearing stablecoins like Ethena’s USDe, Ondo Finance’s USDY, and Mountain Protocol’s USDM. Review their underlying collateral, yield generation mechanisms (e.g., derivatives, U.S. Treasuries), and audit reports to ensure transparency and legitimacy.

-

Assess Regulatory Compliance and Legal RisksWith the SEC’s 2025 approval of yield-bearing stablecoins as regulated certificates, DAOs must verify that their chosen stablecoins comply with securities regulations, registration, and disclosure requirements to avoid legal pitfalls.

-

Evaluate Smart Contract Security and Insurance OptionsExamine the security measures of the stablecoin’s smart contracts, including third-party audits and bug bounty programs. Consider platforms that offer insurance coverage for smart contract risks to protect DAO treasury assets.

-

Analyze Yield Sources and SustainabilityUnderstand how yields are generated—whether from on-chain DeFi strategies, real-world assets like U.S. Treasury bills, or derivatives. Assess the sustainability and risk profile of these yield mechanisms to ensure long-term stability.

-

Establish a Diversified Allocation StrategyMitigate risk by diversifying treasury allocations across multiple yield-bearing stablecoins and platforms. Balance exposure to various collateral types, yield strategies, and regulatory jurisdictions.

-

Implement Robust Treasury Management and Monitoring ToolsUtilize on-chain analytics and risk management platforms to continuously monitor the performance, risk metrics, and regulatory status of allocated stablecoins, ensuring rapid response to market or compliance changes.

The Road Ahead: On-Chain Treasury Yield at Scale

The trajectory is clear: demand for on-chain treasury yield is only accelerating. Analysts now project that yield-bearing stablecoins could capture up to 50% of the total stablecoin market, barring major regulatory headwinds (source). This is driven not just by speculation but by genuine utility, DAOs, protocols, and even TradFi players increasingly seek compliant vehicles for earning predictable returns without sacrificing liquidity or transparency.

The integration of real-world assets (RWAs) into DeFi is likely to deepen further. We’re already seeing tokenized T-bills become standard collateral in DAO vaults; next may come tokenized corporate bonds or diversified RWA baskets designed for specific risk profiles. Protocols will continue innovating around automated rebalancing, cross-chain compatibility, and advanced reporting tools tailored for institutional treasuries.

How DAOs Can Get Started with Stablecoin Yield Protocols

If you’re managing a DAO treasury or advising one on capital allocation strategy, consider these key steps:

- Assess Your Risk Appetite: Decide whether you prefer fully regulated RWA-backed coins (like USDM) or are open to higher-yield synthetic options (like USDe).

- Diversify Across Protocols: Spread exposure across multiple issuers and strategies to mitigate idiosyncratic risks.

- Monitor Regulatory Developments: Stay updated on global guidance, especially if your DAO has members or operations in multiple jurisdictions.

- Pilot Small Allocations First: Start with modest positions to test liquidity, reporting tools, and integration with your existing workflows before scaling up.

Which yield-bearing stablecoin do you trust most for DAO treasury management?

Yield-bearing stablecoins have surged to $11 billion in circulation by mid-2025, with major options like Ethena’s USDe, Ondo Finance’s USDY, and Mountain Protocol’s USDM leading the way. With regulatory clarity and growing adoption, DAOs face new choices for on-chain yield. Which of these do you trust most for your treasury?

The rise of yield-bearing stablecoins marks a pivotal shift in how decentralized organizations approach passive income generation. By combining the best aspects of fiat stability with seamless DeFi yields, these assets are laying the groundwork for more resilient, and more efficient, on-chain treasuries. As adoption grows beyond early adopters into mainstream DAO finance circles, expect innovation and competition to accelerate further. For those ready to embrace this next layer of capital efficiency, now is the time to explore how your treasury can put idle assets to work in this new era of programmable money.