The arrival of Ondo Finance’s USDY on the Sei Network reshapes DAO treasury yield strategies by bridging tokenized US Treasuries with ultra-fast DeFi infrastructure. Currently priced at $1.11, USDY offers daily yields backed by short-term US Treasuries and bank deposits, now composable across Sei’s ecosystem for lending, collateral, and savings protocols. This move taps into a $10 billion tokenized Treasuries market, where over $1.2 billion in USDY circulation meets Sei’s 400ms finality and 12,500 transactions per second capabilities.

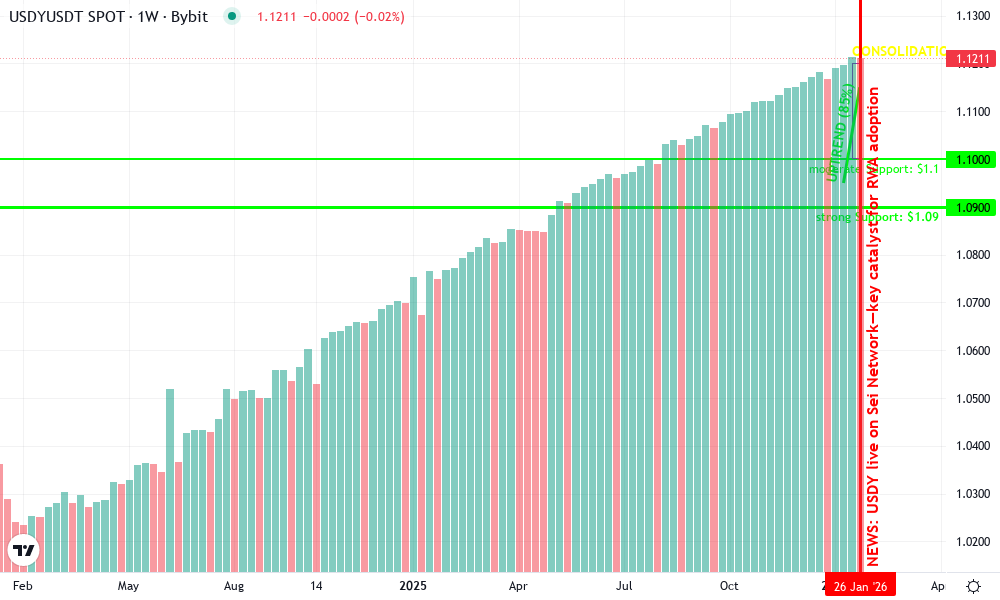

Ondo USDY Technical Analysis Chart

Analysis by Oliver Madden | Symbol: BYBIT:USDYUSDT | Interval: 1W | Drawings: 6

Technical Analysis Summary

As Oliver Madden, apply conservative markings: primary uptrend line from recent lows at 2026-01-15 (1.095) to current highs (1.115); horizontal supports at 1.09 and 1.10; resistance at 1.15; vertical line for Sei integration on 2026-01-28; callouts on volume surge and MACD bullish cross; rectangle for recent consolidation 1.10-1.12 from 2026-01-20 to now; text notes emphasizing patience in yield accrual over speculation.

Risk Assessment: low

Analysis: Fundamentals dominate: Treasury-backed with institutional integrations; chart volatility minimal around $1.11 peg; macro tailwinds from RWA growth outweigh short-term noise.

Oliver Madden’s Recommendation: Accumulate conservatively for long-term hold; patience drives yield compounding in DAO portfolios.

Key Support & Resistance Levels

📈 Support Levels:

-

$1.09 – 24h low aligning with treasury backing floor; tested multiple times

strong -

$1.1 – Recent consolidation base; volume-supported

moderate

📉 Resistance Levels:

-

$1.15 – 24h high; psychological ceiling pre-next yield accrual phase

moderate

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$1.105 – Dip to uptrend line confluence with support; low-risk accumulation for yield

low risk

🚪 Exit Zones:

-

$1.15 – Profit target at resistance; conservative take-profit

💰 profit target -

$1.085 – Tight stop below key support to preserve capital

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on green candles, confirming uptrend strength without spikes indicating distribution

Bullish volume profile supports steady climb

📈 MACD Analysis:

Signal: Bullish crossover post-Sei news

MACD line above signal with growing histogram

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Oliver Madden is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

DAOs managing on-chain treasuries have long grappled with balancing liquidity, security, and returns in volatile crypto environments. USDY on Sei addresses this by delivering stablecoin treasury management Sei style: permissionless access to institutional-grade assets without the friction of traditional finance. In a macro climate of persistent inflation and uncertain rate paths, these tokenized assets provide a low-volatility anchor, accruing yield automatically while remaining fully on-chain.

Sei’s EVM compatibility amplifies USDY’s utility, enabling seamless integration into existing DeFi primitives. Protocols can now collateralize USDY for leveraged positions or deploy it in automated vaults, all while benefiting from sub-second execution. For treasury stewards, this means shifting from idle stablecoins to productive on-chain treasury vaults that compound returns daily.

Sei Infrastructure Powers USDY’s DeFi Composability

Sei’s architecture stands out in the layer-1 landscape, optimized for trading and capital efficiency. With USDY live since January 28,2026, the network unlocks Ondo USDY Sei synergies that traditional chains struggle to match. Transaction speeds eliminate slippage in yield farming or liquidations, critical for DAOs scaling treasury operations.

Consider the mechanics: USDY holders earn yields distributed daily, net of fees, with full transparency via on-chain attestations. On Sei, this translates to real-time composability; deposit USDY into lending markets for additional APY, or pair it in DEXs for efficient swaps. The result? DAOs can construct multi-layered strategies that were previously siloed on slower networks.

Institutional-grade yield is now native to Sei, expanding RWA capabilities with the largest tokenized US Treasuries by TVL.

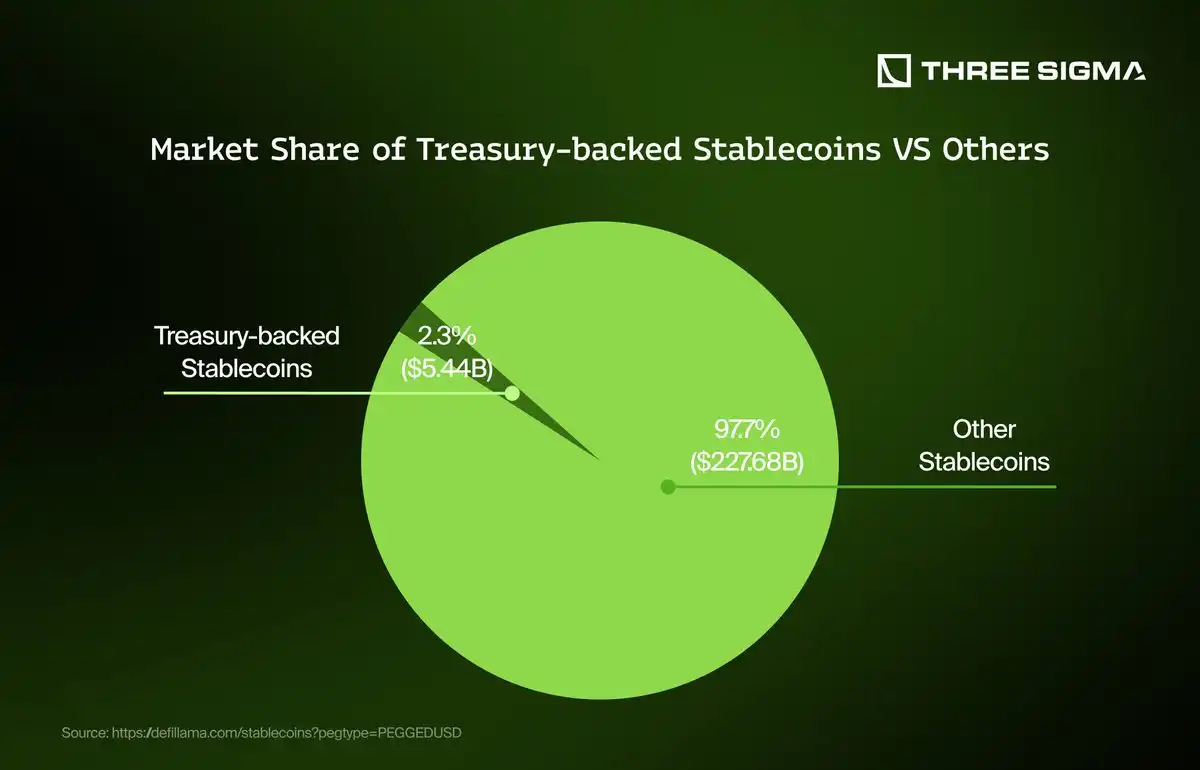

Tokenized Treasuries as DAO Treasury Core Holdings

Tokenized US treasuries DAO allocations are no longer niche; they form the bedrock of resilient strategies. At $1.11, USDY’s 24-hour range from $1.09 to $1.15 underscores its peg stability amid broader market flux. For DAOs, allocating 20-40% of treasuries here hedges against crypto downturns while capturing 4-5% annualized yields, far superior to zero-yield stables.

Strategic layering emerges as key. Start with core USDY holdings for baseline yield, then leverage Sei’s speed for active management: auto-compound via vaults, lend excess for premiums, or use as overcollateralization in perpetuals. This DAO treasury yield Sei approach aligns with macroeconomic patience, prioritizing capital preservation over speculative bets.

Historical precedents reinforce this. DAOs heavy in tokenized RWAs weathered 2022’s crypto winter intact, emerging with compounded gains. USDY on Sei extends that playbook, with Sei’s throughput ensuring scalability as treasury sizes grow into eight figures.

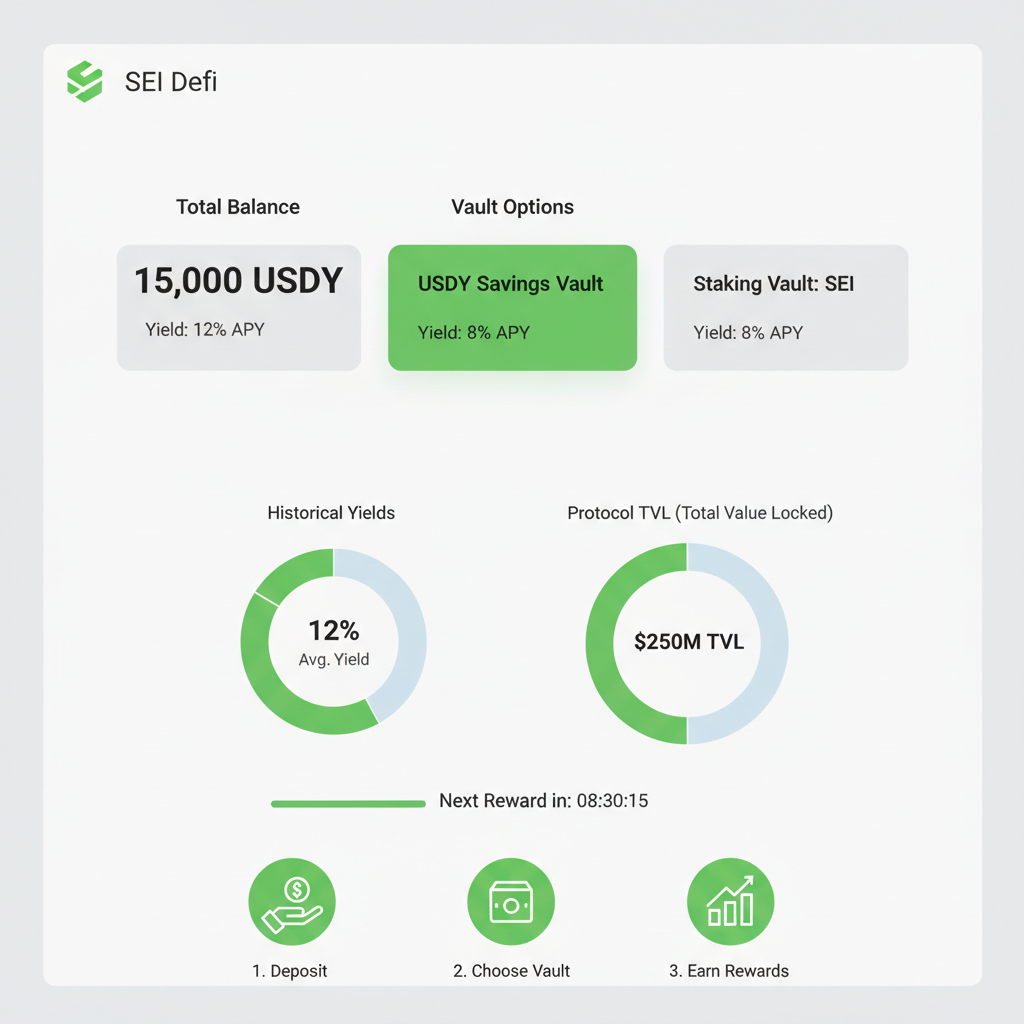

Yield Optimization Blueprints for On-Chain Vaults

Crafting on-chain treasury vaults demands precision. Tier one: passive allocation to USDY for daily accrual. Tier two: integrate with Sei-native yield aggregators, routing funds across optimized pools. Monitor via dashboards for rebalancing triggers, like yield thresholds dipping below benchmarks.

Ondo USDY (USDY) Price Prediction 2027-2032

Tokenized US Treasuries Yield Outlook on Sei Network | Based on RWA Adoption, Treasury Yields, and DeFi Integration

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | Est. YoY Growth (Avg %) |

|---|---|---|---|---|

| 2027 | $1.05 | $1.14 | $1.25 | +2.7% |

| 2028 | $1.08 | $1.20 | $1.35 | +5.3% |

| 2029 | $1.10 | $1.26 | $1.45 | +5.0% |

| 2030 | $1.13 | $1.33 | $1.58 | +5.6% |

| 2031 | $1.16 | $1.41 | $1.70 | +6.0% |

| 2032 | $1.19 | $1.50 | $1.85 | +6.4% |

Price Prediction Summary

USDY, backed by short-term US Treasuries, is expected to exhibit stable growth with a premium over $1 due to daily yield accrual, Sei Network integration boosting DeFi composability, and expanding RWA market. Bullish scenarios driven by high treasury yields and adoption could push max prices toward $1.85 by 2032, while bearish regulatory or yield drops limit mins to ~$1.05. Overall outlook: bullish with moderate volatility.

Key Factors Affecting Ondo USDY Price

- Integration with Sei Network enhancing liquidity and high-speed DeFi use cases (lending, collateral)

- Growth of tokenized treasuries market beyond $10B TVL

- US Treasury yield trends: higher rates support premium pricing

- Regulatory clarity for RWAs boosting institutional adoption

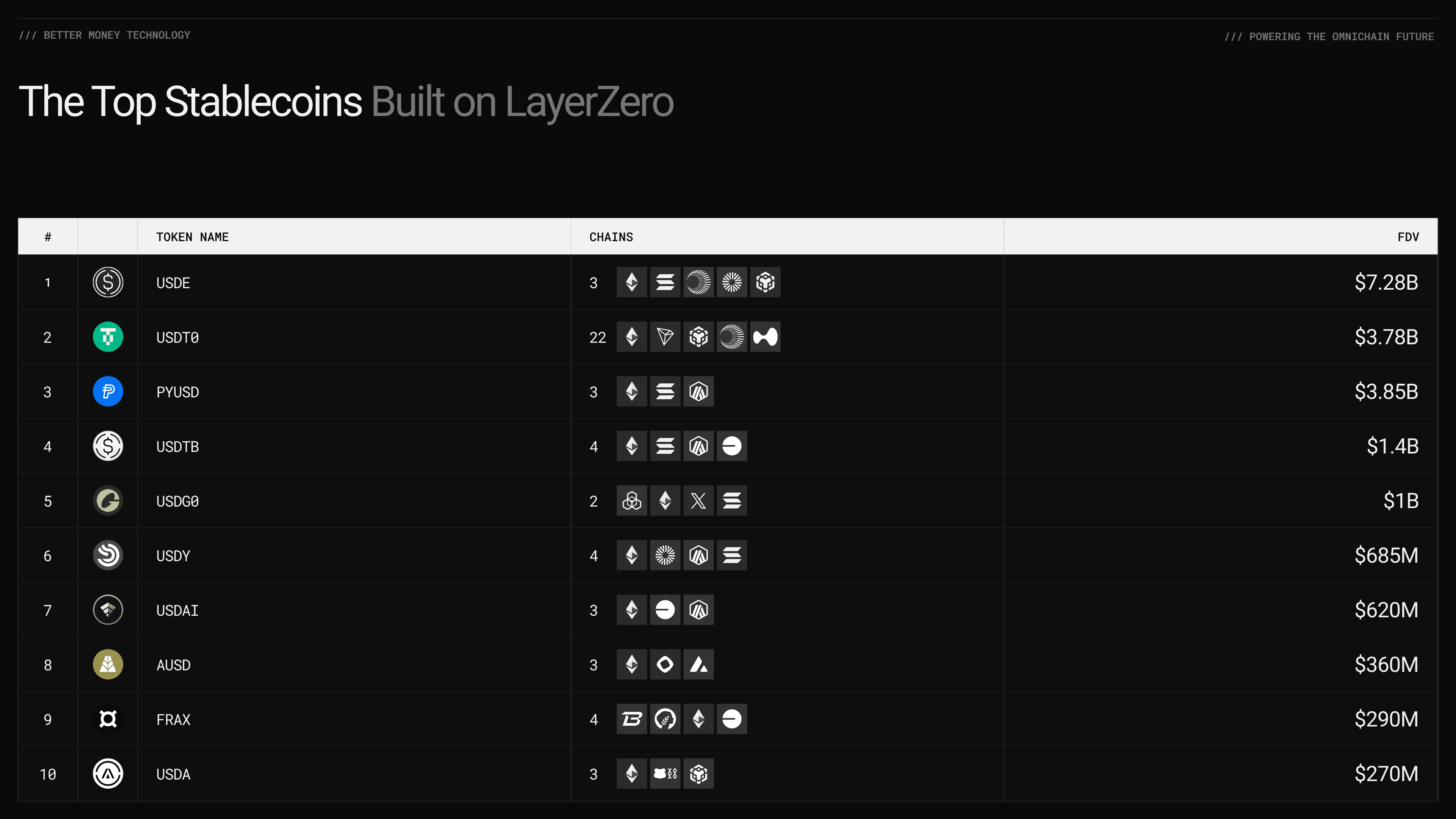

- Competition from other yield-bearing stablecoins like USDe

- Crypto market cycles and broader RWA/DeFi expansion

- Technological scalability on Sei (400ms finality, 12k+ TPS)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Advanced DAOs layer in governance: propose USDY vaults with performance oracles, distributing excess yields as governance tokens. Risks remain minimal; backing by US Treasuries ensures redemption at par, with Sei’s finality mitigating smart contract exploits.

Visit our guide on DAO treasury optimization with stablecoin vaults and tokenized treasuries for deeper implementation steps. This integration signals a maturing DeFi paradigm, where speed meets stability for enduring treasury growth.

Layering USDY into broader stablecoin treasury management Sei frameworks requires deliberate execution. DAOs should benchmark against alternatives like direct T-bill holdings or other RWA tokens, where USDY’s daily compounding and liquidity edge prevails. Sei’s infrastructure minimizes gas costs, making frequent rebalancing viable without eroding yields.

Step-by-Step USDY Treasury Deployment on Sei

Once bridged, DAOs can anchor 30% of assets in USDY core positions, allocating the rest dynamically. This setup captures baseline returns around 4.5% while freeing capital for opportunistic plays. Governance multisigs approve vaults with time-locks, ensuring collective oversight amid Sei’s rapid execution.

Real-world traction builds quickly. Since launch, USDY’s $1.11 price holds steady, with its 24-hour low at $1.09 and high at $1.15 reflecting minimal volatility. This stability suits conservative treasuries, contrasting crypto natives prone to 20% swings. Protocols like lending markets already list USDY, boosting borrow demand and secondary yields.

USDY brings institutional-grade yield to Sei’s high-speed chain, first tokenized Treasuries enabling scalable RWA DeFi.

Multi-Strategy Yield Layers for Resilient DAOs

Key USDY DAO Strategies on Sei

-

Passive Holding: DAO treasuries hold USDY ($1.11) to earn daily yields backed by short-term U.S. Treasuries and bank deposits, with over $1.2B in circulation for stable, low-risk returns on Sei’s high-speed chain.

-

Lending Collateral: Deploy USDY as collateral in Sei DeFi lending markets to borrow assets while accruing base yields, optimizing treasury efficiency with Sei’s 400ms finality and 12,500 TPS.

-

Vault Auto-Compounding: Deposit USDY into Sei vaults that automatically reinvest daily yields, compounding returns for long-term treasury growth in the composable DeFi ecosystem.

-

Perp Overcollateralization: Use USDY as overcollateral for perpetual futures on Sei’s perp platforms, earning yield on excess collateral amid high-liquidity trading.

-

Governance Yield Distribution: Distribute USDY yields to governance token holders or stakers, fostering community alignment and incentivizing participation in DAO decisions.

Each layer compounds advantages. Passive holders secure daily accruals; lenders earn utilization fees atop Treasury yields. Vaults automate across aggregators, chasing apex APYs without manual intervention. For aggressive plays, overcollateralizing perps with USDY hedges directional bets, leveraging Sei’s 400ms finality to avert liquidations.

Governance incentives seal the model. Distribute excess yields as tokens to voters, aligning long-term holders. This mechanics fosters sticky capital, as seen in mature DAOs sustaining multi-year compounding. At scale, eight-figure treasuries benefit most, where Sei’s throughput prevents congestion fees from compounding negatively.

Risk calibration tempers enthusiasm. Credit risk ties to US sovereign debt, negligible in fundamentals-based views. Smart contract vectors exist, but Sei’s audited EVM and USDY’s attestations mitigate. Liquidity dries in extremes, yet $1.2 billion circulation and DEX listings provide buffers. Diversify across 20-50% USDY max, rebalancing quarterly against macro shifts like Fed pivots.

Macro patience underpins success. With inflation lingering above targets and rates plateauing, tokenized Treasuries like USDY at $1.11 deliver uncorrelated ballast. DAOs ignoring this miss the shift from zero-yield stables to yield-bearing anchors. Sei’s speed unlocks what slower chains promise but falter on: executable stability.

Explore further in our analysis on tokenized US treasuries for DAO on-chain treasury yield optimization 2025. As RWAs mature, USDY on Sei positions forward-thinking DAOs to harvest steady returns in any cycle, blending TradFi rigor with DeFi velocity.

Fundamentals dictate: position early, compound relentlessly, govern wisely. Sei’s USDY gateway heralds treasury evolution, where Ondo USDY Sei fusion drives enduring alpha.