DAOs on Arbitrum, Optimism, and Polygon hold billions in treasuries, yet many suffer from stubbornly low utilization rates hovering below 20%. In 2026, with stablecoin supply rocketing past $310 billion after the GENIUS Act’s passage, this inefficiency stands out like a sore thumb. Capital sits idle in USDC, DAI, and USDT, missing out on mature DeFi yields amid Layer 2’s security upgrades and compliance push. The good news? Targeted on-chain treasury strategies can unlock this potential, blending stability with smart growth. Drawing from Arbitrum’s STEP program and top DAO playbooks, we’re zeroing in on six proven tactics to supercharge DAO treasury utilization.

Arbitrum’s treasury has ballooned into one of crypto’s largest community pots, while Optimism and Polygon offer cheap, secure rails for deployment. But governance drag and risk aversion keep funds parked. DeXe V3’s expansion across these chains signals a shift: faster proposals, vetted swaps. Meanwhile, Uniswap’s multi-L2 support and Aave’s lending dominance make execution seamless. It’s time for DAO treasury teams to collaborate on Arbitrum treasury management that actually moves the needle.

Stablecoin Yield Optimization: Aave V3 and Morpho Lead the Way

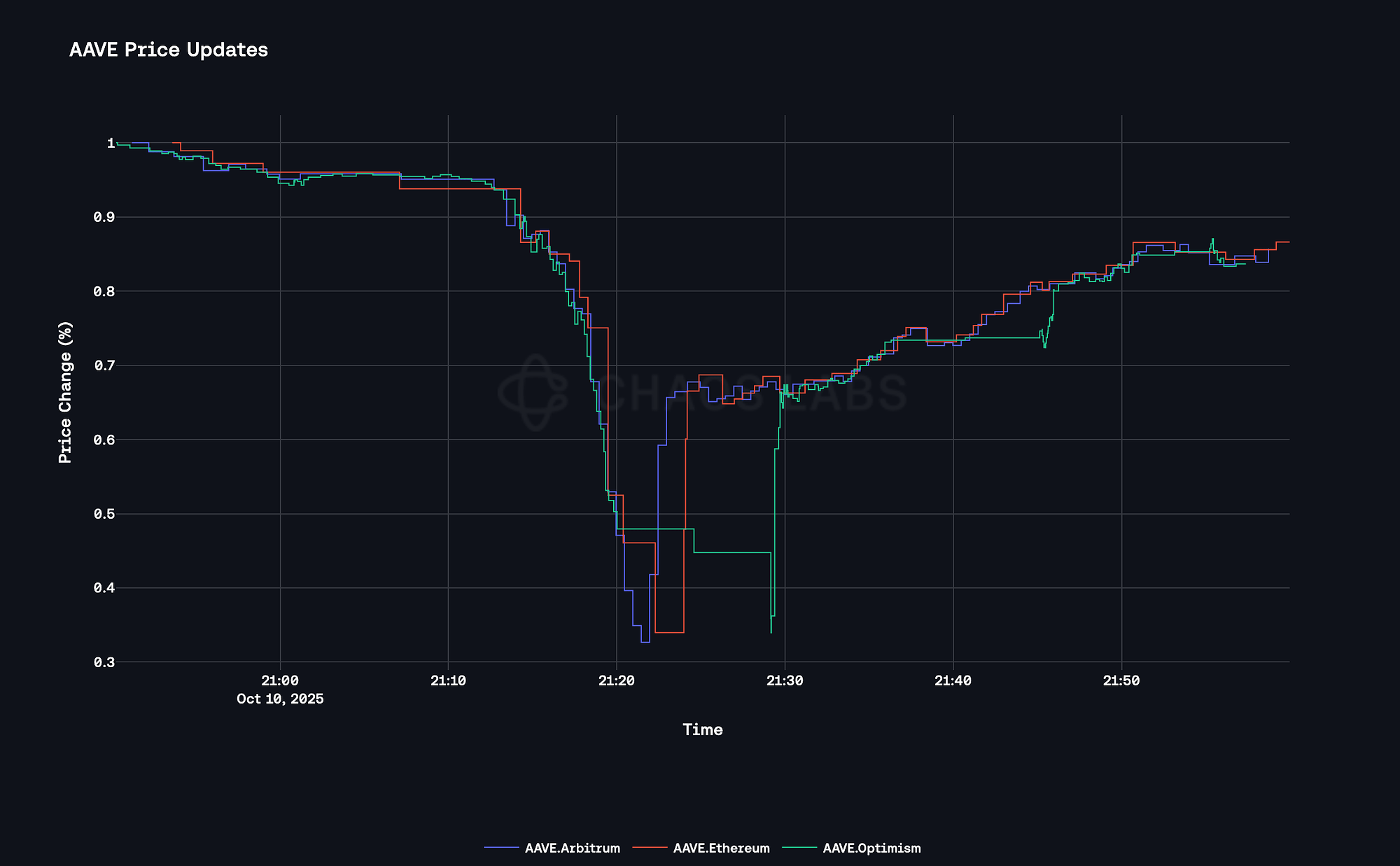

First up, park those stablecoins in Aave V3 and Morpho on Arbitrum and Optimism. These protocols deliver 4-8% APYs with overcollateralized loans and peer-to-peer efficiency, far outpacing idle holdings. Morpho’s optimized matching slashes gas while boosting rates; I’ve seen DAOs like Decentraland rotate inflows here during bull runs, preserving liquidity without liquidation risks. Risk parameters? Ironclad: liquidity thresholds at 80% and oracles from Chainlink. For Optimism treasury deployment, this is low-hanging fruit, especially post their security-focused upgrades.

Arbitrum DAO treasury: one of the most substantial community-controlled funds in L2. Time to deploy smarter. (Inspired by recent X discussions)

L2-Native LP Provisioning: Velodrome and QuickSwap for Steady Fees

Next, dive into liquidity provisioning tailored to each chain. On Optimism, Velodrome’s ve-token model locks in voting power for sustained rewards; pair stablecoin pairs for 10-15% APYs plus governance sway. Polygon DAOs favor QuickSwap’s concentrated liquidity, mirroring Uniswap V3 but with zkEVM boosts for cheaper txns. This isn’t wild speculation; it’s Polygon DAO funds earning from ecosystem volume, like grants-funded projects bootstrapping TVL. Pro tip: Start small, 10-20% allocation, and use impermanent loss hedges via options overlays.

6 Strategies to Boost DAO Treasuries

-

1. Stablecoin Yield Optimization via Aave V3 and Morpho on Arbitrum/Optimism: Leverage 2026 stablecoin supply boom (>$310B) for low-risk yields in vetted lending markets, mirroring Arbitrum’s STEP for capital efficiency.

-

2. L2-Native LP Provisioning on Velodrome (Optimism) and QuickSwap (Polygon): Provide liquidity in native DEXs for fees and incentives, enhancing utilization without leaving L2 ecosystems.

-

3. Restaking Idle ETH with EigenLayer and Pendle for Compounded Yields: Restake ETH for points and yields, tokenizing future rewards via Pendle to compound returns securely.

-

4. RWA Tokenization Allocations through Ondo and Centrifuge on Polygon zkEVM: Diversify into compliant real-world assets with transparent collateral, aligning with DeFi maturity trends.

-

5. Automated Rebalancing with Yearn Finance Vaults Across L2 Chains: Deploy into vaults for dynamic optimization on Arbitrum, Optimism, Polygon, reducing manual intervention like Enzyme protocols.

-

6. Governance Streamlining via DeXe V3 for Faster Deployment Proposals: Use V3 on Arbitrum/Optimism/Polygon for efficient voting, benchmarking top DAOs to accelerate treasury decisions.

Idle ETH? Restake via EigenLayer and Pendle for compounded yields hitting 12-20%, layering AVS security with fixed-rate PTs. Polygon zkEVM shines for RWA allocations through Ondo and Centrifuge, tokenizing treasuries into yield-bearing real estate or bonds at 5-7% with full transparency. Arbitrum DAOs can mirror this, diversifying beyond crypto natives. These moves align with 2026’s hybrid finance wave, where on-chain treasury strategies meet institutional-grade assets. Yearn’s vaults automate the rest, rebalancing across L2s per DAO votes.

DeXe V3 streamlines it all, enabling snapshot votes for deployments in days, not weeks. Top DAOs benchmark against it for Polygon, Arbitrum, Optimism scalability. By tackling governance first, the rest falls into place for robust DAO capital allocation 2026.

These strategies aren’t pie-in-the-sky; they’re battle-tested by DAOs navigating 2026’s governance scaling pains. Arbitrum consolidated operations to cut vote fatigue, and tools like DeXe V3 are the antidote, benchmarking token swaps across L2s with DAO member input.

Automated Rebalancing: Yearn Finance Vaults Keep It Hands-Off

Picture this: your treasury drifts off-course as yields shift. Yearn Finance vaults fix that, auto-rotating funds across Arbitrum, Optimism, and Polygon based on DAO-set parameters. Deposit stables or ETH, and smart contracts chase the best risk-adjusted returns, harvesting 6-12% without babysitting. I’ve watched Polygon DAO funds thrive here, dodging IL in volatile pairs while compounding. Integrate with governance oracles for vote-triggered tweaks, and you’ve got DAO treasury utilization on autopilot. No more quorum quagmires delaying pivots.

Yield Comparison of 6 DAO Treasury Deployment Strategies

| Strategy | Chain Focus | Est. APY Range | Risk Level |

|---|---|---|---|

| Stablecoin Yield Optimization via Aave V3 & Morpho | Arbitrum/Optimism | 4-8% | Low 🟢 |

| L2-Native LP Provisioning on Velodrome & QuickSwap | Optimism/Polygon | 10-15% | Med 🟡 |

| Restaking Idle ETH with EigenLayer & Pendle | Arbitrum/Optimism | 12-20% | Med 🟡 |

| RWA Tokenization Allocations via Ondo & Centrifuge | Polygon zkEVM | 5-9% | Low 🟢 |

| Automated Rebalancing with Yearn Finance Vaults | Arbitrum/Optimism/Polygon | 6-12% | Low 🟢 |

| Governance Streamlining via DeXe V3 | Arbitrum/Optimism/Polygon | Enables 4-15% | Low 🟢 |

Governance Streamlining: DeXe V3 Accelerates Decisions

Last but crucial, overhaul your proposal pipeline with DeXe V3. Expanded to Polygon, Arbitrum, Optimism, and Celo, it slashes deployment timelines from weeks to days via snapshot voting and vetted executors. Top 10 DAOs use it as the gold standard for treasury motions, embedding temperature checks before temp checks bog down. Pair with STEP-like endowments for instant stablecoin deploys. This isn’t just speed; it’s Arbitrum treasury management that scales with community buy-in, turning idle debates into yield machines.

Blending these six tactics, stablecoin yields on Aave/Morpho, Velodrome/QuickSwap LPs, EigenLayer/Pendle restaking, Ondo/Centrifuge RWAs, Yearn automation, DeXe governance, DAOs can push utilization past 60%. Optimism’s security ethos pairs perfectly with Pendle’s fixed yields, Polygon’s zkEVM unlocks RWA depth, and Arbitrum’s hefty pots demand bold plays. Amid stablecoin’s $310 billion boom and L2 maturity, hesitation costs real opportunity. Forward-thinking treasuries collaborate now, codifying paths to sustainable growth that outpace TradFi.

Real-world wins? Decentraland’s stable rotations, Arbitrum’s endowment yields. Your DAO’s next. Dive into these on-chain treasury strategies, vote smart, and watch capital compound.