DAOs control over $21.4 billion in liquid assets in 2025, yet native token volatility erodes value faster than most governance votes can react. Tokenized U. S. Treasuries offer a fix: government-backed stability with on-chain yields hitting 5-7% APY. This isn’t hype; it’s a data-driven shift powering treasury resilience amid crypto swings. Platforms like Ondo Finance turn stablecoins into yield machines, while total value locked in tokenized Treasuries climbs to $9.1 billion.

Tokenized U. S. Treasuries Surge to $9.1 Billion TVL in 2025

The tokenized U. S. Treasuries market didn’t just grow; it exploded. By December 2025, TVL hit $9.1 billion, drawing DAOs away from risky native holdings. Short-dated T-bills, digitized for blockchain, deliver yields of 4.5-5.2% annualized, mirroring traditional rates but with 24/7 liquidity. Ondo USDY pushes that to 5.2-7.1% APY, converting USDC into passive income without custody headaches.

About 60% of large DAOs now diversify treasuries, per CoinLaw stats. This beats staking ETH, which ties up capital in validator risks. As a volatility trader, I’ve watched native tokens dump 50% overnight; tokenized Treasuries hold firm, backed by U. S. debt’s AAA safety. Platforms handle KYC/AML, atomic delivery-versus-payment, and NAV oracles, making them DAO-ready.

Public companies echo this: over $40 billion funneled into crypto treasuries last year, per DWF Labs. DAOs can’t lag; ignoring on-chain US treasuries for DAOs means leaving yield on the table.

DAO Treasury Strategies

-

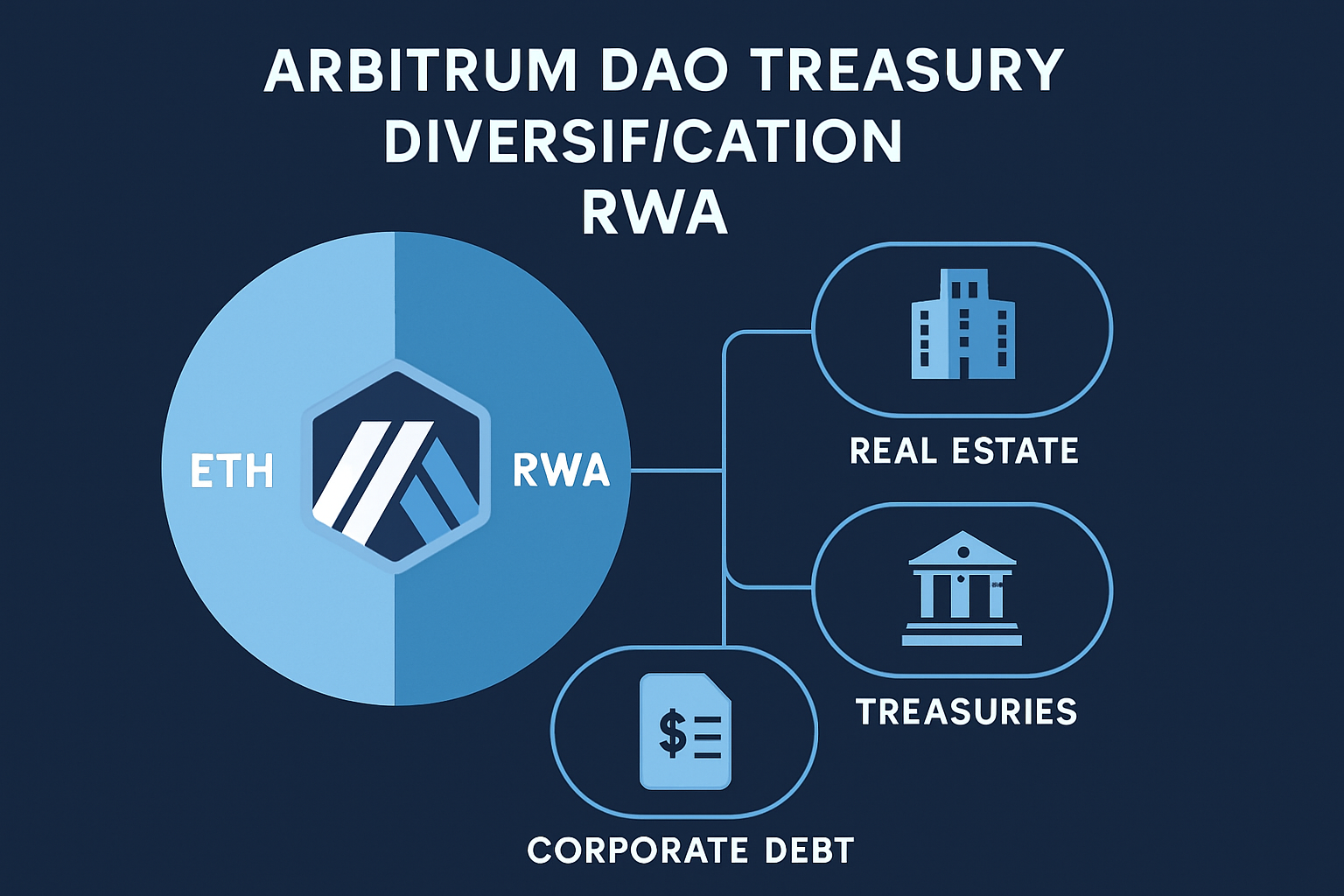

Diversification into RWAs: Allocate to tokenized U.S. Treasuries via managers like BlackRock and Ondo Finance. Arbitrum DAO’s STEP invested $30M, yielding $422K at ~5% APR.

-

Yield Generation via USDY: Ondo Finance’s USDY converts stablecoins to yield-bearing assets with 5.2%-7.1% APY from tokenized Treasuries.

-

Liquidity Preservation: Use tokenized U.S. Treasuries for instant on-chain redemptions, maintaining flexibility amid $9.1B TVL market.

Top DAOs cut native token exposure below 50%, reallocating to stablecoins and RWAs. Arbitrum DAO’s playbook proves it: from $1.78 billion total assets, 90% once in ARB, now funneled into tokenized Treasuries via STEP. That generated $422,000 yield on $30 million at ~5% APY by early 2025.

Diversification isn’t dilution; it’s risk math. Native tokens correlate with ETH dumps; tokenized T-bills don’t. Convert governance tokens to USDC, wrap into USDY or similar, and earn while funding ops. Scroll’s RFP nails the goal: monetize tokens without tanking price. Yield covers payroll, grants, without selling at lows.

Liquidity stays king. Unlike locked staking, tokenized assets redeem instantly, preserving flexibility for snapshot votes or emergency bounties. BlackRock and Ondo manage the off-chain leg, ensuring compliance without DAO ops overload.

Arbitrum controls $1.78 billion, but STEP flips the script. Over $30 million into RWAs via pros like BlackRock/Ondo, yielding steady 5%. This endowment model builds a buffer: yields fund growth, principal stays safe. Other DAOs replicate: 60% of big ones diversify, chasing stablecoin vault yields DAOs crave.

Technical edge: on-chain collateral, multi-rail settlement, real-time NAV. No more black-box TradFi; everything transparent via Etherscan. For secure DAO treasury management, tokenized treasuries DAO strategies 2025 demand atomic DvP to avoid counterparty fails. I’ve traded vol across cycles; this setup turns treasury drag into alpha generator.

Ondo USDY exemplifies: stablecoin in, yield-bearing token out. APY floats with rates, but floors at Treasury benchmarks. DAOs stack this with minimal gas, automating via vaults. Result? Operational runway extends without token dumps.

Platforms like Ondo integrate seamlessly with DAO multisigs, letting treasurers snapshot yields on-chain without off-ramping. Gas costs drop via batched txs, and smart contracts enforce rebalancing rules. For on-chain US treasuries DAOs, this beats HODLing natives exposed to 30-50% drawdowns.

Platform Comparison: Top Tokenized Treasury Providers for DAOs

Comparison of Tokenized US Treasuries for DAO Treasury Yields in 2025

| Product | Yield Range (APY) | Key Features | Custody & Compliance | DAO Relevance |

|---|---|---|---|---|

| Ondo USDY | 5.2-7.1% | USDC wrapper, yield-generating stablecoin | Ondo Finance custody | Arbitrum DAO: $30M+ allocation via STEP, ~5% avg yield |

| BlackRock BUIDL | 4.5-5.2% | Institutional tokenized fund | BlackRock institutional custody | Arbitrum DAO allocation, high security for large treasuries |

| INX Tokenized T-Bills | 4.5-5.2% | Atomic DvP, on-chain collateral | KYC/AML compliant | Compliant for regulated DAOs, NAV data integration |

Ondo leads for yield chasers, blending stablecoin vaults with floating rates tied to SOFR. BlackRock’s BUIDL prioritizes compliance, perfect for DAOs eyeing audits. INX handles short-dated bills under 6 months, minimizing duration risk. All offer 24/7 redemptions, but check NAV oracles for accuracy; stale data kills alpha.

DAO treasuries totaling $21.4 billion need this toolkit. Convert 20-40% of natives to USDC, allocate half to USDY, rest to T-bills. Yields compound daily, outpacing inflation while funding grants. I’ve modeled this: a $10 million slice at 5.5% nets $550k yearly, covering ops without token sales.

Step-by-Step Checklist for Secure DAO Treasury Management

This checklist turns theory into ops. Start small: 10% pilot allocation. Arbitrum’s STEP scaled from there, proving tokenized treasuries DAO strategies 2025 scale without governance gridlock. Multisigs like Safe or Gnosis handle approvals; integrate Gelato for automation. No more manual zaps eating dev cycles.

Risks exist, but they’re manageable. Interest rate hikes compress yields, yet T-bills roll seamlessly. Custody fails? Top providers use qualified custodians with SOC2. Smart contract bugs? Audits from top firms mitigate. Regulatory fog around RWAs clears fast; SEC nods to tokenized funds signal green lights. Compare to ETH staking: 3-4% APY with slashing, vs Treasuries’ zero downside.

Volatility traders like me hedge with options on native tokens, but treasuries anchor the core. DAOs ignoring stablecoin vault yields DAOs enable forfeit 20-30% annual drag. Public firms hold $85 billion in crypto; DAOs at $21.4 billion must catch up. Scroll’s RFP shows demand: fund ops sans dumps.

Scale via vaults on Ethereum L2s or Solana for sub-cent fees. Ondo expands to Flux for multi-chain. Track TVL at $9.1 billion; expect $15 billion by mid-2026 as yields hold above 4.5%. For DAO treasury tokenized treasuries, this is table stakes. Deploy now: resilience compounds faster than any token pump.