In 2025, DAOs heavy in native tokens like UNI, OP, and ARB are pivoting hard toward DAO treasury stablecoins to fuel long-term sustainability. Idle USDC and USDT sitting in multisig wallets earn nothing while inflation and opportunity costs erode value. The solution lies in on-chain stablecoin vaults, where automated protocols turn these assets into revenue streams with yields from 4% to 12% APY. Drawing from real-time insights at onchaintreasury.org, this guide spotlights the top six strategies prioritized by safety, automation, and current market APYs. Treasury teams can deploy these without sacrificing control or introducing undue risk.

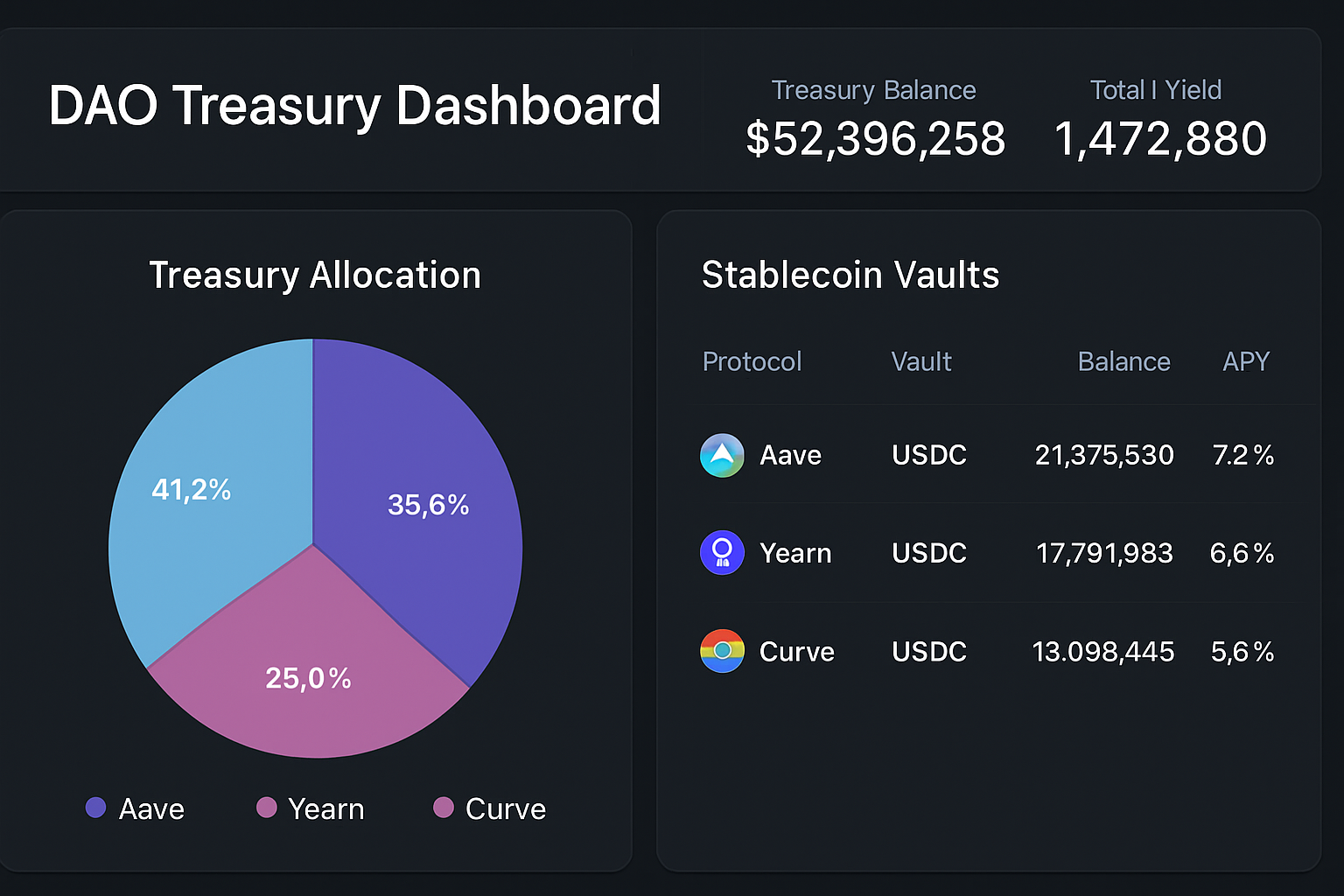

Picture a world where your DAO’s stablecoin reserves compound autonomously across DeFi’s best opportunities. Platforms like Aave, Curve, and Yearn have matured, offering battle-tested infrastructure that aligns with decentralized governance. No more manual zaps or gas wars; these vaults handle rebalancing, compounding, and risk isolation. For DAOs eyeing DeFi treasury management 2025, the data is compelling: protocols managing billions in TVL deliver consistent returns while preserving principal.

Why Prioritize Safety and Automation in Idle Stablecoin Yield Strategies

Traditional holding strategies fail in volatile markets. DAOs need approaches that minimize smart contract risk, impermanent loss, and liquidation events. Automation via vaults like Yearn or Morpho Blue reduces human error, a common pitfall I’ve observed in community forums. These tools dynamically shift capital to highest-yield markets, often outperforming manual management by 2-3% annually. Consider the Scroll DAO’s RFP for treasury sustainability or Compound’s proposal to activate idle assets; both echo the need for capital efficiency without complexity.

Stablecoins are increasingly yield-bearing assets in DeFi, passing income from RWAs or lending directly to holders.

Our ranked list focuses on six proven plays: Deposit into Aave V3 Lending Pools (5-7% APY), Provide Liquidity in Curve 3pool (4-6% APY), Yearn yvUSDC Vault (6-8% APY), Ethena sUSDe (8-12% APY), Morpho Blue Markets (7-10% APY), and Pendle Fixed Yield Tranches (5-9% APY). Each balances reward with resilience, ideal for treasuries over $1M.

Strategy 1: Aave V3 Lending Pools for Steady Variable Yields

Aave V3 stands out for its isolated markets and battle-tested security, making it the safest entry for DAO treasury automation. Depositing USDC or USDT into supply pools earns variable yields of 5-7% APY, driven by borrower demand. Flash loans and efficiency modes amplify returns without leverage risks. For conservative DAOs, this is foundational: overcollateralized lending ensures stability, with health factors monitored on-chain.

Implementation is straightforward. Approve the deposit via your DAO’s safe, and watch accruals compound. Historical data shows minimal drawdowns even in bear markets, outperforming idle holdings by multiples. Pair it with Aera vaults for cross-chain optimization if your treasury spans L2s.

Top 6 DAO Stablecoin Yield Strategies: APY Comparison (2025)

| Strategy | APY Range (%) | Key Features |

|---|---|---|

| Aave V3 | 5-7 | Low risk |

| Curve 3pool | 4-6 | Low IL |

| Yearn yvUSDC | 6-8 | Auto-compound |

| Ethena sUSDe | 8-12 | Funding rates |

| Morpho Blue | 7-10 | Efficient lending |

| Pendle | 5-9 | Fixed |

Strategy 2: Curve 3pool Liquidity for Fee Capture and Rewards

Curve Finance’s 3pool (USDC/USDT/DAI) excels in low impermanent loss environments, perfect for liquidity providers wary of volatility. Yields hit 4-6% APY from swap fees plus CRV incentives, with the stableswap algorithm minimizing slippage. DAOs like those in the Compound forum have used similar LP strategies to boost treasury revenue without directional bets.

Why Curve over Uniswap? Tighter peg stability and veCRV locking for boosted rewards. Deposit via the vault interface, stake LP tokens for extras, and automate harvests. In 2025’s stablecoin surge, this captures organic volume from DeFi’s core plumbing.

Yearn Finance takes automation to the next level with its yvUSDC vault, a staple for idle stablecoin yield strategies. By depositing USDC, DAOs unlock 6-8% APY through auto-compounding across lending markets like Aave and Compound. The vault’s strategists zap funds to the highest yields, harvesting and reinvesting rewards seamlessly. This hands-off approach suits DAO treasury teams juggling governance votes and proposals, freeing bandwidth for strategic decisions.

Strategy 3: Yearn Finance yvUSDC Vault for Auto-Compounding Optimization

I’ve seen DAOs transform stagnant reserves into compounding machines here. Shares appreciate daily as fees accrue, with low gas via keepers. Risk is isolated to vetted strategies, audited rigorously post-exploits. For 2025’s DeFi treasury management, pair with timelocks for governance approval, ensuring community buy-in before scaling positions.

Transitioning to higher-upside plays, Ethena’s sUSDe offers synthetic stability with a twist. Convert USDC to sUSDe to tap funding rate yields from delta-hedged positions, delivering 8-12% APY. Backed by ETH collateral and transparent reserves, it’s gained traction among yield chasers balancing basis trades with peg defense.

Strategy 4: Ethena sUSDe for Synthetic Dollar Funding Rate Yields

This isn’t gambling on perps; Ethena arbitrages basis positively, passing premiums to holders. DAOs benefit from redeemability and no lockups, ideal for operational liquidity. Monitor open interest, though; crowded trades can compress rates. In practice, treasuries allocate 20-30% here for alpha without leverage.

USD Coin Technical Analysis Chart

Analysis by Paige Donnelly | Symbol: BINANCE:USDCUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

In my balanced hybrid approach as Paige Donnelly, start by drawing horizontal_lines at key support 0.999 (strong peg hold) and resistance 1.001 (minor ceiling), using thick green for support and red for resistance. Add a rectangle for the ongoing consolidation zone from Nov 28 to Dec 7 between 0.998-1.002 to highlight the tight range ideal for stablecoin treasury deployment. Sketch a short downtrend_line from early Nov peak at 1.012 to mid-Dec low at 0.996, fading into flat. Place callouts on volume for ‘low volume stability’ and MACD for ‘neutral histogram’. Mark vertical_line at Dec 1 minor breakdown test. Add text notes tying to DeFi yields: ‘Perfect for Morpho Blue vaults ~6% APY’. Use arrows for potential entry at support bounce.

Risk Assessment: low

Analysis: Stablecoin chart shows tight range around $1.000 with low volume and no major deviations, perfect for treasury strategies amid 2025 yield opportunities

Paige Donnelly’s Recommendation: Accumulate on dips for DeFi vault deployment; medium-risk tolerance favors holding over trading

Key Support & Resistance Levels

📈 Support Levels:

-

$0.999 – Primary peg support, multiple bounces

strong -

$0.996 – Recent test low, volume dry-up

moderate

📉 Resistance Levels:

-

$1.001 – Tight overhead resistance, low volume cap

moderate -

$1.002 – Session high, minor friction

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$0.999 – Bounce from strong support in consolidation, low-risk hold for yields

low risk -

$1 – Peg retest on pullback, hybrid yield entry

medium risk

🚪 Exit Zones:

-

$1.002 – Resistance test for profit take on minor upside

💰 profit target -

$0.995 – Break below key support invalidates peg hold

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: low and steady

Minimal volume confirms stable consolidation, no conviction moves

📈 MACD Analysis:

Signal: neutral

Flat histogram and lines, no momentum divergence

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Paige Donnelly is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Morpho Blue elevates lending with peer-to-pool matching, optimizing for 7-10% APY on USDC/USDT. Unlike monolithic pools, it curates markets with custom oracles and risk parameters, slashing waste. DAOs deploy via vaults for dynamic supply, earning optimized rates minus middleman drag.

Strategy 5: Morpho Blue Markets for Peer-to-Pool Lending Efficiency

Customization shines: set LTVs and liquidation thresholds to fit DAO risk appetite. Integrations with Aera enable autonomous rebalancing, turning treasuries into adaptive engines. Yields beat incumbents consistently, per on-chain analytics, with sub-second executions on L2s cutting costs.

Closing the list, Pendle locks stablecoins into fixed yield tranches at 5-9% APY, shielding against rate drops. Trade principal or yield tokens separately, but for treasuries, fixed PTs lock profits upfront. This predictability appeals to governance-focused DAOs planning multi-year roadmaps.

Strategy 6: Pendle Fixed Yield Tranches for Predictable Returns

Pendle’s AMM prices YT discounts efficiently, often yielding premiums over spot rates. Deposit USDC, receive PTs maturing with principal plus yield, no active management needed. Combine with Yearn for hybrids, but fixed appeals for budgeting grants or buybacks. Across these six, APYs stack safety with scalability.

Blending strategies amplifies results. A sample allocation: 30% Aave/Curve for base yield, 40% Yearn/Morpho for optimization, 30% Ethena/Pendle for upside and locks. Simulate via Dune dashboards first, then propose via Snapshot. Risks like oracle fails or depegs demand diversification and insurance via Nexus Mutual.

DAO treasuries thriving in 2025 embrace on-chain stablecoin vaults not as speculation, but infrastructure. Protocols evolve with ZK proofs and shared security, shrinking blast radii. Teams I’ve advised report 4-6x idle returns, funding more delegates and initiatives. Deploy incrementally, monitor via onchaintreasury.org tools, and watch sustainability soar.