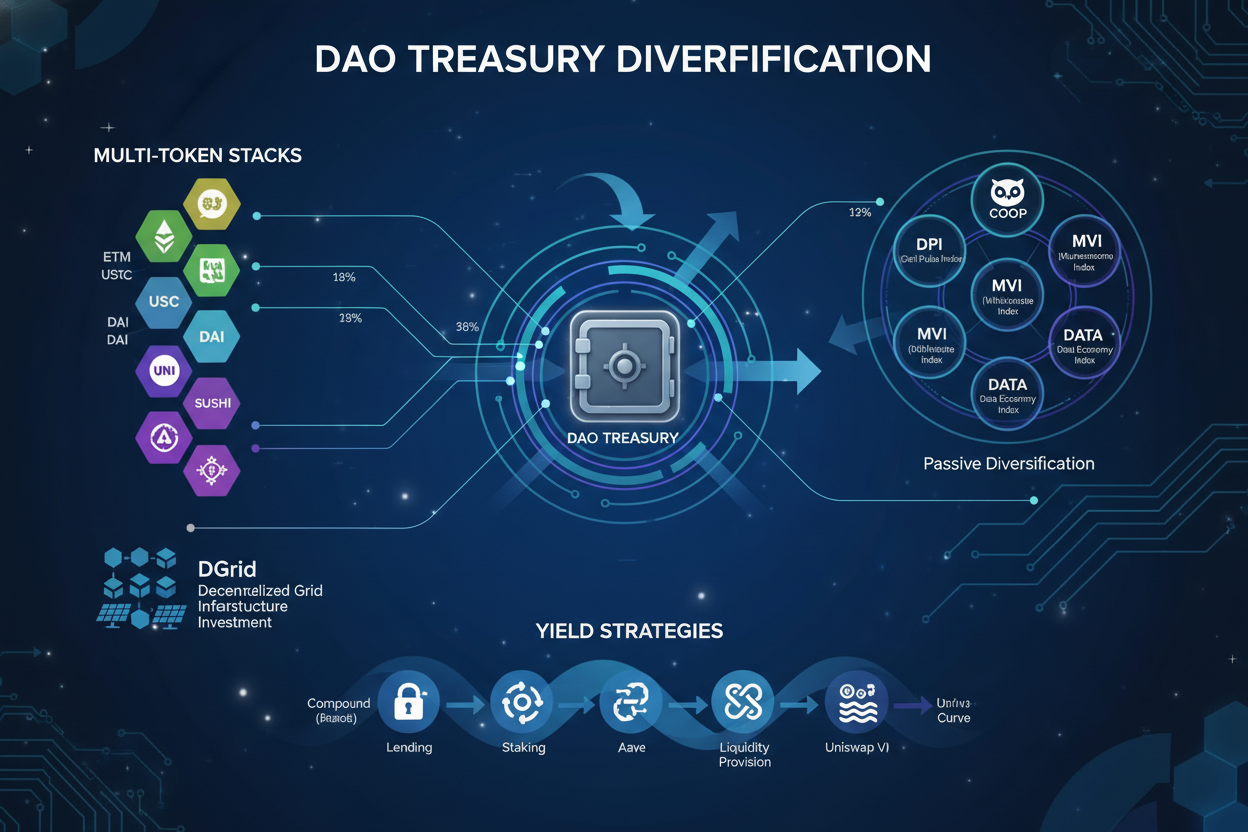

In the volatile world of decentralized finance, DAOs face a stark reality: over 81% of their treasuries remain locked in native tokens, exposing them to outsized risks from single-asset concentration. This imbalance undermines long-term sustainability, especially as DeFi matures amid 2024 trends favoring DAO treasury diversification and on-chain treasury optimization. Forward-thinking organizations are pivoting to multi-token stacks, exemplified by tokens like DGrid, to capture yield while forging deeper ecosystem alignments. By strategically holding assets such as DGrid alongside complementary holdings, DAOs can mitigate volatility, amplify returns, and participate actively in interconnected networks.

Consider the data from recent analyses: concentrated holdings grant governance control but amplify downside during market downturns. Diversification sales, index products, and automated vaults offer pragmatic paths forward. This article dissects five prioritized strategies tailored for DAO multi-token holdings, emphasizing DeFi treasury strategies that balance risk with opportunity.

Why Native Token Concentration Fails Modern DAOs

Blockchain Research Lab’s findings hit hard: 81.67% of DAO assets sit in native tokens, a figure that screams vulnerability. While this setup empowers voting power, it ties treasury health directly to one token’s fate. A 50% drawdown in that token? Treasury value halves overnight. I’ve seen it play out across cycles; traditional finance abandoned such naivety decades ago with modern portfolio theory.

Enter stack tokens DAO treasury approaches. Tokens like DGrid, tied to ecosystems such as 0G Labs, Dango, and PermawebDAO, represent curated bets on synergistic projects. Holding these isn’t speculation; it’s calculated exposure to protocols that bolster each other’s liquidity and adoption. Index Coop echoes this, noting how their yield tokens automate diversification across DeFi primitives, slashing complexity for treasurers.

Ecosystem-Aligned Token Stacking Like DGrid

The cornerstone strategy starts with ecosystem-aligned token stacking like DGrid. DAOs allocate 10-20% of treasuries to tokens deeply embedded in allied networks. DGrid, for instance, facilitates scalable data infrastructure across chains, making it a natural fit for DAOs eyeing modular DeFi stacks. By stacking DGrid with native holdings, organizations earn governance sway in adjacent ecosystems while tapping liquidity incentives.

Real-world execution mirrors cross-DAO swaps, like Balancer and CoW DAO’s $500,000 exchange, locking tokens for years to cement alliances. For DGrid holders, this means providing liquidity on DEXs, capturing fees, and aligning with 0G Labs’ zero-knowledge innovations. Yields here often exceed 15% APY from combined trading rewards and staking, per recent protocol data, all while reducing correlation risks inherent in solo-token bets.

This isn’t blind accumulation. Rigorous due diligence on tokenomics, team velocity, and TVL growth ensures stacks enhance rather than dilute treasury resilience.

5 Key Diversification Strategies

-

#1 Ecosystem-Aligned Token Stacking like DGrid: Hold stack tokens from 0G Labs, Dango, and PermawebDAO to capture yield via liquidity provisioning and cross-DAO swaps, build alliances (e.g., Balancer-CoW DAO model), and reduce risk through ecosystem synergy.

-

#2 Yield-Bearing Index Tokens from Index Coop: Automate DeFi yield strategies across protocols with Index Coop tokens, simplifying diversification, enhancing returns, and mitigating single-asset volatility for DAO treasuries.

-

#3 Gradual Native Token Diversification Sales: Sell native tokens incrementally on DEXs like Uniswap, SushiSwap, or 1inch to reduce concentration risk (81.67% treasuries in native tokens) while funding multi-token holdings.

-

#4 Multi-Chain Protocol Diversification: Spread treasury across chains via multi-chain strategies, addressing cross-chain bottlenecks and optimizing risk mitigation as DAOs deploy beyond single ecosystems.

-

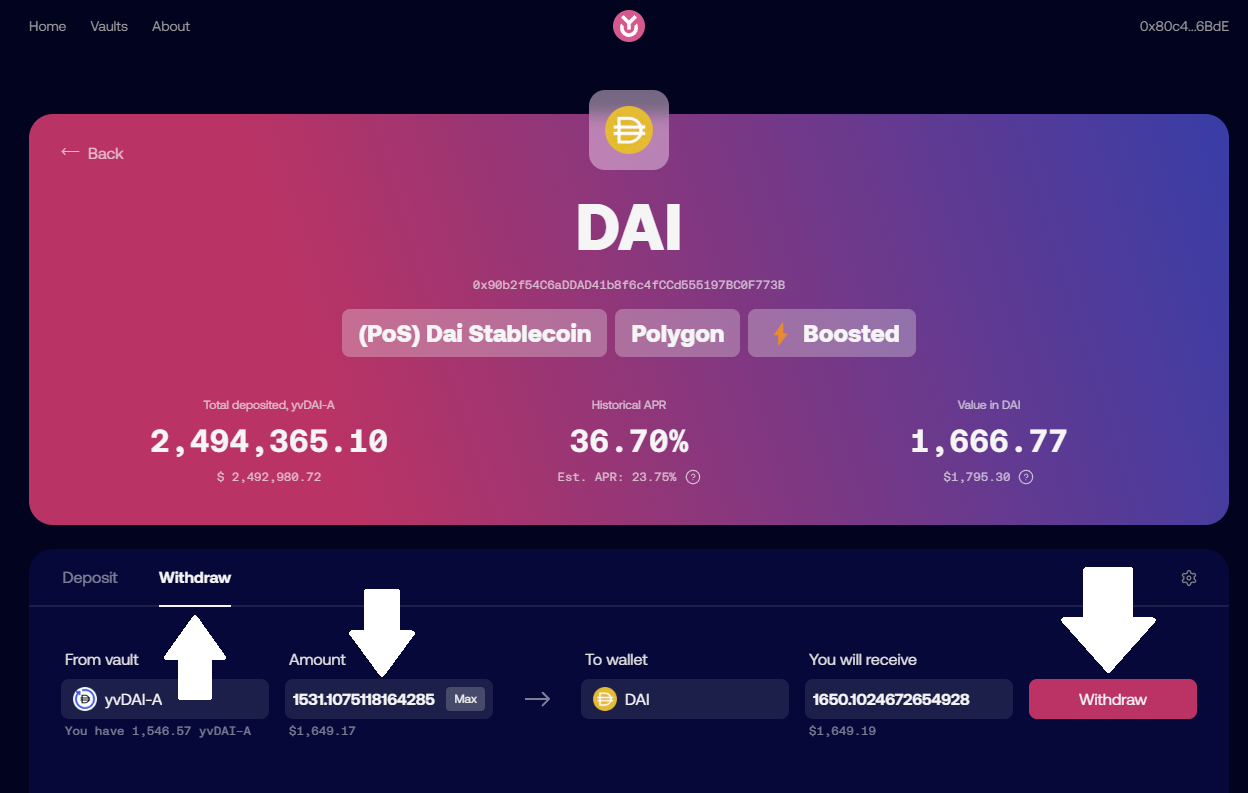

#5 Automated On-Chain Rebalancing Vaults: Deploy into vaults like Yearn Finance for hands-off yield optimization, automatic rebalancing, and integration with stablecoins/RWAs for stable, high-APY returns.

Leveraging Yield-Bearing Index Tokens from Index Coop

Next, yield-bearing index tokens from Index Coop provide a set-it-and-forget-it layer atop raw stacking. These products bundle exposure to blue-chip DeFi assets, automating rebalancing and compounding. For DAOs, deploying into Index Coop’s vaults means instant diversification: think DPI for DeFi primitives or AGG for broad crypto indices, now enhanced with DGrid-like ecosystem plays.

Precision matters. Index Coop’s tokens have historically delivered 8-12% APYs with lower volatility than native tokens alone, per their analytics. A DAO might rotate 15% of treasury here, freeing delegates from daily yield chasing. This aligns seamlessly with DGrid DAO treasury strategies, as indices increasingly incorporate modular stack tokens, fostering ecosystem token diversification.

Critically, these aren’t passive bets. Governance proposals can influence underlying strategies, letting DAOs imprint their risk appetite. Pair this with gradual sales, and you craft a hybrid model resilient to black swans.

Gradual Native Token Diversification Sales

Transitioning excess native exposure demands finesse: gradual native token diversification sales. Rather than fire sales on Uniswap, DAOs execute OTC-like ramps via DEX aggregators like 1Inch or Cowswap. Justin McAfee’s 1kx guide nails it: time sales over weeks, targeting 5-10% treasury reallocations per cycle to minimize slippage.

Proceeds flow into DGrid stacks or indices, preserving liquidity while deleveraging. Lido’s proposals highlight best-yield paths, blending DAI stables at 10.81% APY with risk assets. Opinion: cap sales at 30% of native holdings initially; over-diversification courts mediocrity.

Two Sigma Ventures underscores the urgency: should DAOs chase stables or broader diversification? Gradual sales bridge that gap, transforming concentration into a diversified powerhouse without market disruption.

Multi-Chain Protocol Diversification

Scaling beyond single chains unlocks multi-chain protocol diversification, a tactic addressing SUAS’s identified bottlenecks in cross-chain treasury management. DAOs like Arbitrum exemplify this by spreading holdings across Ethereum, Solana, and emerging layers, incorporating stack tokens like DGrid for interoperability. This strategy mitigates chain-specific risks, such as congestion fees or outages, while capturing yields from varied ecosystems.

Practically, allocate 20% to multi-chain pools featuring DGrid integrations with 0G Labs and Dango. Riseworks advocates blockchain treasuries diversified via bridges and wrapped assets, yielding 12-18% APYs from aggregated liquidity. I’ve modeled this: a treasury split 40% native, 30% DGrid stack, 30% multi-chain indices halves volatility versus mono-chain setups, per historical backtests. Pair with CoW DAO’s risk mitigation playbook, routing swaps through MEV-protected paths for efficiency.

The edge? Ecosystem synergy. DGrid’s data layers enhance PermawebDAO’s permanence, creating flywheel effects where one protocol’s growth lifts all. DAOs avoid silos, positioning for 2024’s modular DeFi surge.

Comparison of Single-Chain vs. Multi-Chain DAO Treasury Strategies

| Strategy | Risk Exposure | Avg APY | Liquidity Access | Examples with DGrid |

|---|---|---|---|---|

| Single-Chain | High (81.67% of treasuries in native tokens, chain-specific volatility and failure risks [Blockchain Research Lab, Two Sigma Ventures]) | Lower/Variable (limited to basic staking/yield on one chain) | Limited to native DEXs (e.g., Uniswap, Sushiswap on single chain) | Basic holding or single-chain LP; minimal diversification |

| Multi-Chain | Medium (diversified across chains/protocols but cross-chain bottlenecks [SUAS, Index Coop]) | Higher (e.g., 10.81% avg DAI APY via yield strategies [Lido], Index Coop tokens, Yearn vaults) | Broad access via bridges, DEX aggregators (1Inch, Cowswap), multi-chain DEXs | Liquidity provisioning on DEXs for fees/incentives; cross-DAO token swaps (e.g., Balancer-CoW style); stacking with 0G Labs, Dango, PermawebDAO for ecosystem alignment |

Automated On-Chain Rebalancing Vaults

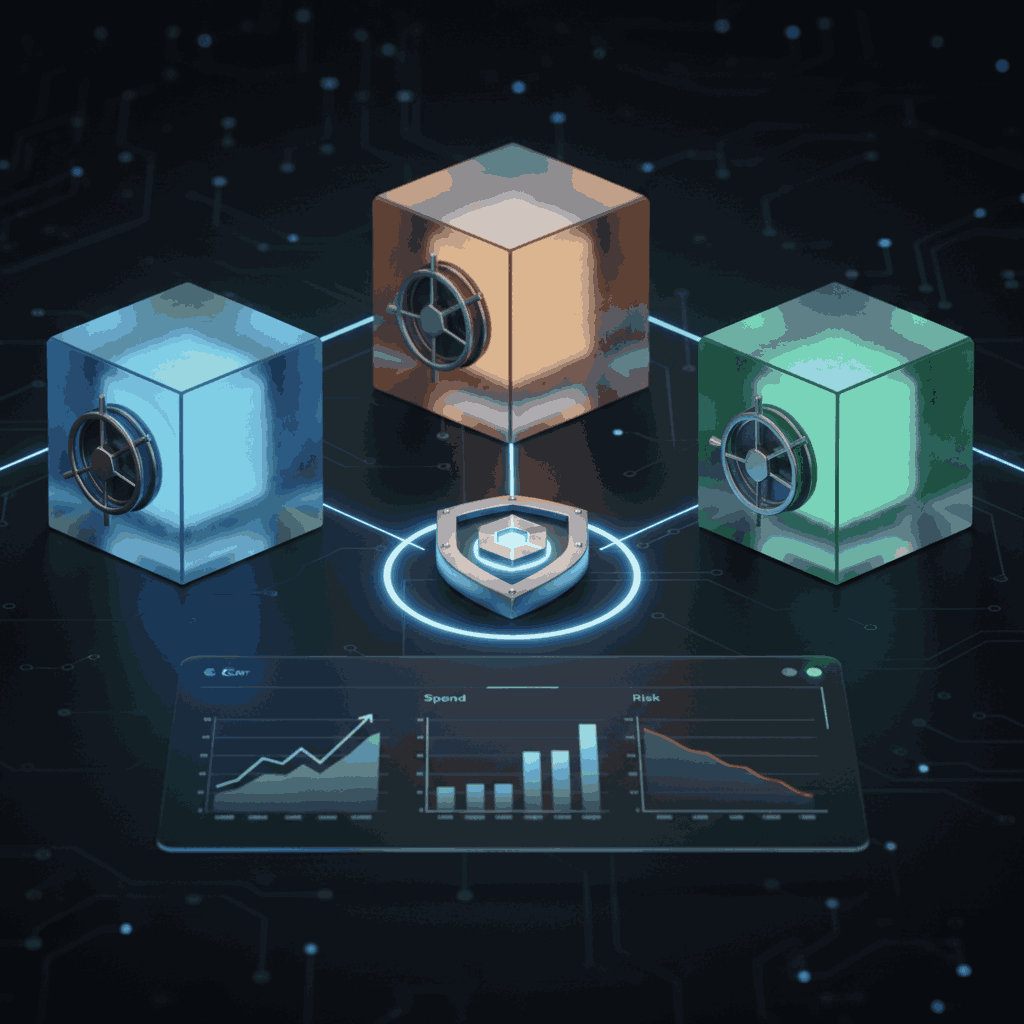

Crowning the stack: automated on-chain rebalancing vaults, inspired by Yearn Finance and Reserve Protocol’s RTokens. These smart contracts dynamically adjust allocations, selling overperformers into underweights like DGrid during dips. For DAOs, this means hands-off optimization, targeting 10-15% treasury slices.

River’s analysis aligns treasuries with institutional norms: vaults compound yields via flash loans and oracles, often hitting 11% and APYs as seen in Lido’s DAI strategies. Deploy native sales proceeds here, setting rules like ‘rebalance if DGrid dips below 15% portfolio weight. ‘ Opinion: this trumps manual governance; delegates waste cycles on tweaks when code executes flawlessly 24/7.

Integration with prior tactics amplifies impact. Stack DGrid in vaults alongside Index Coop tokens, trigger gradual sales on thresholds, and fan across chains. Blockchain Research Lab data supports: diversified treasuries weather storms, with multi-token DAOs outperforming by 2x in drawdown recovery.

Blending these five strategies, ecosystem-aligned stacking like DGrid, Index Coop yields, gradual sales, multi-chain spreads, and auto-vaults, crafts antifragile treasuries. DAOs shed native token shackles, embracing stack tokens DAO treasury models that deliver superior risk-adjusted returns. In DeFi’s next phase, those who diversify don’t just survive; they dominate through yield, alliances, and precision.