In the fast-evolving landscape of decentralized finance, DAOs hold billions in stablecoins, yet much of that capital sits idle, earning nothing while inflation and opportunity costs erode value. As of February 2026, with tokenized U. S. Treasuries surging to nearly $4 billion and stablecoin vaults delivering consistent 5-6% yields, it’s clear: deploying stablecoins into secure on-chain vaults isn’t optional, it’s the definitive fix for DAO treasury yield optimization. This approach transforms dormant reserves into revenue-generating assets without sacrificing liquidity or security.

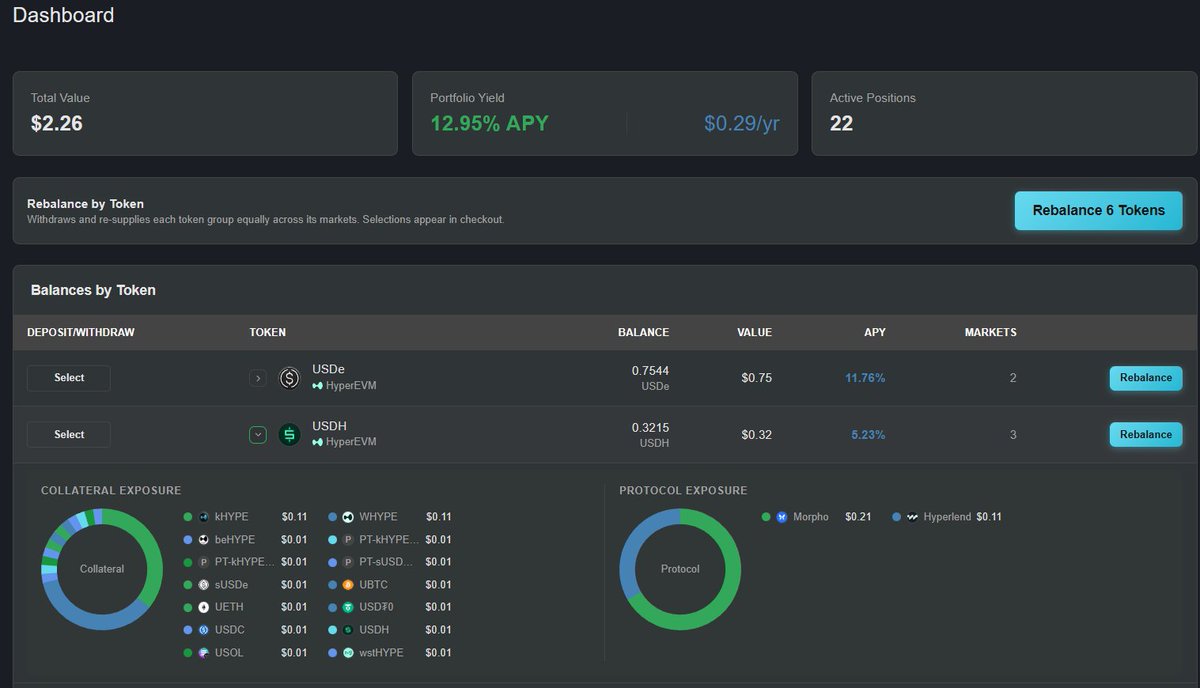

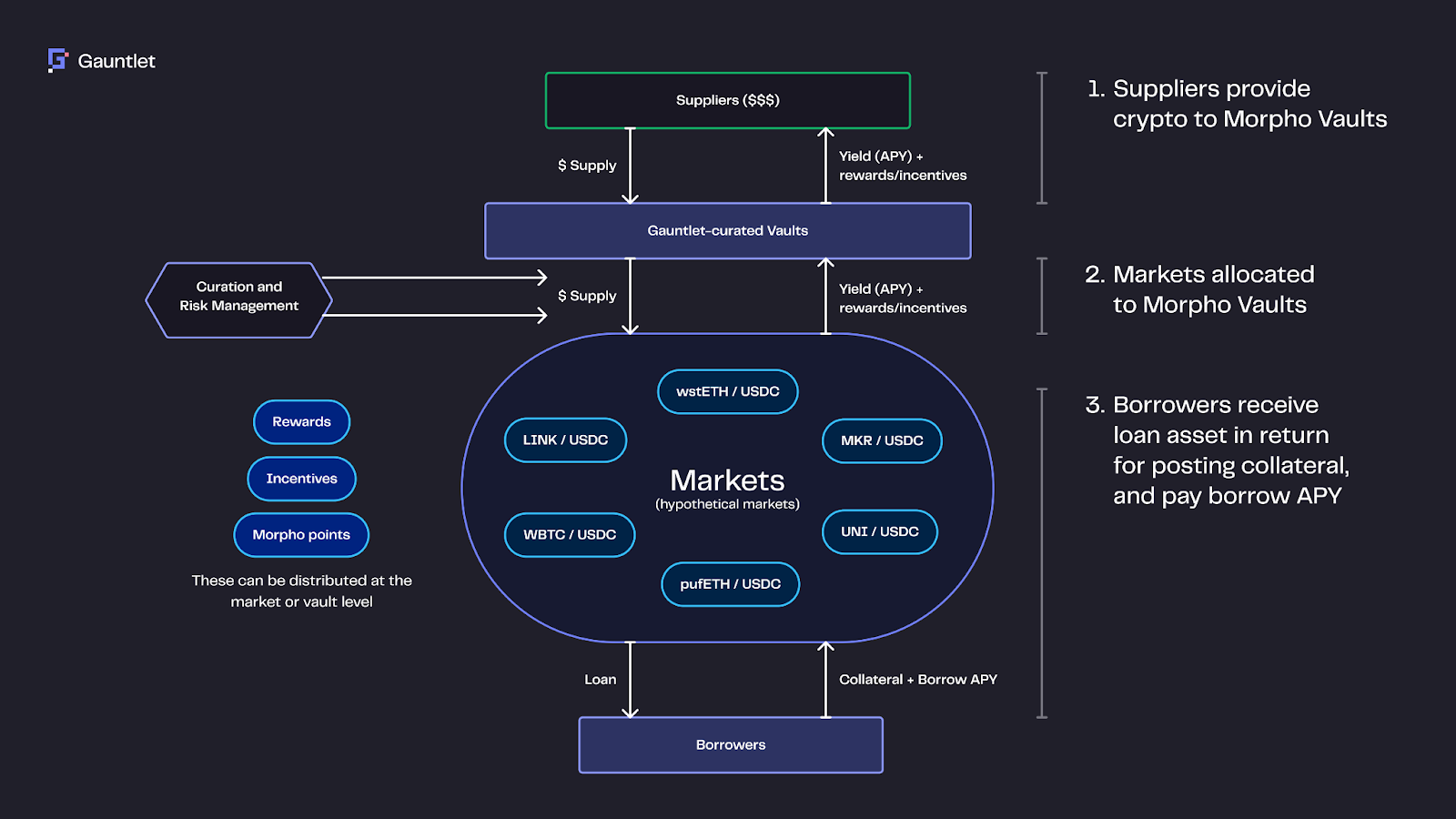

Consider the numbers. Stablecoins have solidified as the monetary base layer for on-chain activity, powering everything from payments to liquidity management. Yet, reports highlight how many DAOs leave USDC and USDT parked in wallets, missing out on risk-adjusted returns. Arbitrum DAO’s move to consolidate $2.54 million in idle USDC into its Treasury Management Committee exemplifies the shift. Institutions and protocols alike are waking up to stablecoin vaults for DAOs, where automated allocators like Morpho Vaults from Steakhouse Financial route capital across protocols for maximized efficiency.

The Scale of Idle Capital in DAO Treasuries

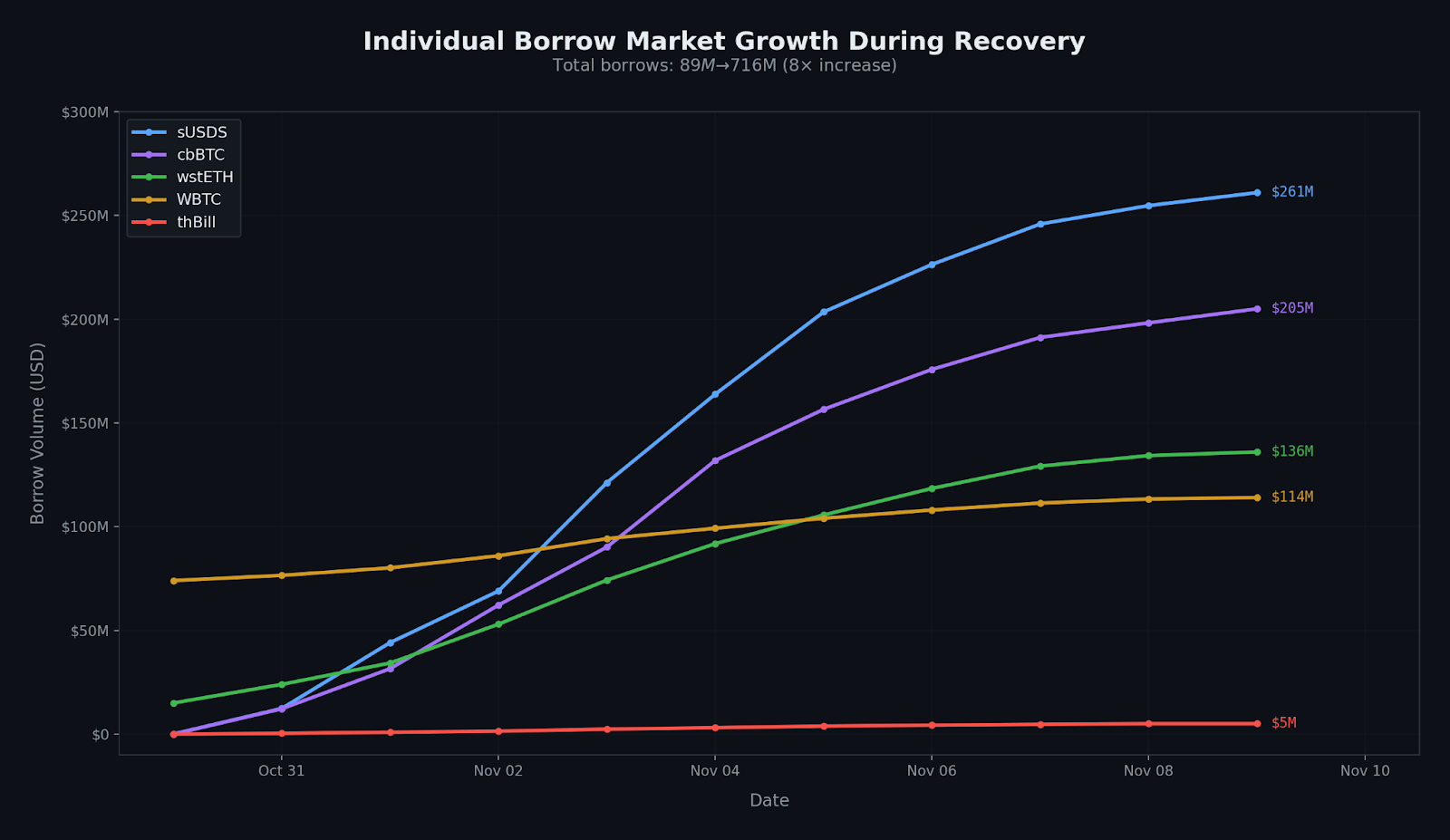

Idle capital drains DAO sustainability. Across major protocols, treasuries ballooned in 2025, but yield generation lagged. Galaxy’s State of Onchain Yield report breaks it down: stablecoins offer baseline returns via lending and restaking, yet without vaults, DAOs forfeit 4-8% APY. The $21 billion RWA wave, including BlackRock’s BUIDL and Ondo’s USDY, underscores the pivot. Tokenized Treasuries grew from $775 million in 2024 to projections of $28 billion by end-2025, providing DAOs with 4-5% stable yields.

Entropy Advisors’ July 2025 update on Arbitrum spotlights ETH-stable looping, but the real game-changer is vaults like Aarna’s atvUSDC, churning 5-6% native yield on idle reserves. In 2026, on-chain treasury management demands these tools. Protocols using MYSO v2 tap alpha strategies, diversifying treasuries while curators automate risk-adjusted deployments. The result? Capital efficiency that counters volatility head-on.

Why Secure On-Chain Vaults Solve the Idle Capital Puzzle

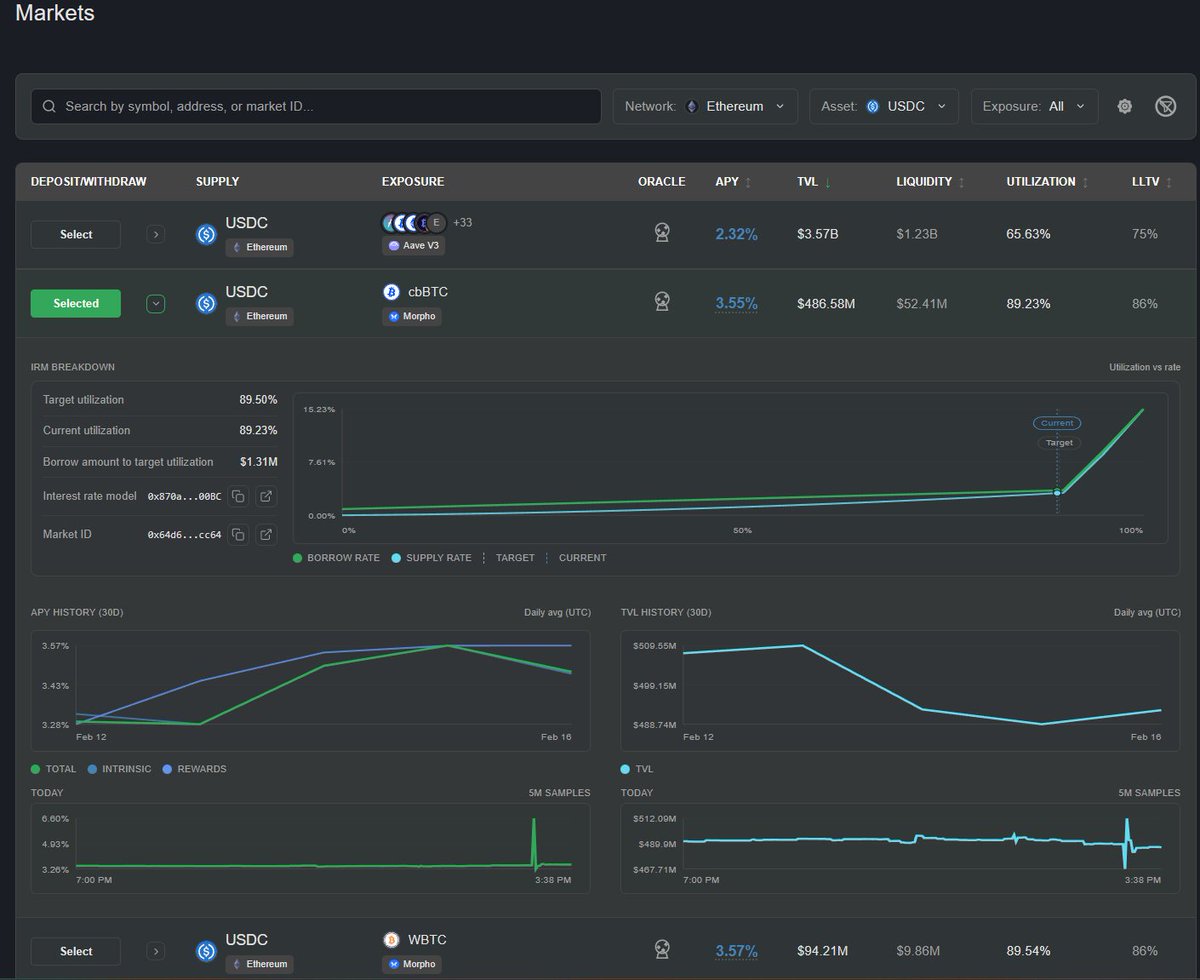

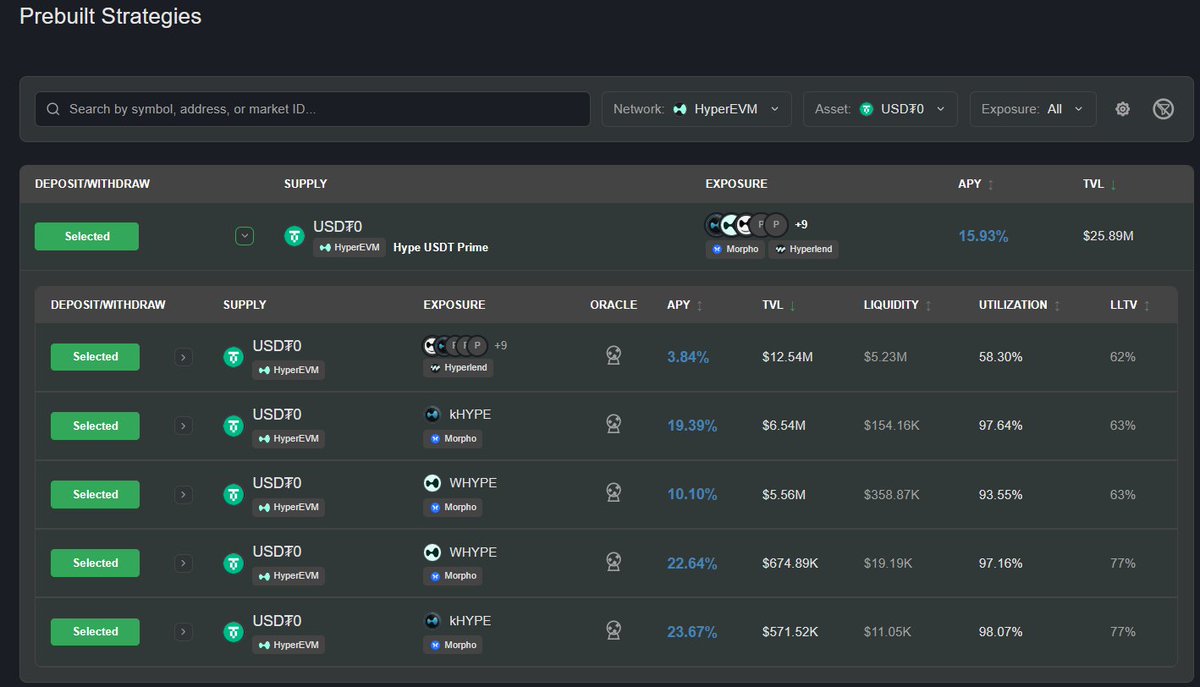

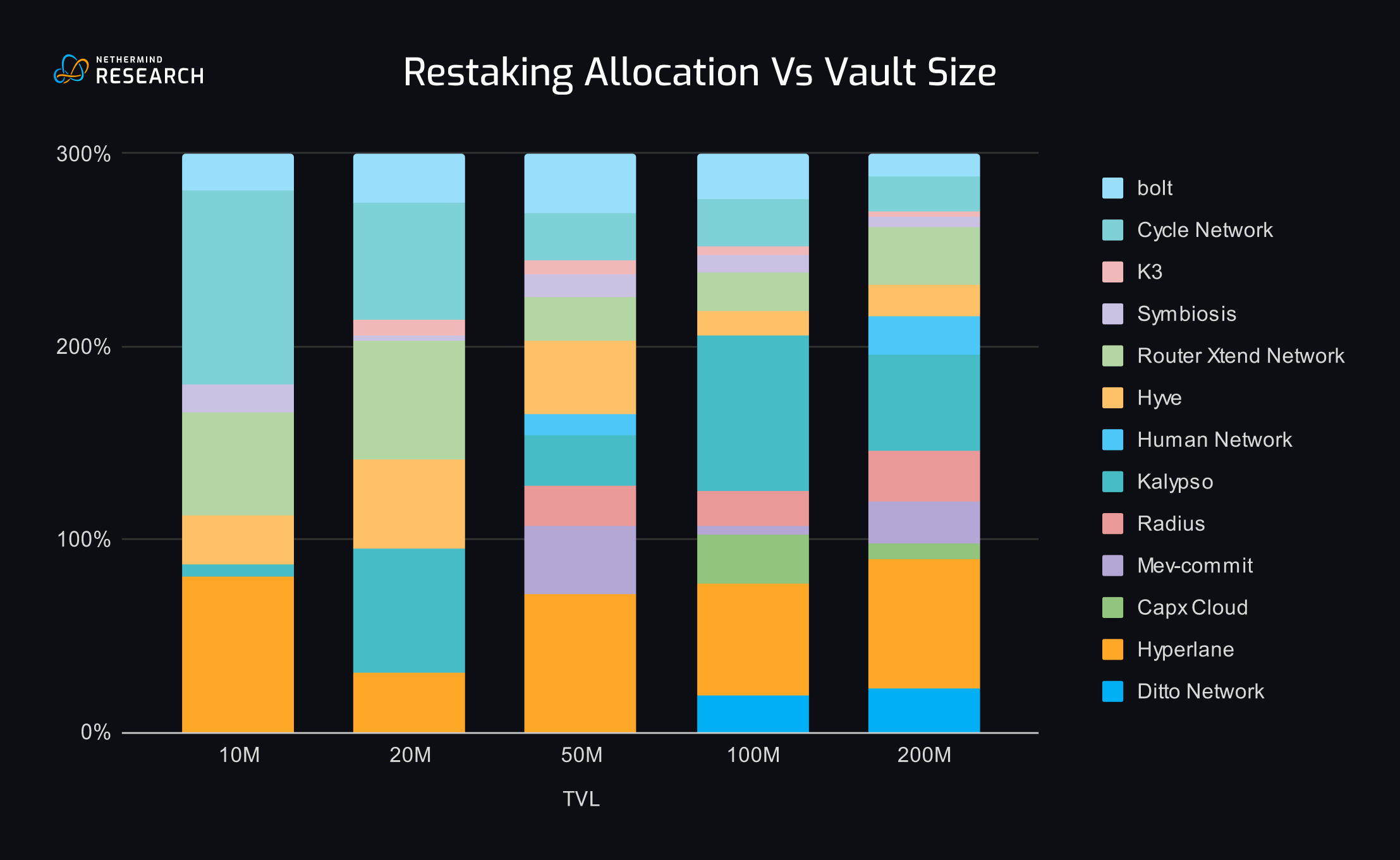

Stablecoin vaults aren’t hype; they’re engineered precision. These protocols, think Morpho, Aave integrations, or Arbitrum-native optimizers, deposit stablecoins into yield-bearing positions, auto-rebalancing across lending markets, tokenized RWAs, and liquidity pools. Risks? Minimal when curated properly. Galaxy notes stablecoin yields hover at 4-7%, spiking to double-digits in looped strategies per Wajahat Mughal’s 2026 outlook.

DAOs gain governance-linked rebalancing, dynamically shifting exposures based on Fed signals or TVL surges. Pair vaults with tokenized Treasuries: deposit USDY as collateral on Aave, borrow at sub-2%, loop back for 7-8% APY flywheels. This isn’t speculation; it’s idle DAO capital strategies backed by on-chain transparency. AlphaPoint’s institutional guide echoes this, emphasizing payments and liquidity optimization via stables.

Top 5 Benefits of Stablecoin Vaults for DAOs

-

1.5-8% Yields on Idle USDC: Vaults like Morpho and Aave deliver 4-8% APY on idle capital, as seen in Arbitrum DAO’s $2.54M USDC deployment.

-

Automated Risk Management: Morpho Vaults by Steakhouse Financial auto-allocate depositor capital across risk strategies for optimized returns.

-

Full On-Chain Auditability: All transactions transparent and verifiable, enabling real-time treasury oversight without intermediaries.

-

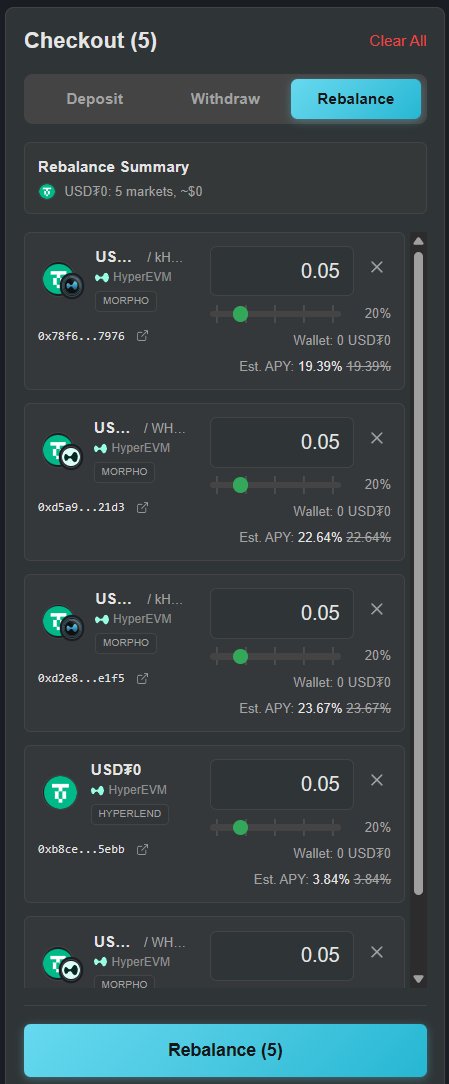

Governance Rebalancing: On-chain proposals dynamically adjust allocations based on risk parameters and market signals.

-

RWA Integration for Stability: Pair with tokenized Treasuries like BlackRock BUIDL or Ondo USDY for 4-5% stable yields amid volatility.

2026 Strategies: From Basic Deposits to Advanced Loops

Start simple: sweep idle stables into vaults like atvUSDC for instant 5-6% native yield. But forward-thinking DAOs layer in RWAs. Franklin Templeton’s BENJI or Ondo tokens earn 4-5%, then collateralize for leverage. On Solana or Sei Network, diversified stacks balance crypto swings with Treasury stability, as detailed in recent onchaintreasury analyses. Arbitrum’s low fees fuel cross-protocol routers, per X insights, pushing yields higher.

DL News’ State of DeFi 2025 confirms stables as the backbone, with 2026 outlooks from 21Shares prioritizing yield optimization. Governance forums buzz with proposals: Season 1 ETH-stable loops on Arbitrum incentivize borrowing against yield-bearers. For DAOs, this means treasuries that self-sustain, funding operations without token emissions or sales.

Advanced DAOs are now scripting these loops via governance proposals, automating treasury rotations that adapt to real-time metrics like RWA TVL growth or lending APYs. This governance-linked rebalancing, highlighted in recent DAO analyses, lets treasuries pivot seamlessly, say from 4-5% Treasury yields to 7-8% looped vaults when conditions align.

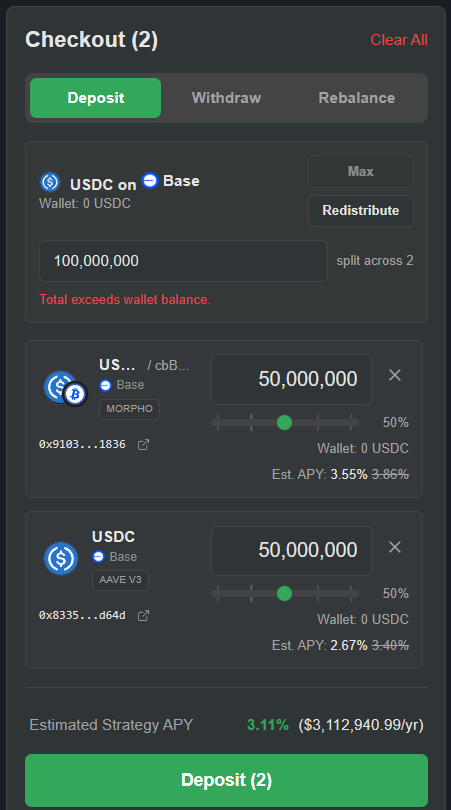

Implementation Roadmap: Deploying Stablecoins into Secure Vaults

Execution starts with a treasury audit. Identify idle USDC or USDT holdings, often sitting in non-custodial wallets post-fundraises. Propose a motion to allocate, say, 50% of reserves to a vetted vault. Platforms like Arbitrum or Solana host low-fee options, with curators handling the rest: auto-routing to Morpho lending pools, Ondo USDY positions, or Aave collateral setups. Once deposited, vaults manage the flywheel, borrowing against yield-bearers at sub-2% and redeploying for compounded gains.

Security layers are non-negotiable. Opt for secure DAO treasury vaults with timelocks, multisig approvals, and on-chain auditability. Aarna’s atvUSDC exemplifies this, delivering 5-6% while governance retains withdrawal controls. Pair with tokenized RWAs for ballast: BlackRock’s BUIDL fund hit scale quickly, offering institutional-grade stability that DAOs can loop without off-chain friction.

Yields and Risks of Secure On-Chain Vaults for DAO Treasuries

| Vault | APY | Chain | Risks |

|---|---|---|---|

| Morpho | 5-8% | Arbitrum | 🟢 Low: Smart Contract |

| atvUSDC | 5-6% | Multi | 🟡 Medium: Oracle |

| Aave RWA Pools | 4-7% | Ethereum | 🟢 Low: Smart Contract & RWA Exposure |

Data from Galaxy’s on-chain yield guide shows these strategies stacking returns predictably. In bull phases, looped ETH-stable plays from Entropy Advisors push toward double-digits, as Wajahat Mughal forecasts for 2026. But discipline matters: cap leverage at 2x, diversify across chains, and stress-test via simulations. AlphaPoint’s institutional playbook stresses this for payments liquidity, a dual win for DAOs funding grants or ops.

Risks, Mitigations, and Real-World Wins

No yield comes risk-free, yet stablecoin vaults for DAOs minimize exposure. Smart contract vulnerabilities top the list, but audited protocols like Morpho, backed by Steakhouse curators, clock billions in TVL with clean records. Oracle risks in looping? Mitigate with diversified feeds and pause mechanisms. Depegs, rare post-2023, are hedged by sticking to USDC/USDT giants.

Real wins abound. Arbitrum DAO’s $2.54 million sweep into managed yields set a benchmark, funding ecosystem grants without dilution. Protocols using MYSO v2 report diversified treasuries yielding 6% baseline, scaling to 10% and in optimized loops. On Solana and Sei, Ondo USDY integrations via vaults capture RWA premiums, balancing volatility as 21Shares’ 2026 outlook predicts yield optimization dominance. DL News pegs stables as DeFi’s base layer, with vaults as the efficiency multiplier.

Institutions echo the pivot. Tokenized Treasuries ballooned to $4 billion early 2025, eyeing $28 billion by year-end, per DAO Times. Franklin Templeton’s BENJI and peers enable seamless collateralization, fueling 7-8% flywheels. DAOs implementing governance rebalancing, per on-chain forums, adjust exposures dynamically: dial up RWAs on Fed cuts, loop stables on rate hikes.

Forward treasuries self-fund. Vault yields cover gas, grants, even buybacks, slashing reliance on emissions. In Arbitrum’s low-fee ecosystem, cross-protocol optimizers route capital surgically, per community insights. This is on-chain treasury management 2026: precise, transparent, resilient.

Vaults like those from independent curators transform idle piles into engines. With RWA growth and stable looping mature, DAOs holding billions stand at an inflection. Deploy now, compound quietly, and watch treasuries fuel the next expansion cycle. Tools exist; governance aligns; yields await.