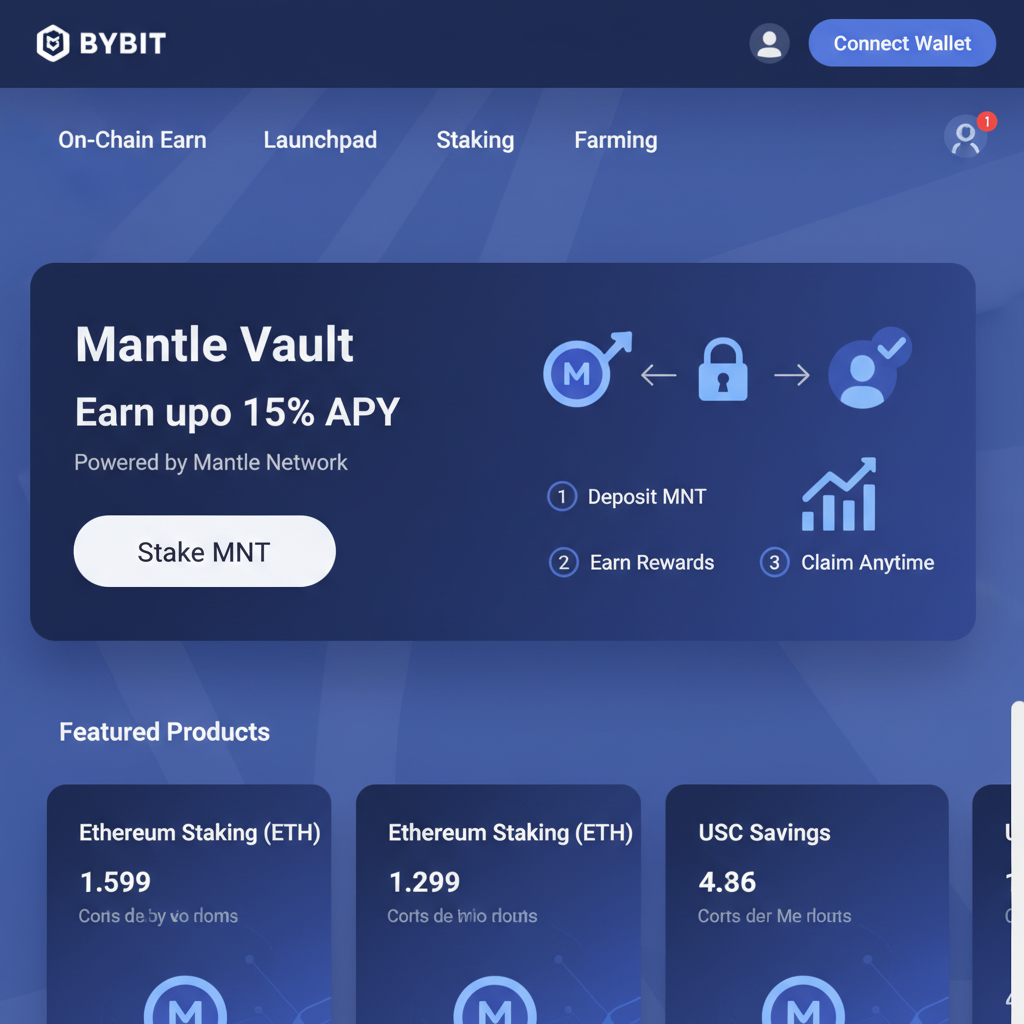

In the dynamic landscape of decentralized finance, DAO stablecoin treasuries face the perpetual challenge of balancing liquidity with yield generation amid market volatility. Enter Mantle Vault, a Bybit-backed on-chain yield product launched in December 2025 that has swiftly become a cornerstone for Mantle Vault DAO treasury management. With Mantle (MNT) trading at $0.6563 – up 0.0418% in the last 24 hours – this vault delivers 10-25% APY through market-neutral strategies, drawing over $150 million in assets under management by early February 2026. For DAOs holding USDT, USDC, or USDe, it offers automated, audited DeFi exposure across Ethereum Mainnet and Mantle Network, transforming idle capital into compounded returns via Cian’s execution layer.

Mantle Vault’s Explosive Growth Signals Shift in Stablecoin Yield Strategies

Since its debut on December 22,2025, through Bybit On-Chain Earn in partnership with Mantle and Cian, Mantle Vault has captured capital flight toward safety, hitting $50 million inflows in its first week and surpassing $100 million within three weeks. This trajectory reflects broader demand for stablecoin yield vaults DAOs can rely on without sacrificing flexibility. Unlike rigid CeFi products, it operates fully on-chain, leveraging Aave V3 deployments on Mantle – a move Aave governance has eyed for Bybit’s 30 million users. I view this as a maturing DeFi primitive: institutions like Anchorage Digital signal readiness, but DAOs lead with on-chain execution.

The vault’s appeal lies in its resilience. In bear markets, it targets 5-10% APY; bull runs push toward 10-25%. Current data shows sustained inflows as crypto capital seeks dependable yields, with MNT at $0.6563 underscoring network stability despite a 24-hour range of $0.6300 to $0.6589.

Key Advantages for On-Chain Treasury Mantle Strategies in DAO Operations

DAOs often grapple with manual treasury management, leading to idle stablecoins and suboptimal yields. Mantle Vault addresses this via DAO stablecoin automation 2026 features: instant deposits from 10 USDT/USDC, anytime withdrawals, and automatic compounding. Its market-neutral design hedges leverage to minimize volatility, sourcing yields from lending interest, staking rewards, and incentives. Operated on audited protocols, it bridges TradFi prudence with DeFi innovation – a philosophy I champion after years analyzing both worlds.

- Transparent Execution: Cian’s infrastructure ensures verifiable, gas-efficient trades.

- Scalable Access: Bybit integration lowers barriers for community treasuries.

- Risk-Adjusted Returns: No principal exposure to directional bets.

Compare this to traditional vaults; Mantle’s edge is liquidity without lockups, ideal for DAOs funding proposals unpredictably. As Messari’s Q4 2025 Mantle report notes, such products accelerate on-chain treasury evolution.

Mantle (MNT) Price Prediction 2027-2032

Forecasts amid Mantle Vault growth targeting 10-25% APY, DeFi adoption, and L2 ecosystem expansion from a 2026 baseline average of $1.00

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.75 | $1.60 | $2.80 | +60% |

| 2028 | $1.00 | $2.40 | $4.50 | +50% |

| 2029 | $1.30 | $3.60 | $6.50 | +50% |

| 2030 | $1.80 | $5.00 | $9.00 | +39% |

| 2031 | $2.50 | $6.80 | $12.00 | +36% |

| 2032 | $3.20 | $9.00 | $16.00 | +32% |

Price Prediction Summary

Mantle (MNT) price is projected to experience steady growth from 2027-2032, with average prices climbing from $1.60 to $9.00, driven by Mantle Vault’s rapid AUM expansion beyond $150M, stable 10-25% yields via Aave V3 and Ethena staking, and bullish market cycles including the 2028 Bitcoin halving. Minimums reflect bearish corrections, while maximums capture peak adoption scenarios.

Key Factors Affecting Mantle Price

- Mantle Vault AUM growth and 10-25% APY from stablecoin lending/staking

- Bybit partnership and on-chain earn product distribution accelerating TVL

- Market-neutral DeFi strategies ensuring yields across bull/bear cycles

- 2028 Bitcoin halving and L2 competition dynamics

- Regulatory advancements for institutional DeFi adoption

- Network upgrades, protocol incentives, and broader crypto market cap expansion to $10T+

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ethena sUSDe Staking Strategy: Building the Base Layer of Yield

The first pillar of Bybit Mantle Vault APY prowess is the Ethena sUSDe staking strategy. Users deposit stablecoins, which the vault stakes into sUSDe – Ethena’s yield-bearing token backed by hedged USDe positions. This generates passive rewards from funding rates and basis trades, typically 5-15% APY, compounded automatically. On Mantle Network, transaction costs plummet, making it viable for smaller DAO allocations.

Consider the mechanics: sUSDe accrues value from Ethena’s delta-neutral delta-hedged positions, insulating against ETH price swings. In practice, DAOs like those in DeFi communities have rotated treasuries here post-2025 volatility, earning steady yields without active management. Risks are contained – smart contract audits and Ethena’s track record mitigate concerns – yet rewards scale with protocol incentives. This strategy alone justifies Mantle Vault for conservative treasuries, forming 40-50% of its yield blend per recent inflows data.

Aave V3 Leveraged USDT/USDC Lending Strategy: Precision Amplification

Complementing staking, the Aave V3 leveraged USDT/USDC lending strategy deploys capital into Mantle’s Aave instance for amplified base rates. The vault borrows against supplied stablecoins at low ratios (e. g. , 2-3x leverage), looping proceeds back into lending pools. This hedges via market-neutral positions, targeting 10-20% APY from utilization spikes and incentives.

Aave’s risk engine – with health factors above 1.8 – ensures liquidation buffers. On Mantle, Bybit synergies boost liquidity, as governance forums highlight. For DAOs, this means stablecoin vaults that automate what treasurers once juggled manually, freeing focus for governance.

Bybit’s integration amplifies this: stablecoins flow seamlessly from exchange balances to on-chain positions, reducing friction for DAO multisigs. In my analysis, this strategy shines during high utilization periods, as seen in early 2026 data where lending APYs on Mantle Aave spiked alongside vault inflows. Yet, leverage is calibrated conservatively – never exceeding parameters that could trigger liquidations in stressed scenarios – aligning with my advocacy for prudent growth.

Synergizing Strategies for Optimized Bybit Mantle Vault APY – Comparison of Ethena sUSDe Staking Strategy vs Aave V3 Leveraged USDT/USDC Lending Strategy

| Strategy Name | Base APY Range | Leverage/Amplification | Risks (e.g., liquidation, delta-neutral stability) | Liquidity Features | Gas Efficiency (Ethereum/Mantle) | Capital Allocation Example (50/50 split) | Synergy Benefits (10-25% total APY, auto-compounding, market-neutral) |

|---|---|---|---|---|---|---|---|

| Ethena sUSDe Staking Strategy 🪙 | 7-12% 📈 | 1x (Delta-Neutral) 🛡️ | Low: Smart contract, protocol stability ⚠️ | Flexible deposits/withdrawals anytime 🔄 | Low on Mantle L2, optimized ⛽💚 | $25K of $50K treasury (50%) 💰 | Stable base yield, auto-compounding foundation 🔄 |

| Aave V3 Leveraged USDT/USDC Lending 📊 | 5-10% base → 12-20% leveraged 📈🔥 | 2-3x Hedged Leverage ⚙️ | Medium: Liquidation, funding rates ⚠️ | High liquidity on Aave V3 & Bybit 🔄 | Ultra-low on Mantle Network ⛽🚀 | $25K of $50K treasury (50%) 💰 | Amplifies returns, hedged stability 🛡️ |

| Combined Synergy Strategy 🔗 | 10-25% Total APY 🎯 | Staking + Leveraged Amplification ⚙️🪙 | Mitigated: Delta-neutral, market-neutral 🛡️⚖️ | Seamless via Mantle Vault, instant 🔄 | Gas-efficient Mantle execution ⛽💨 | 50/50 Split: $25K each 💰 | 10-25% APY spectrum, auto-compounding, market-neutral 🚀 |

| DAO Treasury Transformation 🚀 | Idle → 10-25% APY 📈 | Structured DeFi Strategies ⚙️ | Institutional-grade risk management 🛡️ | Low entry 10 USDT, flexible scaling 🔄 | Mantle L2 for efficiency ⛽ | $50K example → $100M+ AUM scalable 💼 | Optimizes stablecoin treasuries for bull/bear cycles 📊 |

| MNT Price Stability 📊 | N/A | N/A | Low volatility 📉 | N/A | Enables low-cost txns ⛽ | N/A | $0.6563 (+$0.0263, +4.18% 24h) – Stable L2 backbone 🪨 |

Real-world adoption backs the numbers: post-launch, inflows hit $150 million as DAOs rotated from lower-yield alternatives. I see this as evidence of maturing on-chain treasury Mantle strategies, where yield isn’t chased recklessly but engineered for resilience.

Navigating Risks in Stablecoin Yield Vaults DAOs

No strategy is risk-free, yet Mantle Vault’s design mitigates key exposures. Smart contract vulnerabilities? Audits from top firms cover Aave V3 and Ethena protocols. Stablecoin depegs? Diversification across USDT, USDC, USDe spreads risk. Leverage unwind? Health factors and oracles prevent cascades. Protocol incentives, while boosting APY, can fluctuate – but base lending/staking rates provide a floor around 5-10%.

For DAOs, the bigger hurdle is governance alignment. Proposals must ratify vault usage, often via multisig snapshots. I’ve advised communities on this: start small, monitor via dashboards, scale on proven inflows. Compared to unhedged farming, Mantle Vault’s neutrality suits volatile 2026 markets, where MNT’s and 0.0418% daily gain signals quiet confidence.

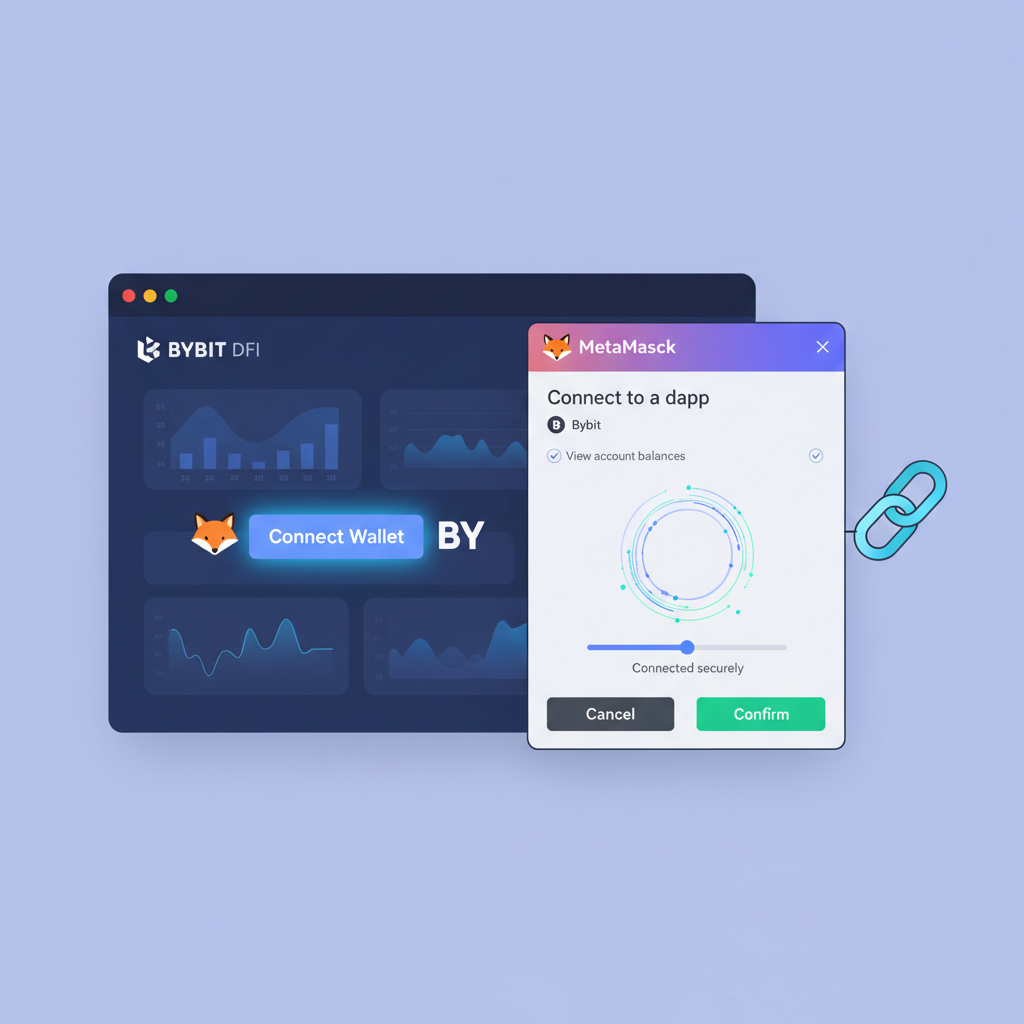

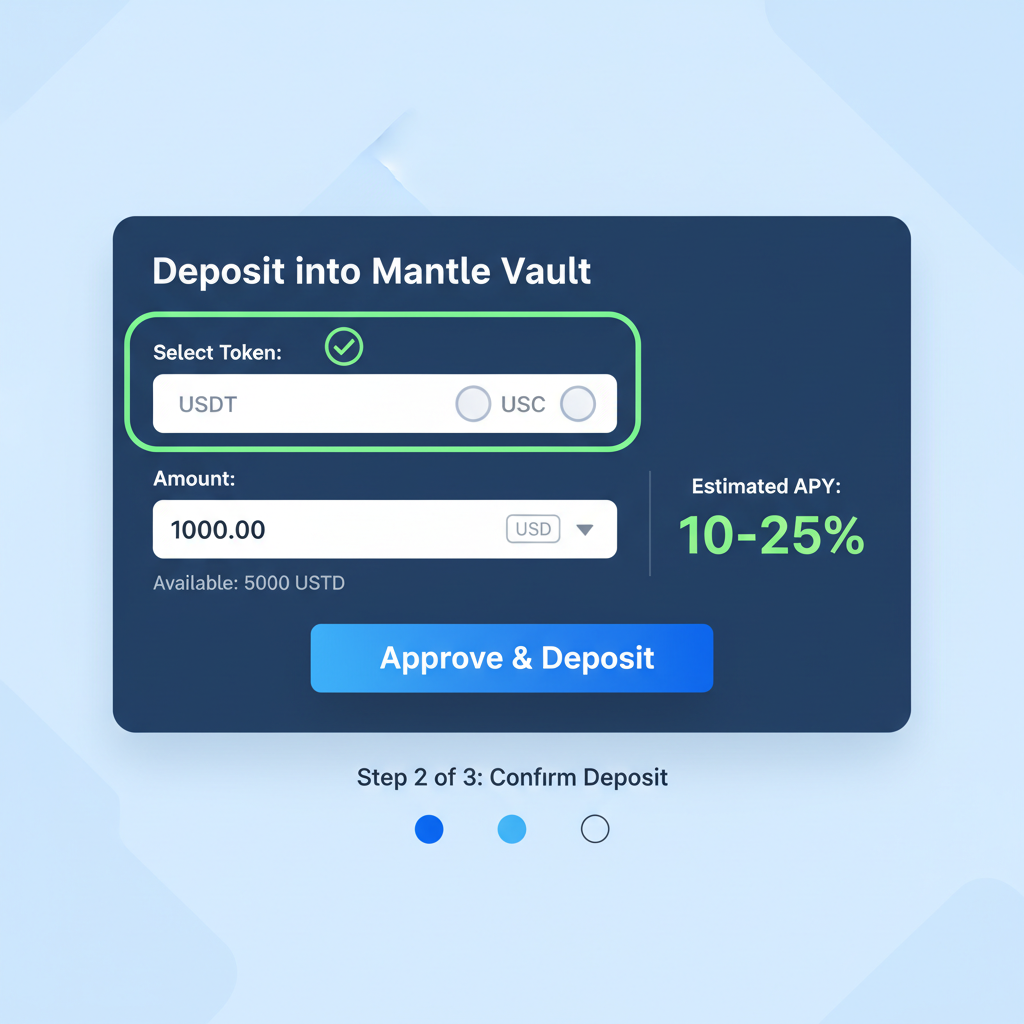

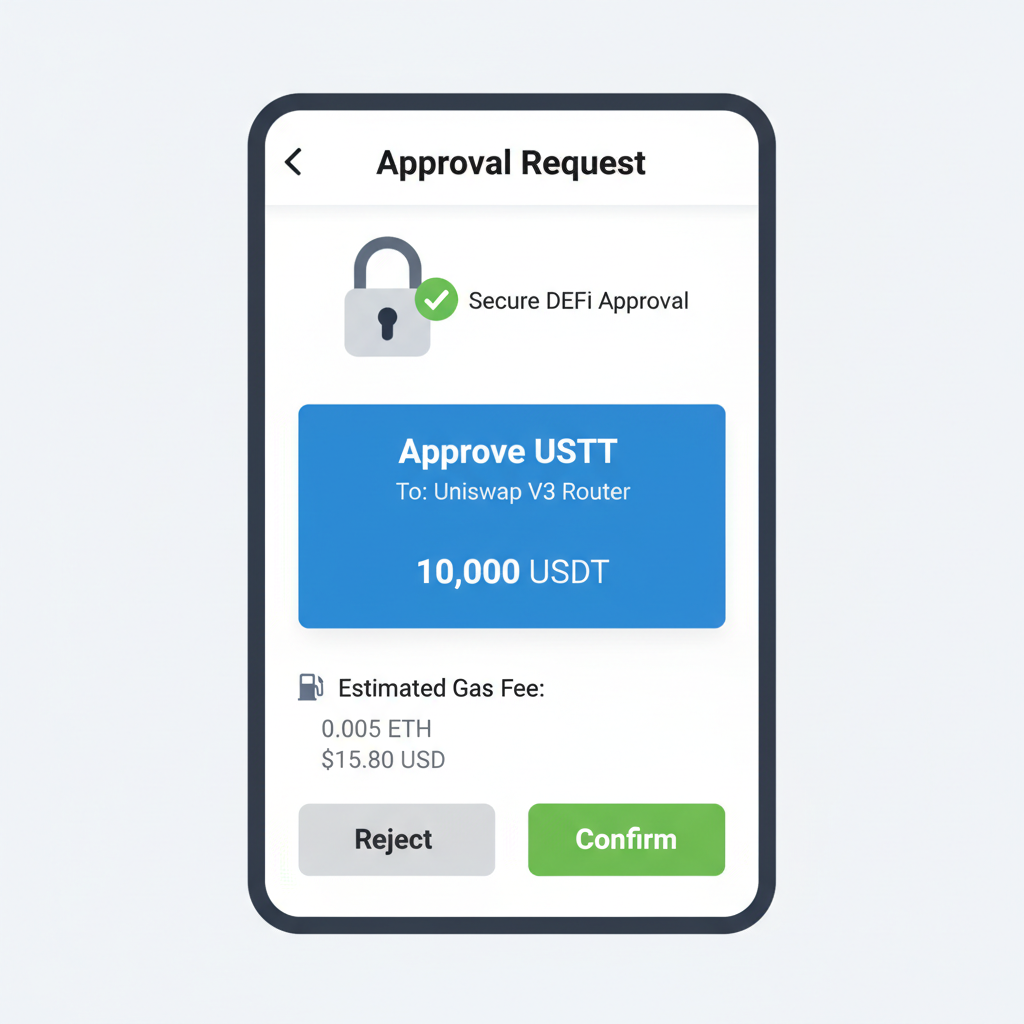

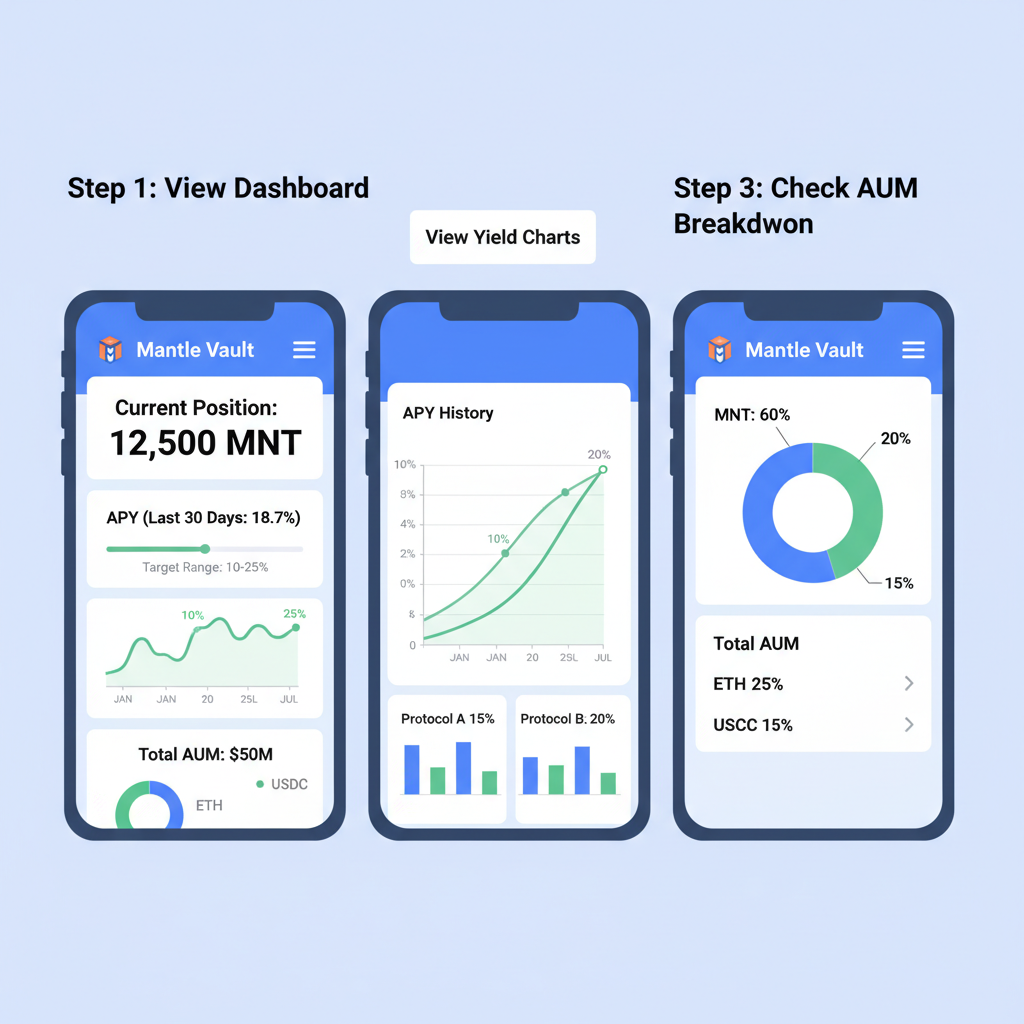

Step-by-Step Deployment for DAO Stablecoin Automation 2026

Implementing these strategies demands precision, but Bybit simplifies the path.

Post-deposit, track via Bybit dashboards or Mantle explorers. Withdrawals process in hours, preserving liquidity for proposals. This frictionless loop embodies DAO stablecoin automation 2026, turning treasuries into active engines.

As Mantle Vault matures, its $150 million AUM milestone – achieved amid MNT’s stable $0.6563 price – positions it as a blueprint for DAO treasuries. Blending Ethena staking with Aave lending, it delivers reliable 10-25% APY without the pitfalls of directional bets. For forward-thinking communities, this isn’t just yield; it’s a foundation for sustainable expansion in DeFi’s next phase. With Bybit’s reach and Mantle’s efficiency, expect broader adoption as DAO treasury yields evolve toward institutional standards.