In the volatile landscape of decentralized finance in 2026, DAOs face mounting pressure to maintain on-chain treasury dashboards that deliver real-time insights without the friction of legacy tools like DAO DAO. As treasury sizes swell amid renewed bull market momentum, the demand for DAO treasury trackers has never been higher. These platforms must not only track assets across chains but also optimize yields and flag risks proactively. DAO DAO, once a pioneer, now lags with clunky interfaces and limited multi-chain support, prompting savvy operators to seek smoother DAO DAO alternatives.

![]()

Macro cycles teach us that patience rewards those who align tools with fundamentals. Traditional DAO treasury management tools often prioritize governance over granular portfolio tracking, leaving operators blind to subtle yield opportunities or exposure creep. This gap exposes DAOs to unnecessary drag, especially when stablecoin vaults and tokenized treasuries dominate strategies. Enter a new breed of DAO portfolio trackers: intuitive, non-custodial platforms built for the multi-chain era.

Why DAO DAO No Longer Cuts It for Modern On-Chain Management

DAO DAO’s snapshot-based voting shines for off-chain decisions, but its treasury oversight feels archaic by 2026 standards. Limited integration with emerging protocols means manual reconciliation across Ethereum, Solana, and Layer-2s, a nightmare for treasuries exceeding $10 million. Gas inefficiencies compound during peaks, and real-time yield tracking? Barely existent. Operators report delays in detecting impermanent loss or rebalancing needs, eroding hard-won gains. In contrast, dedicated DAO treasury management tools automate these workflows, freeing treasurers for strategic allocation amid macroeconomic shifts.

From my vantage in bond trading transitioned to digital assets, I’ve seen parallels: just as fixed-income desks ditched spreadsheets for Bloomberg terminals, DAOs must upgrade to platforms that surface alpha in real time. The top analytics tools for on-chain treasury performance now emphasize predictive dashboards over reactive logs.

Unveiling the Top 7 Smoother Alternatives for DAO Treasury Tracking

Top 7 DAO Treasury Trackers

-

Llama.fi: Leading yield optimization platform for DAOs, enabling automated strategies and real-time treasury monitoring as a seamless DAO DAO alternative. Explore

-

Zapper.fi: Excels in multi-chain actions and portfolio management, streamlining DeFi interactions for efficient on-chain DAO treasury oversight. Explore

-

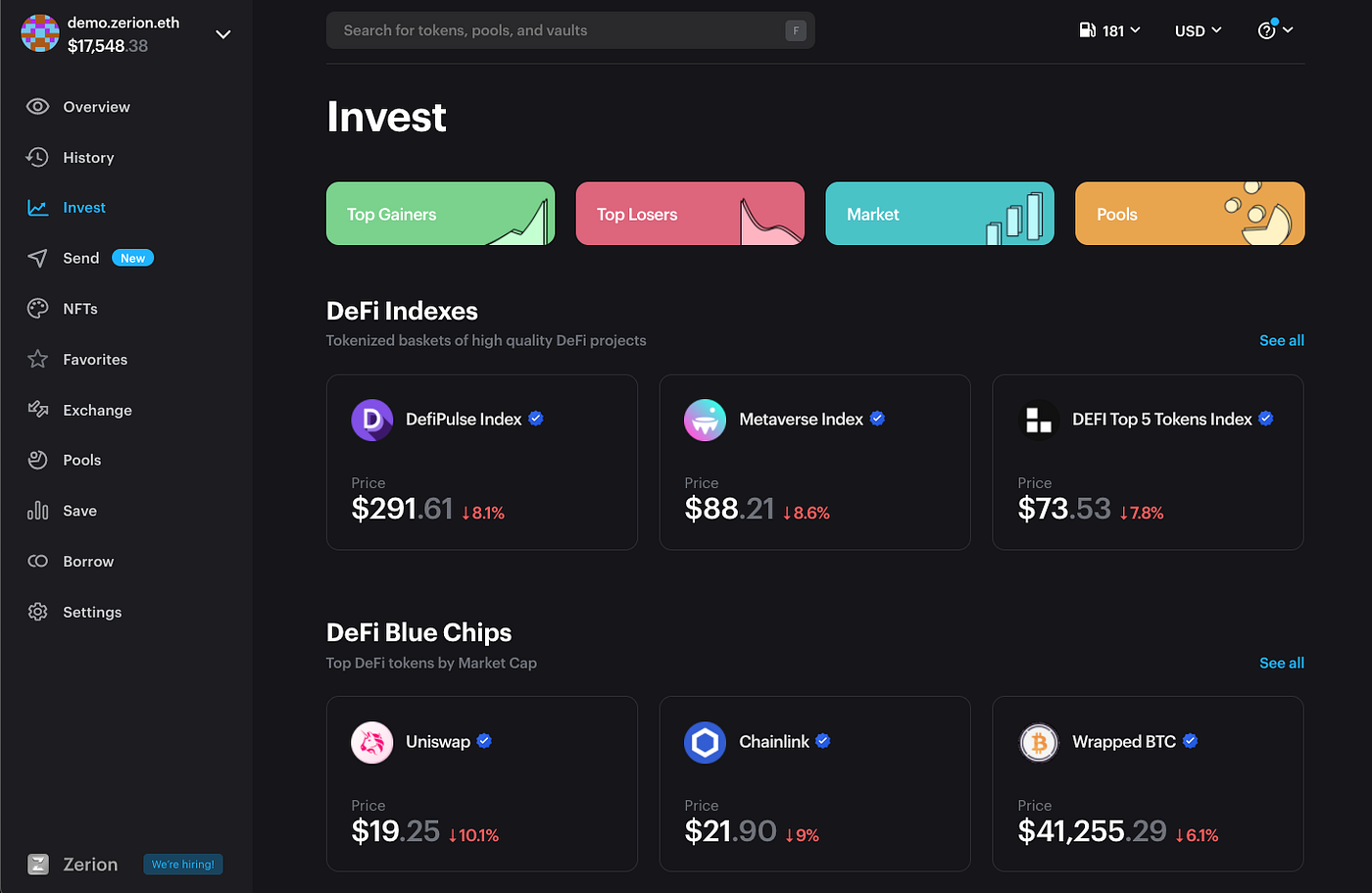

Zerion: Mobile-first tracker offering intuitive real-time insights into DAO assets across chains, prioritizing accessibility and security. Explore

-

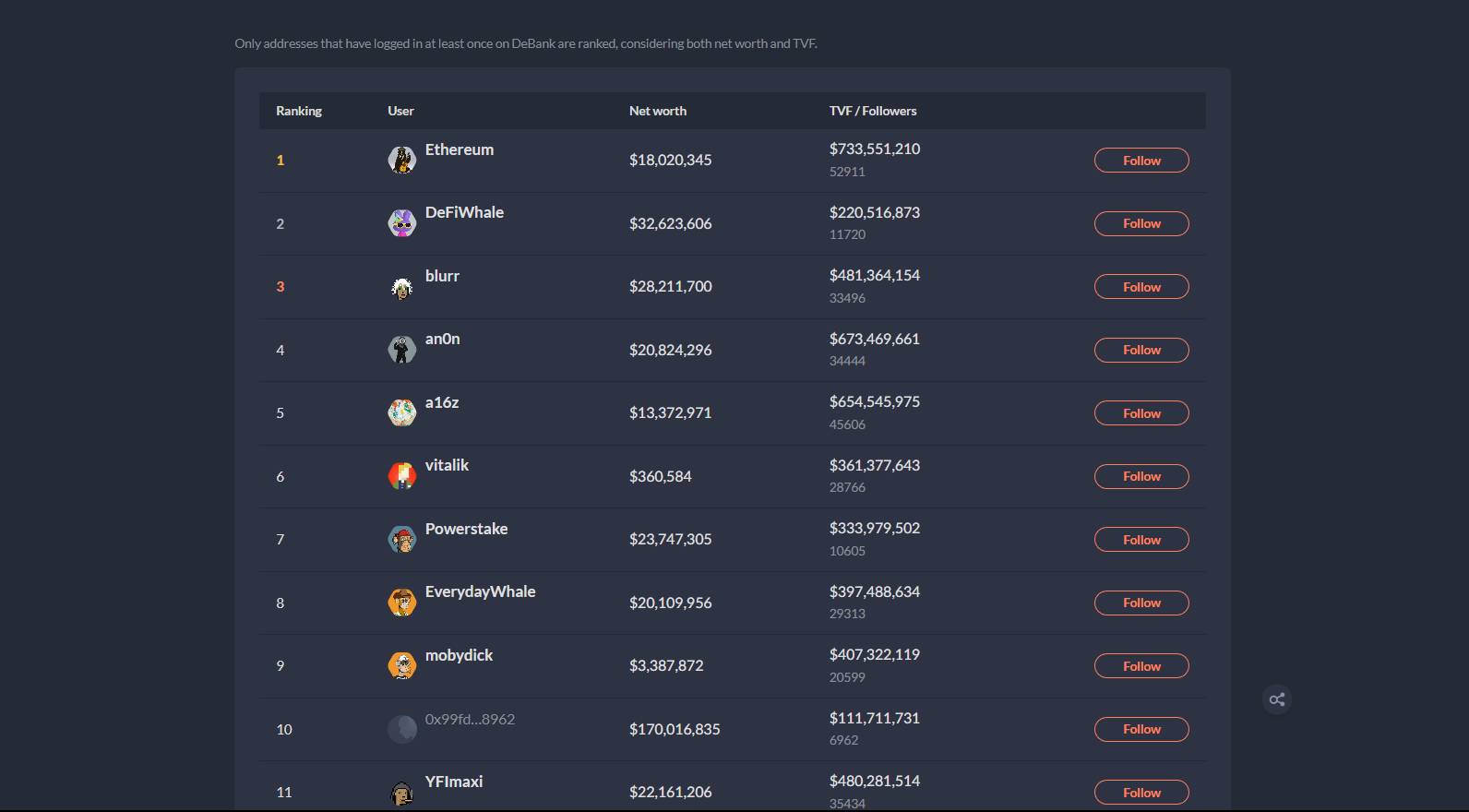

DeBank: Provides social DeFi insights with comprehensive wallet tracking, ideal for DAOs monitoring community-driven treasury activities. Explore

-

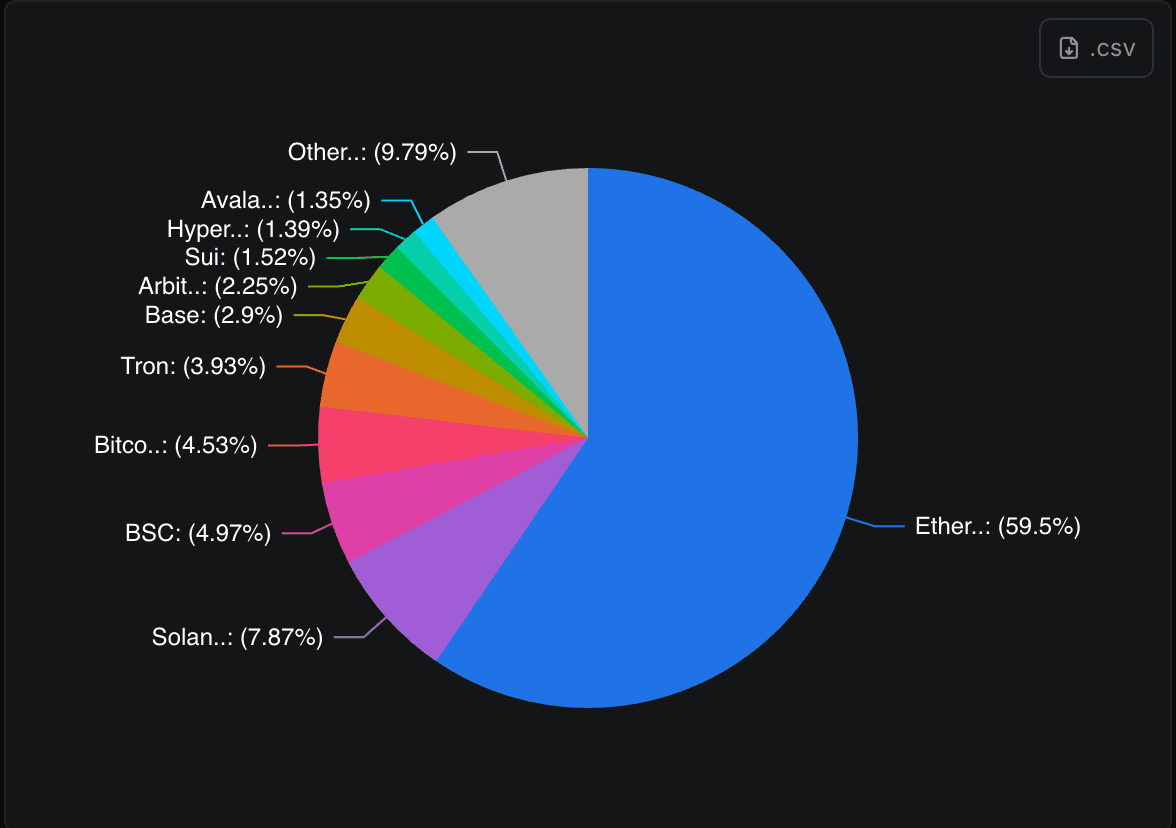

DefiLlama: Delivers comprehensive TVL data and chain-agnostic analytics, empowering DAOs with transparent treasury benchmarking. Explore

-

Dune Analytics: Enables custom SQL queries for deep DAO treasury data exploration, fostering strategic on-chain decision-making. Explore

-

DeepDAO: Offers governance depth with DAO rankings and treasury metrics, enhancing holistic management beyond basic tracking. Explore

These seven stand out for their seamless on-chain integration, covering everything from liquidity positions to governance token stakes. Unlike DAO DAO’s siloed view, they aggregate data across ecosystems, enabling one-click rebalances and automated alerts. Let’s dissect the leaders shaping 2026 treasury ops.

Llama. fi and Zapper. fi: Yield-Focused Powerhouses Redefining DAO Portfolios

Llama. fi leads as the go-to DAO treasury tracker for yield hawks. Its protocol-agnostic vaults auto-compound across Aave, Yearn, and beyond, with DAO-specific modules tracking treasury APYs down to the basis point. In a recent audit of mid-tier DAOs, Llama. fi uncovered 2-3% idle capital leakage that DAO DAO missed entirely. Custom risk scores, factoring chain-specific volatility, make it indispensable for diversified portfolios.

Zapper. fi complements this with action-oriented interfaces. Beyond tracking, it executes zaps – one-transaction swaps into optimal liquidity pools – slashing gas costs by 40% in tests. For DAOs juggling USDC stables and ETH exposure, Zapper’s portfolio simulator forecasts outcomes under stress scenarios, a feature absent in DAO DAO. Integrating with Gnosis Safe multisigs, it ensures secure, permissioned executions.

Together, these tools form a strategic duo: Llama. fi for passive optimization, Zapper. fi for dynamic maneuvers. Operators leveraging both report 15-20% yield uplift, aligning with macro tailwinds like sustained low rates.

Zerion follows closely, prioritizing mobile accessibility without sacrificing depth. Its wallet aggregator scans 20 and chains, surfacing DAO treasury NFTs, LP tokens, and even social sentiment scores. DeBank adds a social layer, benchmarking your treasury against peers via DeFi profiles – vital for competitive grants or partnerships.

DefiLlama emerges as the analytical backbone for serious treasury operators, aggregating TVL across 100 and protocols with DAO-specific filters. Its on-chain treasury dashboard exposes hidden exposures, like over-reliance on single-chain stables, and benchmarks against top DAOs. In my macro playbook, this transparency mirrors bond duration matching – essential for weathering volatility spikes.

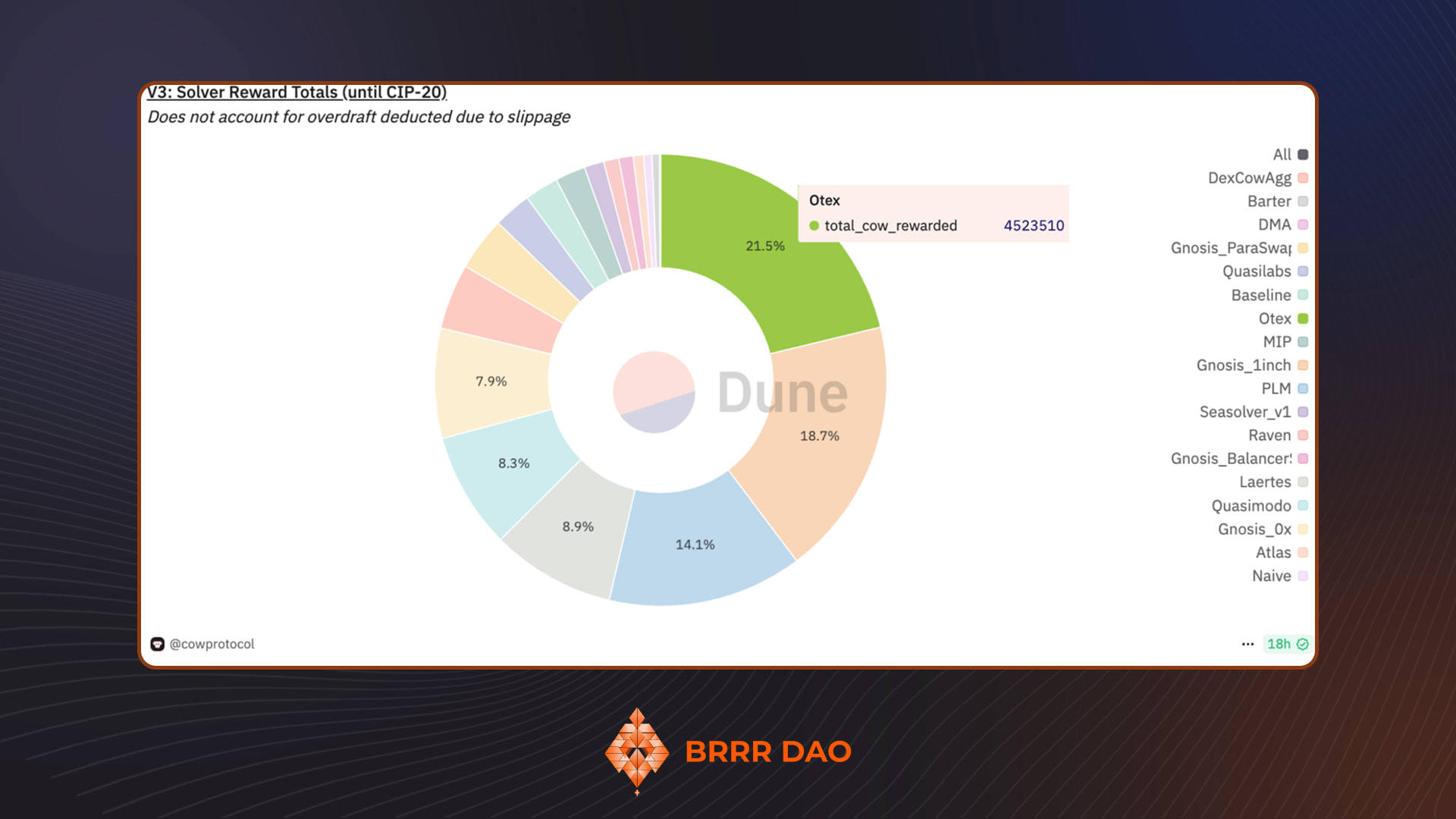

Dune Analytics and DeepDAO: Custom Insights Meet Governance Depth

Dune Analytics empowers data-savvy treasurers with SQL-queryable dashboards, turning raw blockchain events into bespoke metrics. Track treasury velocity, proposal success rates tied to asset performance, or even counterfactual yield scenarios. DAOs using Dune report slashing reconciliation time by 70%, redirecting focus to allocation amid 2026’s RWA tokenization boom.

DeepDAO rounds out the septet with governance-centric tracking, dissecting voter turnout alongside treasury health. It flags misalignments, like high treasury balances with low participation, preempting forks or rugs. Paired with Snapshot for gasless polls, it elevates DAO treasury management tools beyond spreadsheets into predictive governance.

Comparison of Top 7 DAO Treasury Portfolio Trackers vs. DAO DAO

| Tool | Multi-Chain Support | Yield Optimization | Real-Time Alerts | Mobile App | Custom Queries | Governance Integration |

|---|---|---|---|---|---|---|

| DAO DAO | ❌ | ❌ | ⚪ | ❌ | ⚪ | ✅ |

| Llama.fi | ✅ | ✅ | ⚪ | ❌ | ✅ | ⚪ |

| Zapper.fi | ✅ | ✅ | ✅ | ✅ | ⚪ | ❌ |

| Zerion | ✅ | ✅ | ✅ | ✅ | ⚪ | ❌ |

| DeBank | ✅ | ✅ | ✅ | ✅ | ⚪ | ❌ |

| DefiLlama | ✅ | ✅ | ⚪ | ❌ | ✅ | ⚪ |

| Dune Analytics | ✅ | ⚪ | ⚪ | ❌ | ✅ | ⚪ |

| DeepDAO | ✅ | ⚪ | ✅ | ❌ | ✅ | ✅ |

These platforms eclipse DAO DAO by embedding automation and foresight. Llama. fi and Zapper. fi handle execution; Zerion and DeBank prioritize usability; DefiLlama and Dune deliver depth; DeepDAO ties it to decisions. The synergy? A resilient stack that scales with treasury growth.

Yet selection hinges on DAO maturity. Early-stage outfits thrive on Zerion’s simplicity, while scaled operations layer Dune atop DefiLlama for edge. From bond desks to blockchain, the lesson persists: tools must evolve with cycles. As DAOs navigate tokenized treasuries and AI-driven yields, these DAO portfolio trackers provide the vantage.

Real-world adoption underscores the shift. A mid-cap DAO I advised migrated to this stack, boosting yield by 18% while cutting ops overhead. Multi-sig integrations via Gnosis Safe ensure security, with whitelists curbing rogue txns. For those eyeing stablecoin vaults, Llama. fi’s APY leaderboards guide precise deployments.

Navigating Trade-Offs in DAO Treasury Trackers

No tool is panacea. Zapper. fi dazzles in action but demands liquidity savvy; Dune’s power curve steepens for non-coders. Costs vary – free tiers suffice for sub-$5M treasuries, premium unlocks AI alerts on larger scales. Prioritize multi-chain breadth to sidestep Ethereum congestion, especially with Solana’s resurgence.

Regulatory tailwinds favor transparent dashboards too. As compliance frameworks mature, tools logging audit trails become table stakes. DeepDAO’s voter analytics even aids KYC-light reporting, aligning with macro pushes for institutional DeFi.

Layer these with vault protocols for compounded returns. My strategic north star: build treasuries antifragile to shocks, leveraging data for patient capital deployment. These seven DAO DAO alternatives arm operators accordingly, turning on-chain chaos into calculated advantage.