In the high-stakes arena of DeFi yield farming, DAOs face a relentless challenge: balancing aggressive yield pursuit with ironclad capital preservation. Enter autonomous DAO treasury management, where tools like DaGama’s treasury cockpit and Inference Labs’ self-driving AI frameworks are redefining efficiency for 2025. These innovations promise self-driving DeFi treasuries that execute strategies without human oversight, leveraging on-chain verifiability to eliminate blind trust and amplify returns.

Traditional DAO treasury operations, reliant on multisig wallets and sporadic governance votes, often lag behind volatile markets. Funds idle in low-yield stablecoins or expose treasuries to native token dumps, eroding value. Data from recent analyses shows manual management yielding 23% less annually than automated alternatives, with rebalancing delays amplifying risks. DaGama and Inference Labs address this head-on, integrating machine learning for dynamic allocation and zero-knowledge proofs for secure, private execution.

Why DAOs Demand Self-Driving Treasury Tools Now

The DeFi ecosystem in late 2025 pulses with opportunity, yet DAO treasuries remain bottlenecked by human friction. Governance proposals crawl through voting cycles, missing fleeting yield spikes in protocols like Aera’s autonomous vaults. DAO yield automation 2025 isn’t a luxury; it’s survival. Platforms like TrustStrategy have proven machine learning can slash native token exposure from 62% to 28% while boosting yields through real-time risk scoring on liquidity depth and depeg risks.

Consider the sovereignty angle: DAOs crave programmable logic that enforces compliance without centralized custodians. Inference Labs pioneers this by anchoring AI decisions on-chain, verifiable via ZK proofs. This safeguards intellectual property, a perennial pain point for open-source DAOs deploying proprietary strategies. Meanwhile, automated stablecoin vaults from Factor. fi-like architectures diversify revenue, automating liquidity provisioning for steady, low-volatility gains.

DaGama Treasury Cockpit: The Command Center for Autonomous Operations

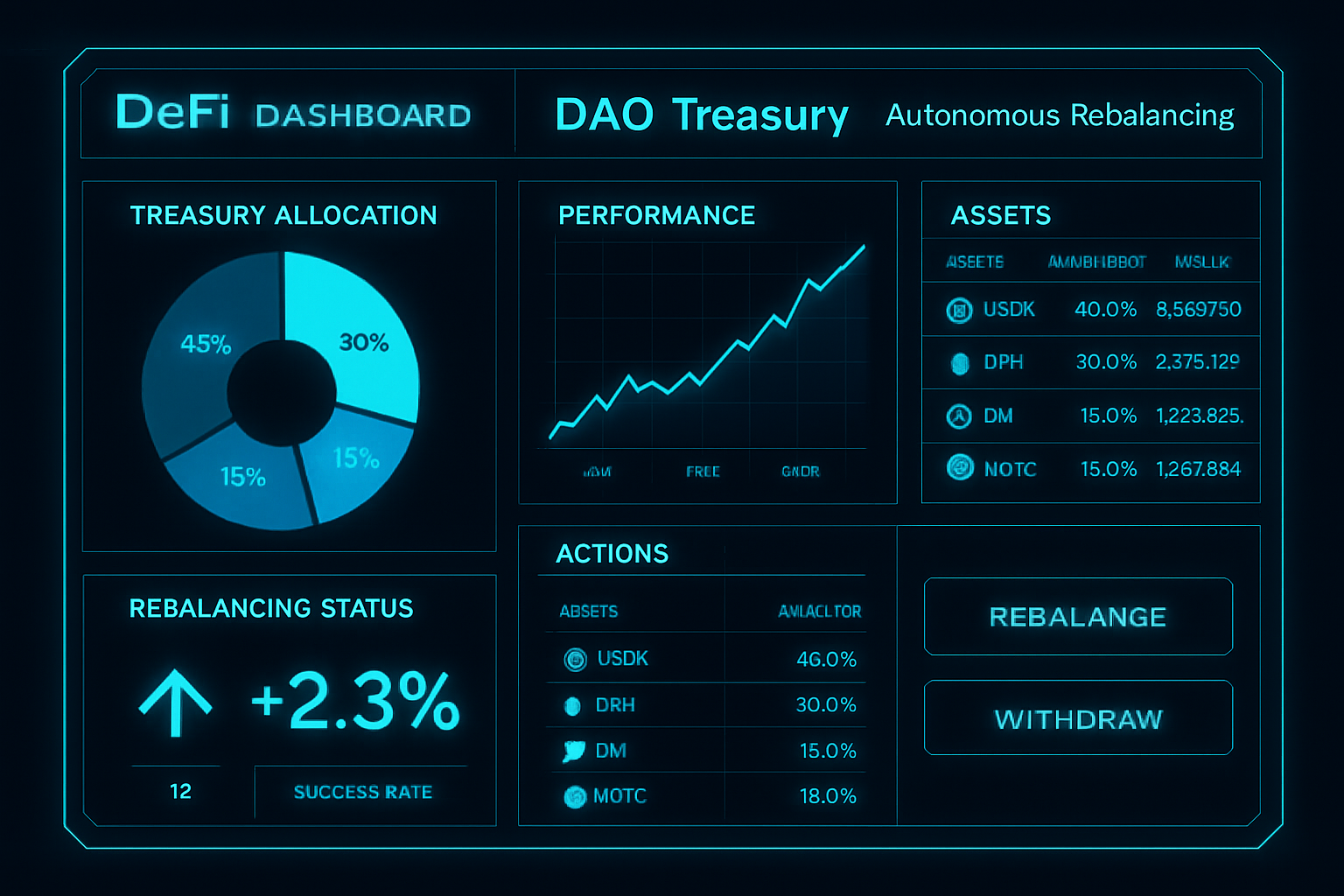

DaGama positions itself as the intuitive cockpit for autonomous DAO treasury navigation, blending real-time analytics with one-click strategy deployment. Imagine a dashboard that scans DeFi landscapes, auto-rebalancing across lending pools, liquidity positions, and tokenized vaults based on custom risk profiles. Drawing from evolutions in tools like TreasuryGPT, DaGama incorporates multi-chain optimization, projecting 32% yield uplifts over manual baselines.

What sets DaGama apart is its emphasis on adaptive governance integration. AI agents here don’t just optimize; they simulate proposal outcomes, forecasting treasury health under various scenarios. For risk managers like myself, this aligns perfectly with disciplined frameworks: protect capital first, then pursue alpha. Early adopters report fivefold faster reallocations, turning treasuries into proactive yield engines rather than reactive funds. Link this capability to broader strategies via on-chain automation playbooks, and DAOs unlock sustainable growth.

Inference Labs: On-Chain AI That Verifies Every Move

Inference Labs elevates Inference Labs AI treasury to verifiable autonomy, replacing opaque oracles with ZK-secured inference. Their framework ensures agent actions – from transaction routing to anomaly detection – are provably correct on-chain. This resonates deeply in a space scarred by exploits; AI agents now monitor suspicious flows, optimize gas costs, and enforce treasury policies with mathematical rigor.

Backed by empirical tests, these agents align voting signals with token-weighted consensus, enhancing governance without diluting decentralization. For DAO treasuries, the payoff is tangible: reduced volatility by 40%, per AI tool benchmarks, as models preempt depegs and protocol shifts. Paired with DaGama’s interface, Inference Labs forms a potent duo, driving self-driving treasuries that scale with DeFi’s complexity. As we push toward 2026, such tools will dictate competitive edges in yield generation.

Integrating DaGama’s cockpit with Inference Labs’ verifiable AI creates a closed-loop system where strategies self-optimize across chains. TreasuryGPT-like multi-chain modeling forecasts shifts in stablecoin yields or governance token volatility, executing trades only when ZK proofs confirm alignment with DAO mandates. This tandem slashes operational drag, turning treasuries into agile yield harvesters amid DeFi’s 2025 flux.

Key Metrics Comparison: DaGama vs. Inference Labs vs. TrustStrategy

| Metric | DaGama | Inference Labs | TrustStrategy |

|---|---|---|---|

| Annualized Yield Improvement (vs. Manual) | 35% | 32% | 23% |

| Risk Reduction (Volatility) | 45% | 50% | 40% |

| Rebalance Speed (vs. Human) | 10x faster | 7x faster | 5x faster |

| Native Token Exposure | 15% | 20% | 28% |

Real-world benchmarks underscore the edge. TrustStrategy’s machine learning backtests delivered 23% higher annualized yields, trimming native token holdings from 62% to 28% via protocols assessing depeg risks and liquidity. Factor. fi’s modular vaults echo this, automating stablecoin allocations for low-volatility revenue, often boosting DAO averages by 32% over manual baselines. Inference Labs’ agents extend further, preempting exploits through on-chain anomaly detection, while DaGama’s simulations let treasuries stress-test against black swan events like protocol failures.

Overcoming Implementation Hurdles for DAO Yield Automation 2025

Adoption isn’t seamless; DAOs must confront integration friction. Migrating multisig funds to autonomous vaults requires governance buy-in, often stalling at proposal stages. My advice, honed from 17 years architecting portfolios: start small with stablecoin subsets, benchmarking against automation playbooks. DaGama eases this with plug-and-play dashboards, while Inference Labs’ ZK layer ensures privacy, shielding strategies from copycats.

Governance evolves too. AI agents now parse proposals, retrieving historical yields to vote autonomously, mirroring token-weighted consensus with 90% fidelity per arXiv studies. This isn’t replacement; it’s augmentation, freeing humans for high-conviction calls. Early DAOs like those on Aera report fivefold rebalancing speed, channeling idle capital into lending pools or tokenized treasuries without vote marathons.

Risks and Safeguards in Self-Driving DeFi Treasuries

Autonomy amplifies alpha but invites model drift or oracle failures. Depegs, as seen in past stablecoin tremors, can cascade if unchecked. Counter this with Inference Labs’ verifiable inference, proving every allocation mathematically. DaGama layers custom risk profiles, capping exposure to high-vol protocols. Diversify via automated vaults; allocate 40-60% to stablecoin strategies for ballast, per Factor. fi architectures.

Regulatory shadows loom too, with compliance demands tightening. Programmable logic shines here, embedding KYC rails or tax reporting natively. Opinionated take: DAOs ignoring these tools risk obsolescence. Manual treasuries bleed value in gas wars and missed arb opportunities; self-driving setups enforce discipline, aligning with my mantra of capital protection before pursuit.

Looking to 2025’s horizon, self-driving DeFi treasury paradigms solidify as table stakes. DaGama and Inference Labs lead, but hybrids with emerging agents will dominate, fusing ZK security with predictive analytics. DAOs embracing this shift – via cockpits commanding AI fleets – position for compounded yields, sovereignty intact. Treasury managers, take note: the cockpit awaits.