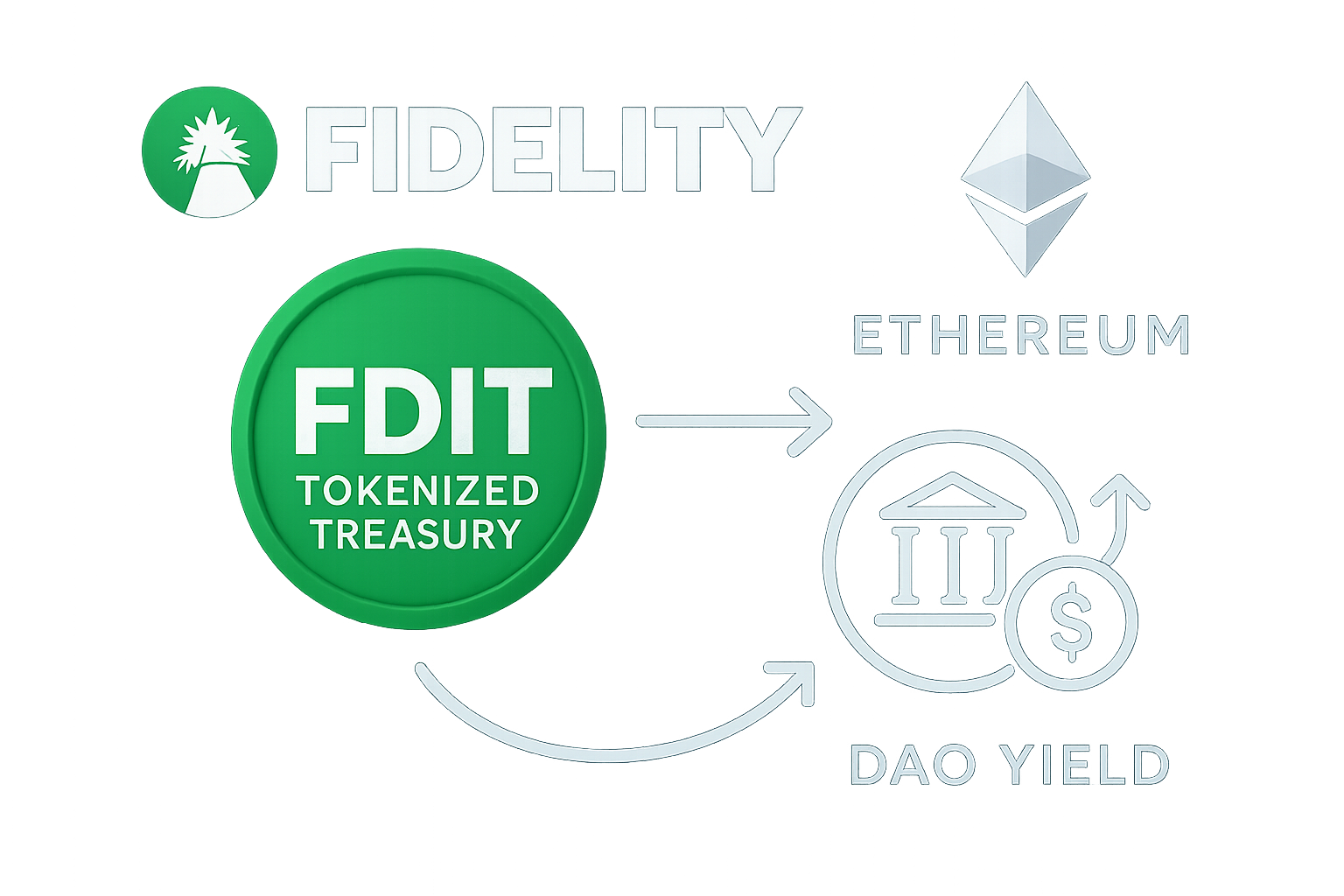

As 2025 unfolds, the tokenized U. S. Treasuries market has surged past $7.42 billion in assets on public blockchains, with Ethereum commanding about 70% or $5.3 billion. Fidelity Investments’ Fidelity Digital Interest Token (FDIT), a tokenized share class of its Treasury Digital Fund (FYOXX), has quietly amassed $203.7 million on Ethereum by September. This isn’t just institutional flexing; it’s a beacon for DAOs recalibrating on-chain treasury strategies amid volatile crypto cycles.

Fidelity’s move bridges traditional finance’s stability with DeFi’s composability. Launched in stealth around Christmas 2024, FDIT emerged with assets exceeding $200 million by early 2025, signaling deep-pocketed confidence. For DAO treasury teams, this means accessing tokenized US treasuries in DeFi without custodial headaches, yielding steady returns backed by short-term U. S. government securities.

Fidelity’s Stealthy Ethereum Entry Reshapes Fixed Income

What started as whispers in March 2025 under the “Fidelity Treasury Digital Fund” banner has evolved into a powerhouse. Public docs reveal Fidelity’s pivot to blockchain-based shares, allowing seamless on-chain transfers and integration into protocols. By September 12,2025, the broader market hit $7.42 billion, underscoring Ethereum’s lead. FDIT’s $203.7 million haul isn’t isolated; it’s part of a wave where tokenized RWAs like these promise trillions by 2030.

Institutional interest in tokenized treasuries like FDIT is growing, as Ethereum extends its lead with $5.3B in assets.

This Ethereum-based structure empowers DAOs to park funds in low-risk, yield-bearing assets. No more bridging fiat or wrestling off-chain yields; FDIT accrues daily interest, redeemable on-chain. I’ve seen DAO multisigs evolve from zero-yield stables to hybrid vaults blending USDC with tokenized T-bills, and Fidelity’s entry accelerates that shift.

Why DAOs Can’t Ignore Tokenized Treasuries Anymore

Picture a DAO treasury bloated with idle stablecoins earning 0% while BTC swings. Enter FDIT: tokenized exposure to money market treasuries yielding 4-5% annually, fully on-chain. DAOs like those in DeFi are allocating 5-10% to these RWAs, optimizing for stablecoin vault DAO management. The composability shines; wrap FDIT as collateral in lending protocols or liquidity pools, amplifying yields without equity dilution.

Ethereum’s dominance here feels inevitable. With $5.3 billion in tokenized treasuries, it’s the settlement layer institutions trust. Fidelity’s fund, managed by pros, sidesteps retail pitfalls while inviting programmable money. For treasury managers, this means dashboards tracking real-time APYs, automated rebalancing via smart contracts, and compliance baked in.

Practical Strategies for DAO Yield Maximization

Integrating FDIT starts simple: approve spending on Ethereum, swap stables for tokens via supported DEXs or direct mints. From there, layer on RWA treasury automation Ethereum tools – think vaults that auto-compound yields or hedge via options. One DAO I advise shifted 20% of its $10M treasury here, netting 3.8% risk-adjusted returns versus 1.2% in pure USDC pools.

The beauty lies in transparency; every accrual is verifiable on-chain, quelling governance debates. As projections eye $2 trillion in tokenized securities, early adopters gain edge. Fidelity’s Ethereum play isn’t hype; it’s the blueprint for sustainable DAO growth in 2025.

Collaborate with your community: propose FDIT pilots in forums, benchmark against peers. The data screams opportunity – $7.42 billion market, Ethereum at $5.3 billion, FDIT at $203.7 million. Treasury teams ignoring this risk complacency.

That said, jumping into FDIT demands nuance. DAO treasuries thrive on iteration, not blind leaps, so let’s unpack the mechanics that make this tick without the pitfalls.

Yield Benchmarks: Tokenized Treasuries vs. Traditional Stables

DAO Treasury Yield Comparison: Boosting On-Chain Yields with FDIT in 2025

| Strategy | APY Range | Risk Level |

|---|---|---|

| Pure USDC | 0-1.5% | Low 🟢 |

| FDIT Tokenized T-Bills | 4-5% | Low 🟢 |

| Hybrid Vault | 3.5-4.5% | Low-Medium 🟡 |

| BTC Staking | 2-8% (volatile) | High 🔴 |

Tokenized US treasuries like FDIT aren’t a silver bullet, but they crush idle stables in a DAO on-chain treasury strategies 2025 playbook. At 4-5% yields from underlying short-term T-bills, they deliver predictable income, audited daily and accruing on-chain. Compare that to USDC pools scraping 1% amid rate cuts; the spread funds real governance initiatives. Ethereum’s liquidity layer lets DAOs stack these with perps or options, but start conservative – 5-15% allocation smooths volatility without overexposure.

I’ve watched protocols like Ondo Finance pave this path, partnering with Fidelity to embed FDIT in vaults. The result? Stablecoin vault DAO management evolves from static holdings to dynamic engines, auto-reinvesting yields via Chainlink oracles. One mid-cap DAO piloted this, lifting treasury returns 2.2% net while slashing idle capital by 30%.

Risks linger, sure – smart contract exploits top the list, though Fidelity’s institutional wrappers add layers of due diligence absent in wildcat RWAs. Regulatory fog around tokenized funds could thicken, but SEC nods for money market shares position FDIT as compliant catnip. Counter with diversified vaults: blend FDIT with blue-chip stables and governance tokens. Tools like DAO treasury optimization frameworks automate this, triggering rebalances on yield drifts.

Composability Unlocks Next-Level Treasury Plays

Where FDIT shines brightest is DeFi composability. Deposit into Aave as collateral, borrow against it for leveraged stables, or LP in Curve pools for extra kick. This isn’t theoretical; Ethereum’s $5.3 billion tokenized treasury dominance fuels protocols chasing TVL. DAOs I’ve consulted layer FDIT under perpetuals hedges, neutralizing downside while capturing upside – think 6% blended APY in bull runs.

Automation takes it further. RWA treasury automation Ethereum scripts, coded in Solidity, harvest yields nightly, dodging gas wars. Pair with snapshot voting for community buy-in; transparency turns skeptics into advocates. As the market swells to $7.42 billion, laggards face governance pressure – why settle for subpar when Fidelity’s $203.7 million proves the model?

Forward-thinking treasuries eye hybrids: 50% stables, 30% FDIT, 20% growth assets. Projections to $2 trillion tokenized securities by 2030 aren’t pie-in-sky; they’re arithmetic on institutional inflows. Ethereum’s throughput upgrades will only accelerate this, making DAO yields as reliable as TradFi benchmarks.

Engage your multisig holders now. Fork a proposal template, benchmark peers on Nansen, and test small. Fidelity’s Ethereum foothold isn’t a trend; it’s the new baseline for treasuries that endure. With tools at hand, your DAO can lead the yield renaissance.