For Decentralized Autonomous Organizations (DAOs), treasury management is no longer just about holding digital assets. The modern landscape demands automation, security, and transparency, especially when it comes to stablecoin reserves. As DAOs scale in both size and complexity, the risks associated with manual treasury processes and volatile governance tokens become more pronounced. Enter automated stablecoin treasury management: a suite of strategies and technologies enabling DAOs to safeguard funds, optimize yield, and eliminate operational bottlenecks.

Why Automate Stablecoin Treasury Management?

Historically, most DAOs have held large portions of their treasuries in native tokens. While this aligns incentives, it exposes organizations to price swings that can jeopardize long-term planning. By integrating programmable stablecoins such as USDC or DAI into their treasuries, and automating their management, DAOs can achieve:

- Reduced volatility: Stablecoins shield treasuries from the wild price fluctuations seen in crypto markets.

- Predictable budgeting: With less exposure to market risk, DAOs can plan grants, payrolls, and investments with greater confidence.

- Operational efficiency: Automation slashes manual intervention and human error while boosting transparency for all stakeholders.

This shift is not theoretical, leading protocols are already leveraging on-chain automation to transform how decentralized organizations operate. Let’s examine three standout solutions shaping this new era of secure stablecoin management.

Avantgarde Finance: Automated Stablecoin Vaults and Real-Time Reporting

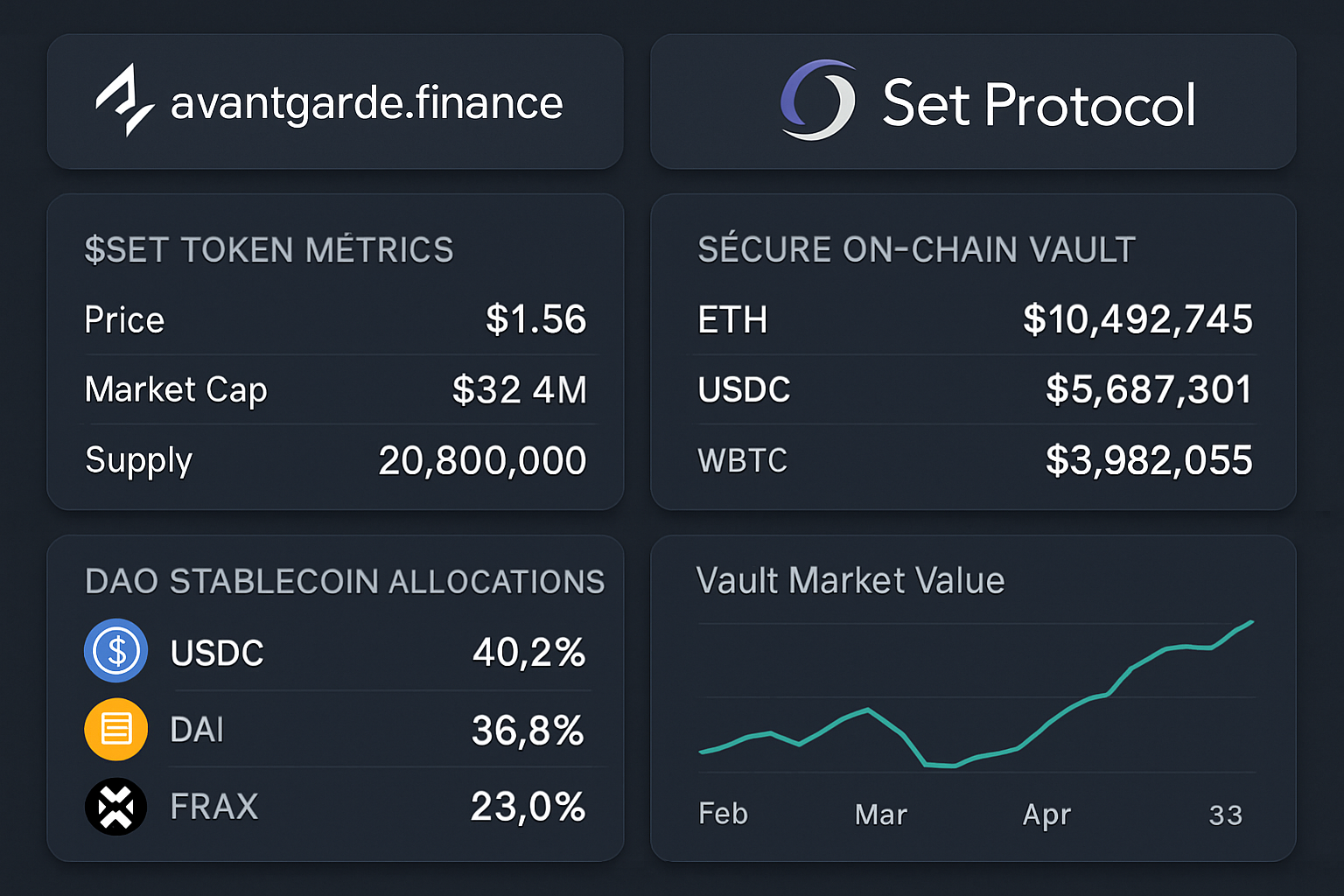

Avantgarde Finance is at the forefront of providing DAOs with automated vault infrastructure purpose-built for stablecoins. Their system enables organizations to deploy capital-efficient strategies while maintaining robust risk controls:

- Bespoke vaults: DAOs can configure custom rules for asset allocation across different stablecoins or DeFi protocols.

- Real-time reporting: Transparent dashboards offer granular visibility into treasury performance, exposures, and transaction histories, crucial for DAO governance and compliance.

- Automated rebalancing: Smart contracts monitor market conditions and adjust positions automatically according to predefined mandates.

This level of automation not only secures assets against market shocks but also empowers DAO operators to focus on growth rather than manual oversight. For a deeper dive into how these vaults fortify DAO treasuries during turbulent markets, see our coverage on stablecoin vault protection strategies.

Set Protocol: On-Chain Asset Management Automation for DAOs

If Avantgarde specializes in vault security and transparency, Set Protocol excels at seamless on-chain asset management for diverse portfolios. As one of the largest protocols in this space, Set enables DAOs to:

- Create programmable asset sets: Bundle multiple stablecoins (and other assets) into managed portfolios governed by smart contract logic.

- Automate routine operations: From recurring payments (payroll, grants) to liquidity rebalancing across DeFi platforms, all executed without manual intervention.

- Enforce compliance rules: Built-in modules allow DAOs to define access controls and approval workflows tailored to their governance structure.

The result? Streamlined operations that minimize human error while meeting the high bar for auditability demanded by today’s decentralized communities. For step-by-step guidance on setting up automated stablecoin vaults via Set Protocol or similar solutions, explore our detailed guide: How to Set Up Automated Stablecoin Vaults for DAO Treasury Management.

Token Metrics AI Tools: Automated Risk Management and Treasury Rebalancing

No discussion of automated DAO treasury management would be complete without considering advanced analytics and AI-powered optimization. Token Metrics offers a suite of tools that harness machine learning signals to help DAOs:

- Dynamically assess protocol risks: Real-time ratings flag smart contract vulnerabilities or liquidity risks across supported DeFi platforms.

- Automate treasury rebalancing: AI-driven models recommend portfolio adjustments based on evolving risk-return profiles, ensuring optimal allocation between stablecoins and yield-generating strategies.

- Streamline governance decisions: Data-driven insights empower token holders with actionable intelligence when voting on proposals or adjusting treasury mandates.

Integrating AI tools like those from Token Metrics not only reduces the cognitive load on treasury stewards but also brings a level of sophistication that manual processes simply cannot match. By automating risk assessment and portfolio rebalancing, DAOs can swiftly adapt to market shifts while maintaining robust compliance and security postures. The result is a more resilient treasury, one capable of weathering volatility and capitalizing on emerging opportunities without exposing the organization to undue risk.

Best Practices for Secure, Automated Stablecoin Management

While these platforms provide powerful automation capabilities, security remains paramount. DAOs should layer multiple controls to safeguard their assets:

- Multi-signature wallets: Require consensus from several trusted parties before executing transactions, mitigating single-point-of-failure risk.

- Continuous smart contract audits: Regularly review codebases for vulnerabilities, especially as new automation features are deployed.

- Transparent reporting: Leverage real-time dashboards (as offered by Avantgarde Finance) so all stakeholders can monitor treasury health and flag anomalies quickly.

- Automated compliance checks: Utilize programmable rules within platforms like Set Protocol to enforce spending limits and access controls in line with governance mandates.

For a comprehensive breakdown of how stablecoin vaults bolster DAO security during periods of heightened market stress, refer to our in-depth analysis: How Stablecoin Vaults Protect DAO Treasuries During Market Volatility.

The Road Ahead: From Manual Oversight to Autonomous Treasury Operations

The convergence of automated vaults, on-chain asset management protocols, and AI-powered analytics is rapidly redefining what’s possible for decentralized treasury operations. DAOs adopting these systems are seeing tangible benefits: reduced operational drag, enhanced risk-adjusted returns, and a stronger foundation for long-term sustainability. As regulatory scrutiny intensifies and the stakes rise for on-chain organizations, embracing secure automation is no longer optional, it’s essential.

For teams considering the leap into automated stablecoin management, starting with proven solutions like Avantgarde Finance’s vaults, Set Protocol’s programmable asset sets, or Token Metrics’ AI suite offers both a technological edge and peace of mind. Each platform addresses different pain points, from security to compliance to yield optimization, allowing DAOs to tailor their approach based on unique governance needs and risk appetites.

The future of DAO treasury management will be defined by transparency, automation, and resilience. By leveraging these leading-edge tools now, decentralized organizations can turn their treasuries from static reserves into dynamic engines for innovation and growth, without compromising security or compliance along the way.