Decentralized Autonomous Organizations (DAOs) are entering a new era of financial sophistication, leveraging automated on-chain treasury tools to transform the way they manage and optimize stablecoin reserves. In 2024, with DAO treasuries often holding millions in USDC, DAI, or USDT, the imperative is clear: maximize yield while maintaining robust security and transparency. The proliferation of advanced DeFi protocols and intelligent automation has empowered DAOs to extract more value from their stablecoin holdings than ever before, without sacrificing risk controls or governance standards.

Automated Stablecoin Yield Aggregators: Streamlining On-Chain Returns

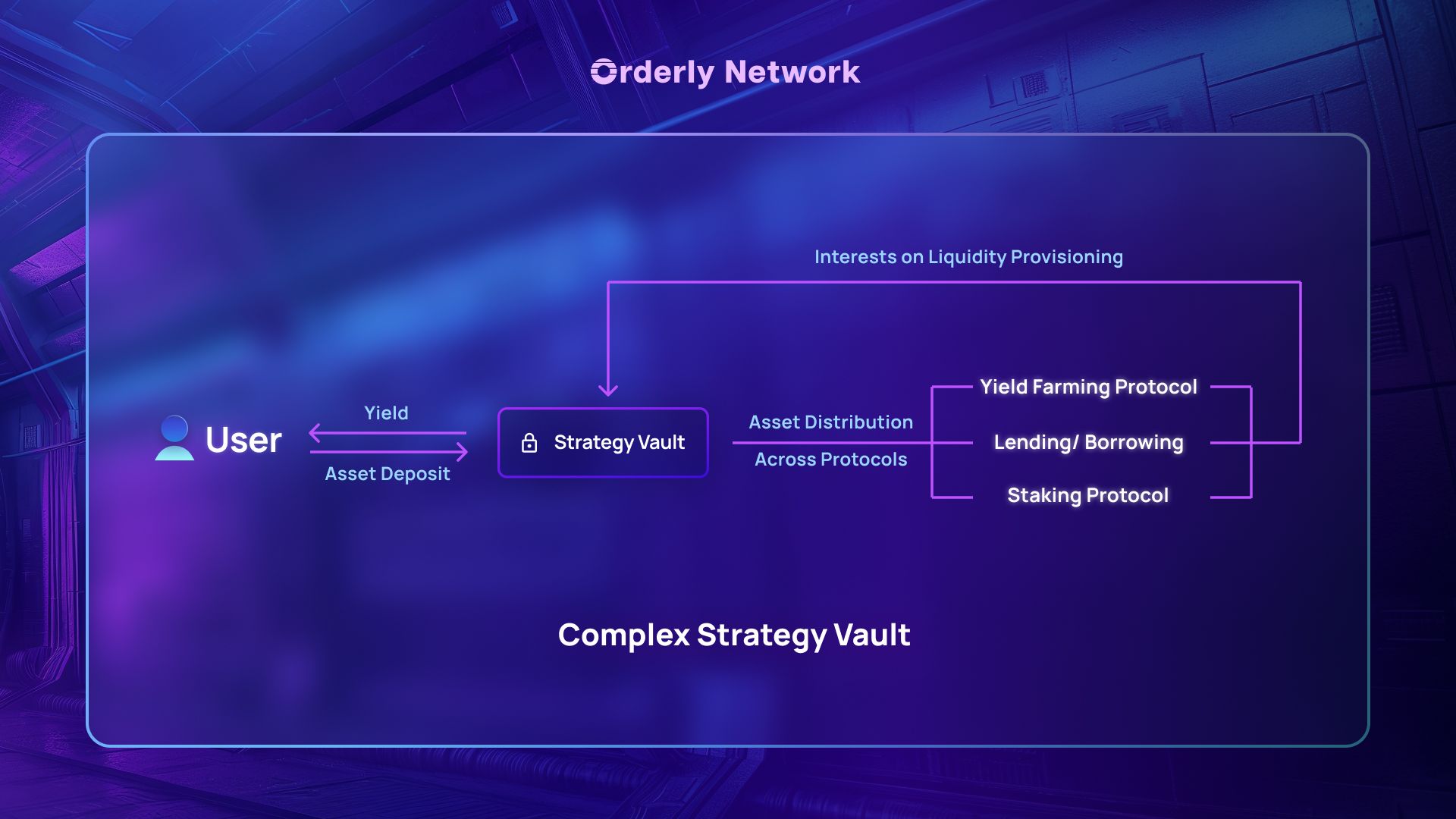

For DAOs seeking efficient yield generation without constant manual oversight, automated stablecoin yield aggregators have become indispensable. Platforms like Yearn Vaults, Beefy Finance, and especially Coinshift offer programmable strategies that automatically allocate DAO-held stablecoins across the most competitive DeFi protocols. These aggregators monitor real-time APYs, transaction fees, and protocol risks to rebalance assets dynamically, ensuring capital is always working in the most productive pools.

The result? DAOs can capture attractive yields (often between 5% and 8% annually for top-tier stablecoins) while minimizing idle funds. Coinshift stands out for its tailored treasury management interface designed for organizational workflows, enabling batch payments, multi-chain support, and robust accounting features. For a deeper dive into how vault strategies drive capital efficiency in DAO treasuries, see our guide on optimizing capital efficiency with yield strategies.

AI-Powered Treasury Rebalancing Tools: Intelligent Allocation at Scale

The advent of AI-driven analytics is reshaping on-chain treasury management. Tools such as Token Metrics and custom integrations by Karpatkey are setting new standards for data-driven decision making in DAOs. These platforms ingest real-time market data, including protocol APYs, liquidity depth, volatility signals, and smart contract risk scores, and use machine learning models to recommend or automate rebalancing decisions.

This means DAOs can continuously optimize their portfolio allocations without relying solely on human intervention or slow-moving governance processes. AI-powered rebalancers help organizations respond swiftly to changing market conditions, maximizing returns while reducing exposure during periods of heightened risk or declining yields. Importantly, these systems can be configured with custom risk parameters set by the DAO’s governance framework.

If you want to understand how these intelligent systems fit into broader DAO treasury operations, and how they compare to traditional manual approaches, refer to our breakdown of automated strategies for optimizing DAO treasury yields.

Treasury Security: Multi-Signature and Role-Based Access Controls

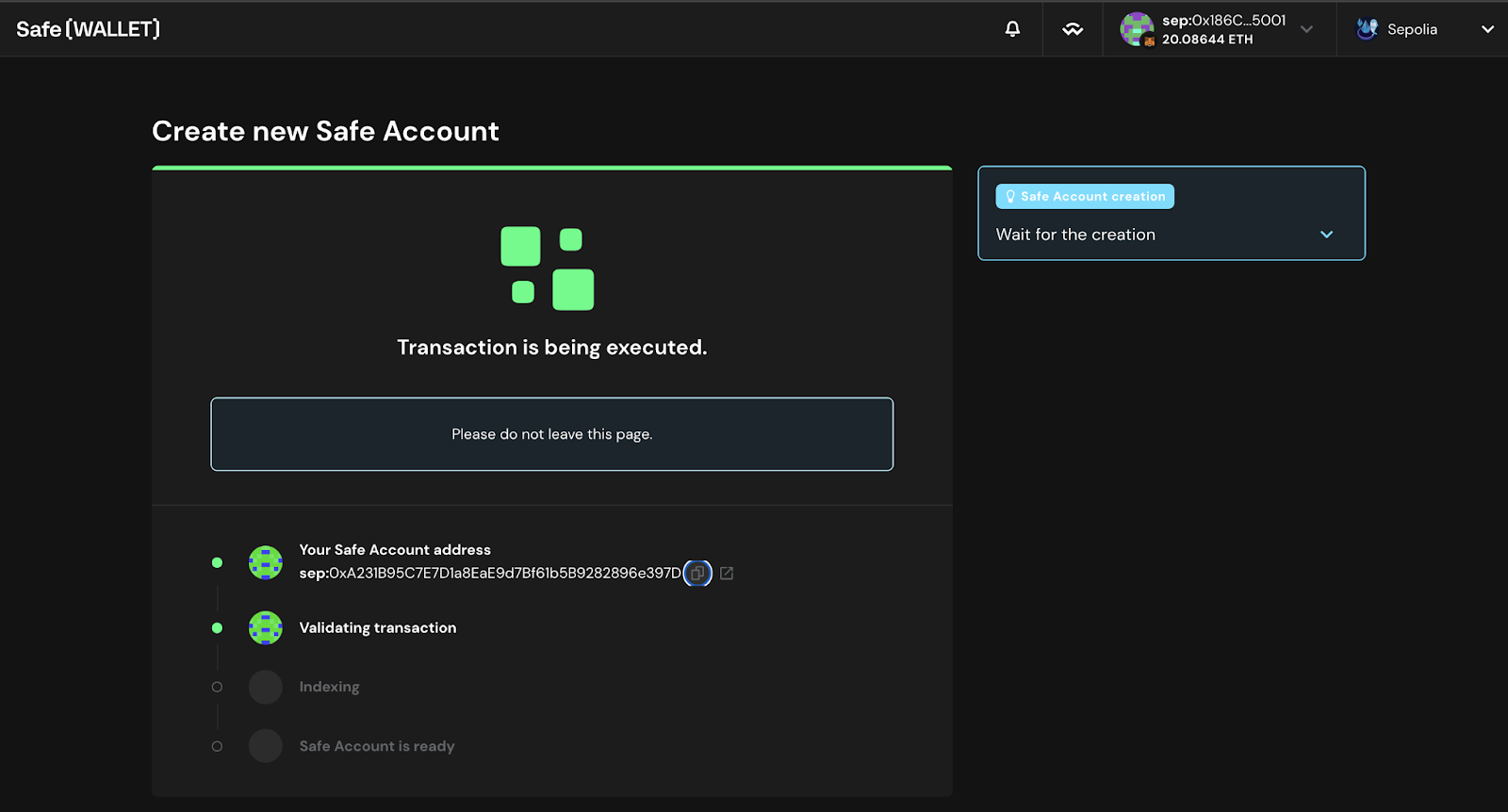

No discussion of automated DAO treasury management is complete without addressing security, the foundation upon which all yield optimization must rest. Solutions like Safe (formerly Gnosis Safe) provide multi-signature wallets that require multiple approvals before any transaction is executed from the treasury. This mitigates single-point-of-failure risks and ensures that asset movements are subject to collective oversight.

Colony’s role-based access control system takes this further by allowing DAOs to define granular permissions based on contributor roles, limiting who can initiate transactions, adjust strategies, or access sensitive data within the treasury platform. By combining multi-sig frameworks with programmable access controls, DAOs achieve both operational agility and robust defense against internal threats or mismanagement.

This layered approach is essential as treasuries grow in size and complexity; it also supports regulatory compliance efforts by providing transparent audit trails for all asset movements, a topic explored further in our resource on DAO risk management with stablecoin vaults.

To truly harness the power of automated on-chain treasury tools, DAOs must go beyond simply deploying capital, they need to orchestrate a seamless workflow that integrates yield generation, intelligent rebalancing, and uncompromising security. This holistic approach not only maximizes stablecoin returns but also ensures that treasury operations remain transparent and resilient in the face of evolving DeFi risks.

Top 3 Automated Strategies & Tools for DAO Stablecoin Yield Optimization (2024)

-

Automated Stablecoin Yield Aggregators (e.g., Yearn Vaults, Beefy Finance, Coinshift):These platforms automatically allocate DAO stablecoin reserves across top DeFi protocols to maximize yield. Yearn Vaults and Beefy Finance optimize returns by routing funds through the most lucrative lending and liquidity pools, while Coinshift streamlines treasury operations and yield strategies with integrated reporting and automation.

-

AI-Powered Treasury Rebalancing Tools (e.g., Token Metrics, Karpatkey integrations):These solutions leverage AI and machine learning to monitor market conditions, rebalance stablecoin allocations, and identify yield opportunities in real time. Token Metrics provides automated signals and portfolio optimization, while Karpatkey offers custom integrations for DAOs seeking data-driven treasury management.

-

Multi-Signature and Role-Based Access Control for Treasury Security (e.g., Safe, Colony):Implementing robust security practices is essential for DAO treasuries. Safe (formerly Gnosis Safe) enables multi-signature approvals for transactions, reducing the risk of unauthorized fund movement. Colony adds granular, role-based permissions, ensuring only authorized members can access and manage treasury assets.

Automated stablecoin yield aggregators like Yearn Vaults, Beefy Finance, and Coinshift offer DAOs plug-and-play access to sophisticated yield farming strategies. By routing stablecoins into optimized pools and vaults, these platforms abstract away complexity while delivering consistent returns. The real breakthrough comes when these aggregators are combined with AI-powered rebalancing tools, such as those provided by Token Metrics or custom Karpatkey integrations. Here, algorithmic models analyze on-chain data, protocol incentives, risk metrics, even emerging governance proposals, to dynamically shift allocations as market conditions change.

For example, a DAO might allocate 60% of its USDC holdings to Coinshift for steady vault yields, while an AI-driven module monitors APY fluctuations across protocols. If a spike in rewards appears on Beefy Finance or a sudden risk emerges on a previously safe protocol, the system can recommend (or automatically execute) a rebalance, protecting principal while seeking optimal returns. This not only boosts capital efficiency but also reduces the cognitive load on DAO contributors and treasury committees.

Security Practices That Scale With Growth

As DAOs scale their treasuries, sometimes into the tens or hundreds of millions, security becomes existential. Multi-signature wallets from Safe are now considered industry standard; they ensure that no single actor can move funds unilaterally. Each transaction requires consensus from multiple trusted parties (often elected by governance), dramatically reducing internal fraud risk and creating a verifiable audit trail.

Colony’s role-based access control adds another dimension: permissions can be finely tuned based on contributor roles (e. g. , finance lead vs. developer vs. auditor). This flexibility is critical for larger DAOs with diverse teams or subDAOs managing separate budgets. By enforcing least-privilege principles and automating access updates as roles change, DAOs maintain operational agility without compromising security posture.

Best Practices for Sustainable Yield Optimization

The most successful DAOs blend these tools into a repeatable process:

- Diversify across multiple aggregators (Yearn Vaults, Beefy Finance) to avoid protocol-specific risks.

- Automate routine rebalancing with AI-powered dashboards (Token Metrics) to capture short-term opportunities without manual intervention.

- Enforce multi-sig approvals and granular permissions via Safe and Colony to safeguard against both external exploits and internal mistakes.

- Maintain regular reporting, using integrated analytics from platforms like Coinshift or external trackers such as Octav. fi for full transparency.

- Pilot new strategies in smaller tranches, gradually increasing exposure as confidence in automation grows.

This integrated framework not only drives higher yields but also positions DAOs for long-term sustainability, a core principle for any organization stewarding community-owned capital. For those looking to deepen their understanding or implement advanced workflows, our resource library covers everything from best stablecoin vault strategies for maximizing yield to comprehensive risk management techniques in 2024.