For DAOs, automating stablecoin treasury management isn’t just a matter of convenience, it’s a fundamental requirement for maximizing security, transparency, and operational efficiency. As on-chain organizations grow in complexity and scale, manual treasury operations leave too much room for human error, delayed reactions to market shifts, and potential vulnerabilities. The solution? Leverage programmable stablecoins, robust DeFi integrations, and a smart set of automation strategies designed specifically for decentralized treasuries.

Why Automate DAO Stablecoin Treasury Management?

Recent market cycles have proven that volatility is an ever-present risk for DAOs holding large reserves of native tokens. That’s why stablecoins like USDC and DAI have become the backbone of modern DAO treasuries, they minimize exposure to wild price swings while enabling efficient on-chain financial operations. But holding stablecoins isn’t enough. To truly protect assets and optimize returns, DAOs must embrace automation across every layer of their treasury stack.

Automated crypto treasury management means:

- Instant execution of pre-approved financial policies

- Real-time risk monitoring and mitigation

- Frictionless yield optimization without compromising on security

- Transparent, programmable workflows that reduce governance overhead

Let’s dive into five actionable strategies every DAO should consider for automating stablecoin treasury management using best-in-class on-chain tools.

1. Implement Multisig and Smart Contract-Based Stablecoin Vaults

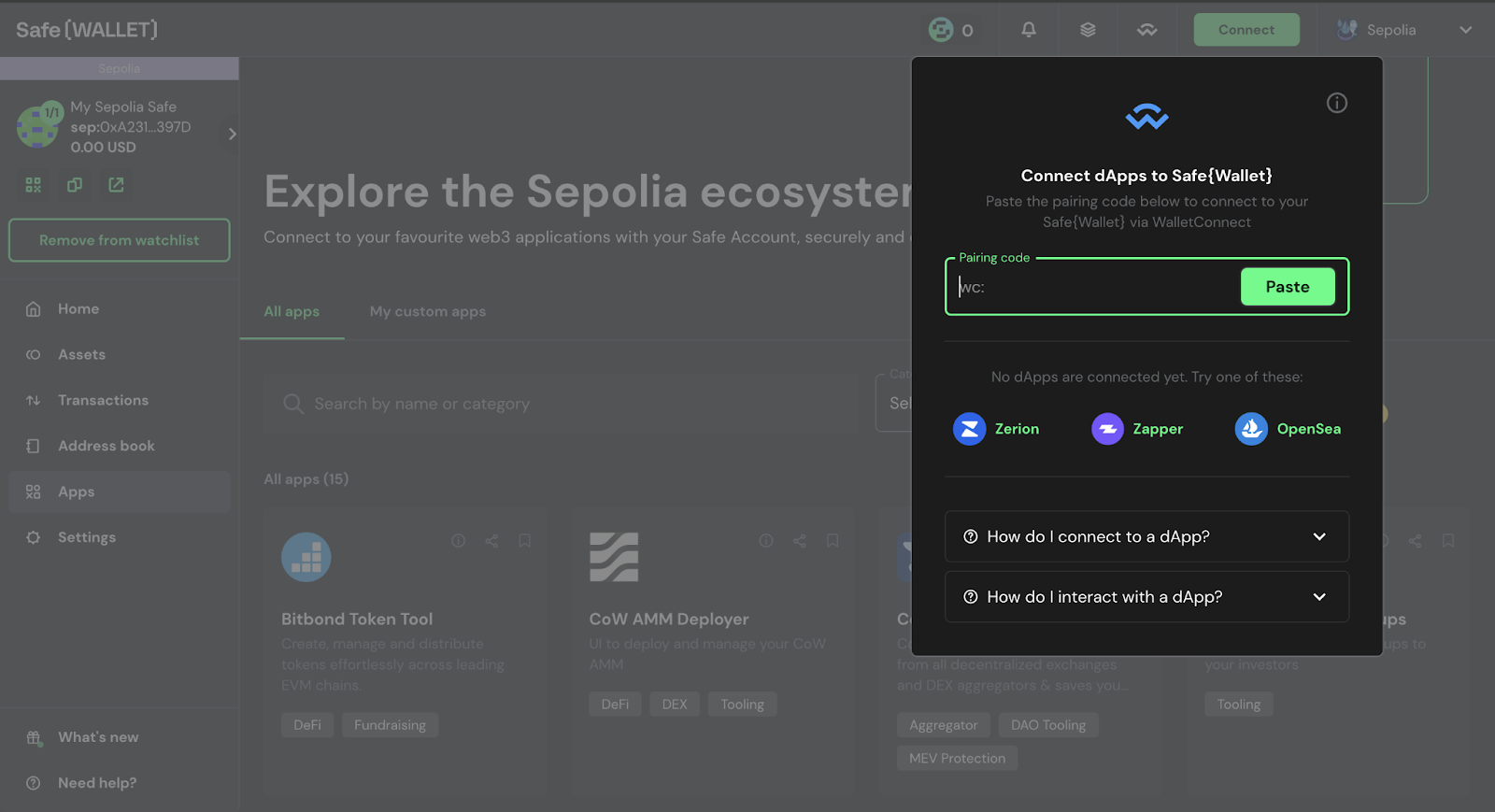

The first line of defense for any DAO treasury is secure custody. Multisignature (multisig) wallets remain the gold standard for on-chain asset protection, requiring a set number of approvals before funds can move. However, DAOs are increasingly combining multisigs with audited smart contract-based stablecoin vaults to create programmable, tamper-resistant storage solutions.

This hybrid approach allows DAOs to automate scheduled disbursements, enforce withdrawal limits, and set access controls directly in code, eliminating single points of failure. For a deeper dive into vault security mechanics, check out this guide to securing DAO stablecoin vaults.

2. Automate Yield Optimization via Permissionless DeFi Protocol Integrations

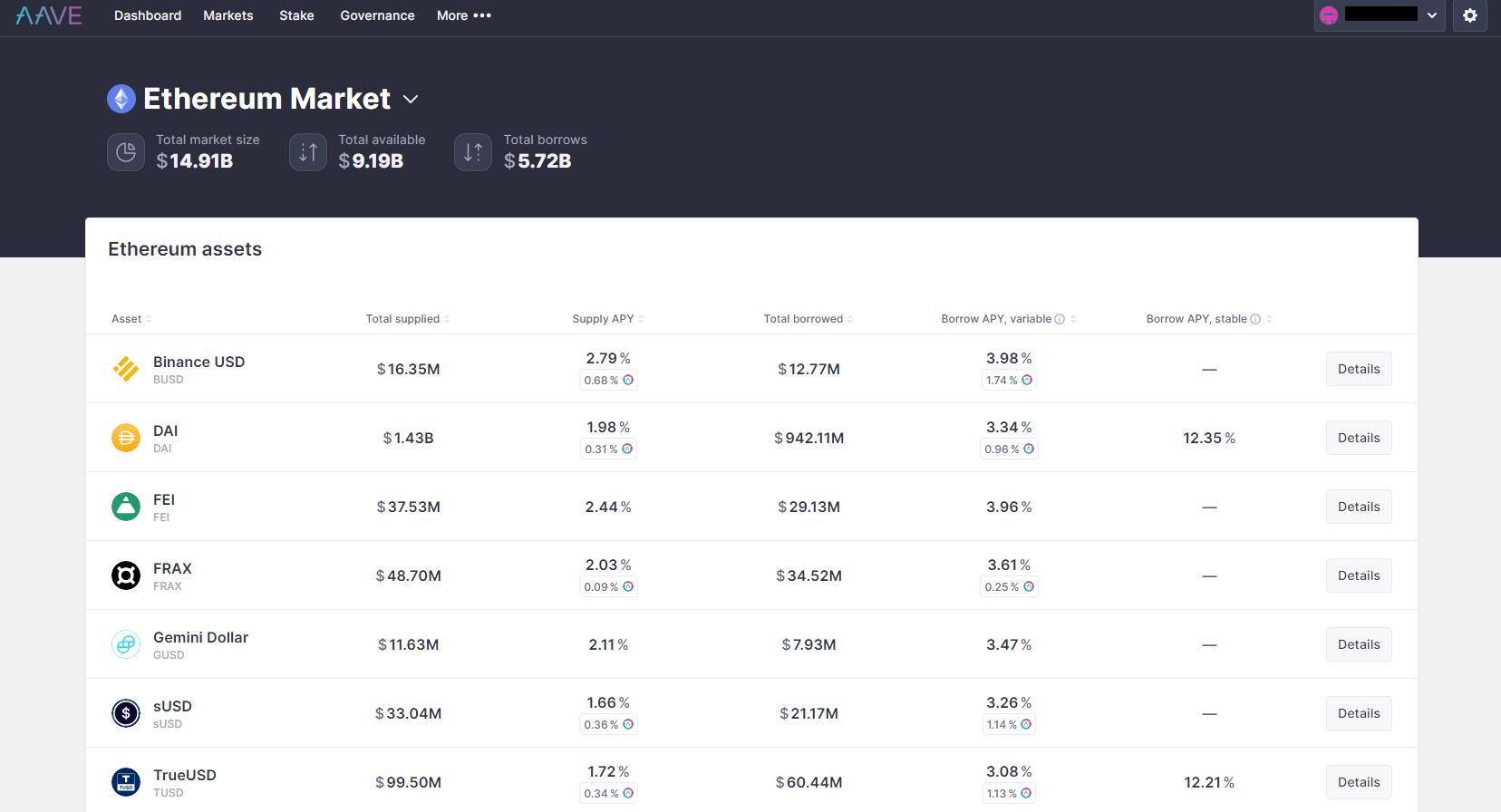

Leaving stablecoins idle in a treasury wallet means missing out on potential yield. Today’s best-practice is to automate yield optimization by integrating with permissionless DeFi protocols like Aave, Compound, or Yearn. Smart contracts can dynamically allocate treasury stablecoins into lending pools or liquidity strategies based on predefined risk parameters.

This approach ensures that the treasury is always working to generate returns, but only within the guardrails set by the DAO community. Automation here is key: funds can be rebalanced across protocols in real time, responding instantly to shifts in interest rates or risk conditions, without requiring constant human oversight.

Read more about how automated stablecoin vaults are revolutionizing on-chain treasury management for DAOs in this in-depth article.

3. Establish Automated Risk Controls and Real-Time Monitoring

No automation strategy is complete without robust risk management. DAOs should deploy automated monitoring tools that track key metrics like protocol health, stablecoin peg status, and exposure concentration in real time. Smart contracts can be programmed to trigger alerts or even execute defensive actions, such as withdrawing funds from risky protocols or pausing certain operations, if predefined risk thresholds are breached.

For example, if a stablecoin depegs or a lending protocol’s utilization spikes beyond a safe limit, the system can automatically unwind positions or reallocate assets to safer venues. This kind of proactive, code-driven risk mitigation is what sets automated on-chain treasury management apart from legacy finance.

Top 5 Strategies for Automating DAO Stablecoin Treasuries

-

Implement Multisig and Smart Contract-Based Stablecoin Vaults: Secure stablecoin reserves with Safe (formerly Gnosis Safe) multisig wallets and audited smart contracts. This ensures that all treasury actions require multiple approvals and are transparently executed on-chain, significantly reducing the risk of unauthorized access.

-

Automate Yield Optimization via Permissionless DeFi Protocol Integrations: Leverage integrations with established protocols like Aave and Compound to programmatically allocate stablecoins for yield generation. Automated smart contract strategies can rebalance funds to maximize returns while maintaining liquidity and security.

-

Establish Automated Risk Controls and Real-Time Monitoring: Deploy on-chain monitoring tools such as OpenZeppelin Defender and Forta to set up automated alerts, risk thresholds, and real-time activity tracking. These systems help DAOs react quickly to abnormal events and enforce treasury safety protocols.

-

Utilize On-Chain Governance for Automated Treasury Policy Enforcement: Implement governance frameworks like Compound Governor or Aragon to automate policy changes, spending approvals, and parameter adjustments through on-chain voting, ensuring transparency and community oversight.

-

Integrate Scheduled Stablecoin Diversification and Rebalancing Mechanisms: Use platforms such as Enzyme Finance or Balancer to automate periodic rebalancing and diversification of stablecoin holdings. This reduces exposure to any single asset or protocol and helps maintain a resilient treasury.

4. Utilize On-Chain Governance for Automated Treasury Policy Enforcement

Automation doesn’t mean sacrificing community control. In fact, on-chain governance mechanisms allow DAOs to encode treasury policies directly into smart contracts, ensuring that rules are enforced transparently and without manual intervention. With automated governance, proposals such as spending limits, payout schedules, or emergency withdrawal rules are executed only if approved by token holders, and every action is recorded on-chain for full auditability.

This approach dramatically reduces the risk of rogue actors or accidental breaches of policy. Automated enforcement also streamlines operations by reducing the administrative burden on core contributors. For DAOs seeking to scale, it’s a game-changer: you get the security and consistency of code, without losing the flexibility of collective decision-making. Interested in how governance automation is shaping the future of DAO treasuries? Explore how stablecoin vaults are revolutionizing on-chain treasury management.

5. Integrate Scheduled Stablecoin Diversification and Rebalancing Mechanisms

Even the most robust treasury can be undermined by overexposure to a single stablecoin or protocol. That’s why leading DAOs are implementing automated diversification and rebalancing strategies. Smart contracts can be programmed to regularly assess the treasury’s allocation across different stablecoins (like USDC, DAI, USDT) and DeFi platforms, then execute swaps or transfers as needed to maintain target allocations.

For example, if a DAO’s risk policy states that no more than 40% of reserves should be held in any one stablecoin, the automation logic will trigger rebalancing whenever allocations drift outside those boundaries. Scheduled diversification not only protects against depegs or black swan events but also ensures the treasury remains agile and ready to capitalize on new opportunities. For practical steps on setting up these mechanisms, see this setup guide.

Bringing It All Together: The Future of Automated DAO Treasury Management

By combining these five strategies, multisig and smart contract-based vaults, automated yield optimization, real-time risk controls, on-chain governance enforcement, and scheduled diversification, DAOs can achieve a level of treasury resilience and efficiency that simply isn’t possible with manual processes. The shift toward automation is already underway across the leading decentralized organizations, with more DAOs adopting programmable stablecoins and advanced DeFi integrations every quarter.

Ultimately, automated crypto treasury management isn’t just a technical upgrade, it’s a cultural shift toward transparency, security, and collective intelligence. As new tools emerge and best practices evolve, DAOs that invest in automation today will be best positioned to thrive in tomorrow’s dynamic on-chain economy.

Want to dive deeper? Explore more actionable guides on protecting your DAO treasury from volatility here.