The landscape of on-chain payments is undergoing a seismic shift as Layer 1 stablecoin blockchains like Stable come to the forefront. These purpose-built networks are optimizing the way stablecoins such as USDT and USDC are transacted, addressing long-standing pain points around speed, cost, and user experience. With a laser focus on stablecoin utility, these infrastructures are not just technical upgrades, they’re catalysts for the next era of decentralized payments and DAO treasury management.

Why Layer 1 Stablecoin Blockchains Matter Now

Until recently, stablecoins have been deployed atop general-purpose blockchains like Ethereum or Tron. While functional, these networks weren’t optimized for the unique requirements of high-frequency, low-latency transactions that stablecoin payments demand. Enter the new breed: Layer 1 stablecoin blockchains, engineered from the ground up to serve as high-throughput rails for digital dollars.

The emergence of Stable, a Layer 1 chain co-developed by Bitfinex and Tether, has drawn significant attention after its $28 million seed round. Stable leverages the StableBFT consensus (a CometBFT proof-of-stake system), enabling up to 10,000 transactions per second with optimistic parallel execution. Critically, it uses USDT as both the payment and gas token, eliminating friction caused by needing a volatile native asset for transaction fees. This design unlocks truly seamless peer-to-peer transfers and merchant payments, with users paying fees in the same currency they’re sending or receiving.

For DAOs and DeFi projects managing treasuries, this means predictable dollar-denominated costs, easier accounting, and fewer operational headaches. The implications extend well beyond crypto-native use cases, these chains are positioning themselves as core infrastructure for global payments, remittances, and even B2B settlements.

“Stablecoin-centric Layer 1s are not just about speed, they’re about making digital money work as intuitively as cash. ”

The Rise of Specialized Payment Chains: Not Just Stable

Stable isn’t alone in this race. Several projects are building dedicated networks to capture the stablecoin payment opportunity:

Key Features of Top Layer 1 Stablecoin Blockchains

-

Stable: Purpose-built for USDT payments, Stable uses USDT as its native gas token, enabling users to pay transaction fees directly in USDT. It leverages the StableBFT consensus mechanism for high throughput (up to 10,000 TPS) and low latency, with features like gas-free P2P transfers via LayerZero relays and planned fiat on/off-ramps.

-

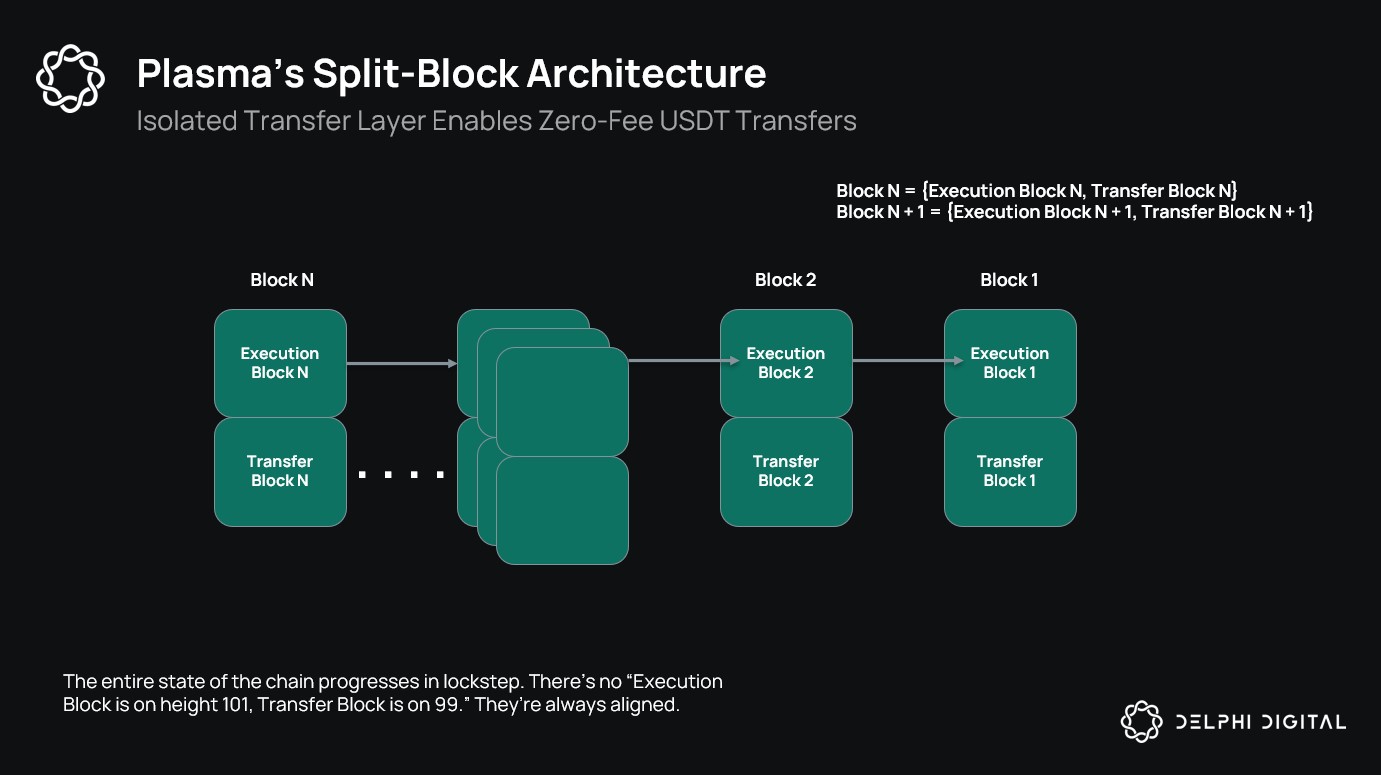

Plasma: Launched in September 2025, Plasma is a high-performance Layer 1 blockchain optimized for USDT. It offers zero-fee USDT transfers, processes over 1,000 TPS with instant finality, and is fully EVM-compatible. A native Bitcoin bridge enables trust-minimized BTC flows into the network.

-

Arc by Circle: Arc is an open Layer 1 blockchain from Circle, purpose-built for stablecoin finance. It uses USDC as its gas token, offers low, predictable fees, and features a built-in foreign exchange engine, instant finality via the Malachite consensus, and opt-in privacy. Arc is fully EVM-compatible for developer flexibility.

-

1Money: Founded by Brian Shroder, 1Money is a next-generation Layer 1 payment network designed exclusively for stablecoin transactions. It employs a patent-pending Byzantine Consistent Broadcast (BCB) protocol to replace traditional block-based processing, boosting transaction throughput and efficiency.

Plasma, which launched in September 2025, offers zero-fee USDT transfers with instant finality and processes over 1,000 transactions per second. Its EVM compatibility ensures that existing Ethereum apps can migrate effortlessly. Meanwhile, Arc by Circle is pushing boundaries with USDC as its native gas token and built-in FX engines for cross-border payments, another nod to the growing demand for real-world stablecoin utility.

Stable’s approach is especially innovative: through LayerZero relays, it enables gas-free P2P transfers and plans to integrate fiat on/off-ramps plus debit card support. This ambition is echoed across the sector as networks compete to deliver the lowest-friction experience possible.

How Native Gas Tokens Transform On-Chain Payments

The game-changer here is clear: using stablecoins as both value transfer and network fuel solves a fundamental usability problem. On legacy blockchains, users often need ETH or another volatile token just to pay fees, an awkward hurdle for mainstream adoption. By making USDT or USDC the native gas token, networks like Stable eliminate this complexity entirely.

This model also streamlines DAO treasury operations. For organizations managing large multi-signature vaults or automating payrolls in stablecoins, predictable fee structures remove unnecessary volatility from their balance sheets. In turn, this boosts confidence among institutional users who require transparency and compliance in their financial operations.

Key Takeaways So Far

- Layer 1 stablecoin blockchains are purpose-built for high-speed, low-cost stablecoin transactions.

- Stable’s USDT-native model eliminates friction by using the payment currency as gas.

- This evolution is unlocking new possibilities for DAOs, DeFi treasuries, and mainstream payment use cases.

- The competition among projects like Plasma and Arc signals a broader shift toward specialized payment infrastructure in crypto.

But the implications of this new paradigm go even deeper. By removing the need for volatile gas tokens and optimizing for stablecoin flows, Layer 1 stablecoin blockchains are quietly laying the groundwork for a new era of composability and interoperability in decentralized finance. These networks don’t just move money faster, they enable a new class of on-chain applications built around reliable, programmable dollars.

For DAOs, this means treasury management can finally be both robust and user-friendly. Multi-signature vaults can automate recurring payments, payrolls, or grants in stablecoins without worrying about fluctuating fee costs or operational complexity. Accounting becomes simpler when every transaction is denominated in a stable value asset. The result: DAOs and crypto communities can focus on governance and growth, not technical hurdles.

Wider Impacts: From Remittances to On/Off-Ramps

Perhaps the most promising frontier is global payments. By leveraging networks like Stable or Arc, cross-border transfers become as easy as sending a text, with settlement finality measured in seconds and fees that are predictable, often fractions of a cent. This has profound implications for remittances, B2B commerce, and emerging market access to dollar-denominated assets.

Moreover, the integration of fiat on/off-ramps directly into these chains (as outlined in recent coverage) means users can seamlessly enter or exit the crypto economy without intermediaries. Debit card support and enterprise-grade transaction “fast lanes” are on the horizon, features that could finally bridge the gap between decentralized finance and everyday spending.

As these infrastructures mature, expect to see more integrations with merchant payment processors, payroll platforms, and even point-of-sale systems. The days of clunky wallet interfaces and unpredictable transaction costs are numbered, replaced by smooth user experiences that rival Web2 fintech apps.

What Comes Next?

The race is now on for developer mindshare and ecosystem growth. EVM compatibility across leading networks ensures that existing dApps can migrate with minimal friction. Meanwhile, innovations like Plasma’s native Bitcoin bridge or Arc’s opt-in privacy features hint at a future where stablecoin-centric blockchains aren’t just payment rails but foundational layers for the next generation of DeFi protocols.

Top 5 Ways Layer 1 Stablecoin Blockchains Will Transform DAO Treasuries by 2026

-

1. Real-Time, Dollar-Denominated Treasury ManagementLayer 1 stablecoin blockchains like Stable, Plasma, and Arc enable DAOs to manage treasuries entirely in stablecoins (e.g., USDT, USDC), ensuring assets retain a stable value and eliminating volatility risks. This allows for predictable budgeting, accounting, and reporting—all denominated in dollars.

-

2. Ultra-Low and Predictable Transaction FeesPlatforms such as Stable and Arc by Circle use stablecoins as native gas tokens, letting DAOs pay fees directly in USDT or USDC. This removes the need to hold volatile tokens for gas and ensures transaction costs remain low, transparent, and easy to forecast.

-

3. Instant, Automated On-Chain Payments and PayrollWith high-throughput networks like Plasma and Stable (processing thousands of transactions per second), DAOs can automate recurring payments, contributor payroll, and grant disbursements—executed instantly, 24/7, with finality and no manual intervention.

-

4. Seamless Cross-Chain and Fiat On/Off-RampsLayer 1 stablecoin blockchains are integrating fiat on/off-ramps and cross-chain bridges (e.g., Stable’s LayerZero relays, Plasma’s Bitcoin bridge), allowing DAOs to move funds between crypto and fiat or across blockchains efficiently, reducing friction for treasury inflows and outflows.

-

5. Enhanced Security and Compliance FeaturesNew L1s like Arc by Circle offer opt-in privacy, built-in compliance tools, and enterprise-grade controls. This empowers DAOs to meet regulatory requirements, conduct transparent audits, and protect treasury assets with advanced security protocols.

For investors and organizations evaluating their treasury strategies, it’s time to look beyond legacy L1s. The rise of specialized Stablechain infrastructure offers not only lower fees but also new tools for compliance automation, real-time analytics, and risk management tailored to digital dollars. As adoption accelerates, those who adapt early will be best positioned to lead in an increasingly dollarized crypto economy.

To track ongoing developments across this fast-moving sector, from protocol upgrades to new enterprise integrations, check out deep dives like this comprehensive guide to Stablechain’s impact on DeFi payments.

Layer 1 stablecoin blockchains aren’t just an upgrade, they’re an inflection point for decentralized finance. As USDT-native chains like Stable reach production scale, expect a wave of real-world adoption that will redefine what’s possible with digital payments both on-chain and off.