In 2024, the race to optimize DAO treasuries has intensified as decentralized organizations seek both sustainable yield and exposure to the next wave of airdrop opportunities. Stablecoin vaults have emerged as a cornerstone of this strategy, offering DAOs a way to earn high APY on idle assets while maintaining robust risk controls and transparent on-chain management. With yields on traditional platforms lagging and airdrop farming becoming a core part of DeFi playbooks, selecting the right vault is now a matter of both tactical execution and long-term treasury resilience.

Why Stablecoin Vaults Are Central to DAO Treasury Yield in 2024

The modern DAO faces a unique set of challenges: maintain liquidity, preserve principal, and generate returns that outpace inflation and opportunity cost. Stablecoin vaults address these needs by pooling user deposits into automated strategies that optimize for yield, security, and sometimes even governance influence or protocol rewards. The best stablecoin vaults in 2024 are not only about raw APY – they balance risk management, composability, and the potential to farm valuable airdrop points.

Below we analyze the top five stablecoin vaults for DAOs and crypto investors this year. Each selection is based on protocol reputation, consistent APY delivery, security track record, and the additional upside of airdrop eligibility or governance incentives. For more on the principles behind these strategies, see our comprehensive stablecoin yield guide.

Top 5 Stablecoin Vaults for DAOs in 2024

-

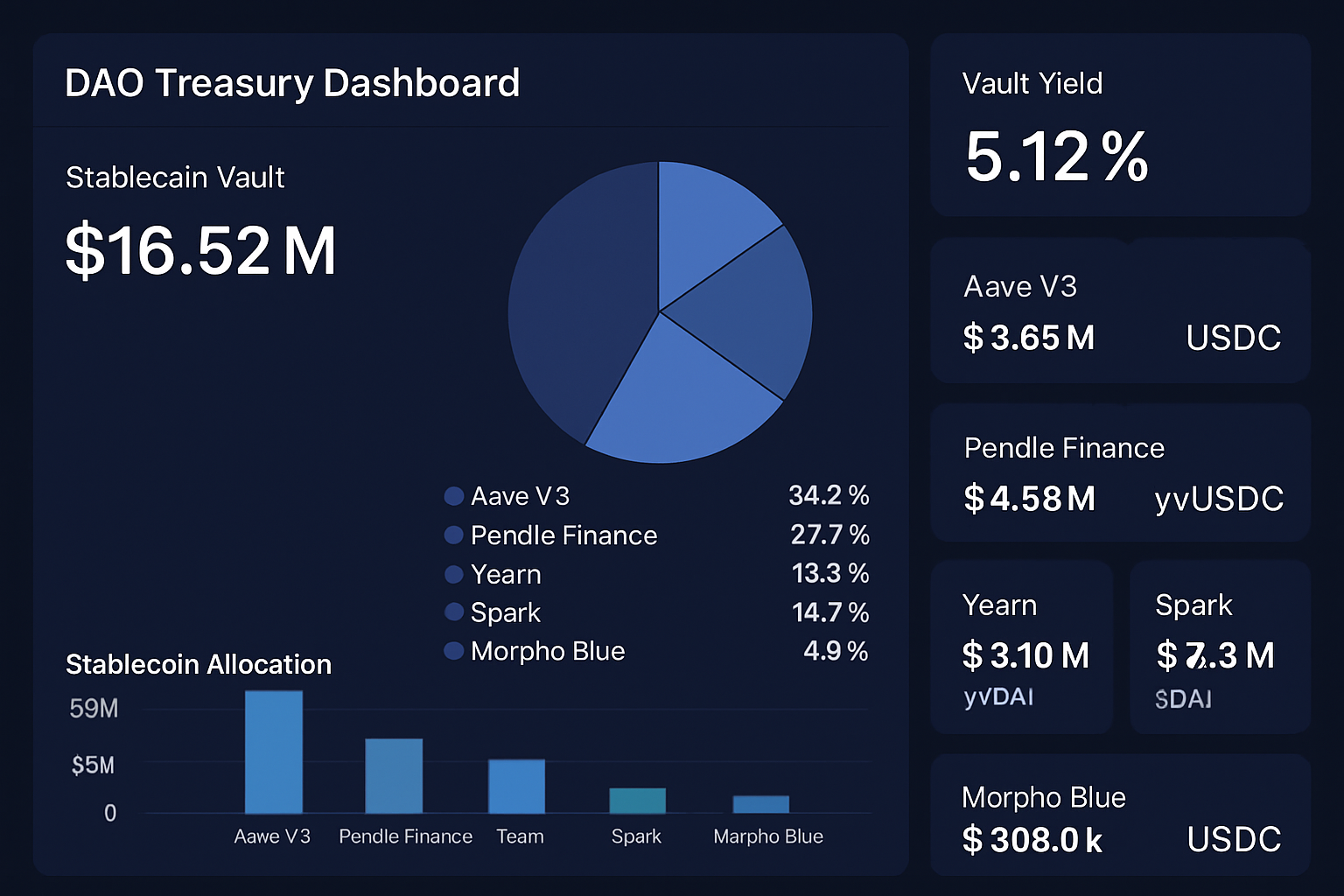

Aave V3 USDC Vault: Aave V3 is a leading decentralized lending protocol, offering DAOs a secure and flexible USDC vault with robust risk controls. APY: 4.67% (as of October 2025). Reputation: High security, extensive audits, and multi-chain support make it a top choice for treasury management.

-

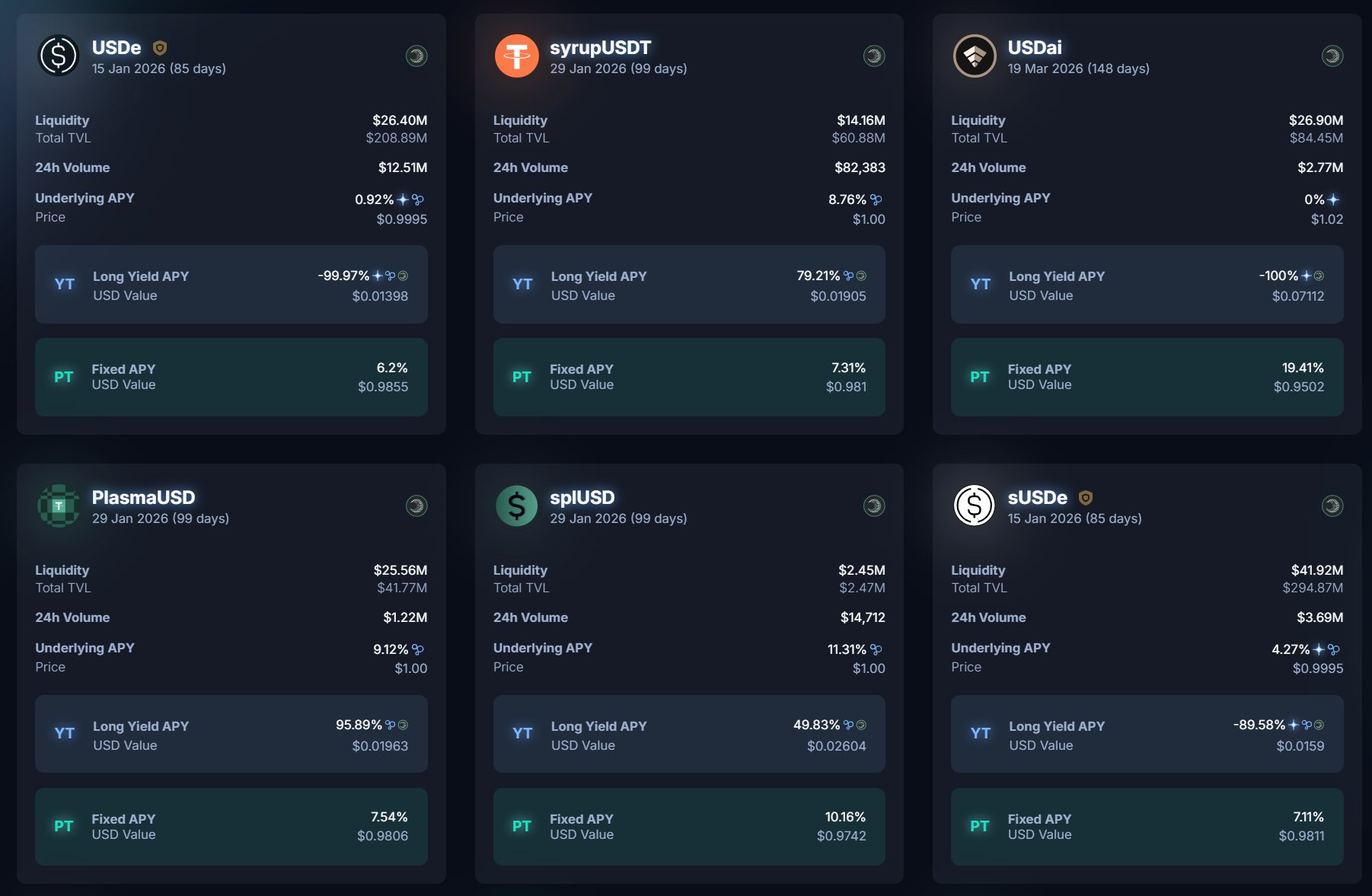

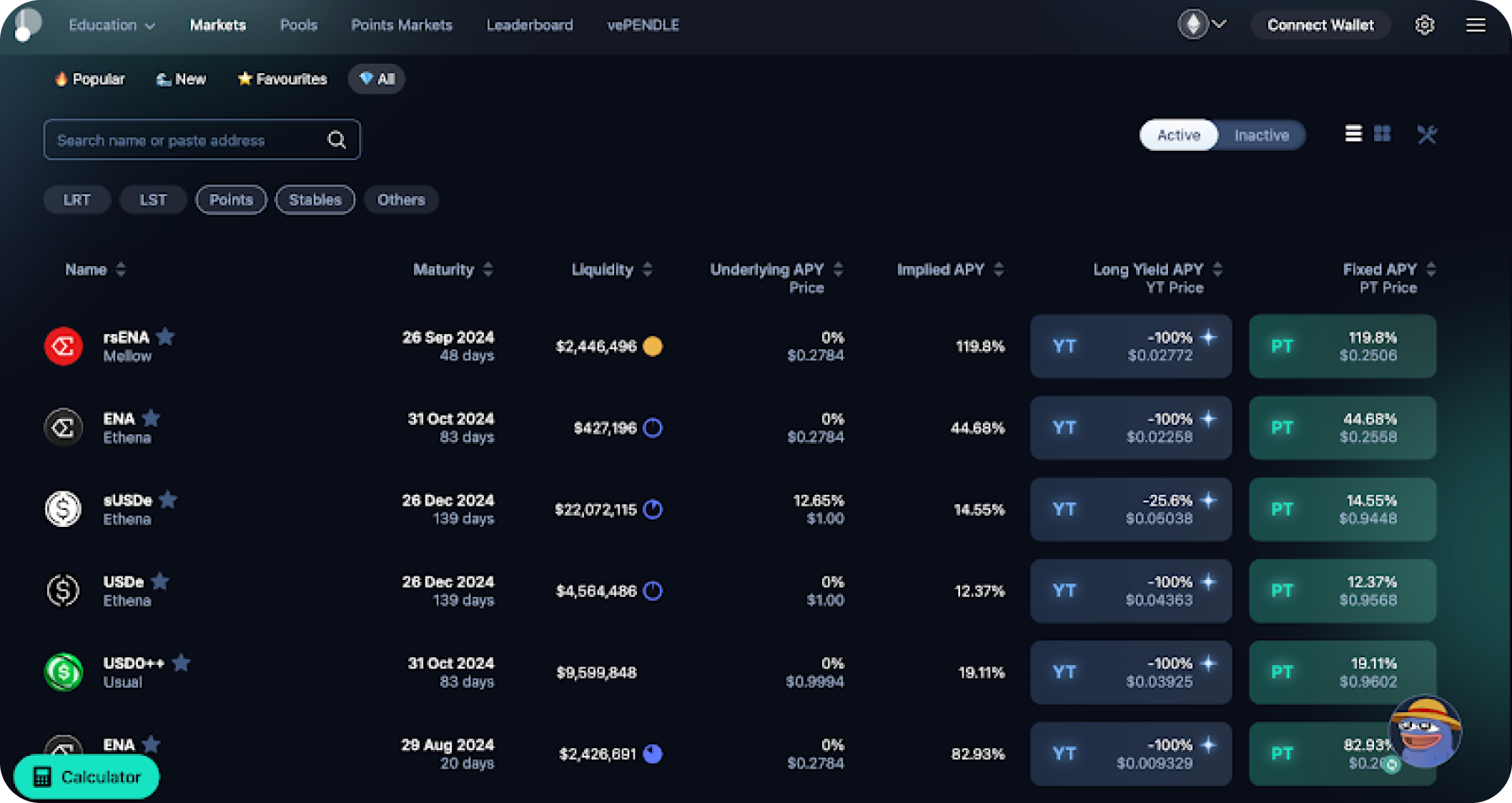

Pendle Finance USDT/USDC Yield Vault: Pendle Finance enables DAOs to earn fixed or variable yields by separating principal and yield on USDT/USDC deposits. APY: Up to 13.58% fixed yield. Unique Feature: Tokenized yield strategies and potential airdrop rewards for active users.

-

Yearn Finance yvUSDC/yvDAI Stablecoin Vaults: Yearn’s automated vaults optimize stablecoin yields by allocating funds across top DeFi strategies. Reputation: One of the most battle-tested yield aggregators. Benefits: Automated compounding and strong community governance.

-

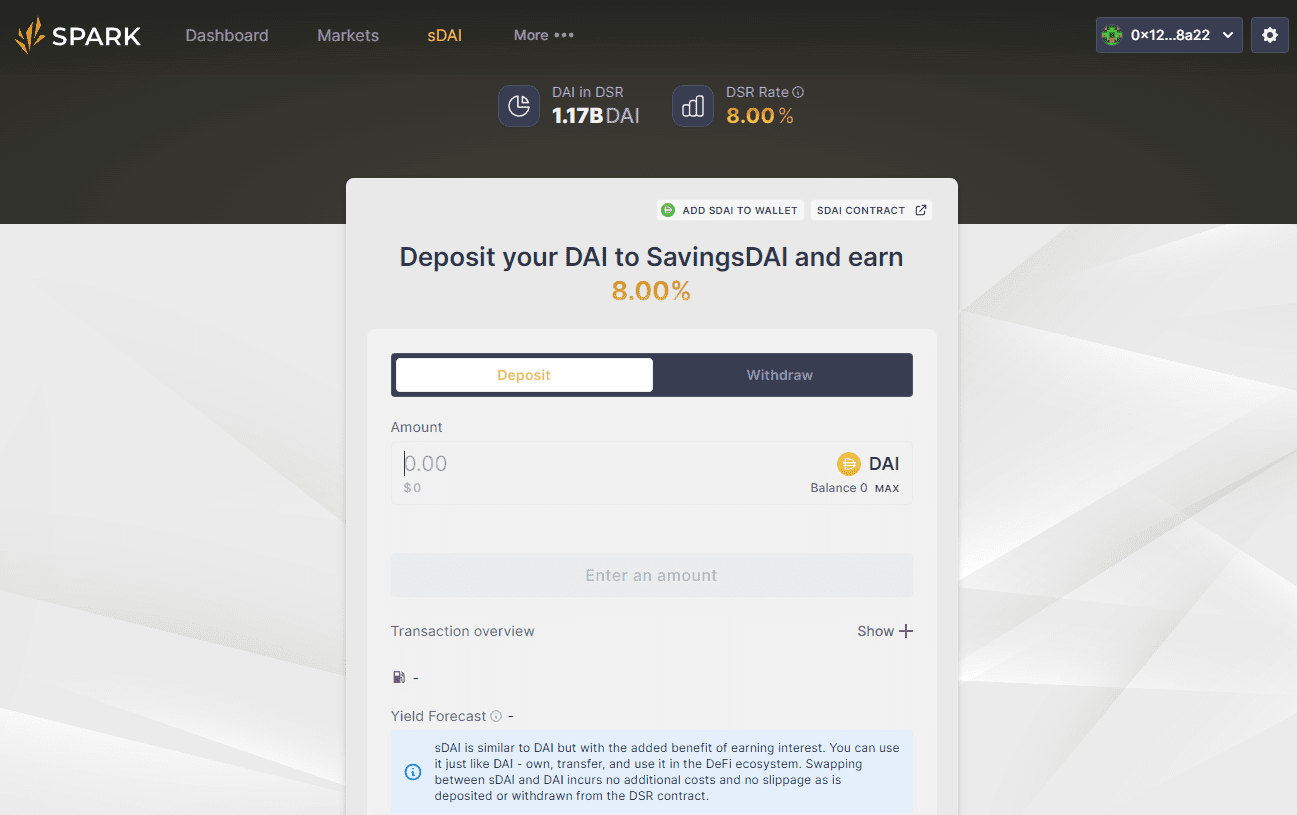

Spark Protocol sDAI Vault: Spark Protocol offers a secure sDAI vault, allowing DAOs to earn yield on DAI with minimal risk. Integration: Built on top of MakerDAO’s infrastructure for added stability. Yield: Competitive rates with transparent risk parameters.

-

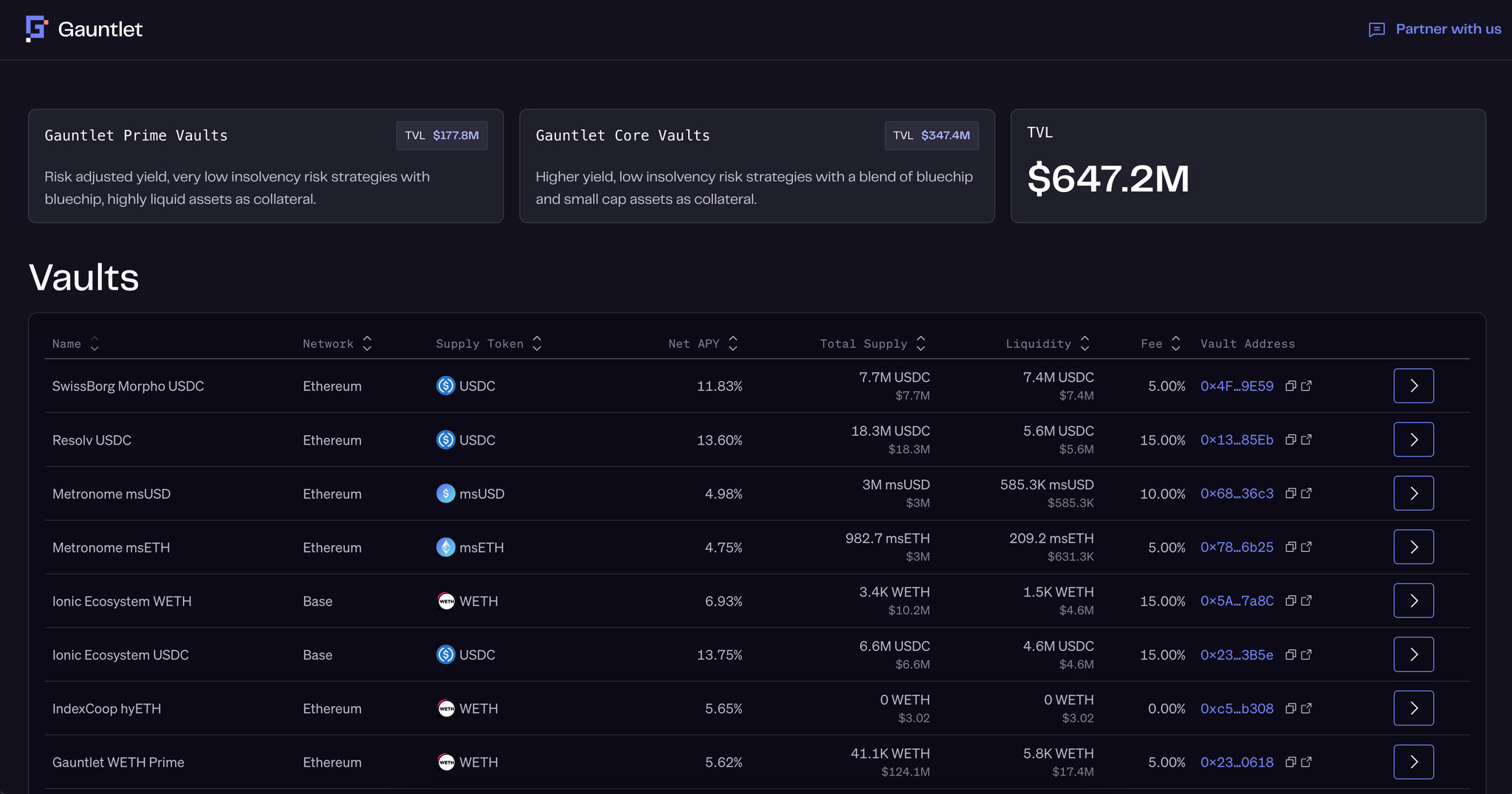

Morpho Blue USDC Lending Vault: Morpho Blue combines peer-to-peer lending efficiency with DeFi composability, offering DAOs higher yields on USDC deposits. Advantages: Low slippage, optimized rates, and enhanced transparency. Security: Open-source and audited smart contracts.

Aave V3 USDC Vault: The Gold Standard for Safety and Liquidity

Aave V3 remains the benchmark for institutional-grade DeFi lending. Its USDC vault is favored by DAOs prioritizing capital preservation and seamless liquidity management. As of October 2025, Aave V3 offers an impressive 4.67% APY on USDC – a rate that surpasses most centralized alternatives while benefiting from Aave’s time-tested risk framework and insurance modules.

For DAOs with large treasuries or strict risk mandates, Aave V3’s permissionless architecture and robust auditing history make it an obvious first port of call. While Aave’s native airdrop potential is limited compared to newer protocols aggressively incentivizing TVL growth, its governance participation can still unlock additional protocol-native rewards over time.

Pendle Finance USDT/USDC Yield Vault: Fixed Yields and Airdrop Leverage

Pendle Finance has carved out a niche as the go-to protocol for fixed-rate yield strategies on blue-chip stablecoins. Its USDT/USDC yield vault stands out by allowing users to tokenize future yield streams (Yield Tokens) separately from principal (Principal Tokens), enabling both fixed income plays and speculative yield trading.

In Q4 2025, Pendle’s fixed yields on USDC have reached as high as 13.58%, making it one of the highest-yielding low-risk options available. For DAOs seeking predictable cash flows or looking to hedge against rate volatility, this structure offers unique flexibility. Crucially, active participation in Pendle’s ecosystem also accrues points toward future airdrops – an often-overlooked source of alpha for savvy treasuries.

Yearn Finance yvUSDC/yvDAI Vaults: Automated Yield Optimization at Scale

Yearn Finance remains a powerhouse for DAOs seeking passive yet sophisticated yield farming. Its yvUSDC and yvDAI vaults aggregate capital across multiple lending protocols (including Aave, Compound, Morpho) to algorithmically chase the highest risk-adjusted returns without manual intervention. Yearn’s battle-tested smart contracts and real-time strategy rebalancing have made it a mainstay for organizations that value automation and transparency.

While current APYs on Yearn’s stablecoin vaults are typically lower than speculative DeFi plays (often ranging between 5%–7% APY), the protocol’s longevity and continuous strategy upgrades ensure that DAOs can deploy large sums with confidence. Yearn’s governance model also means active depositors may gain exposure to protocol-level decisions or future incentive programs.

Spark Protocol sDAI Vault: MakerDAO-Backed Stability Meets On-Chain Yield

Spark Protocol introduces the sDAI vault, a product deeply integrated with MakerDAO’s DAI Savings Rate (DSR) mechanism. This vault is engineered for DAOs prioritizing absolute stability and seamless access to on-chain yield. Spark’s sDAI vault directly leverages the underlying DSR, currently one of the most robust risk-free rates in DeFi, while layering in additional protocol incentives. As of October 2025, DAOs can earn a competitive APY that tracks above the base DSR, benefiting from Spark’s composability with other DeFi primitives and its close alignment with MakerDAO governance.

For treasuries seeking to park significant stablecoin reserves without sacrificing liquidity or exposure to smart contract innovation, Spark’s sDAI vault stands out. It also offers strategic optionality: by holding sDAI, DAOs may be eligible for future governance airdrops or Spark-native incentive programs as the protocol expands its ecosystem footprint. For deeper insight on how these mechanisms optimize security and returns, see our research on DAO treasury yield optimization.

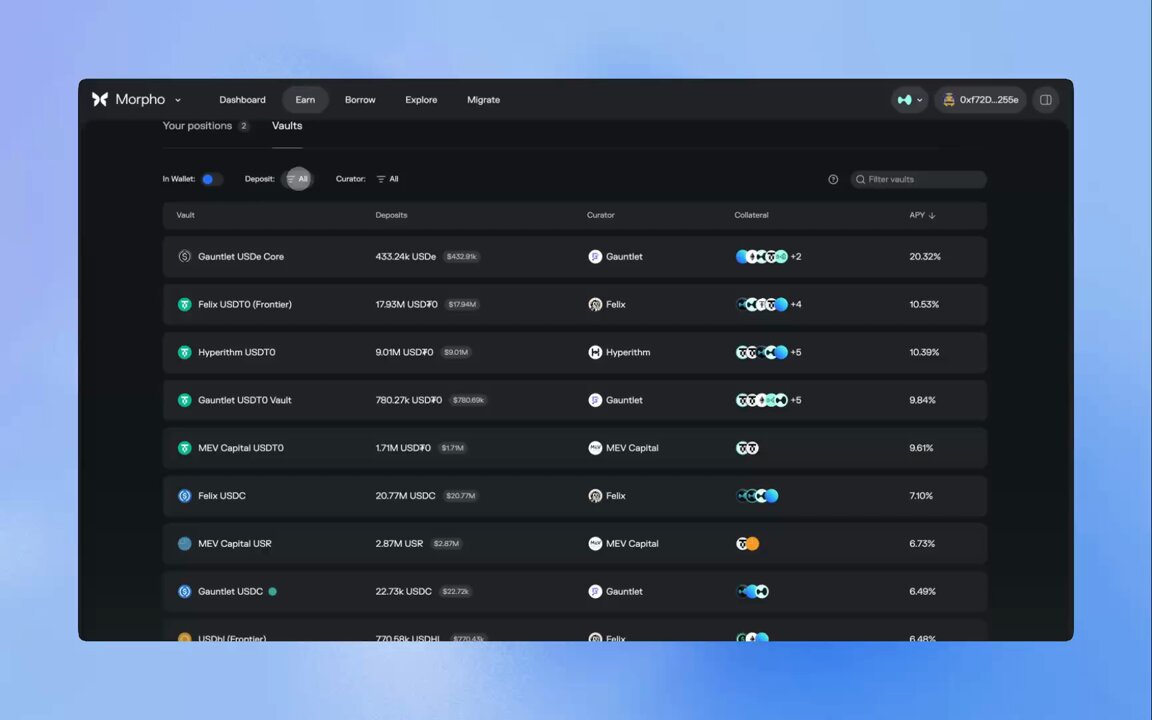

Morpho Blue USDC Lending Vault: Efficient Lending Aggregation with Custom Risk Controls

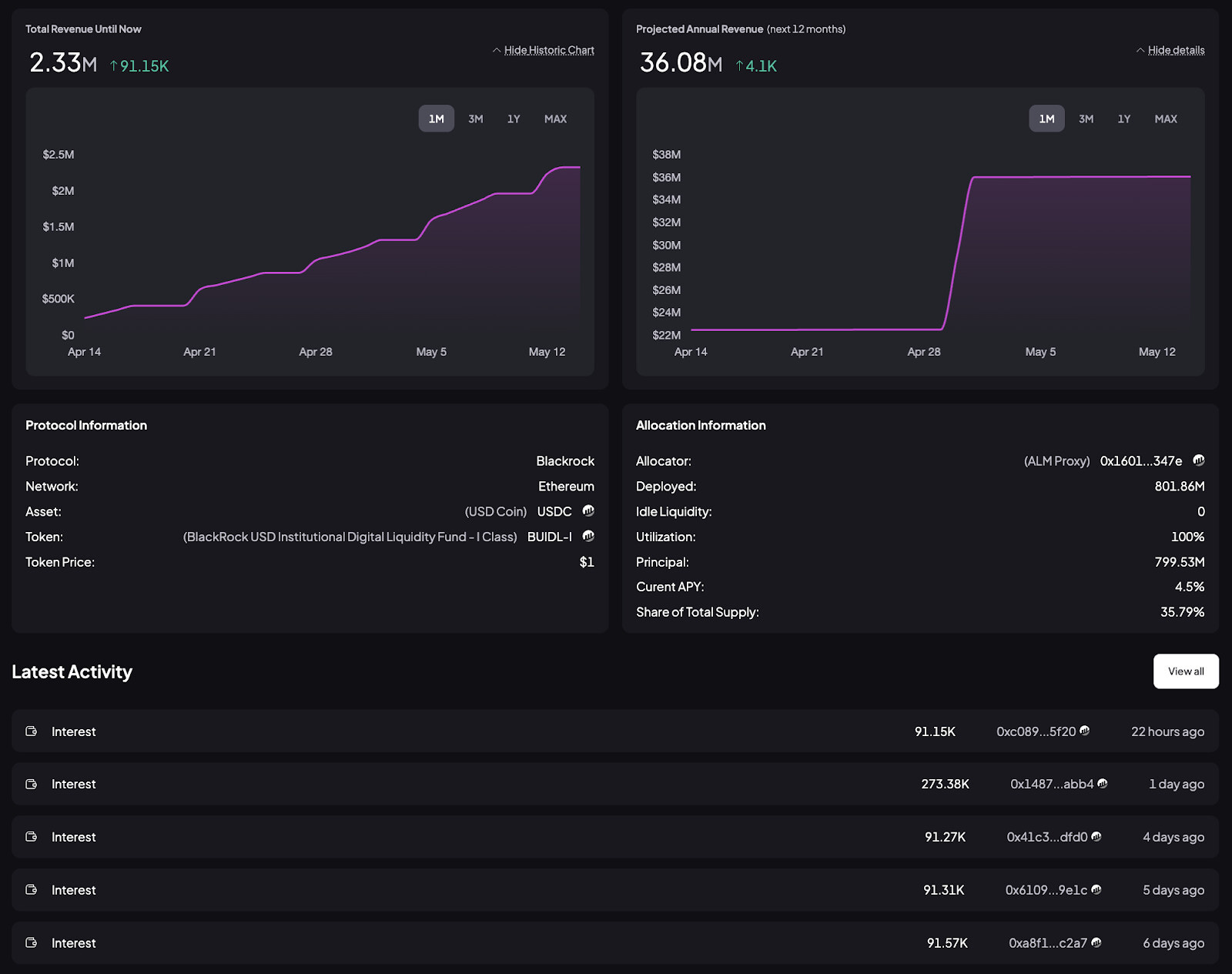

Morpho Blue is rapidly redefining lending markets by aggregating liquidity across major protocols while allowing users to tailor risk parameters at the strategy level. The Morpho Blue USDC lending vault has become a favorite among DAOs that want an edge in both APY and granular risk management. By routing deposits through platforms like Aave, Compound, and others, Morpho Blue dynamically optimizes for the best available rates, recently delivering yields that rival even aggressive yield farming strategies, all while maintaining a focus on security and transparency.

Morpho’s modular architecture means DAOs can fine-tune their exposure according to treasury mandates, whether targeting ultra-conservative lending or slightly higher-yielding pools with mild risk premiums. As an added bonus, active participation in Morpho Blue often accrues points toward protocol governance or future incentive distributions, a valuable consideration for organizations looking to maximize both yield and influence within the DeFi ecosystem.

Strategic Considerations for DAO Treasury Managers

The landscape of stablecoin vaults in 2024,2025 is defined by choice: from conservative blue-chip protocols like Aave V3 and Spark Protocol to innovative reward-maximizing strategies on Pendle Finance and Morpho Blue. The optimal allocation depends heavily on each DAO’s unique mix of liquidity needs, risk tolerance, and appetite for emerging opportunities like airdrop farming.

Key questions every treasury manager should ask:

- What is our required baseline liquidity versus lock-up flexibility?

- Are we optimizing solely for APY or also seeking protocol-native rewards/airdrops?

- How do we monitor evolving smart contract risks across multiple protocols?

- Do we have governance capacity to actively participate in protocol upgrades or incentive programs?

Diversification across these five leading stablecoin vaults provides a robust foundation for treasury growth while preserving optionality as DeFi continues to evolve rapidly. For tactical allocation models tailored to your organization’s profile, explore our step-by-step guides on optimizing DAO stablecoin vaults.

Checklist: Top 5 Stablecoin Vaults for DAO Treasuries (2024)

-

Aave V3 USDC Vault: A market-leading lending protocol offering robust security and a strong track record. The Aave V3 USDC Vault provides DAOs with competitive APYs (recently up to 4.67% APY), advanced risk controls, and deep liquidity for stablecoin management.

-

Pendle Finance USDT/USDC Yield Vault: Pendle enables users to separate and trade future yield, allowing DAOs to lock in fixed rates or speculate on variable returns. The Pendle Finance USDT/USDC Yield Vault is notable for high fixed APYs (up to 13.58%) and innovative airdrop farming opportunities.

-

Yearn Finance yvUSDC/yvDAI Stablecoin Vaults: Yearn automates yield optimization across DeFi protocols. Its yvUSDC and yvDAI vaults aggregate stablecoin deposits, auto-compound returns, and minimize risk via diversified strategies, making them a reliable choice for DAOs seeking passive yield.

-

Spark Protocol sDAI Vault: Built on MakerDAO infrastructure, the Spark Protocol sDAI Vault offers DAOs direct access to sDAI yields with high security and transparency. It supports flexible management of DAI-based treasury assets while earning competitive APY.

-

Morpho Blue USDC Lending Vault: Morpho Blue innovates on peer-to-peer lending, optimizing rates and reducing counterparty risk. The Morpho Blue USDC Lending Vault delivers attractive yields for DAOs, with efficient capital utilization and a focus on protocol safety.

Final Thoughts: Building Resilient On-Chain Treasuries in 2024

The best stablecoin vaults of 2024 offer more than just high APY, they provide DAOs with secure rails for automated asset management, built-in risk controls, and real opportunities to capture value from emerging airdrop ecosystems. By leveraging platforms like Aave V3 USDC Vault, Pendle Finance Yield Vaults, Yearn yvUSDC/yvDAI Vaults, Spark Protocol sDAI Vault, and Morpho Blue USDC Lending Vault, decentralized organizations can construct resilient portfolios that thrive across market cycles.

As always, rigorous due diligence remains paramount: monitor smart contract audits regularly, stay informed about protocol upgrades via governance forums and social channels, and allocate capital according to your DAO’s evolving mandate. For further reading on how DAOs are transforming their treasury management playbooks through advanced stablecoin strategies this year, and practical case studies, see our feature analysis on the revolution in DAO treasury management.