DAO treasuries are sitting at the heart of the decentralized revolution, but with great power comes a relentless need for security and efficiency. As DAOs scale, they face a critical challenge: how to protect their digital assets from volatility, operational risk, and ever-evolving threats, while still maximizing growth and transparency. Enter automated stablecoin vaults, the new standard for on-chain treasury management. These smart vaults are transforming how decentralized organizations secure their funds and empower communities to act swiftly without sacrificing safety.

1. Automated Stablecoin Vaults with Multi-Signature Access Controls

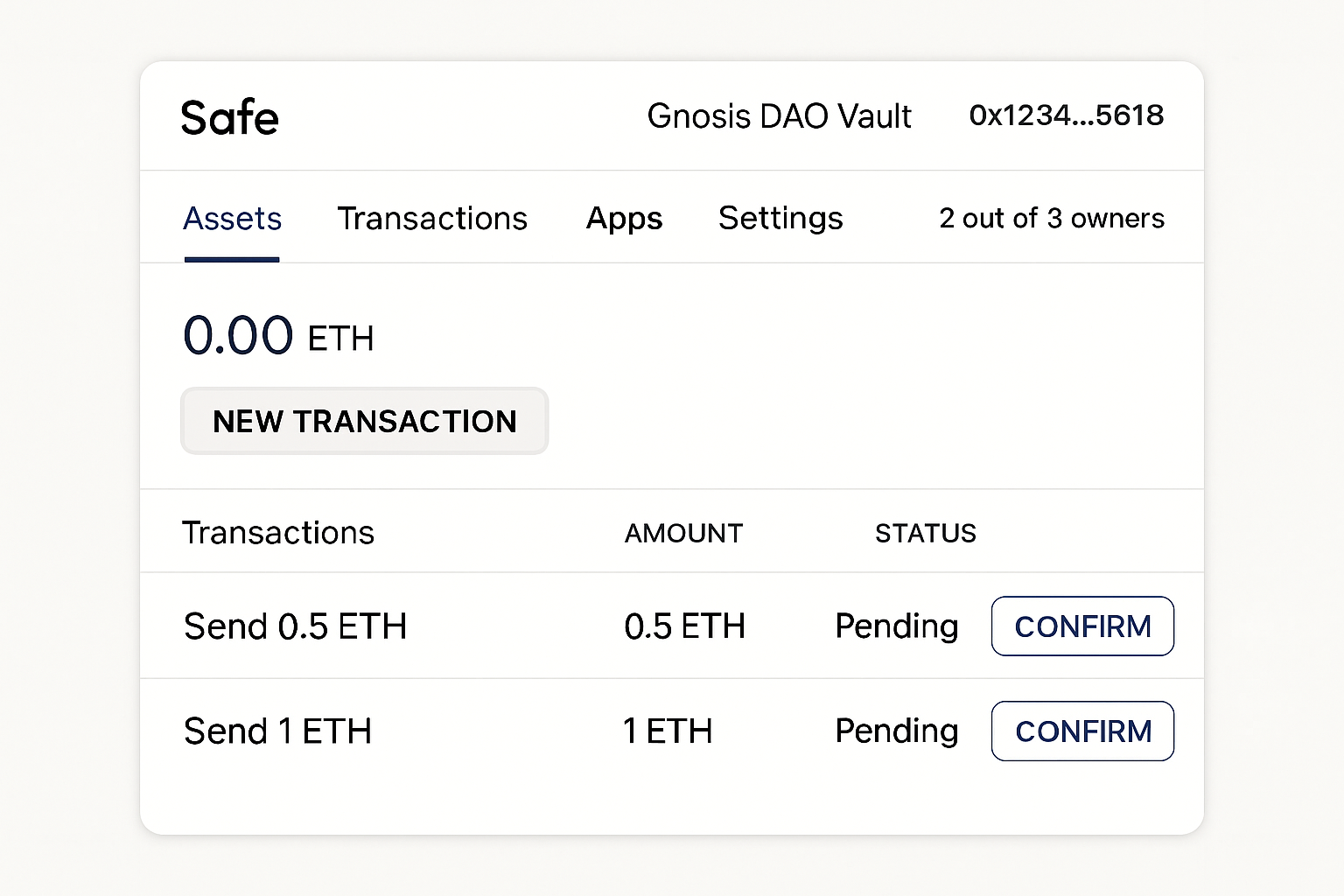

First up is the backbone of secure DAO treasury operations: automated stablecoin vaults enhanced with multi-signature (multisig) access controls. While traditional multisig wallets have long been a staple for safeguarding assets, today’s vault solutions go further by combining programmable automation with robust governance. Every treasury move, whether it’s deploying capital, rebalancing assets, or executing payments, requires consensus from multiple trusted signers, not just a single admin.

This approach drastically reduces the risk of unauthorized withdrawals or rogue proposals. Plus, automated workflows allow DAOs to set spending limits, time locks, and approval thresholds, all enforced by code, not trust. Whether you’re managing a $100,000 treasury or scaling into the millions, this structure is essential for both peace of mind and regulatory compliance.

Want to see how this works in practice? Check out our deep dive on how automated stablecoin vaults are revolutionizing on-chain DAO treasury management.

2. Real-Time Risk Monitoring and Automated Rebalancing Protocols

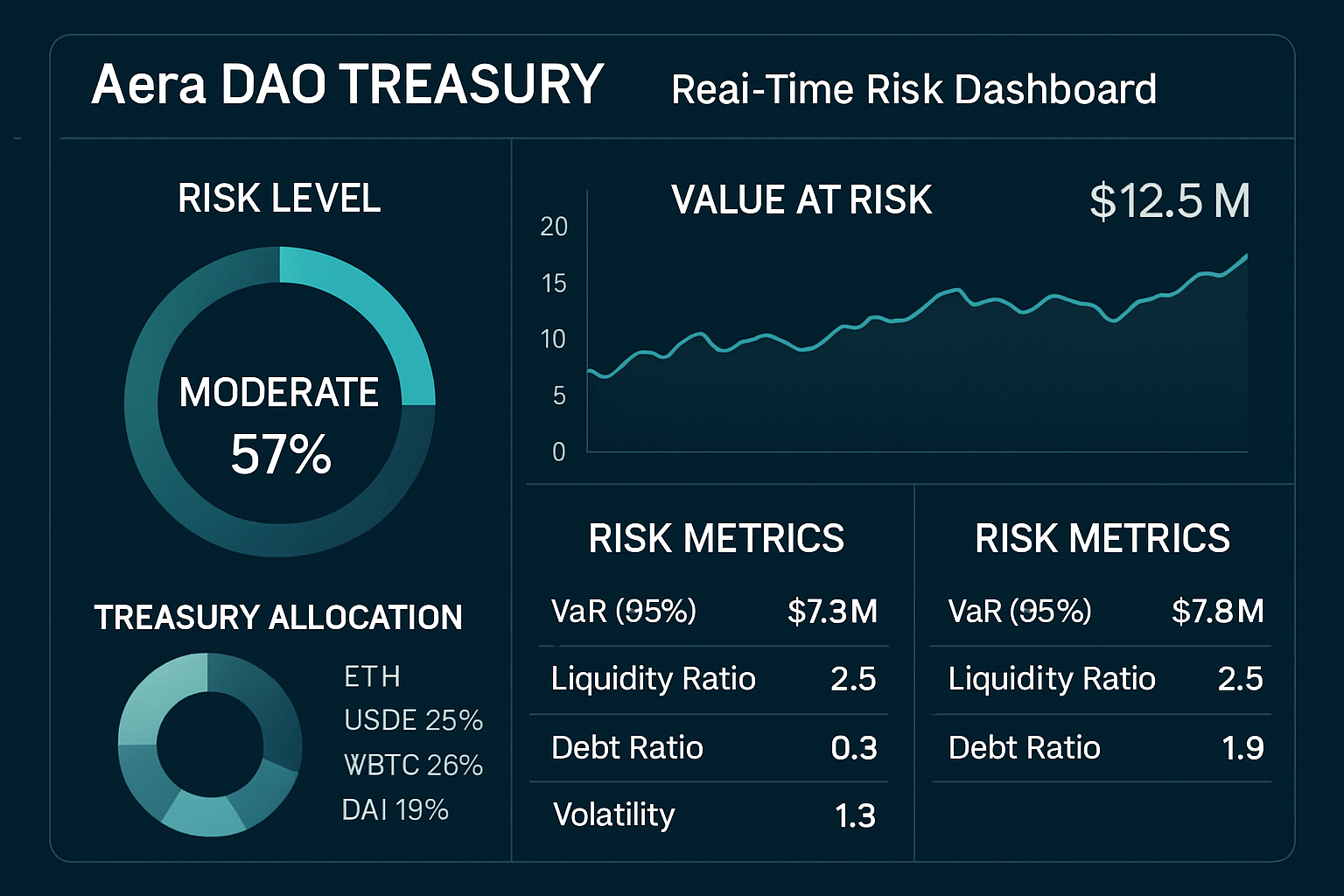

The next frontier is dynamic risk management. Crypto markets never sleep, and neither should your treasury’s defense mechanisms. Automated vault platforms now integrate real-time risk monitoring tools that constantly scan for threats, think depegs, liquidity crunches, or sudden governance token volatility. When the system detects anomalies or breaches predefined risk thresholds, it can automatically trigger rebalancing actions.

For example, if a stablecoin in your vault starts to lose its peg, smart contracts can shift assets into safer alternatives or diversify across multiple stablecoins in seconds, not hours or days. This agility is crucial for DAOs managing multi-million dollar treasuries where every minute counts. It’s not just about avoiding losses; it’s about seizing yield opportunities as market conditions change.

If you’re curious about how programmable strategies like these keep DAOs ahead of market shocks, explore our feature on how stablecoin vaults protect DAO treasuries during market volatility.

Top 3 Benefits of Automated Risk Monitoring for DAOs

-

Implement Automated Stablecoin Vaults with Multi-Signature Access Controls: Secure your DAO’s treasury by leveraging platforms like Safe (formerly Gnosis Safe) and Aera. These solutions combine automated stablecoin vaults with robust multi-signature access, ensuring that no single party can move funds unilaterally. This dramatically reduces the risk of unauthorized withdrawals and internal breaches.

-

Integrate Real-Time Risk Monitoring and Automated Rebalancing Protocols: Enhance treasury resilience by adopting platforms like Aera and Enzyme Finance. These tools provide real-time monitoring of asset exposure and automate rebalancing strategies, helping DAOs swiftly respond to market volatility and maintain optimal treasury allocations—without manual intervention.

-

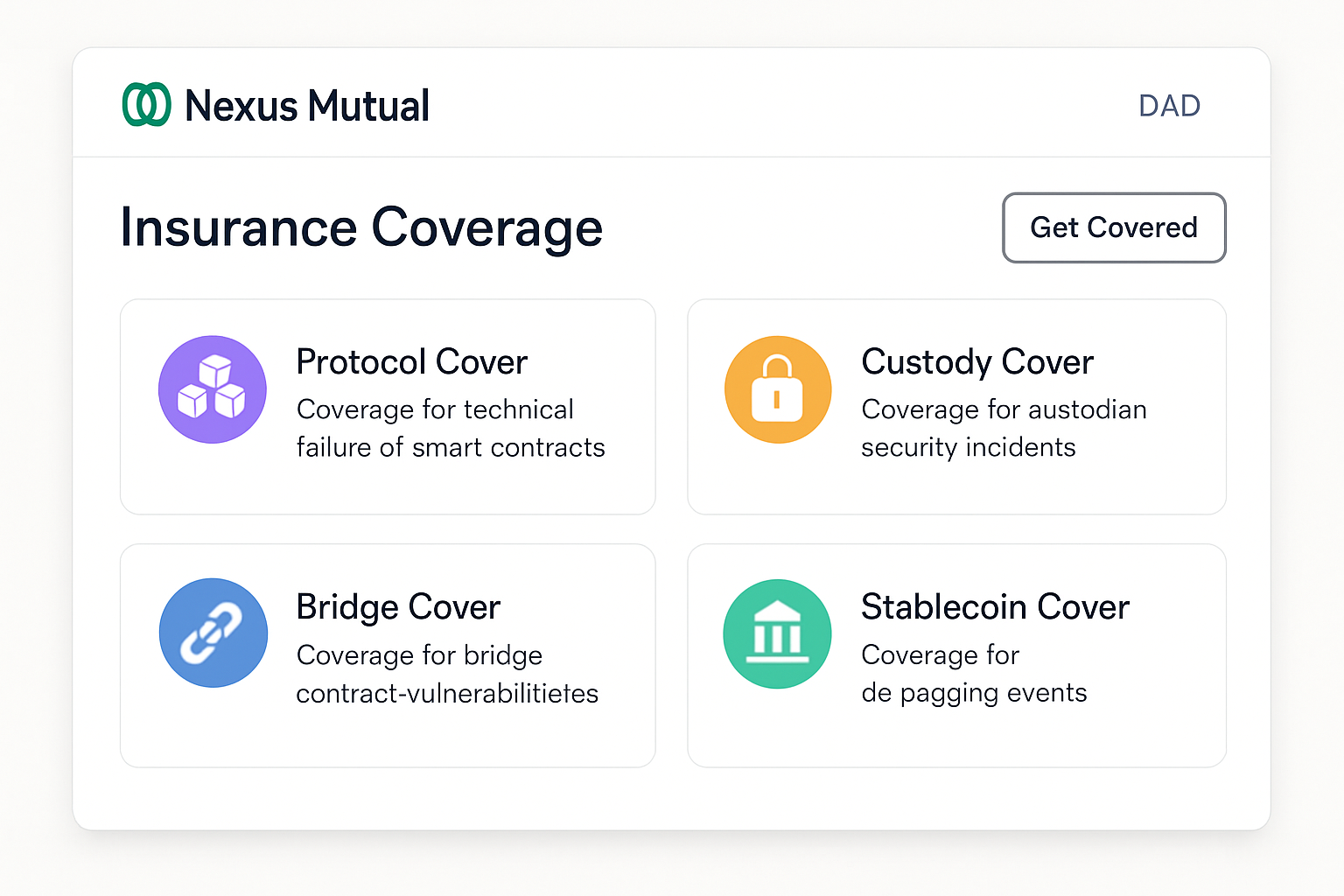

Utilize Decentralized Insurance Solutions for Treasury Asset Protection: Safeguard your DAO’s assets by integrating decentralized insurance providers like Nexus Mutual or InsurAce. These protocols offer on-chain coverage against smart contract exploits and protocol failures, giving DAOs an extra layer of protection and peace of mind.

3. Decentralized Insurance Solutions for Treasury Asset Protection

No matter how robust your access controls or risk engines are, black swan events can still strike. That’s why leading DAOs are now layering decentralized insurance solutions directly into their automated vault stack. These protocols allow treasuries to purchase on-chain coverage against smart contract exploits, depegs, or catastrophic failures, without relying on centralized insurers.

The result? If an exploit occurs or a major asset loses its value suddenly, the insurance protocol automatically pays out covered losses to the DAO’s treasury wallet. This additional layer of protection is critical for maintaining contributor trust and ensuring long-term solvency, even in turbulent markets.

This trifecta, multisig automation, real-time risk management, and decentralized insurance, is rapidly becoming best practice in DAO treasury security. Want step-by-step guidance? See our guide on how to set up automated stablecoin vaults for DAO treasury management.

But technology alone isn’t enough, community buy-in and transparency are just as vital. DAOs leveraging automated stablecoin vaults with these advanced controls often publish on-chain reports or real-time dashboards, so every member can verify balances, insurance status, and risk metrics at a glance. This level of radical transparency not only deters bad actors but also fosters a culture of shared responsibility and informed governance.

As more DAOs adopt these best-in-class strategies, we’re seeing measurable improvements in treasury resilience and operational agility. Automated rebalancing protocols have already proven their worth during recent market shocks, helping major DAOs avoid multi-million dollar losses by moving assets out of depegging stablecoins in real time. Meanwhile, decentralized insurance solutions are paying out claims faster than legacy providers ever could, keeping projects solvent and contributors engaged even during black swan events.

Actionable Next Steps for DAO Treasury Security

- Audit your current treasury setup: Are you using multisig controls? If not, this should be your first upgrade.

- Integrate automated risk monitoring: Choose a vault provider that offers real-time analytics and programmable rebalancing triggers.

- Add decentralized insurance coverage: Protect against the unexpected with on-chain policies tailored to your treasury’s unique risk profile.

The future of decentralized organization treasury management is composable, automated, and community-driven. By embracing these three pillars, multi-signature automation, dynamic risk management, and on-chain insurance, DAOs can finally move beyond reactive defense to proactive growth. The result is a treasury that’s not only secure but also flexible enough to seize new opportunities as they arise.

If you’re ready to safeguard your DAO’s assets for the long haul while maximizing efficiency, now’s the time to explore the latest generation of automated stablecoin vaults. For deeper insights into implementation strategies and real-world case studies, check out our resources on how DAOs can secure their treasury with automated stablecoin vaults.