Layer 1 stablechains are rapidly altering the landscape of DAO treasury management. As decentralized organizations seek greater efficiency, transparency, and risk mitigation, solutions like Stable: an EVM-compatible Layer 1 blockchain purpose-built for stablecoin transactions, are emerging as game-changers. The integration of stablecoins as native assets, combined with gas-free transfers and instant settlement, is not just a technical upgrade. It represents a fundamental shift in how DAOs can structure, protect, and grow their treasuries in an increasingly complex DeFi environment.

Why Layer 1 Stablechains Are a Breakthrough for DAO Treasuries

Traditional DAO treasury management has long relied on a patchwork of third-party stablecoins and cross-chain bridges, introducing layers of custodial risk and operational friction. With the advent of Layer 1 stablechains like Stable, DAOs can now leverage a blockchain infrastructure where stablecoins, such as USDT0, are native to the protocol. This means:

- No dependency on centralized issuers for asset movement

- Gas-free stablecoin transfers, dramatically reducing transaction costs

- Sub-second settlement speeds for treasury operations

- Direct plug-in to DeFi protocols for yield and liquidity strategies

The technical leap is significant. For example, USDT0 on Stable leverages the Layer Zero OFT standard, ensuring direct Tether redemptions on Ethereum while maintaining a strict 1: 1 backing with USDT. This architecture not only boosts security but also unlocks new capital efficiency for DAOs looking to optimize their reserves.

Decentralization and Security: Aligning with DAO Values

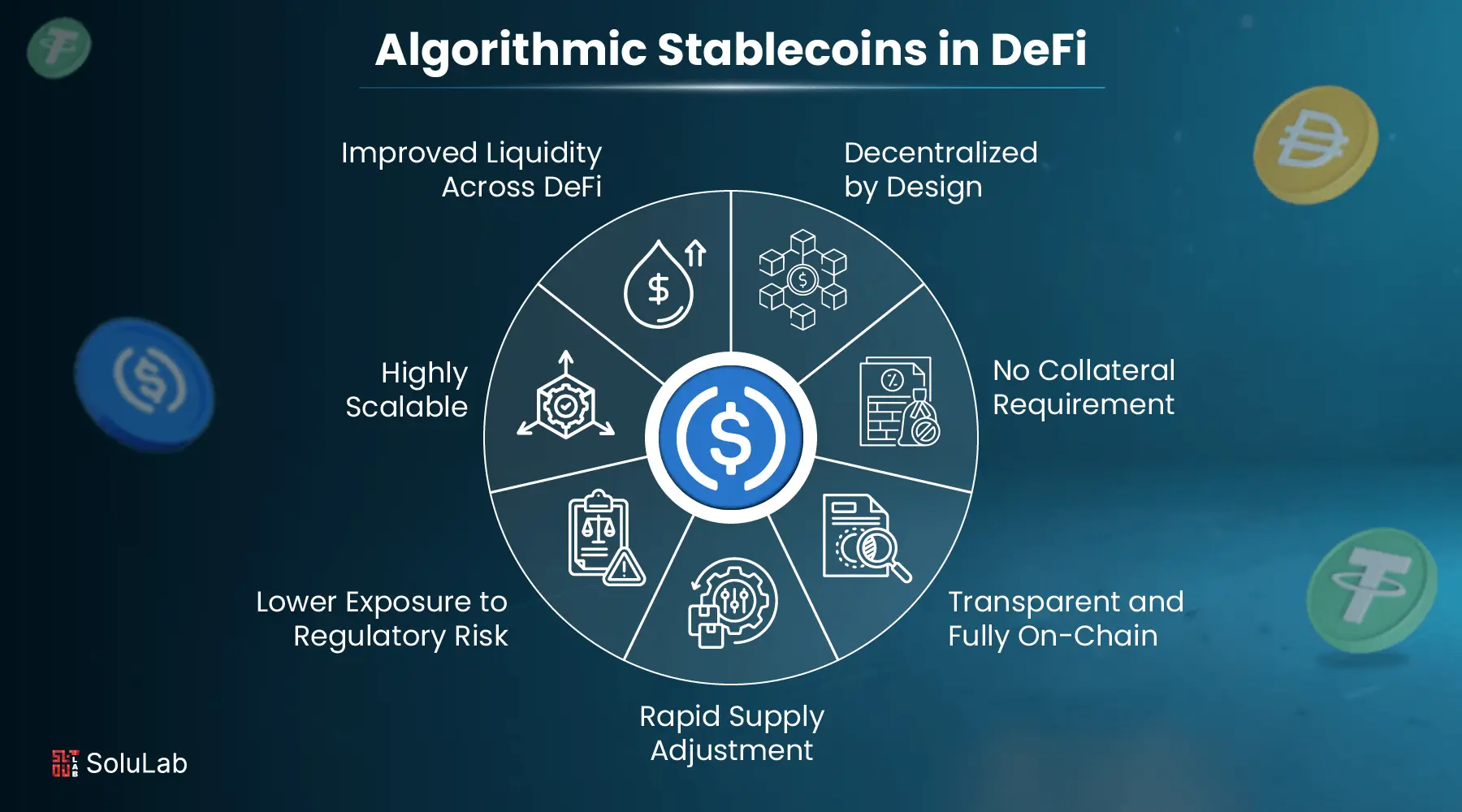

At the heart of every DAO is a commitment to decentralization and censorship resistance. Many legacy stablecoins, while popular, present notable risks: centralized issuers can freeze assets or face regulatory hurdles, threatening treasury autonomy. In contrast, stablecoins built directly into Layer 1 blockchains (such as LUSD by Liquity or USDT0 on Stable) are fully decentralized. Their value stability is maintained through smart contract logic and transparent collateralization, not opaque banking relationships.

This shift to stablecoin-native infrastructure aligns with the core ethos of DAOs. It ensures that treasuries remain accessible, auditable, and immune to single points of failure. For DAOs with global membership and cross-jurisdictional exposure, this level of security is not just desirable, it’s essential.

Key Advantages of Layer 1 Stablechains for DAO Treasuries

-

Enhanced Decentralization and Security: Layer 1 stablechains like Stable and Liquity’s LUSD operate on decentralized networks, ensuring stablecoins are censorship-resistant and governed by the community. This aligns with DAO principles and reduces reliance on centralized issuers.

-

Improved Capital Efficiency: Native stablecoins on Layer 1 chains, such as USDT0 and JANUS protocol’s stablecoin, utilize innovative stabilization mechanisms and multi-collateral models, allowing DAOs to optimize capital allocation and maintain peg stability.

-

Risk Mitigation and Diversification: By incorporating decentralized stablecoins like LUSD, DAOs can diversify away from centralized assets (e.g., USDC, USDT), lowering risks of censorship or regulatory intervention and enhancing treasury resilience.

-

Yield Generation Opportunities: Layer 1 stablecoins can be deployed in DeFi protocols for lending, liquidity provision, or yield farming, enabling DAOs to earn interest and grow their treasuries over time.

Capital Efficiency and Gas-Free Operations

One of the most compelling innovations brought by Layer 1 stablechains is the elimination of gas fees for core stablecoin transactions. On Stable, USDT serves as both the settlement asset and the gas token, enabling gas-free stablecoin transfers. This is particularly impactful for DAOs executing frequent rebalancing, payroll disbursements, or liquidity provisioning.

Moreover, advanced mechanisms such as multi-collateralization and AI-driven stabilization (as seen in protocols like JANUS) further enhance capital efficiency. DAOs can now deploy treasury assets with minimal slippage and optimal utilization, maximizing both safety and yield potential without the drag of excessive fees or bridge risks.

For a deeper dive into how these innovations are reshaping the space, see How Stablecoin-Native Blockchains Are Transforming DAO Treasury Management.

Gas-free operations are not just a cost-saving measure, they fundamentally alter the economics of DAO treasury management. By removing friction from treasury movements, DAOs can rebalance portfolios, execute automated yield strategies, and respond to market opportunities in real time. This agility is especially valuable during periods of market volatility, when speed and efficiency can make the difference between safeguarding assets and incurring losses.

“The ability to move stablecoins natively and instantly, without worrying about gas fees, is a game changer for DAOs managing large treasuries. It unlocks a new level of operational flexibility and risk management. “: Claire Benton, CFA

Cross-Chain Liquidity and Treasury Diversification

Another breakthrough enabled by Layer 1 stablechains is seamless cross-chain liquidity. With innovations like USDT0, DAOs can move stable value across multiple blockchains while maintaining strict 1: 1 backing with USDT. This cross-chain capability reduces fragmentation and enables treasuries to diversify across ecosystems without exposure to bridge risks or custodial bottlenecks.

For example, a DAO can allocate assets on Stable for gas-free operations, while simultaneously deploying liquidity on other EVM-compatible chains. This flexibility supports advanced treasury strategies such as risk-adjusted yield farming, liquidity mining, and hedged positions, all while keeping the core stablecoin exposure decentralized and secure.

Yield Generation and Sustainable Growth

Yield generation remains a cornerstone of DAO treasury management. Layer 1 stablechains facilitate this with native integrations into DeFi protocols, lending, staking, and automated market makers, while ensuring that yield strategies remain transparent and on-chain. The composability of these ecosystems means DAOs can automate complex strategies, such as liquidity provision or collateralized lending, with reduced operational risk.

By utilizing stablecoins like USDT0 or LUSD directly within these protocols, DAOs not only earn competitive yields but also retain full control over their assets. This is a marked improvement over legacy systems, where yield opportunities often came with hidden custodial or counterparty risks. The result is a more robust, resilient treasury that can weather market cycles and regulatory shifts.

Top DAO Treasury Strategies Enabled by Layer 1 Stablechains

-

Holding Decentralized Stablecoins Like LUSD for Censorship ResistanceDAOs can enhance security and decentralization by allocating treasury funds to fully decentralized stablecoins such as LUSD (by Liquity), which is solely backed by ETH and immune to centralized control or asset freezes.

-

Utilizing Native Stablecoins for Gas-Free, Low-Cost TransactionsLayer 1 stablechains like Stable enable DAOs to perform treasury operations using native stablecoins (e.g., USDT0) as gas, resulting in gas-free or ultra-low-cost transfers and settlements.

-

Diversifying Treasury Assets Across Multiple Layer 1 StablecoinsBy holding a mix of decentralized stablecoins (e.g., LUSD), multi-collateral stablecoins (e.g., DAI), and stablechain-native tokens (e.g., USDT0), DAOs can reduce exposure to single points of failure and regulatory risk.

-

Deploying Stablecoins in DeFi Protocols for Yield GenerationDAOs can use Layer 1 stablechain assets in lending platforms, liquidity pools, or automated market makers (AMMs) to earn interest or fees, thereby increasing treasury returns while maintaining value stability.

-

Leveraging Cross-Chain Stablecoin Solutions for Enhanced LiquidityWith cross-chain stablecoins like USDT0 (powered by LayerZero OFT), DAOs can move stable value seamlessly between blockchains, improving treasury liquidity and access to diverse DeFi ecosystems.

The Road Ahead: Compliance, Transparency, and On-Chain Governance

As regulatory scrutiny of stablecoins intensifies globally, Layer 1 stablechains offer a transparent, auditable alternative for DAOs. Every transaction, collateralization event, and governance action is written immutably on-chain. This level of transparency not only satisfies compliance requirements but also builds trust among DAO members and external stakeholders.

Looking forward, the combination of decentralized treasury tools, programmable yield strategies, and cross-chain interoperability positions Layer 1 stablechains as the backbone of future DAO finance. As more DAOs migrate to these infrastructures, expect to see rapid innovation in treasury analytics, automated risk management, and even AI-driven asset allocation, all powered by stablecoin-native blockchains.

For further insights and advanced guides, visit How Stablecoin-Native Blockchains Like Stable Are Transforming On-Chain Treasury Management.