DAO treasury diversification isn’t just a buzzword, it’s the backbone of resilient, future-proof decentralized organizations. In 2025, as market volatility and regulatory scrutiny intensify, DAOs can’t afford to sit on their native tokens and hope for the best. The smartest treasuries are leveraging stablecoins and automation to lock in stability, maximize yield, and bulletproof their operations.

Why Stablecoin Diversification is Non-Negotiable

Relying on a single stablecoin is like putting all your chips on one number at the roulette table, risky and unnecessary. Even the most established stablecoins (think USDC, DAI, TUSD, USDT) have faced technical hiccups or regulatory headwinds. That’s why allocating treasury holdings across multiple stablecoins is mission-critical. This spreads counterparty and depeg risks while ensuring your DAO has uninterrupted access to operational capital if one asset stumbles.

Top Strategies & Tools for DAO Stablecoin Diversification

-

Allocate Treasury Holdings Across Multiple Stablecoins (e.g., USDC, DAI, TUSD, and USDT) to mitigate counterparty and depeg risks. Diversifying stablecoin exposure protects the treasury from regulatory shocks or technical failures affecting any single asset.

-

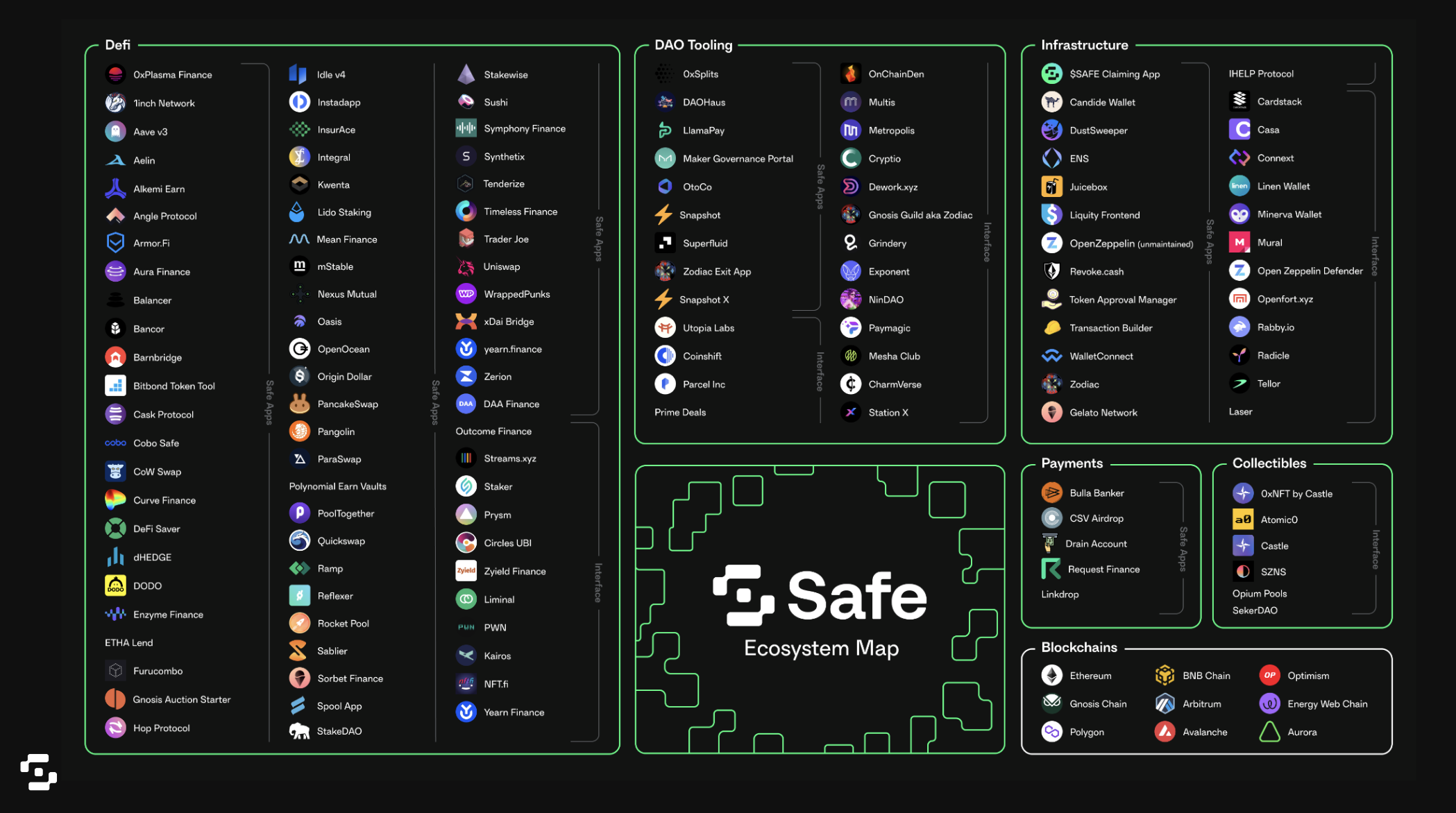

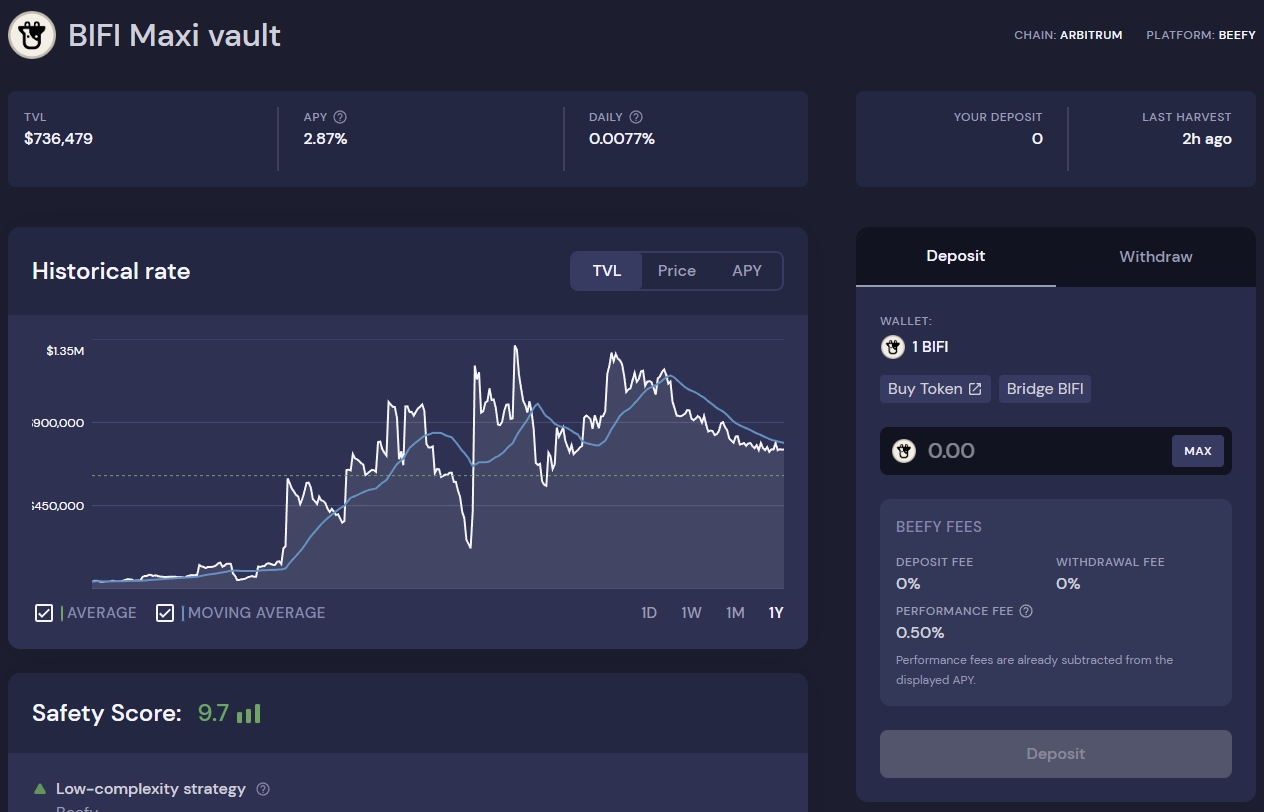

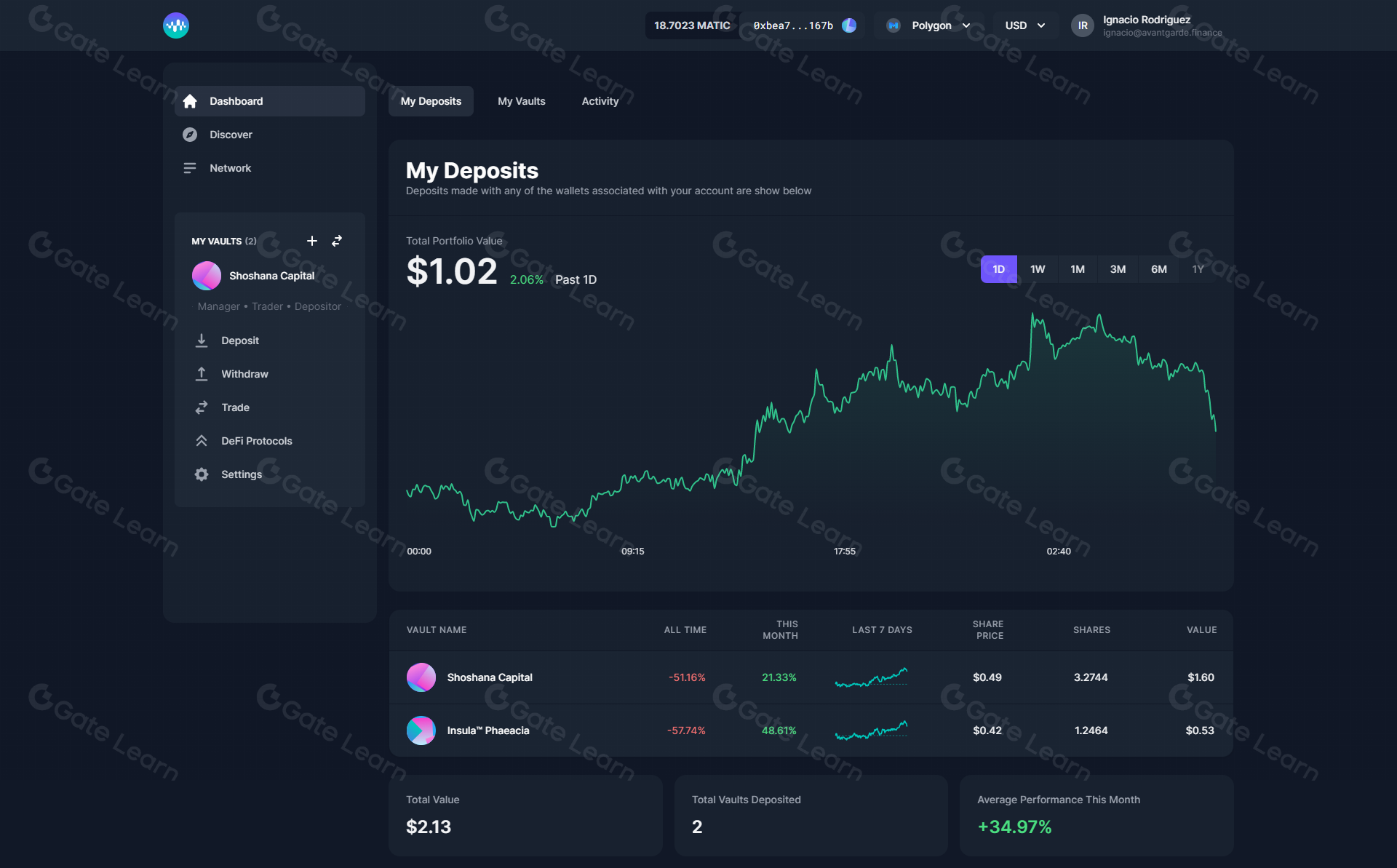

Utilize Decentralized Stablecoin Vaults (such as Yearn Finance or Beefy) for automated yield generation while maintaining on-chain transparency. These platforms optimize stablecoin returns through smart contract strategies.

-

Implement Automated Rebalancing Protocols (like Balancer or Enzyme Finance) to maintain target stablecoin allocations and reduce manual intervention. Automation ensures consistent portfolio risk management.

-

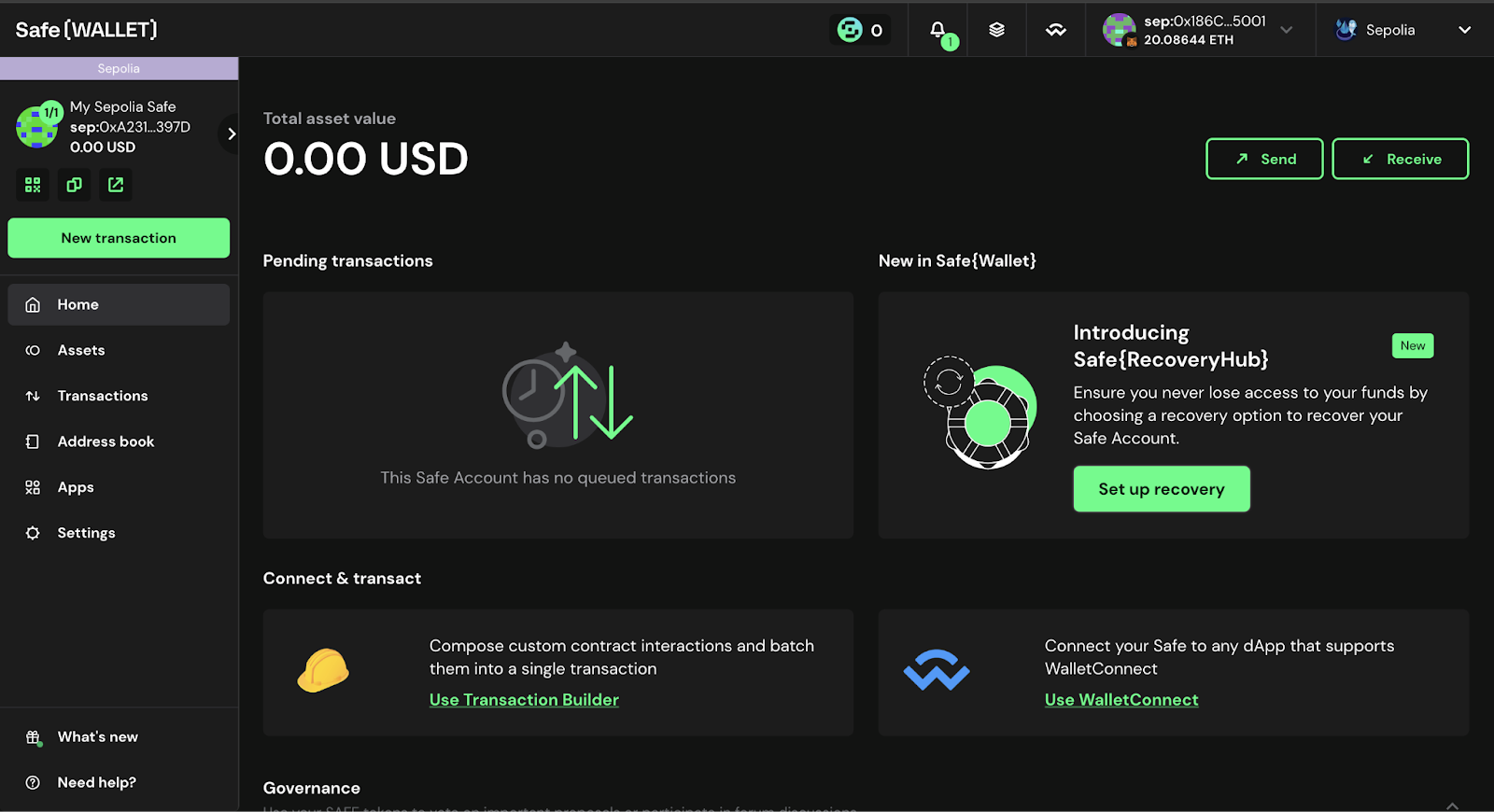

Adopt Multi-Signature Wallets and Permissioned Access Controls (e.g., Gnosis Safe) to enhance security and governance over stablecoin assets. Multi-sig wallets require multiple approvals for transactions, reducing the risk of unauthorized access.

-

Regularly Conduct On-Chain Audits and Real-Time Monitoring Using Analytics Tools (such as Nansen or Dune Analytics) for compliance, risk assessment, and treasury health. These tools provide actionable insights and transparency for DAO stakeholders.

This multistablecoin approach isn’t theory, it’s best practice among leading DAOs. By holding a blend of assets, you sidestep catastrophic losses if any single coin falters. The Sushi DAO and Lido proposals are prime examples: both projects diversified into a basket of stablecoins to buffer against market shocks and regulatory clampdowns.

Automated Yield Generation with Decentralized Stablecoin Vaults

Letting your stablecoins sit idle is leaving money on the table. Enter decentralized stablecoin vaults like Yearn Finance or Beefy. These protocols automate yield generation by routing your assets through optimized DeFi strategies, think lending, liquidity provision, or arbitrage, while keeping everything transparent and auditable on-chain.

The beauty? Automation slashes manual overhead and emotion-driven errors. Your DAO earns passive income with minimal effort, compounding returns that can be reinvested for growth or used to cover expenses during bear markets. For a deep dive into how these vaults protect treasuries during turbulent periods, check out this guide.

The Power of Automated Rebalancing Protocols

If you’re manually rebalancing your treasury every week, you’re doing it wrong (and wasting precious governance time). Automated rebalancing protocols like Balancer or Enzyme Finance take this pain away by continuously adjusting your allocations to maintain target weights across multiple stablecoins.

This not only reduces manual intervention but also ensures your risk profile remains aligned with DAO objectives, even as market conditions shift rapidly. Automation here means less human error, lower transaction costs, and more predictable treasury performance.

- Balancer: Customizable pools that auto-rebalance based on predefined ratios.

- Enzyme Finance: On-chain asset management with programmable rulesets for rebalancing and reporting.

If you want to see how these strategies stack up in real-world scenarios, and which protocols deliver consistent results, read our analysis at Analyzing DAO Treasury Diversification Strategies in 2024.

Securing DAO Assets with Multi-Signature Wallets

Automation and diversification are powerful, but without robust security, your treasury is one hack away from disaster. That’s why multi-signature wallets and permissioned access controls (think Gnosis Safe) are the gold standard for DAO stablecoin management. Multi-sig wallets require multiple trusted signers to approve any transaction, slashing the risk of insider theft, rogue proposals, or single-point compromises.

Gnosis Safe, for example, lets DAOs set custom approval thresholds and granular permissions. This means your stablecoin reserves can’t be drained by a single bad actor or compromised key. Layered governance and transparent transaction logs keep your community in the loop and your assets locked down tight.

Want to see how secure wallet infrastructure fits into the bigger picture? Our coverage of how stablecoin vaults are reshaping DAO treasury management in 2025 breaks it all down.

Real-Time Monitoring and On-Chain Audits

Set-it-and-forget-it doesn’t cut it in DeFi. Regular on-chain audits and real-time monitoring are essential for compliance, risk assessment, and maintaining DAO trust. Tools like Nansen and Dune Analytics empower treasurers to track every stablecoin movement, flag anomalies, and generate transparent reports for the community.

These analytics platforms provide dashboards for real-time treasury health, historical performance, and wallet activity. Spot an unexpected outflow or a depeg event? You’ll know about it instantly, not after the damage is done. Proactive monitoring means you can pivot fast, whether it’s reallocating assets, pausing protocols, or initiating emergency governance votes.

For practical guidance on optimizing your monitoring stack and keeping your treasury audit-ready, explore our resource: How to Optimize DAO Stablecoin Vaults for Consistent Yield and Low Risk in 2024.

The DAO Treasury Diversification Playbook

Let’s recap the five essential moves for bulletproof DAO treasury diversification using stablecoins:

Top 5 Strategies & Tools for DAO Stablecoin Diversification

-

Allocate Treasury Holdings Across Multiple Stablecoins (e.g., USDC, DAI, TUSD, and USDT) to mitigate counterparty and depeg risks. Diversifying across reputable stablecoins reduces exposure to the failure or depegging of any single asset, strengthening the treasury’s resilience.

-

Utilize Decentralized Stablecoin Vaults (such as Yearn Finance or Beefy) for automated yield generation while maintaining on-chain transparency. These platforms optimize returns by auto-compounding stablecoin deposits and provide clear, auditable transaction histories.

-

Implement Automated Rebalancing Protocols (like Balancer or Enzyme Finance) to maintain target stablecoin allocations and reduce manual intervention. These tools ensure your treasury stays aligned with diversification goals, even as market conditions shift.

-

Adopt Multi-Signature Wallets and Permissioned Access Controls (e.g., Gnosis Safe) to enhance security and governance over stablecoin assets. Multi-sig wallets require multiple approvals for transactions, protecting funds from single points of failure or unauthorized access.

-

Regularly Conduct On-Chain Audits and Real-Time Monitoring using analytics tools (such as Nansen or Dune Analytics) for compliance, risk assessment, and treasury health. These platforms provide powerful insights into asset flows, wallet activity, and risk exposure.

Every one of these best practices is about more than just risk reduction. It’s about empowering DAOs to operate confidently, no matter what the market throws at them. Diversifying across stablecoins, automating yield and rebalancing, locking down security with multi-sig, and keeping eyes on every transaction, these aren’t optional anymore. They’re the new baseline for serious decentralized finance treasury management.

Ready to take your DAO’s treasury security and yield to the next level? Dive into our expert insights on best stablecoin vault strategies for DAO treasuries and build a playbook that thrives in any market.