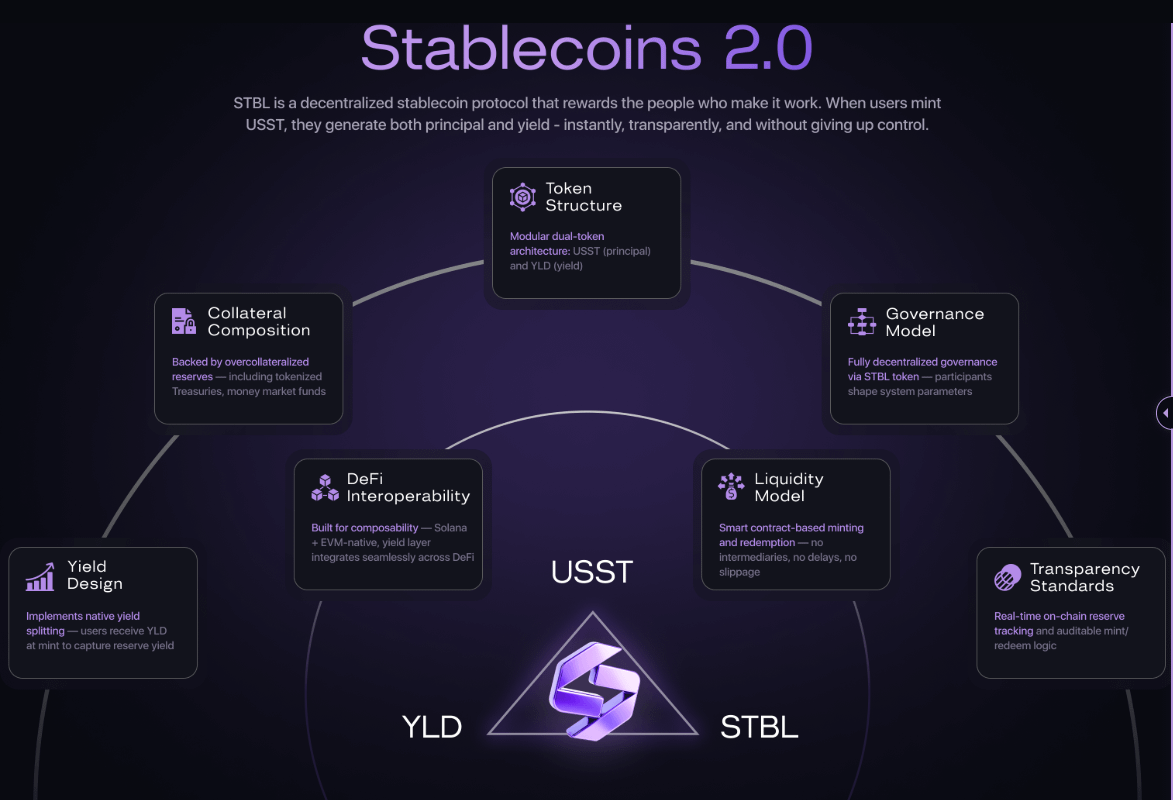

The rapid evolution of decentralized finance (DeFi) has put a spotlight on the limitations of traditional stablecoins for on-chain treasury management. As DAOs, DeFi protocols, and crypto-native funds seek both stability and yield, RWA-backed stablecoins like $STBL are emerging as the new backbone for digital asset treasuries. These innovative assets blend the transparency and programmability of blockchain with the trust and yield of real-world financial instruments, reshaping how organizations manage risk, optimize liquidity, and pursue sustainable returns.

Why RWA-Backed Stablecoins Are Gaining Momentum in 2025

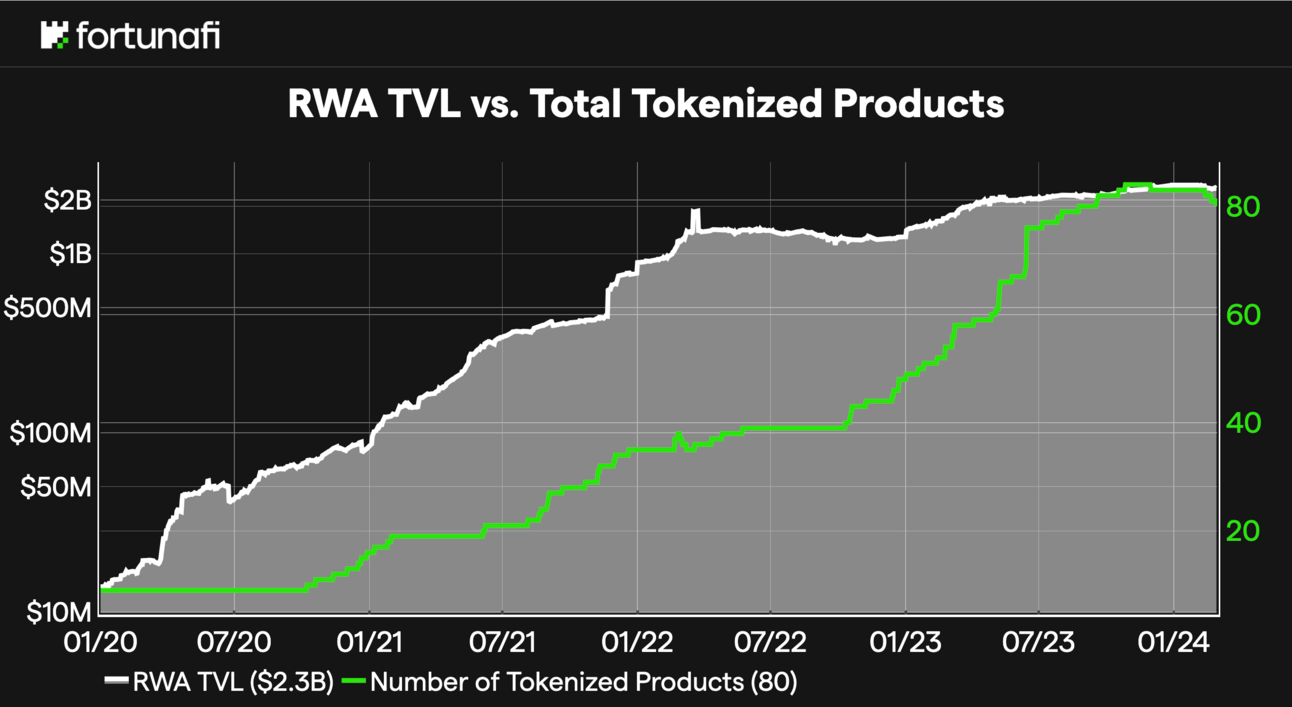

In the wake of volatile macroeconomic cycles and increased regulatory scrutiny, the market is demanding stablecoin solutions that go beyond the simple fiat peg. RWA-backed stablecoins, collateralized by tokenized real-world assets such as U. S. Treasuries and bank deposits, have surged in popularity. According to the latest industry data, the RWA tokenization sector exploded from $5 billion in 2022 to over $24 billion by June 2025, a staggering 380% increase, making it crypto’s second fastest-growing segment.

What sets protocols like STBL apart is their ability to deliver both on-chain liquidity and off-chain yield. By integrating assets like Ondo Finance’s USDY, a tokenized, yield-bearing instrument backed by short-term U. S. Treasuries, STBL enables DAOs and treasuries to mint USST, a USD-pegged stablecoin, while retaining access to yield through YLD tokens. This structure is a leap forward for DeFi treasury optimization, allowing organizations to put idle capital to work without sacrificing transactional flexibility or compliance.

$STBL at $0.0954: A New Paradigm for On-Chain Treasury Stability

As of today, $STBL trades at $0.0954, reflecting its position as a next-generation stablecoin protocol with a sophisticated three-token system. The 24-hour range has seen $STBL fluctuate between $0.0949 and $0.1382, with a modest change of -0.2519%. This price action underscores the protocol’s growing role in the DeFi ecosystem, especially as it leverages institutional-grade collateral for its USST stablecoin.

STBL’s partnership with Ondo Finance is a pivotal development, unlocking up to $50 million in USST minting capacity. The integration of USDY as primary collateral not only enhances stability but also provides a compliant, yield-generating foundation for DAOs and crypto treasuries. For organizations managing multi-million dollar treasuries, this means access to a stablecoin that is both resilient and productive, backed by real-world assets and transparent on-chain governance.

Yield Separation: Unlocking New Treasury Strategies

The yield separation mechanism at the heart of STBL’s architecture is a game changer for decentralized treasury management. By splitting the principal (USST) from the yield (YLD), DAOs and DeFi protocols can more efficiently allocate resources. For example, a DAO can hold USST for operational expenses and liquidity needs while simultaneously selling or staking YLD tokens to optimize risk-adjusted returns.

This dual-token model not only enhances transparency but also empowers organizations to fine-tune their treasury strategies. The result is a more agile and diversified treasury, capable of weathering market volatility and regulatory shifts. As more projects recognize the value of stablecoin 2.0 models, the adoption curve for RWA-backed solutions like STBL is expected to accelerate.

STBL Price Prediction 2026-2031

Professional outlook based on RWA-backed stablecoin adoption, market trends, and technological/regulatory developments.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.09 | $0.12 | $0.18 | +25.8% | Gradual adoption in DeFi, continued RWA growth, but volatile regulatory climate keeps min price near $0.09. |

| 2027 | $0.11 | $0.16 | $0.27 | +33.3% | Deeper integration with institutional finance, increased USST minting capacity, and improved DeFi yields drive demand. |

| 2028 | $0.14 | $0.21 | $0.36 | +31.3% | RWA-backed stablecoins become the backbone of on-chain treasury management; regulatory clarity in US/EU boosts confidence. |

| 2029 | $0.16 | $0.27 | $0.45 | +28.6% | STBL benefits from network effects, DAO treasury adoption, and expansion into new markets (Asia, LatAm). |

| 2030 | $0.19 | $0.33 | $0.56 | +22.2% | Stablecoin sector consolidation; STBL remains a top RWA governance token, though competition from new protocols increases. |

| 2031 | $0.22 | $0.41 | $0.71 | +24.2% | Matured RWA markets, mainstream institutional adoption, and on-chain treasury management as standard practice. |

Price Prediction Summary

STBL is positioned for significant growth as RWA-backed stablecoins gain traction for on-chain treasury management. With its innovative three-token system, partnerships with institutional-grade RWA providers, and rising DeFi/DAO adoption, STBL’s price could see steady, logical appreciation through 2031. Volatility and regulatory shifts remain, but the average price trend is bullish as the sector matures.

Key Factors Affecting STBL Price

- Acceleration in RWA tokenization and integration with DeFi protocols.

- Institutional adoption of on-chain treasury tools and stablecoins.

- Expansion of STBL’s ecosystem (USST minting, YLD tokens, governance upgrades).

- Regulatory clarity in major markets (US, EU, Asia).

- Partnerships with RWA issuers like Ondo Finance and major DeFi protocols.

- Competition from other RWA-backed stablecoins and new entrants.

- Macro market cycles and risk appetite for crypto assets.

- Technical upgrades and security of the STBL protocol.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Institutional Adoption and Regulatory Clarity

One of the driving forces behind the rise of RWA-backed stablecoins is the growing appetite from institutional players. With frameworks for compliance and risk management maturing, products like USST and YLD are positioned to meet the needs of both crypto-native and traditional finance organizations. The partnership with Ondo Finance, known for its institutional-grade controls, further cements STBL’s reputation as a trusted solution for on-chain treasury management.

As regulatory clarity improves and tokenized real-world assets become more accessible, DAOs and DeFi treasuries will increasingly allocate capital to yield-bearing stablecoin vaults backed by RWAs. This trend is already evident in the surge of on-chain cash management solutions that blend blockchain efficiency with real-world trust, driving broader adoption across the digital asset landscape.

Beyond yield and compliance, the transparency of on-chain governance is a defining feature of the STBL stablecoin treasury ecosystem. The protocol’s governance token, $STBL, not only accrues value as adoption grows but also gives holders a direct voice in risk management, collateral allocation, and protocol upgrades. This participatory model stands in stark contrast to opaque, black-box stablecoin issuers, aligning incentives and fostering a resilient community.

For DAOs and DeFi treasuries, the practical impact is profound. Liquidity managers can now construct treasury portfolios that balance operational liquidity (via USST), passive yield (via YLD), and protocol influence (via $STBL) in a way that was simply not possible with legacy stablecoins. This modular approach unlocks a new era of DeFi treasury optimization, enabling organizations to adapt rapidly as market conditions change.

Key Benefits for DAOs and Crypto Treasuries

Top 5 Advantages of RWA-Backed Stablecoins for On-Chain Treasuries

-

Enhanced Stability Through Real-World Collateral: RWA-backed stablecoins like USST are collateralized by tangible assets such as short-term U.S. Treasuries and bank deposits, providing a robust foundation that reduces volatility compared to algorithmic or crypto-only stablecoins.

-

On-Chain Yield Generation: With protocols like STBL and its integration of Ondo Finance’s USDY, treasuries can earn yield from real-world assets while maintaining on-chain liquidity. The innovative yield-splitting model allows organizations to hold stablecoins for transactions and separately claim yield via YLD NFTs.

-

Regulatory Clarity & Institutional Adoption: RWA-backed stablecoins benefit from clearer regulatory frameworks, as seen with USDY’s institutional-grade compliance. This fosters greater trust among enterprises and paves the way for broader adoption by DAOs and corporate treasuries.

-

Efficient Treasury Management & Liquidity: The ability to mint stablecoins like USST against RWAs enables organizations to optimize idle capital, automate cash management, and maintain instant access to funds for on-chain operations.

-

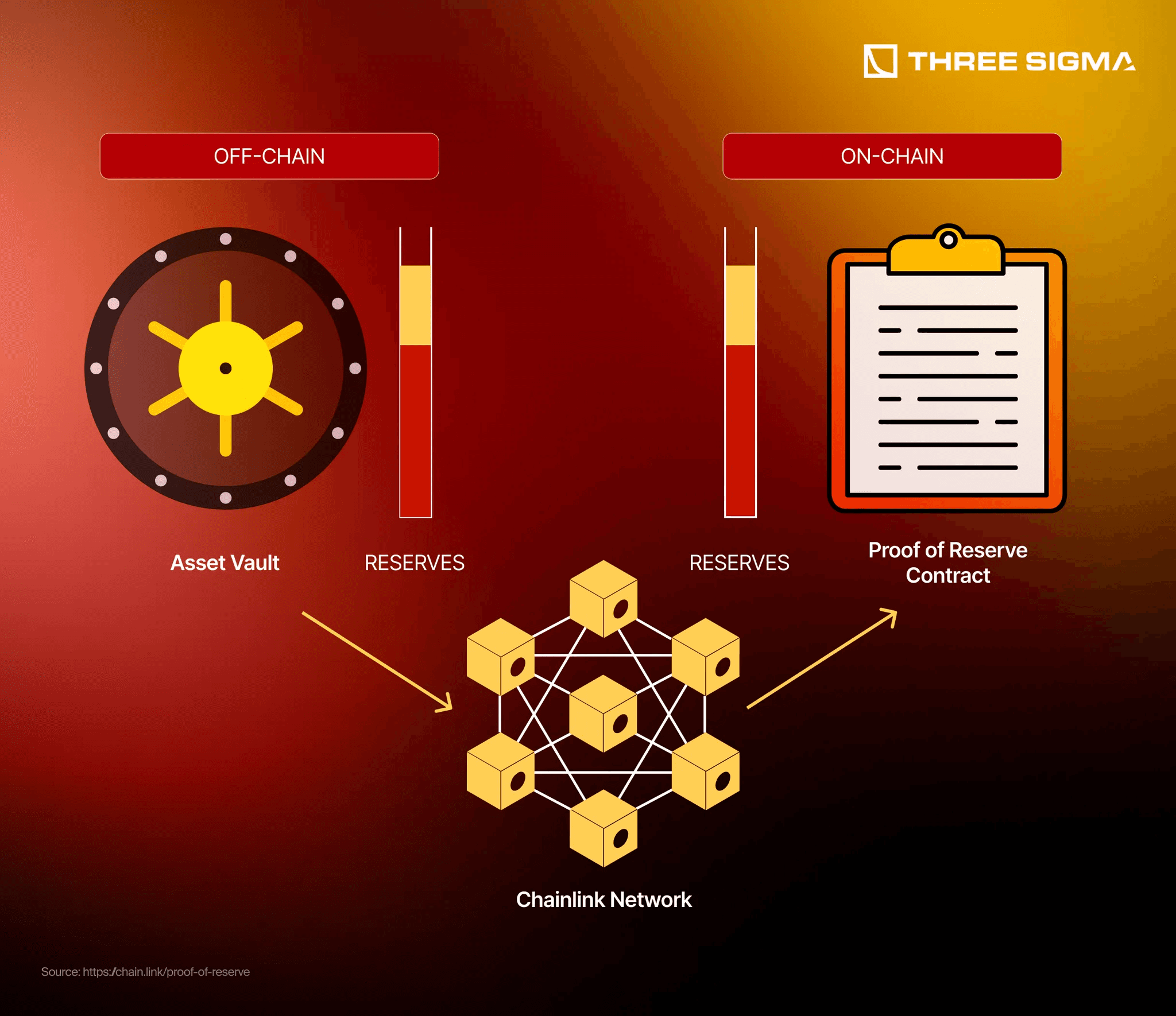

Transparency and Auditability: Tokenized real-world assets on public blockchains offer transparent, verifiable collateralization. Platforms like RWA.xyz provide analytics and tracking of tokenized assets, enhancing auditability for treasuries and stakeholders.

As macroeconomic headwinds persist, the ability to access yield from real-world assets while maintaining stablecoin liquidity is no longer a luxury, it’s a necessity. RWA-backed stablecoins like USST and the broader STBL ecosystem provide DAOs with robust tools for hedging, diversification, and sustainable growth. The result is a more anti-fragile treasury, capable of navigating both crypto-native risks and global financial turbulence.

It’s also worth noting that as the RWA sector matures, secondary markets for yield claims (YLD tokens) are emerging. This adds an extra layer of flexibility for treasuries: they can monetize future yield streams or acquire discounted yield exposure depending on their risk profile. Such innovations are moving the industry beyond simple stablecoin peg algorithms toward dynamic, programmable cash management.

“Diversity is the ultimate risk reducer. “ This principle, foundational to both traditional finance and DAOs, is finally achievable at scale thanks to RWA-backed stablecoins. With protocols like STBL at the forefront, on-chain treasuries are no longer forced to choose between safety and performance.

What’s Next for Stablecoin 2.0?

The momentum behind RWA-backed stablecoins shows no sign of slowing. As of October 2025, with $STBL holding steady at $0.0954, all eyes are on how these protocols will integrate even more diverse collateral types, ranging from tokenized credit to real estate and commodities. The next wave of innovation will likely focus on cross-chain interoperability, automated risk controls, and seamless integration with DAO governance frameworks.

For DAOs, DeFi projects, and forward-thinking investors seeking to future-proof their treasuries, the message is clear: it’s time to move beyond static stablecoins and embrace programmable, yield-bearing assets that reflect the best of both worlds. The era of stablecoin 2.0 has arrived, and RWA-backed solutions like STBL are leading the charge.