In 2025, automated stablecoin vaults have become the backbone of on-chain treasury management for DAOs seeking to maximize yield while minimizing operational risk. As DAOs scale in both assets and complexity, the need for secure, transparent, and efficient capital deployment has never been greater. The latest generation of stablecoin vaults leverages automation, programmable strategies, and dynamic rebalancing to ensure that DAO treasuries are not just protected, but actively optimized for yield in a volatile DeFi landscape.

Why Automated Stablecoin Vaults Are Essential for DAO Treasury Yield Optimization

The DeFi ecosystem in 2025 is marked by rapid innovation in yield strategies and an explosion of tokenized assets. Yet, DAOs face persistent challenges: idle capital, manual intervention risks, and the complexity of balancing risk versus return across multiple protocols. Automated stablecoin vaults directly address these pain points through:

- Continuous auto-compounding: Vaults like Stability DAO’s USDC vault on Silo Finance automatically reinvest earnings, pushing effective APY up to 13% on USDC deposits, with additional sGEM1 rewards boosting total yield potential.

- Automated rebalancing: Protocols such as Factor and Summer. fi deploy smart contracts that dynamically shift capital between lending pools and strategies based on real-time market data, removing human error and timing risk.

- Risk isolation and compliance: Customizable vault frameworks allow DAOs to segment assets by risk profile, operational reserves in conservative stablecoin vaults, growth capital in higher-yield strategy vaults, streamlining governance and reporting for stakeholders.

This automation ensures that treasuries are always working, never sitting idle, while maintaining strict security controls. For a deeper dive into how these mechanisms protect DAO assets, see our security-focused guide.

Key Developments: The Automated Vault Landscape in 2025

The current wave of innovation can be seen in several leading protocols and products:

Top Automated Stablecoin Vaults for DAOs in 2025

-

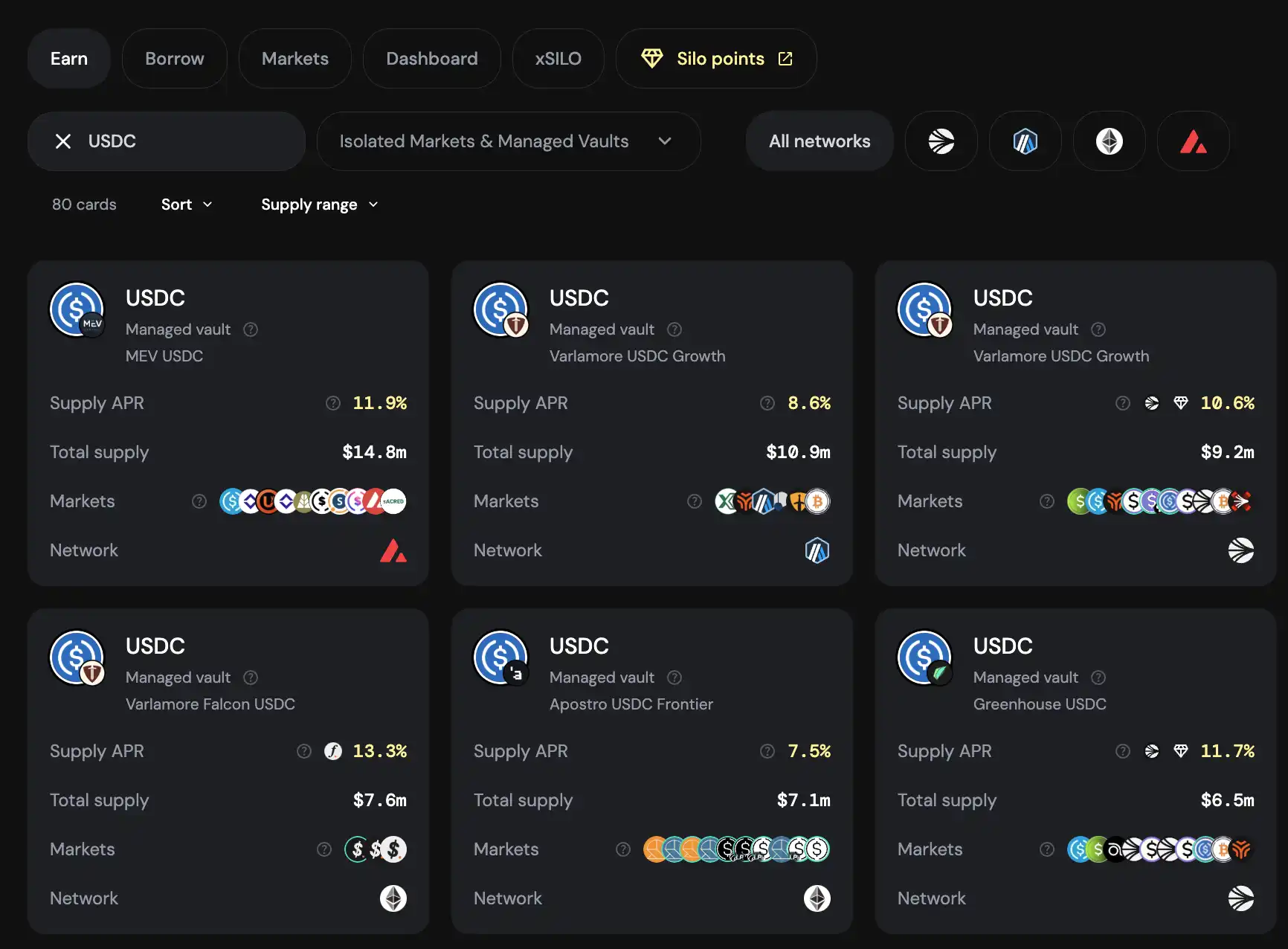

Stability DAO’s USDC Vault on Silo Finance: Launched in September 2025, this vault delivers up to 13% APY on USDC deposits, with an additional 7% APR in sGEM1 rewards. It features auto-compounding via Silo V2 strategies, enabling DAOs to optimize yield with minimal oversight.

-

Factor Vaults for Custom Risk Profiles: Factor allows DAOs to create programmable vaults tailored to specific risk appetites. Features include automated rebalancing, yield harvesting, and support for both stable and delta-neutral strategies, enhancing capital efficiency and risk management.

-

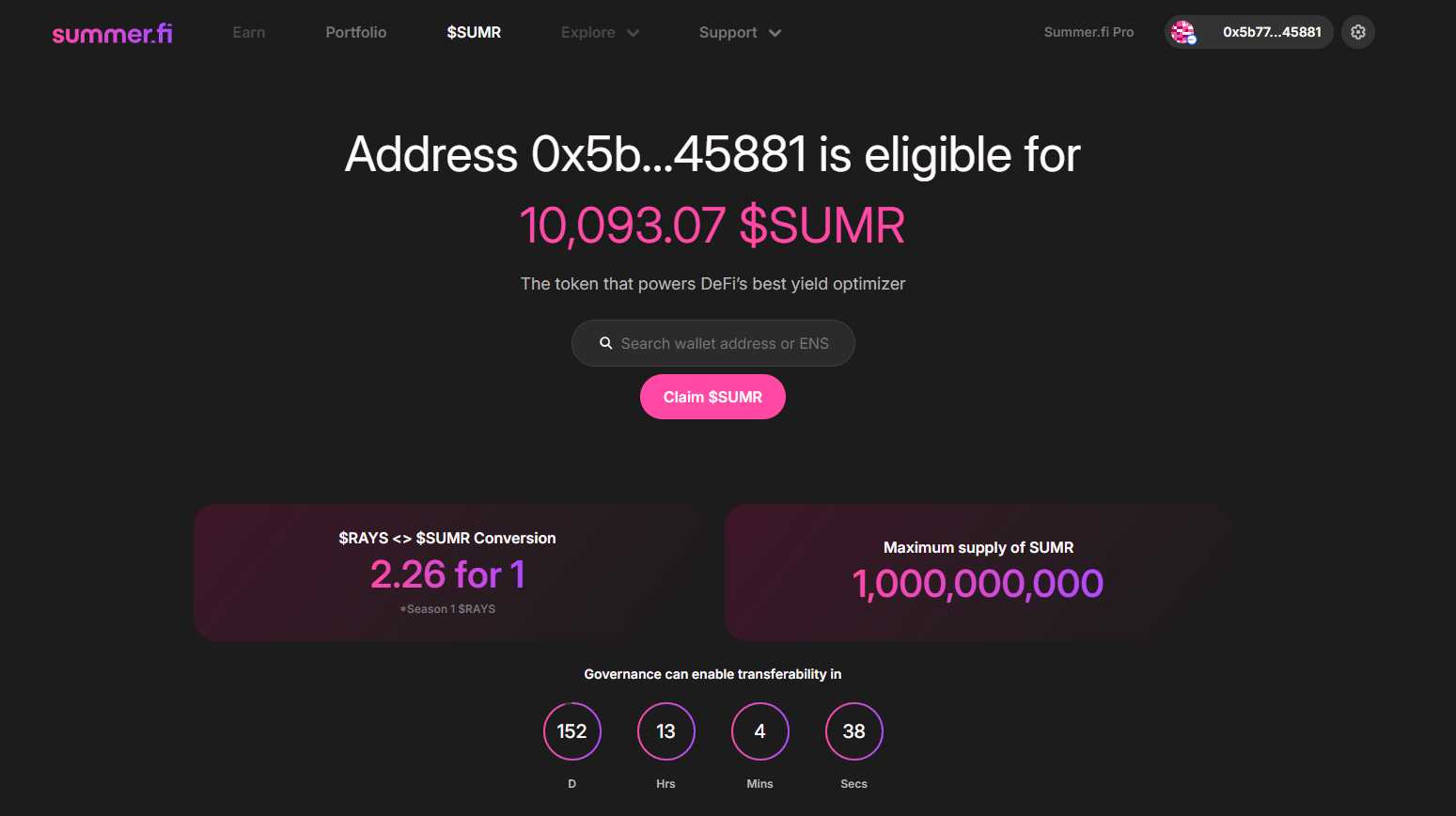

Summer.fi’s Lazy Summer Vaults: These vaults automatically rebalance stablecoin deposits across top-performing strategies. For example, the USDC Base Vault achieved a 6.32% 30-day APY, outperforming benchmarks by 2.43%. The platform prioritizes passive yield optimization and protocol quality.

-

Fusion Protocol’s Yield Optimization for USD3 Assets: Fusion Protocol offers automated ERC-4626 vaults for USD3 assets, integrating multiple protocols into a unified smart contract layer. This enables complex operations like looping, carry trades, and passive lending to maximize capital deployment efficiency.

-

Avantgarde’s DeFi Yield Vault: Avantgarde provides an actively managed, non-custodial vault for DAOs, focusing on diversification across stablecoins and protocols. The vault leverages large, established DeFi protocols and balances yield with risk, supporting robust treasury management.

Stability DAO’s USDC Vault on Silo Finance, launched September 2025, exemplifies the new standard. It combines up to 13% APY with an extra 7% APR in protocol rewards. The auto-compounding Silo V2 strategy means DAOs no longer need to manually harvest or redeploy yield, a crucial step forward for capital efficiency and operational security.

Factor Vaults empower DAOs to design custom vaults based on specific risk appetites. Whether it’s a delta-neutral strategy for runway funds or a stable-only approach for critical reserves, Factor’s programmable vaults automate rebalancing and harvesting across protocols. This modularity is vital for DAOs managing multi-million dollar treasuries with diverse mandates.

Summer. fi’s Lazy Summer Vaults take passive optimization to the next level. By continuously reallocating stablecoin deposits across top-performing DeFi protocols, these vaults delivered a 30-day APY of 6.32% for the USDC Base Vault, outperforming the average stablecoin yield by over two percentage points. Such performance demonstrates the tangible value of automated yield selection and dynamic vault rebalancing for DAO treasuries.

Security and Transparency: The Non-Negotiables of On-Chain Treasury Management

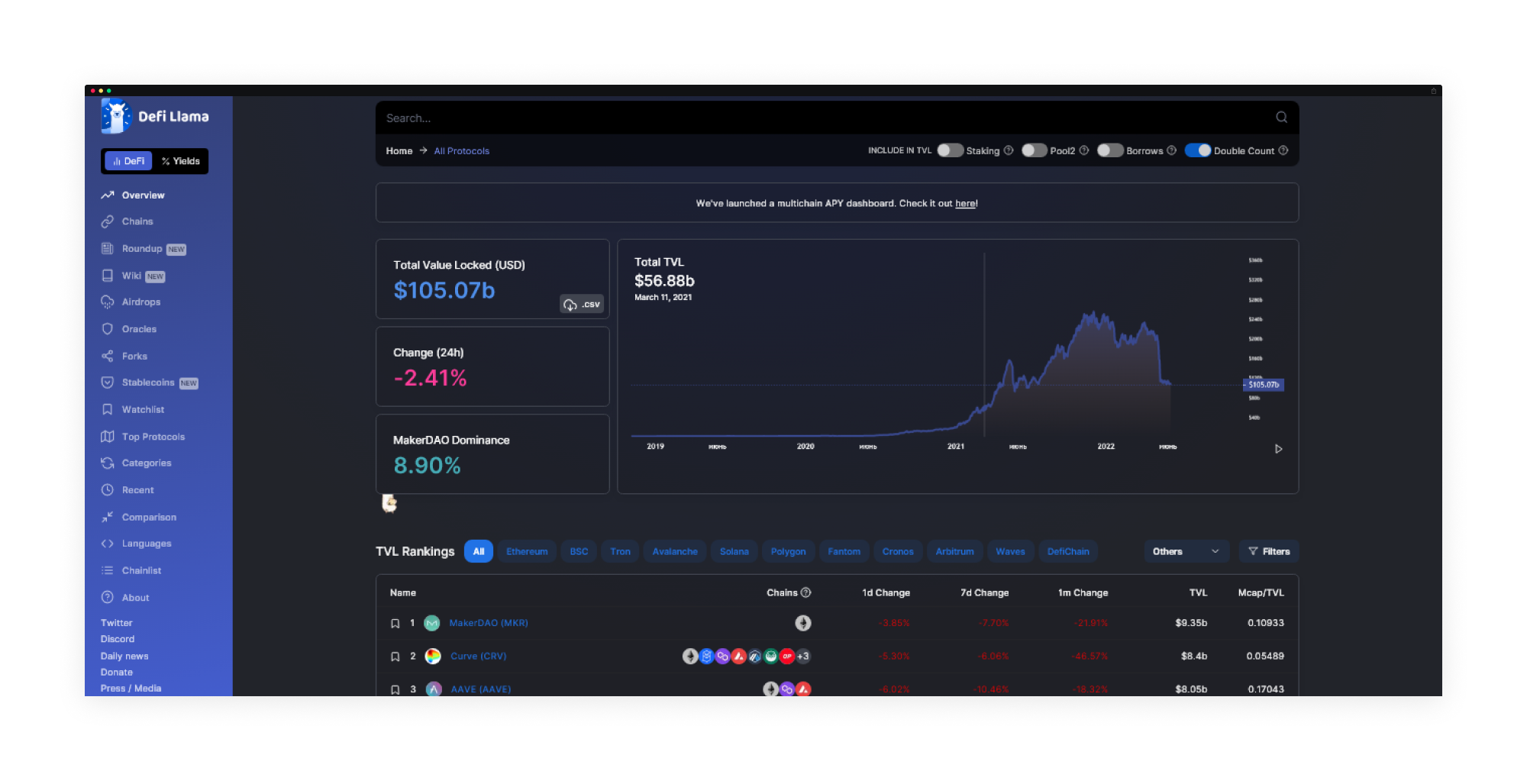

No discussion of DAO treasury optimization is complete without addressing security. Automated stablecoin vaults are only as robust as their underlying smart contracts and governance models. In 2025, best-in-class protocols undergo regular audits, maintain transparent reporting dashboards, and offer granular access controls via multi-signature wallets or role-based permissions. This is not just best practice, it is essential for maintaining community trust and regulatory compliance as treasuries grow in size and visibility.

The integration of real-time analytics, automated alerts for abnormal activity, and rigorous segregation of assets by risk profile sets a new bar for transparency. DAOs can now track every yield event, rebalance operation, and protocol interaction directly on-chain, streamlining both internal audits and external reporting obligations.

The next section will explore advanced DeFi yield strategies enabled by these automated vaults, and how forward-thinking DAOs are leveraging them to achieve sustainable growth while minimizing exposure to systemic risks. For more on the evolution of on-chain treasury management tools, visit our detailed breakdown.

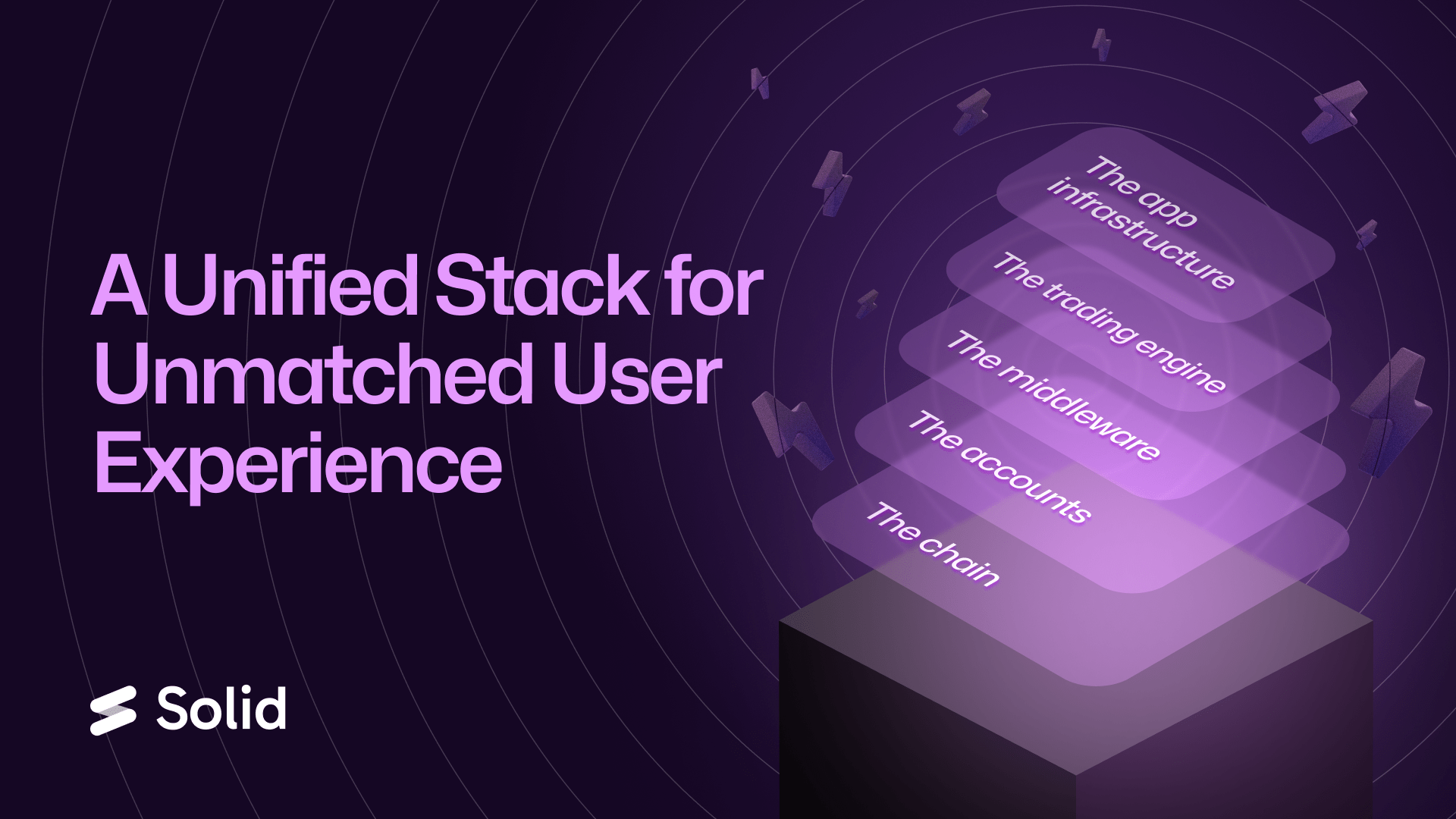

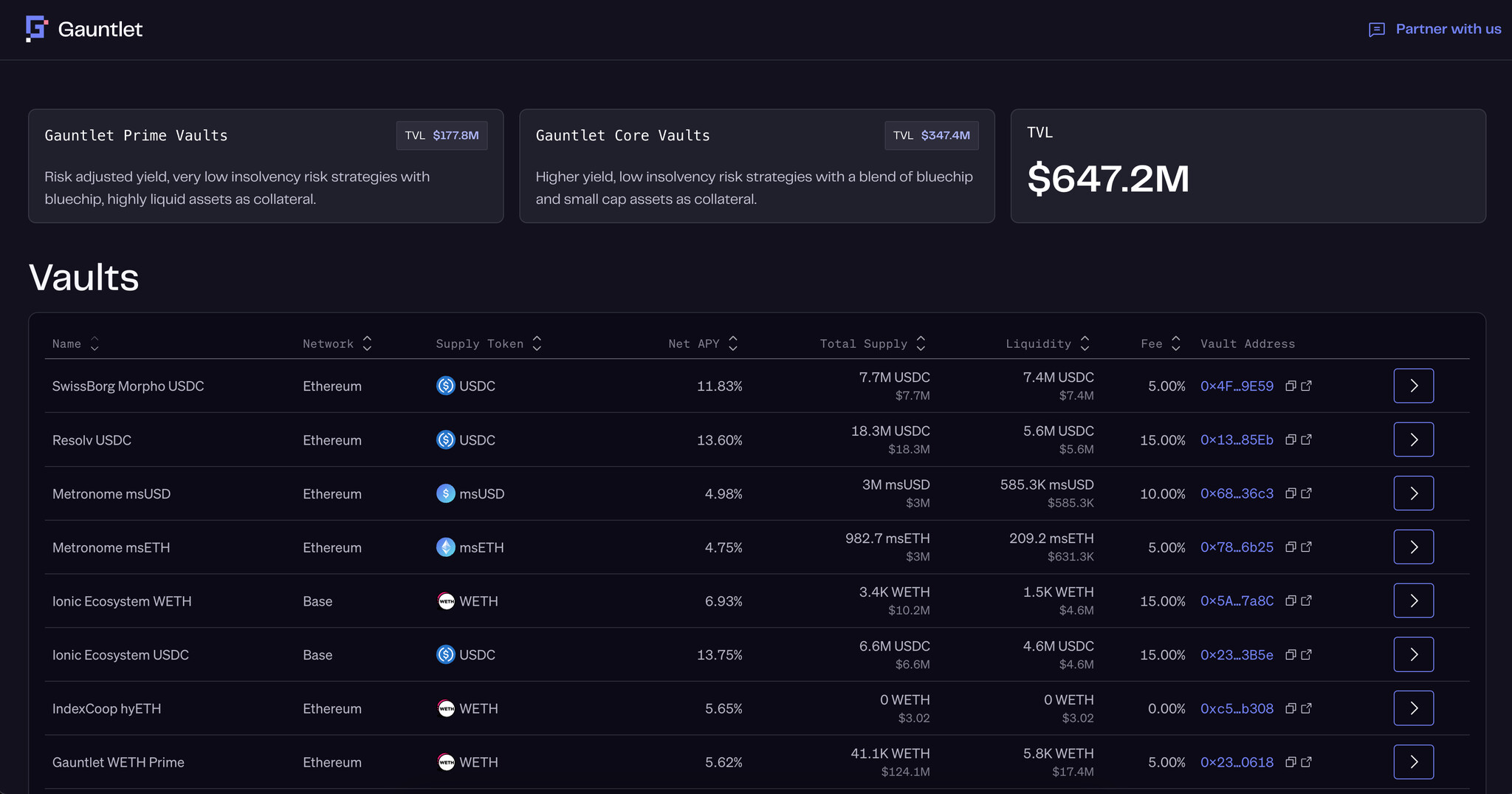

Advanced automation is now the driving force behind DAO treasury yield optimization. Leading protocols like Fusion Protocol and Avantgarde are pushing boundaries with innovative vault frameworks designed to maximize capital efficiency while maintaining rigorous security standards. Fusion Protocol’s automated ERC-4626 vaults, for example, integrate multiple yield sources and strategies into a unified smart contract layer, automating complex operations such as looping and passive lending. This not only streamlines capital deployment but also minimizes manual intervention and operational risk, critical for DAOs managing large, diversified treasuries.

Avantgarde’s DeFi Yield Vault takes a conservative, multi-pronged approach: it prioritizes blue-chip protocols, diversifies across stablecoins and yield sources, and enforces non-custodial, transparent management. This balance between yield maximization and risk control is precisely what compliance-focused DAOs require in 2025. With the proliferation of tokenized U. S. Treasuries and stablecoin-based money markets, DAOs can now access yields that rival or surpass traditional finance, all while retaining on-chain transparency and auditability.

Automated Vaults: Practical Benefits and Governance Implications

The tangible benefits of automated stablecoin vaults extend beyond yield figures. By ensuring zero idle capital through smart contract-driven deployment, DAOs can maintain liquidity buffers, automate reserve management, and execute on-chain policy changes with minimal human oversight. For instance, triggers can be set to automatically convert volatile assets to stablecoins if certain thresholds are breached, or to rebalance allocations in response to market shifts, all governed by transparent, auditable rules.

Governance is also evolving in step with these technical advancements. Automated vaults allow DAOs to implement granular access controls and role-based permissions, reducing the attack surface for treasury exploits while enabling more efficient operational workflows. Stakeholders now expect, and receive, real-time reporting on yield events, risk exposures, and protocol interactions. This level of transparency is not just a regulatory checkbox; it’s a foundation for long-term community trust.

Best Practices for Secure DAO Treasury Yield Optimization

Security remains paramount as DAOs adopt increasingly sophisticated DeFi yield strategies. Here are best practices every DAO should follow in 2025:

DAO Treasury Security & Yield Optimization Checklist (2025)

-

Leverage Automated Stablecoin Vaults with Proven Track Records: Choose vaults like Stability DAO’s USDC Vault on Silo Finance, offering up to 13% APY plus additional rewards, and featuring robust auto-compounding and on-chain automation.

-

Implement Customizable Vault Strategies for Risk Management: Utilize platforms like Factor to create vaults tailored to your DAO’s risk profile, such as stable or delta-neutral strategies, ensuring automated rebalancing and efficient yield harvesting.

-

Automate Yield Rebalancing Across Top Protocols: Opt for solutions like Summer.fi’s Lazy Summer Vaults, which dynamically allocate stablecoins to high-performing strategies, achieving consistent outperformance (e.g., 6.32% APY on USDC Base Vault).

-

Centralize Yield Operations with Unified Smart Contract Layers: Adopt protocols such as Fusion Protocol to manage USD3 assets in ERC-4626 vaults, enabling seamless integration of complex strategies like looping and carry trades for optimized capital deployment.

-

Diversify Across Stablecoins and Protocols for Risk Mitigation: Use actively managed, non-custodial vaults like Avantgarde’s DeFi Yield Vault to spread exposure across multiple stablecoins and DeFi protocols, balancing yield generation with security and capacity constraints.

-

Continuously Monitor Vault Performance and Security: Regularly review on-chain analytics and audit reports for all vault platforms in use, ensuring smart contract integrity, up-to-date risk parameters, and real-time performance tracking.

-

Establish Automated Emergency Protocols: Set up on-chain triggers (e.g., automated swaps if ETH declines by 10%) and multi-signature controls to rapidly respond to market volatility and safeguard treasury assets.

Regular smart contract audits are non-negotiable, as is the use of multi-signature wallets for all treasury movements. DAOs should enforce strict role separation between strategy managers and signers, maintain comprehensive documentation of all vault parameters, and monitor all protocol upgrades or integrations for new risks. For more on securing your DAO treasury with automated vaults, see our in-depth guide.

For those seeking to maximize DAO treasury yield without compromising on risk controls, it is essential to leverage platforms that prioritize both automation and transparency. As demonstrated by Summer. fi’s Lazy Summer Vaults and Stability DAO’s USDC Vault on Silo Finance, the combination of dynamic rebalancing, auto-compounding, and real-time analytics delivers measurable outperformance while safeguarding assets from both technical and governance failures.

The evolution of automated stablecoin vaults marks a new era for on-chain treasury management in 2025, one where DAOs can confidently pursue sustainable yield strategies at scale without sacrificing security or compliance. As the ecosystem matures, expect further innovations in programmable vault logic, cross-chain integrations, and risk isolation frameworks. The future of DAO treasury management will be defined by those who embrace automation while maintaining an uncompromising focus on transparency and capital protection.

For more actionable insights on deploying advanced vault strategies and optimizing your DAO’s on-chain treasury, explore our comprehensive resources at On-Chain Treasuries.