Decentralized Autonomous Organizations (DAOs) are redefining how digital assets are managed, emphasizing transparency, automation, and real-time risk mitigation. As crypto markets become more volatile and regulatory scrutiny intensifies, on-chain treasury risk engines have emerged as the backbone of robust DAO treasury management. These systems empower DAOs to safeguard their portfolios, automate risk analytics, and react to threats with machine precision, without compromising on decentralization or transparency.

Why DAOs Need On-Chain Treasury Risk Engines

Unlike traditional firms, DAOs operate in a trust-minimized environment, where code enforces rules and on-chain data is the single source of truth. This structure brings unique challenges: asset mismanagement, unauthorized withdrawals, and exposure to market shocks can erode stakeholder trust in seconds. On-chain treasury risk engines are designed to counter these threats by delivering:

- Real-time portfolio stress monitoring that continuously evaluates asset allocations and market exposures

- Automated risk analytics that flag anomalies, unauthorized transactions, or slippage events

- Transparent, auditable logs for every treasury movement, strengthening governance and compliance

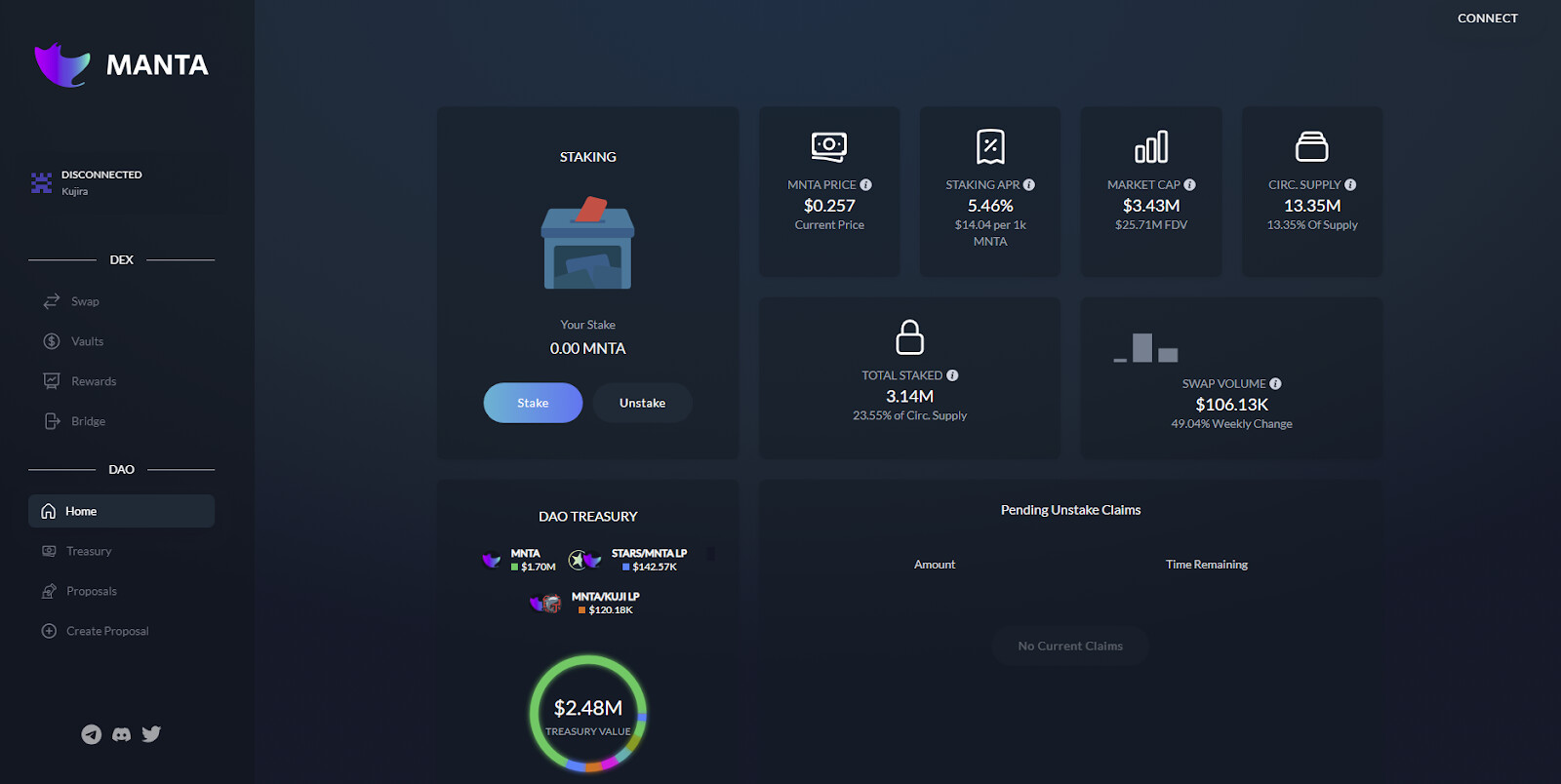

For example, platforms like dHEDGE provide DAOs with non-custodial trading solutions where activities are verifiable and auditable on-chain. This ensures that designated traders operate within strict, pre-approved parameters, reducing the risk of mismanagement and unauthorized access. Read more on dHEDGE’s approach to DAO treasury management.

Automated Rebalancing: The First Line of Defense

Volatility is a constant in crypto. To remain resilient, DAOs are increasingly adopting automated rebalancing strategies powered by on-chain risk engines. These tools adjust asset allocations in real time, capturing gains from high-performing tokens while reducing downside risk from underperformers.

Clipper’s Daily Rebalancing Portfolio (DRP) is a leading example, recalibrating treasury holdings daily to a predetermined ratio. This systematic approach leverages modern portfolio theory, aiming to maximize yield while minimizing exposure to sudden market swings. By automating these adjustments, DAOs avoid human error, eliminate latency, and ensure that capital is always working within risk parameters. Explore how Clipper automates DAO treasury rebalancing.

Key Features of On-Chain Treasury Risk Engines for DAOs

-

Transparent, On-Chain Asset Management: Platforms like dHEDGE enable DAOs to manage and track all treasury activities directly on-chain, ensuring full auditability and verifiable records for every transaction.

-

Automated Risk Assessment and Controls: On-chain risk engines enforce predefined trading and allocation parameters, preventing unauthorized transactions and reducing human error through smart contract automation.

-

Real-Time Portfolio Rebalancing: Solutions such as Clipper Daily Rebalancing Portfolio (DRP) automatically adjust asset allocations daily, helping DAOs capture gains from volatile assets while maintaining stability with safer holdings.

-

AI-Driven Predictive Analytics: Advanced risk engines integrate AI to continuously analyze on-chain and market data, enabling DAOs to forecast risks and opportunities and automate protective strategies, such as hedging against stablecoin de-pegging events.

-

Non-Custodial and Permissioned Access: By utilizing non-custodial frameworks, DAOs ensure that designated traders or managers can operate within strict, on-chain parameters without direct access to treasury funds, greatly reducing the risk of mismanagement or theft.

AI-Driven Risk Analytics and Predictive Modeling

The latest evolution in DAO treasury automation is the integration of AI-driven predictive analytics. These systems ingest vast amounts of on-chain and market data, scanning for patterns that signal emerging risks or opportunities. For instance, if a stablecoin in the treasury is at risk of de-pegging, the risk engine can autonomously execute hedging strategies, selling or swapping assets to preserve value, at speeds no human operator could match.

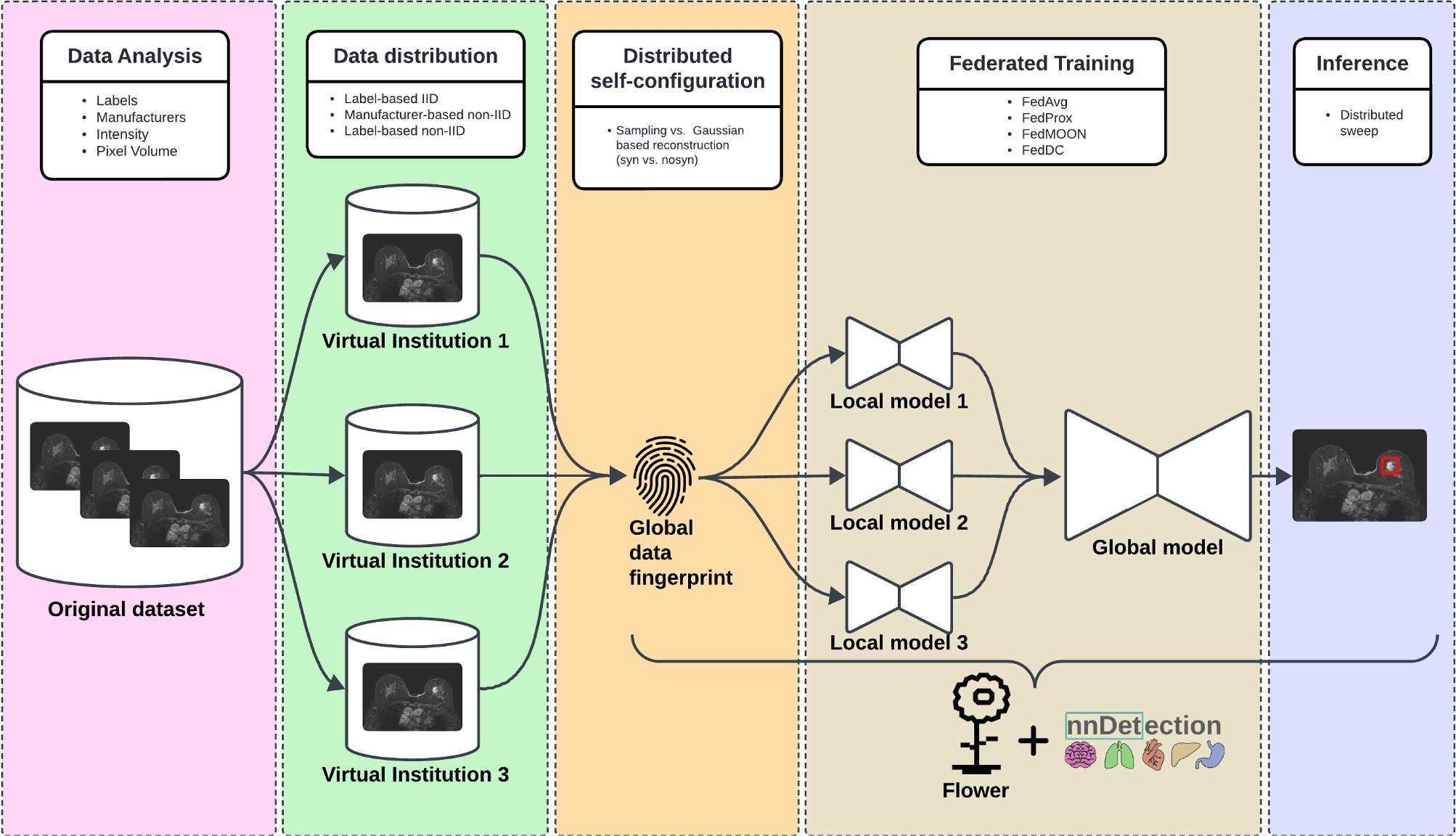

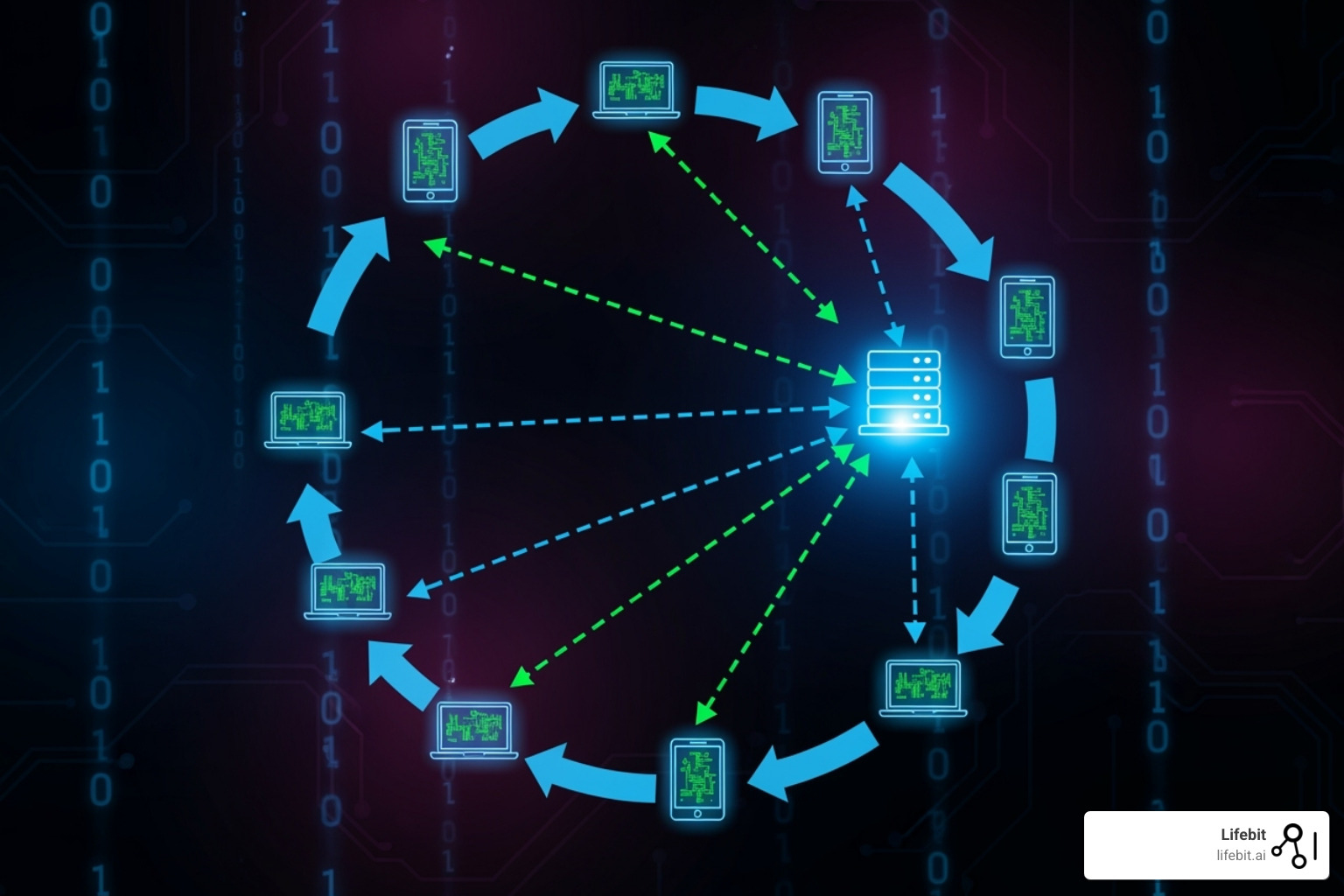

By combining federated learning in DeFi with continuous data feeds, these AI-powered engines provide DAOs with a security posture that is both proactive and adaptive. As a result, decentralized asset protection is no longer reactive, it’s anticipatory, minimizing losses and maximizing capital preservation in fast-moving markets.

As DAOs continue to evolve, the adoption of on-chain treasury risk engines will remain central to secure, transparent, and scalable asset management. In the next section, we’ll dive deeper into real-world case studies and explore how leading DAOs deploy these technologies to protect their capital and stakeholders.

Examining real-world deployments reveals how on-chain treasury risk engines are not just theoretical tools, but mission-critical infrastructure for DAOs navigating today’s unpredictable crypto landscape. Leading organizations are now prioritizing automated, rules-based systems that enforce treasury policy 24/7 and offer ironclad audit trails for every transaction.

Case Studies: Resilience in Action

Consider the integration of automated risk analytics by DAOs managing diverse asset portfolios. By deploying smart contract-based engines, these DAOs have achieved:

- Instant anomaly detection – Automated alerts trigger within seconds of suspicious activity, protecting treasuries from exploits and human error.

- Continuous compliance monitoring – Risk engines enforce investment policy statements, ensuring no single asset or protocol breaches pre-set allocation limits.

- Seamless auditability – Every rebalancing, trade, or fund movement is logged and publicly verifiable, supporting both internal governance and external regulatory requirements.

For example, dHEDGE’s approach enables DAOs to maintain operational agility while strictly limiting the authority of individual traders. All activity is on-chain and subject to real-time scrutiny, dramatically reducing the attack surface and building trust among token holders. Automated rebalancing solutions like Clipper’s DRP further demonstrate how DAOs can capture upside in volatile markets while maintaining a conservative risk profile. These strategies are increasingly being adopted as best practice for decentralized asset protection.

The Role of Federated Learning and Predictive Defense

Beyond automation and transparency, federated learning is emerging as a powerful tool for DAOs seeking a competitive edge in risk management. By securely aggregating insights from multiple treasuries without exposing private data, federated learning allows DAOs to benefit from collective intelligence while preserving confidentiality. This approach enhances predictive models used by on-chain treasury risk engines, enabling them to anticipate market disruptions or protocol-specific vulnerabilities with greater accuracy.

AI-powered analytics are now being leveraged to simulate portfolio stress scenarios based on real-time market conditions. For instance, if predictive models detect rising volatility or early signs of a stablecoin de-pegging event, the treasury can be automatically hedged or rebalanced before losses materialize. This level of responsiveness is unattainable with manual oversight alone, underscoring the necessity of advanced risk engines for modern DAO treasury management.

Key Benefits of Federated Learning for DAO Treasuries

-

Enhanced Privacy for Sensitive Treasury Data: Federated learning enables DAOs to train risk models across multiple nodes without sharing raw financial data, preserving the confidentiality of treasury allocations and transaction histories.

-

Decentralized Risk Assessment: By distributing model training across various participants, federated learning reduces single points of failure and aligns with the decentralized ethos of DAOs, improving resilience against targeted attacks.

-

Real-Time Model Updates for Rapid Market Response: Federated learning allows DAOs to continuously update risk models with new on-chain data, enabling faster adaptation to market volatility and emerging threats.

-

Improved Model Accuracy Without Data Centralization: DAOs benefit from collective intelligence by aggregating insights from multiple sources, enhancing the predictive power of risk engines without compromising data sovereignty.

-

Regulatory and Compliance Advantages: By keeping sensitive data local, federated learning helps DAOs comply with data protection regulations and internal governance standards, reducing legal and operational risks.

Building Confidence Through Transparent Automation

Ultimately, the adoption of on-chain treasury risk engines is enabling DAOs to operate with a level of transparency and security that rivals – and often surpasses – traditional asset managers. Automated governance, real-time portfolio protection, and immutable audit trails are not just compliance features; they are foundational to stakeholder trust and long-term capital preservation.

As the regulatory environment evolves and the scale of DAO treasuries grows, expect continued innovation in automated risk analytics and predictive modeling. The DAOs that invest in robust, security-first infrastructure now will be best positioned to thrive in an increasingly complex DeFi ecosystem.