In the last year, the landscape of on-chain treasury management for DAOs has shifted dramatically. The catalyst? A new breed of AI-driven automation known as DeFAI. Where once decentralized treasuries required relentless manual oversight and the constant vigilance of community stewards, today’s organizations can leverage intelligent agents to optimize allocation, mitigate risk, and execute complex strategies in real time. This transformation is not simply about efficiency – it’s about unlocking a fundamentally more adaptive and resilient approach to managing digital assets in an increasingly volatile market.

AI Agents: The New Backbone of DAO Treasury Operations

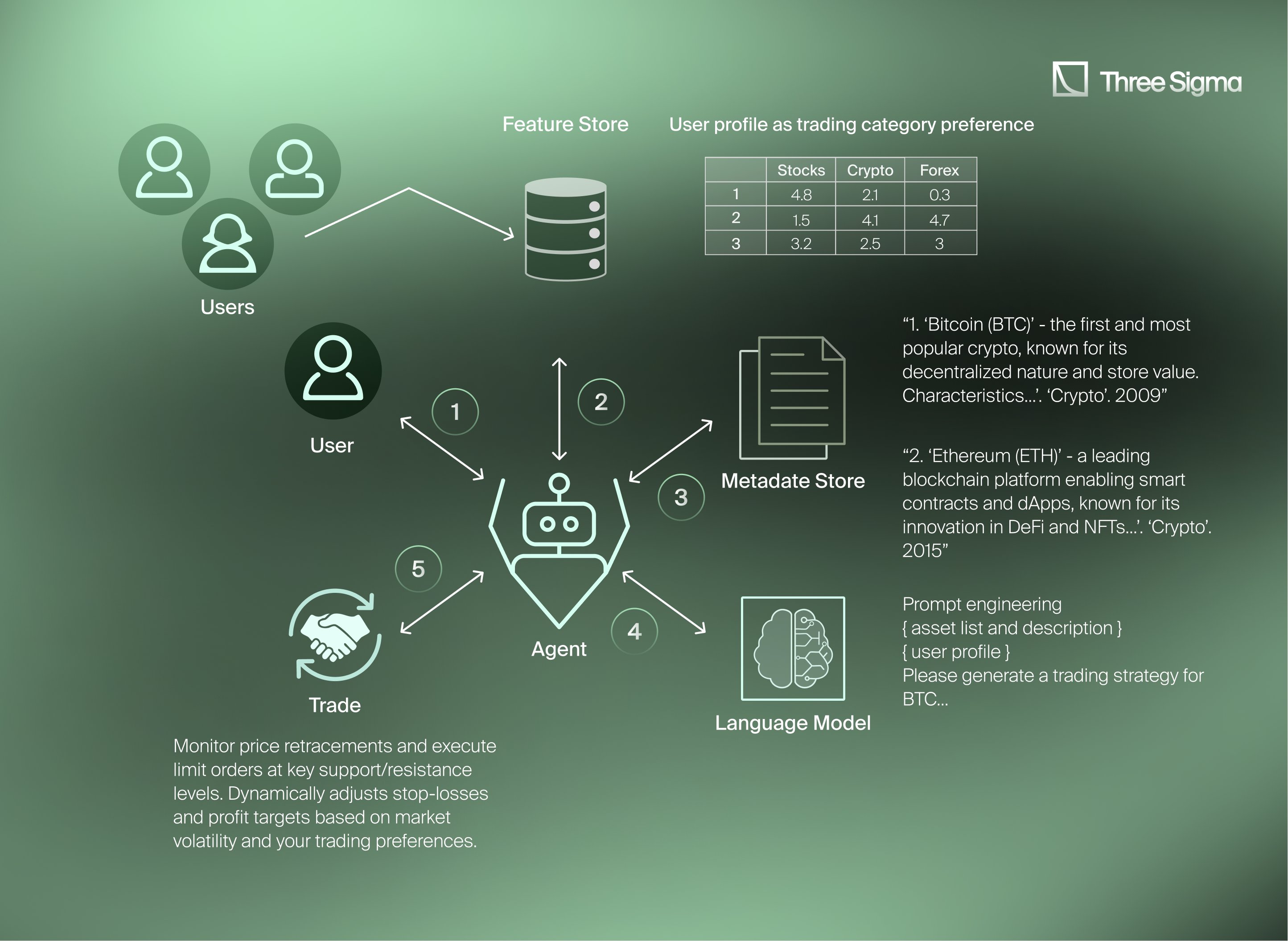

DAOs are no strangers to experimentation, but DeFAI automation marks a decisive leap forward in how these organizations steward their capital. With tools like Octav offering real-time analytics across 30 and blockchains and thousands of protocols, DAOs can now track holdings and performance with unprecedented granularity. But the true power lies in active management: AI agents analyze portfolio risk factors such as asset concentration and market correlation, then suggest or even execute rebalancing maneuvers to maintain yield targets while reducing exposure.

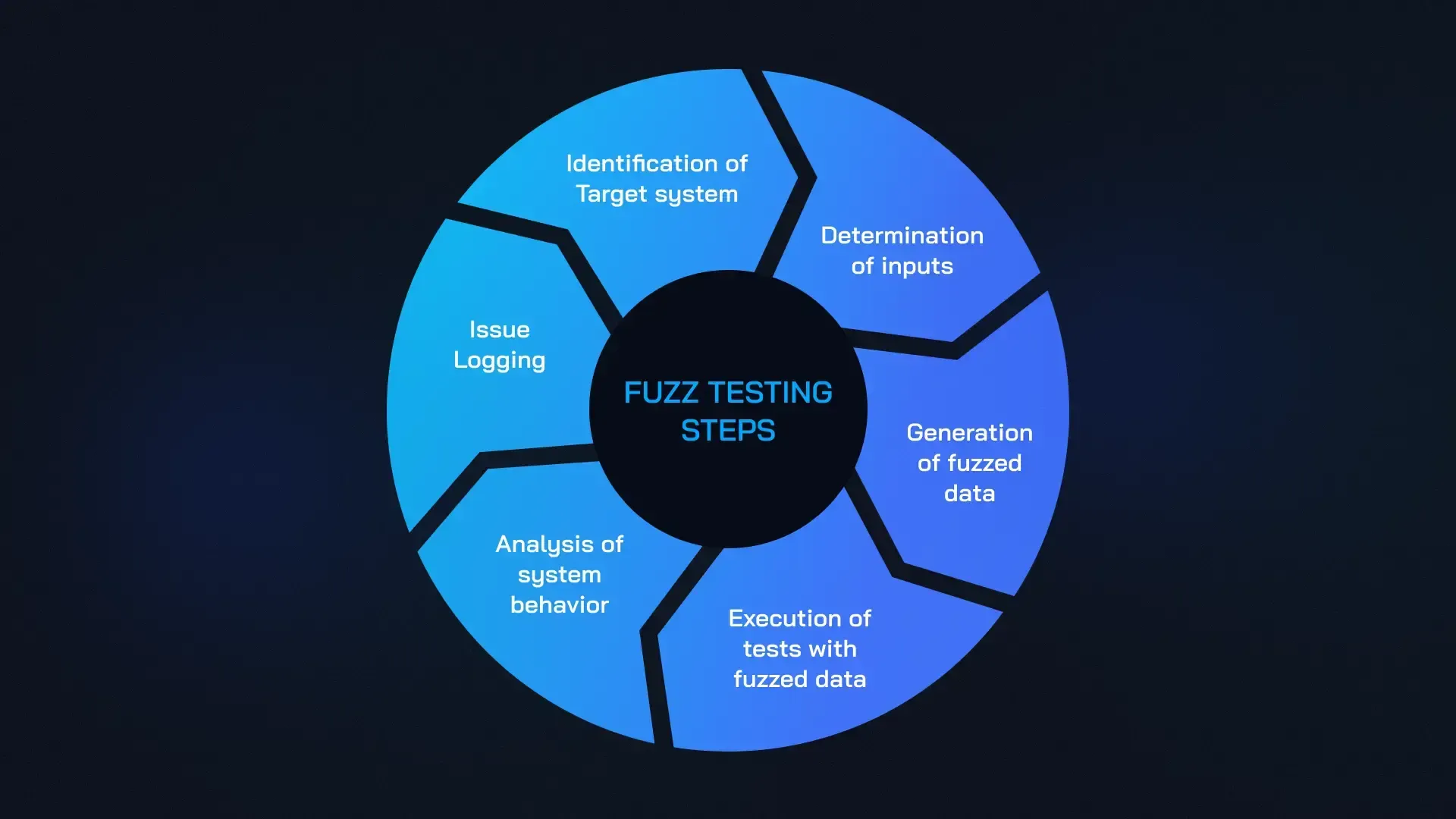

Platforms like AUTOMATE by HeyAnon are setting new standards for secure integration by enforcing strict schema-based interactions for every transaction. This ensures that automated moves are both predictable and compliant with DAO governance rules – a crucial consideration as treasuries scale into the millions or even billions of dollars.

The Strategic Edge: Adaptive Yield and Automated Risk Mitigation

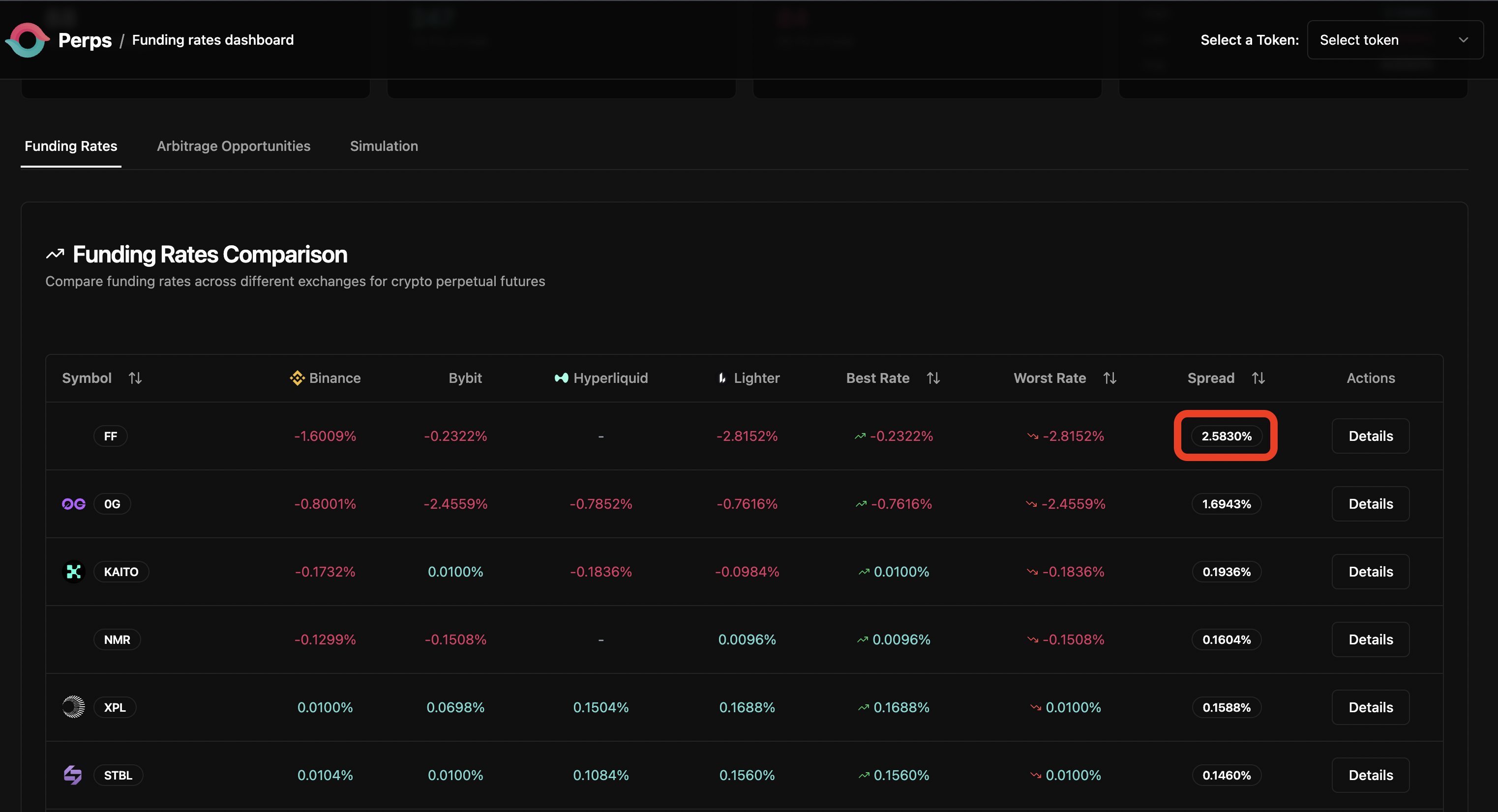

The core advantage of DeFAI automation is its capacity to make treasury management both proactive and adaptive. Instead of static allocations or periodic manual interventions, DAOs can now deploy dynamic strategies that continuously seek out the best risk-adjusted returns across chains. For example, DeFAI-powered frameworks monitor yield rates on protocols spanning Ethereum, Base, and beyond – reallocating liquidity when opportunities shift or when risk profiles change.

This is particularly relevant given recent volatility in both token prices and stablecoin yields. AI-driven risk assessment tools not only flag potential vulnerabilities but also recommend actionable steps such as diversification or hedging within minutes. The result is a treasury posture that is always one step ahead of market turbulence – far more robust than legacy approaches that relied on after-the-fact committee decisions.

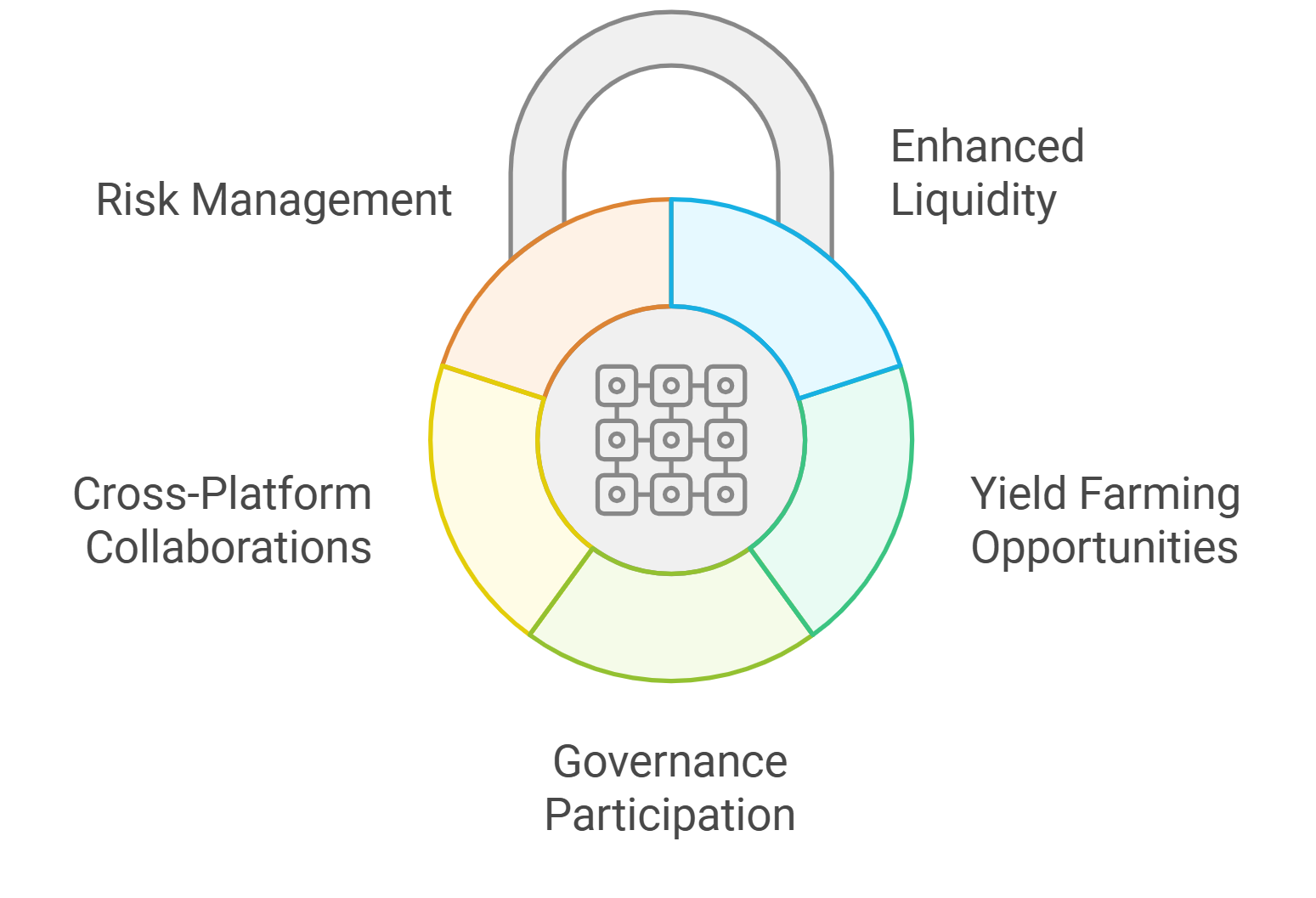

Key Benefits of DeFAI Automation for DAOs

-

Automated Risk Assessment: DeFAI platforms use AI to continuously analyze DAO portfolios, identifying risk factors such as asset concentration and market correlations. This enables DAOs to proactively rebalance assets and maintain robust risk profiles.

-

Cross-Chain Yield Optimization: With DeFAI tools, DAOs can monitor yield rates across multiple blockchains, dynamically reallocating assets to maximize returns without manual intervention.

-

Real-Time Analytics and Reporting: Platforms like Octav provide DAOs with real-time insights into their holdings and performance, supporting over 30 blockchains and 9,000 DeFi protocols for comprehensive treasury oversight.

-

Enhanced Operational Efficiency: Automation frameworks such as AUTOMATE by HeyAnon streamline on-chain transactions, reducing manual workload and operational overhead for DAO members.

-

Secure and Predictable Execution: Schema-based frameworks enforce strict transaction protocols, minimizing the risk of errors or unauthorized actions in treasury management.

-

Optimized Treasury Strategies: Modular platforms like Factor allow DAOs to automate diversification, yield farming, and token swaps, ensuring agile and data-driven treasury strategies.

-

Proactive Risk Mitigation: Continuous monitoring by AI agents helps DAOs detect market anomalies early and adjust strategies to safeguard assets.

Frameworks Powering Decentralized Treasury Automation

The rise of modular infrastructure platforms like Factor signals a new era for community-governed asset management. Factor enables DAOs to automate everything from yield farming participation to cross-chain swaps without sacrificing transparency or governance oversight. Meanwhile, persistent agent protocols allow organizations to delegate routine operations – voting on proposals, routing liquidity, executing token swaps – to autonomous entities that act according to pre-set parameters.

This modularity empowers DAOs to build bespoke treasury workflows tailored to their unique mission and risk appetite while maintaining full auditability on-chain. As compliance requirements evolve and regulatory scrutiny intensifies, such frameworks will be indispensable for scaling responsibly in the years ahead.

Perhaps most compelling, DeFAI automation is fundamentally shifting the role of DAO participants. Instead of spending countless hours on manual approvals, reconciliations, or chasing yield opportunities, contributors can focus on higher-order strategy and community engagement. The AI agents take care of repetitive tasks and complex calculations, but the ultimate direction remains in human hands, empowering decentralized organizations to be both nimble and principled.

Crucially, this new paradigm does not come at the expense of transparency or trust. Each automated action, whether it’s reallocating stablecoins to a higher-yield pool or executing a hedging strategy, is recorded immutably on-chain. Tools like Octav provide an audit trail that satisfies both internal stakeholders and external auditors, reinforcing the ethos of open governance that defines the DAO movement.

Best Practices: Building a Resilient On-Chain Treasury with DeFAI

For DAOs looking to implement DeFAI automation, several best practices are emerging:

Best Practices for DAOs Using AI-Powered Treasury Tools

-

Leverage Automated Risk Assessment Platforms: Adopt AI systems that continuously analyze treasury portfolios, identifying risk factors such as asset concentration and market correlation. Solutions like MarkAI Code provide actionable insights and suggest rebalancing strategies to maintain yield targets while reducing vulnerabilities.

-

Implement Cross-Chain Yield Optimization: Use AI-powered tools that monitor yield rates across multiple blockchains, enabling efficient asset allocation for maximum returns. Platforms that facilitate this, such as those highlighted by MarkAI Code, help DAOs stay competitive in a multi-chain DeFi ecosystem.

-

Adopt Real-Time Analytics Platforms: Integrate comprehensive analytics solutions like Octav, which offers real-time portfolio tracking across 30+ blockchains and 9,000 DeFi protocols, ensuring transparent and informed treasury decisions.

-

Utilize Secure Automation Frameworks: Employ frameworks such as AUTOMATE by HeyAnon to enforce schema-based, predictable execution of on-chain treasury transactions, reducing operational risks and ensuring compliance.

-

Deploy Modular DeFi Infrastructure: Use platforms like Factor to automate treasury strategies directly on chains like Base, enabling asset diversification, yield farming, and token swaps without manual intervention.

-

Continuously Monitor and Optimize: Establish processes for ongoing review of AI-driven treasury strategies, leveraging real-time insights and automated alerts to adapt to market changes and optimize DAO financial performance.

First, start with clear governance parameters, define what actions agents may execute autonomously versus those requiring community sign-off. Next, ensure robust monitoring and reporting by integrating analytics platforms that support multi-chain visibility. Finally, regularly review and update risk models as market conditions evolve; DeFAI excels when its underlying assumptions are kept current.

The competitive advantage is clear: DAOs equipped with adaptive yield strategies and real-time risk management can outpace their peers in both performance and resilience. As more organizations adopt these tools, expect to see a new standard emerge for what constitutes responsible, and successful, on-chain treasury management.

Looking Ahead: The Future of AI-Powered DAO Treasuries

The integration of DeFAI automation into on-chain treasury management is still in its early innings but already shows transformative potential. As frameworks mature and agent protocols become more sophisticated, we’ll likely see even greater autonomy, think DAOs whose treasuries can self-adapt not just to market changes but also to shifts in governance priorities or regulatory landscapes.

Ultimately, this is about more than efficiency, it’s about building decentralized institutions capable of weathering volatility while remaining agile enough to seize new opportunities as they arise. For forward-thinking DAOs and crypto communities committed to sustainable growth, embracing DeFAI-driven treasury automation isn’t just an upgrade, it’s fast becoming a necessity.