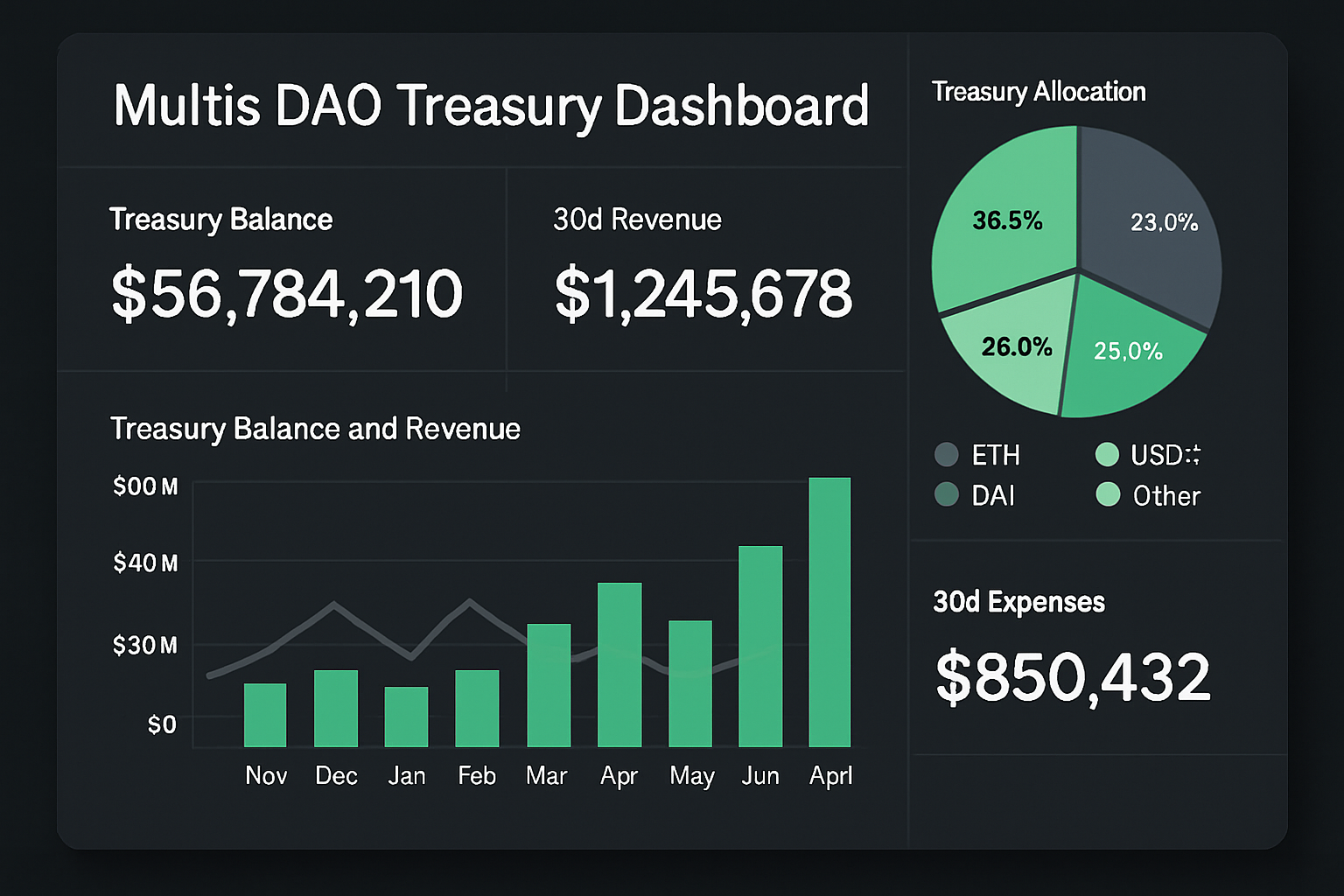

Decentralized Autonomous Organizations (DAOs) are rewriting the playbook for treasury management, and scenario modeling is their secret weapon. In a crypto market defined by volatility and rapid innovation, DAOs need more than spreadsheets and gut instinct. They need dynamic simulations that forecast risk, liquidity, and yield, giving communities the confidence to steer their treasuries through anything the market throws at them.

Why Scenario Modeling is a Game-Changer for DAOs

Scenario modeling isn’t just a buzzword, it’s the backbone of modern DAO treasury management. By simulating market shifts, sudden crashes, or unexpected windfalls, DAOs can proactively plan for every curveball. This approach transforms decision-making from reactive to strategic, empowering communities to:

- Test asset allocation strategies before deploying funds

- Forecast liquidity needs under multiple market conditions

- Stress-test treasury health against black swan events

- Optimize yield generation without overexposing to risk

- Create data-driven governance proposals

The result? Fewer panic moves during downturns, smarter investments in bull markets, and a culture of transparency that builds trust with token holders.

The Pillars of Effective DAO Treasury Scenario Modeling

Top 5 Uses of Scenario Modeling in DAO Treasuries

-

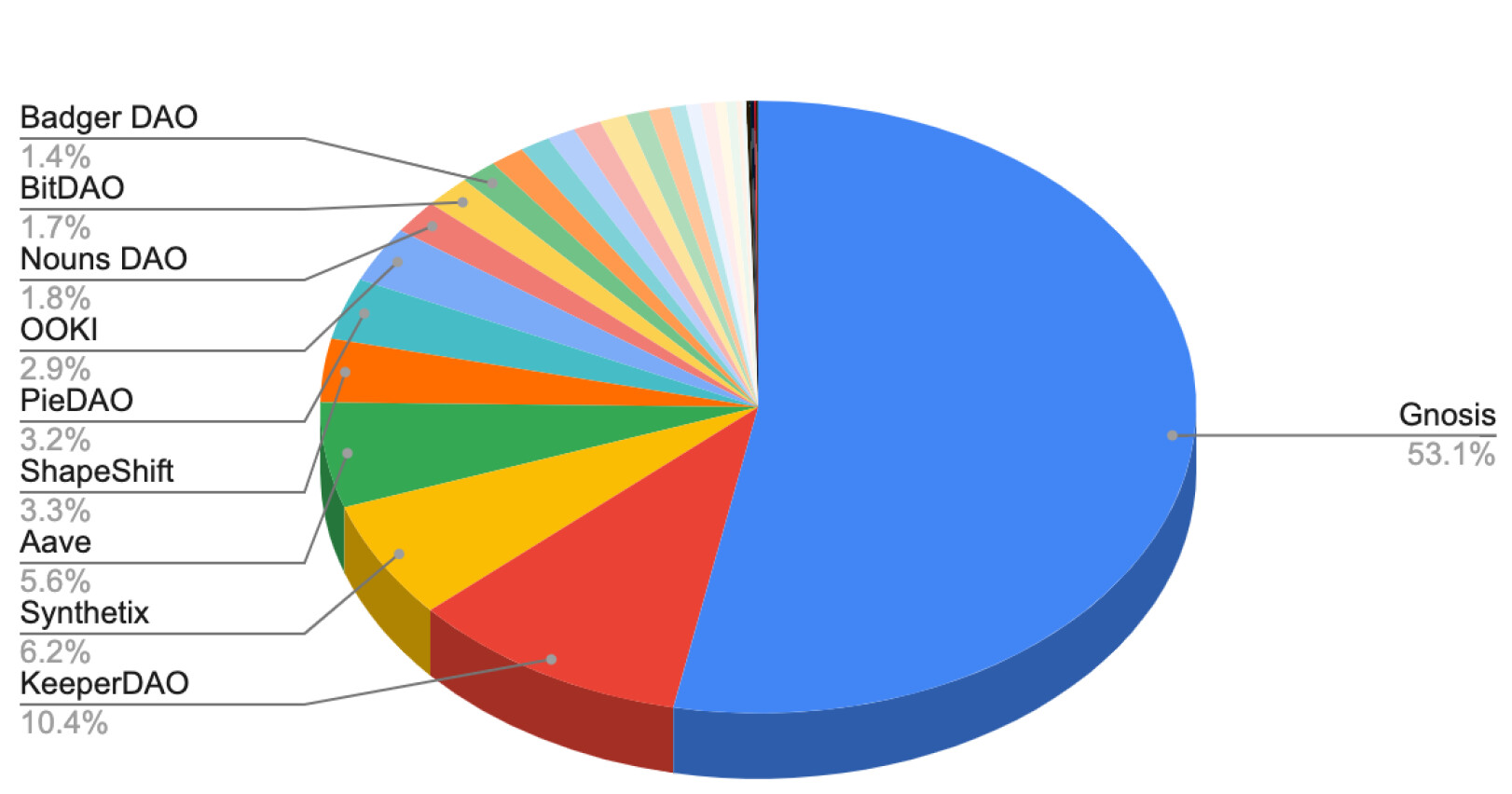

Asset Allocation & Diversification: DAOs use scenario modeling to test how diversifying treasury assets—like stablecoins, Bitcoin (BTC), and Ethereum (ETH)—impacts risk and stability, helping to shield funds from market volatility.

-

Liquidity Management: By simulating different market conditions, DAOs forecast liquidity needs to ensure they can cover payroll, operations, and unexpected expenses, even during downturns.

-

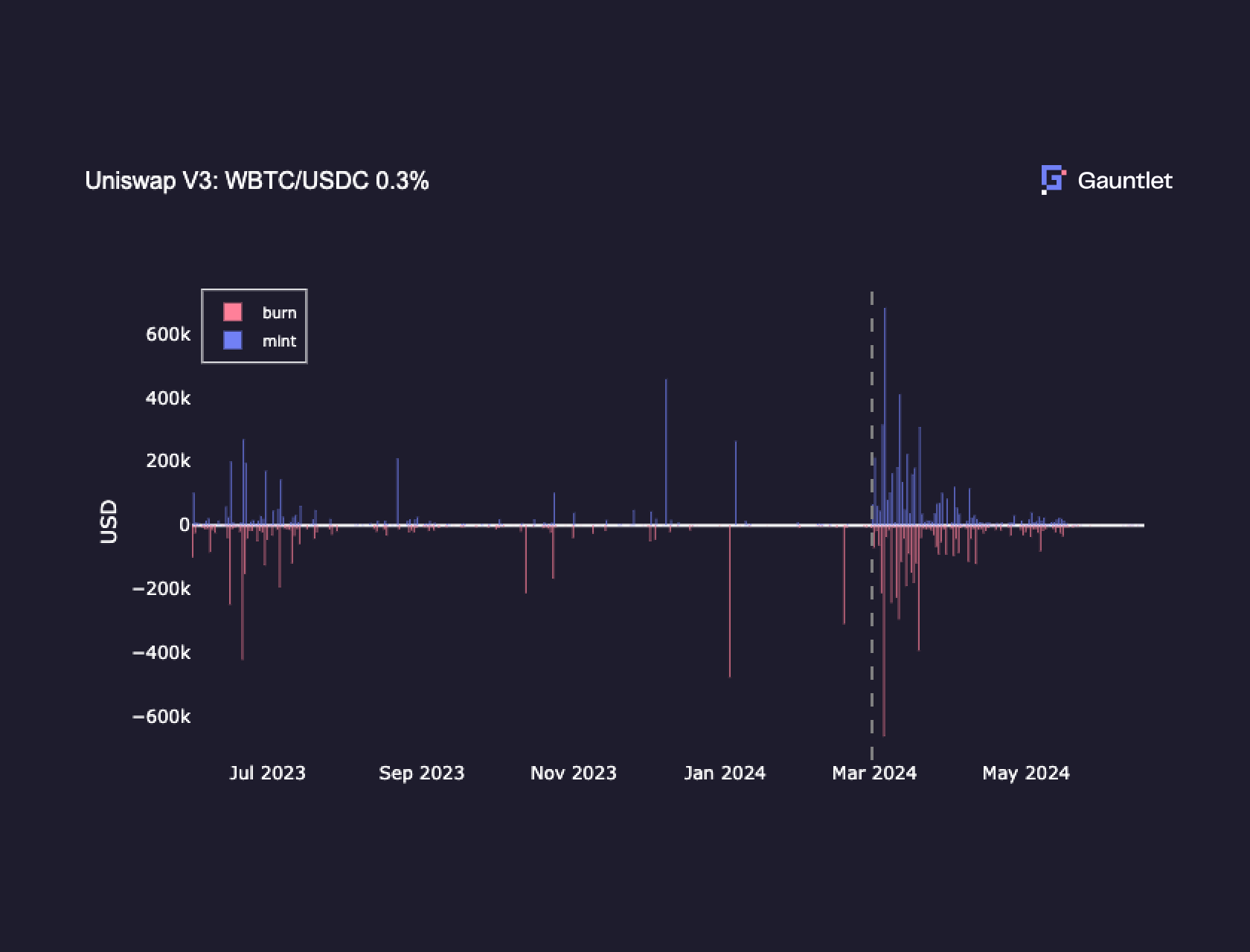

Risk Assessment & Stress Testing: Scenario modeling enables DAOs to stress test their treasuries against extreme events, revealing vulnerabilities and guiding proactive risk mitigation strategies.

-

Yield Optimization: DAOs evaluate various investment strategies through scenario modeling to maximize returns while balancing risk, ensuring optimal deployment of treasury assets.

-

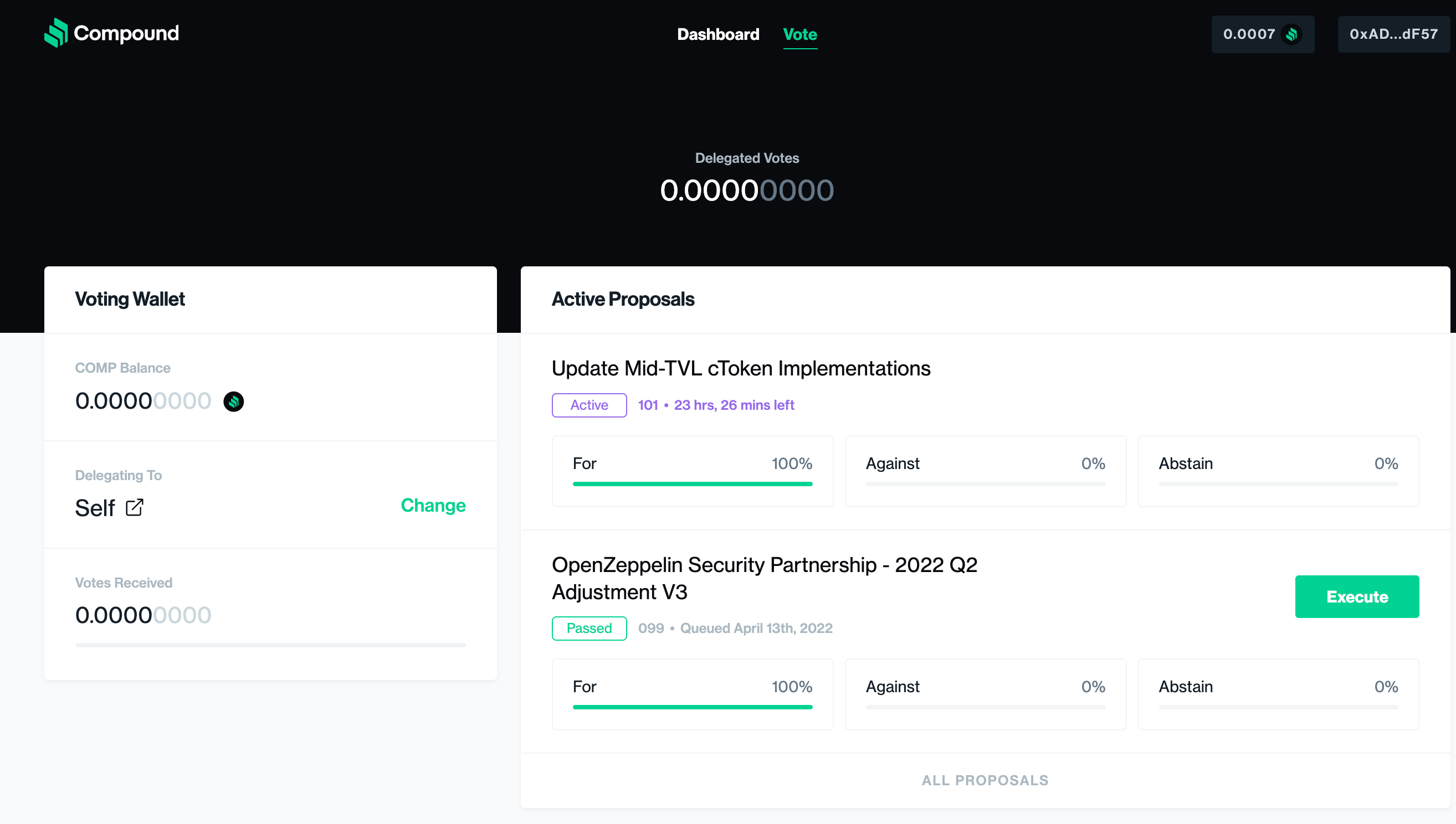

Data-Driven Governance: Scenario modeling provides actionable insights for treasury-related proposals, empowering DAO members to make informed, transparent decisions backed by robust financial analysis.

The best DAOs don’t just model one or two scenarios, they build robust frameworks that cover all angles. Here’s how they do it:

- Diversification Analysis: By simulating different mixes of stablecoins (like USDC), blue-chip tokens (BTC, ETH), and DeFi assets, DAOs can see which portfolios weather storms best. More on diversification strategies here.

- Liquidity Forecasting: Scenario models help predict when cash flow might tighten, ensuring payrolls get met even if the market tanks. Explore liquidity forecasting tools.

- Stress Testing: What happens if ETH drops 30% overnight? Stress tests reveal weak spots so DAOs can shore up reserves or adjust allocations in advance. Check out these best practices on stress testing from Tokenomics.net.

- Yield Optimization: Simulate staking vs lending vs LP positions to find the sweet spot between risk and reward, without risking real capital first.

- Governance Readiness: Data-backed scenario outcomes let DAO members vote on proposals with confidence, not just hope.

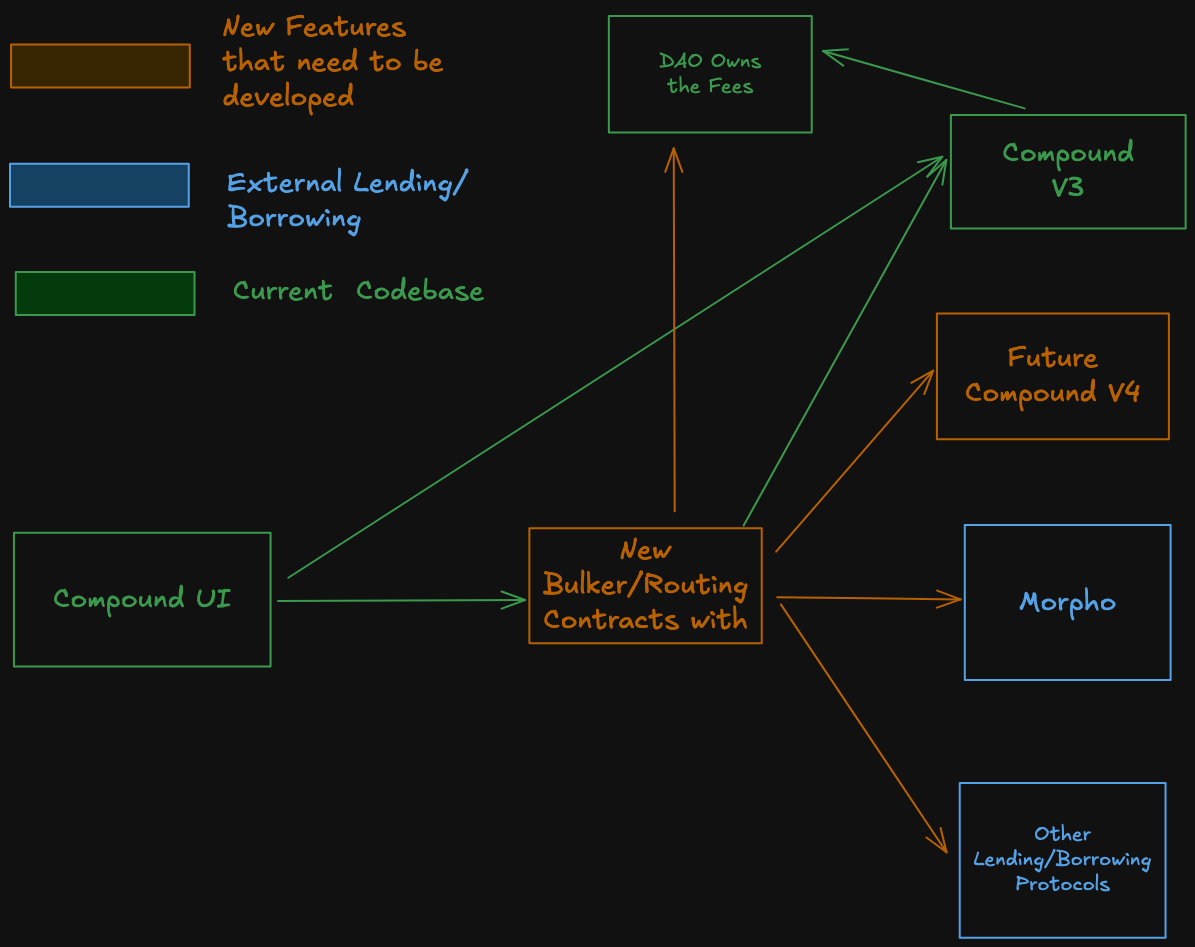

The Tech Stack: Tools Powering Data-Driven DAO Treasuries

A new wave of platforms is making scenario modeling accessible, even for non-quant communities. Tools like dHEDGE offer transparent dashboards for simulation and risk analysis, while frameworks such as P. A. L. O. (Preservation, Alignment, Longevity, Optimization) guide long-term strategy development through continuous scenario review. For DAOs looking to go pro with their treasury ops, leveraging these solutions is becoming non-negotiable.

This tech-first approach doesn’t just make treasuries safer, it makes them smarter. With real-time data feeds and automated reporting baked in, teams can react instantly to changing conditions while keeping every member in the loop.

Scenario modeling elevates DAO treasury management from guesswork to precision engineering. But the real magic happens when these models are woven into every layer of treasury operations, from daily cash flow decisions to long-term capital deployment. Let’s look at how top DAOs are turning simulation insights into winning strategies.

Real-World Impact: Scenario Modeling in Action

Imagine a DAO facing a sudden market downturn. Instead of scrambling, the treasury team consults their scenario models, which have already mapped out the impact of a 30% ETH drawdown or a stablecoin depeg event. With this foresight, they can:

- Rebalance assets toward stablecoins or less volatile holdings

- Trigger automated liquidity provisions to cover operating expenses

- Communicate transparently with the community, showing exactly how risks are being managed

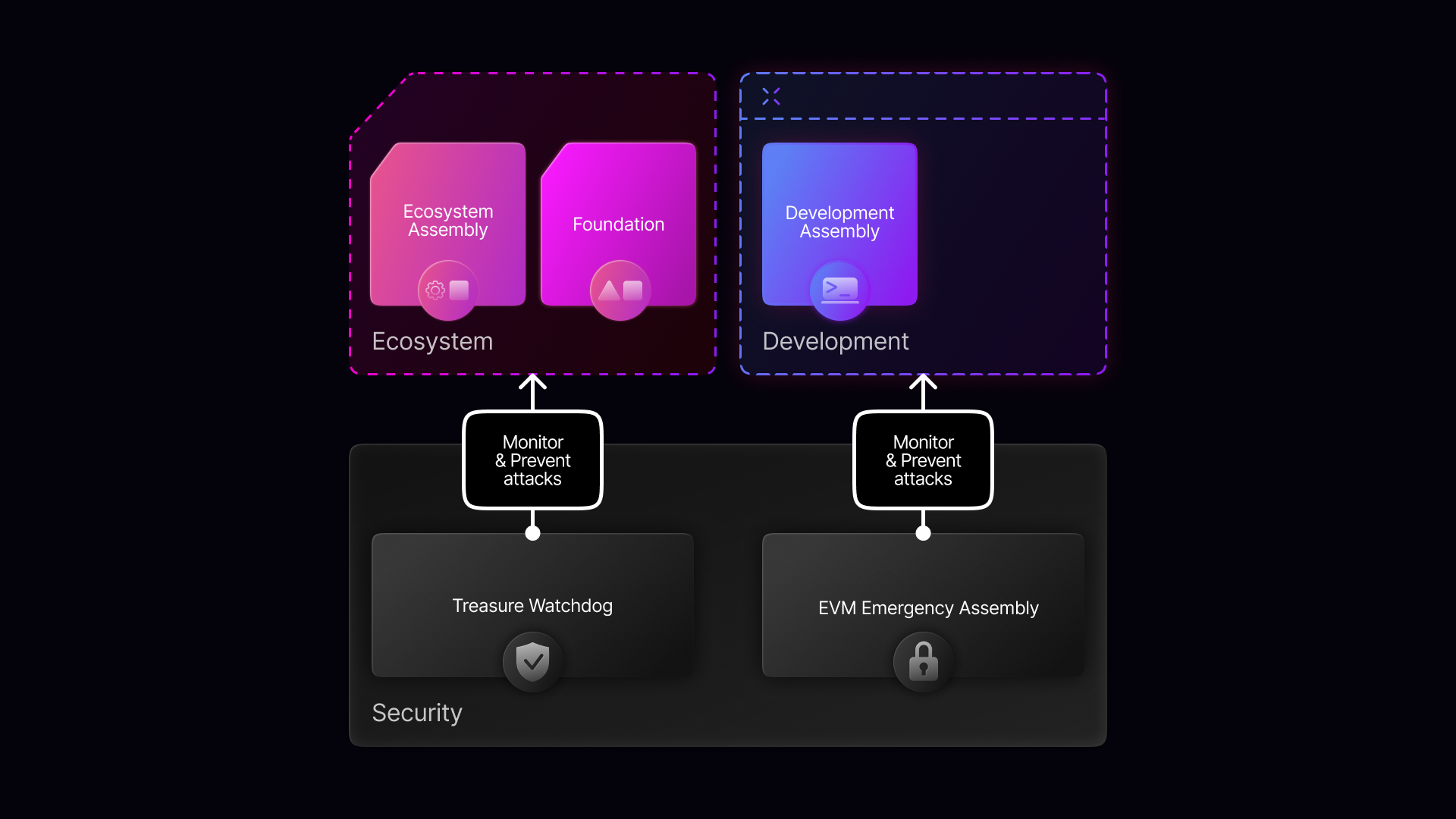

This proactive playbook isn’t hypothetical, it’s fast becoming standard operating procedure for DAOs using platforms like dHEDGE and following frameworks such as P. A. L. O. For more on how DAOs are mastering risk and capital allocation, check out this deep dive on dHEDGE’s approach.

Unlocking Community Confidence and Governance Power

The beauty of data-driven scenario modeling is that it doesn’t just keep funds safe, it empowers every token holder. When proposals come with clear, model-backed projections (for example, showing the effect of reallocating 20% of the treasury from ETH to USDC), voters can weigh options with full transparency. This transforms governance from speculation to science.

Top DAO Treasury Management Tools for Scenario Modeling

-

Gauntlet: Industry-leading platform for scenario modeling, risk assessment, and dynamic parameter optimization, empowering DAOs with data-driven treasury strategies.

-

Balancer: Automated portfolio management and scenario modeling for DAOs, enabling dynamic asset allocation and risk simulations through customizable liquidity pools.

-

dHEDGE: Non-custodial asset management protocol offering transparent scenario modeling, risk analysis, and performance tracking for DAO treasuries.

-

Harbor: Comprehensive DAO treasury management suite providing scenario analysis, cross-chain monitoring, and real-time risk assessment tools.

-

Multis: All-in-one treasury management platform for DAOs, featuring cashflow visualization, budgeting, and scenario forecasting for better financial decision-making.

-

Parcel: Streamlined treasury operations with scenario modeling, budgeting, and automated payments, helping DAOs optimize resource allocation and governance proposals.

The ripple effect? Higher participation rates, fewer contentious votes, and a reputation for professionalism that attracts both builders and capital.

Best Practices for Sustainable Treasury Growth

Pioneering DAOs don’t stop at running one-off simulations, they build scenario modeling into their financial DNA. Here’s what sets them apart:

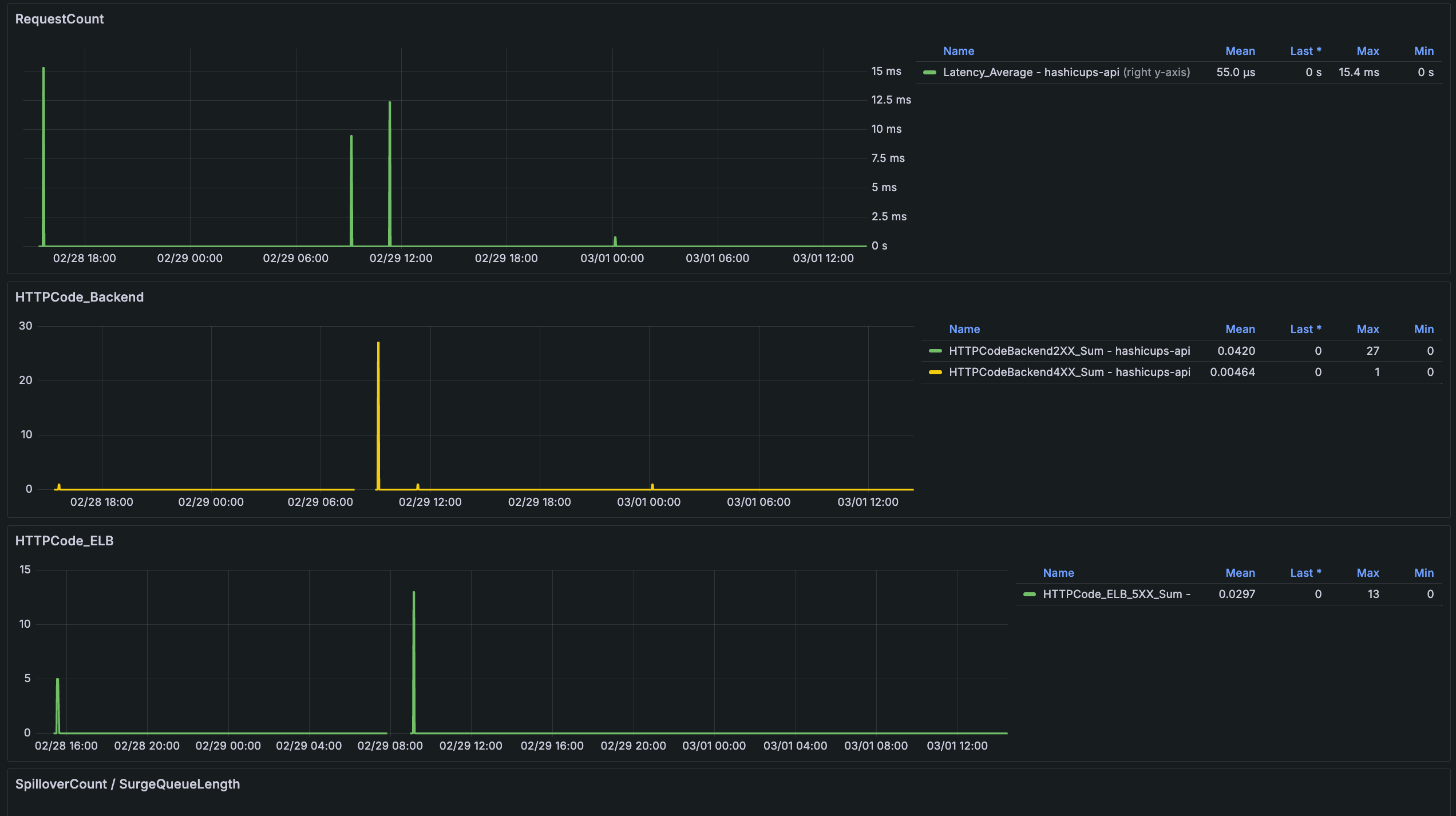

- Continuous Monitoring: Keep models updated with live market data and protocol changes.

- Diverse Scenarios: Go beyond bull/bear cases, model regulatory shocks, DeFi exploits, or sudden inflows.

- Open Reporting: Share results in public dashboards so every member stays informed.

- Iterative Governance: Use new insights from each cycle to refine both strategy and simulation parameters.

Calculated risks fuel innovation, but only when you know your downside as well as your upside.

The Future: Automation Meets Decentralized Foresight

The next frontier is automation, embedding scenario triggers directly into smart contracts so treasuries adapt in real time without waiting for human intervention. Imagine automated asset swaps or liquidity injections kicking in instantly when on-chain metrics hit predefined thresholds. This level of agility could redefine what it means to be a resilient DAO in an unpredictable market.

The bottom line: Scenario modeling isn’t just another tool, it’s the compass guiding DAOs through uncharted territory. As more communities embrace data-driven forecasting and open up their playbooks, expect smarter risk-taking, stronger governance, and treasuries that stand tall no matter where the crypto winds blow.