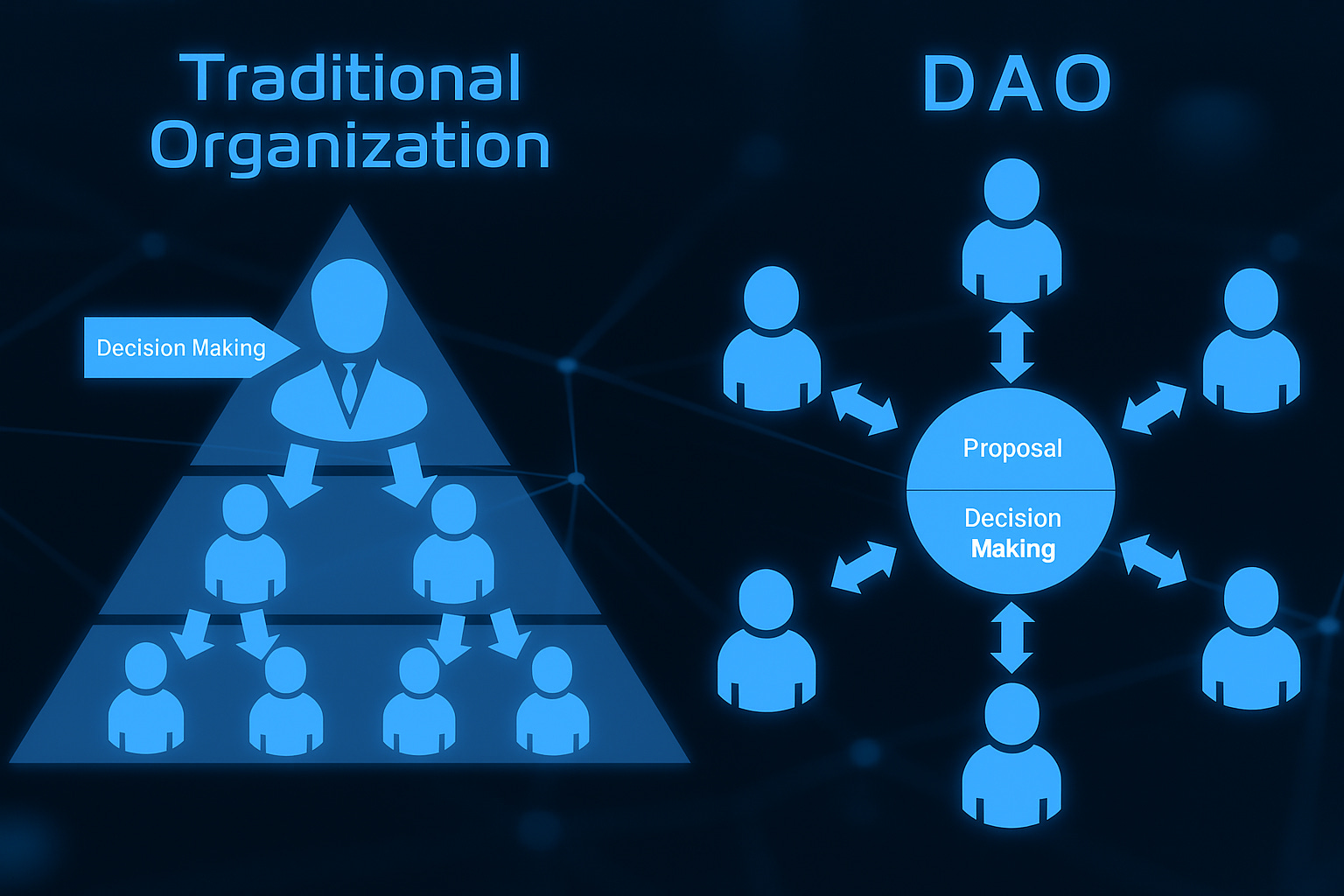

DAO treasuries are the beating heart of decentralized organizations, powering everything from ecosystem grants to protocol upgrades. But as DAOs scale and diversify, treasury risk management becomes a high-stakes game. The answer? Automated, on-chain analytics that transform risk oversight from a manual slog into a seamless, data-driven engine.

Why Manual Treasury Management is Outdated

Legacy treasury operations relied on spreadsheets, siloed wallets, and human decision-making prone to bias and error. In the current DeFi era, this approach is not just slow – it’s risky. DAOs need to keep pace with volatile markets, evolving regulatory demands, and the relentless march of automation. That means embracing tools that offer real-time transparency, automated compliance, and dynamic risk detection.

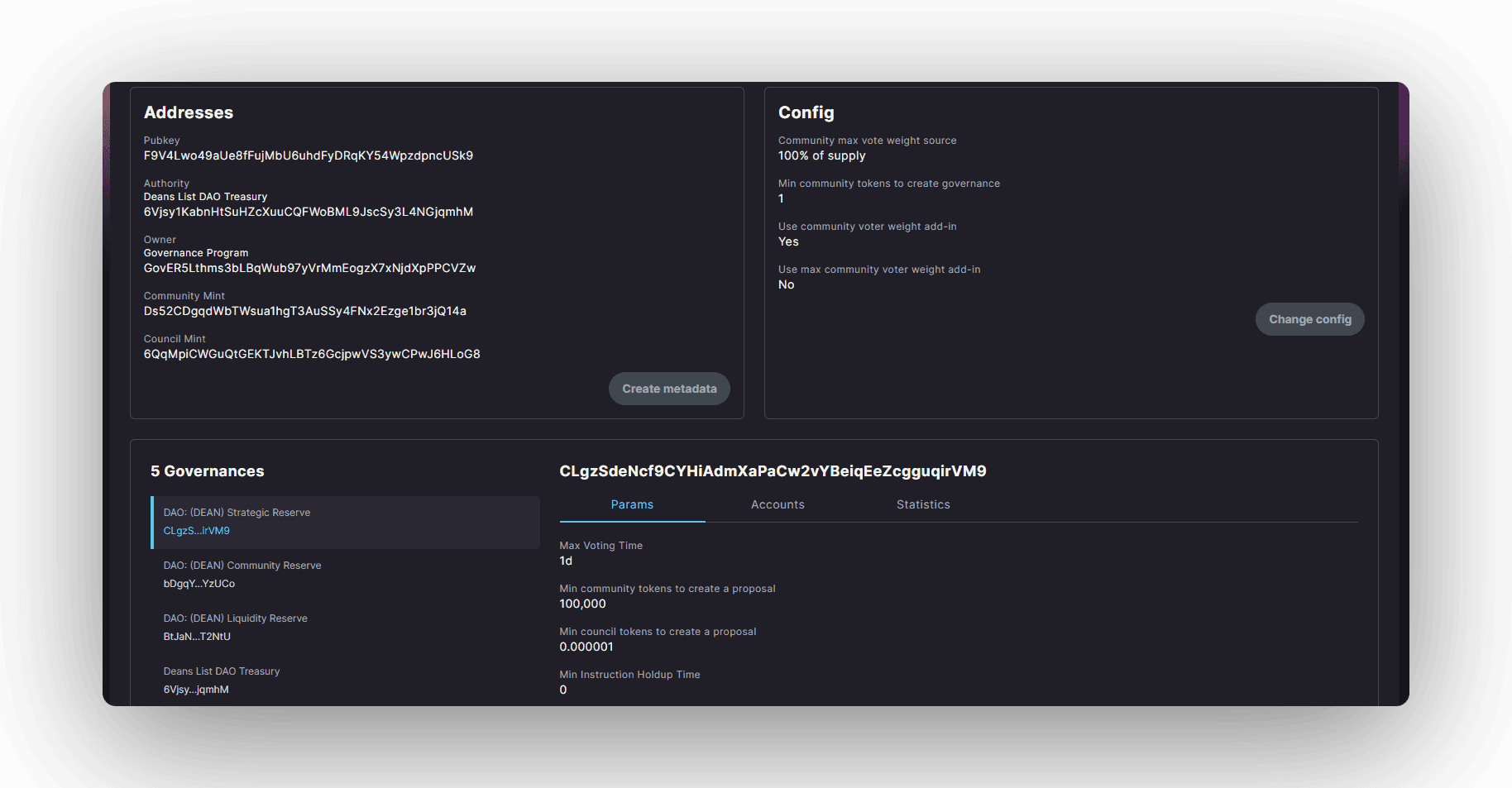

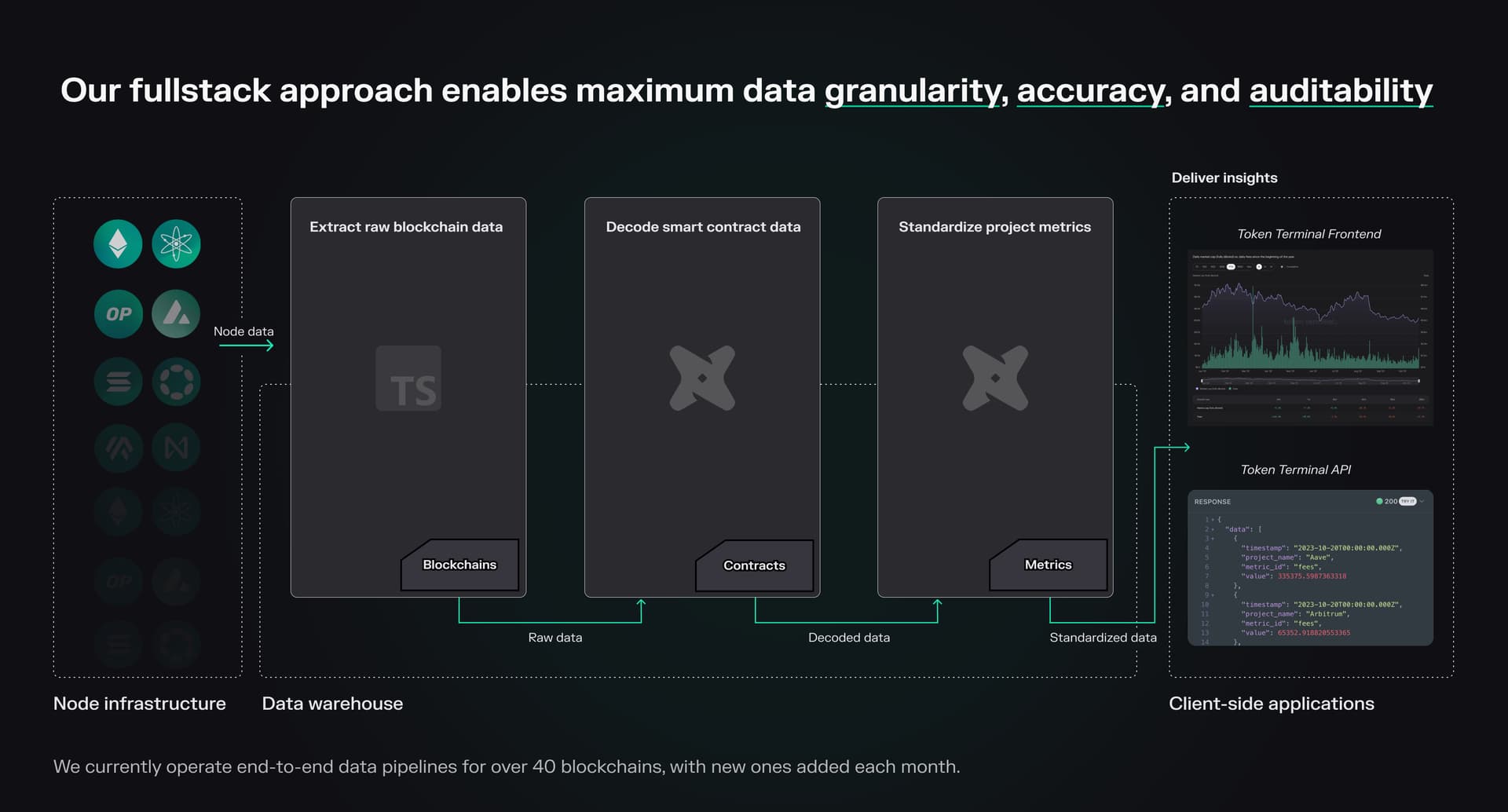

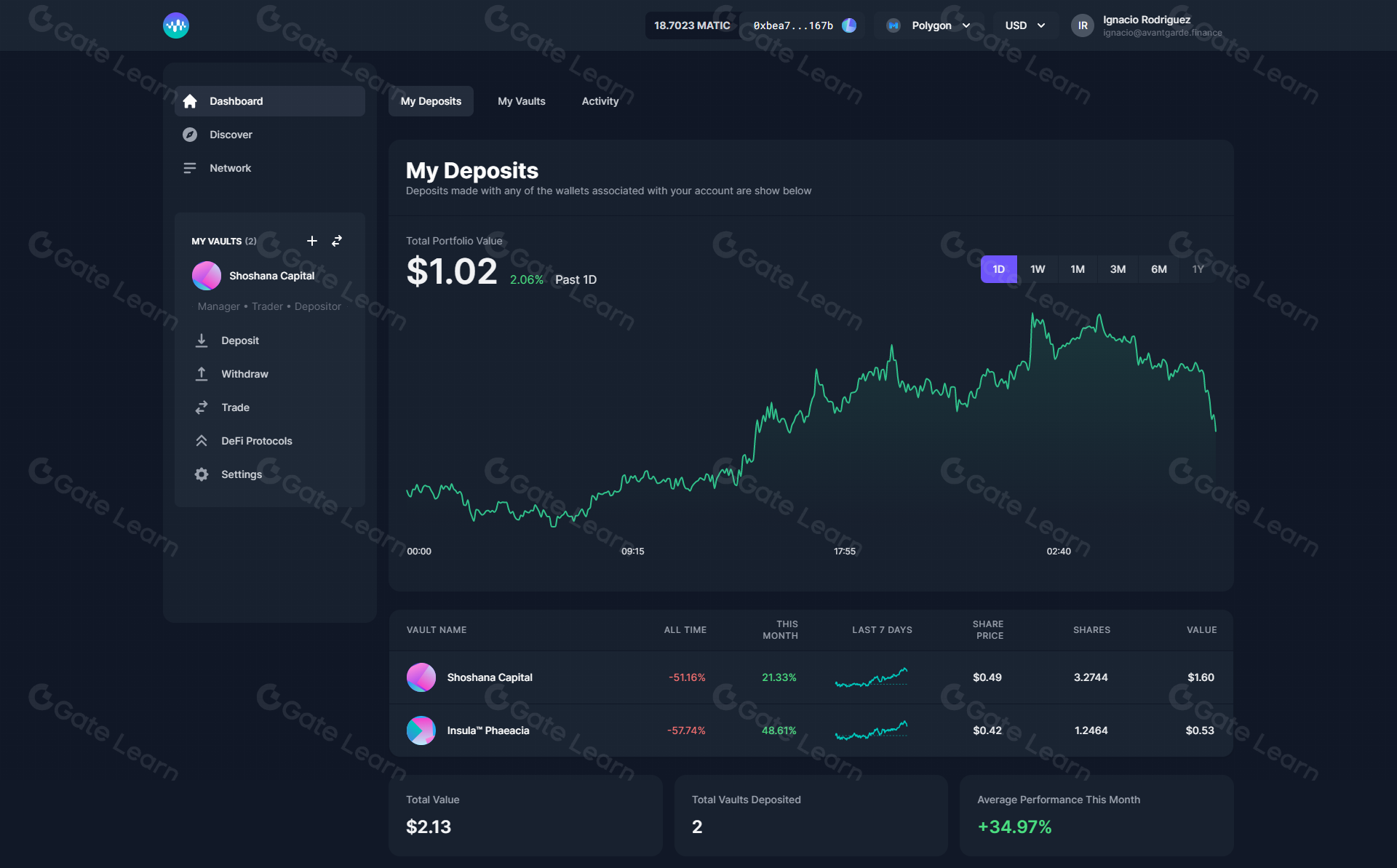

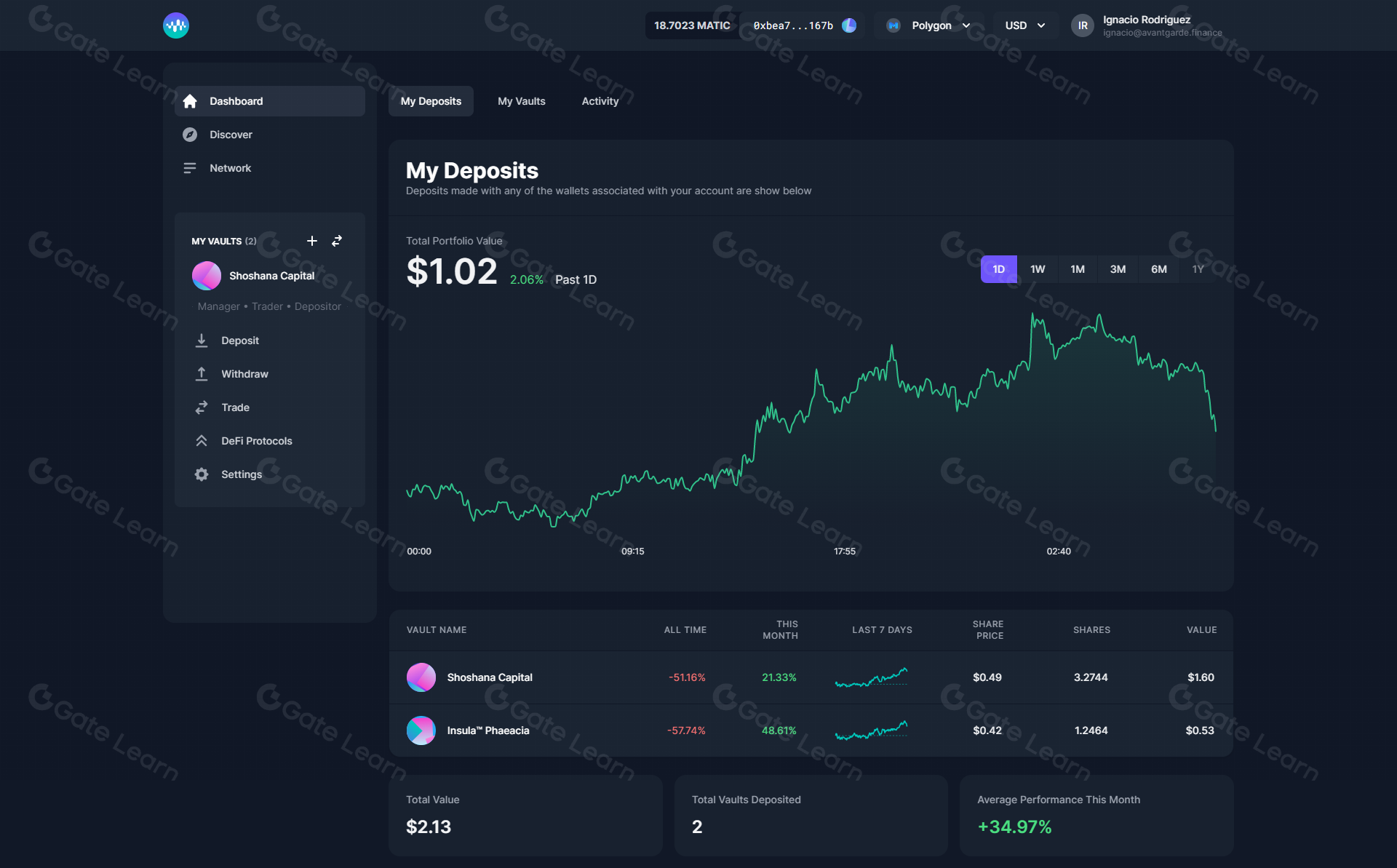

The new wave of DAO treasury management leverages permissionless smart contracts and on-chain data feeds. Platforms like Set Protocol and dHEDGE enable DAOs to automate yield strategies across DeFi protocols using audited code – no more black boxes or off-chain guesswork. This shift empowers communities to react instantly to market shocks or governance votes, rather than waiting for quarterly reports or manual interventions.

The Power of On-Chain Analytics for DAOs

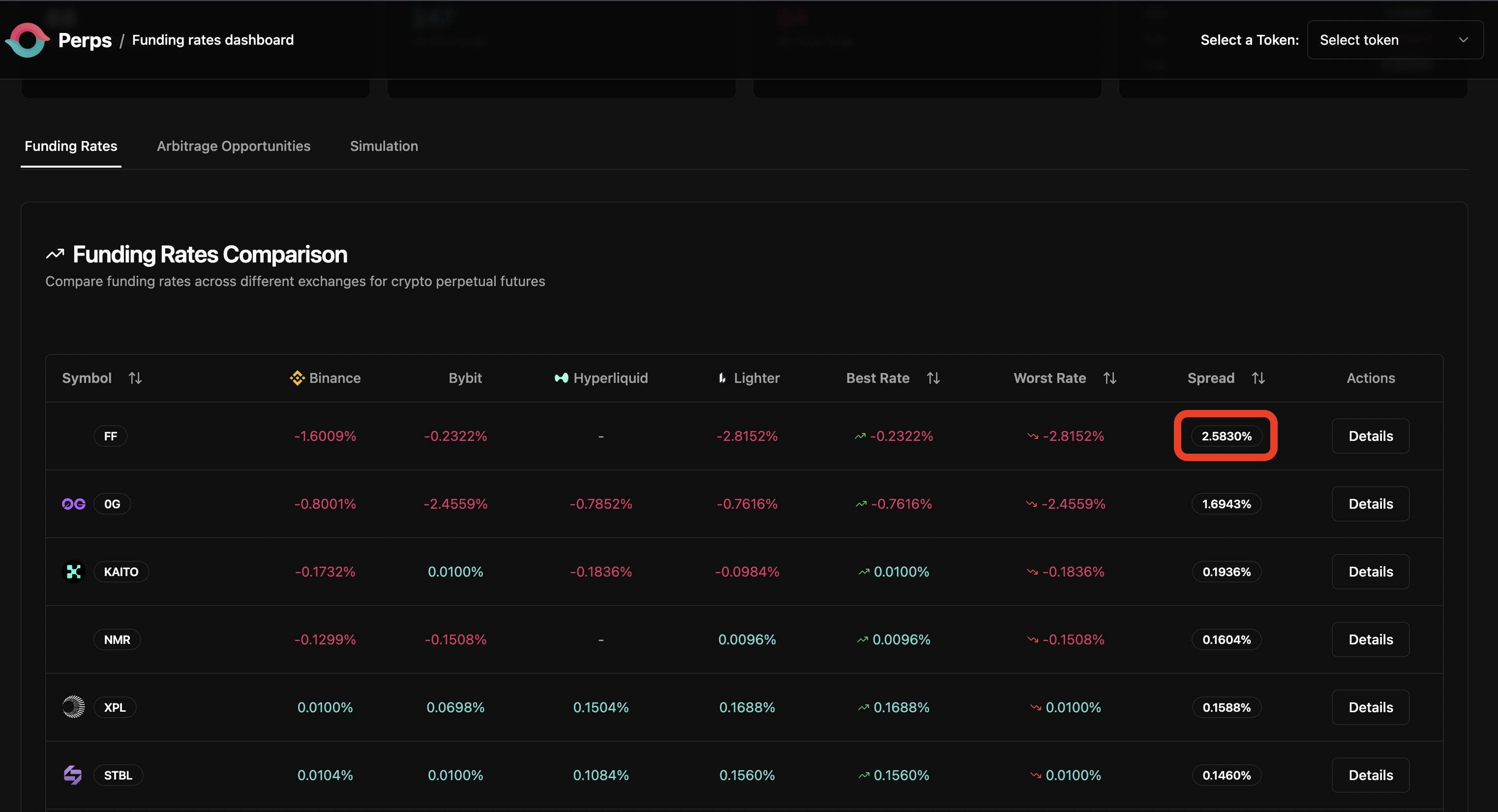

On-chain analytics for DAOs are more than just dashboards – they’re automated sentinels watching every transaction 24/7. With solutions like Octav providing daily historical snapshots, automated transaction labeling, and portfolio health metrics, treasuries gain granular insight into their exposures across stablecoins, governance tokens, LP positions, and more.

This level of visibility enables DAOs to:

Top Benefits of Automating DAO Treasury Risk Management

-

Real-Time Risk Monitoring: Automated on-chain analytics platforms like Octav deliver up-to-the-minute portfolio insights, enabling DAOs to instantly detect and respond to market shifts.

-

Enhanced Transparency & Auditability: Solutions such as dHEDGE ensure all treasury activities are fully transparent, trustless, and verifiable on-chain, fostering community trust.

-

Automated Risk Assessment: AI-powered tools, like those highlighted by MarkAI, dynamically evaluate portfolio risks and recommend strategy adjustments—minimizing human error and bias.

-

Streamlined Operations: Platforms such as Set Protocol automate yield strategies and asset allocation, reducing manual workload and operational costs for DAOs.

-

Improved Security & Resilience: Non-custodial, permissionless solutions like Avantgarde Finance safeguard DAO assets, ensuring funds remain under DAO control and protected from centralized risks.

Even better? AI-powered tools are now entering the arena. These systems can flag anomalous activity in real time or automatically rebalance portfolios based on algorithmic models tuned to community-approved risk parameters (see how AI is reshaping DAO treasury automation here). By integrating these innovations with privacy-preserving analytics on blockchain infrastructure, DAOs can maintain both transparency for members and security from external threats.

Treasury Diversification and Automated Risk Mitigation Strategies

Diversification isn’t just a buzzword – it’s essential insurance against systemic shocks in crypto markets. Automated systems can execute pre-set rebalancing strategies whenever asset allocations drift outside approved bands. For example: if ETH outpaces stablecoins during a bull run, the protocol can automatically sell down ETH to restore balance without waiting for a governance vote.

“Calculated risks fuel innovation. ”

This hands-off approach minimizes emotional trading decisions while maximizing capital efficiency. It also creates an immutable audit trail directly on-chain – every move is transparent and verifiable by the community at any time.

But automation doesn’t mean giving up oversight. The best DAO treasury risk management frameworks blend algorithmic execution with clear, community-driven governance parameters. Think of it as setting the rails: DAOs define risk thresholds, asset whitelists, and emergency triggers, while smart contracts do the heavy lifting in real time. This synergy ensures that treasury actions always align with the collective’s intent, without bottlenecking on human intervention.

Automated Compliance and On-Chain Audit Trails

Regulatory scrutiny is heating up, and DAOs can’t afford to be caught flat-footed. Automated compliance isn’t just a nice-to-have, it’s mission critical. By leveraging on-chain analytics for DAOs, organizations can generate tamper-proof audit trails for every treasury transaction. This not only satisfies external auditors but also reassures token holders that funds are managed responsibly.

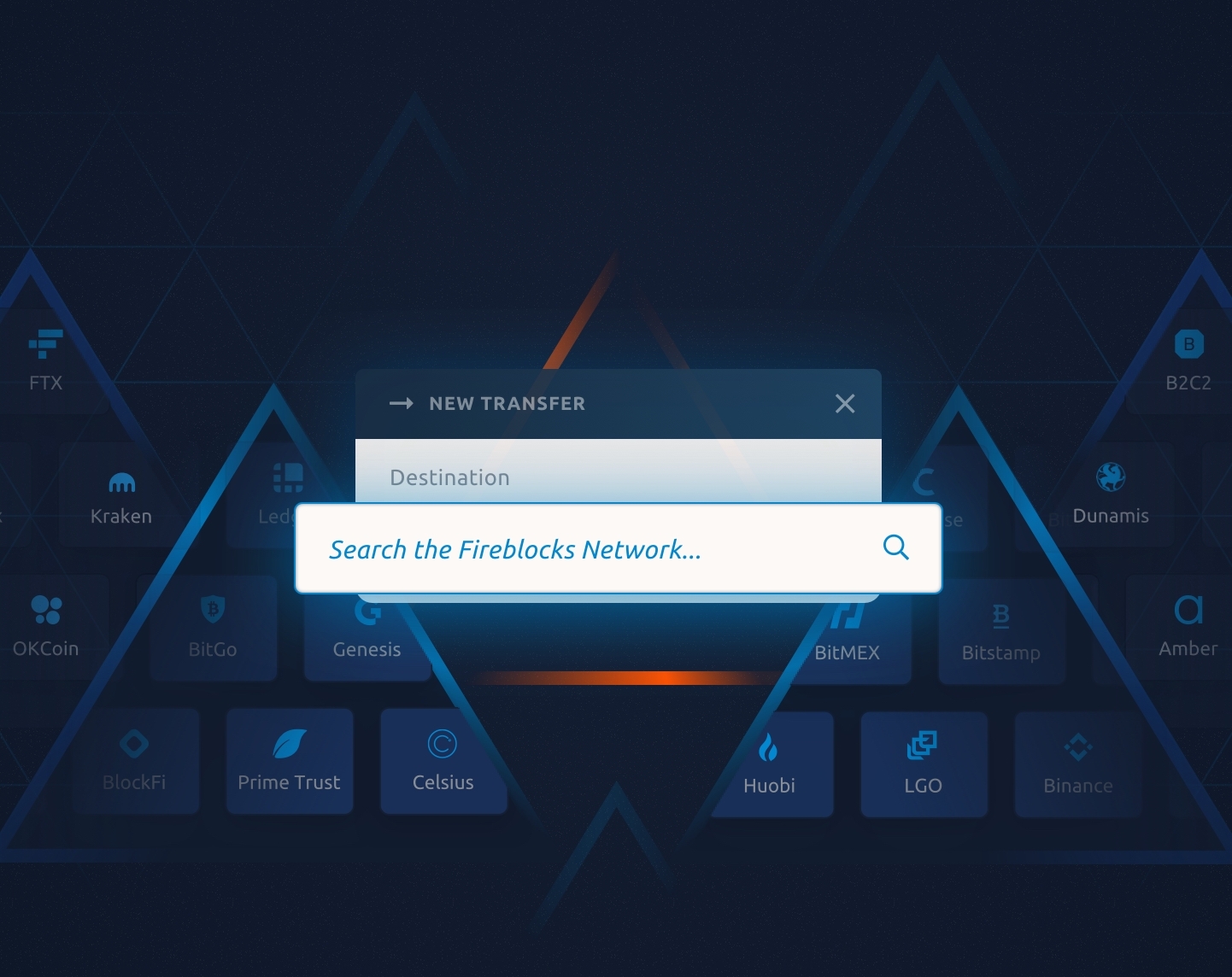

Platforms like dHEDGE offer fully transparent, non-custodial management with auditable trading activity (read more about dHEDGE’s approach). Meanwhile, Octav’s automated transaction labeling streamlines reporting and makes compliance checks a breeze, no more sifting through endless wallet logs or reconciling off-chain spreadsheets.

AI-Powered Risk Engines: The Next Leap Forward

The cutting edge of automated treasury risk engines is all about AI integration. Imagine an autonomous system that continuously analyzes market volatility, protocol exposures, and liquidity risks, then dynamically adjusts allocations to minimize downside without sacrificing upside potential. That’s not sci-fi; it’s already happening in leading DAOs piloting AI-powered solutions (see live examples here).

This tech isn’t just for whales or mega-treasuries either. Even smaller DAOs can harness AI-driven analytics to set stop-losses, automate insurance coverage when volatility spikes, or flag suspicious activity before it becomes a crisis.

AI Tools Revolutionizing DAO Treasury Management

-

dHEDGE offers fully transparent, trustless, and non-custodial DAO treasury management. Its on-chain analytics and AI-driven automation enable auditable trading and real-time risk monitoring, empowering DAOs to optimize capital allocation securely.

-

Octav delivers comprehensive crypto portfolio management tailored for DAOs, featuring real-time analytics, daily historical snapshots, and automated transaction labeling. Its AI-powered tools streamline oversight and enhance treasury transparency.

-

Set Protocol enables DAOs to automate asset allocation and risk management using audited smart contracts. Its AI-driven strategies dynamically rebalance portfolios across DeFi protocols, reducing manual intervention and systemic risk.

-

Avantgarde Finance provides AI-enhanced treasury solutions that help DAOs optimize financial strategies, meet operational expenses, and improve long-term sustainability through automated reporting and risk assessment.

Best Practices for Implementing Automated Risk Management

If your DAO wants to level up its treasury game using on-chain analytics and automation:

- Define clear risk parameters: Set asset caps, diversification targets, and loss thresholds in code, not just in docs.

- Pilot automation in stages: Start with non-critical funds or parallel sandboxes before rolling out to the main treasury.

- Prioritize transparency: Use platforms that provide real-time dashboards and accessible audit trails for all members.

- Continuously review models: Markets evolve fast, so should your risk parameters and automation logic.

The future of DAO treasury diversification automation is bright, and bold DAOs will lead the way by embracing these innovations early. With the right mix of smart contracts, on-chain analytics, and AI-powered oversight, decentralized organizations can transform their treasuries into resilient engines for growth, even as crypto markets continue their wild ride.