Stablecoin-native blockchains are rapidly redefining the landscape of on-chain treasury management, offering a new foundation for DAOs, DeFi protocols, and institutional treasuries seeking both efficiency and resilience. The recent $28 million seed round for Stable: a Bitfinex-backed, EVM-compatible Layer 1 designed with USDT as its native gas token, signals a strategic shift toward stablecoin-centric infrastructure. As treasurers and DAO operators face mounting pressure to optimize cost, security, and liquidity, the emergence of platforms like Stable represents a watershed moment for decentralized treasury solutions.

Stable Layer 1 USDT Gas: Eliminating Friction in Treasury Operations

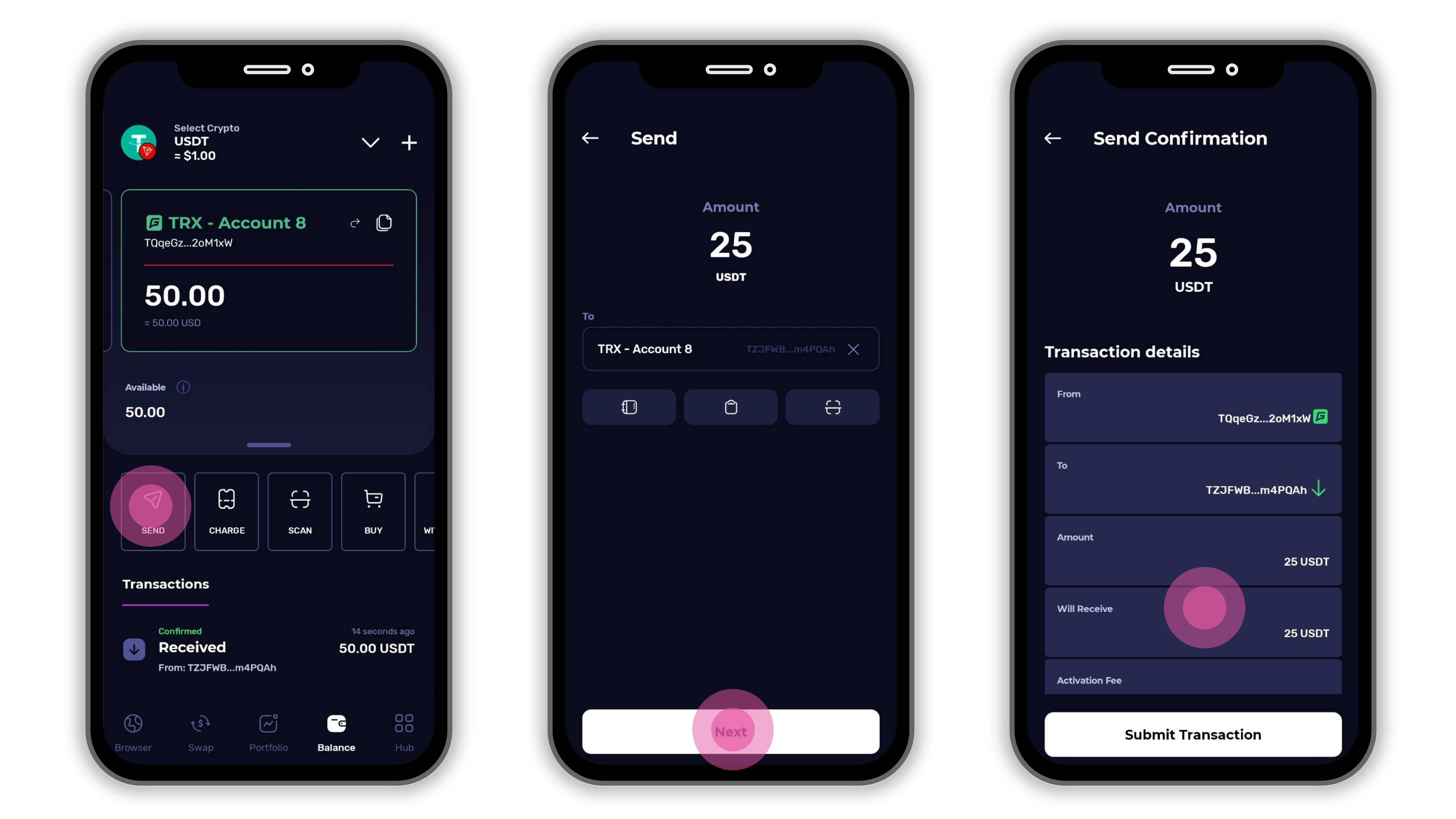

One of the most significant innovations introduced by Stable is the use of USDT as the native gas token. This design eliminates the need for DAOs and treasurers to juggle multiple assets simply to pay network fees. During periods of network congestion on traditional blockchains, organizations are often forced to sell stablecoins, sometimes at unfavorable rates, to acquire native gas tokens like ETH or SOL. This can trigger depeg spirals and introduce unnecessary volatility into treasury reserves.

With Stable’s gas-free USDT transfers and sub-second settlement times, treasurers gain predictable transaction costs and can execute real-time treasury operations without exposure to additional market risk. The result is a more robust environment for managing DAO stablecoin vaults, executing payroll, or rebalancing liquidity pools, even during periods of extreme volatility.

Advanced Risk Management: Automation and Real-Time Safeguards

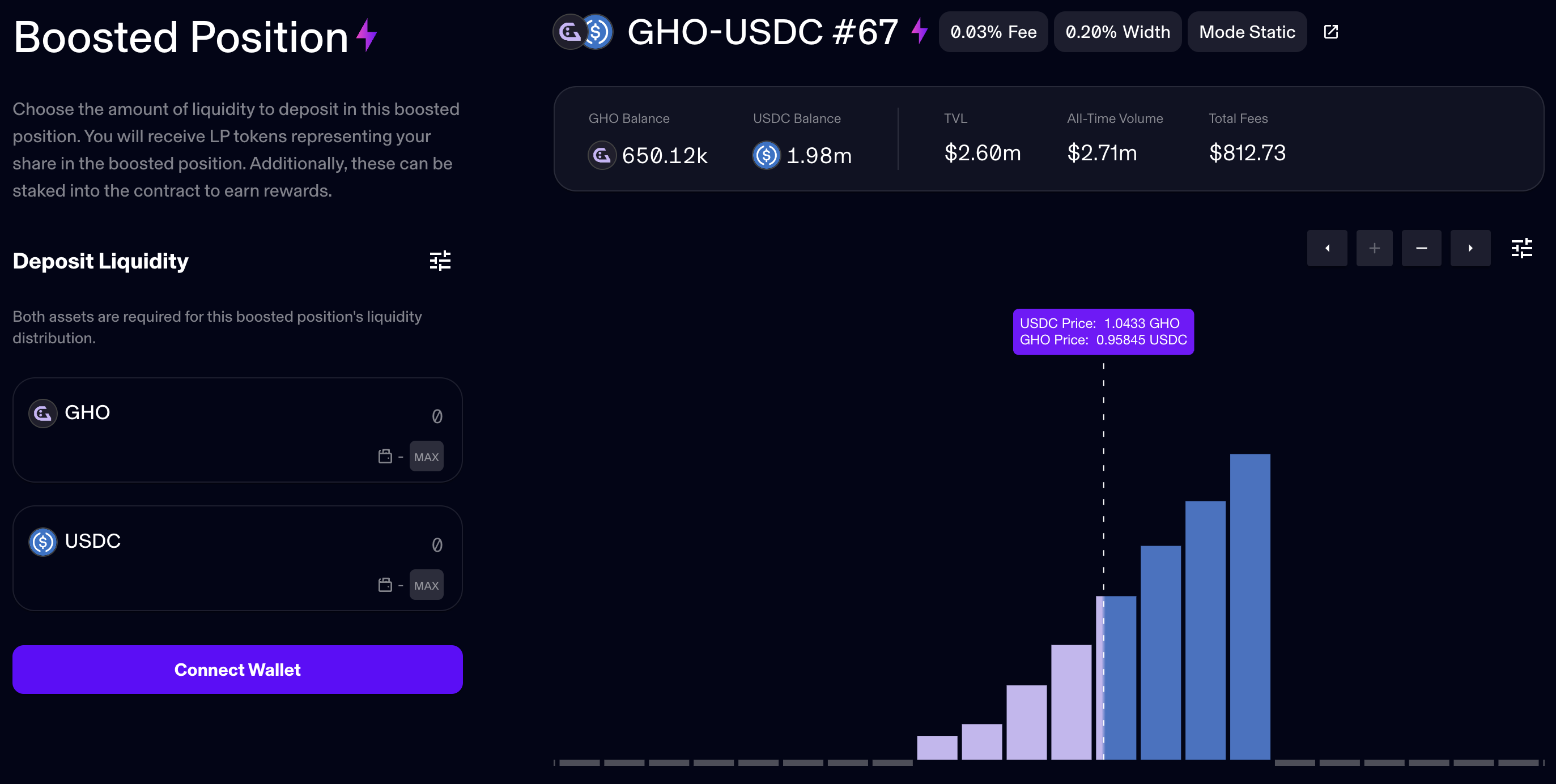

The composability of stablecoin-native blockchains is enabling a new generation of automated risk management tools. Protocols now implement built-in circuit breakers that pause markets during abnormal flows, on-chain insurance triggers that execute payouts instantly when USDT deviates from its peg, and liquidity monitoring bots that continuously analyze pool depth and utilization rates. These mechanisms are crucial for DAOs managing large treasuries or DeFi protocols safeguarding user funds.

This proactive approach, impossible on legacy chains, reduces the risk of front-running attacks and sandwich trades that have plagued stablecoin pools in the past. By minimizing settlement latency and providing atomic guarantees, platforms like Stablechain foster a more resilient ecosystem where treasurers can act quickly to hedge exposures or rebalance portfolios in response to real-time market signals.

Key Advantages of Stablecoin-Native Blockchains for Treasury Management

-

Gasless and Real-Time Stablecoin Transfers: Platforms like Stablechain enable gas-free USDT transfers and sub-second settlement, eliminating the need for native gas tokens and reducing transaction costs. This prevents forced asset sales during network congestion and enhances operational efficiency.

-

Enhanced Risk Management with Automated Safeguards: Stablecoin-native blockchains support advanced DeFi risk controls, such as on-chain circuit breakers, insurance triggers for automatic payouts on depegs, and liquidity monitoring bots that continuously oversee pool health. These features proactively mitigate risks like depegging and front-running.

-

Unified Liquidity Layer and Composability: The composable nature of stablecoin-native chains allows for the creation of new DeFi primitives—such as USDT-settled derivatives, flash loans with atomic settlement, and instant insurance payouts—without bridging risks. This fosters innovation and security in treasury operations.

-

Seamless Corporate Payments and 24/7 Global Payouts: Integration with platforms like Modern Treasury and Brale enables instant, secure, and compliant cross-border payments, including weekend and after-hours transactions, improving cash flow management for enterprises.

-

Yield-Bearing Stablecoins for Treasury Optimization: Solutions like Verified USD (USDV) allow treasuries to hold stablecoins fully collateralized by on-chain U.S. Treasury bills, offering yield opportunities and enhancing on-chain capital efficiency.

EVM Compatibility and New DeFi Primitives

Stable’s EVM compatibility ensures seamless integration with existing DeFi infrastructure while unlocking new primitives tailored to stablecoin use cases. Derivatives can now be settled directly in USDT without bridging risks; flash loans benefit from atomic settlement guarantees; insurance products pay out instantly based on on-chain peg monitoring. This unified liquidity layer not only enhances capital efficiency but also accelerates innovation across DAO treasury management and decentralized finance.

The combination of real-time settlement, gasless transactions, and composable risk management tools positions stablecoin-native blockchains as the backbone for next-generation treasury solutions, offering transparency, automation, and stability at scale.

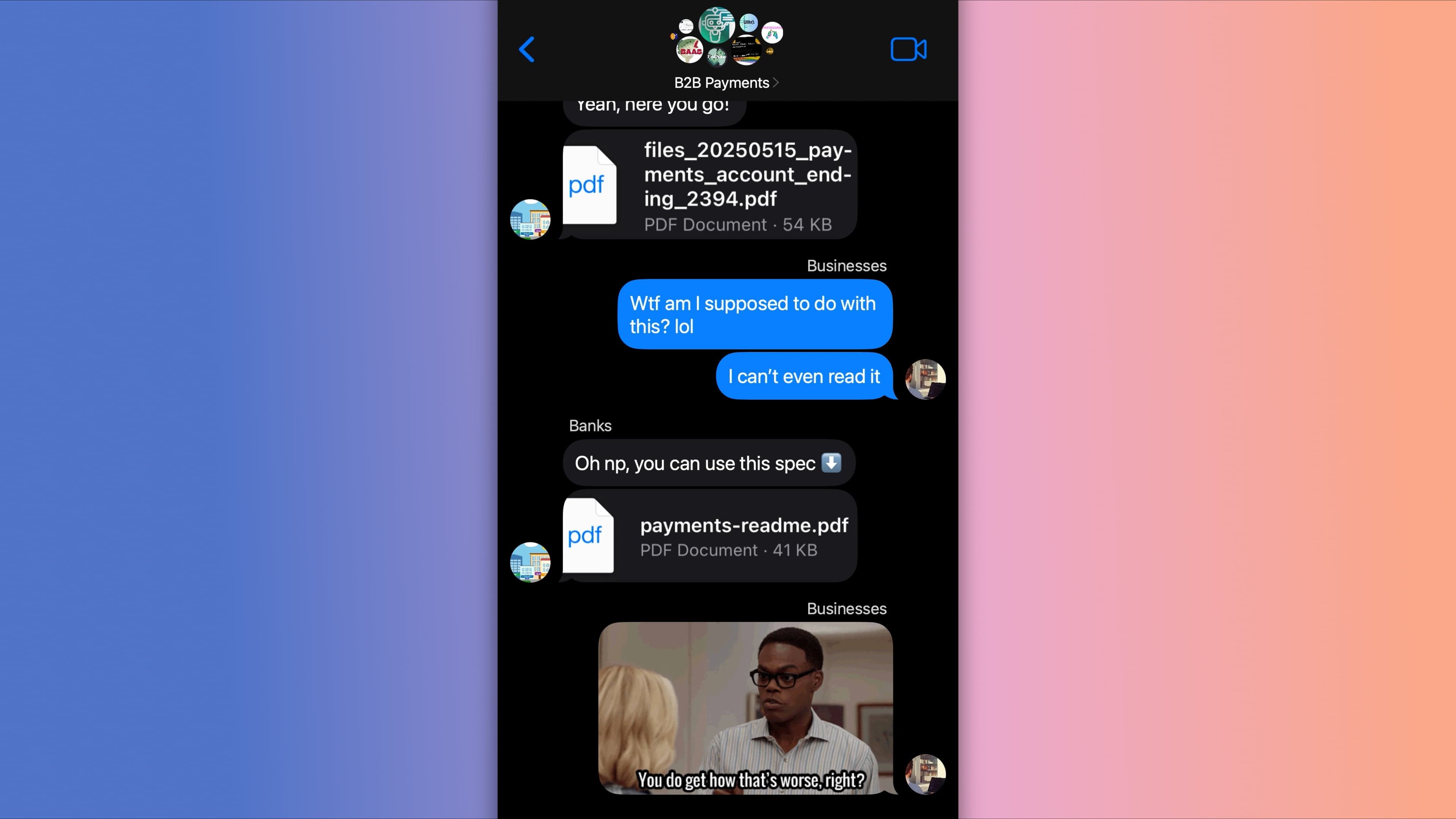

Beyond DeFi, these innovations are rapidly gaining traction in the corporate world. Platforms like Modern Treasury, in partnership with Brale, are integrating stablecoin payments to enable secure, instant global payouts and 24/7 treasury operations. This means companies can pay international vendors over weekends, fund accounts instantly, and manage foreign exchange risk with a level of efficiency that traditional rails simply cannot match. For treasurers, the implications are profound: reduced operational costs, enhanced compliance tooling, and the ability to automate routine processes without sacrificing security or auditability. For more on this real-world integration, see Modern Treasury’s announcement.

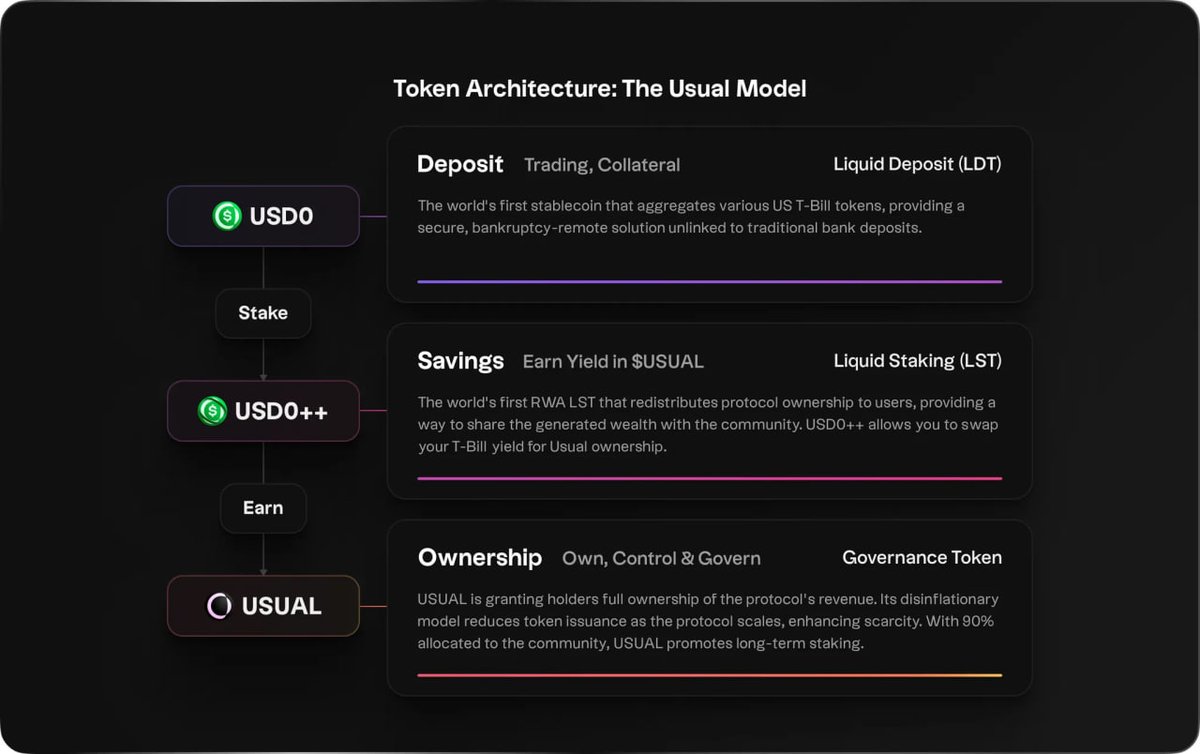

Another critical development is the rise of yield-bearing stablecoins collateralized by on-chain U. S. Treasury bills. Solutions like Verified USD (USDV) give DAOs and institutional treasuries access to stablecoins that are not only fully collateralized but also generate yield from tokenized government debt. This aligns on-chain treasury management with best practices in traditional finance, where capital efficiency and risk-adjusted returns are paramount. By holding assets like USDV, treasuries can simultaneously maintain liquidity and earn yield, without sacrificing the transparency and programmability that blockchain infrastructure provides. More details are available in this analysis from The Defiant.

Strategic Implications for DAOs and Decentralized Treasury Solutions

For DAOs and crypto-native organizations, the migration to stablecoin-native blockchains represents a strategic upgrade. Automated risk controls, gasless stablecoin operations, and instant settlement collectively reduce operational overhead and mitigate systemic risks. This is especially relevant for large treasuries managing diversified portfolios or those exposed to volatile DeFi markets. With the ability to deploy circuit breakers and on-chain insurance, treasurers can respond to market shocks with precision and speed, protecting both core reserves and community trust.

Key Ways Stablecoin-Native Blockchains Transform DAO Treasury Management

-

Gasless and Real-Time Stablecoin Transfers: Blockchains like Stablechain enable gas-free USDT transfers and sub-second settlement, eliminating the need for DAOs to acquire and manage native gas tokens. This reduces transaction costs, prevents forced asset sales during network congestion, and ensures uninterrupted treasury operations.

-

Enhanced Risk Management with Automated Tools: Stablecoin-native chains support on-chain circuit breakers, insurance triggers, and liquidity monitoring bots that automatically pause markets or trigger payouts when USDT deviates from its peg. This proactive infrastructure helps DAOs mitigate depeg risks and maintain treasury stability.

-

Composability for Advanced DeFi Primitives: Platforms like Stablechain facilitate directly settled USDT derivatives, atomic flash loans, and instant insurance payouts upon peg deviations. This unified liquidity layer enables DAOs to deploy innovative treasury strategies without bridging risks or settlement delays.

-

Seamless Integration with Corporate Treasury Platforms: Services such as Modern Treasury (in partnership with Brale) integrate stablecoin-native payments, offering 24/7 global payouts, instant funding, and automated compliance. DAOs and organizations can pay vendors and manage funds across borders efficiently, even on weekends.

-

Yield-Bearing Stablecoins for Treasury Optimization: New stablecoins like Verified USD (USDV) are fully collateralized by tokenized U.S. Treasury bills, enabling DAOs to earn yield on their stablecoin holdings while maintaining liquidity and on-chain transparency.

Moreover, the composability of these platforms accelerates the development of DAO-specific tools: automated payroll modules, dynamic liquidity rebalancers, and transparent audit dashboards are now within reach. As the ecosystem matures, expect to see a proliferation of plug-and-play treasury apps optimized for stablecoin-native environments, further democratizing access to institutional-grade financial infrastructure.

The Road Ahead: Building Resilience and Unlocking Innovation

Stablecoin-native blockchains are not just a technical evolution, they are a strategic enabler for the next era of decentralized finance and treasury management. By eliminating friction in everyday operations, automating risk controls, and aligning with yield-generating real-world assets, platforms like Stable are setting new standards for transparency, efficiency, and security. As adoption accelerates among DAOs, DeFi protocols, and forward-thinking corporates, these innovations will define the competitive edge in on-chain treasury strategy.