Arbitrum DAO has emerged as a leading force in on-chain treasury management, setting new standards for sustainable yield generation in the decentralized finance (DeFi) ecosystem. With the recent launch and expansion of its Stable Treasury Endowment Program (STEP), the DAO is not only safeguarding its treasury but also driving adoption of tokenized real-world assets (RWAs) on-chain. This analytical deep dive explores how Arbitrum DAO leverages innovative strategies to deliver robust, transparent, and sustainable returns for its community.

Arbitrum DAO’s Treasury: From Idle Funds to Productive Yield

Historically, DAO treasuries have struggled with the challenge of capital efficiency. Idle on-chain assets, often denominated in native tokens, expose DAOs to volatility risk and missed income opportunities. Arbitrum DAO has addressed this head-on, implementing a multi-phase treasury management program that turns passive reserves into yield-generating instruments while maintaining a focus on risk management and transparency.

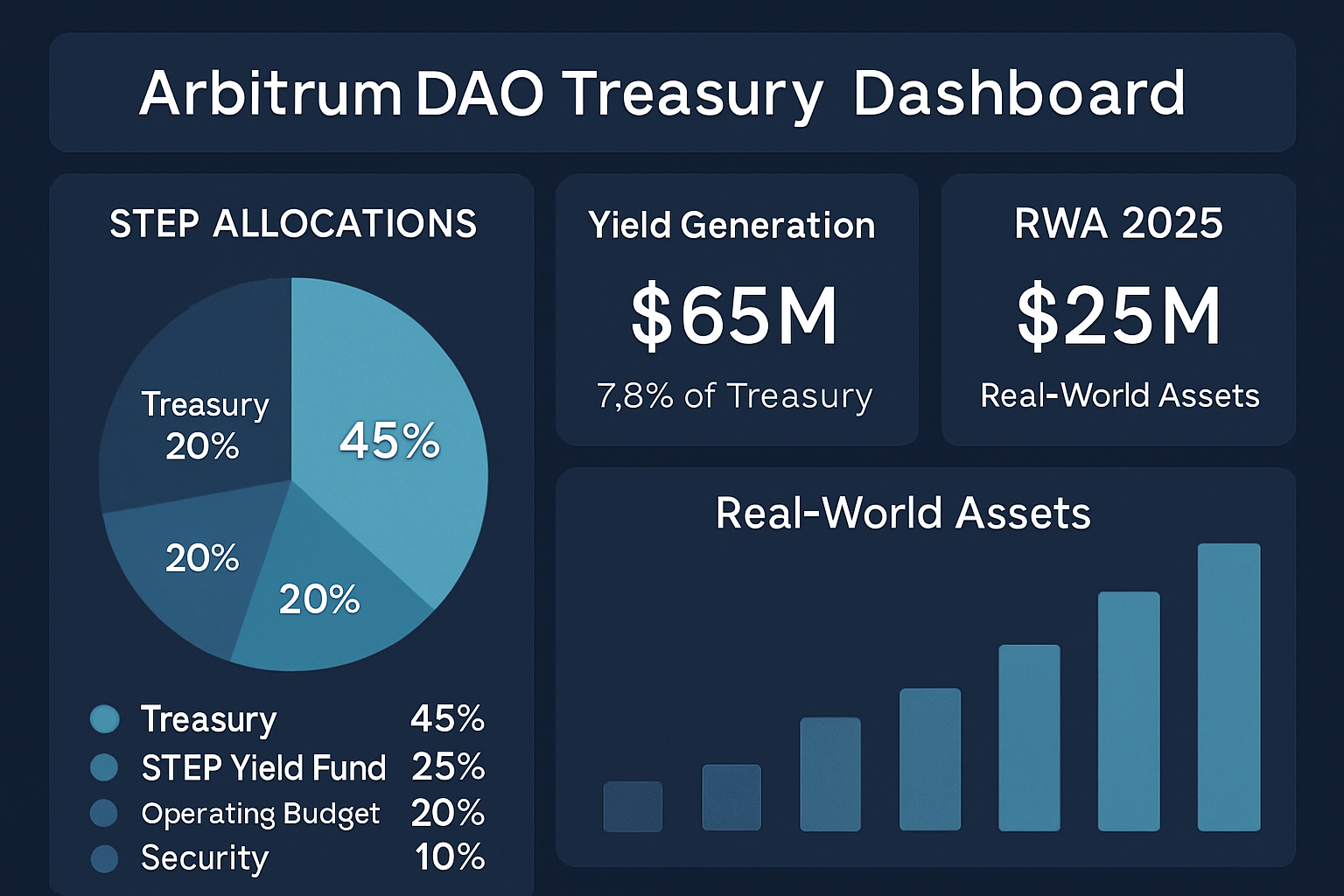

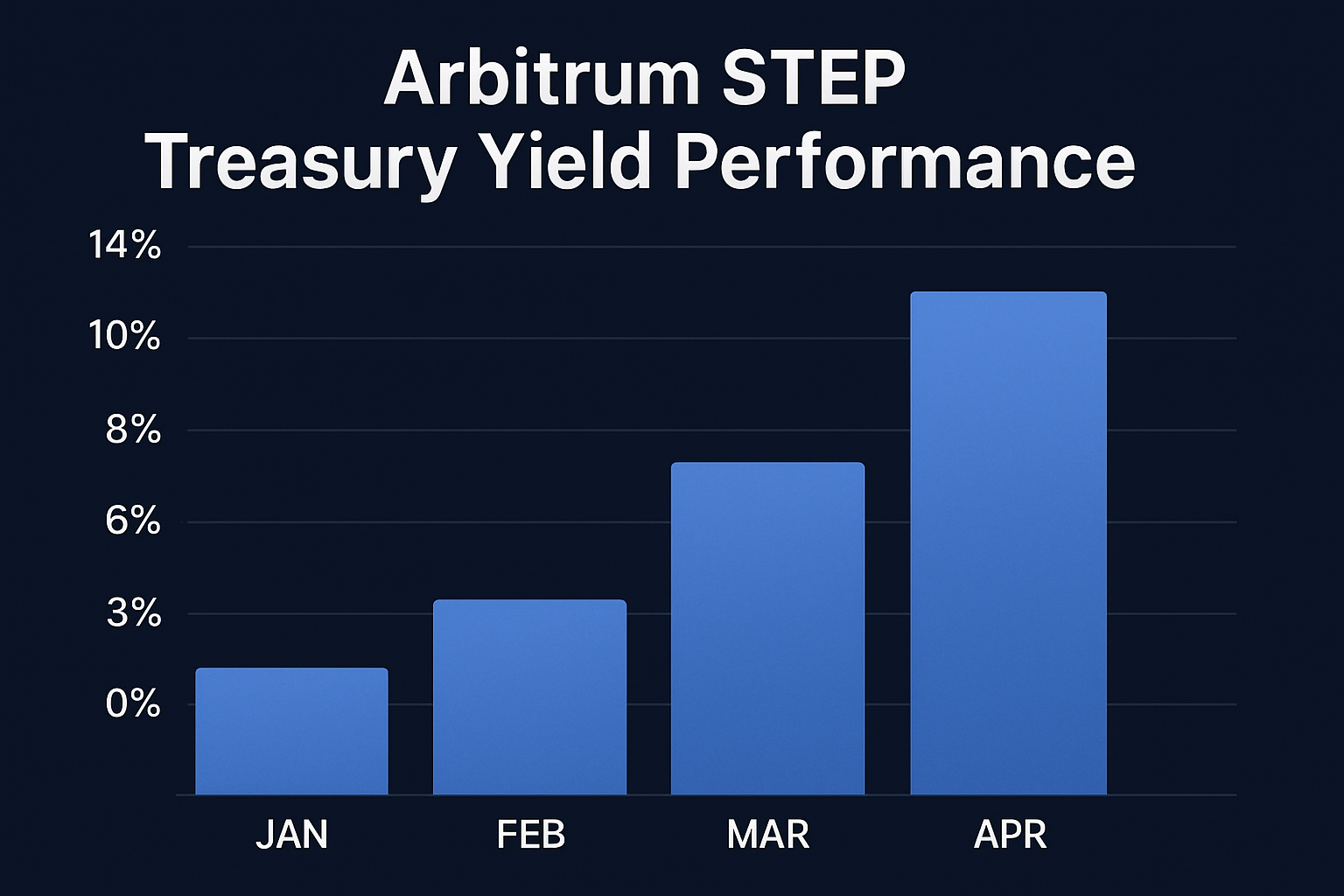

The DAO’s approach is rooted in diversification and institutional-grade asset selection. In July 2024, STEP was launched as a flagship initiative to allocate treasury capital into tokenized U. S. Treasury products. This move marked a strategic shift towards blending traditional finance (TradFi) rigor with DeFi agility. By October 2025, the DAO had allocated over $30 million in the first phase, generating nearly $700,000 in passive yield and setting a precedent for other DAOs to follow.

STEP 2: Scaling Up with Institutional Partners

Building on its initial success, Arbitrum DAO greenlit STEP 2 in May 2025, allocating an additional 35 million ARB (valued at approximately $15.5 million, with ARB currently priced at $0.4208). The selection process for STEP 2 was notably rigorous, with over 50 proposals reviewed before settling on three institutional-grade issuers:

- Franklin Templeton’s FOBXX (tokenized as BENJI) – 35% allocation

- Spiko’s USTBL – 35% allocation

- WisdomTree’s WTGXX – 30% allocation

This portfolio construction not only diversifies issuer risk but also exposes the treasury to a blend of liquidity profiles and yield curves. By anchoring its on-chain portfolio in tokenized U. S. Treasuries, the DAO benefits from the stability and predictable returns of government securities, now accessible on the blockchain via regulated platforms. This is a significant evolution from speculative DeFi yield farming, representing a more sustainable and compliant approach to DAO treasury management.

Strategic Objectives: Sustainability, Transparency, and Ecosystem Growth

The overarching objective of Arbitrum’s treasury program is to generate sustainable DAO returns that can reliably support operational expenses, ecosystem incentives, and long-term growth initiatives. By investing in tokenized RWAs, the DAO aligns its interests with both its token holders and the broader DeFi community. The income generated via STEP is not only passive but also highly transparent, with on-chain reporting and real-time analytics available to all stakeholders.

In parallel, initiatives like the $40 million DeFi Renaissance Incentive Program (DRIP) are incentivizing capital-efficient strategies across the Arbitrum ecosystem. By encouraging borrowing against yield-bearing assets and supporting leveraged looping strategies, DRIP amplifies liquidity and composability without compromising the core treasury’s safety or sustainability.

For more detailed insights and ongoing updates about Arbitrum DAO’s evolving treasury strategies, visit this comprehensive resource.

Risk management remains front and center in Arbitrum DAO’s treasury playbook. By prioritizing regulated issuers and integrating real-time on-chain analytics, the DAO ensures that treasury allocations are both secure and auditable. This transparency is critical for building trust among stakeholders and for setting a benchmark in DAO treasury transparency. Every allocation, yield event, and risk parameter is visible to the community, reinforcing the ethos of decentralized governance.

Yield Generation in Practice: A Model for DeFi Treasury Best Practices

Arbitrum’s approach to DAO yield generation strategies stands out for its measured balance between innovation and prudence. The DAO’s shift from speculative DeFi farming to institutional-grade tokenized assets has established a new paradigm: sustainable, risk-adjusted returns that are less correlated with crypto market volatility. With ARB trading at $0.4208, the DAO’s careful capital deployment not only mitigates drawdown risk but also secures predictable income streams that can be reinvested or allocated as incentives.

Key Benefits of Arbitrum DAO’s On-Chain Treasury Deployment

-

Diversification through Tokenized Real-World Assets (RWAs): Arbitrum DAO strategically invests in tokenized U.S. Treasury products from reputable issuers like BlackRock’s BUIDL, Ondo’s USDY, and Mountain Protocol’s USDM, reducing reliance on volatile crypto assets and enhancing treasury resilience.

-

Consistent and Sustainable Yield Generation: The Stable Treasury Endowment Program (STEP) has generated nearly $700,000 in passive yield by deploying over $30 million into institutional-grade assets, providing DAOs with reliable income streams to fund operations and growth.

-

Institutional-Grade Security and Transparency: By partnering with established issuers such as Franklin Templeton (BENJI), Spiko (USTBL), and WisdomTree (WTGXX), the program ensures high standards of asset security, regulatory compliance, and on-chain transparency.

-

Promotion of On-Chain RWA Adoption: Arbitrum DAO’s investments encourage broader adoption of tokenized real-world assets within the DeFi ecosystem, bridging traditional finance and blockchain for enhanced capital efficiency.

-

Enhanced Financial Stability for DAOs and DeFi Projects: Sustainable yield from low-risk, real-world assets strengthens the financial foundation of DAOs, enabling more predictable budgeting and long-term ecosystem development.

This disciplined framework is further enhanced by the DAO’s commitment to continuous improvement. Community-driven governance ensures that treasury strategies remain adaptive to evolving market conditions, regulatory shifts, and new opportunities in on-chain finance. The result is a treasury program that is not only resilient but also scalable, capable of supporting Arbitrum’s expanding ecosystem without sacrificing long-term sustainability.

The Road Ahead: Institutional Adoption Meets DeFi Innovation

Arbitrum DAO’s treasury management program is more than just a yield engine, it’s a blueprint for the next generation of decentralized financial stewardship. As tokenized real-world assets continue to gain traction on-chain, DAOs that emulate Arbitrum’s model will be better positioned to weather market cycles, fund innovation, and drive ecosystem growth.

Looking forward, the integration of additional RWA issuers, expanded incentive programs like DRIP, and a relentless focus on transparency will keep Arbitrum at the forefront of DeFi treasury best practices. The DAO’s success demonstrates that sustainable returns are achievable when on-chain governance, institutional rigor, and DeFi composability converge.

For DAOs and crypto communities seeking robust, compliant, and transparent treasury management solutions, Arbitrum’s evolving program provides a compelling case study, and a playbook worth following. Explore more about these strategies at On-Chain Treasuries.