In 2024, Decentralized Autonomous Organizations (DAOs) are redefining treasury management by leveraging the automation and transparency of smart contracts. As the landscape matures, DAOs are moving beyond manual, human-driven processes and embracing code-based automation for everything from fund allocation to security protocols. This shift is not just about operational efficiency; it is a fundamental evolution in how decentralized communities safeguard and grow their assets.

Core Building Blocks: Smart Contracts and Multi-Signature Wallets

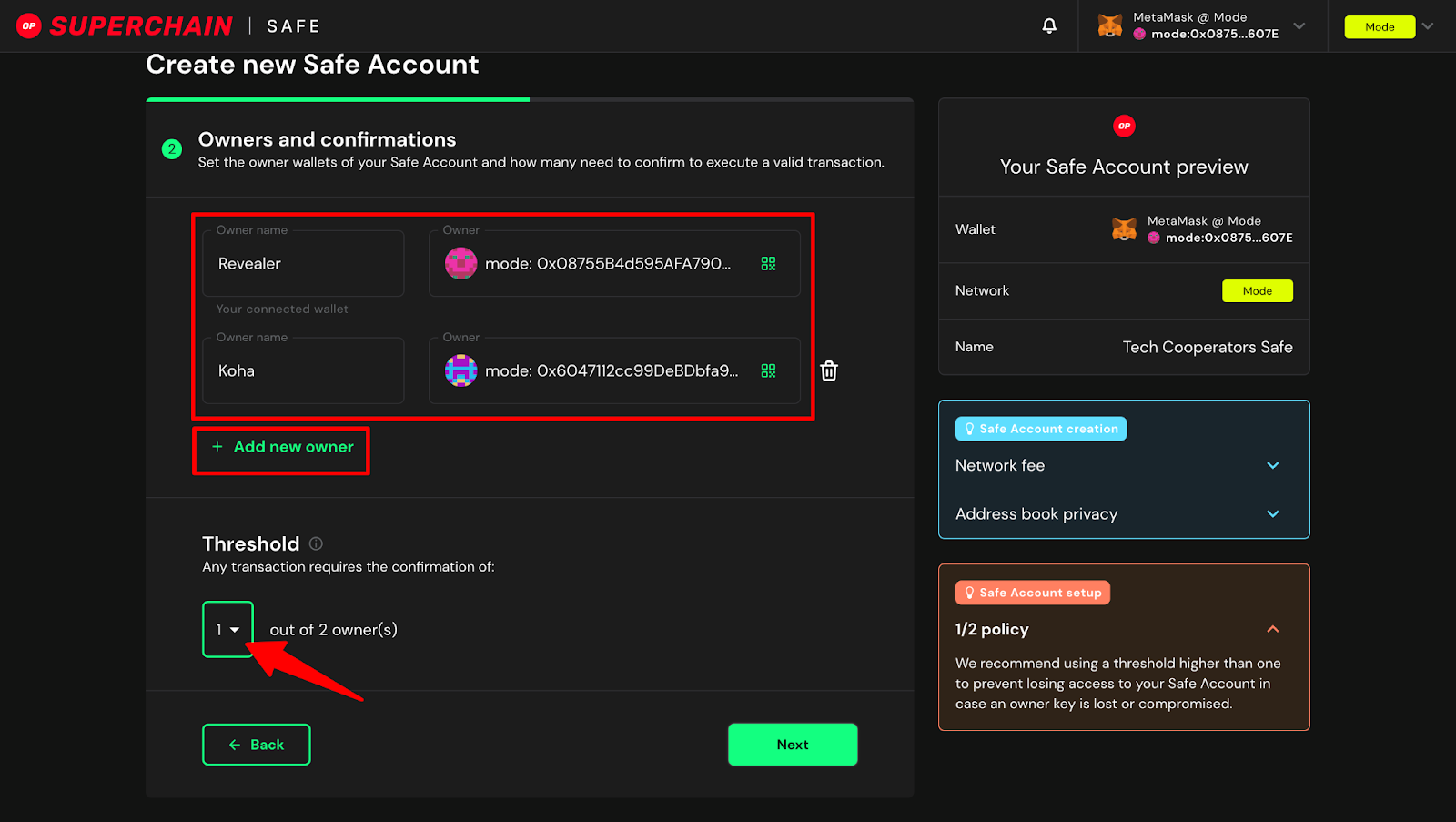

At the heart of DAO treasury automation are smart contracts: self-executing code that governs how funds are managed, allocated, and secured. These contracts are immutable once deployed, ensuring that treasury operations follow predefined rules without the need for centralized oversight. In parallel, multi-signature wallets like Gnosis Safe have become the industry standard for safeguarding DAO assets. By requiring multiple approvals for transactions, multisig wallets align with DAO governance models and dramatically reduce the risk of unilateral fund movement or insider threats.

For example, a DAO may configure its Gnosis Safe wallet to require three out of five core contributors to approve any outgoing transaction. This approach is detailed in the Tokenomics DAO Treasury Management Guide, which highlights how multisig wallets underpin trust and resilience in decentralized organizations.

Automated Fund Allocation: Efficiency Meets Governance

Smart contract automation enables DAOs to move beyond static, manual treasury management. Funds can be allocated automatically based on governance votes, contributor performance, or predefined schedules. For instance, Uniswap DAO utilizes smart contracts to distribute grants and invest in ecosystem growth, eliminating bottlenecks and ensuring transparent execution of community decisions. This model not only increases operational efficiency but also enhances auditability, as every allocation is recorded on-chain in real time.

DAOs are also integrating with DeFi protocols to diversify their portfolios and generate yield. By staking assets, providing liquidity, or participating in yield farming, DAOs can automate treasury growth strategies. These activities are governed by smart contracts, which execute complex strategies without human intervention, reducing operational risk and increasing capital efficiency.

Key Tools Powering DAO Treasury Automation in 2024

Top 5 DAO Treasury & Smart Contract Tools in 2024

-

Gnosis Safe: The industry-standard multi-signature wallet for DAOs, Gnosis Safe secures treasury assets by requiring multiple approvals for transactions. Its robust access controls and integration with major DAO platforms make it a cornerstone for decentralized fund management.

-

Aragon: Renowned for its modular governance framework, Aragon enables DAOs to deploy and manage customizable smart contracts for treasury operations, voting, and automated fund allocation, all with a strong focus on security and transparency.

-

Colony: Colony streamlines DAO treasury management with automated payments, contributor rewards, and reputation-based governance, leveraging smart contracts to ensure efficient and transparent fund distribution.

-

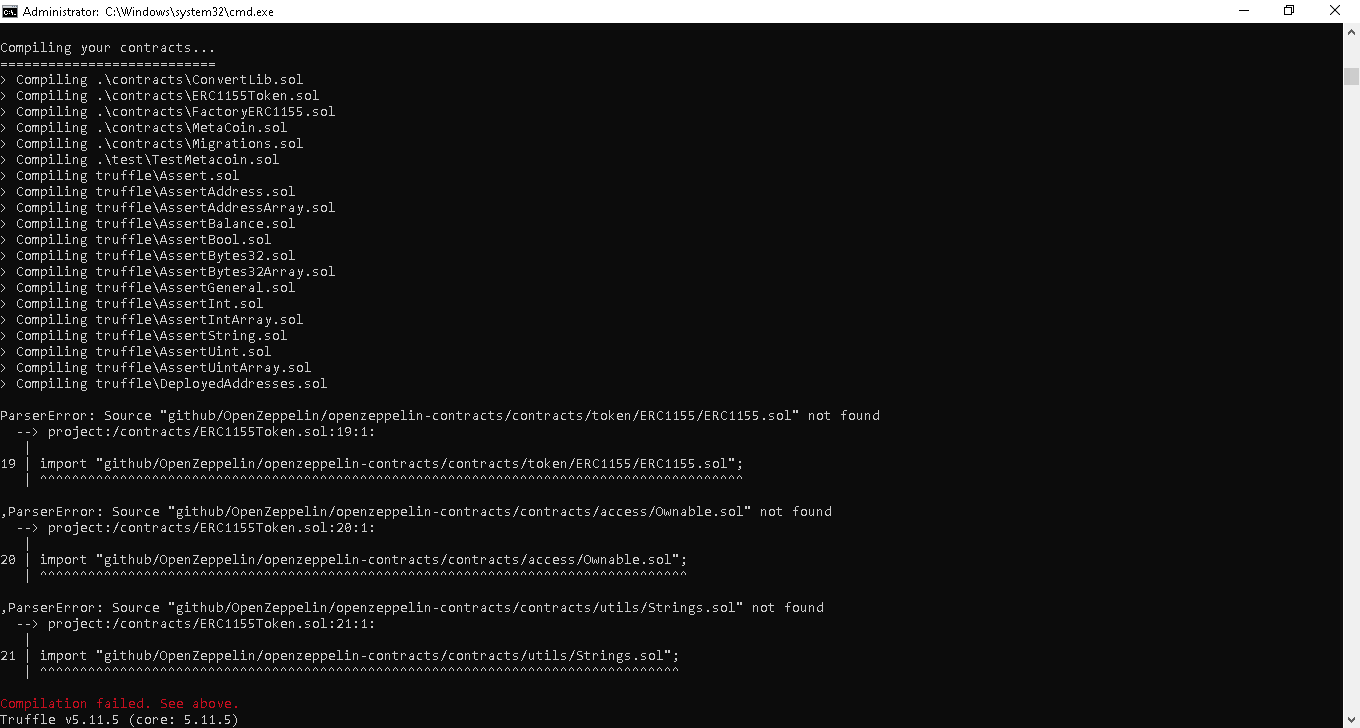

OpenZeppelin Defender: A leading smart contract security and automation platform, OpenZeppelin Defender enables DAOs to automate treasury actions, schedule transactions, and monitor contract health, all while benefiting from industry-leading audit tools.

-

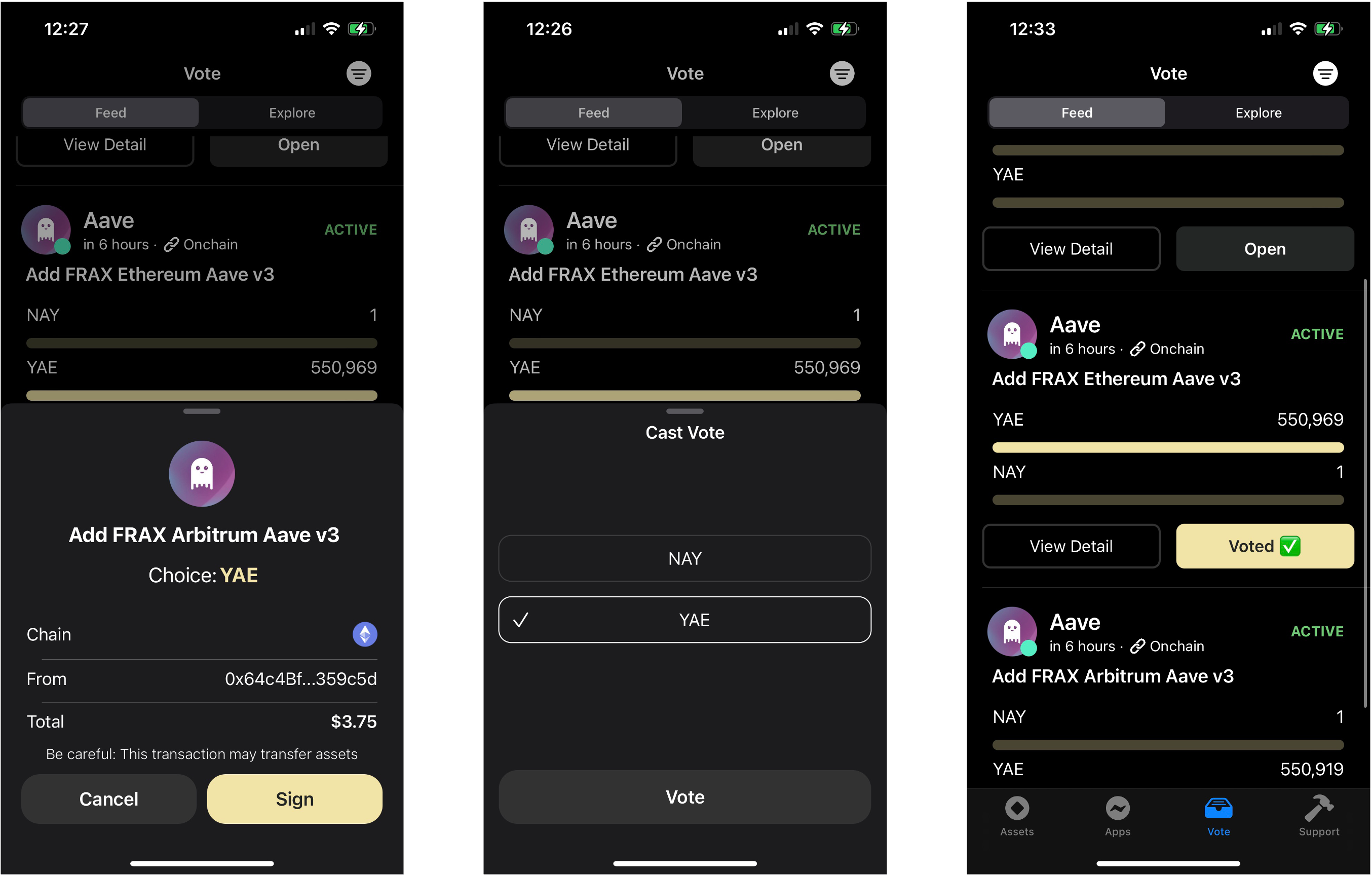

Snapshot: Widely adopted for off-chain governance, Snapshot integrates seamlessly with DAO treasuries, allowing token holders to propose and vote on fund allocations, with results executable via smart contracts for secure, transparent treasury management.

Choosing the right tooling stack is critical for secure and scalable DAO asset management. Platforms like Aragon, DAOstack, Colony, MolochDAO, and Gnosis Safe remain popular due to their robust governance frameworks and seamless integration of smart contract automation. Specialized tools such as OpenZeppelin for contract security and SolidityScan for vulnerability detection are now considered best practice for any DAO serious about safeguarding its treasury. For a comprehensive comparison of leading DAO platforms and their automation features, see the Top 7 DAO Platforms Compared: Ultimate Guide for 2024.

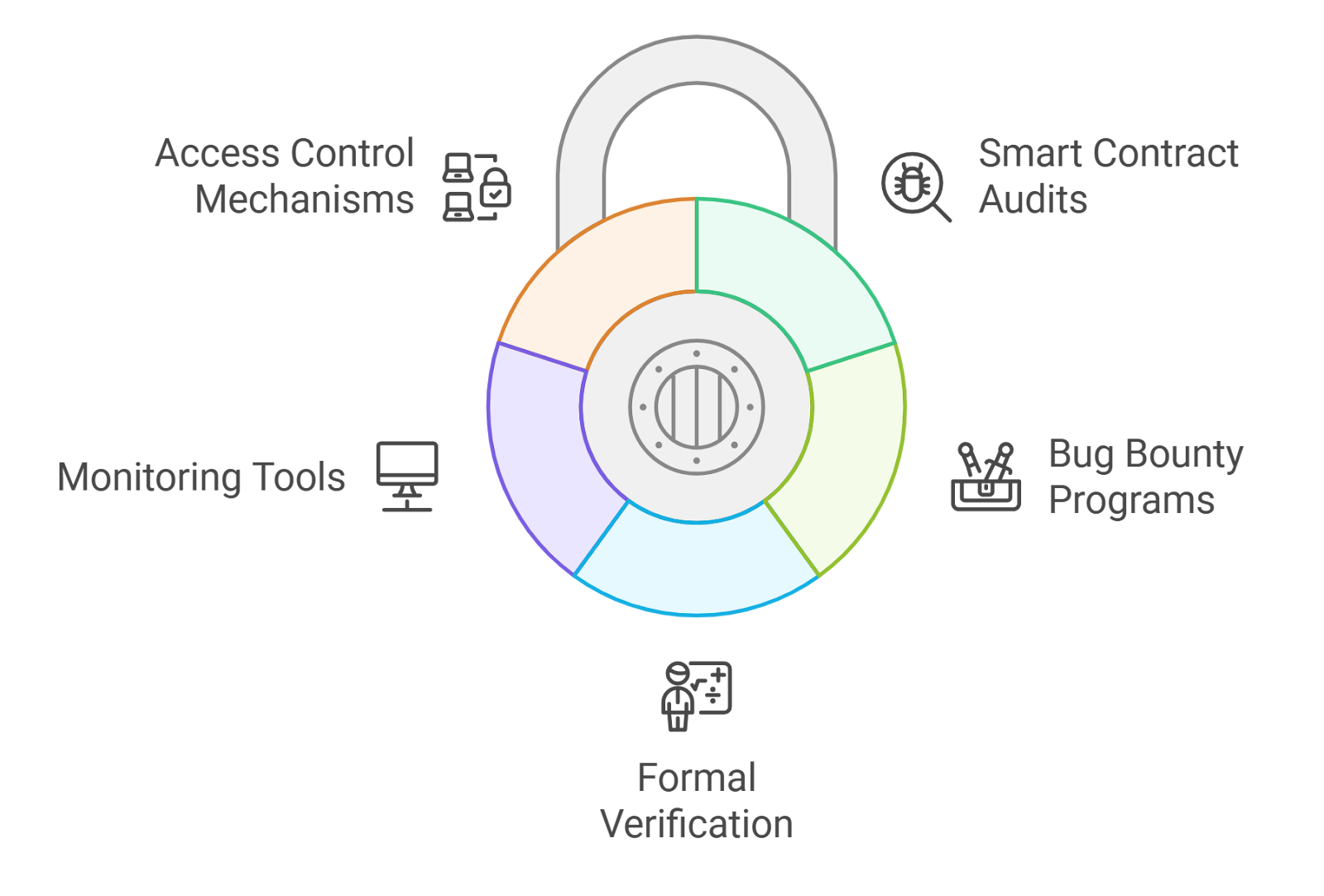

Security First: Automation Without Compromise

As automation increases, so does the attack surface. DAOs must prioritize continuous smart contract auditing, real-time monitoring, and compliance automation. Leading projects are integrating on-chain monitoring tools to detect suspicious proposal activity or unauthorized fund movements instantly. Regular audits by firms like OpenZeppelin and ConsenSys Diligence help ensure that code is free from vulnerabilities before deployment. This security-first mindset is essential to maintaining trust and resilience in an increasingly automated DAO ecosystem.

Automating payments and payroll is another area where DAOs are seeing significant gains in reliability and transparency. By leveraging smart contracts, organizations can schedule recurring disbursements to contributors, vendors, or ecosystem partners. This not only guarantees that obligations are met on time but also minimizes the risks of manual errors or delays. Stablecoins have become the preferred medium for these transactions, offering both cost efficiency and protection from crypto market volatility. Every payment is immutably recorded on-chain, providing a clear audit trail for all stakeholders.

Security remains paramount as automated treasury flows increase in complexity. The best DAOs treat security as a continuous process, not a one-time event. Smart contract vulnerability scanners like SolidityScan and regular third-party audits are now industry standards. On-chain monitoring solutions such as Dispatch allow teams to track proposal execution and fund movements in real time, immediately flagging any anomalies for investigation. For DAOs managing substantial assets, these layers of defense are non-negotiable.

Best Practices for DAO Treasury Automation in 2024

To maximize the benefits of automation while minimizing risk, DAOs should adhere to several key best practices:

5 Best Practices for Secure DAO Treasury Automation

-

Configure Multi-Signature Wallets with Gnosis Safe: Employing Gnosis Safe for multisig wallets ensures that no single party can unilaterally move funds. Require multiple trusted DAO members to approve transactions, aligning with your governance model to reduce the risk of unauthorized access.

-

Conduct Continuous Smart Contract Auditing: Partner with reputable auditing firms like OpenZeppelin and use automated tools such as SolidityScan to regularly audit treasury smart contracts. Ongoing audits help identify vulnerabilities and ensure code integrity as protocols evolve.

-

Implement Permissioned Access Controls: Use platforms like Aragon to establish granular, role-based permissions for treasury management. Clearly define who can propose, approve, or execute transactions to minimize internal threats and enforce accountability.

-

Enable Real-Time On-Chain Monitoring: Integrate monitoring solutions such as Dispatch by Esprezzo to track treasury activity in real time. Automated alerts for suspicious transactions or governance actions allow for rapid response to potential security incidents.

-

Deploy Emergency Pause Mechanisms: Incorporate circuit breaker or pause functions into treasury smart contracts, using open-source libraries from OpenZeppelin. These mechanisms allow DAOs to halt contract operations instantly in the event of an attack or critical bug, safeguarding assets while issues are resolved.

Adopting these measures ensures that automation enhances rather than undermines the core principles of decentralized governance. For an in-depth guide on how DAOs can leverage automation tools for better outcomes, consult the DAO guide: How to use automation for better outcomes.

Looking Ahead: The Future of Automated On-Chain Treasury Management

The trajectory is clear: as DAO infrastructure matures, we will see even greater integration between governance frameworks, DeFi protocols, and advanced security tooling. Emerging trends include AI-assisted treasury optimization, cross-chain asset management, and real-time compliance reporting embedded directly into smart contracts. The ultimate vision is a system where treasury operations are not only fully automated but also adaptive, responding intelligently to changing market conditions and governance signals.

For DAOs committed to transparency, resilience, and sustainable growth, embracing robust smart contract automation is no longer optional, it is foundational. The organizations that invest in secure, auditable automation today will set the standard for capital stewardship in the decentralized economy of tomorrow.