DAOs are rewriting the rules of treasury management, but with great autonomy comes great risk. As of May 2025, DAOs collectively manage over $25 billion in assets. Yet, in just the first quarter, vulnerabilities led to losses exceeding $130 million. With this much capital at stake, robust defense mechanisms are non-negotiable for any DAO or DeFi project serious about longevity and trust.

Smart Contract Audits: The First Line of Defense

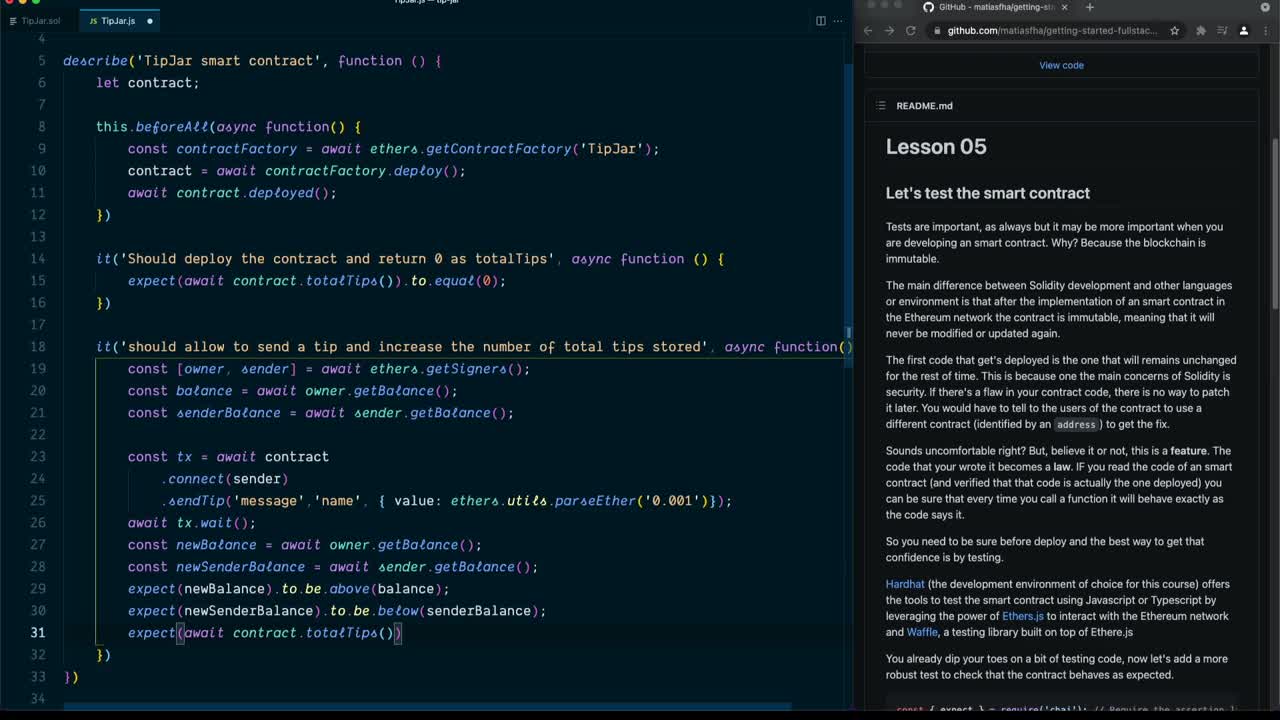

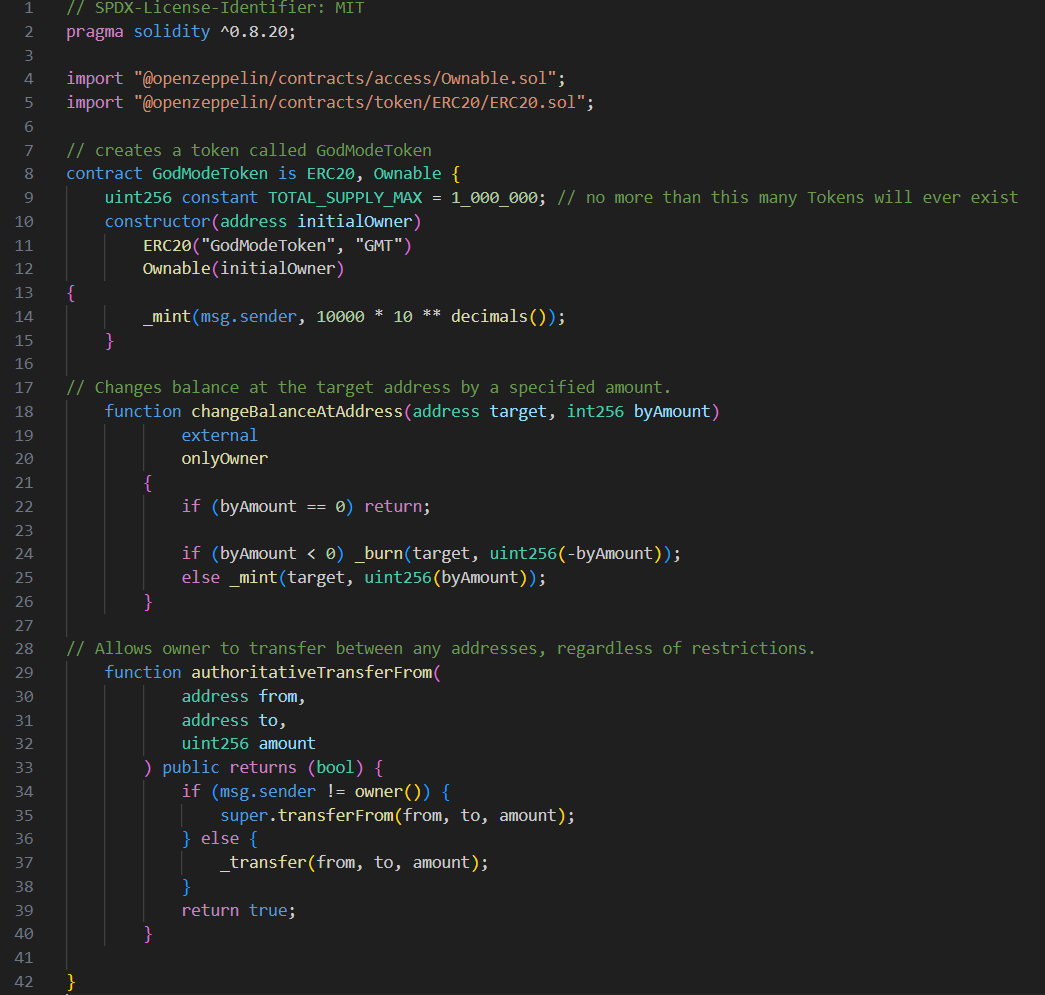

Before a DAO’s treasury smart contract ever touches mainnet, it must pass through the crucible of a smart contract audit. This is not some box-ticking exercise – it’s an exhaustive review where every line of code is scrutinized for vulnerabilities like reentrancy attacks, integer overflows, logic bugs, and flawed access controls. Top-tier auditors like ChainSecurity have been safeguarding DeFi protocols since 2017, using a blend of automated tools and manual expertise to uncover both obvious flaws and subtle attack vectors. (ChainSecurity)

A typical audit workflow includes:

Key Steps in a DAO Smart Contract Audit

-

Define Audit Scope and Objectives: Clearly outline which smart contracts, modules, and integrations will be reviewed, including treasury management and voting mechanisms. This ensures all critical DAO functions are covered.

-

Manual Code Review by Security Experts: Engage professional auditors from reputable firms like ChainSecurity or Trail of Bits to perform in-depth, line-by-line code analysis, identifying complex logic flaws and business logic vulnerabilities.

-

Reporting and Remediation: Deliver a detailed audit report highlighting vulnerabilities, severity levels, and actionable recommendations. Collaborate with the DAO’s development team to patch issues and confirm fixes.

-

Final Review and Public Disclosure: After remediation, conduct a final review and publish the audit report for transparency. Platforms like GitHub or Aragon OSx documentation are commonly used for sharing audit results.

The result? A comprehensive report with actionable recommendations – often the difference between a secure launch and catastrophic loss.

On-Chain Monitoring: Real-Time Protection Beyond Deployment

An audit is only as good as the code at deployment. But what happens when new threats emerge or integrations change? Here’s where on-chain monitoring enters the arena. Unlike audits, which are point-in-time assessments, on-chain monitoring delivers continuous surveillance post-launch.

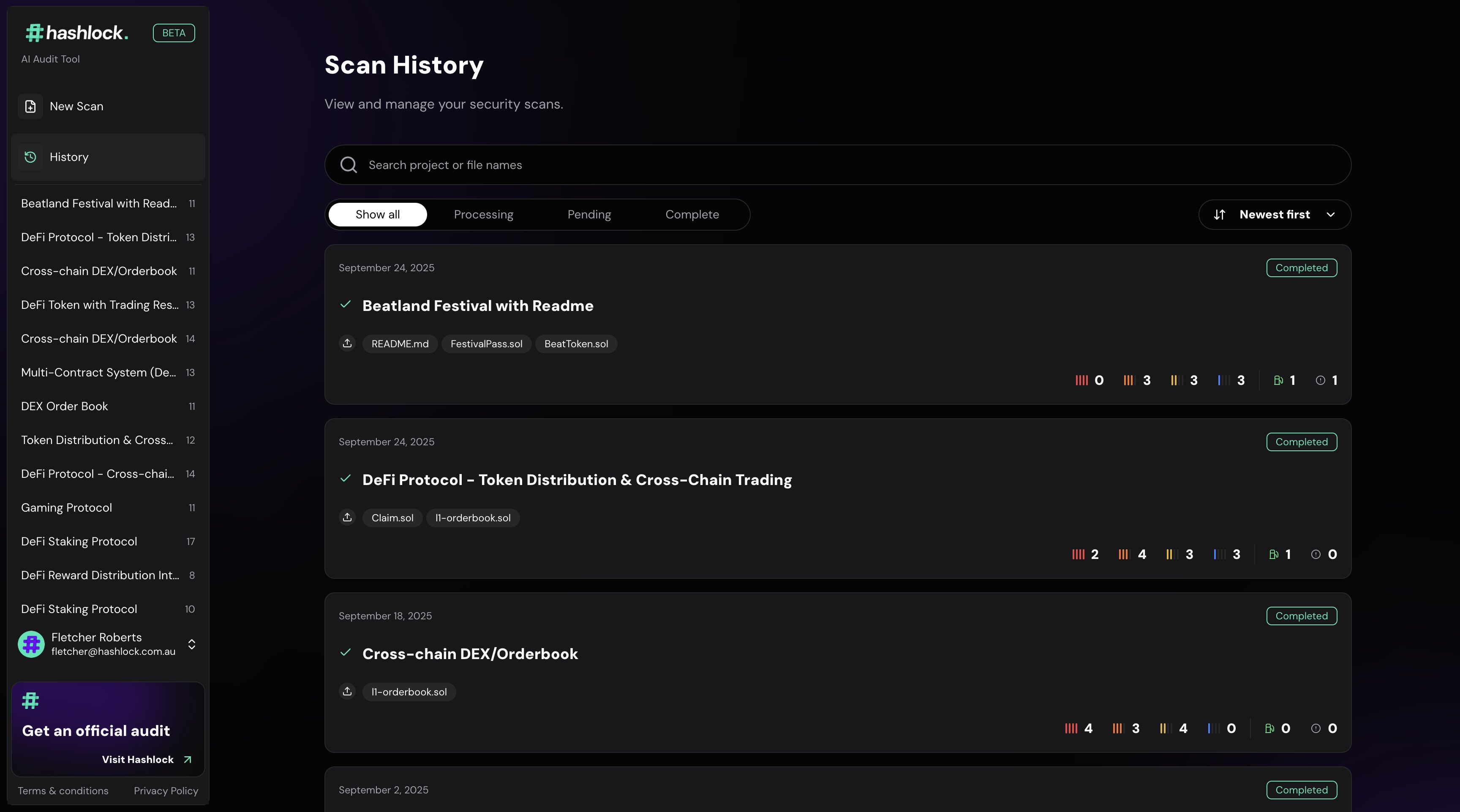

Platforms like Hashlock track live transactions, flagging suspicious activity such as unauthorized withdrawals or abnormal voting patterns in real time. This enables DAOs to respond instantly instead of discovering breaches after assets vanish. Think of it as an always-on security camera for your treasury smart contracts. (Hashlock)

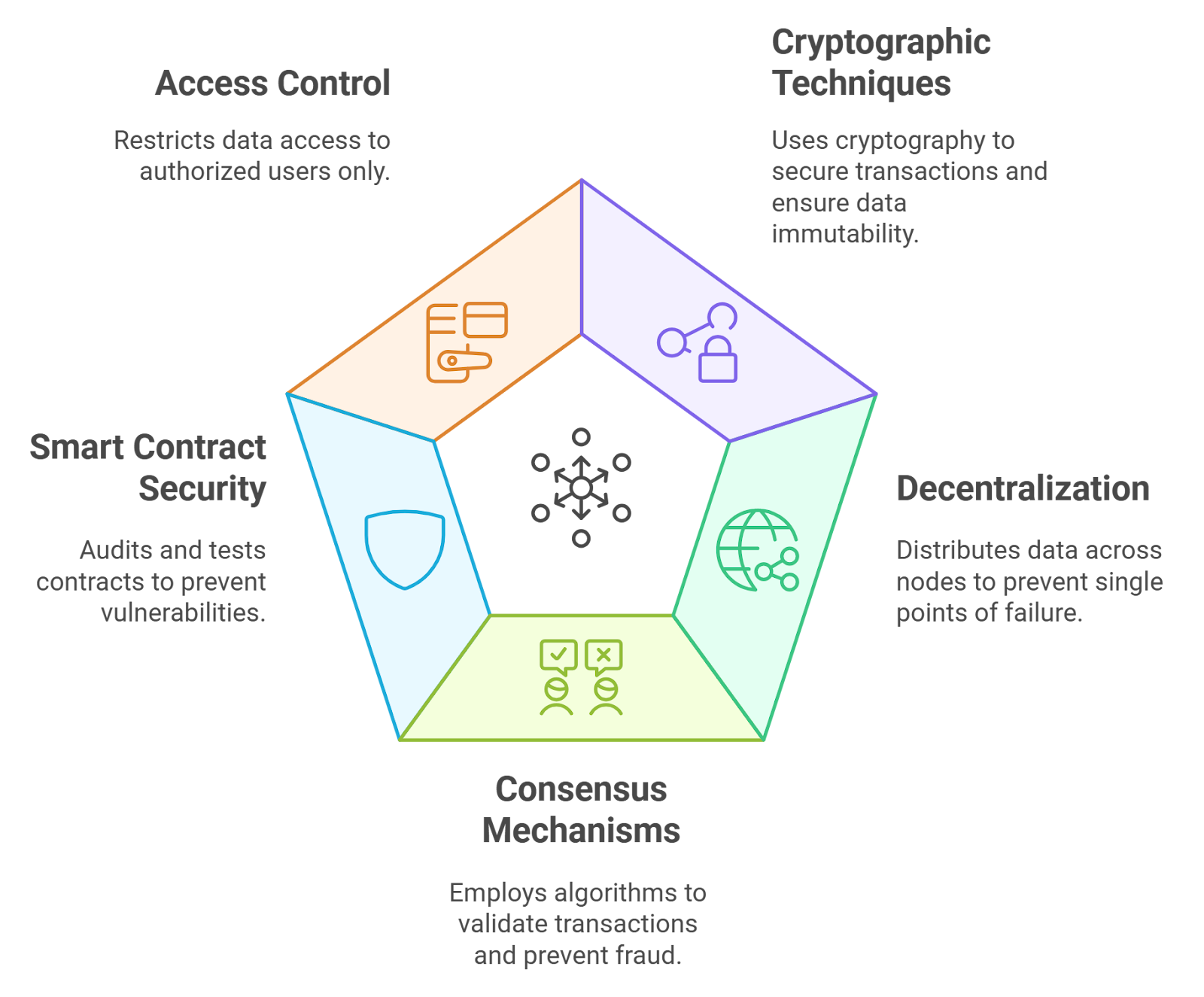

The Dynamic Duo: Why Audits and Monitoring Are Both Essential

Audits and on-chain monitoring work best together. An audit eliminates known risks before launch; monitoring catches unforeseen threats as they arise. It’s not either-or – it’s both-and for true decentralized treasury protection.

Top Benefits of Audits Plus On-Chain Monitoring for DAOs

-

Proactive Vulnerability Detection: Smart contract audits by firms like ChainSecurity identify critical code issues—such as reentrancy or access control flaws—before deployment, drastically reducing the risk of exploits.

-

Real-Time Threat Response: On-chain monitoring services like Hashlock provide continuous surveillance, instantly flagging suspicious transactions or unauthorized access attempts to help DAOs react before assets are lost.

-

Comprehensive Security Coverage: Combining audits and monitoring safeguards DAO treasuries from both pre-existing vulnerabilities and emerging threats, creating a robust, layered defense.

-

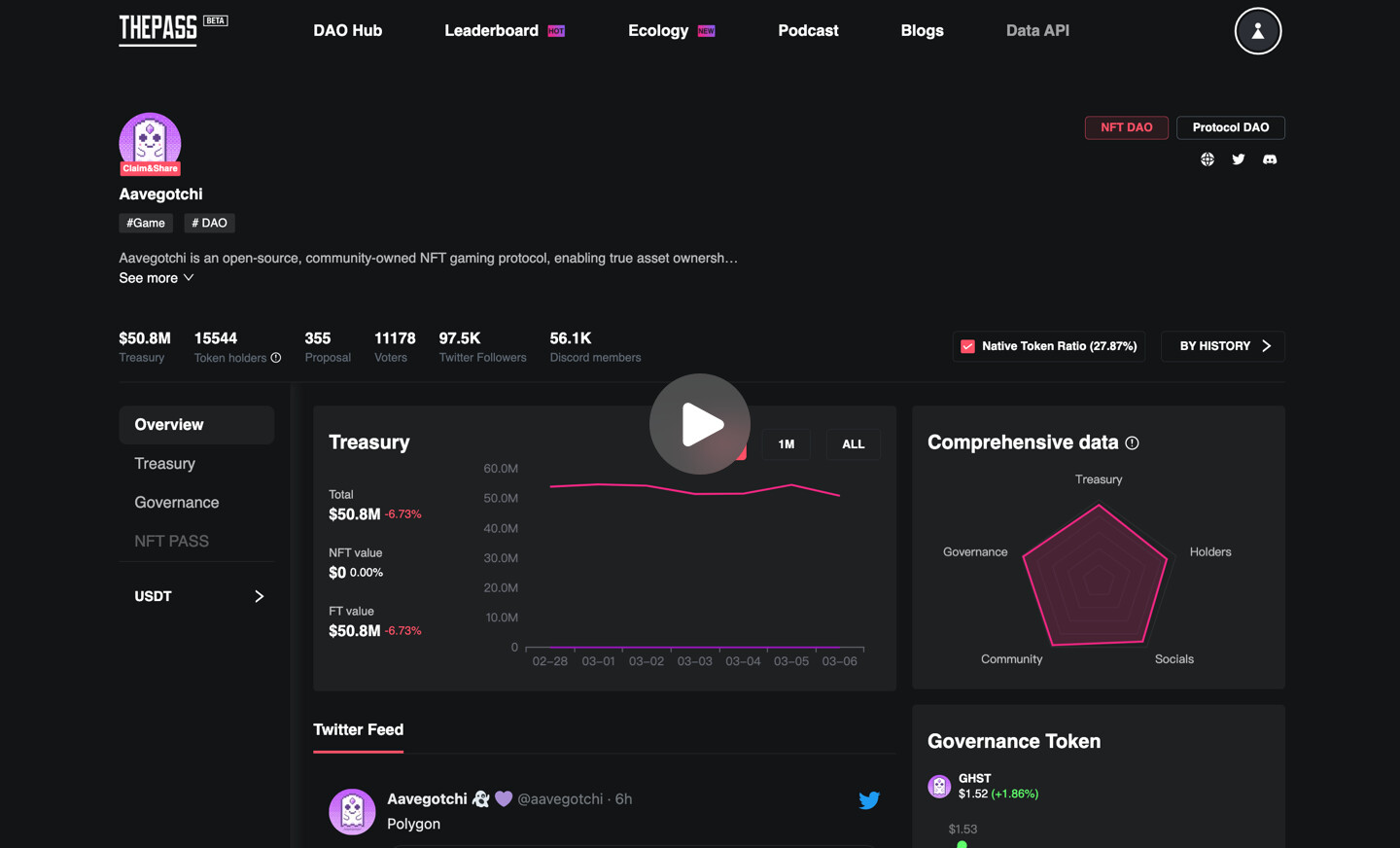

Increased Transparency and Trust: Continuous monitoring ensures all treasury transactions are verifiable on-chain, boosting transparency and strengthening member confidence in DAO governance.

-

Regulatory and Community Assurance: Demonstrating regular audits and active monitoring helps DAOs meet best practices, reassuring both regulators and token holders about the safety of over $25 billion in managed assets (as of May 2025).

This layered approach forms the backbone of modern DeFi risk management strategies and is rapidly becoming industry standard among leading protocols.

The Modular Future: Security Built-In from Day One

The latest frameworks like Aragon OSx are embracing modularity so DAOs can adapt security features without major code overhauls. By integrating security tools directly into their governance stacks, DAOs can streamline upgrades and automate compliance checks without sacrificing flexibility. (Aragon OSx)

Security is no longer just a launch-phase concern. As DAOs scale and their treasuries swell, attackers get bolder and more sophisticated. Real-world incidents have shown that even after a successful audit, protocol upgrades, third-party integrations, or governance changes can introduce new vulnerabilities overnight. This is why continuous contract monitoring is indispensable for DAOs aiming to stay one step ahead of evolving threats.

Proactive Incident Response: Turning Data Into Action

With real-time analytics and alerting, DAOs can move from reactive to proactive treasury defense. On-chain monitoring platforms provide actionable insights – not just raw data – enabling automated responses such as freezing contracts or pausing withdrawals the moment an anomaly is detected. This agility can mean the difference between stopping an exploit in its tracks and suffering multimillion-dollar losses.

By leveraging both audits and monitoring, DAOs establish a culture of continuous improvement. Access controls are regularly reviewed, codebases are kept up-to-date, and all treasury movements remain fully transparent to stakeholders.

Best Practices: Building Resilient DAO Treasuries

If you’re serious about decentralized treasury protection, make these best practices non-negotiable:

- Schedule periodic audits before every major upgrade or integration.

- Integrate automated on-chain monitoring with customizable alerts for abnormal activity.

- Enforce multisig wallets and granular access permissions for all treasury operations.

- Document incident response protocols so your community knows exactly how to react when risks arise.

- Foster a transparent security culture, sharing audit reports and monitoring dashboards openly with DAO members.

The stakes have never been higher – with over $25 billion in DAO treasuries on the line as of May 2025, robust defense isn’t optional; it’s existential. By combining rigorous smart contract audits with relentless on-chain surveillance, DAOs can build resilient financial systems that thrive amid uncertainty while protecting their communities from the next wave of exploits.