Stablecoin vault yields have become the backbone of secure DeFi strategies for DAOs, treasuries, and investors who prioritize both yield and safety. In 2025, with the on-chain landscape evolving rapidly, maximizing returns without exposing assets to undue risk is more achievable than ever, if you know where to look and how to manage your positions.

Why Stablecoin Vaults Remain the Gold Standard for Secure Yield

Unlike volatile crypto assets, stablecoins like USDC, DAI, and USDT offer a reliable peg to the dollar while unlocking consistent yields across top DeFi protocols. This stability makes them ideal for organizations seeking predictable income streams or individuals wary of wild price swings. But not all stablecoin vaults are created equal, security audits, automated risk management, and protocol transparency are essential factors that separate robust options from risky experiments.

The curated list below highlights six standout strategies and protocols for maximizing stablecoin vault yields in 2025. Each has been selected based on security track record, transparency, market performance, and their relevance for DAOs and conservative DeFi participants.

Top 6 Secure High-Yield Stablecoin Vault Strategies for DAOs (2025)

-

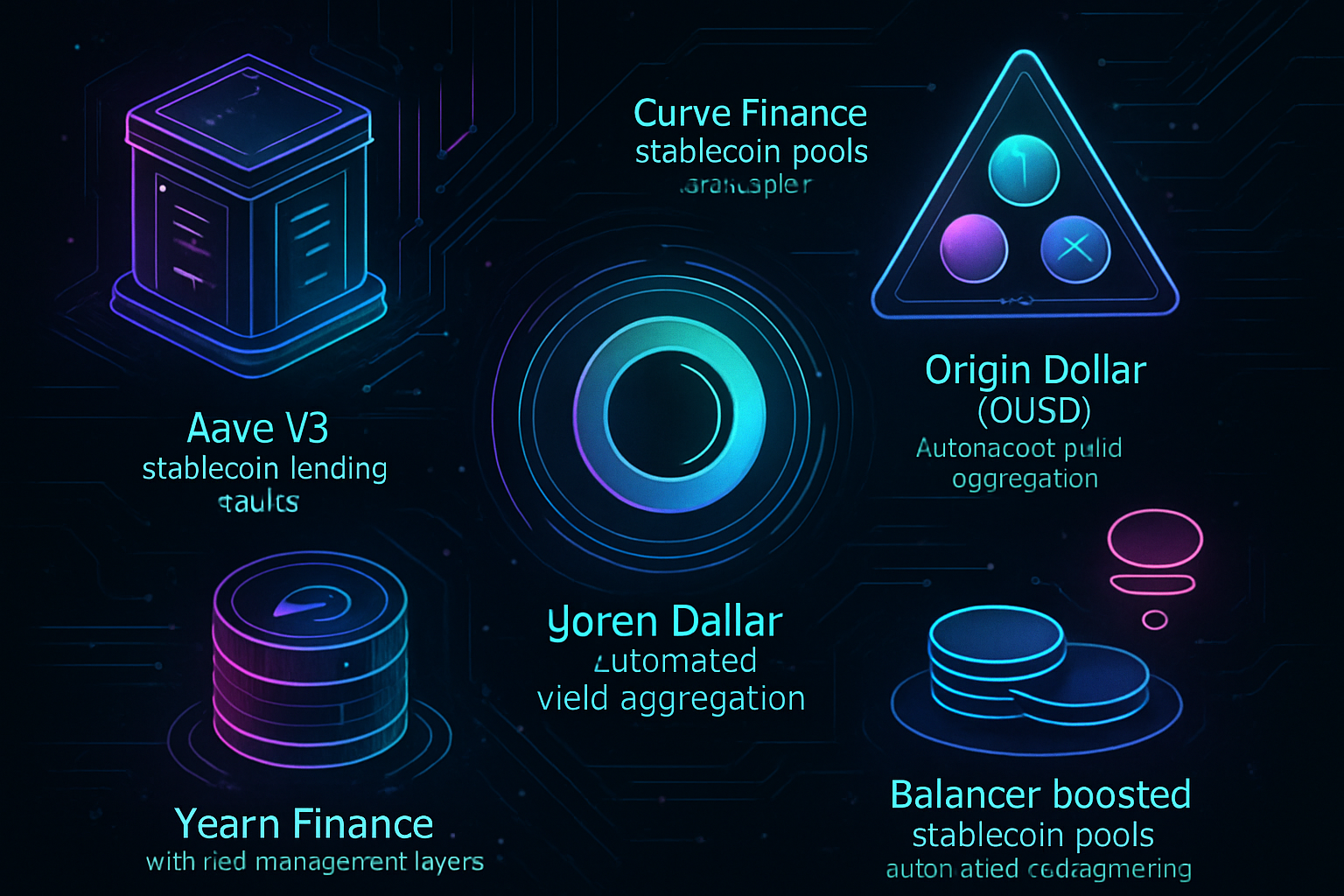

Aave V3 Stablecoin Lending Vaults: Aave V3 is a leading DeFi protocol offering robust stablecoin lending vaults for assets like USDC, USDT, and DAI. With advanced risk controls, isolation modes, and real-time monitoring, DAOs can earn competitive yields (recently up to 4.67% APY on USDC) while maintaining high security. Aave V3’s extensive audits and proven track record make it a top choice for institutional-grade stablecoin strategies.

-

Curve Finance Stablecoin Pools (e.g., TriCrypto, 3pool): Curve is renowned for its stablecoin pools such as 3pool (USDC/USDT/DAI) and TriCrypto (USDT, WBTC, ETH). These pools enable efficient, low-slippage swaps and steady yield generation through trading fees and liquidity mining. Curve’s protocol is battle-tested, with regular audits and large TVL, making it a secure option for DAOs seeking stablecoin yield.

-

Origin Dollar (OUSD) Automated Yield Aggregation: OUSD automatically allocates deposited stablecoins across top DeFi protocols to maximize yield, distributing rewards directly in OUSD tokens. With strategies that adapt to market conditions and a focus on security (including audits and non-custodial design), OUSD offers a hands-off, high-yield solution for DAOs prioritizing both returns and safety.

-

Yearn Finance Stablecoin Vaults with Risk Management Layers: Yearn Finance’s vaults deploy stablecoins into diversified, automated strategies across multiple protocols. Their risk management layers include continuous audits, strategy reviews, and community oversight. The DAI vault, for example, has historically delivered yields around 15% APY by dynamically reallocating capital, making Yearn a trusted choice for DAOs seeking optimized, secure returns.

-

Balancer Boosted Stablecoin Pools with Automated Rebalancing: Balancer’s boosted stablecoin pools integrate automated rebalancing and external yield sources (like Aave or Euler), allowing DAOs to earn yield both from swaps and underlying lending. Balancer’s smart contracts are rigorously audited, and the protocol’s flexibility enables DAOs to fine-tune risk and return profiles.

-

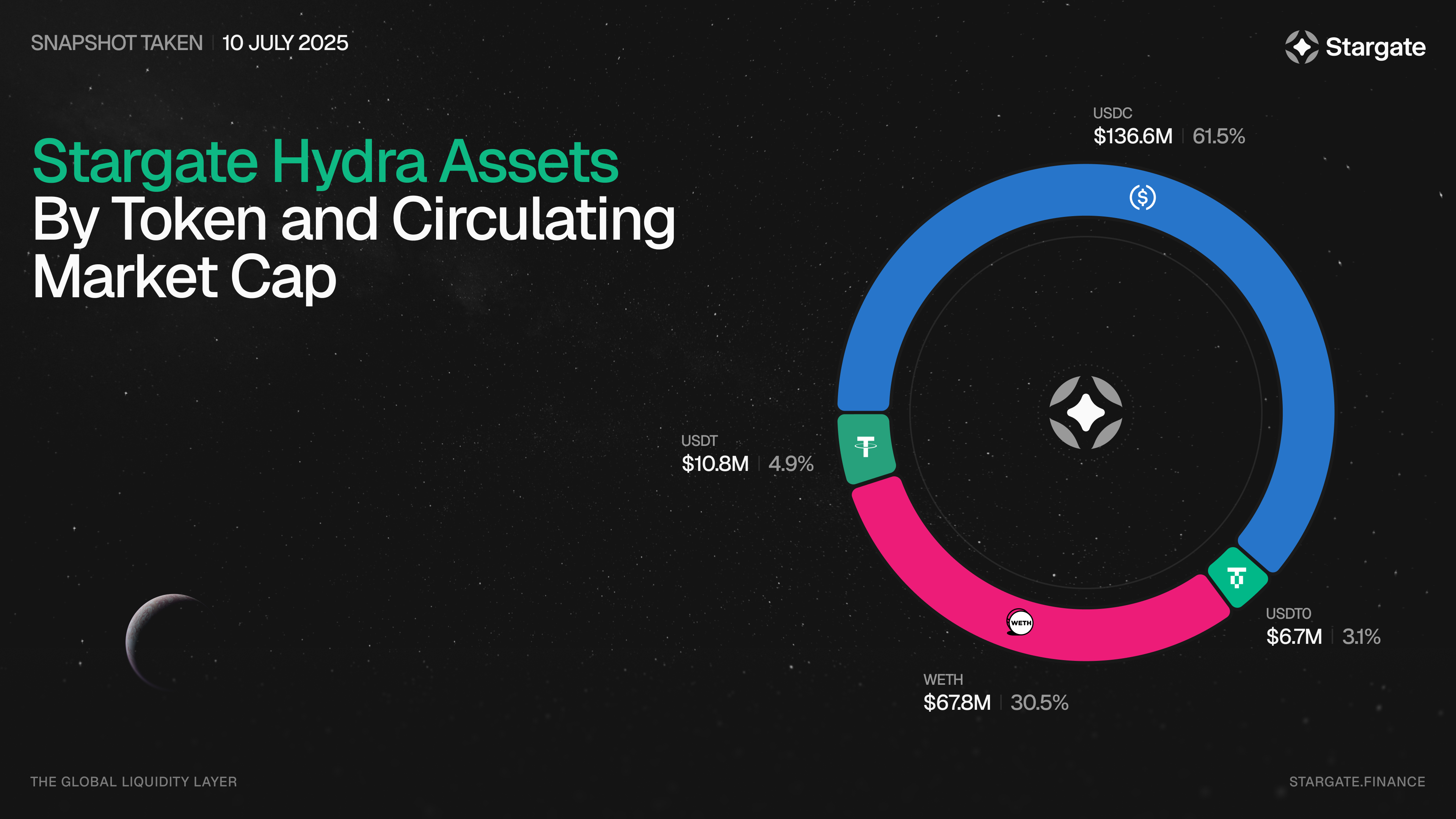

Stargate Finance Cross-Chain Stablecoin Vaults with Audited Security: Stargate Finance enables seamless cross-chain stablecoin vaults, letting DAOs deploy capital across multiple blockchains while earning yield. The protocol’s security is reinforced by comprehensive audits and a transparent, community-driven approach. Stargate’s interoperability and focus on secure bridging make it ideal for DAOs seeking yield diversification without compromising safety.

Aave V3 Stablecoin Lending Vaults: Safety Meets Flexibility

Aave V3 continues to lead as a foundational pillar for secure DeFi lending. With over $10 billion in total value locked (TVL) across its ecosystem as of October 3,2025, Aave’s V3 upgrade introduced advanced risk controls, like isolation mode and granular collateral parameters, that protect users against systemic shocks. For stablecoin holders, Aave V3 offers lending vaults where you can deposit assets like USDC or DAI and earn variable APY (currently averaging around 4-5% for major coins) while retaining full custody of your funds.

The protocol’s open-source codebase is regularly audited by leading security firms. Plus, Aave’s governance structure empowers DAO treasuries to participate in risk parameter updates, making it an attractive base layer for automated yield strategies or Treasury diversification.

Curve Finance Stablecoin Pools: Deep Liquidity and Composability

If you’re seeking both yield and liquidity flexibility, Curve Finance’s stablecoin pools stand out. The iconic 3pool (USDC/USDT/DAI) remains one of DeFi’s most liquid venues for swapping between top stablecoins with minimal slippage. Meanwhile, TriCrypto pools add exposure to wrapped BTC and ETH alongside stables, enabling more diversified yield farming opportunities.

Curve pools generate returns from two sources: trading fees (from users swapping between coins) and rewards from integrated incentive programs. When combined with boosted rewards via CRV staking or external protocols like Convex Finance (not covered here), annualized yields can reach competitive levels without sacrificing asset stability. Curve’s contracts are some of the most battle-tested in DeFi history, withstanding multiple market cycles thanks to rigorous audits and community oversight.

Origin Dollar (OUSD): Automated Yield Aggregation Without Sacrificing Control

Origin Dollar (OUSD) offers a hands-off approach to earning high APY on your stables by automatically allocating deposited funds across leading lending protocols, including Aave V3 and Compound, to maximize returns while minimizing risk exposure. As of October 2025, OUSD consistently delivers strong yields thanks to its real-time rebalancing algorithm that reacts dynamically to shifting market conditions.

The OUSD smart contracts are non-custodial; users retain ownership at all times. Security is further bolstered by comprehensive audits conducted by reputable firms before every major update, a must-have feature when entrusting capital to automated aggregators in the DeFi space.

Yearn Finance Stablecoin Vaults: Smart Automation With Layered Risk Controls

Yearn Finance’s stablecoin vaults remain a top choice for DAOs and investors who want automated yield optimization without sacrificing transparency or oversight. Yearn’s vaults route user deposits through a curated set of DeFi lending and liquidity strategies, automatically reallocating funds to wherever yields are highest. For example, the DAI vault has historically delivered up to 15% APY by dynamically moving assets between platforms like Aave, Compound, and Curve.

What sets Yearn apart is its commitment to risk management: each strategy undergoes rigorous peer review and continuous monitoring by a dedicated security team. Vaults can include built-in loss mitigation features, such as withdrawal queues during periods of high volatility, and users benefit from detailed on-chain reporting of all underlying positions. This layered approach makes Yearn’s stablecoin vaults especially attractive for those seeking high APY stablecoin vaults with robust DeFi risk management.

Balancer Boosted Stablecoin Pools: Automated Rebalancing Meets Capital Efficiency

Balancer’s boosted stablecoin pools offer another innovative avenue for maximizing yield while keeping risk in check. These pools integrate with trusted lending protocols (like Aave V3) under the hood, so idle assets within the pool are lent out to generate extra returns. Meanwhile, Balancer’s smart AMM logic ensures that liquidity is always available for swaps, no matter how much capital is being put to work elsewhere.

The result? Users enjoy boosted yields (often outperforming traditional AMM pools) without giving up instant access or composability. Automated rebalancing mechanisms keep the pool healthy and aligned with target allocations, reducing manual intervention and slippage risk. Security is reinforced through regular audits and an active governance process that enables rapid response to emerging threats or market changes.

Stargate Finance Cross-Chain Stablecoin Vaults: Liquidity Without Borders

Stargate Finance brings cross-chain interoperability to stablecoin yield farming, an essential feature as DAOs increasingly operate across multiple blockchains. Stargate’s audited cross-chain vaults let users deposit stablecoins on one network (like Ethereum or Arbitrum) and seamlessly earn yields from opportunities on others. This unlocks access to deeper liquidity and potentially higher APYs without the complexity of bridging assets manually.

Security remains front-and-center at Stargate: all smart contracts undergo extensive third-party audits before launch, and protocol upgrades are governed by community vote. For organizations managing multi-chain treasuries or individuals looking to diversify exposure across ecosystems, Stargate offers a streamlined route to secure DeFi vaults with transparent risk controls.

Best Practices for DAO Treasury Management in 2025

- Diversification: Spread allocations across multiple protocols (such as Aave V3, Curve, OUSD, Yearn, Balancer, Stargate) to reduce single-point-of-failure risk.

- Regular Audits: Prioritize platforms that have undergone recent security reviews by reputable firms, don’t hesitate to review audit reports yourself.

- Non-Custodial Solutions: Whenever possible, use non-custodial vaults so you retain full control over your keys and funds at all times.

- Hardware Wallet Integration: Secure DeFi interactions via hardware wallets for an added layer of protection against phishing or browser exploits.

- Continuous Monitoring: Leverage analytics dashboards and automated alerts to stay ahead of protocol changes or market shifts that could impact yield or safety.

Final Thoughts: Navigating High-Yield Stablecoin Vaults With Confidence

The landscape for maximizing stablecoin vault yields in DeFi has never been richer, or more secure, for those who know where to look. By focusing on rigorously-audited protocols like Aave V3 lending vaults, Curve’s deep-liquidity pools, automated aggregators like Origin Dollar (OUSD), advanced risk-managed options from Yearn Finance, Balancer’s boosted pools with smart rebalancing, and cross-chain solutions like Stargate Finance, DAOs and individual investors can capture competitive returns without compromising security or transparency.

If you’re ready to level up your DAO treasury management strategy in 2025, or simply want peace of mind as you farm yields, these six protocols represent the gold standard in secure DeFi yield generation. �a0

Top Strategies & Protocols for Secure Stablecoin Yields

-

Aave V3 Stablecoin Lending Vaults: Earn yield by supplying stablecoins like USDC or DAI to Aave V3, a leading lending protocol with advanced risk controls and real-time monitoring. Aave V3’s isolation mode and supply caps help protect against protocol-wide risks.

-

Curve Finance Stablecoin Pools (e.g., TriCrypto, 3pool): Provide liquidity to Curve Finance’s stablecoin pools, such as TriCrypto or 3pool, to earn trading fees and protocol rewards. Curve is renowned for its efficient stablecoin swaps and robust security track record.

-

Origin Dollar (OUSD) Automated Yield Aggregation: Hold OUSD to automatically earn yield from a diversified set of audited DeFi strategies. OUSD automatically allocates funds to top protocols, optimizing returns for risk-averse users.

-

Yearn Finance Stablecoin Vaults with Risk Management Layers: Deposit stablecoins into Yearn Finance vaults, which dynamically move funds between protocols for the best yields. Yearn’s built-in risk management and frequent audits help protect user funds.

-

Balancer Boosted Stablecoin Pools with Automated Rebalancing: Use Balancer’s boosted stablecoin pools, which leverage automated rebalancing and integrated lending strategies to maximize yields while maintaining liquidity and minimizing risk.

-

Stargate Finance Cross-Chain Stablecoin Vaults with Audited Security: Access Stargate Finance’s cross-chain stablecoin vaults to earn yield while benefiting from audited smart contracts and seamless transfers between blockchains.

�a0