Let’s be real: managing a DAO treasury is no walk in the park. With millions in digital assets at stake and a community of stakeholders expecting both growth and transparency, DAOs can’t afford to leave treasury management on autopilot, unless that autopilot is smart, secure, and built for yield. In 2025, the best-run DAOs are automating their treasury operations to maximize returns while minimizing manual headaches. Let’s dive into the top three ways you can put your DAO’s capital to work with confidence.

Automated Yield Aggregators: Let Your Stablecoins Work Overtime

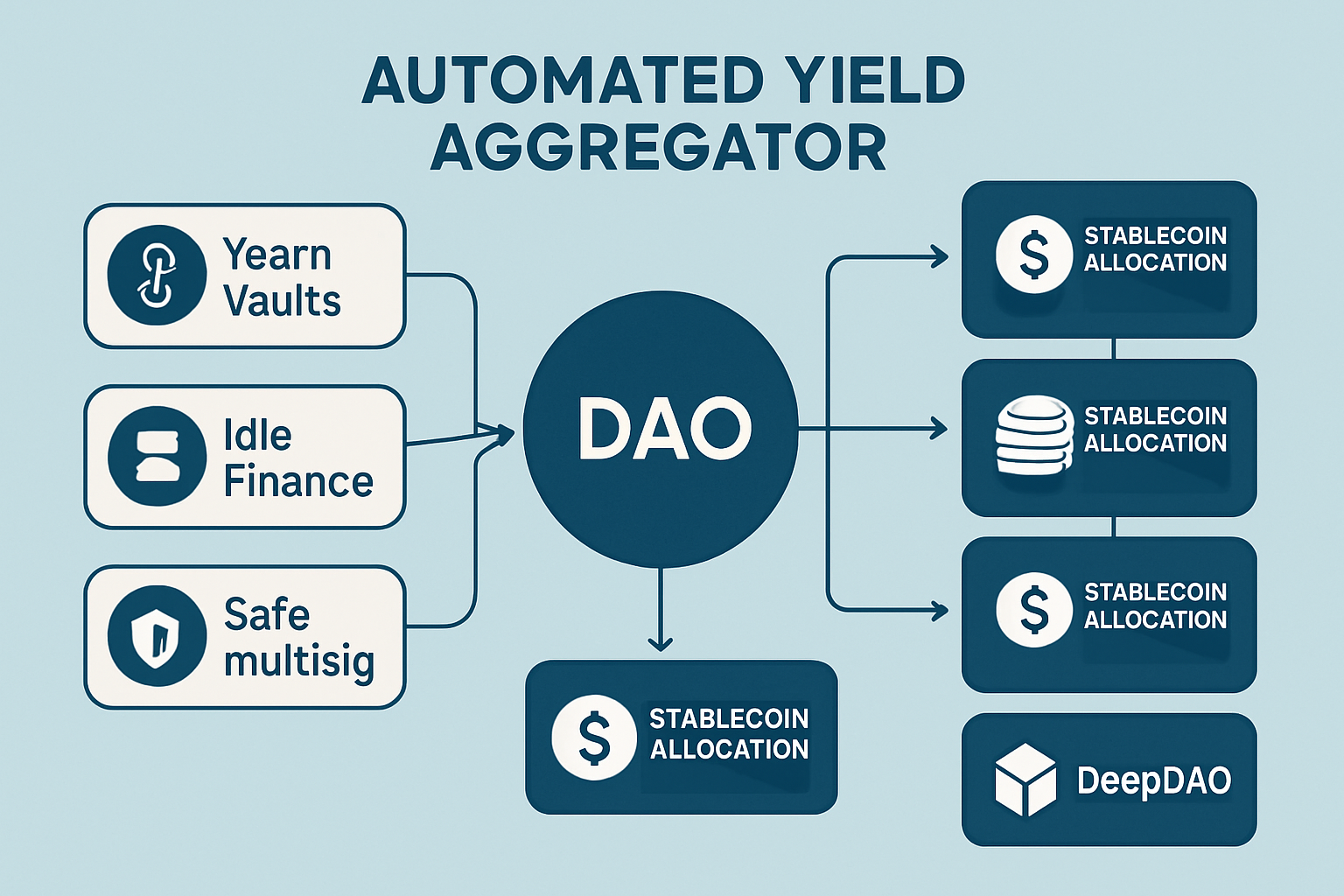

DAOs are sitting on piles of stablecoins, but if they’re just holding USDC or DAI in a multisig, they’re missing out on consistent yield. Automated yield aggregators like Yearn Vaults and Idle Finance have become essential tools for DAOs looking to optimize their on-chain treasury management strategies. These platforms automatically route stablecoins into the highest-yielding DeFi opportunities, rebalancing allocations as market conditions shift.

Here’s why this matters: instead of chasing every new farm or protocol manually (and risking missed opportunities or costly mistakes), your DAO can set parameters and let the aggregator do the heavy lifting. Yearn Vaults, for example, pool user deposits and deploy them across vetted DeFi strategies, think lending markets, liquidity pools, or even structured products like covered calls. Idle Finance takes a similar approach but lets you fine-tune risk preferences and allocation logic.

The result? Consistent, sustainable yield with minimal manual intervention. And because these aggregators are transparent by design, your community can always see exactly where funds are allocated and how much revenue is being generated. It’s decentralized asset management at its finest.

Multisig and Smart Contract-Based Controls: Rule-Based Automation You Can Trust

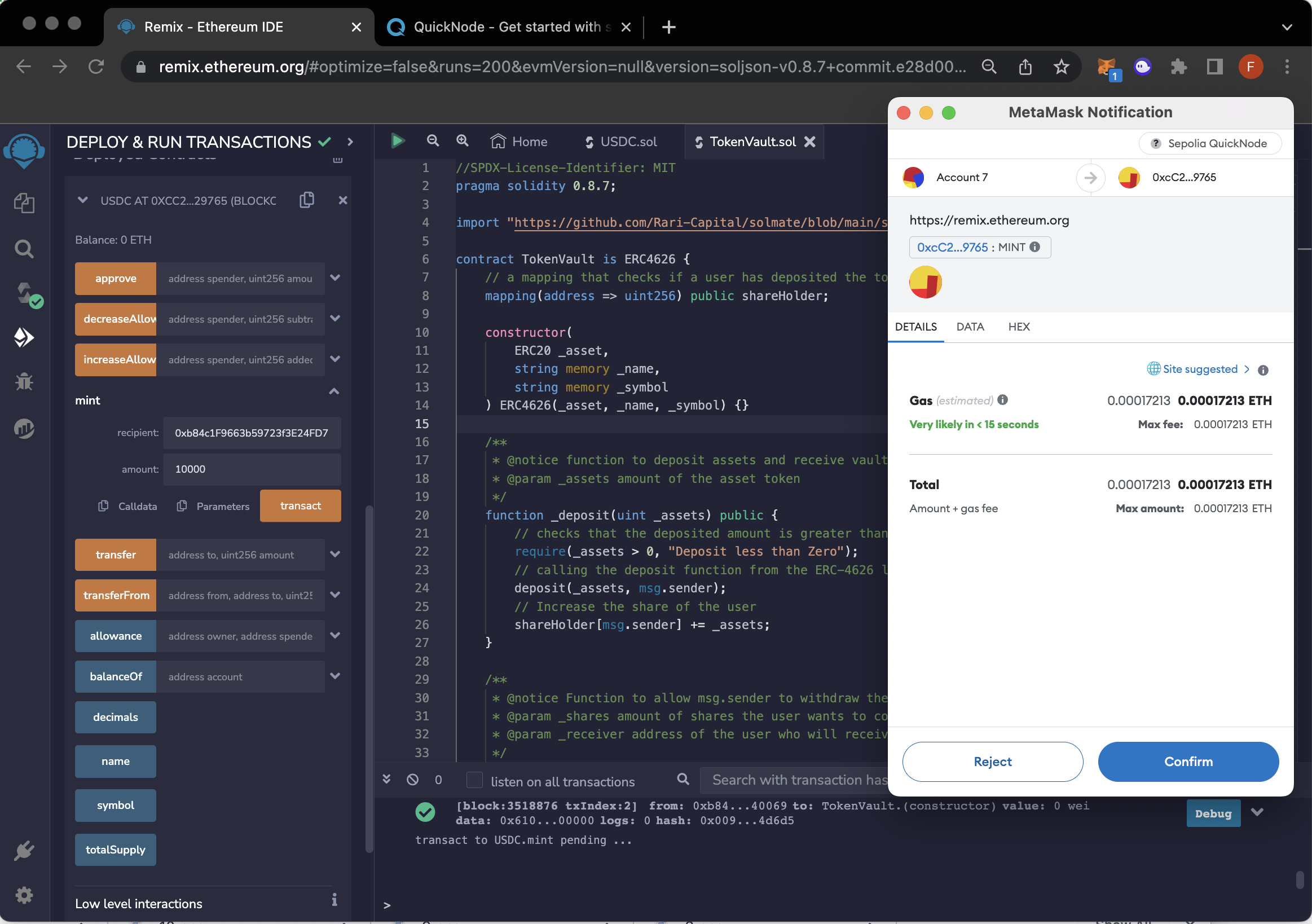

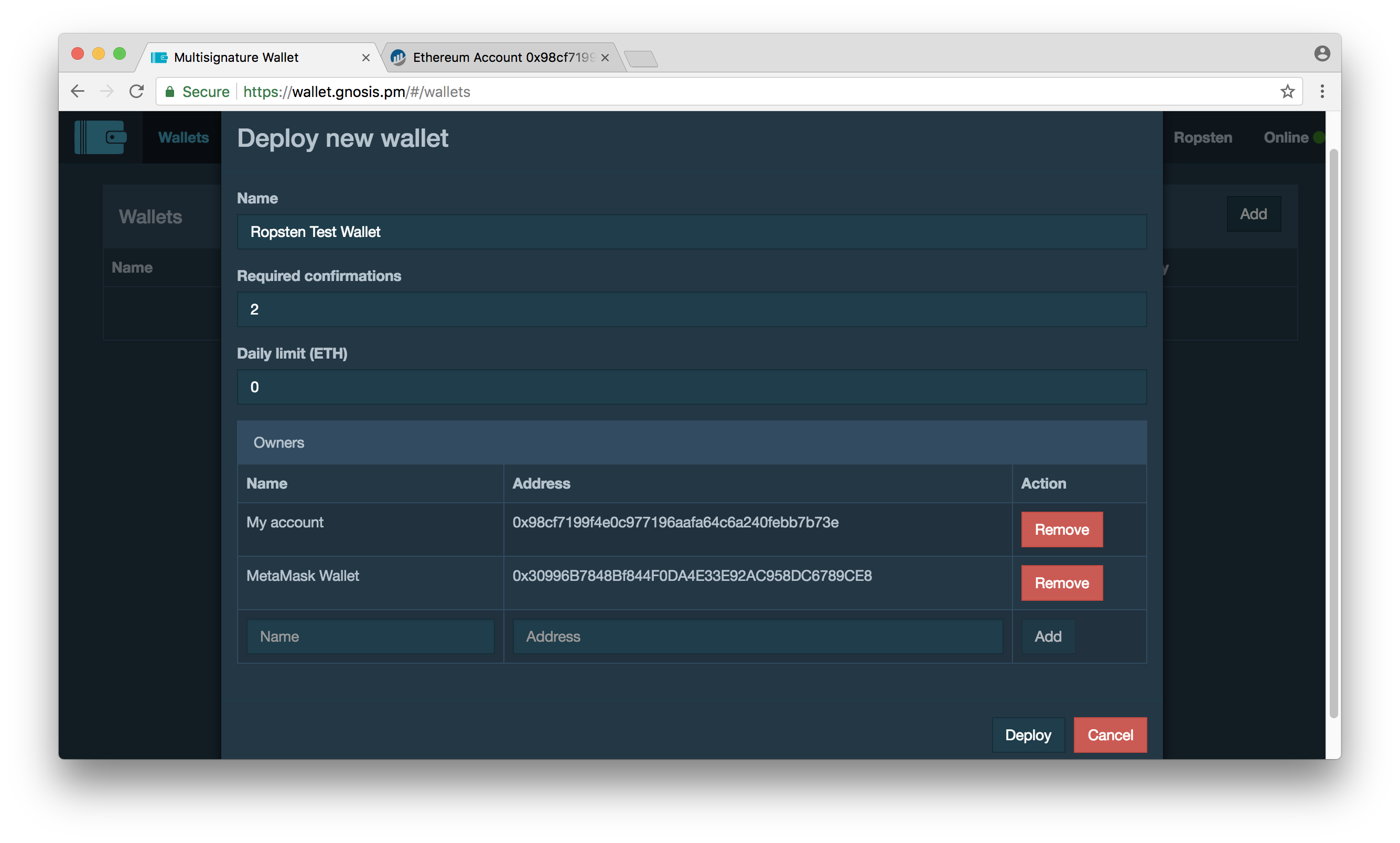

No matter how slick your automation is, security comes first. That’s why every serious DAO pairs automated strategies with multisig wallets and smart contract-based controls. Platforms like Safe (formerly Gnosis Safe) and Zodiac Modules make it possible to enforce rule-based automation without sacrificing governance or transparency.

The magic here is programmable security: you can set spending limits, require multiple approvals for transactions above certain thresholds, and automate recurring actions (like yield harvesting or token swaps) according to predefined logic. Zodiac Modules even let you compose governance workflows that trigger specific treasury actions when proposals pass, think auto-rebalancing into ETH when a vote hits quorum.

This approach doesn’t just protect against rogue actors or fat-finger mistakes, it also ensures that every move aligns with your DAO’s risk appetite and strategic goals. By combining human oversight with bulletproof automation, DAOs get the best of both worlds: speed and safety.

Real-Time On-Chain Analytics Dashboards: Data-Driven Decisions FTW

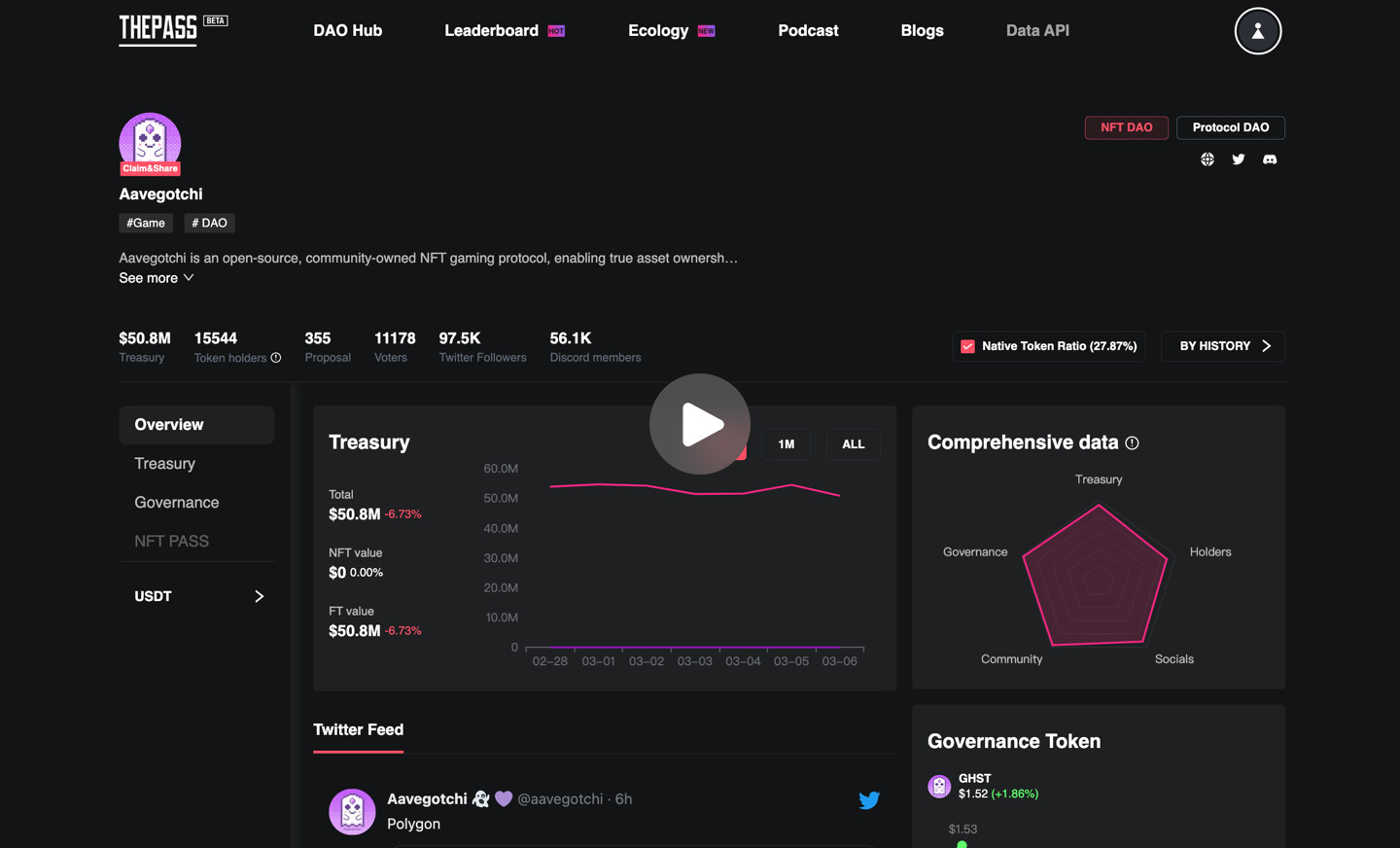

If you can’t measure it, you can’t improve it, and that goes double for DAO treasuries. Enter real-time on-chain analytics dashboards like Dune Analytics and DeepDAO. These platforms pull live data from public blockchains to give DAOs an instant snapshot of their portfolio performance, risk exposures, revenue streams, and more.

The killer feature? Actionable insights at your fingertips. With customizable dashboards tracking everything from APY fluctuations to protocol fees earned (and even governance participation rates), treasury managers can spot trends before they become problems, or opportunities. Want to know if it’s time to rebalance out of an underperforming vault? Or how much runway your stablecoin reserves provide at current burn rates? The answers are just a dashboard away.

Top Tools for Automating DAO Treasury Management

-

Integrate Automated Yield Aggregators (e.g., Yearn Vaults, Idle Finance) for Stablecoin AllocationsAutomated yield aggregators like Yearn Vaults and Idle Finance let DAOs put stablecoins to work with minimal manual effort. These platforms automatically move assets between DeFi protocols to maximize yield, auto-compound rewards, and reduce risk through diversification. This hands-off approach helps DAOs earn sustainable returns while freeing up governance bandwidth.

-

Implement Multisig and Smart Contract-Based Treasury Controls (e.g., Safe, Zodiac Modules) for Secure, Rule-Based AutomationUsing multisig wallets like Safe (formerly Gnosis Safe) and modular governance tools like Zodiac, DAOs can automate treasury actions with built-in security. These tools enable rule-based spending, access controls, and automated workflows, ensuring that treasury moves are transparent, auditable, and require collective approval—reducing the risk of rogue transactions.

-

Adopt Real-Time On-Chain Analytics Dashboards (e.g., Dune Analytics, DeepDAO) to Monitor Performance and Inform Rebalancing DecisionsPlatforms like Dune Analytics and DeepDAO provide DAOs with real-time, customizable dashboards to track treasury balances, yield performance, and risk exposures. With up-to-date on-chain data and visualizations, DAO members can make informed decisions about rebalancing, diversification, and yield strategies—keeping treasury management transparent and data-driven.

This data-driven approach empowers DAOs to iterate faster, justify decisions transparently to their communities, and ultimately squeeze more value out of every on-chain dollar. No more flying blind, just clear signals guiding sustainable growth.

When you combine these three pillars, automated yield aggregators, robust multisig and smart contract controls, and real-time analytics, you unlock a new level of treasury automation that’s both resilient and responsive. DAOs can now set up vaults that automatically harvest yield, rebalance allocations based on governance votes or market volatility, and enforce spending rules without endless Discord debates or governance fatigue. It’s not just about efficiency; it’s about making your treasury work as hard as your contributors do.

Let’s break down how these strategies fit together in practice. Imagine your DAO allocates 60% of its stablecoin reserves into Yearn Vaults for passive yield, while the rest sits in a Safe multisig with Zodiac modules enforcing automated rebalancing every quarter. Meanwhile, your treasury lead monitors a Dune dashboard showing real-time APY trends, protocol revenues, and token price movements, reacting proactively when market conditions shift. This isn’t theory; it’s the current playbook for some of the most successful decentralized organizations out there.

Tips for Seamless DAO Treasury Automation

- Start Small: Test automation on a portion of your treasury before scaling up. This minimizes risk and lets you iterate quickly.

- Customize Governance: Use Zodiac modules to automate routine actions but keep major reallocations under community control.

- Monitor Continuously: Set up Dune or DeepDAO alerts to flag unusual activity or sudden drops in yield so you’re never caught off guard.

It’s also worth noting that automation doesn’t mean set-and-forget. The best DAOs treat these systems as living infrastructure, reviewing parameters regularly, adapting to new DeFi protocols, and staying plugged into on-chain analytics. With the right mix of technology and oversight, even small DAOs can punch above their weight in terms of capital efficiency and risk management.

Which automation tool or strategy do you trust most for DAO treasury management?

With DAOs increasingly automating treasury operations for sustainable yield, we’re curious: Which of these leading tools or practices do you rely on most to manage risk and maximize returns?

If you’re ready to take your DAO’s capital strategy to the next level, or just tired of spreadsheet chaos, now’s the time to explore these tools. Not only will you boost sustainable yield across market cycles, but you’ll also build deeper trust with your community by making every allocation transparent and data-driven.

The bottom line? Sustainable DAO revenue generation is no longer reserved for whales or protocol giants. With automated yield aggregators like Yearn Vaults and Idle Finance, programmable security via Safe multisigs and Zodiac Modules, plus real-time insights from Dune Analytics and DeepDAO, any DAO can achieve institutional-grade treasury management without sacrificing decentralization or transparency.

Keen to go even deeper into optimizing fees and compounding returns? Check out our advanced guide on how DAOs can optimize treasury fees and reinvest for sustainable growth.