Stablecoin-native blockchains are at the heart of a profound transformation in DAO treasury management as we enter Q4 2025. What began as a niche experiment for crypto traders has matured into a foundational layer for decentralized organizations seeking liquidity, yield, and compliance. The convergence of programmable money, real-world asset integration, and cross-chain infrastructure is giving DAOs unprecedented control and predictability over their financial operations.

Stability and Predictability: The New Baseline for DAO Treasuries

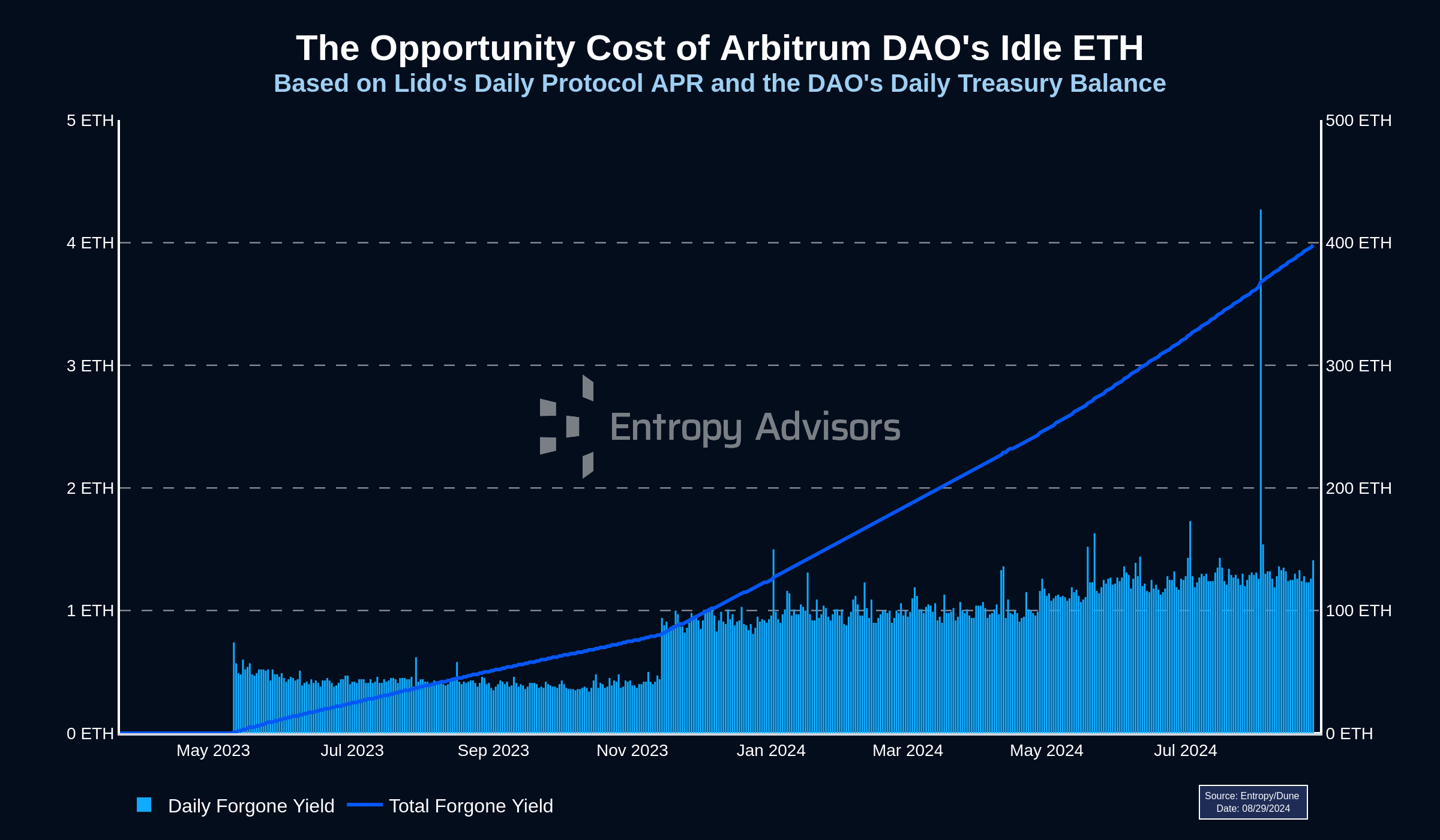

The volatility that once defined crypto treasuries has been decisively curtailed by stablecoin-native blockchains. With Dai (DAI) currently priced at $0.9996, DAOs can now anchor their reserves in assets designed to maintain parity with fiat currencies. This stability is not theoretical; it underpins real-world programs like Arbitrum’s Stable Treasury Endowment Program (STEP), which allocated over $30 million into tokenized real-world assets through institutional managers such as BlackRock. By January 2025, STEP generated $422,000 in yield at an average annual rate near 5%, demonstrating how predictably DAOs can now budget, plan, and deploy capital (source).

Efficiency Gains: Transaction Speed and Cost Optimization

The second major leap comes from the operational efficiency of these new chains. Startups like Plasma are building blockchains expressly for stablecoin payments, raising $20 million in Series A funding to deliver Bitcoin sidechains with Ethereum-like programmability (source). For DAOs, this means fast settlements and low transaction fees across treasury operations – a sharp contrast to the congestion and unpredictability seen on legacy chains during periods of high demand.

“We moved our primary treasury from native tokens to stablecoins on a dedicated chain. Suddenly, budgeting became simple – no more wild swings undermining our runway. “

This operational edge is reinforced by emerging solutions such as Stable Layer 1 USDT gas systems and cross-chain transfer protocols that enable seamless movement of funds between ecosystems without losing composability or incurring prohibitive costs.

Bridging On-Chain Treasuries with Traditional Finance

The integration of stablecoin infrastructure with established financial systems is not just theoretical – it is happening at scale in 2025. In September, nine major European banks joined forces to launch a euro-denominated stablecoin aimed at providing instant settlement for cross-border payments (source). This move signals that DAOs can now access banking-grade rails while maintaining transparency and programmability unique to blockchain-based assets.

- Liquidity: Stablecoins allow DAOs to move capital between protocols or off-chain partners instantly.

- Compliance: Transparent reserves (e. g. , USDC) provide auditable proof for regulators or stakeholders.

- Diversification: MakerDAO’s allocation into U. S. Treasuries, private credit, and tokenized real estate showcases how on-chain treasuries are evolving beyond pure crypto exposure (source).

This fusion of DeFi speed with TradFi reliability positions DAOs at the frontier of programmable value transfer – capable of leveraging both worlds for optimal treasury outcomes.

The Rise of Yield-Bearing Stablecoins and On-Chain Treasury Optimization

Perhaps the most significant development in DAO treasury management 2025 is the proliferation of yield-bearing stablecoins and composable DeFi infrastructure. DAOs are no longer passive holders of stable assets; they are actively optimizing yield through automated strategies, liquidity provisioning, and real-world asset exposure, all while maintaining a stable base denominated in assets like Dai (DAI) at $0.9996. The emergence of protocols purpose-built for on-chain treasury optimization enables DAOs to deploy capital across lending markets, tokenized bonds, and permissioned pools with risk controls encoded at the smart contract level.

Top Protocols Powering DAO Treasury Optimization in 2025

-

MakerDAO: The leading decentralized protocol for issuing and managing DAI, a stablecoin currently priced at $0.9996. MakerDAO enables DAOs to diversify treasuries with real-world assets and generate yield through partnerships with entities like Monetalis and BlockTower.

-

Arbitrum Stable Treasury Endowment Program (STEP): Arbitrum’s STEP initiative allocated over $30 million into real-world assets, generating $422,000 in yield at an average annual rate of approximately 5% by January 2025, setting a benchmark for on-chain treasury optimization.

-

Fireblocks: A trusted digital asset custody and treasury management platform, Fireblocks delivers secure, compliant infrastructure for DAOs to manage stablecoin treasuries, automate workflows, and ensure regulatory alignment.

-

Circle: The issuer of USDC, Circle provides robust APIs and blockchain-native infrastructure, facilitating seamless integration of stablecoins into DAO treasuries and enabling real-time payments and settlements.

-

Plasma: A next-generation blockchain purpose-built for stablecoin payments, Plasma raised $20 million in Series A funding in February 2025. It offers DAOs enhanced transaction efficiency and programmability for treasury operations.

-

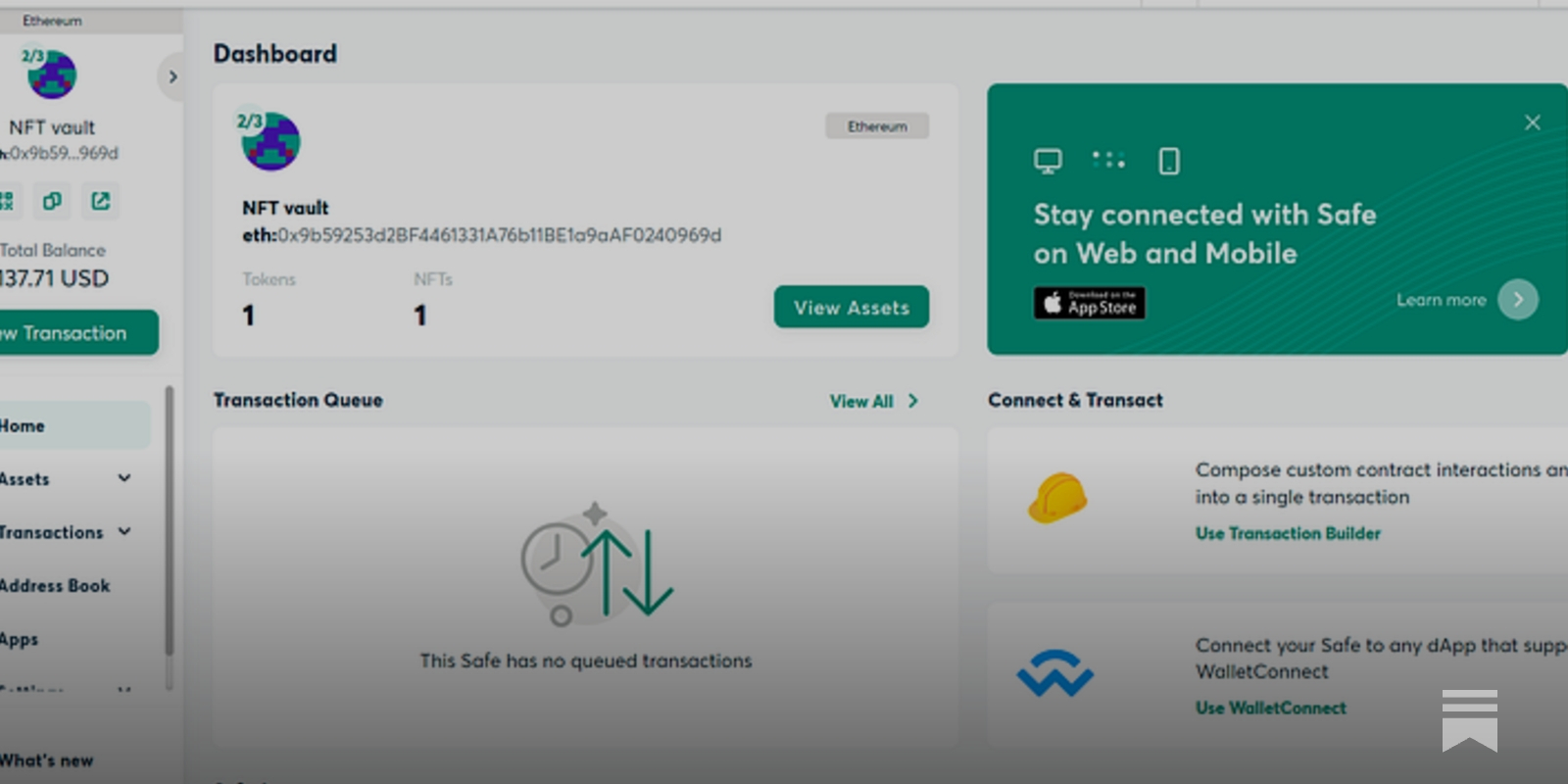

Gnosis Safe: The industry-standard multi-signature wallet for DAOs, Gnosis Safe enables secure, transparent, and programmable management of stablecoin reserves and other treasury assets on-chain.

-

USDH on Hyperliquid: Launched on September 23, 2025, USDH is the first native stablecoin on Hyperliquid, offering DAOs a decentralized and transparent option for on-chain treasury holdings.

This dynamic approach to treasury management is reinforced by advances in cross-chain stablecoin transfers. Innovations like Plasma’s stablechain architecture enable DAOs to move value frictionlessly between ecosystems, reducing counterparty risk and unlocking new sources of liquidity. With solutions such as Stable Layer 1 USDT gas mechanics, DAOs can minimize transaction costs even as they diversify their holdings across multiple blockchains.

Regulatory Alignment and Transparent Governance

As regulators sharpen their focus on digital asset reserves and auditability, operating on stablecoin native blockchains provides DAOs with a crucial compliance edge. The transparency inherent to these infrastructures, where every movement of funds is traceable, makes it significantly easier for decentralized organizations to meet evolving legal requirements. This transparency also builds trust with DAO participants, who can independently verify treasury balances and governance actions in real time.

Moreover, the programmability of stablecoin-native chains allows for automated compliance checks, whitelisting/blacklisting mechanisms, and instant reporting to stakeholders or auditors. These features are rapidly becoming baseline expectations for any DAO seeking institutional partnerships or broader adoption.

Strategic Takeaways for Forward-Thinking DAOs

The evidence is clear: stablecoin infrastructure DeFi is no longer experimental, it is foundational. As we look ahead:

- DAOs must prioritize chain selection: Choose platforms that offer both stability (e. g. , DAI at $0.9996) and access to robust DeFi yield strategies.

- Diversification goes beyond crypto: Integrate real-world asset exposure via tokenized bonds, treasuries, or private credit pools.

- Compliance readiness is non-negotiable: Adopt transparent frameworks that facilitate audits and regulatory reporting from day one.

- Leverage automation: Use programmable vaults to optimize capital allocation without introducing operational risk.

The Road Ahead: From Curiosity to Cornerstone

The trajectory for DAO treasuries is set: what was once a curiosity has become a cornerstone of digital finance strategy. With the market cap of stablecoins projected to reach trillions by the end of this decade (source), early adopters who master these new tools will secure lasting advantages, in resilience, efficiency, and credibility.

![]()

‘Patience is a position. ‘ In an age where speed can amplify mistakes as much as returns, disciplined stewardship remains the hallmark of successful DAO treasury management.

The next chapter belongs to those who treat their on-chain treasuries not just as reserves but as strategic engines, leveraging stablecoin-native blockchains for sustainable growth in an era defined by transparency, automation, and composability.