Optimizing DAO treasury fees has become a defining challenge for decentralized organizations navigating the fast-moving world of DeFi. With treasuries like Uniswap’s now valued in the billions and DAOs facing increasing scrutiny from both their communities and the broader market, every basis point saved, or earned, can fuel sustainable growth. Let’s break down five actionable strategies that leading DAOs are using right now to maximize yield, reduce costs, and future-proof their financial operations.

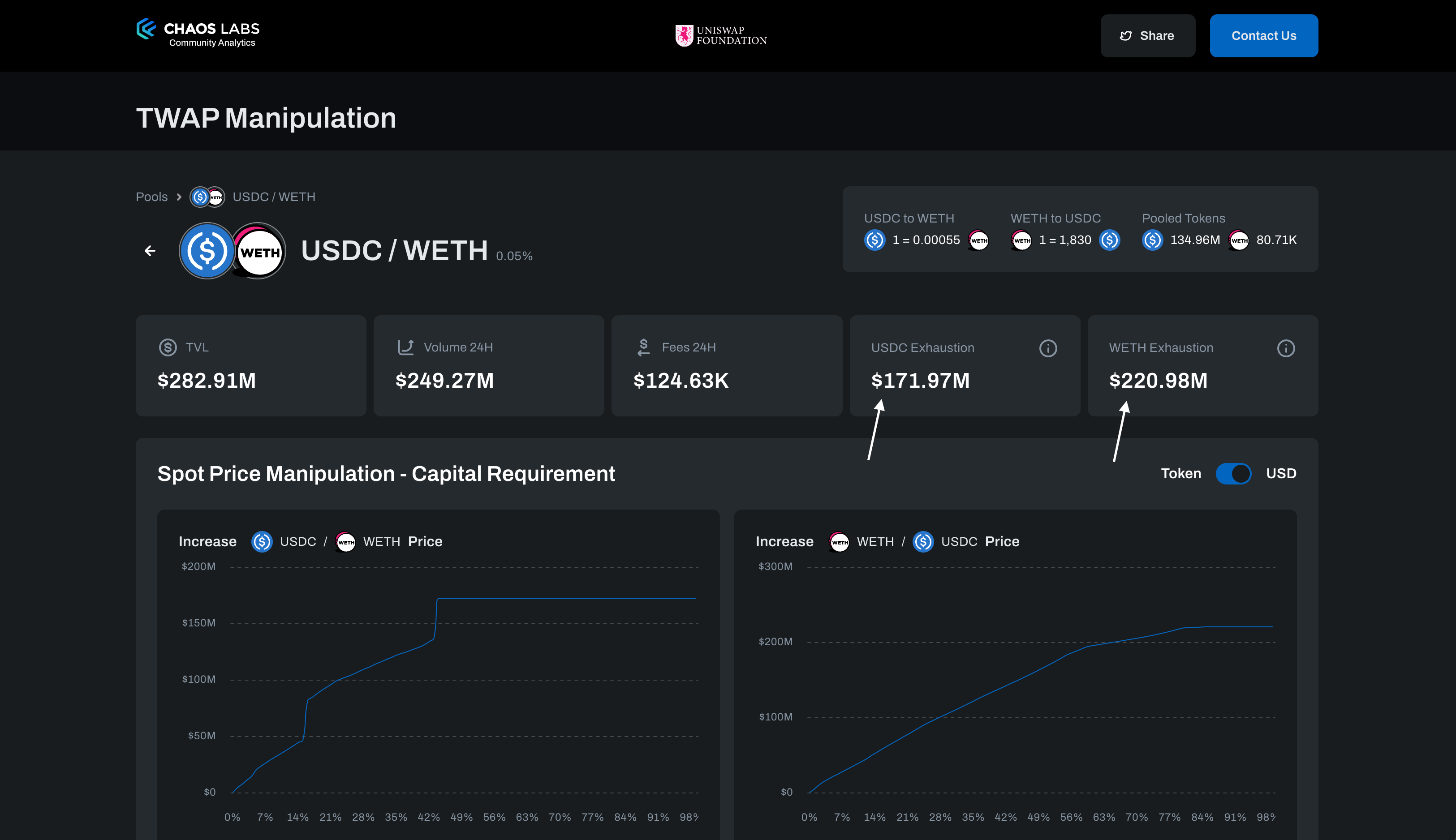

1. Implement Dynamic Fee Structures Based on Treasury Health and Market Volatility

Gone are the days when fixed-fee models could keep pace with the volatility of crypto markets. Modern DAOs are shifting toward dynamic fee structures that automatically adjust based on treasury health indicators (like liquidity ratios or runway) and real-time market conditions. This approach helps mitigate impermanent loss for liquidity providers and ensures that fee income adapts to changing trading volumes or asset prices.

For example, protocols can set smart contracts to increase fees during periods of high volatility, when protecting assets is paramount, and lower them in stable markets to encourage participation. Recent research shows that adaptive fee algorithms consistently outperform static models by both reducing losses and maintaining robust trading activity. The result? More resilient treasuries that can weather market storms without overcharging their communities.

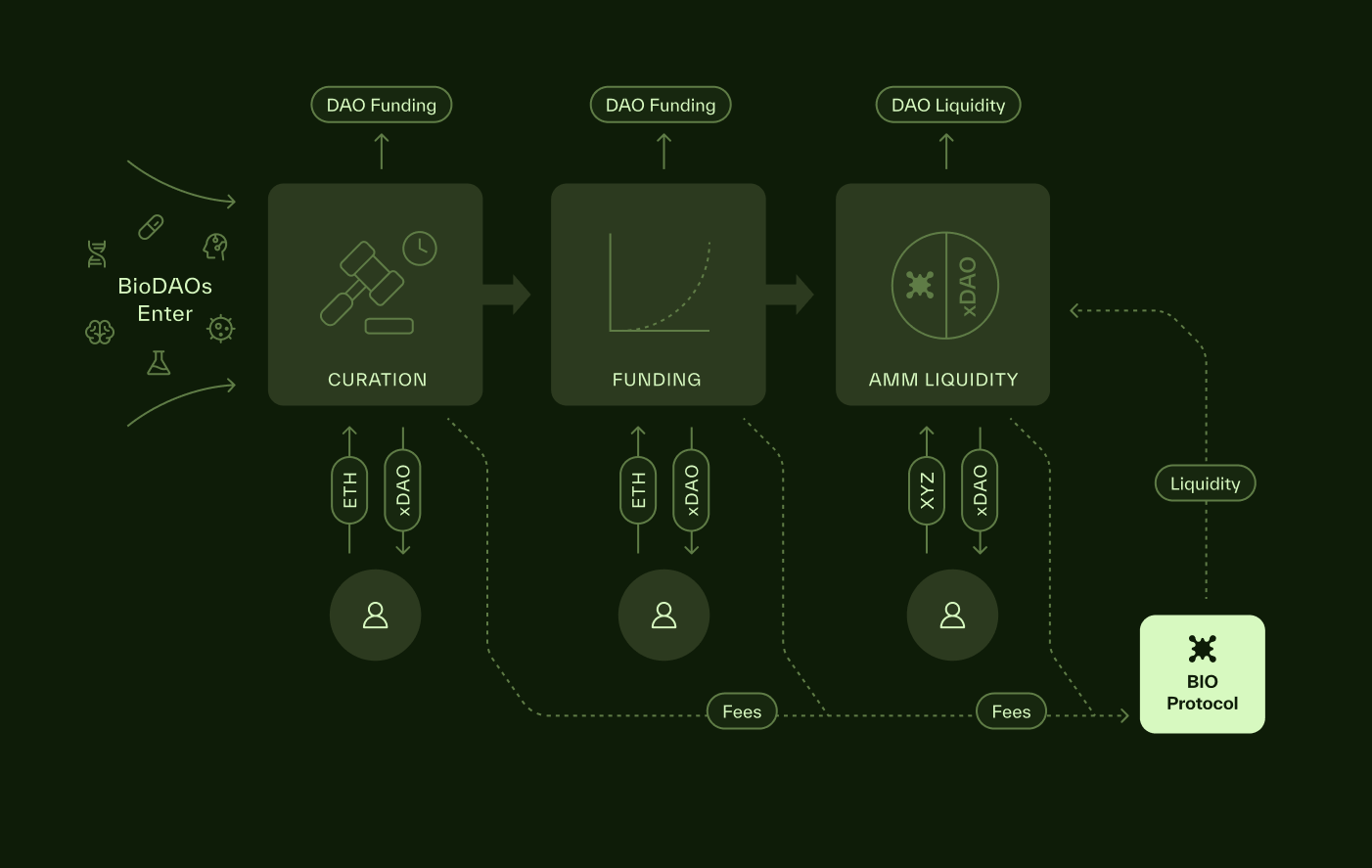

2. Centralize All DAO Revenue Streams and Payments Through a Unified On-Chain Platform

Fragmented revenue streams create friction, obscure transparency, and complicate reporting for DAOs, especially those managing multiple products or partners. That’s why centralizing all inflows (protocol fees, grants, royalties) and outflows (operational payments, contributor rewards) through a single on-chain platform is rapidly becoming best practice.

This centralization not only streamlines accounting but also enables real-time visibility into cash flows for all stakeholders, a core tenet of decentralized governance. Platforms like Request Finance have demonstrated how unifying treasury operations can improve auditability while making it easier to automate recurring payments or bulk distributions.

5 Actionable Strategies to Optimize DAO Treasury Fees

-

Implement Dynamic Fee Structures Based on Treasury Health and Market VolatilityAdopt adaptive fee models that automatically adjust based on treasury status and real-time market conditions. For example, Uniswap V3 and Curve Finance use dynamic fee algorithms to optimize trading fees and reduce impermanent loss, ensuring more efficient treasury growth.

-

Centralize All DAO Revenue Streams and Payments Through a Unified On-Chain PlatformUtilize platforms like Request Finance or Aragon to consolidate all income and payments. This streamlines financial operations, enhances transparency, and simplifies auditing for the entire DAO community.

-

Diversify Treasury Holdings Across Stablecoins, Blue-Chip Tokens, and Yield-Bearing AssetsReduce risk by allocating assets to a mix of stablecoins (like USDC, DAI), blue-chip tokens (such as ETH, BTC), and yield-generating protocols (e.g., Compound, Yearn Finance). This approach provides stability and consistent returns, as seen with DAOs like Uniswap and Index Coop.

-

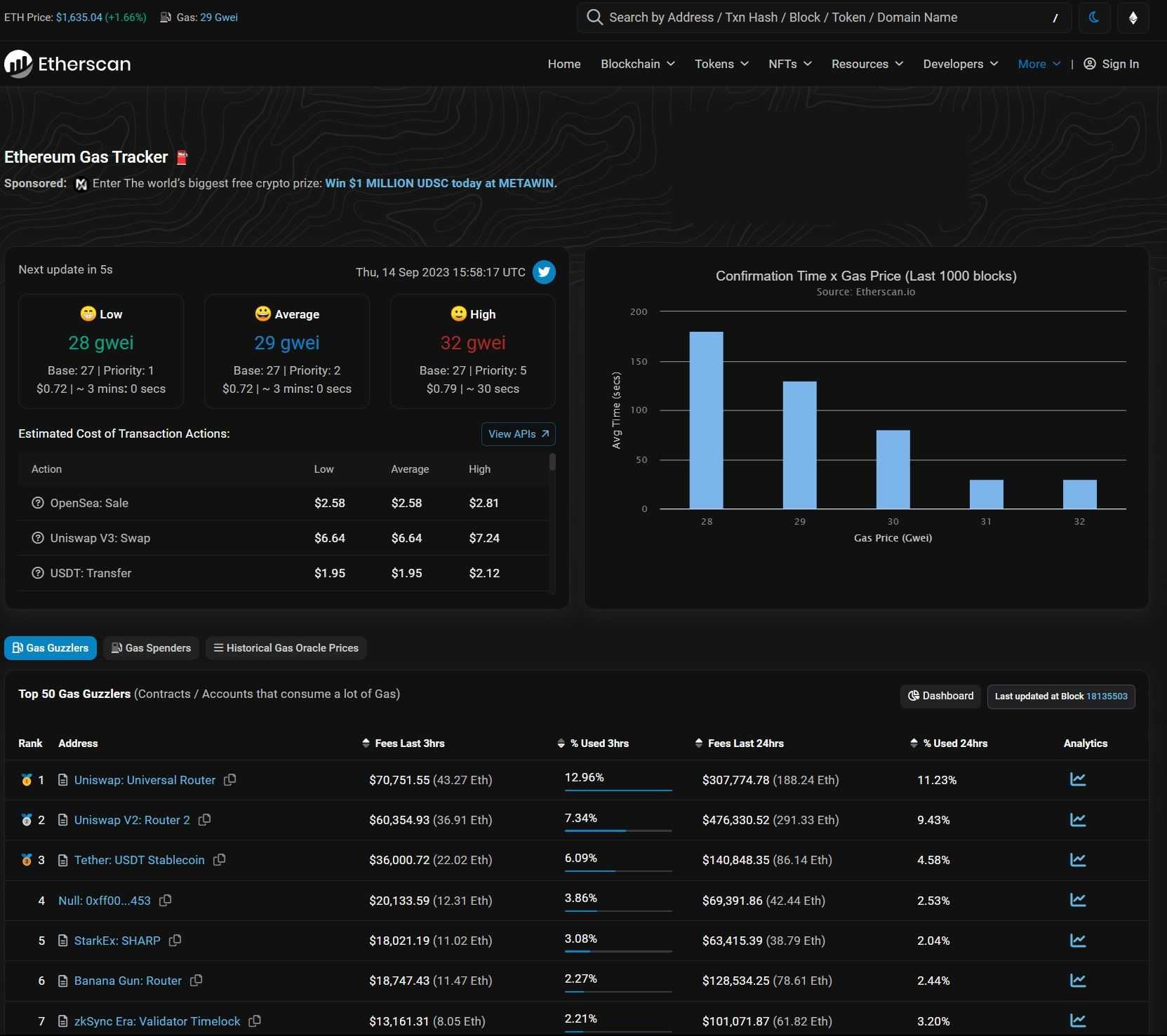

Regularly Audit and Optimize Gas Usage for Treasury TransactionsConduct frequent audits using tools like Etherscan Gas Tracker and DeBank to minimize transaction costs. Optimizing gas usage ensures more funds remain in the treasury, supporting long-term sustainability.

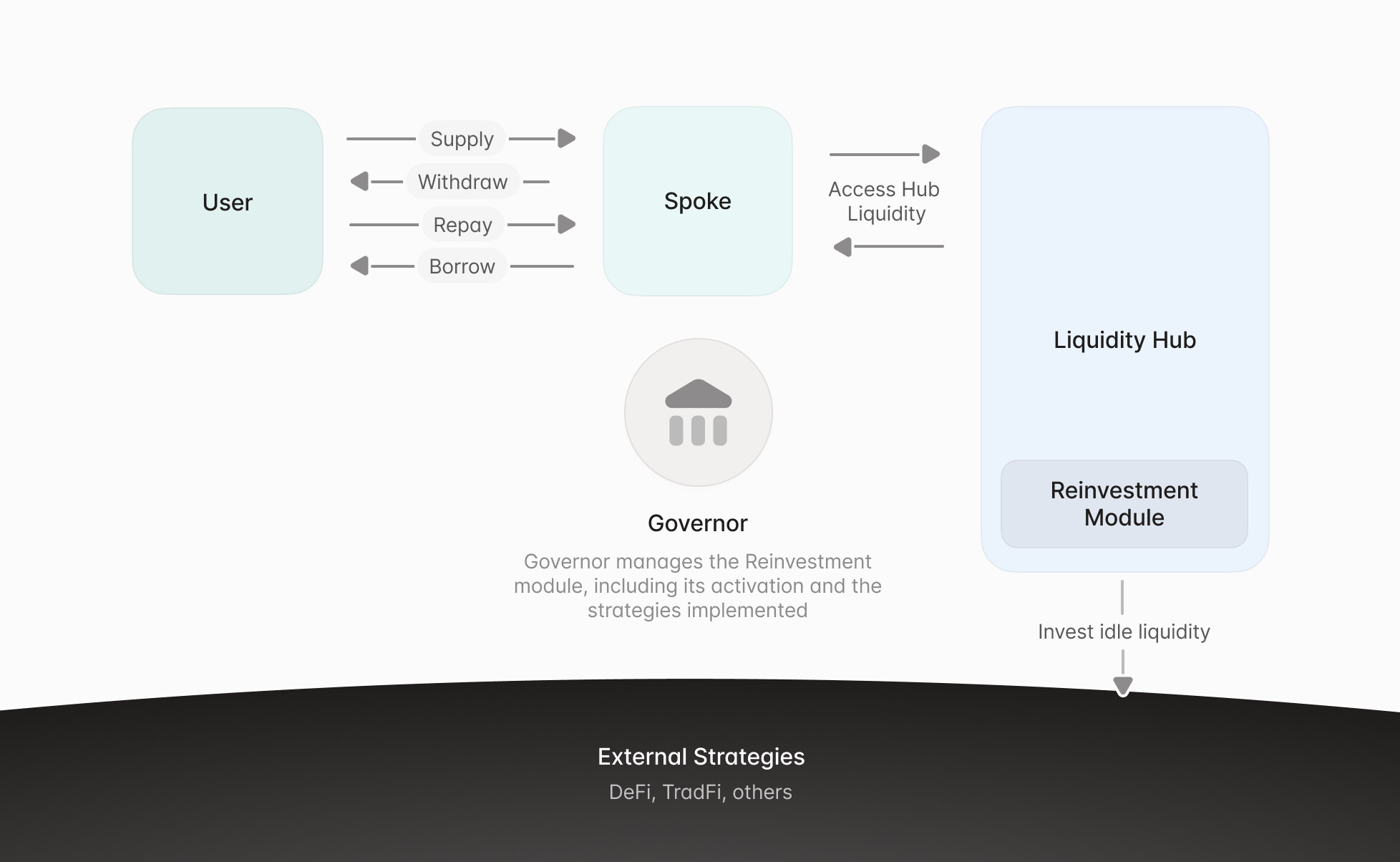

3. Automate Buyback and Reinvestment Mechanisms Using Smart Contracts

Manual buybacks and reinvestment cycles are inefficient, and prone to human error or governance delays. Leading DAOs are now deploying smart contracts that automatically execute buybacks when certain conditions are met (e. g. , surplus revenue thresholds), then reinvest those assets into pre-approved strategies such as staking or liquidity provision.

This automation not only reduces operational overhead but also ensures that excess capital is working for the community 24/7, maximizing compounding effects over time. By codifying these processes transparently on-chain, DAOs can demonstrate responsible stewardship while aligning incentives between token holders and contributors.

The Power of Automation in Sustainable Treasury Growth

The move toward automated buyback-and-reinvest loops reflects a broader trend: leveraging DeFi’s programmable infrastructure to minimize idle capital and optimize returns without sacrificing transparency or security. For more insights on how these mechanisms work in practice, including real-world case studies, check out our dedicated guide at this resource.

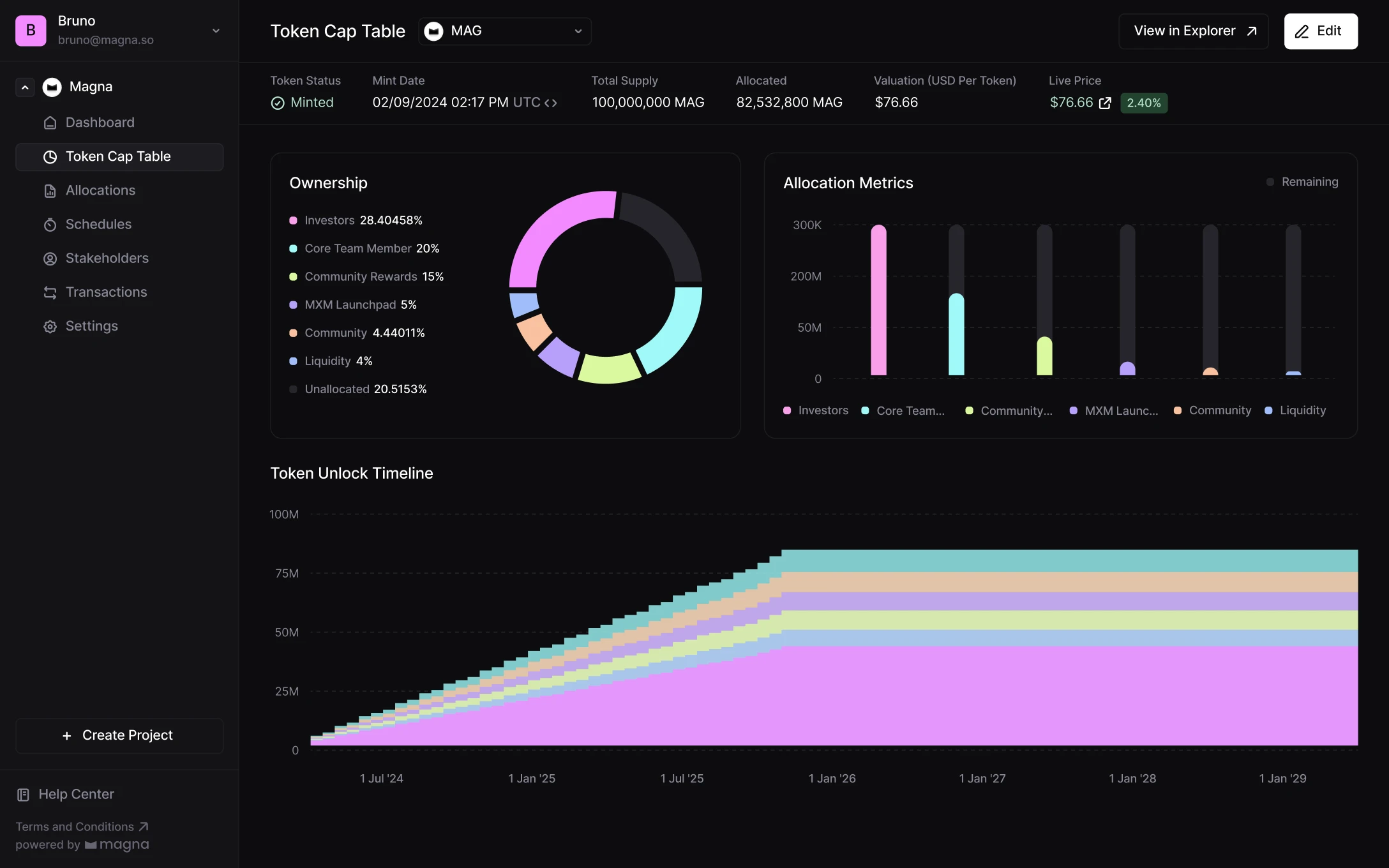

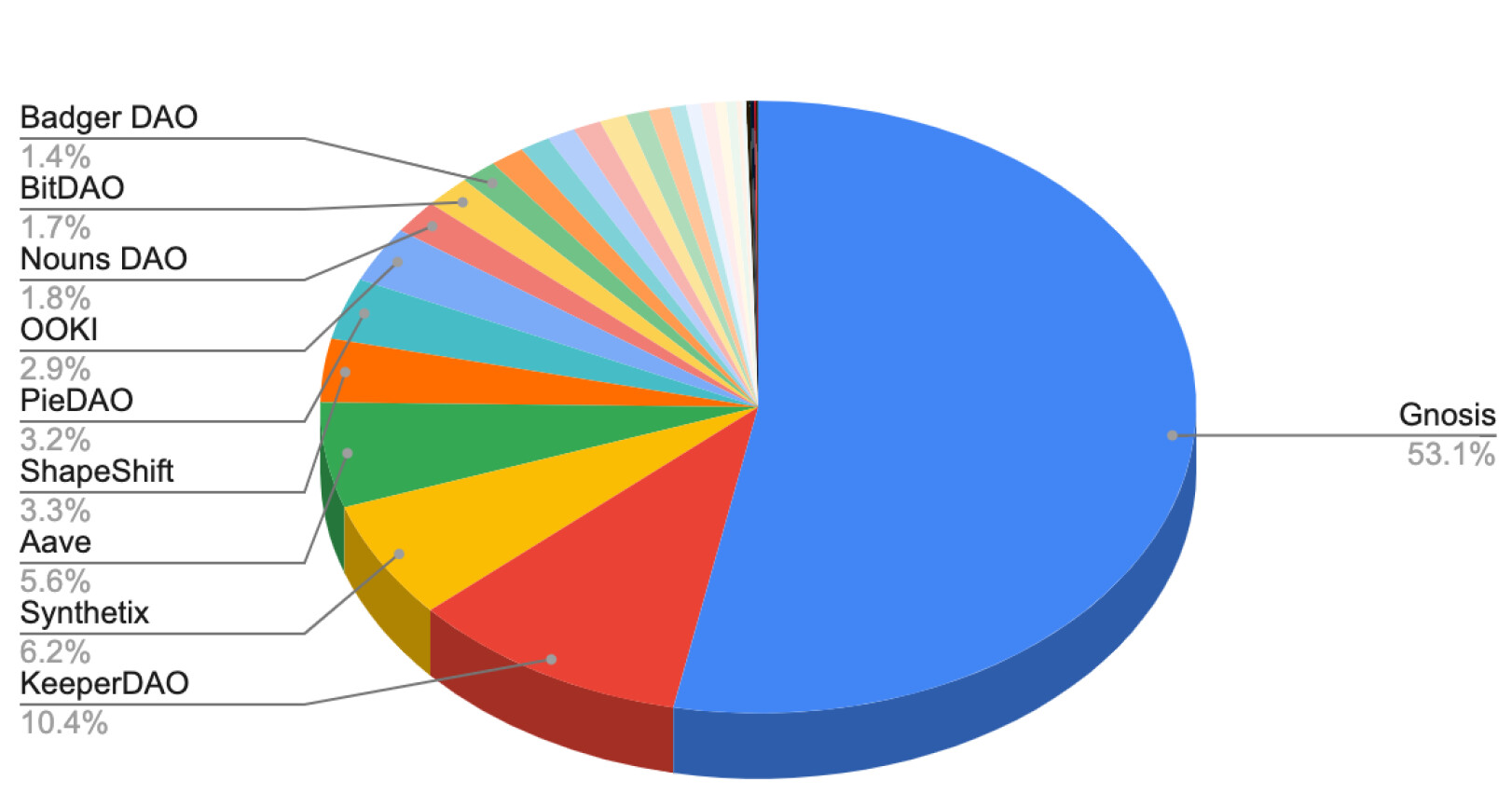

4. Diversify Treasury Holdings Across Stablecoins, Blue-Chip Tokens, and Yield-Bearing Assets

Concentration risk is one of the most overlooked threats to DAO treasury sustainability. Relying too heavily on a single asset, especially the DAO’s native token, can expose the organization to wild price swings and sudden liquidity crunches. Instead, forward-thinking DAOs are diversifying across a basket of stablecoins (for capital preservation and predictable spending), blue-chip tokens (like ETH or BTC for long-term upside), and yield-bearing assets (such as staked tokens or LP positions that generate passive income).

This diversified approach cushions treasuries from market shocks while creating multiple streams of yield. For example, allocating a portion of reserves to decentralized lending platforms can earn steady returns in stablecoins, while blue-chip exposure maintains upside potential if the broader crypto market rallies. The key is to rebalance regularly based on evolving risk appetites and market conditions, a process that can be further streamlined with automated tools.

5. Regularly Audit and Optimize Gas Usage for Treasury Transactions

Gas fees remain an unavoidable cost for every on-chain action, from multisig approvals to mass payments. Over time, these fees can quietly erode treasury value, especially during periods of network congestion or when executing frequent transactions. That’s why regular gas audits are essential for any DAO serious about fee optimization.

Best-in-class DAOs use analytics dashboards to monitor historical gas spend, identify inefficiencies (like redundant contract calls or batchable transactions), and implement optimizations such as transaction batching or leveraging L2 solutions where possible. Even modest improvements here can save thousands of dollars annually, savings that compound directly into the community’s bottom line.

“DAO treasuries that treat gas optimization as an ongoing discipline, not a one-off exercise, are consistently able to stretch their budgets further without sacrificing transparency or control. ”

Putting It All Together: A Sustainable Blueprint for DAO Treasuries

The most successful DAOs in 2025 are those that blend dynamic fee structures with unified revenue management, automation, diversification, and relentless gas optimization. This holistic approach not only maximizes yield but also builds trust with stakeholders by demonstrating prudent stewardship and operational excellence.

If you’re looking to level up your DAO’s treasury management strategy or want practical frameworks for implementing these best practices, explore our in-depth resources at this guide.