Decentralized Autonomous Organizations (DAOs) are rapidly evolving, and so are the tools underpinning their financial operations. One of the most significant shifts in recent years is the move toward USDT-native blockchains like Stable, a Layer 1 chain purpose-built for stablecoin infrastructure. With Stable raising $28 million in seed funding, market participants are taking note: USDT is no longer just a bridge asset for traders but is becoming foundational to on-chain treasury management.

Why DAOs Are Rethinking Treasury Composition

Historically, DAOs have held the majority of their treasuries in native governance tokens. Uniswap, for example, ended 2024 with a treasury valued at approximately $3.5 billion, heavily concentrated in UNI tokens. This approach exposes organizations to significant liquidity risk; any attempt to liquidate large portions of native tokens can depress prices and erode overall treasury value (source).

To mitigate these risks, DAOs are increasingly diversifying into stablecoins such as USDT. This provides a buffer against market volatility and ensures that operational expenses can be met regardless of broader crypto market swings (source). The current price of Polygon Bridged USDT (Polygon) stands at $1.00, reflecting its role as a stable store of value within DeFi ecosystems.

Cross-Chain USDT and Major Crypto Price Comparison (6-Month Performance)

Comparing the price stability of Polygon Bridged USDT with USDT on Ethereum, Tron, Stable, and major cryptocurrencies over the past 6 months.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Polygon Bridged USDT (Polygon) | $1.00 | $1.00 | +0.0% |

| USDT (Ethereum) | $1.00 | $1.00 | +0.0% |

| USDT (Tron) | $1.00 | $1.00 | +0.0% |

| USDT (Stable) | $1.00 | $1.00 | +0.0% |

| Bitcoin | $109,694.00 | $65,000.00 | +68.8% |

| Ethereum | $4,029.33 | $3,500.00 | +15.1% |

| USD Coin (USDC) | $1.00 | $1.00 | +0.0% |

| Dai (DAI) | $0.9995 | $1.00 | -0.1% |

Analysis Summary

All USDT stablecoins across Polygon, Ethereum, Tron, and Stable blockchains have maintained perfect price stability at $1.00 over the past six months, demonstrating robust cross-chain peg integrity. In contrast, major cryptocurrencies like Bitcoin and Ethereum have experienced significant growth, while other stablecoins such as USDC and DAI have also shown minimal variance.

Key Insights

- USDT maintains a perfect $1.00 peg across all major blockchains, including Polygon, Ethereum, Tron, and Stable, with zero price deviation over six months.

- Bitcoin (+68.8%) and Ethereum (+15.1%) have seen substantial price appreciation, highlighting the volatility of non-stablecoin assets.

- Other stablecoins (USDC, DAI) also show strong price stability, with DAI exhibiting only a negligible -0.1% change.

- Cross-chain USDT price stability supports its use as a reliable treasury asset for DAOs, regardless of the underlying blockchain.

This comparison uses real-time market data as of 2025-09-27, referencing exact current and 6-month historical prices for each asset from reputable sources such as CoinGecko. Only the provided data was used, ensuring accuracy and consistency in the analysis.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/polygon-bridged-usdt-polygon/usd

- USDT on Ethereum (USDT-ETH): https://www.coingecko.com/en/coins/tether/usd

- USDT on Tron (USDT-TRON): https://www.coingecko.com/en/coins/tether/usd

- USDT on Stable (USDT-STABLE): https://www.coingecko.com/en/coins/tether/usd

- Bitcoin (BTC): https://www.coingecko.com/en/coins/bitcoin/usd

- Ethereum (ETH): https://www.coingecko.com/en/coins/ethereum/usd

- USD Coin (USDC): https://www.coingecko.com/en/coins/usd-coin/usd

- Dai (DAI): https://www.coingecko.com/en/coins/dai/usd

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

The Emergence of USDT-Native Blockchains Like Stable

The introduction of Layer 1 chains such as Stable and MStableChain marks a turning point for DAO treasury management. These platforms treat USDT and other stablecoins not just as supported assets but as native tokens, enabling frictionless transactions with predictable fees. For DAOs, this unlocks several advantages:

- Stable Transaction Fees: Budgeting becomes more accurate when transaction costs are denominated in stablecoins rather than volatile native assets.

- Simplified Treasury Operations: Holding and transacting directly in USDT reduces reliance on potentially unstable governance tokens.

- Improved Financial Resilience: Native stablecoin infrastructure shields treasuries from sudden market downturns.

This trend aligns with broader industry recognition that stablecoins have evolved from mere trading tools into critical financial rails for payments and treasury operations (source). As McKinsey and Company noted, “stablecoins have emerged as a global alternative to conventional payments, ” and now they’re shaping how organizations manage reserves at scale.

Treasury Diversification: From Theory to Practice

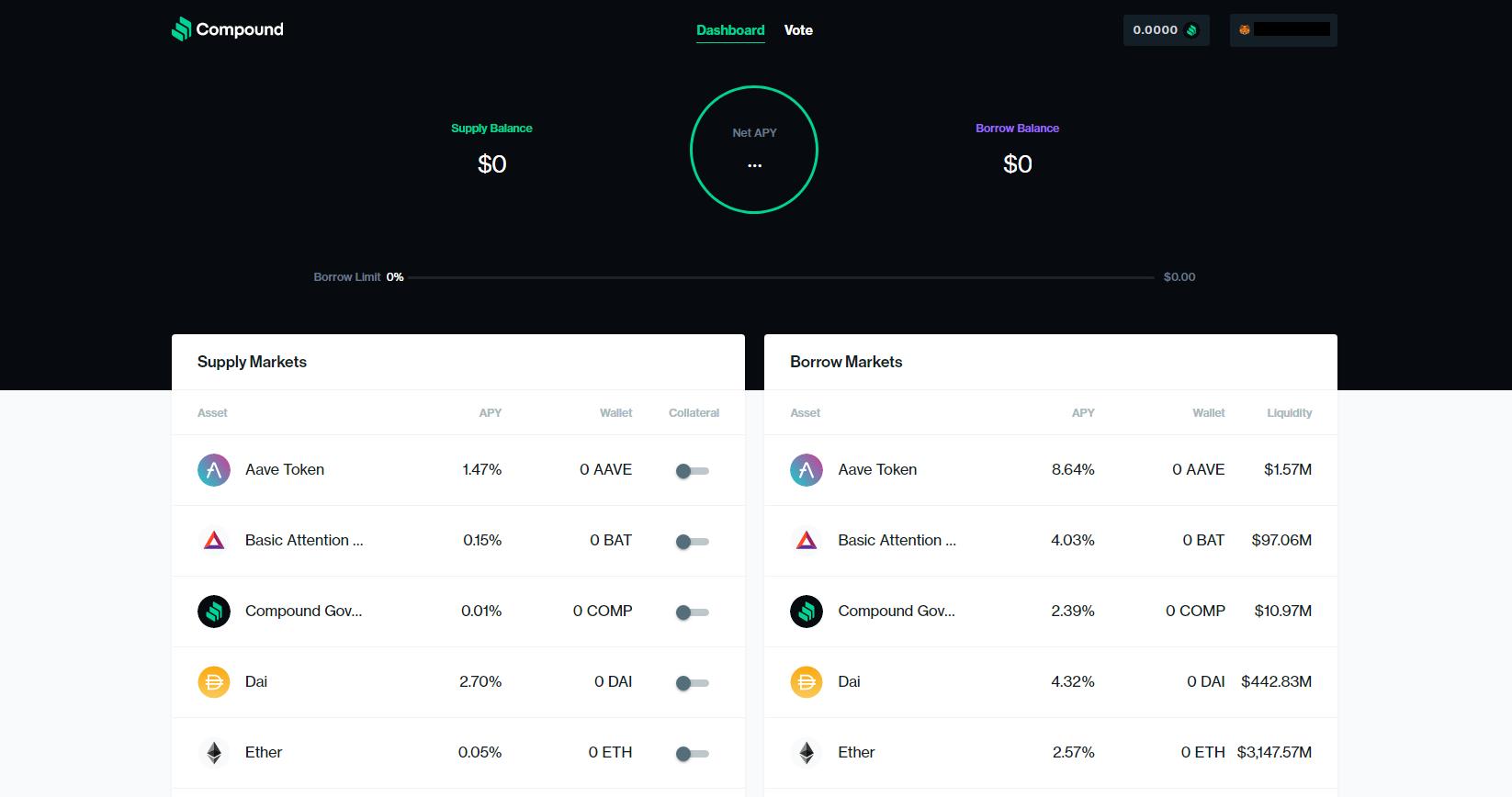

Diversification strategies are no longer academic exercises for DAOs; they’re operational imperatives. By allocating part of their holdings to stablecoins like USDT at its current price of $1.00, DAOs gain enhanced liquidity and the ability to deploy assets into yield-generating DeFi protocols such as Aave or Compound (source). Managed liquidity solutions via platforms like dHEDGE further optimize returns while maintaining robust risk controls.

Key Benefits of Stablecoin Reserves in DAO Treasuries

-

Reduced Volatility and Market Risk: Holding stablecoins like USDT helps DAOs avoid the price swings associated with native tokens, ensuring reserves maintain their value even during market downturns.

-

Improved Liquidity for Operations: Stablecoins provide immediate, predictable liquidity, allowing DAOs to fund development, pay contributors, and cover expenses without the risk of slippage from large token sales.

-

Access to On-Chain Yield Opportunities: Platforms such as Aave and Compound enable DAOs to deploy stablecoin reserves to earn yield, turning idle funds into productive assets.

-

Predictable Transaction Fees on USDT-Native Blockchains: Emerging blockchains like Stable and MStableChain allow for stable, transparent transaction costs, aiding DAOs in accurate budgeting and financial planning.

-

Enhanced Transparency and Reporting: Stablecoin transactions are easily tracked on-chain, and tools like the Aragon App provide clear, real-time views of DAO treasury balances and movements.

This shift is also about transparency and compliance. Tools like Aragon App allow DAO members to track treasury status on-chain, an essential feature when managing diversified assets across multiple protocols (source). The move towards enterprise-ready stablecoin infrastructure is making decentralized treasury optimization both practical and scalable.

Tether (USDT) Price Prediction 2026-2031

Professional Outlook for USDT Stability Across Major and Native Blockchains

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | 0% | USDT continues to track the US dollar closely; volatility remains minimal due to strong reserves and adoption on native blockchains. |

| 2027 | $0.97 | $1.00 | $1.03 | 0% | Expansion of USDT-native blockchains increases on-chain utility; regulatory clarity in major markets supports price stability. |

| 2028 | $0.96 | $1.00 | $1.03 | 0% | USDT’s role in DAO treasuries grows; minor depegs possible during high market stress but swiftly corrected by arbitrage and issuer response. |

| 2029 | $0.96 | $1.00 | $1.04 | +0% | Continued competition from algorithmic and collateralized stablecoins; USDT maintains dominance through network effects and partnerships. |

| 2030 | $0.95 | $1.00 | $1.04 | 0% | Potential for new regulatory standards globally; short-lived volatility from policy changes, but peg remains robust. |

| 2031 | $0.95 | $1.00 | $1.05 | 0% | USDT’s integration into mainstream payment systems and DAOs cements its $1.00 peg; rare depegs possible in extreme scenarios. |

Price Prediction Summary

USDT is expected to maintain its $1.00 price peg with minimal deviation through 2031, supported by increased adoption on native blockchains (like Stable), growing use in DAO treasury management, and maturing regulatory frameworks. Minimum and maximum price scenarios reflect rare, temporary volatility during systemic shocks or regulatory events, but the peg is projected to be swiftly restored due to strong market mechanisms and issuer interventions.

Key Factors Affecting Tether Price

- Expansion and adoption of USDT-native blockchains (e.g., Stable, MStableChain) improving transaction efficiency and utility.

- Growing use of USDT in DAO treasuries for risk mitigation and operational stability.

- Regulatory clarity and global policy developments affecting stablecoin operations and reserves.

- Competition from new stablecoin models (e.g., algorithmic, collateralized) and central bank digital currencies (CBDCs).

- Market stress events (e.g., liquidity crises or black swan events) temporarily impacting the peg but historically corrected quickly.

- Issuer transparency, reserve audits, and robust arbitrage mechanisms maintaining market confidence.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

USDT-native blockchains are fundamentally changing how DAOs approach treasury management by embedding stability and flexibility at the protocol layer. The ability to pay for gas, execute payroll, and conduct cross-chain settlements using stablecoins like USDT at a consistent price of $1.00 removes a major source of operational uncertainty for decentralized organizations.

How USDT as Native Gas Changes Treasury Operations

On Layer 1 stablecoin chains such as Stable, DAOs can use USDT directly as gas, eliminating the need to swap into volatile native tokens just to cover transaction fees. This innovation simplifies accounting and enables more granular financial planning. With predictable costs, DAOs can confidently allocate resources for development, grants, or liquidity incentives without worrying about unexpected fee spikes.

This model also supports multi-stablecoin ecosystems. Chains like MStableChain are exploring support for multiple fiat-backed tokens as native assets, allowing DAOs to further diversify their on-chain operations while maintaining seamless interoperability across protocols.

Yield Generation and Risk Management on Stable Blockchains

Holding stablecoins is only part of the equation; deploying them effectively is equally crucial. On USDT-native chains, DAOs can tap into a growing suite of DeFi protocols purpose-built for stable assets. For example, yield farming platforms are optimizing returns specifically for stablecoin pools, while risk-managed vaults allow treasuries to participate without overexposing themselves to smart contract or protocol risks.

It’s important to note that while platforms may offer attractive yields on USDT (currently $1.00), these returns are typically funded by the platform’s own incentive programs rather than from reserve income (source). This distinction underscores the need for robust due diligence and ongoing monitoring of counterparty risk when allocating treasury assets.

“Stablecoins have evolved into a cornerstone of modern DAO finance, not just as a hedge against volatility but as programmable money powering real-world use cases. ”

Transparency and Automation: The Next Frontier

The move toward enterprise-ready stablecoin infrastructure brings automation and transparency front and center. Smart contracts now facilitate recurring payments, automated rebalancing between yield strategies, and real-time auditability of treasury movements, all denominated in stablecoins like USDT at $1.00. This level of automation reduces manual intervention and lowers operational risk while maintaining full compliance with DAO governance frameworks.

What Comes Next?

The rapid adoption of Layer 1 stablecoin chains signals a new era in decentralized treasury optimization, one where stability is not an afterthought but an integral design principle. As DAOs continue to professionalize their financial operations, we can expect further innovation around multi-chain interoperability, regulatory compliance tools, and bespoke yield products tailored specifically for large-scale treasuries operating in the on-chain economy.

The rise of USDT-native blockchains like Stable is more than just a technical upgrade; it represents a paradigm shift toward resilient, transparent, and enterprise-grade asset management in crypto-native organizations. For forward-thinking DAOs seeking sustainable growth without sacrificing security or flexibility, this evolution offers both opportunity and assurance.