Automated treasury management isn’t just a buzzword – it’s the backbone of modern DAO resilience in DeFi. As market volatility reaches new heights and protocol exploits make headlines, DAOs are turning to a new generation of smart contract-powered “traps” to instantly protect their funds. These advanced features aren’t theoretical: they’re live, on-chain, and already defending some of the largest treasuries in crypto.

Why Real-Time Traps Are Now Essential for DAO Treasury Security

DAOs operate in an environment where seconds matter. A sudden depeg, flash loan attack, or price cascade can wipe out months of strategic planning. That’s why leading protocols are deploying automated traps, purpose-built smart contract tools that act the moment risk is detected. Forget manual committee votes or delayed multi-sig responses; these systems react with machine precision, 24/7.

Let’s break down the three most powerful automated traps driving this new era of DAO treasury automation:

Top 3 Automated Traps Protecting DAO Treasuries

-

StablecoinTrap: Instantly converts volatile assets to stablecoins during high market swings, locking in value and minimizing treasury losses with real-time oracles and automated smart contract triggers.

-

DiversificationTrap: Enforces automatic portfolio rebalancing across multiple uncorrelated assets or protocols, reducing single-asset risk and guarding against protocol-specific failures.

-

YieldOptimizerTrap: Continuously monitors and migrates idle treasury funds into secure, high-yield DeFi opportunities, using risk assessment tools to avoid unstable or unaudited protocols.

StablecoinTrap: Instant Value Preservation During Market Chaos

The StablecoinTrap is a game-changer for DAOs facing wild price swings. When real-time oracles detect abnormal volatility, think double-digit drops in minutes, this trap springs into action. It triggers an automated conversion of volatile assets (like ETH or governance tokens) into stablecoins such as USDC or DAI, locking in treasury value before cascading losses hit.

This isn’t just theory: recent market events have shown that DAOs without instant stablecoin conversion mechanisms suffered drawdowns of 30% or more while automated peers preserved capital. The StablecoinTrap leverages on-chain triggers and oracle feeds to ensure that no human intervention is needed, the protocol acts faster than any Discord alert ever could.

DiversificationTrap: Automated Rebalancing for True Resilience

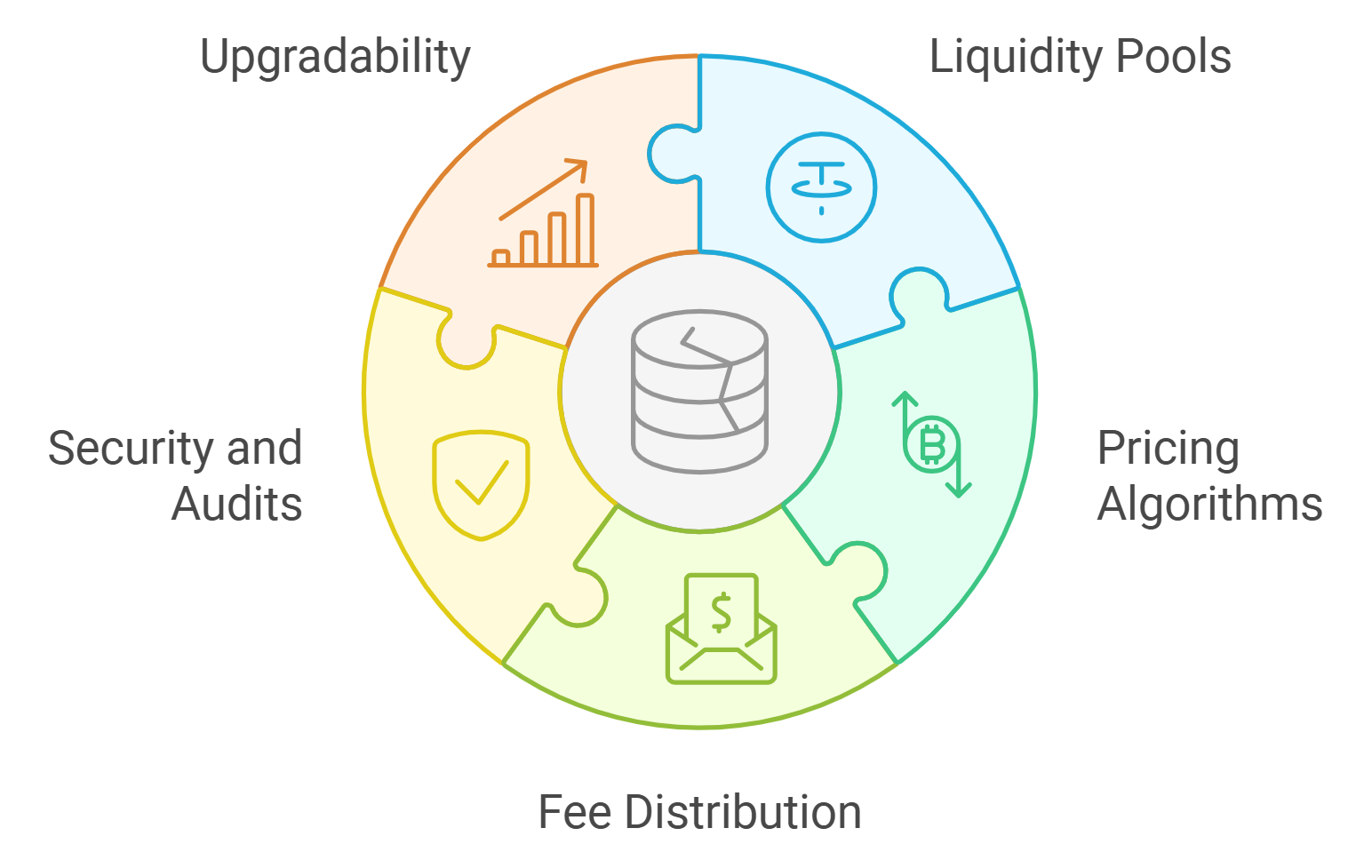

Single-asset exposure is a ticking time bomb for any DAO treasury. Enter the DiversificationTrap: an on-chain portfolio rebalancer that automatically redistributes funds across multiple uncorrelated assets and protocols when risk thresholds are breached. If one asset tanks or a partner protocol falters, the treasury’s overall health remains intact.

This trap isn’t about chasing every new token, it’s about enforcing smart diversification rules coded directly into your treasury contracts. By continuously monitoring correlations and asset health, DiversificationTrap reduces vulnerability to black swan events and protocol-specific failures.

YieldOptimizerTrap: Secure Yield Without Overexposure

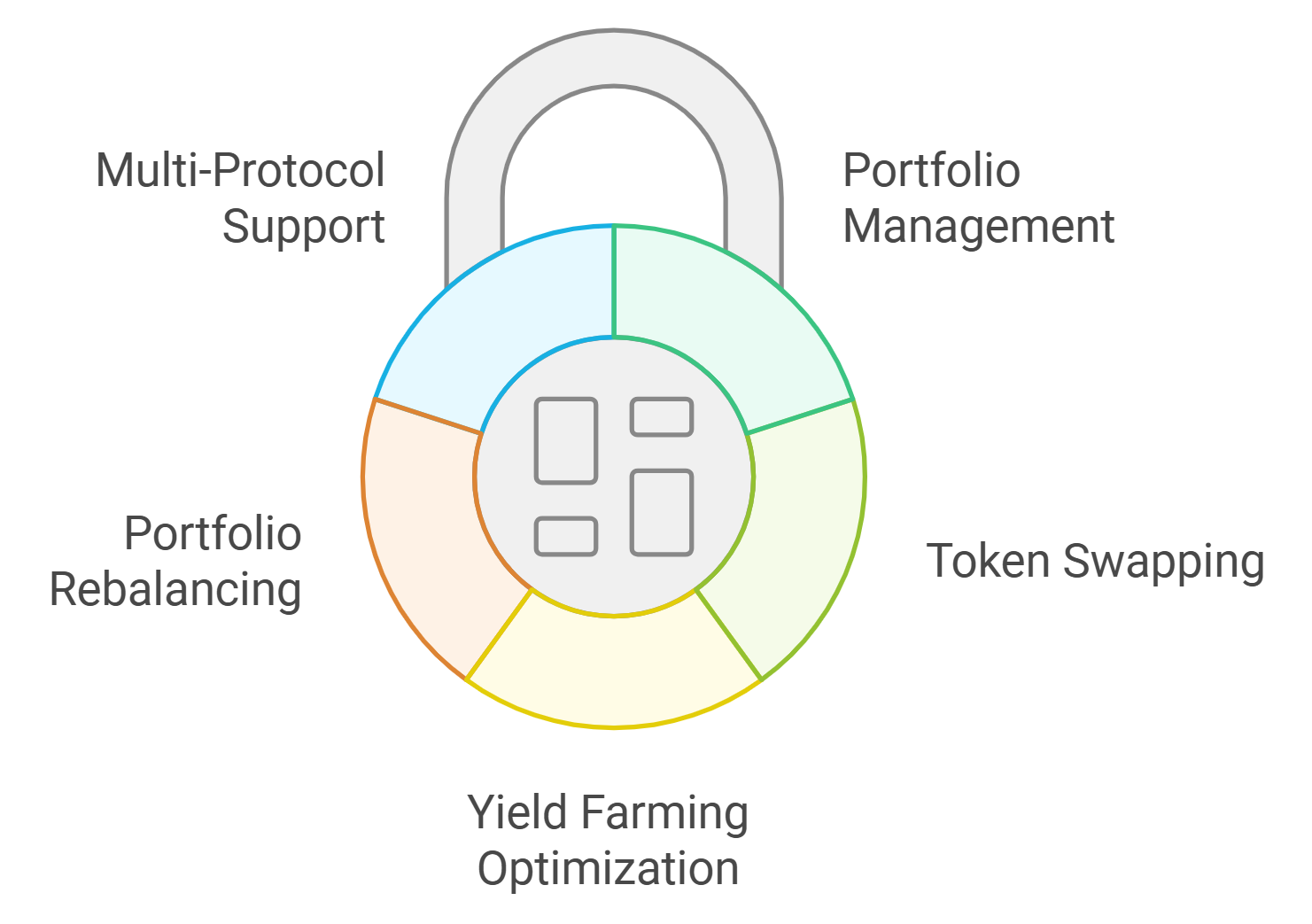

The final pillar is YieldOptimizerTrap, which supercharges idle assets by seeking out top-tier DeFi yields, but with built-in safety rails. Unlike manual yield farming (which often leads to overexposure or rug pulls), this trap continuously scans vetted protocols for high-yield opportunities while running real-time risk assessments. If conditions change or an opportunity becomes unsafe (for example, if TVL drops sharply or audits flag issues), funds are migrated instantly to safer havens.

This approach not only maximizes returns but also ensures your DAO never ends up as collateral damage in the next unaudited exploit, a critical edge as composability and complexity accelerate across DeFi.

Automated treasury management is only as strong as its weakest link. That’s why integrating these three traps, StablecoinTrap, DiversificationTrap, and YieldOptimizerTrap, has become the gold standard for DAOs determined to survive every market storm and protocol scare. But how do these mechanisms actually work together in real-world scenarios?

How the Traps Work in Real-Time: An Example Flow

Picture a DAO treasury in action:

- Market volatility spikes, with ETH dropping 15% in minutes.

- StablecoinTrap auto-converts a portion of ETH holdings into USDC, preserving value instantly.

- DiversificationTrap detects increased correlation between DAO-held tokens and triggers rebalancing, spreading exposure across uncorrelated assets like LSTs or blue-chip DeFi coins.

- YieldOptimizerTrap simultaneously redirects idle stablecoins into a newly-audited lending protocol offering higher APY, but only after confirming risk parameters are met.

This seamless choreography of smart contract automation means DAOs don’t just react, they anticipate and neutralize threats before they can inflict lasting damage. The result? Fewer sleepless nights for treasury managers and a dramatically reduced risk of catastrophic loss.

Why Manual Intervention No Longer Cuts It

The days of relying on Discord votes or multi-sig delays are over. As DeFi composability grows, so does the attack surface, and the speed at which events unfold. Automated traps give DAOs the agility to operate at blockchain speed, enforcing rules without human bottlenecks or emotional bias. This is especially critical during black swan events or coordinated exploits when every second counts.

Dive deeper into automated DAO treasury risk management strategies here.

Building Trust Through Transparency and Audits

No automation is complete without transparency. Leading protocols publish their trap logic on-chain and undergo regular third-party audits to prove there are no hidden backdoors or exploitable flaws. Communities can inspect every trigger condition, conversion threshold, and yield migration event in real time, building trust not just in code, but in governance itself.

DAO Treasury Traps: Best Practices Checklist

-

StablecoinTrap: Automated conversion of volatile assets into stablecoins during periods of high market volatility. This preserves DAO treasury value and minimizes drawdowns by leveraging real-time oracles (e.g., Chainlink) and on-chain triggers. Ensure your smart contracts integrate reliable price feeds and set clear volatility thresholds for instant execution.

-

DiversificationTrap: Smart contract-enforced portfolio rebalancing that automatically reallocates DAO funds across multiple uncorrelated assets or protocols. Reduce single-asset risk and exposure to protocol-specific failures by using platforms like Enzyme Finance or Balancer for automated, rule-based diversification.

-

YieldOptimizerTrap: Continuous monitoring and migration of idle treasury assets into secure, high-yield DeFi opportunities. Employ built-in risk assessment tools (such as Yearn Finance or Beefy Finance) to avoid overexposure to unstable or unaudited protocols, maximizing returns while maintaining treasury safety.

The Road Ahead: Automated Treasury Management as Standard Practice

The adoption curve is clear: what was once cutting-edge is quickly becoming table stakes for any serious DAO. As more protocols embrace real-time DeFi risk management tools like StablecoinTrap, DiversificationTrap, and YieldOptimizerTrap, we’ll see fewer headlines about catastrophic treasury losses, and more about sustainable growth powered by automation.

If your DAO isn’t leveraging these automated defenses yet, now’s the time to level up your treasury game. The future belongs to those who build resilience into their very foundation, one trap at a time.