Decentralized Autonomous Organizations (DAOs) are rewriting the rules of treasury management, and the secret weapon driving this evolution is automation. Automated agents are now taking center stage in how DAOs monitor, protect, and optimize their on-chain treasuries. Forget slow, manual oversight – today’s DAO treasuries demand real-time intelligence and lightning-fast responses to risk. The rise of AI-driven agents marks a new era: one where risk is anticipated, not just reacted to.

Why Manual Treasury Management Is Fading Fast

Managing millions in digital assets isn’t just about spreadsheets and quarterly reviews anymore. In the high-volatility world of DeFi, threats move at machine speed – so must your defenses. Traditional audits and human committees simply can’t keep up with flash loan exploits, protocol interdependencies, or sudden governance attacks. That’s why leading DAOs are turning to automated DAO treasury management tools that offer relentless vigilance and instant action.

Platforms like Drosera Network have set a new standard for proactive security. Drosera’s real-time monitoring doesn’t just flag suspicious activity – it can alert or trigger emergency responses when dependencies fail or unauthorized transfers occur. This isn’t hypothetical: DAOs already use Drosera to catch threats before they spiral into disasters, as highlighted in recent case studies.

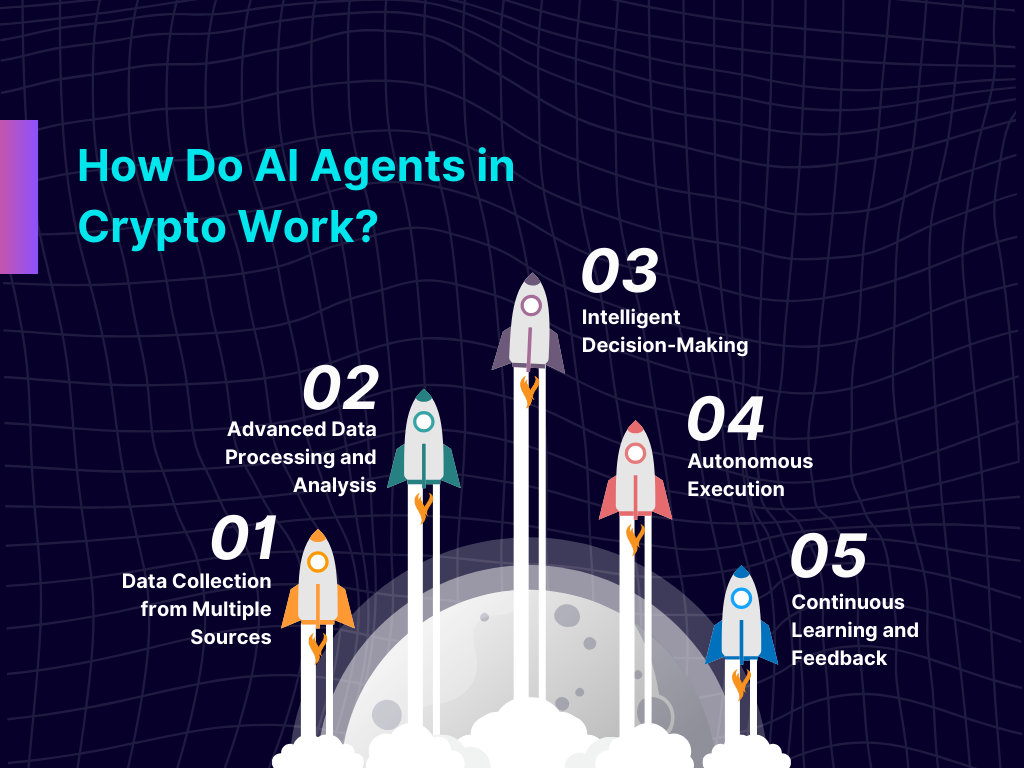

The Rise of Adaptive Agents: Smarter Risk Mitigation

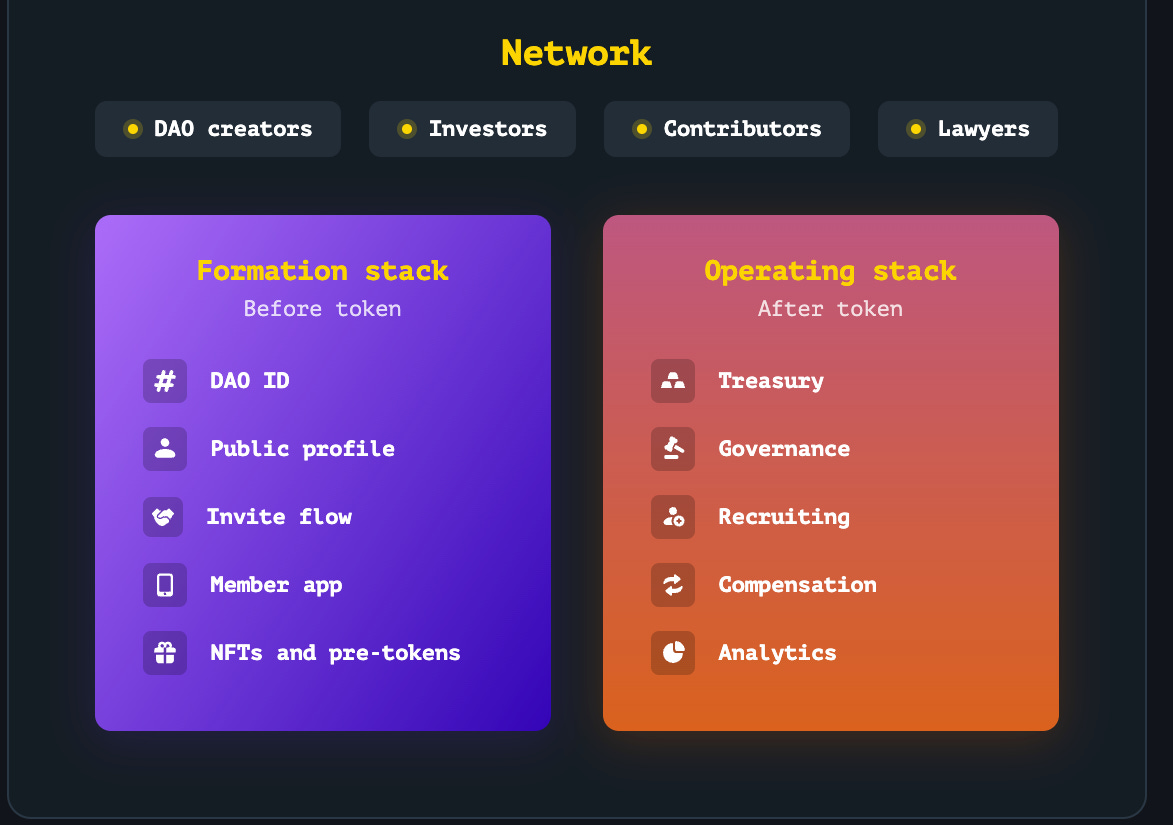

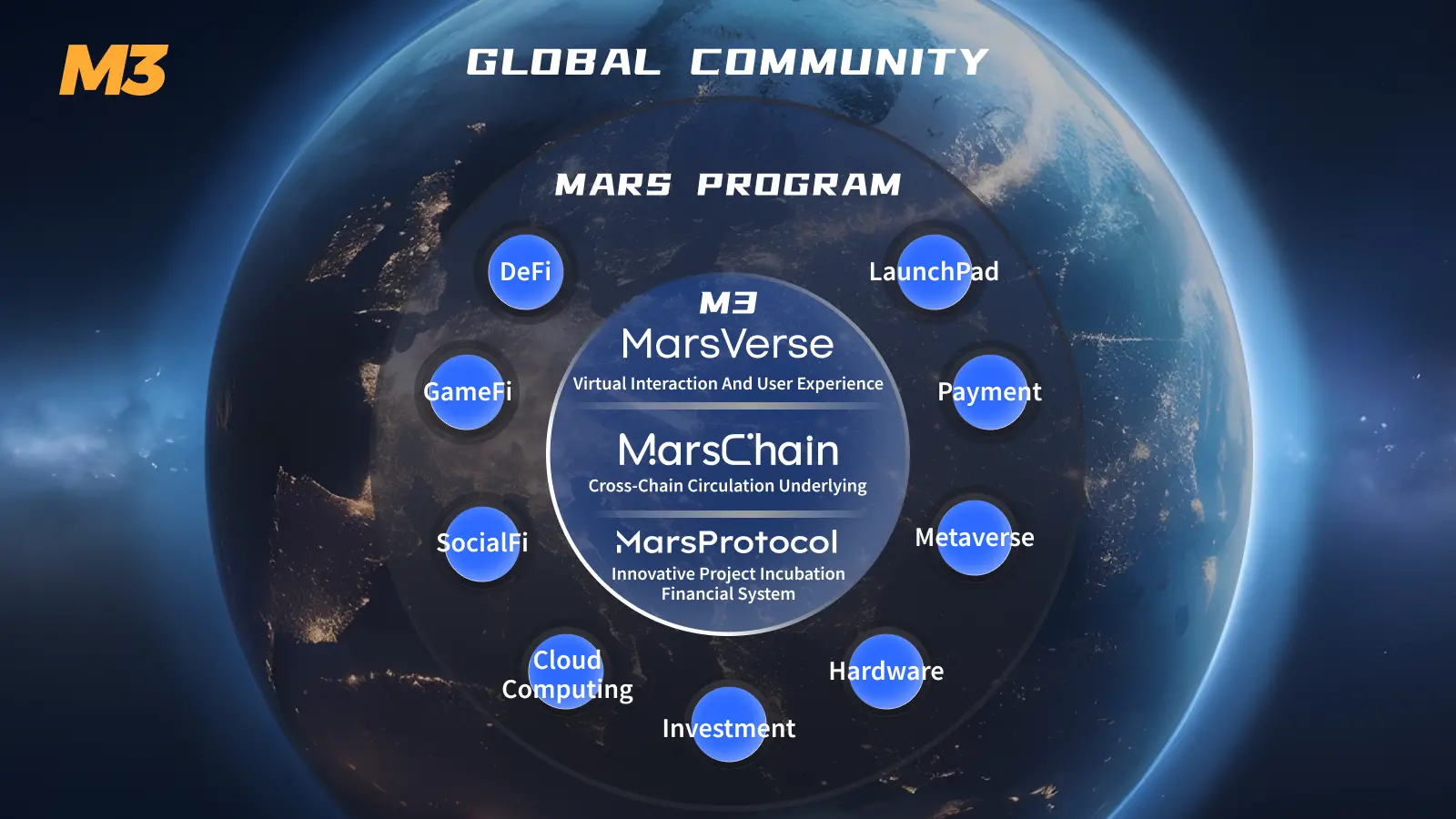

The next generation of on-chain treasury risk tools doesn’t just watch – it acts. Enter frameworks like MARS (Meta-controlled Agents for a Risk-aware System), which orchestrate multiple AI agents with different risk profiles. When markets turn volatile, MARS can shift assets into safer strategies; during bull runs, it lets aggressive agents chase higher returns. This dynamic allocation minimizes drawdowns while maximizing upside – a game-changer for DAOs that need both resilience and growth.

Top 5 Ways Automated Agents Reduce DAO Treasury Risks

-

1. Real-Time Monitoring & Alerts: Platforms like Drosera Network enable DAOs to monitor treasury transactions in real time, instantly flagging suspicious activity or unauthorized transfers to prevent losses.

-

2. Automated Emergency Responses: Automated agents can trigger circuit breakers—halting operations during extreme market volatility or detected exploits, as seen with Drosera’s emergency protocols, to minimize potential financial damage.

-

3. Adaptive Portfolio Management: Frameworks like MARS (Meta-controlled Agents for a Risk-aware System) use multi-agent systems to dynamically rebalance portfolios, reducing volatility during downturns and optimizing for growth in bull markets.

-

4. Transparent, Non-Custodial Execution: Solutions such as dHEDGE offer on-chain, auditable trading activity with built-in guardrails, ensuring only authorized actions are executed and assets remain secure within DAO-defined parameters.

-

5. Automated Governance & Decision-Making: AI agents assess proposals and execute treasury decisions based on predefined rules and historical data, reducing human bias and expediting critical governance actions for DAOs.

This level of adaptability is essential as DeFi grows more complex and interconnected. For example, if a lending protocol integrated with your DAO’s vault suddenly faces insolvency risks, an agent like Drosera can instantly freeze funds or reroute liquidity – all without waiting for human intervention.

Automated Decision-Making: From Proposals to Portfolio Rebalancing

The automation wave isn’t limited to security alone; it’s transforming governance too. AI-powered agents now analyze proposals based on historical data and predefined parameters, slashing decision times while reducing bias. This means faster approvals for critical actions like rebalancing portfolios or responding to market shocks.

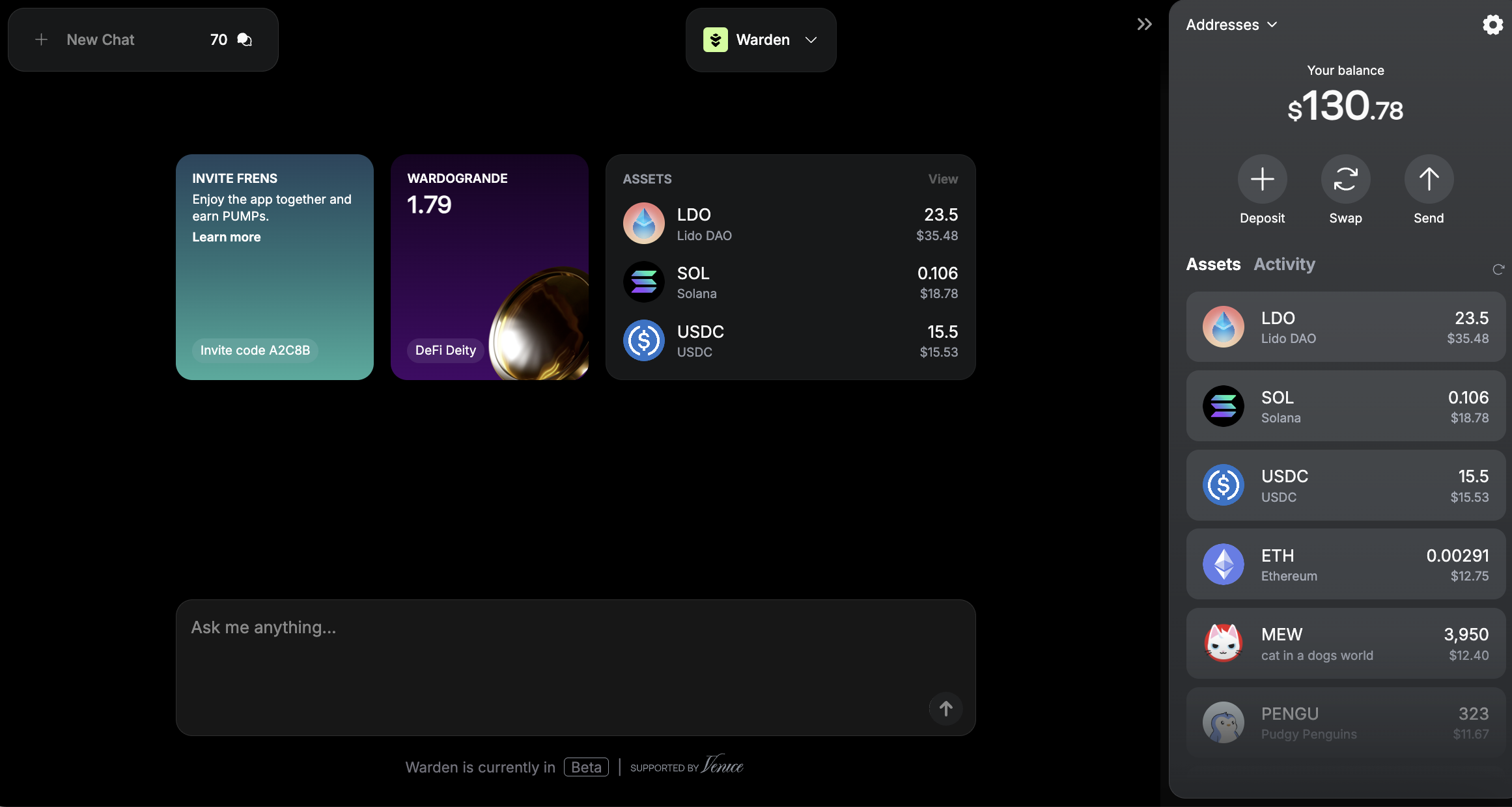

Warden Protocol takes this further by giving developers the toolkit to build custom AI agents that interact directly with blockchain networks. These institutional-grade agents enforce guardrails (think circuit breakers) that prevent reckless trades or catastrophic losses during black swan events.

The result? Real-time DAO asset rebalancing becomes routine rather than reactive – an essential upgrade as treasuries balloon in size and complexity.

But automation isn’t just about speed, it’s about precision. With on-chain treasury risk tools like Drosera and Warden Protocol, DAOs can set granular controls that align with their unique risk appetites. Imagine a world where your treasury instantly detects when a partner protocol is faltering, or when an abnormal transfer pattern hints at a governance attack. Instead of relying on human vigilance, AI agents take the wheel, executing pre-approved emergency actions in seconds.

Consider how real-time DAO asset rebalancing is evolving. Agents monitor market signals and liquidity pools 24/7, shifting stablecoins or yield-bearing assets between protocols based on volatility or yield changes. This isn’t theory, projects are already deploying these systems to protect against cascading liquidations and sudden depegs.

Guardrails and Circuit Breakers: Automation with Accountability

The biggest fear with automation? Unchecked bots going rogue. That’s where circuit breakers come in. By embedding safety valves directly into agent logic, DAOs ensure that if markets go haywire, think sudden flash crashes or governance exploits, automated systems can halt trades, freeze transfers, or require human confirmation before resuming operations. These circuit breakers are now best practice for any serious automated DAO treasury management stack.

This blend of autonomy and oversight is what makes modern risk management so robust. As seen in frameworks like MARS and platforms like dHEDGE (read more), transparency isn’t sacrificed for speed; every move remains auditable and aligned with community governance.

What’s Next? The Future of Automated Treasury Agents

The pace of innovation is only accelerating. Expect to see deeper integration between automated agents and DAO voting systems, smarter cross-chain monitoring, and even predictive analytics that spot systemic risks before they materialize. As protocols like Drosera evolve beyond simple alerting to full-blown mitigation (think automatic liquidity rerouting during protocol failures), the days of manual treasury oversight are numbered.

The bottom line: If your DAO isn’t already leveraging these tools, you’re not just behind, you’re exposed. Automation is no longer optional; it’s the backbone of resilient DeFi governance.

Essential Features in On-Chain Treasury Risk Tools

-

Real-Time Monitoring & Automated Alerts: Tools like Drosera Network provide continuous, on-chain surveillance of treasury assets, instantly flagging suspicious activity or unauthorized transfers.

-

Automated Incident Response: Platforms such as Drosera can trigger emergency actions—like freezing funds or executing circuit breakers—when threats or anomalies are detected, minimizing potential losses.

-

Adaptive Portfolio Management: Solutions like Warden Protocol and the MARS framework dynamically rebalance assets and adjust risk exposure based on market conditions, helping DAOs stay ahead of volatility.

-

Transparent, Auditable Activity Logs: Platforms such as dHEDGE offer on-chain, non-custodial trading with full transparency—every action is recorded and auditable, ensuring accountability.

-

Customizable Guardrails & Access Controls: Modern tools allow DAOs to set granular permissions and risk limits, ensuring automated agents act only within clearly defined parameters and governance frameworks.

Ready to future-proof your treasury? Dive deeper into real-world applications and technical guides from innovators like Drosera (see use cases) and keep an eye on emerging standards from Warden Protocol (Warden Protocol Docs). The next wave of DeFi security will be automated, and fiercely intelligent.