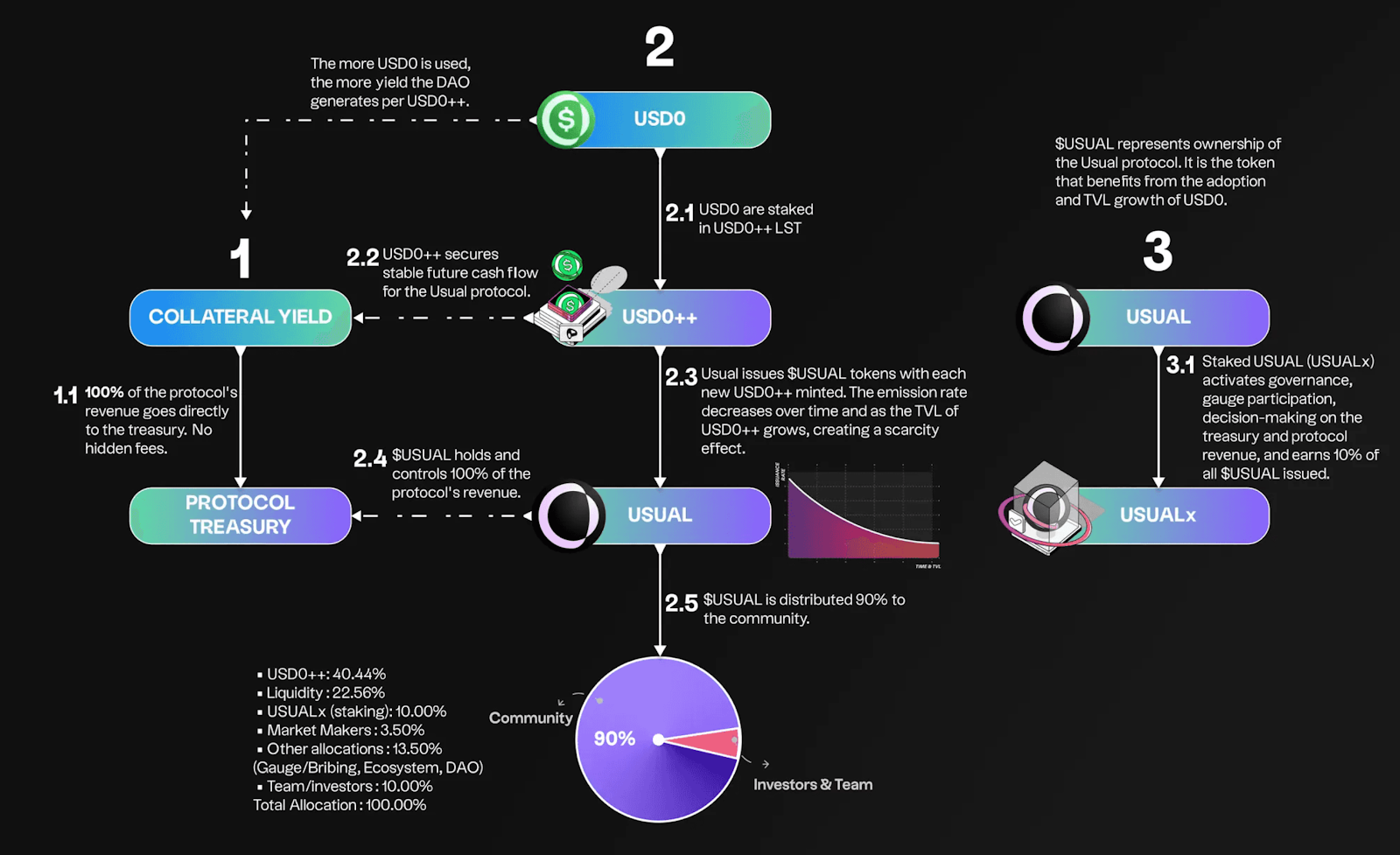

In 2024, the landscape of DAO treasury management underwent a fundamental shift as stablecoin vaults emerged as the backbone of decentralized asset protection and optimization. Gone are the days when DAOs relied solely on native governance tokens or volatile cryptocurrencies to fund their operations. Today, leading decentralized organizations leverage stablecoin vaults to enhance capital efficiency, mitigate risk, and unlock new avenues for yield generation. This transformation is not just technical – it is strategic, ushering in an era where treasury management aligns with institutional-grade financial discipline while retaining DeFi’s transparency and composability.

Why Stablecoin Vaults Became Essential for DAOs in 2024

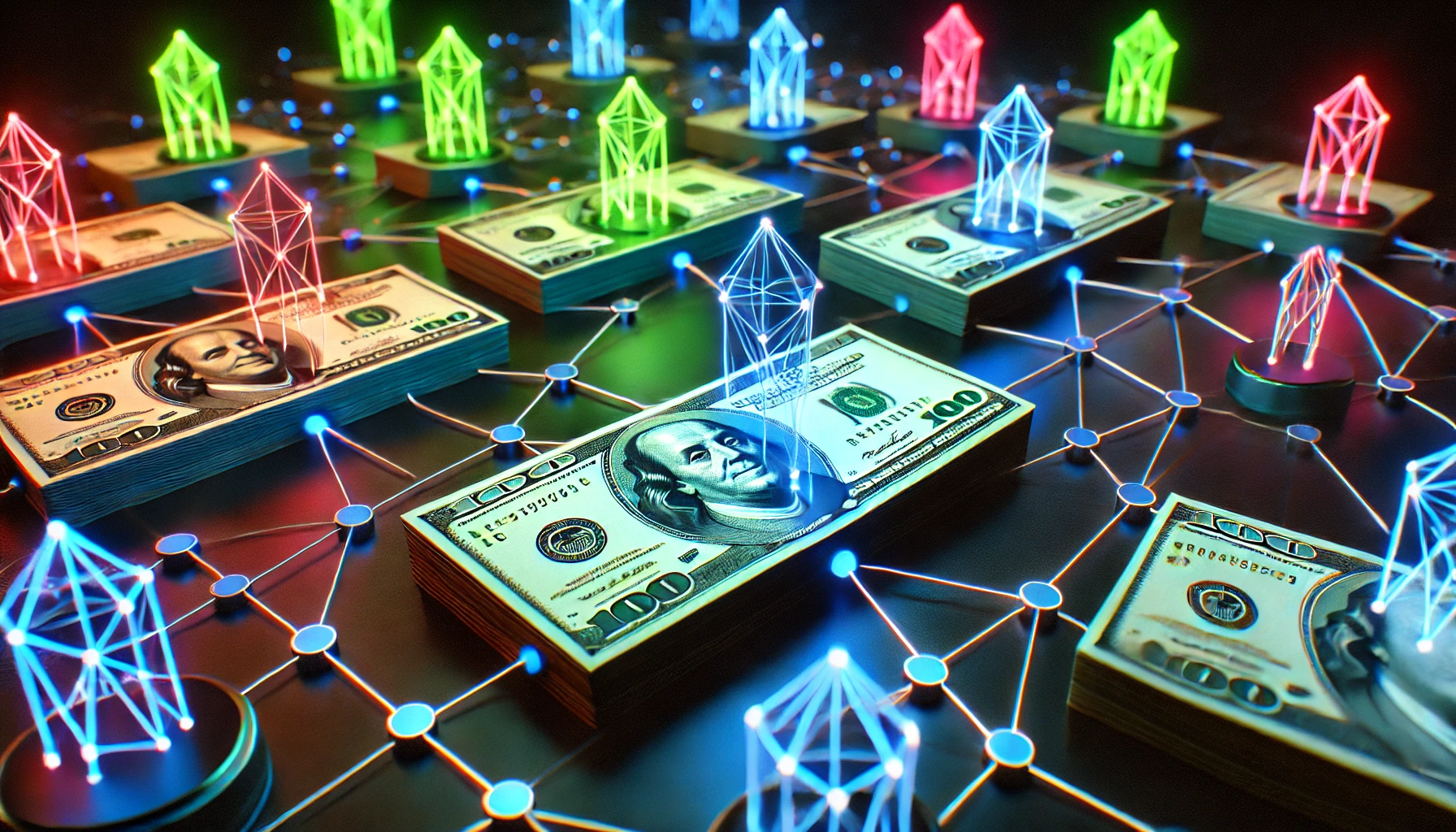

DAOs are no longer experimental collectives managing modest treasuries. By mid-2025, tokenized real-world assets (RWAs) accounted for nearly 20% of DeFi’s total value locked (TVL), underscoring the scale and sophistication of on-chain capital management. Yet, this growth exposed DAOs to heightened volatility when treasuries were concentrated in native tokens. The solution? Diversification into stablecoins via automated vault protocols.

The Arbitrum DAO’s Secure Treasury Endowment Program (STEP 2.0) illustrates this evolution: by reallocating a portion of its assets into stablecoins and deploying them across lending protocols and RWA vaults, Arbitrum achieved greater financial stability and consistent on-chain yield. This strategy is increasingly common among top DAOs seeking to insulate themselves from market swings while maintaining liquidity for governance and operations.

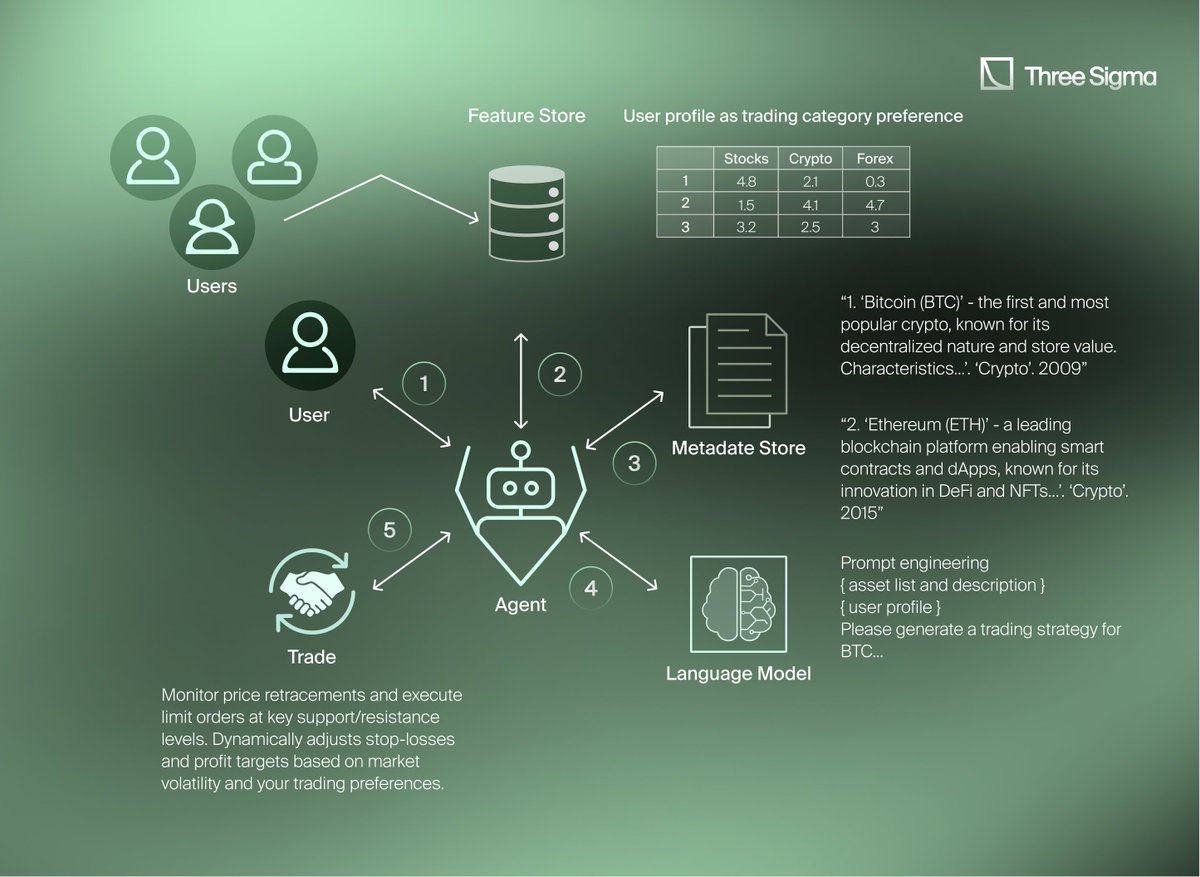

Automated Treasury Management: From Manual Rebalancing to Autonomous Vaults

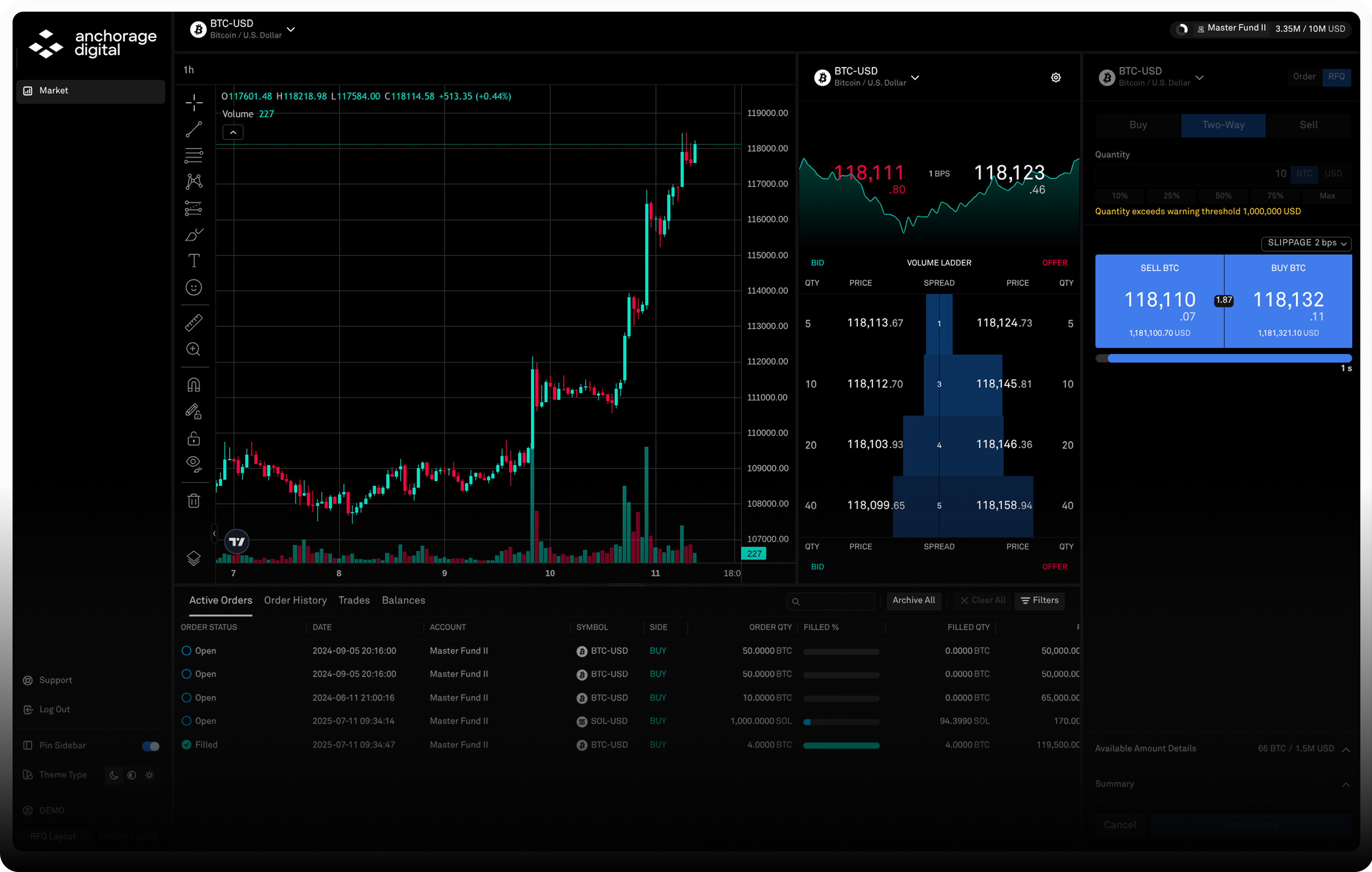

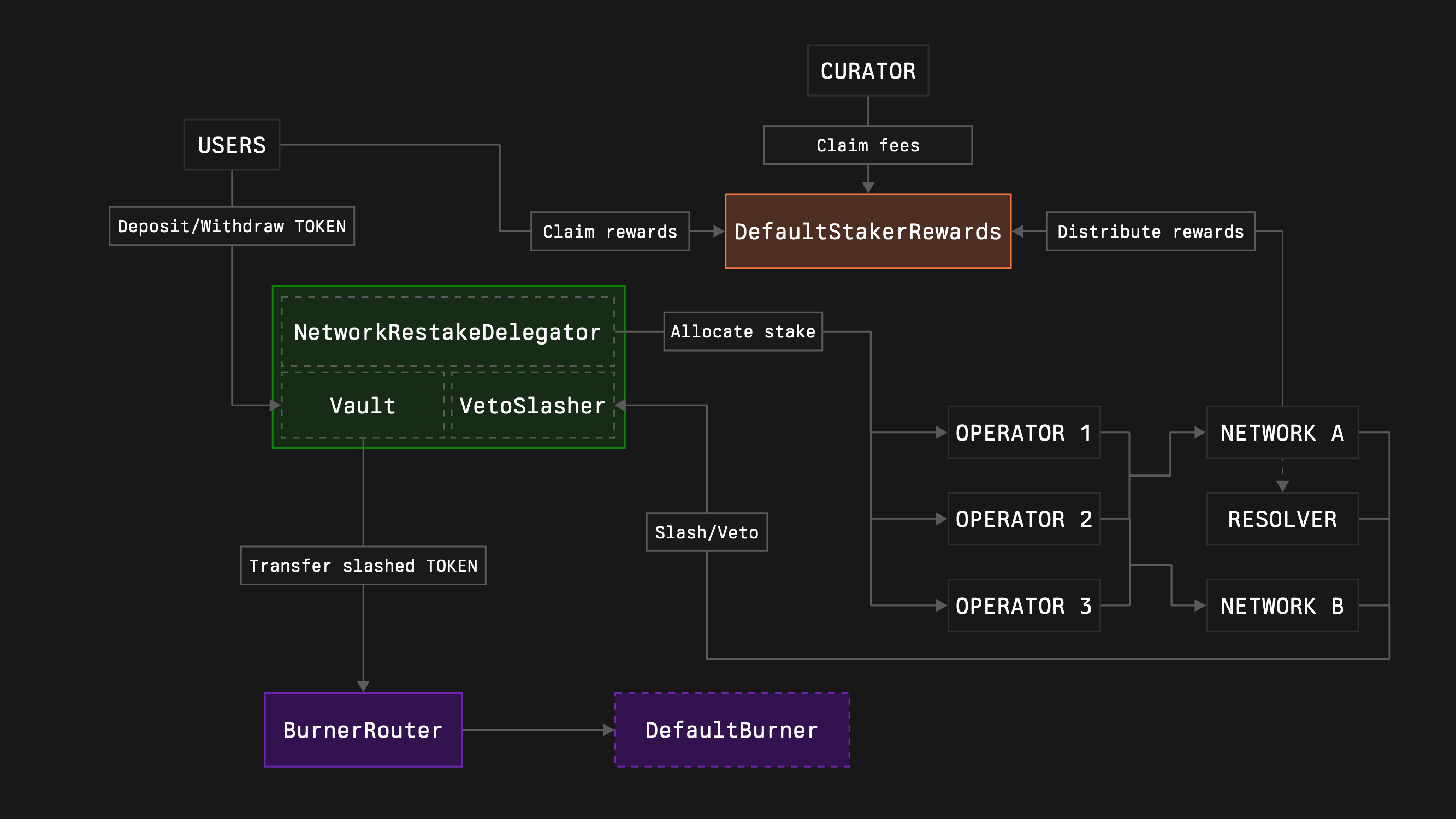

The rise of autonomous treasury management platforms like Aera has further revolutionized how DAOs operate. Instead of relying on manual proposals or off-chain committees, DAOs can now deposit reserves into non-custodial smart contract vaults managed by decentralized networks of ‘vault guardians. ’ These guardians propose dynamic asset allocation strategies and stake their own capital as performance collateral – aligning incentives between treasurers and protocol health.

This automation streamlines operations while maximizing capital efficiency. For example, a DAO can delegate its USDC reserves to an automated vault that dynamically shifts allocations between lending pools, RWA strategies, or fixed APY DeFi vaults based on market conditions and risk parameters set by governance.

Key Benefits of Automated Stablecoin Vaults for DAOs

-

Enhanced Capital Efficiency & Risk Mitigation: Automated stablecoin vaults enable DAOs to diversify away from volatile native tokens, reducing exposure to market swings. For example, Arbitrum DAO reallocated treasury assets into stablecoins and deployed them across lending protocols and RWA vaults for greater financial stability.

-

Automated Treasury Management: Platforms like Aera provide DAOs with autonomous, non-custodial vaults managed by decentralized networks. This automation streamlines asset allocation and optimization, improving operational efficiency and freeing up DAO resources.

-

Customizable Risk Profiles: Solutions such as Factor.fi offer modular vaults, allowing DAOs to tailor strategies to specific risk appetites and capital goals. Automated rebalancing and yield optimization ensure treasuries remain aligned with evolving DAO objectives.

-

Integration of Real-World Assets (RWAs): Modern stablecoin vaults allow DAOs to access tokenized real-world assets like bonds and real estate, which accounted for nearly 20% of DeFi TVL by mid-2025. This diversification expands yield opportunities and enhances treasury resilience.

-

Stablecoin Adoption and Regulatory Clarity: The use of transparent, widely accepted stablecoins such as USDC has surged in DAO treasuries, supported by regulatory clarity and institutional partnerships. USDC’s multi-chain support and transparent reserves make it a preferred choice for stability and integration with traditional finance.

Customizable Risk Profiles and Real Yield Opportunities

The modularity offered by platforms like Factor. fi allows DAOs to construct bespoke treasury strategies tailored to their unique risk tolerances. Rather than a one-size-fits-all approach, DAOs can segment their capital:

- Stablecoins as operational reserves with low-volatility exposure

- ETH or BTC allocations for directional upside

- RWA-backed stablecoin vaults targeting predictable real yield

This flexibility is vital in an environment where regulatory clarity around assets like USDC has made them preferred instruments for both stability and integration with traditional finance rails. The surge in cross-chain stablecoin vaults further enhances liquidity access for multi-chain DAOs.

If you want a deeper dive into how these mechanisms work in practice, see our detailed analysis at On-Chain Treasuries: How DAOs Use Stablecoin Vaults for Treasury Risk Management.

Beyond risk segmentation, the integration of real-world assets (RWAs) into DeFi vaults has opened new frontiers for DAOs seeking sustainable, uncorrelated returns. With tokenized bonds and yield-bearing instruments now accounting for a significant share of DeFi TVL, stablecoin vaults are increasingly positioned as gateways to “real yield” – not just speculative gains. This is especially relevant as DAOs look to balance operational liquidity with long-term endowment growth, leveraging fixed APY DeFi vaults and RWA strategies that mirror institutional best practices.

On-Chain Security and Transparency: The New Standard

Security remains paramount for any treasury strategy. The latest generation of stablecoin vault protocols emphasizes non-custodial architecture, on-chain transparency, and continuous auditability. Smart contracts underpinning these vaults are routinely stress-tested and open-sourced, allowing DAO members to verify asset flows in real time. This level of transparency not only builds trust among stakeholders but also serves as a critical defense against governance attacks or mismanagement.

The rise of cross-chain stablecoin vaults also means DAOs can diversify counterparty risk by spreading assets across multiple blockchains and protocols. Automated insurance modules and circuit breakers further mitigate tail risks, creating a robust foundation for decentralized treasury strategies in 2024 and beyond.

Key Features of Secure On-Chain Stablecoin Vaults

-

Automated Asset Optimization: Protocols such as Aera enable autonomous treasury management, where ‘vault guardians’ optimize allocations and stake their own capital, aligning incentives and enhancing capital efficiency for DAOs.

-

Customizable Risk Profiles: Factor.fi offers modular, programmable vaults, allowing DAOs to tailor risk exposure and yield strategies to specific treasury segments, such as operational reserves or growth funds.

-

Integration with Real-World Assets (RWAs): Modern vaults support tokenized assets like bonds and real estate, enabling DAOs to diversify beyond crypto and access new yield streams. By mid-2025, RWAs represented nearly 20% of DeFi TVL.

-

Multi-Chain Stablecoin Support: Secure vaults prioritize stablecoins with transparent reserves and regulatory clarity, such as USDC, which offers multi-chain compatibility and seamless integration with both DeFi and traditional finance.

-

Transparent Governance and Auditing: Platforms like Aragon and DAOstack provide on-chain governance, transparent voting, and auditable transaction histories, ensuring accountability and robust security for DAO-managed vaults.

-

Automated Rebalancing and Yield Optimization: Advanced vaults employ smart contracts for continuous rebalancing and yield harvesting, maximizing returns while maintaining target risk parameters for DAO treasuries.

Stablecoin Vault Adoption: Key Trends and Takeaways

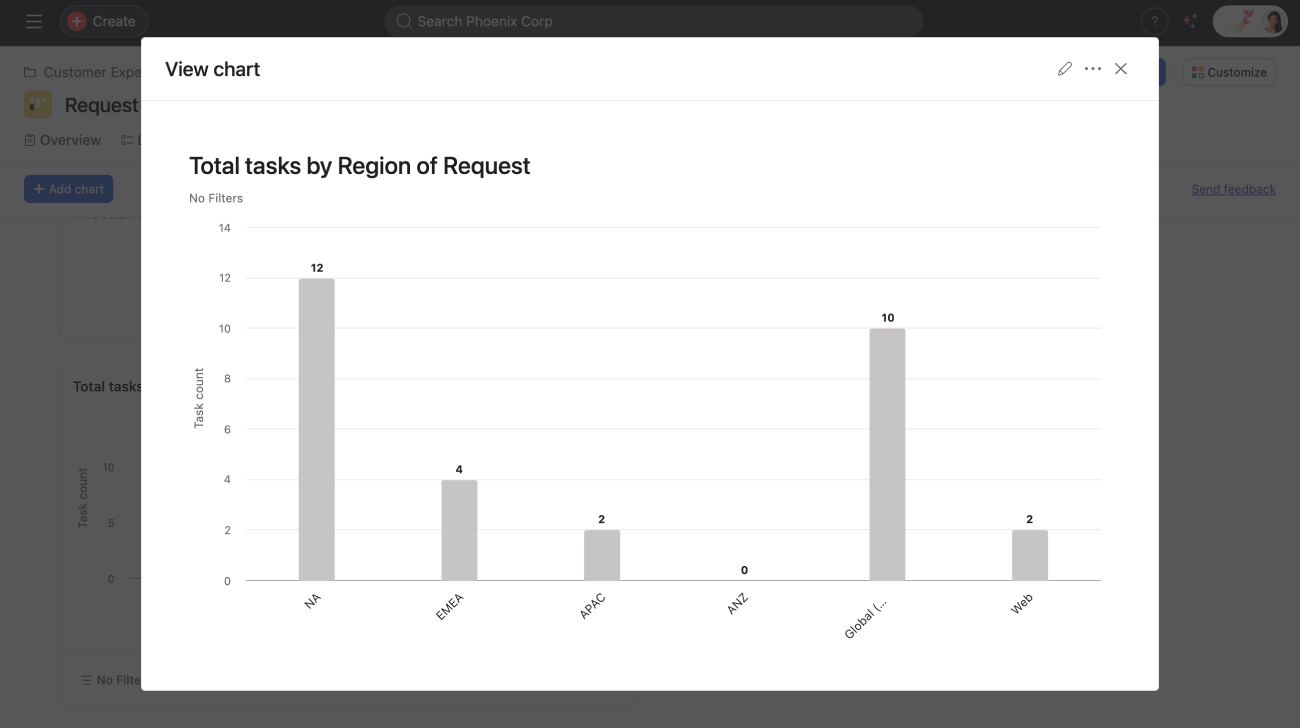

The data speaks volumes: by Q3 2025, DAOs controlling treasuries worth billions had shifted substantial allocations into stablecoins like USDC due to its regulatory clarity, transparent reserves, and seamless multi-chain support. As highlighted in recent DAO growth statistics, increased governance participation often correlates with robust treasury diversification – a trend amplified by the accessibility of programmable stablecoin vaults.

Looking forward, expect continued innovation in areas such as fixed APY DeFi vaults, dynamic rebalancing powered by AI-driven algorithms, and deeper integration with real-world payment rails. For DAOs aiming to future-proof their financial infrastructure while maximizing capital efficiency, adopting advanced stablecoin vault solutions is no longer optional – it’s essential.

“Risk is not a four-letter word. ” The evolution of DAO treasury management proves that embracing sophisticated risk tools like stablecoin vaults can unlock both resilience and opportunity in an unpredictable market environment.

For comprehensive insights into how these trends are reshaping the DAO landscape this year and next, visit our dedicated guide at How Stablecoin Vaults Are Reshaping DAO Treasury Management in 2025.