Stablecoins are no longer just a DeFi experiment – they’ve become the backbone of modern on-chain treasury management. With Polygon Bridged USDT (USDT) currently holding steady at $1.00 (with zero volatility in the last 24 hours), stablecoins now offer a level of price stability and liquidity that’s reshaping how DAOs, DeFi projects, and institutional treasuries operate. But as the stablecoin supercycle accelerates, tokenization is opening new frontiers for asset management, risk mitigation, and capital efficiency across the crypto ecosystem.

The Stablecoin Supercycle: From Payments to Treasury Backbone

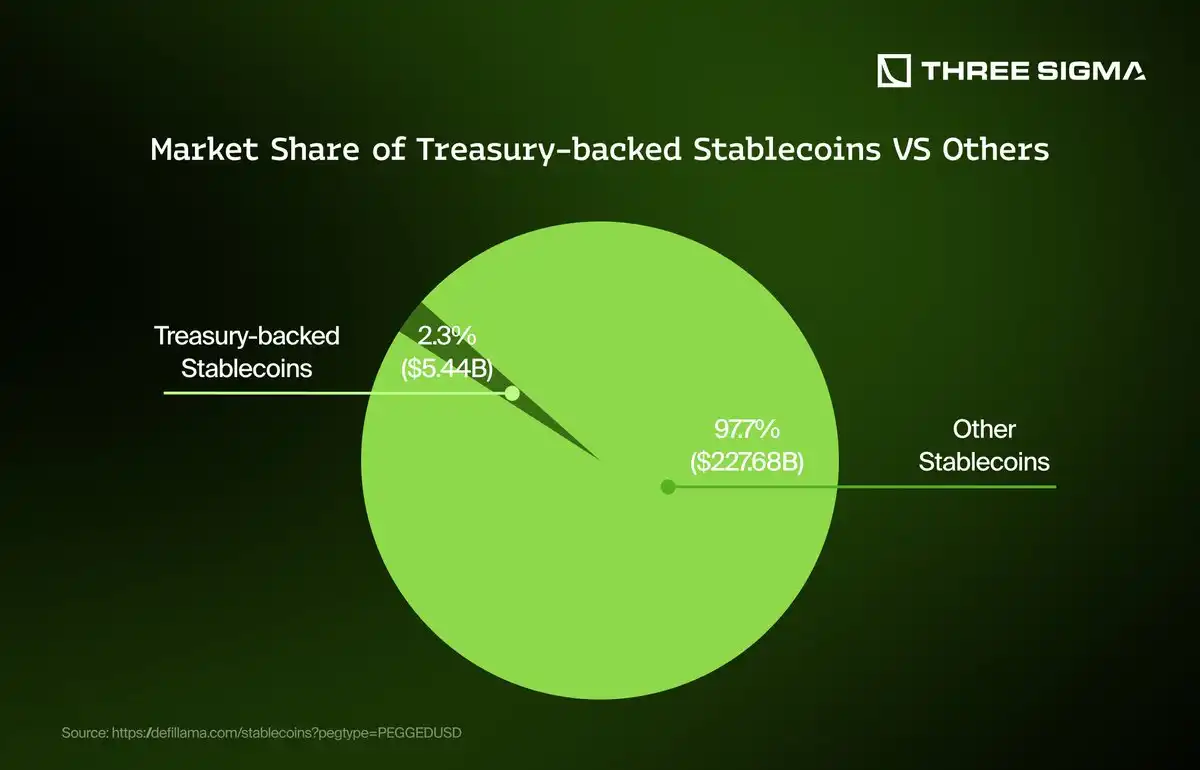

Today’s stablecoin market is worth approximately $240 billion and projected to reach $2 trillion by 2028 – a staggering leap that underscores their growing role in financial infrastructure. What’s driving this supercycle? It’s not just speculation. Rather, it’s the convergence of regulatory clarity, technological maturity, and real-world adoption by both crypto-native organizations and traditional financial institutions.

One of the most profound shifts is how stablecoins are used as on-chain treasury rails. DAOs and DeFi protocols increasingly rely on stablecoins for rapid settlements, cross-border payments, yield generation, and transparent accounting. Recent data shows that stablecoin issuers now hold roughly $200 billion in U. S. Treasury bills (T-bills) – about 2% of the entire Treasury market – as reserves to maintain their pegs (source). This dynamic is transforming both digital asset management and the broader U. S. government debt market.

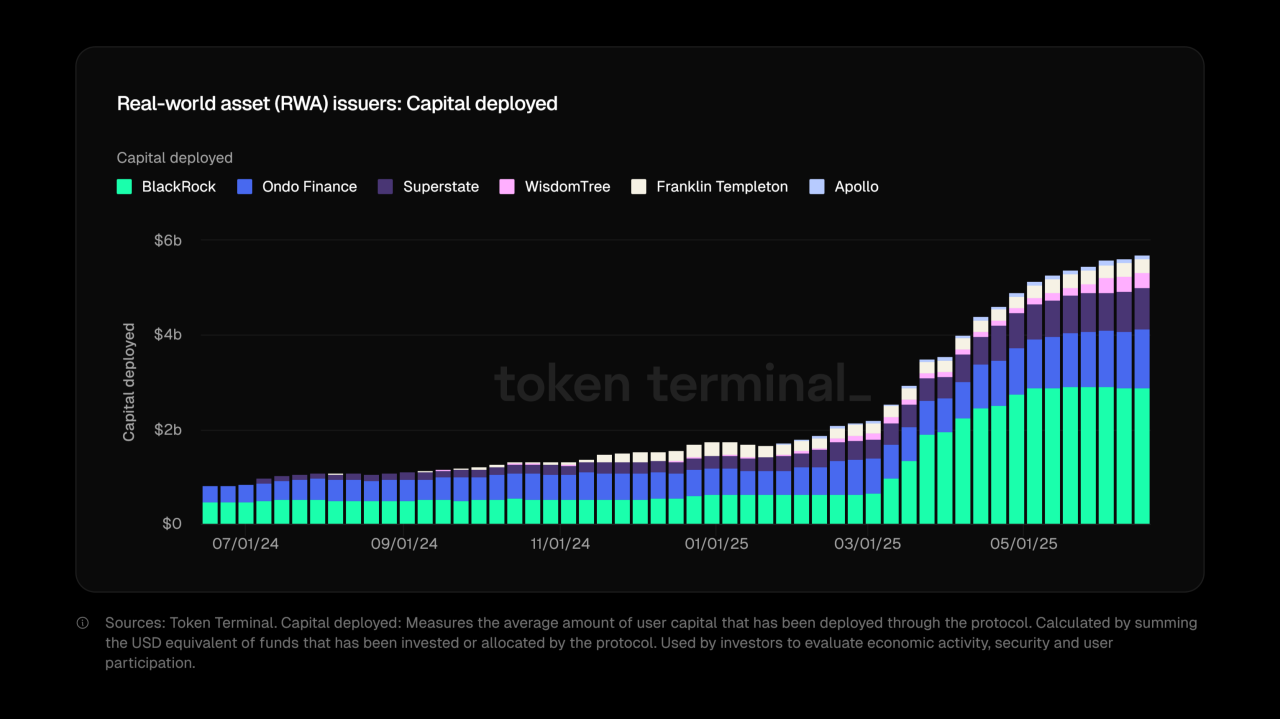

Tokenization: Unleashing New Opportunities for DAO Treasuries

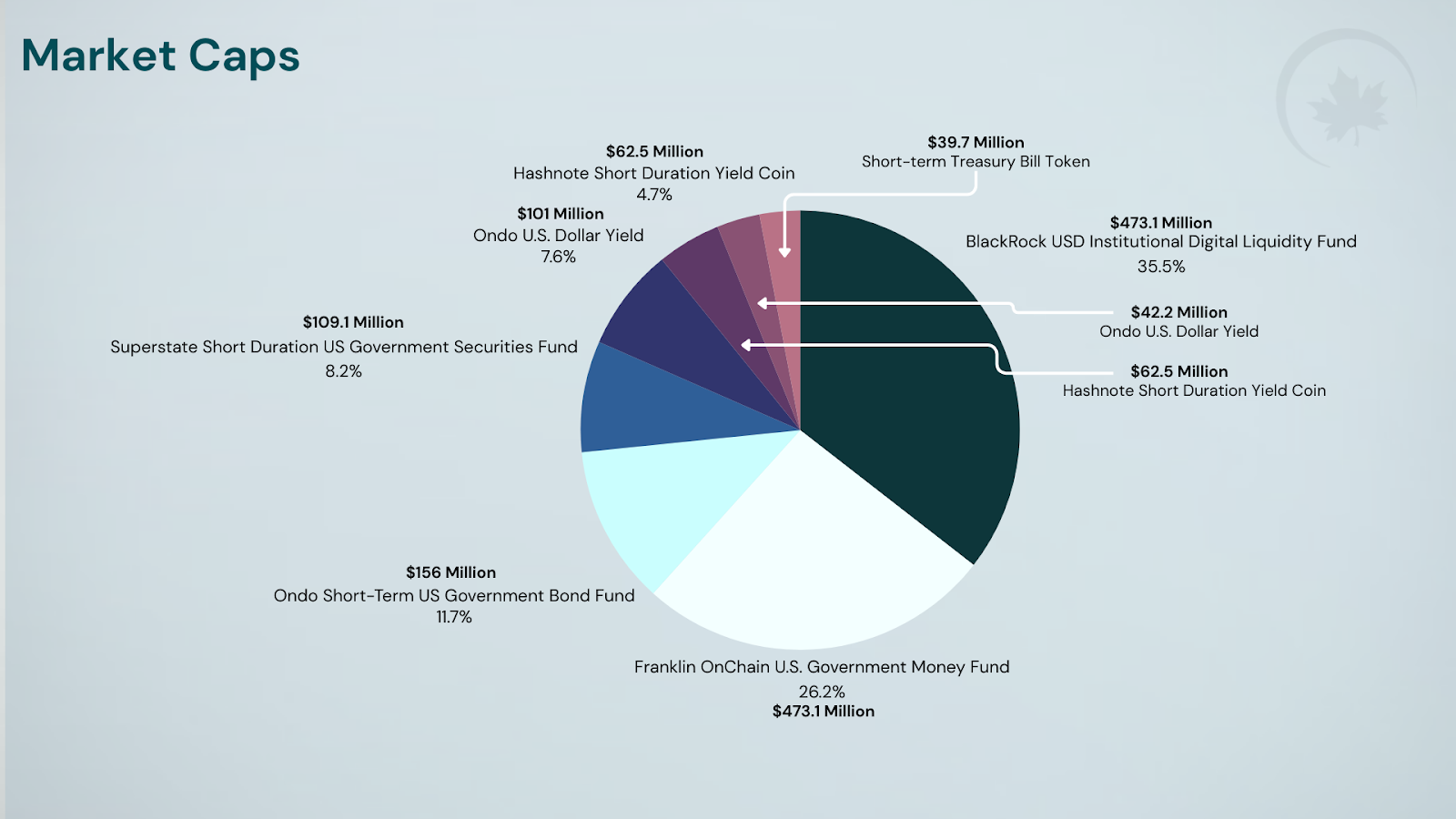

The next wave isn’t just about holding digital dollars – it’s about tokenizing everything from short-term T-bills to money market funds and even exotic assets like carbon credits or private equity shares. Tokenization brings traditional assets onto blockchains as programmable tokens, enabling real-time settlement, 24/7 trading access, fractional ownership, and composability with DeFi protocols.

This year saw a watershed moment: major Wall Street firms completed the first real-time on-chain financing of U. S. Treasuries against USDC on the Canton Network (source). For DAOs and crypto treasuries, this means enhanced capital efficiency – assets can be put to work around the clock while maintaining regulatory compliance and minimizing counterparty risk.

Comparing Stablecoins vs Tokenized Securities: Risks and Benefits

While both stablecoins and tokenized securities run on similar blockchain infrastructure, their risk profiles differ significantly. Stablecoins like USDT or USDC are typically backed one-to-one by cash or highly liquid assets such as T-bills; they’re engineered for price stability and instant transferability. In contrast, tokenized securities represent ownership claims on underlying off-chain assets – such as a specific U. S. Treasury bond or money market fund share – introducing new considerations around custody, redemption rights, regulatory oversight, and secondary market liquidity (source).

Stablecoins vs. Tokenized Securities: Treasury Management Face-Off

-

Liquidity & Settlement Speed: Stablecoins like USDT and USDC enable near-instant, 24/7 settlement and high liquidity for treasury operations. In contrast, tokenized securities (e.g., tokenized U.S. Treasuries on platforms like Canton Network) offer real-time trading but may face liquidity constraints compared to stablecoins, especially outside traditional market hours.

-

Risk Profile: Stablecoins are typically pegged 1:1 to fiat currencies and backed by liquid reserves (often U.S. dollars or T-bills), but are exposed to issuer risk and regulatory changes. Tokenized securities represent direct ownership of real-world assets (like U.S. Treasuries), offering lower counterparty risk but introducing market and custodial risks tied to the underlying asset.

-

Yield and Income: Some stablecoins are moving towards offering interest or yield (e.g., USDC Yield), but rates are typically lower and depend on issuer policies. Tokenized securities (such as Ondo Finance’s tokenized T-bills) directly pass through government bond yields, making them attractive for treasurers seeking predictable, regulated income streams.

-

Regulatory Landscape: Stablecoins are under increasing regulatory scrutiny in the U.S., with Congress poised to require full backing by liquid assets. Tokenized securities are subject to existing securities regulations, often requiring investor accreditation and compliance checks, which can limit accessibility but provide greater investor protection.

-

Integration & Use Cases: Stablecoins are widely used for cross-border payments, on-chain liquidity, and DeFi operations. Tokenized securities are emerging as tools for on-chain collateral, repo markets, and programmable finance—as seen in the first 24/7 U.S. Treasury financing on the Canton Network in August 2025.

The trend toward hybrid models is accelerating: some stablecoins are beginning to pay interest or offer programmable yield features. Meanwhile, money market funds are actively exploring tokenization to enable direct blockchain-native access for institutional clients (source). The upshot? Treasurers now have an expanded toolkit for balancing liquidity needs with risk-adjusted returns.

Tether (USDT) Supply and Price Forecast 2026-2031

Forecasting USDT Supply Growth and Price Stability Amidst Tokenization and Regulatory Advancements

| Year | Minimum Price | Average Price | Maximum Price | Estimated Year-End Supply (USDT) | % Change in Supply (YoY) | Market Scenario Insights |

|---|---|---|---|---|---|---|

| 2026 | $0.99 | $1.00 | $1.01 | $340,000,000,000 | +41.7% | Continued regulatory clarity and institutional adoption drive robust supply growth; price remains tightly pegged. |

| 2027 | $0.99 | $1.00 | $1.01 | $510,000,000,000 | +50% | Wider integration in DeFi and tokenized securities boosts demand; USDT maintains price stability. |

| 2028 | $0.99 | $1.00 | $1.01 | $800,000,000,000 | +56.9% | Legal frameworks mature; USDT supply surges as tokenized treasuries and cross-border payments expand. |

| 2029 | $0.98 | $1.00 | $1.02 | $1,200,000,000,000 | +50% | Bullish scenario: explosive adoption in emerging markets; Bearish: potential competition from CBDCs increases volatility. |

| 2030 | $0.98 | $1.00 | $1.02 | $1,500,000,000,000 | +25% | Stablecoin-specific regulations globally harmonized; supply growth slows but remains strong. |

| 2031 | $0.98 | $1.00 | $1.02 | $1,800,000,000,000 | +20% | USDT remains dominant but faces growing competition; price peg holds with rare volatility events. |

Price Prediction Summary

USDT is forecasted to maintain its $1.00 price peg through 2031, with minor deviations during extreme market events. Supply is projected to grow rapidly, potentially reaching $1.8 trillion by 2031, driven by institutional adoption, regulatory clarity, and expanded use in tokenized assets and global payments. While the price remains stable, supply growth will be influenced by macroeconomic conditions, regulatory shifts, and competition from new digital assets and CBDCs.

Key Factors Affecting Tether Price

- Regulatory clarity and the passage of stablecoin-specific legislation in major economies.

- Institutional adoption of stablecoins for on-chain treasury and liquidity management.

- Expansion of tokenized U.S. Treasuries and other real-world assets on blockchain.

- Technological advancements improving blockchain scalability, security, and interoperability.

- Potential competition from central bank digital currencies (CBDCs) and other stablecoins.

- Macro-economic factors impacting demand for digital dollars and U.S. Treasuries.

- Market events or black swan risks that could temporarily de-peg USDT.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

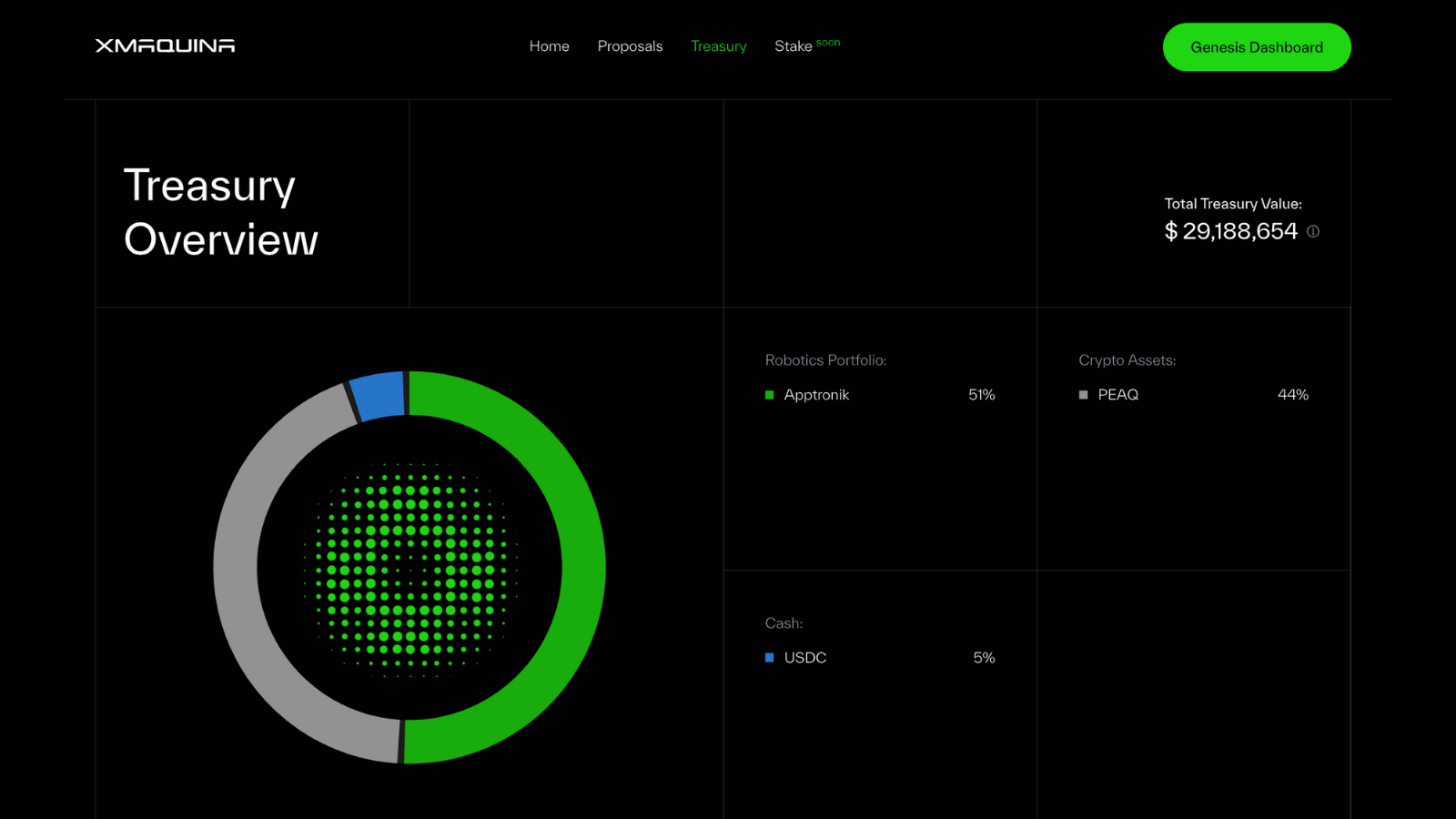

For decentralized organizations, the implications are profound. With stablecoins like Polygon Bridged USDT holding at $1.00, DAOs can confidently manage operational budgets, payroll, and grant programs without worrying about wild price swings or banking delays. Tokenized Treasuries and money market funds add another layer: treasurers can allocate idle capital into yield-bearing products while retaining real-time access for governance votes or emergency disbursements.

Regulatory momentum is also a catalyst. As Congress moves closer to passing comprehensive stablecoin legislation, the line between traditional and on-chain finance continues to blur. This regulatory clarity is expected to further legitimize stablecoins as core treasury assets, drive institutional adoption, and expand the pool of tokenized U. S. government debt (source). For DAOs and DeFi projects, this means more secure, compliant options for holding reserves, and potentially earning yield, without sacrificing transparency or auditability.

Emerging On-Chain Treasury Trends: Automation, Analytics, and Security

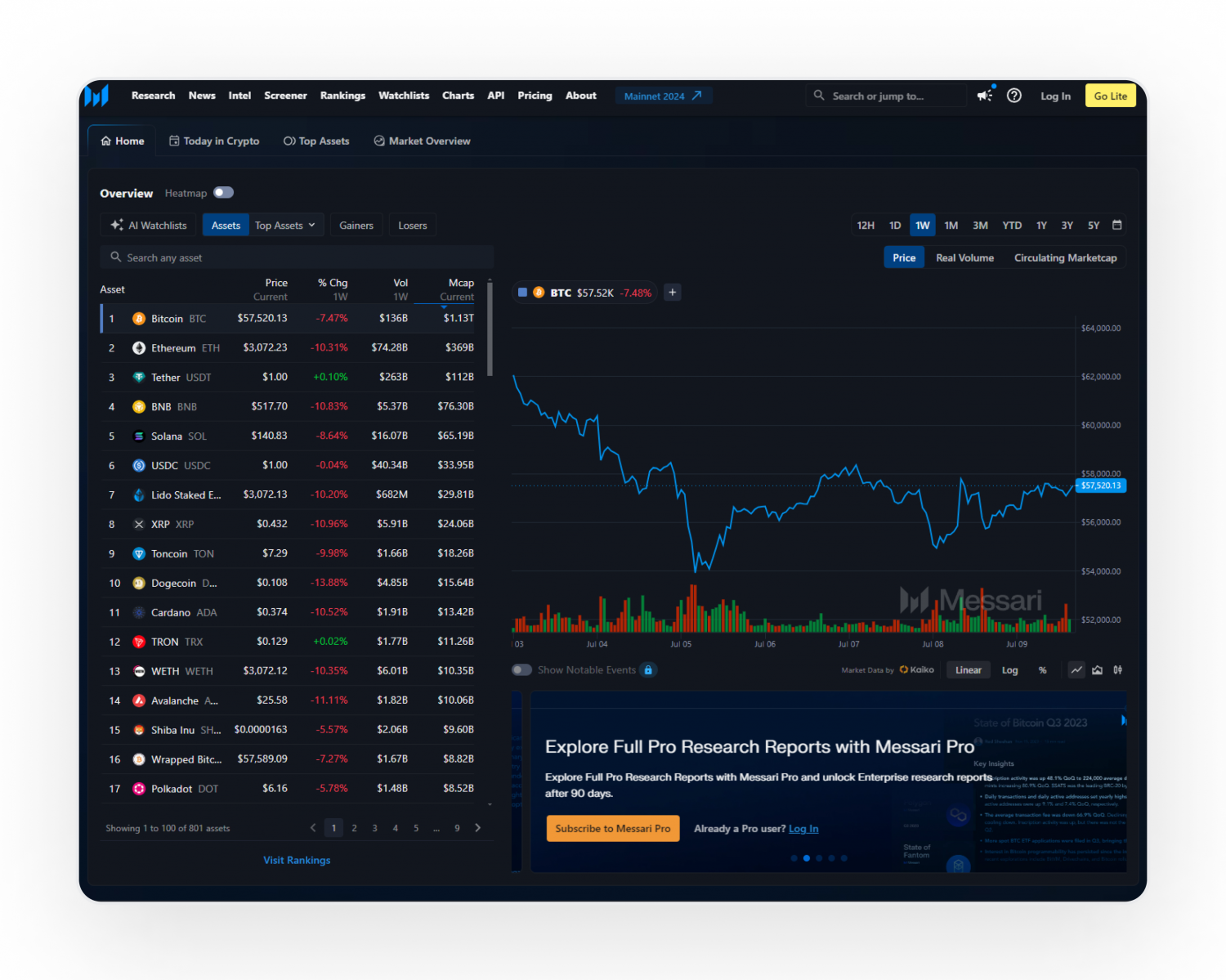

The supercycle isn’t just about asset types; it’s about smarter management. On-chain analytics platforms now give treasurers granular insights into portfolio allocations, risk exposures, and historical yields, all in real time. Automated rebalancing tools can optimize for safety or yield based on DAO-approved parameters. Institutional-grade wallets offer multi-signature security and customizable permissions to mitigate internal risks.

Expect further innovation as tokenization expands beyond T-bills to include ESG-linked bonds, real estate, or even intellectual property rights. Each new asset class brings unique yield curves and risk profiles, empowering DAOs to construct diversified portfolios tailored to their missions.

What This Means for Crypto Asset Managers

The upshot? The stablecoin supercycle is a game-changer for crypto asset management. Treasurers now have access to an unprecedented array of programmable assets, each with transparent on-chain records and composability across DeFi protocols. The result is a new era of capital efficiency: idle assets can generate yield through automated strategies while remaining instantly accessible for governance or operations.

Top 5 Ways Tokenization is Transforming DAO Treasury Management

-

1. Real-Time On-Chain Settlement of U.S. Treasuries: Tokenization enables DAOs to hold and trade tokenized U.S. Treasury securities on blockchain platforms like the Canton Network, allowing for 24/7 settlement and liquidity management that was previously impossible in traditional finance.

-

2. Enhanced Liquidity with Stablecoins: Stablecoins such as USDT (currently priced at $1.00 on Polygon) and USDC provide DAOs with rapid, cost-effective, and borderless transactions, improving treasury flexibility and enabling instant access to funds for operational or investment needs.

-

3. Automated Treasury Operations via Smart Contracts: Tokenized assets and stablecoins allow DAOs to leverage smart contracts for automated yield strategies, payments, and compliance, reducing manual intervention and operational risks.

-

4. Increased Transparency and On-Chain Analytics: The use of tokenized assets and stablecoins enhances transparency, as all transactions are recorded on public blockchains. Institutional-grade analytics tools now provide DAOs with real-time insights into treasury performance and risk exposure.

-

5. Regulatory Alignment and Institutional Adoption: Evolving regulatory frameworks, such as the anticipated U.S. stablecoin legislation, are legitimizing tokenized assets. This fosters greater institutional participation and allows DAOs to confidently hold regulated, liquid assets like tokenized T-bills as part of their treasury reserves.

But with innovation comes responsibility. Effective on-chain treasury management requires robust risk frameworks, ongoing monitoring of regulatory developments, and a commitment to transparency with stakeholders. As the market matures toward that projected $2 trillion mark by 2028, those who embrace analytics-driven decision-making will be best positioned to thrive.

Tether (USDT) Supply and Price Prediction Table (2026-2031)

Forecasting USDT Supply Growth and Price Stability Amid the Stablecoin Supercycle and Tokenization Trends

| Year | Minimum Price | Average Price | Maximum Price | Estimated Circulating Supply (Billion USDT) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.99 | $1.00 | $1.01 | $340B | Stablecoin regulation passes; rapid institutional adoption; minor depegs possible during volatility |

| 2027 | $0.99 | $1.00 | $1.01 | $520B | Tokenized treasuries widely used; supply surges as on-chain finance expands |

| 2028 | $0.98 | $1.00 | $1.02 | $2T | USDT and stablecoin market reach $2T cap; increased competition but USDT remains dominant |

| 2029 | $0.98 | $1.00 | $1.02 | $2.6T | Broader usage in global settlements; regulatory clarity boosts trust, minor stress tests on pegs |

| 2030 | $0.98 | $1.00 | $1.02 | $3.3T | CBDCs emerge but USDT retains market share due to network effects; stable price |

| 2031 | $0.97 | $1.00 | $1.03 | $3.8T | Competitive landscape intensifies; technical risks and regulatory changes challenge stability, but USDT remains core instrument |

Price Prediction Summary

USDT is forecasted to maintain its $1.00 peg through 2031, with only minor deviations in periods of market stress or regulatory uncertainty. Circulating supply is projected to grow rapidly, potentially reaching $3.8 trillion by 2031, reflecting the supercycle in stablecoin adoption, institutional treasury management, and tokenization of traditional assets. While USDT faces increasing competition from other stablecoins and emerging CBDCs, its early mover advantage, deep liquidity, and integration into financial infrastructure keep it a dominant player.

Key Factors Affecting Tether Price

- Regulatory clarity and passage of stablecoin legislation in the US and EU

- Institutional adoption for on-chain treasury and settlement purposes

- Expansion of tokenized assets and real-world asset (RWA) integration

- Competition from other stablecoins (e.g., USDC, DAI) and central bank digital currencies (CBDCs)

- Technological advancements in blockchain scalability and security

- Market stress events or black swan incidents impacting peg stability

- Changes in US Treasury yields and reserve management strategies

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Stablecoins at $1.00 may seem static on the surface, but under the hood, they’re powering a dynamic transformation in how digital organizations steward value in a global marketplace that never sleeps.