Programmable stablecoins are rewriting the playbook for DAO treasury management. Forget the days of manual spreadsheets and sleepless nights watching token prices tumble. Today’s DAOs are wielding programmable money like a scalpel, slicing through volatility and inefficiency to create robust, agile on-chain treasury operations.

Why Programmable Stablecoins Are a Game Changer for DAOs

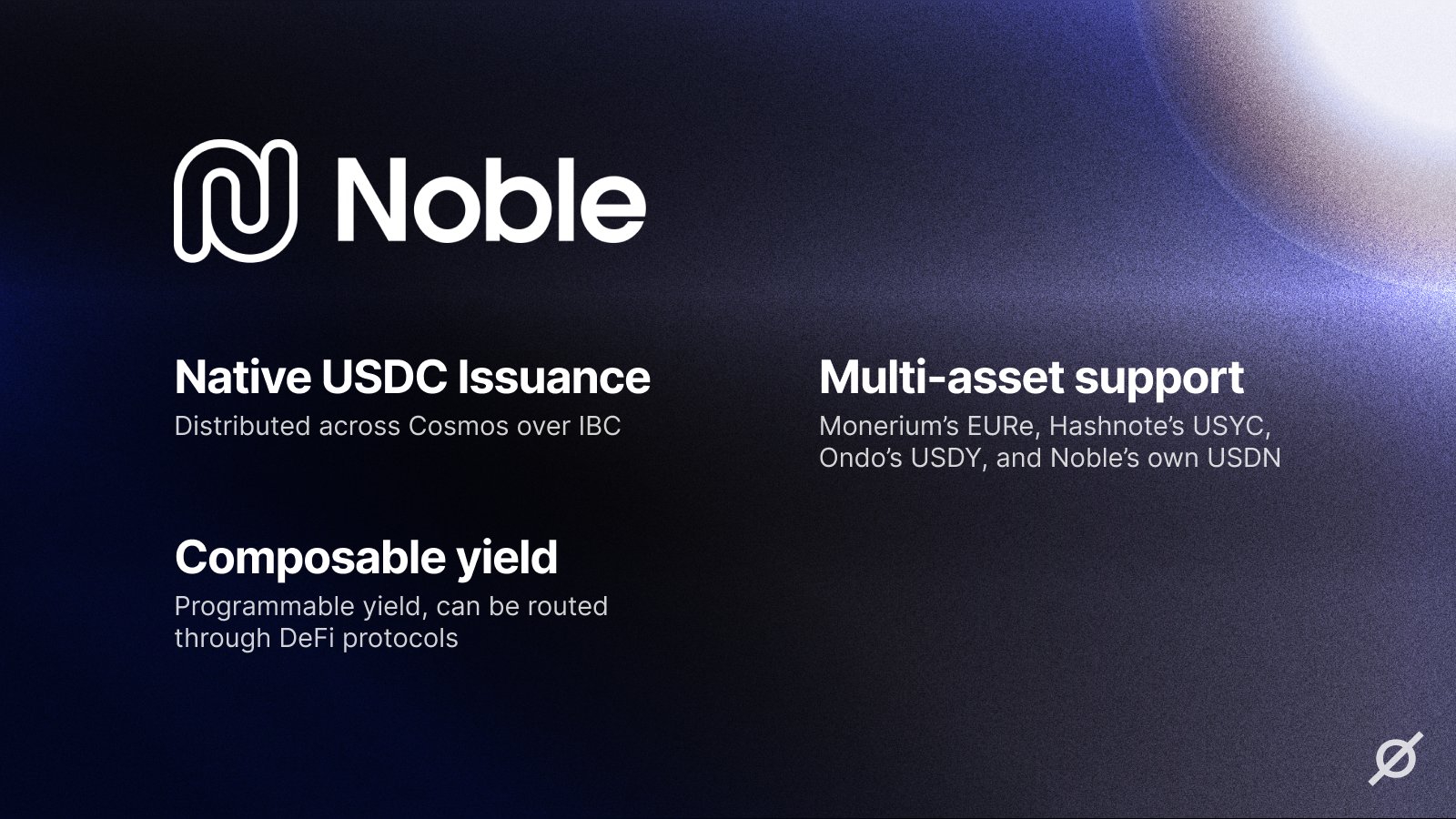

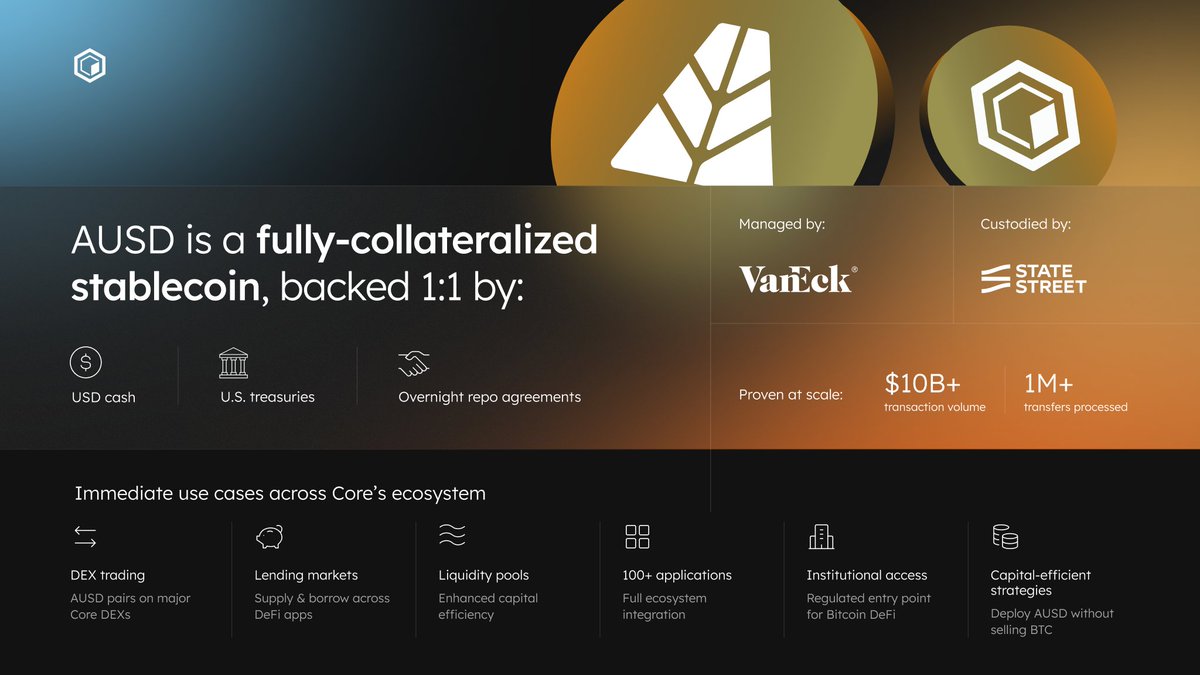

DAOs have always faced a core dilemma: how to balance growth with stability. Native tokens fuel innovation and governance but are notoriously volatile. Enter programmable stablecoins like USDC, DAI, and USDT – assets pegged to the dollar, yet supercharged with smart contract logic. These digital dollars don’t just sit idle; they work 24/7, automating everything from payouts to risk management.

Take the Decentraland DAO, which recently proposed converting 3,700,000 MANA into stablecoins over several months. The goal? Fortify their treasury against market swings while ensuring liquidity for future grants and initiatives. This is not just diversification – it’s proactive defense against crypto chaos.

From Idle Assets to Yield Machines

The magic of programmable stablecoins is their ability to generate yield without sacrificing security or transparency. By deploying stablecoins into DeFi protocols like Aave or Uniswap via platforms such as dHEDGE, DAOs can tap into lending pools and liquidity strategies that turn dormant funds into active revenue streams. No more letting assets gather dust in cold storage – every dollar works as hard as your contributors do.

5 Ways Programmable Stablecoins Boost DAO Treasuries

-

Diversification & Stability: DAOs like Decentraland DAO convert volatile native tokens into stablecoins (e.g., USDC, DAI, USDT) to reduce risk and ensure liquidity for grants and operations.

-

Yield Generation via DeFi: Platforms such as dHEDGE let DAOs deploy stablecoins into protocols like Aave and Uniswap, earning returns on idle assets through lending and liquidity pools.

-

Operational Efficiency: Stablecoins enable DAOs to pay contributors, fund projects, and manage expenses seamlessly—seen in action with Reform DAO, which uses stablecoins for transparent, real-time treasury tracking.

-

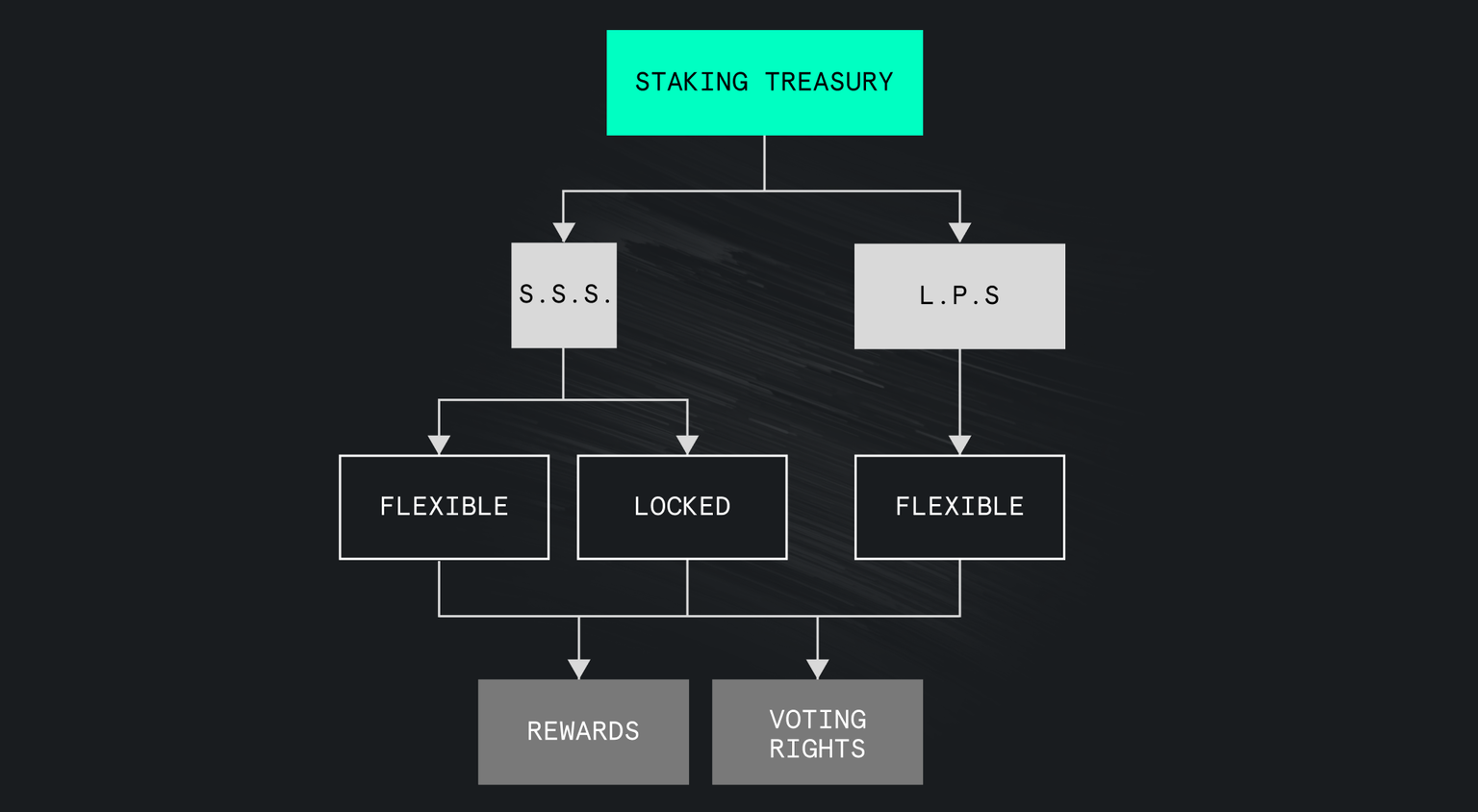

Automated Treasury Management: Programmable stablecoins power smart contracts and bots that optimize portfolios, rebalance assets, and execute payments automatically—boosting agility and minimizing manual intervention.

-

Strategic Partnerships & Liquidity Provision: DAOs use stablecoins to secure funding from partners and provide liquidity in pools, supporting token price stability and deeper markets, as highlighted by Bankless.

And it’s not just theory – it’s happening in real time. dHEDGE’s blog details how DAOs are leveraging these tools for hands-off yield generation while maintaining control over risk parameters and access permissions.

Operational Efficiency on Autopilot

Stablecoins bring instant liquidity and frictionless payments to DAO operations. Contributors can be paid in seconds, expenses managed transparently, and multi-currency headaches eliminated overnight. For example, Reform DAO uses its treasury to fund trading algorithms and buybacks with real-time tracking of every transaction, no more waiting on end-of-day reports or chasing down missing funds.

Strategic Partnerships and Liquidity Provision

The power of programmable stablecoins goes beyond internal ops. DAOs can forge alliances by swapping native tokens for stables with long-term partners, securing funding without tanking token prices. Deploying stables into liquidity pools also deepens markets for native tokens, creating stability that benefits everyone in the ecosystem.

This isn’t just about managing risk; it’s about unlocking new possibilities for growth and resilience in an unpredictable market. With programmable stablecoins at the core of their treasuries, DAOs are poised to outmaneuver volatility and build lasting value.

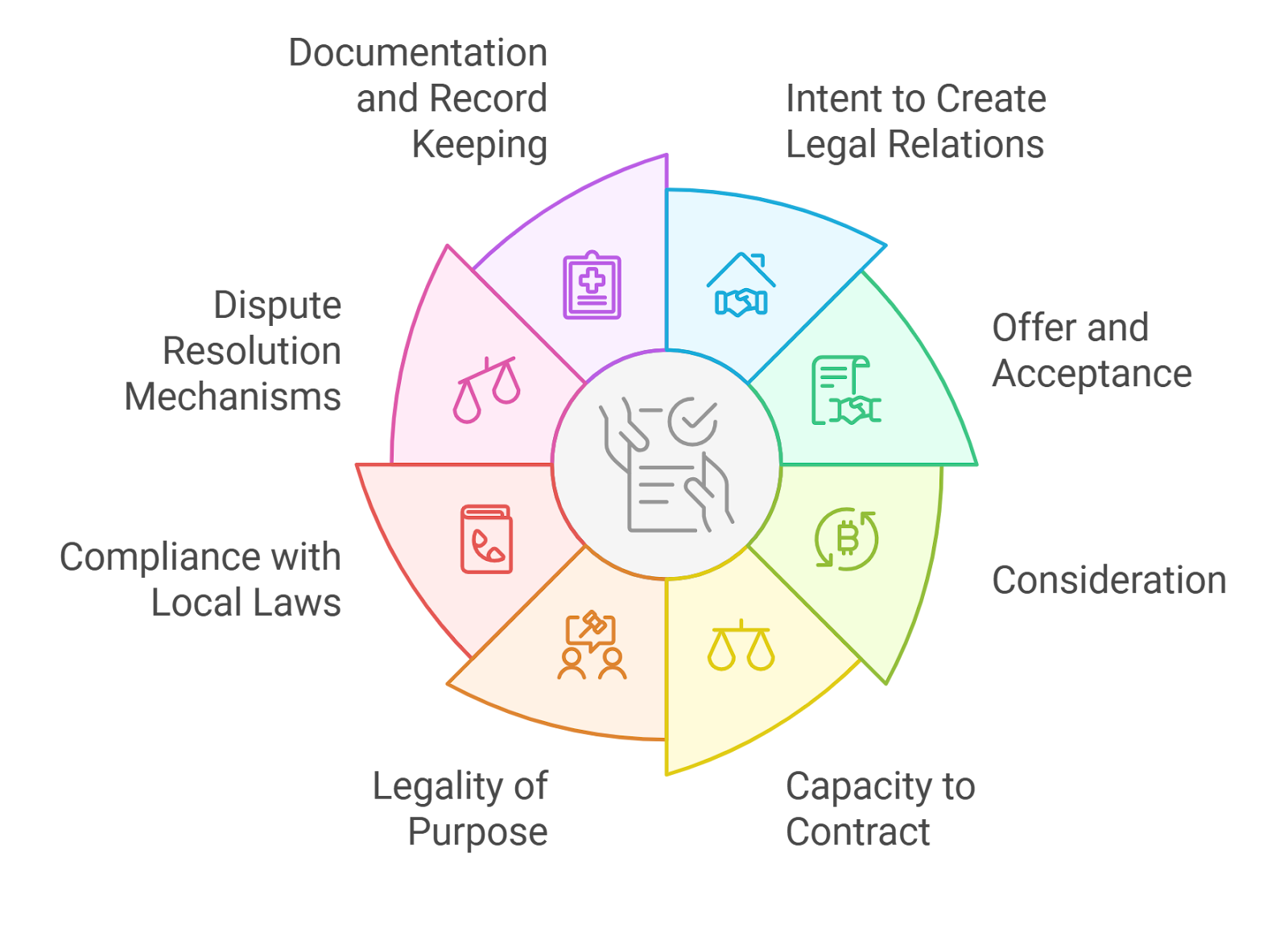

Programmable stablecoins also empower DAOs to automate compliance, enforce spending limits, and create custom payout schedules with code. This isn’t just convenience – it’s a seismic shift in transparency and accountability. Treasury teams can embed rules directly into smart contracts, ensuring that every dollar is allocated according to community-approved mandates. No more off-chain trust assumptions or opaque accounting.

Next-Level Risk Management and Real-Time Analytics

Volatility is the enemy of long-term planning, but programmable stablecoins offer a built-in safety net. By allocating a portion of their holdings to stablecoins, DAOs can reduce exposure to wild price swings while maintaining the flexibility to deploy capital when opportunity knocks. This approach is already highlighted in best practices for treasury diversification, and it’s quickly becoming the gold standard for on-chain treasury operations.

Real-time analytics dashboards now let DAOs monitor their treasury health at a glance: track yield generation, view risk metrics, and audit all transactions instantly. This level of visibility was once unthinkable in traditional finance – now it’s table stakes for any serious crypto organization.

Unlocking Agility in Crypto Payouts

With programmable stablecoins, DAOs can execute complex payout logic without human intervention. Imagine a contributor rewards program that adjusts based on KPIs or a grant system that releases funds only after milestones are verified on-chain. These aren’t pipe dreams – they’re live features in many modern DAO stacks.

- Automated payroll: Contributors get paid accurately and on time, no matter where they are in the world.

- Milestone-based funding: Grants are disbursed only when pre-programmed conditions are met.

- Dynamic budgeting: Treasury allocations adjust automatically based on market conditions or governance votes.

The result? Leaner operations, happier contributors, and fewer headaches for governance leads.

The Future: Composable Treasury Stacks

The next wave of DAO treasury management will be defined by composability – the ability to snap together modules for yield farming, risk analysis, compliance checks, and more using programmable stablecoins as the backbone. Picture an ecosystem where every DAO can build its own custom treasury stack without reinventing the wheel.

Calculated risks fuel innovation – but programmable stablecoins give DAOs the tools to manage those risks with surgical precision.

The bottom line: programmable stablecoins aren’t just another tool in the DeFi kit – they’re the foundation for resilient, transparent, and agile DAO treasuries. As adoption accelerates, expect even more creative use cases that push the boundaries of what decentralized organizations can achieve on-chain.