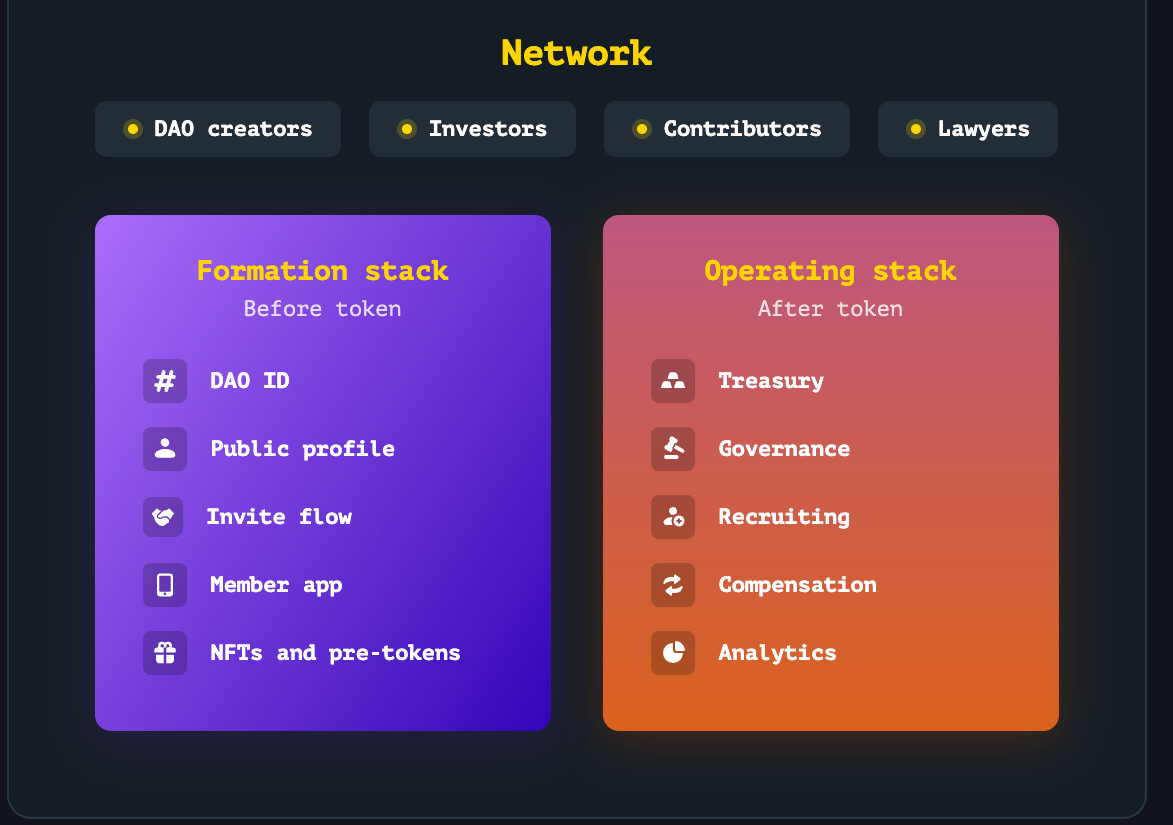

Programmable stablecoins are rapidly transforming how DAOs manage their on-chain treasuries, empowering decentralized organizations with new levels of stability, transparency, and automation. As the backbone of modern DAO treasury management, these digital assets – pegged to stable values like the US dollar – are unlocking capabilities that were previously impossible in traditional finance or even early crypto ecosystems.

Why Programmable Stablecoins Are a Game-Changer for DAO Treasury Management

Most DAOs historically held large portions of their treasuries in native governance tokens. While this approach maximizes alignment with the protocol’s mission, it exposes treasuries to significant market volatility. Integrating programmable stablecoins introduces a much-needed layer of diversification and risk management. For example, the Decentraland DAO recently proposed converting part of its MANA holdings into stablecoins to reinforce financial stability and support long-term initiatives. This move reflects a growing trend among DAOs seeking to cushion their reserves against unpredictable token price swings (forum.decentraland.org).

But programmable stablecoins aren’t just about holding value. Their true power lies in how they leverage smart contracts to automate complex treasury operations. Think of them as programmable money: assets that can be locked, released, or routed according to rules set by DAO governance. This enables everything from automated payrolls and grant disbursements to real-time liquidity rebalancing across multiple DeFi platforms.

Automating Crypto Payouts and On-Chain Operations

The ability to encode payment logic directly into smart contracts is revolutionizing how DAOs handle routine financial workflows. With programmable stablecoins, DAOs can:

How Programmable Stablecoins Streamline DAO Treasury Tasks

-

Enhancing Diversification and Stability: Programmable stablecoins like USDC and DAI enable DAOs to reduce exposure to volatile native tokens by holding assets pegged to stable values, as seen in the Decentraland DAO‘s treasury diversification strategy.

-

Automating Financial Operations: Through integration with DeFi platforms such as dHEDGE, programmable stablecoins allow DAOs to automate liquidity management, trading, and fund distribution via smart contracts, minimizing manual intervention and operational risk.

-

Enabling Yield Generation and Liquidity Provision: DAOs can deploy programmable stablecoins in yield farming and liquidity pools on platforms like Spiral DAO and Uniswap, boosting treasury returns while supporting token liquidity and utility.

-

Ensuring Transparent and Auditable Transactions: All treasury actions involving programmable stablecoins are recorded on public blockchains, providing an auditable and transparent trail that strengthens accountability for DAO members and stakeholders.

-

Implementing Secure, Rule-Based Treasury Management: Smart contracts governing programmable stablecoins can embed security measures and custom rules, ensuring that treasury operations comply with DAO governance and are protected from unauthorized access.

This automation reduces manual overhead, minimizes human error, and ensures that all transactions remain transparent and auditable on-chain. Platforms like dHEDGE are already integrating with DeFi protocols so that DAOs can deploy managed liquidity strategies or participate in yield farming using only smart contract instructions (blog.dhedge.org).

Yield Generation and Liquidity Provision with Stablecoin Vaults

Beyond safety and automation, programmable stablecoins unlock new revenue streams for DAO treasuries through yield generation. By allocating portions of their reserves into lending protocols or liquidity pools, DAOs can earn interest while maintaining exposure to low-volatility assets. Spiral DAO offers a compelling example by deploying its treasury into diversified yield strategies designed both to protect against dilution and expand its token’s market presence (docs.spiral.farm).

This approach not only boosts returns but also supports the broader DeFi ecosystem by providing deep liquidity for governance tokens and other assets.

Transparency is another major advantage programmable stablecoins bring to on-chain treasury operations. Every transfer, allocation, and payout is immutably recorded on the blockchain, enabling real-time auditing and fostering trust among DAO members. This level of visibility is essential for decentralized governance, where accountability must be both provable and accessible to all stakeholders.

Risk Management and Security Considerations

While programmable stablecoins offer significant benefits, DAOs must also consider risk management. Diversification is key: allocating too much to a single stablecoin or protocol introduces counterparty and smart contract risks. Many leading DAOs utilize a mix of top-tier stablecoins (such as USDC, DAI, or USDT) across multiple platforms to mitigate exposure. Smart contract audits and multisig wallet controls further reduce attack surfaces and ensure that no single actor can compromise treasury security.

To help DAO treasury managers navigate these complexities, here’s a quick checklist of best practices:

Programmable Stablecoins in Action: Real-World Use Cases

The real impact of programmable stablecoins shines through in practical applications:

- Automated Contributor Payments: DAOs schedule recurring crypto payouts for contributors using smart contracts tied to task completion or governance approval.

- Grant Disbursements: Funding proposals can trigger instant payouts directly from the treasury once approved by token holders.

- Real-Time Liquidity Rebalancing: Treasuries dynamically adjust liquidity across DeFi protocols based on market conditions or pre-set thresholds.

This shift toward automation not only streamlines operations but also unlocks new forms of financial coordination previously out of reach for decentralized organizations. As programmable money continues to evolve, expect even more sophisticated workflows, such as conditional vesting schedules or cross-chain asset transfers, to become standard practice in DAO treasury management.

The Future of On-Chain Treasury Operations

The convergence of programmable stablecoins with advanced DeFi infrastructure marks a watershed moment for DAOs. By combining stability with automation and robust risk controls, these tools empower communities to manage treasuries with unprecedented efficiency and transparency. Whether optimizing yield, automating crypto payouts, or safeguarding against volatility, programmable stablecoins are becoming indispensable to any serious DAO treasury strategy.

If you’re ready to explore how these innovations can future-proof your organization’s finances, and participate in shaping the next wave of decentralized governance, now is the time to start integrating programmable stablecoins into your on-chain treasury operations.