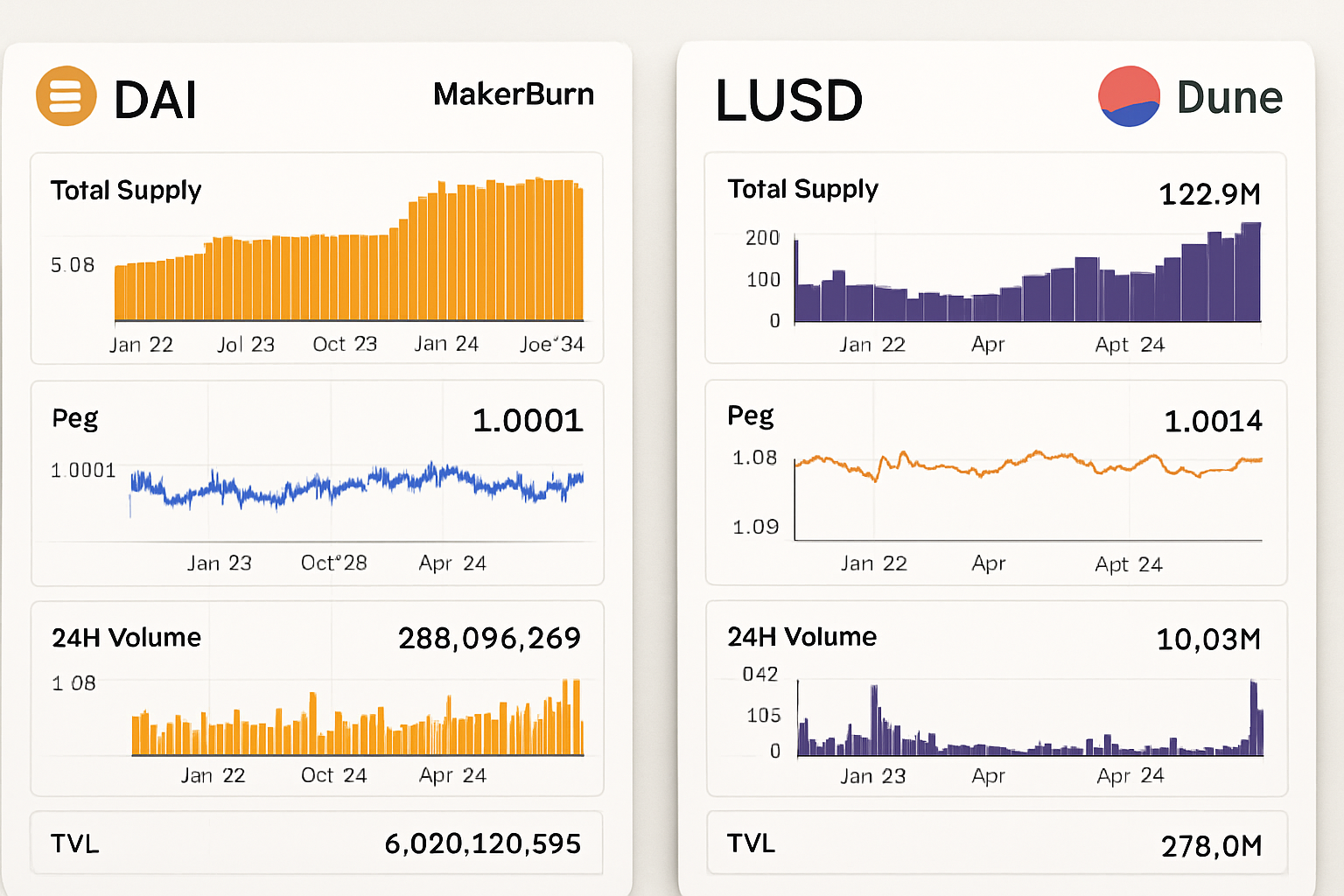

Crypto-collateralized stablecoins have emerged as a cornerstone of decentralized finance, offering DAOs a pathway to financial autonomy and programmable liquidity. As of September 2025, Dai (DAI) is priced at $0.9994, reflecting its ongoing commitment to maintaining a soft USD peg while navigating the volatility of underlying crypto assets. Alongside DAI, Liquity USD (LUSD) continues to gain traction among DAO treasuries for its decentralized structure and censorship-resistant design.

Why Crypto-Collateralized Stablecoins Matter for DAO Treasury Management

Unlike fiat-backed stablecoins, crypto-collateralized stablecoins such as DAI and LUSD are overcollateralized with digital assets like Ethereum (ETH). This approach enables non-custodial issuance through smart contracts, aligning perfectly with the ethos of DAOs seeking transparency and autonomy. For DAOs, integrating these assets into treasury portfolios unlocks several strategic advantages:

- Financial Autonomy: Operating independent of traditional banks, DAOs can manage reserves directly on-chain.

- Liquidity Provision: Stablecoins can be deployed in DeFi protocols for yield generation or as collateral in lending markets.

- Diversification: Exposure to stablecoins backed by multiple cryptocurrencies helps buffer against the volatility inherent in single-asset holdings.

This structure not only supports day-to-day operations but also empowers DAOs to participate in broader DeFi ecosystems without centralized gatekeepers. For an in-depth look at how DAI pioneered this model, see BlockApps: A Comprehensive Overview of Cryptocolateralized Stablecoins.

The Mechanics Behind Collateralization and Liquidation

The stability of crypto-collateralized stablecoins hinges on robust collateral management. In protocols like MakerDAO, users lock up ETH or other approved assets in smart contracts to mint DAI. The system enforces overcollateralization – typically requiring every $1 worth of DAI to be backed by significantly more than $1 in crypto assets – to safeguard against market swings.

If the collateral value drops below a set threshold due to market volatility, liquidation mechanisms are triggered automatically. These liquidations sell off collateral to maintain the peg and protect the protocol from insolvency. The process is transparent but not without risk; a cascade of liquidations can amplify downward pressure on both the collateral asset and the stablecoin itself.

The March 2020 ‘Black Thursday’ event illustrated this risk when a sudden ETH price crash led to mass liquidations in MakerDAO’s vaults, straining DAI’s peg and testing its resilience.

This underscores why active monitoring and dynamic risk management are essential for any DAO relying on these instruments. For further reading on liquidation events and their systemic impact, review this analysis from arxiv.org.

Navigating Liquidation Risks: What Every DAO Should Know

The promise of on-chain autonomy comes with new responsibilities – especially around managing liquidation risk. The primary threats include:

- Collateral Volatility: Large price swings in ETH or other backing assets can rapidly erode overcollateralization ratios.

- Cascading Liquidations: Sharp downturns may trigger automated sell-offs across multiple vaults simultaneously, compounding losses.

- Oracle Failures: If price feeds are manipulated or malfunctioning, incorrect valuations could lead to unnecessary or missed liquidations (mayerbrown.com).

- Smart Contract Vulnerabilities: Bugs or exploits could result in forced liquidations or loss of funds.

This landscape demands that treasuries implement best practices around risk assessment frameworks, diversified collateral pools, regular audits, and contingency planning. As adoption grows among DAOs seeking both yield and stability, mastering these operational nuances becomes non-negotiable for sustainable growth.

Dai (DAI) Peg Resilience Price Prediction Table (2026-2031)

Forecasting DAI’s USD Peg Stability Under Varied Market Scenarios

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Yearly % Deviation (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.9850 | $0.9990 | $1.0150 | -0.10% | Mild volatility; steady DeFi adoption |

| 2027 | $0.9800 | $0.9985 | $1.0180 | -0.15% | Increased competition; collateral diversification |

| 2028 | $0.9750 | $0.9980 | $1.0200 | -0.20% | Regulatory tightening; smart contract upgrades |

| 2029 | $0.9700 | $0.9975 | $1.0230 | -0.25% | Major market event; oracle improvements |

| 2030 | $0.9650 | $0.9970 | $1.0250 | -0.30% | DeFi mainstreaming; expanded DAO use |

| 2031 | $0.9600 | $0.9965 | $1.0280 | -0.35% | Mature DeFi landscape; increased systemic stress resilience |

Price Prediction Summary

DAI is expected to maintain a strong peg to the US dollar, with average prices remaining within 0.5% of $1.00 over the next six years. While short-term deviations below $0.98 or above $1.02 are possible during periods of heightened volatility, robust risk management, diversified collateral, and ongoing protocol upgrades are likely to support peg resilience. Maximum prices may spike above $1.02 in bullish or high-stress scenarios, while minimums could briefly dip below $0.97 during severe market downturns or liquidation cascades. Overall, DAI remains one of the most resilient decentralized stablecoins for DAOs, but vigilance around liquidation and oracle risks is essential.

Key Factors Affecting Dai Price

- Collateral volatility (especially ETH price swings)

- DAO and DeFi adoption rates

- Regulatory changes impacting stablecoins

- Emergence of new decentralized stablecoin competitors

- Improvements in oracle and smart contract security

- Macro market cycles and crypto market sentiment

- Protocol governance and emergency response mechanisms

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Successful DAO treasury management with crypto-collateralized stablecoins requires a disciplined, methodical approach to both asset selection and ongoing risk mitigation. The current price of Dai (DAI) at $0.9994 exemplifies the system’s ability to track its USD peg closely, even amid fluctuating market conditions. However, this apparent stability is only as robust as the DAO’s internal protocols for monitoring collateral ratios, responding to market shocks, and maintaining infrastructure integrity.

Best Practices for On-Chain Collateral Management

To navigate the evolving landscape of stablecoin liquidation risk, DAOs should adopt a set of proven best practices:

Best Practices for DAO Treasuries Managing DAI and LUSD

-

Diversify Stablecoin Holdings: Hold both DAI and LUSD to reduce exposure to the risks of a single protocol or collateral type. This approach leverages the strengths of both MakerDAO and Liquity Protocol, enhancing treasury resilience.

-

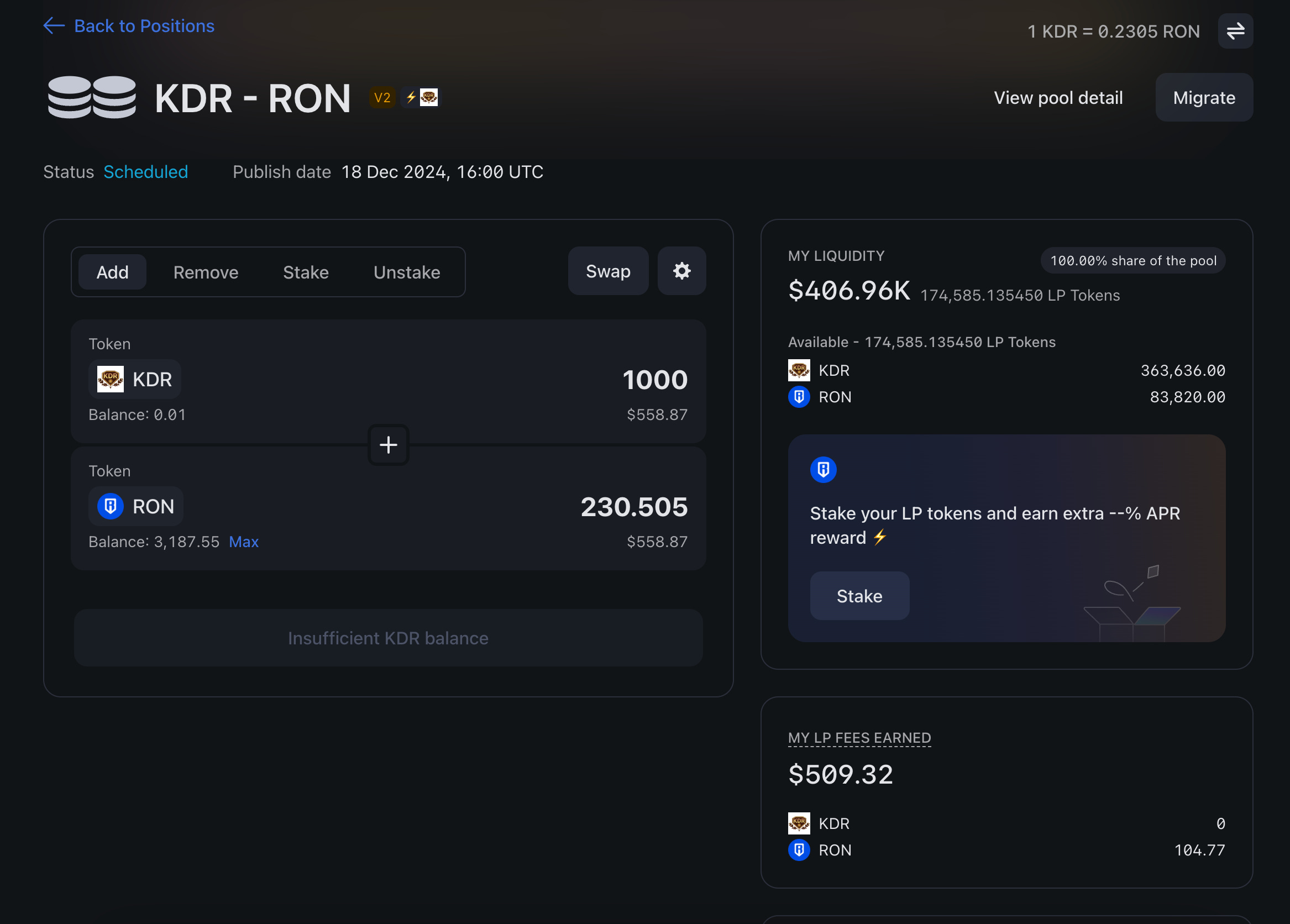

Monitor Collateralization Ratios Closely: Regularly track the collateralization levels of DAI and LUSD positions using platforms like MakerBurn and Dune Analytics. This helps preempt liquidation risks due to collateral volatility.

-

Set Automated Alerts for Liquidation Thresholds: Implement monitoring tools such as DeBank or DeFi Saver to receive real-time notifications when positions approach critical collateralization levels.

-

Regularly Audit Smart Contracts and Oracles: Schedule periodic audits with reputable firms like Trail of Bits or ConsenSys Diligence to ensure the security and reliability of smart contracts and price oracles.

-

Utilize Stability Pools for Yield and Protection: Deposit LUSD into the Liquity Stability Pool to earn yield and help absorb liquidations, supporting both DAO returns and protocol stability.

-

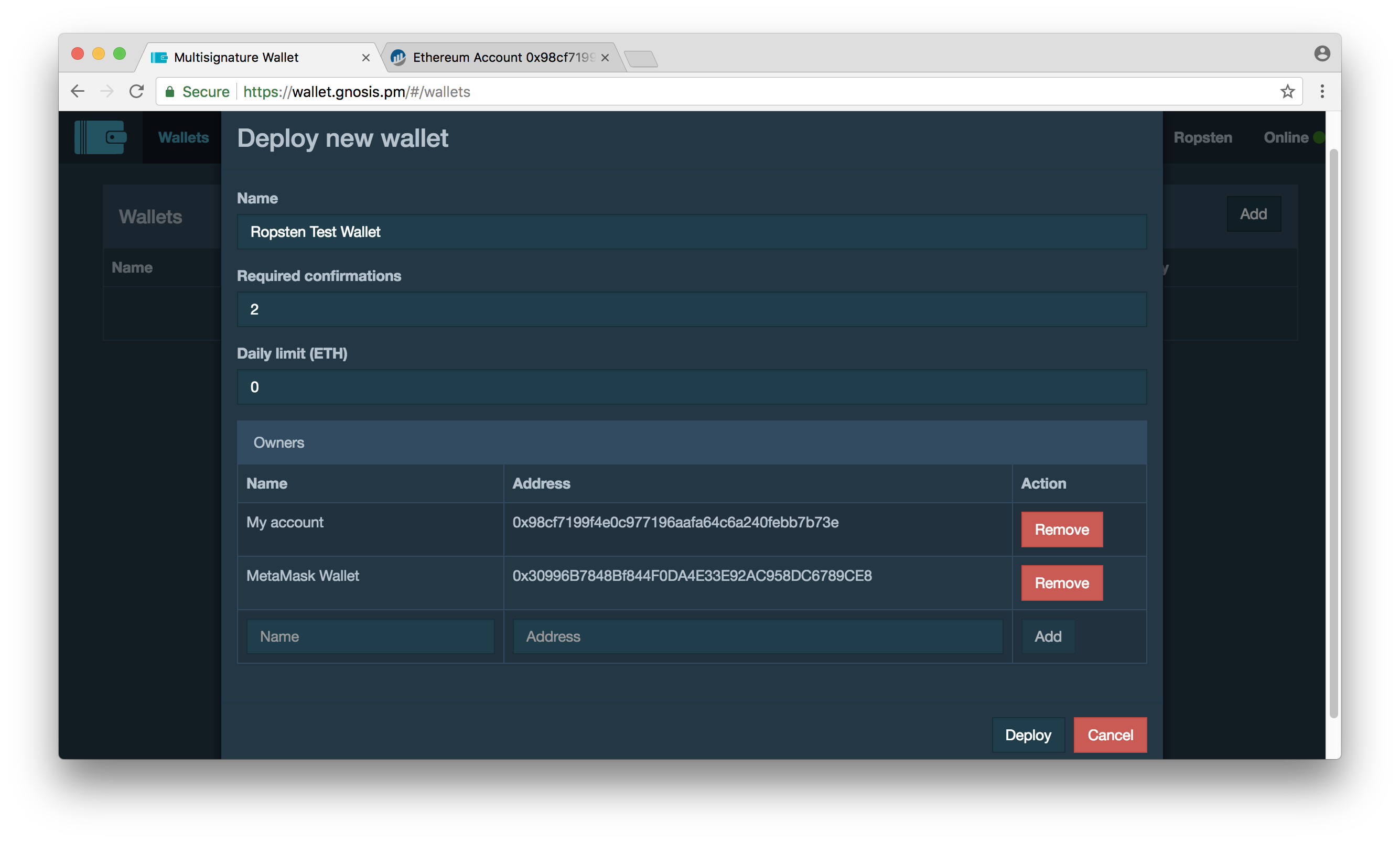

Establish Emergency Protocols: Develop and document clear contingency plans for rapid response to market downturns, oracle failures, or smart contract exploits, including multi-signature transaction processes via Gnosis Safe.

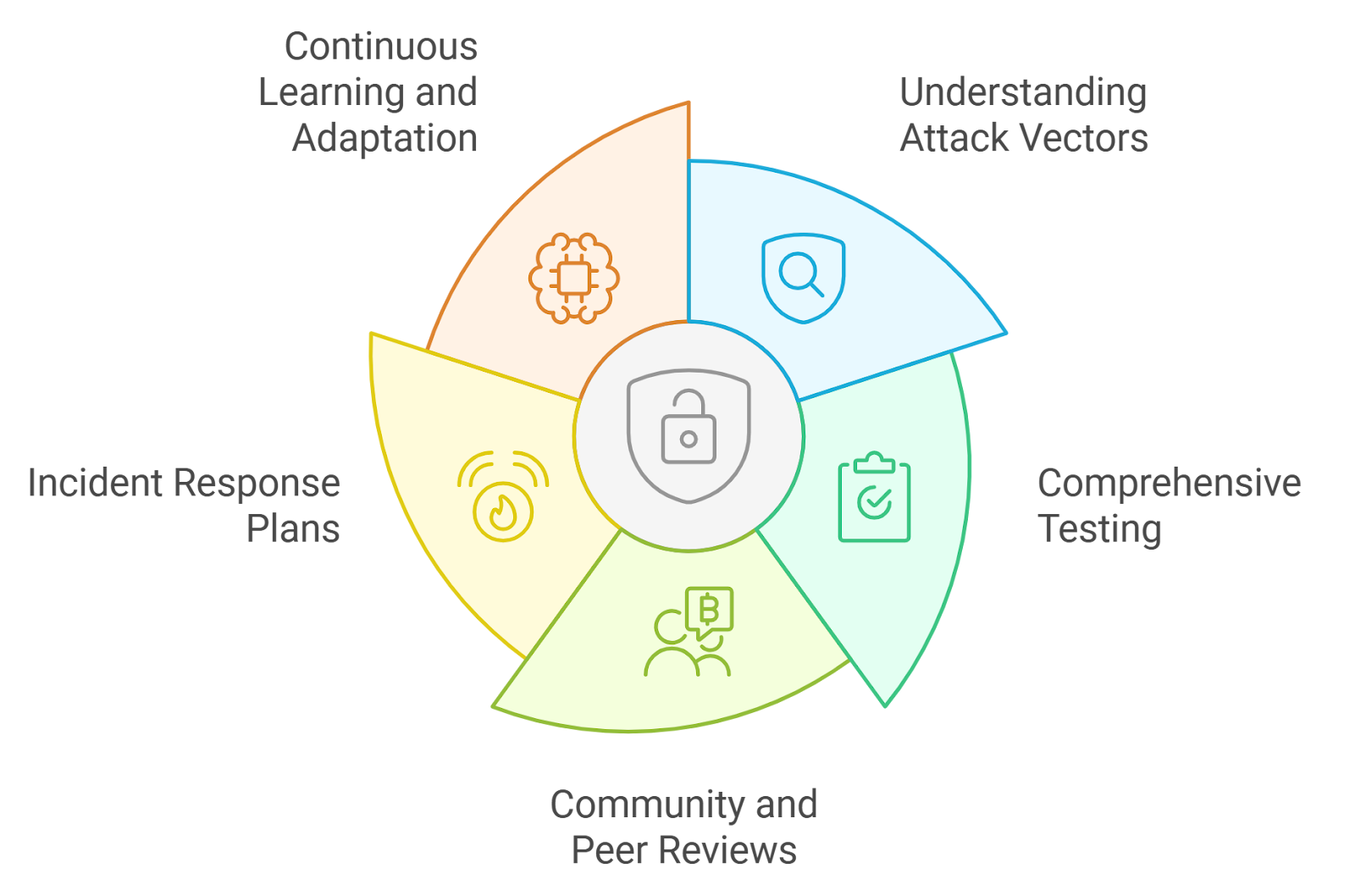

1. Dynamic Collateral Monitoring: Leverage on-chain analytics tools to track real-time collateralization ratios across vaults. Automated alerts can provide early warnings if thresholds are breached, allowing preemptive action rather than reactive crisis management.

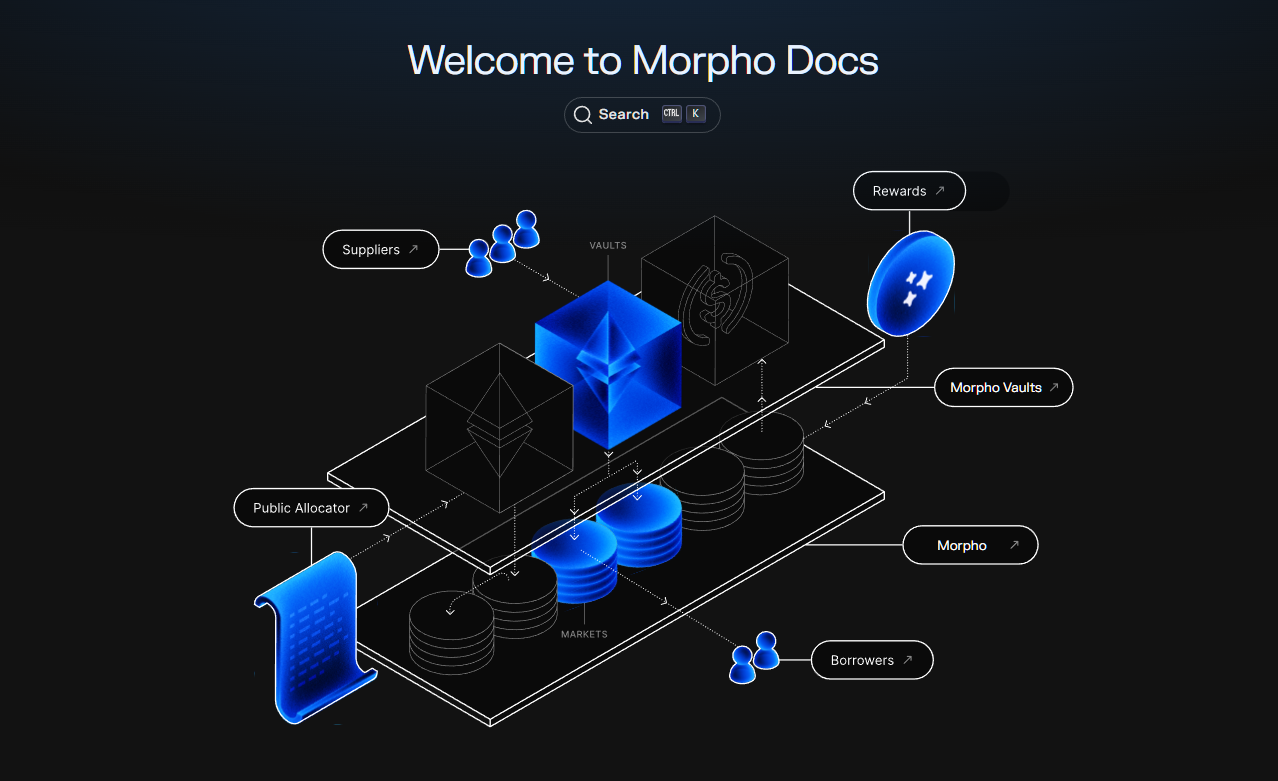

2. Protocol Diversification: Avoid overexposure to a single stablecoin or collateral type by allocating treasury assets across multiple protocols (e. g. , DAI, LUSD). This not only spreads risk but also enables DAOs to capitalize on yield opportunities in different DeFi ecosystems.

3. Regular Security Audits: Schedule frequent audits of all smart contracts and oracle connections. Third-party reviews help ensure that vulnerabilities are identified and patched before they can be exploited, a critical step given the history of exploits in DeFi.

4. Emergency Response Planning: Develop clear playbooks for responding to extreme market events or technical failures. This includes predefined steps for rebalancing collateral, pausing certain operations, or communicating transparently with stakeholders during periods of stress.

The Role of Community Governance

The decentralized nature of DAOs means that treasury decisions are often made collectively via governance votes. This participatory model can be a double-edged sword: while it increases transparency and buy-in, it may also slow down urgent responses during periods of high volatility or technical crisis. To address this, many leading DAOs implement delegated authority frameworks, granting trusted members or committees temporary powers to act swiftly if liquidation risks spike unexpectedly.

The resilience of crypto-collateralized stablecoins such as DAI and LUSD ultimately hinges on both technological safeguards and active community stewardship.

Looking Ahead: Opportunities Beyond Stability

The utility of DAI and LUSD extends well beyond basic price stability within DAO treasuries. These assets unlock access to advanced DeFi strategies including automated liquidity provision, participation in yield farms, and integration with cross-chain protocols, all while preserving on-chain transparency and auditability.

As the DeFi sector matures into 2026, we can expect continued innovation around decentralized collateral management solutions, from more resilient oracle architectures to next-generation smart contract security standards. For forward-thinking DAOs willing to invest in robust risk management infrastructure today, crypto-collateralized stablecoins will remain an indispensable tool for both operational stability and growth.