For DAOs and decentralized finance treasuries, cross-chain stablecoin minting has long been a logistical headache. The need to manually bridge assets, manage fragmented liquidity, and navigate complex smart contract interactions across multiple blockchains has limited treasury agility and increased operational risk. But with the recent launch of OneStable, powered by Enso Shortcuts and Reservoir’s rUSD ecosystem, that paradigm is shifting fast.

Enso, known for its intent-based architecture that abstracts away multi-protocol complexity, has partnered with Reservoir to enable true one-click omnichain stablecoin minting. This integration means DAOs can now move native stablecoin liquidity across chains without ever touching a manual bridge or swap interface. The result? Radically improved DeFi treasury flexibility and an easier path to yield optimization.

How Enso Shortcuts Streamline Cross-Chain Minting

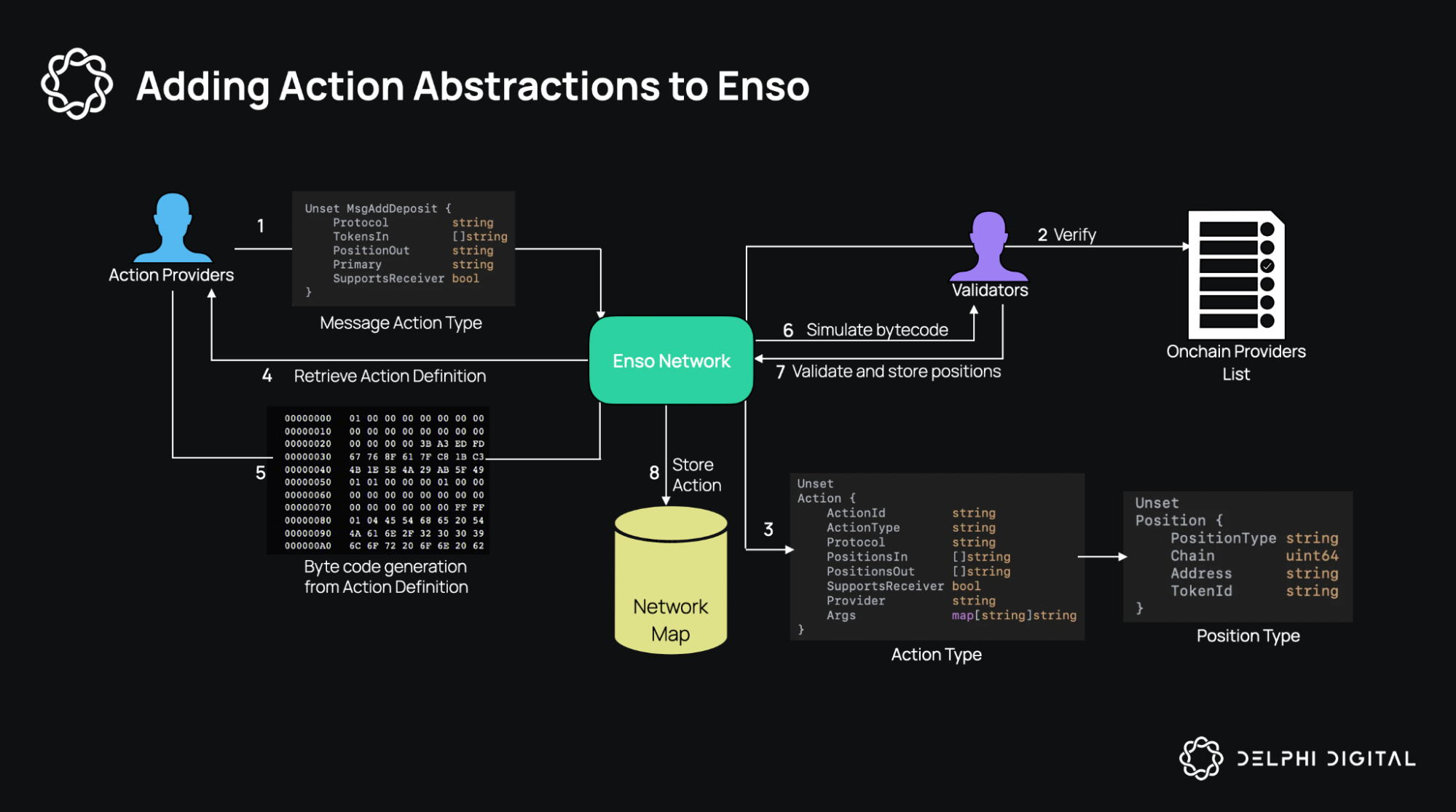

Traditionally, moving stablecoins like rUSD between Ethereum, Arbitrum, or Polygon required a series of steps: bridging tokens, swapping into new assets for local liquidity pools, then interacting with dApps on the destination chain. Each step introduced delay, cost, and risk. Enso Shortcuts flips this model on its head by letting users define their intent (for example: “Mint srUSD on Arbitrum using my ETH on Ethereum”) and executing all underlying actions atomically in a single transaction.

This approach is not just about convenience – it’s about composability. By abstracting away the technical hurdles of cross-chain movement, treasury managers can focus on where their capital works hardest rather than how to get it there. The Reservoir PSM module further enhances this by supporting instant swaps between rUSD and its yield-bearing siblings srUSD and wsrUSD without slippage or exposure to bridge risk.

The Mechanics Behind One-Click Omnichain Liquidity

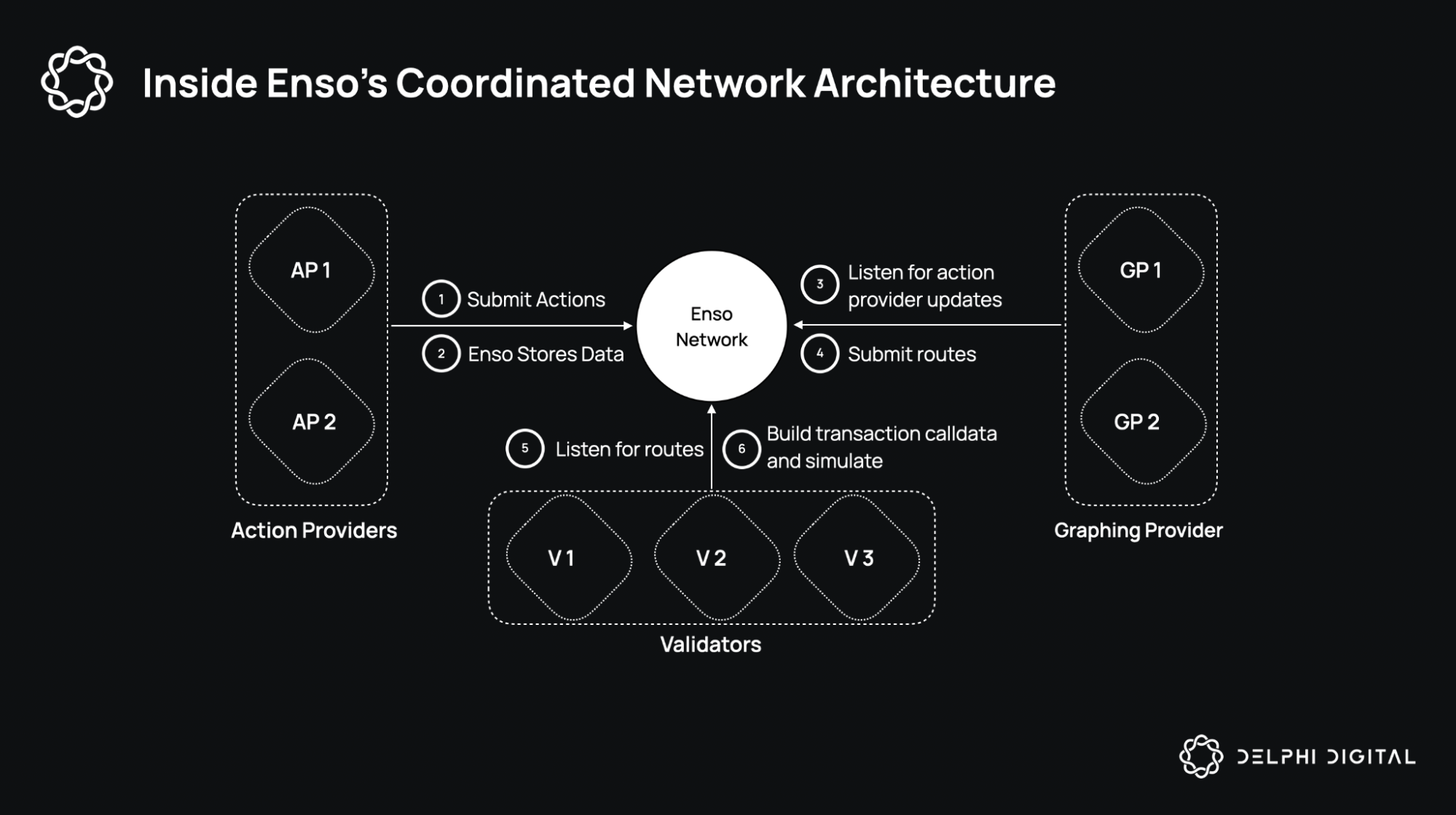

Diving deeper into the mechanics: when a user initiates a cross-chain mint via OneStable, Enso’s shared execution engine fetches the best route for asset transfer across supported protocols and chains. It then bundles all necessary transactions – including swaps, mints, burns, or redeems – into a single shortcut that executes atomically. This ensures no partial execution or stuck funds if any step fails.

Top Benefits of Enso Shortcuts for DAO Treasuries

-

Seamless Cross-Chain Stablecoin Minting: Enso Shortcuts enable DAOs to mint stablecoins like rUSD across multiple blockchains in a single click, eliminating the need for manual bridging or swaps.

-

Instant Access to Omnichain Liquidity: By integrating with Reservoir’s PSM module, Enso Shortcuts allow treasuries to tap into deep, yield-bearing stablecoin liquidity (such as srUSD and wsrUSD) across chains without operational friction.

-

Reduced Operational Complexity: Enso abstracts away complex multi-protocol and multi-chain interactions, letting DAOs manage treasury assets efficiently without custom smart contract integrations.

-

Enhanced Treasury Flexibility: With one-click minting and liquidity movement, DAOs can quickly rebalance or deploy funds to new DeFi opportunities across ecosystems, improving capital efficiency.

-

Improved Security and User Experience: By removing the need for manual bridging and reducing transaction steps, Enso Shortcuts minimize risk and offer a streamlined, user-friendly interface for treasury managers.

The upshot is clear: DAOs no longer need to maintain fragmented liquidity or rely on risky bridges that can be targets for exploits. Instead, they gain unified access to rUSD’s ecosystem-wide liquidity pools plus Reservoir’s innovative yield strategies in srUSD (staked) and wsrUSD (wrapped staked), all managed from a single dashboard.

Why Cross-Chain Stablecoin Minting Matters for Treasury Flexibility

The ability to move stablecoins seamlessly across chains unlocks several strategic advantages:

- Yield Maximization: Treasuries can chase the highest APYs wherever they emerge without operational drag.

- Risk Mitigation: Avoids overexposure to any single chain’s risks (congestion, downtime) while reducing reliance on bridges prone to hacks.

- Treasury Diversification: By supporting multiple yield-bearing options (srUSD/wrsUSD), DAOs can construct more resilient portfolios tailored to their needs.

- Simplified Accounting: Unified reporting tools mean less time spent reconciling balances across fragmented wallets or chains.

This marks an inflection point for on-chain treasury management tools: as more protocols adopt intent-based architectures like Enso’s shortcuts, expect frictionless cross-chain capital movement to become the norm rather than the exception.